Market Overview

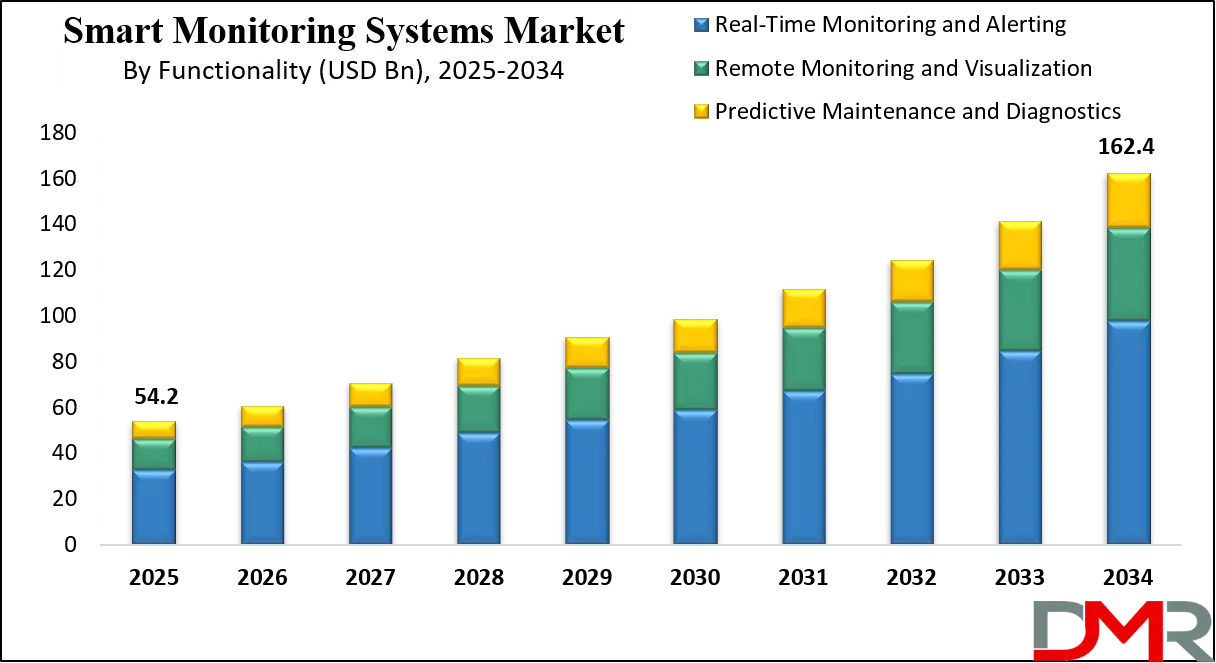

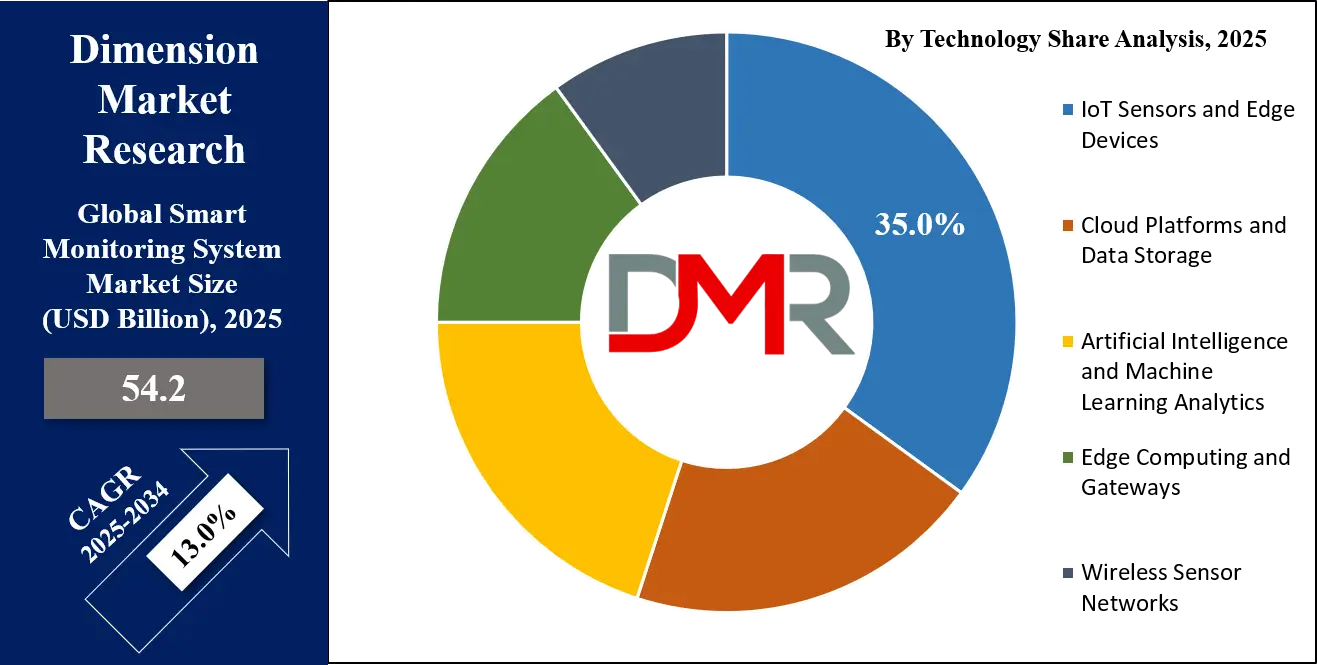

The global smart monitoring system market is projected to reach USD 54.2 billion in 2025 and is expected to grow significantly, hitting USD 162.4 billion by 2034, expanding at a CAGR of 13.0%. This growth is driven by the growing adoption of IoT-enabled monitoring solutions, AI-based analytics, and cloud-connected infrastructure across industrial, healthcare, energy, and smart city applications.

A smart monitoring system refers to an integrated network of intelligent sensors, connected devices, data analytics platforms, and communication technologies designed to collect, analyze, and transmit real-time information for improved operational efficiency and decision-making. It enables continuous monitoring of assets, processes, and environments through the use of Internet of Things (IoT), artificial intelligence, and cloud computing.

These systems provide predictive insights, automate alerts, and optimize performance across diverse applications such as industrial automation, energy management, healthcare, and smart infrastructure. By enabling proactive control and remote accessibility, smart monitoring systems help reduce downtime, enhance safety, and promote sustainable operations.

The global smart monitoring system market represents a rapidly expanding sector that integrates advanced sensing technologies, connectivity solutions, and AI-driven analytics to deliver real-time intelligence across industries. This market is witnessing strong growth due to the growing adoption of digital transformation initiatives, the expansion of smart cities, and the rising need for predictive maintenance in industrial and utility sectors. With IoT and edge computing becoming mainstream, enterprises are increasingly leveraging smart monitoring platforms to achieve operational transparency, improve asset performance, and enhance energy efficiency.

Furthermore, the market is evolving toward greater interoperability, scalability, and automation as organizations seek flexible monitoring solutions tailored to complex industrial ecosystems. The growing demand for connected infrastructure, integrated with the emergence of 5G networks and cloud-based analytics, is reshaping how data is collected and utilized for decision-making. From manufacturing and energy to transportation and healthcare, the smart monitoring system market is poised to play a pivotal role in enabling smarter, safer, and more sustainable global operations.

The US Smart Monitoring System Market

The US Smart Monitoring System Market is projected to be valued at USD 13.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 38.5 billion in 2034 at a CAGR of 12.2%.

The US smart monitoring system market is witnessing strong expansion driven by rapid industrial automation, widespread IoT integration, and the growing emphasis on predictive maintenance and operational intelligence. American enterprises across manufacturing, energy, healthcare, and logistics sectors are increasingly adopting connected monitoring solutions to improve asset visibility, reduce downtime, and enhance energy efficiency.

The presence of advanced digital infrastructure, strong 5G connectivity, and extensive cloud adoption further accelerates the deployment of intelligent monitoring platforms. Additionally, government initiatives promoting smart infrastructure development, integrated with rising investments in data-driven industrial solutions, are fostering the growth of smart monitoring systems across both private and public sectors in the United States.

Moreover, the US market benefits from the strong presence of leading technology providers such as IBM, Honeywell, Cisco, and General Electric, which continue to innovate in AI-based analytics, edge computing, and cybersecurity integration for real-time monitoring applications. Increasing demand for smart building management systems, remote healthcare monitoring, and environmental monitoring solutions is also reshaping the domestic landscape. With industries shifting toward Industry 4.0 and sustainable energy systems, the US smart monitoring system market is poised for substantial growth, offering advanced data insights, automation, and predictive capabilities that support efficiency, compliance, and long-term digital transformation.

Europe Smart Monitoring System Market

The Europe smart monitoring system market is projected to reach a value of approximately USD 8.0 billion in 2025, reflecting steady growth across multiple industrial and commercial sectors. The adoption of IoT-enabled sensors, edge computing devices, and AI-driven analytics is driving demand for real-time monitoring solutions in manufacturing plants, energy facilities, transportation networks, and building management systems. Increasing investments in smart city initiatives and sustainable infrastructure are further contributing to market expansion, as governments and enterprises seek energy-efficient and predictive monitoring solutions to optimize operations and reduce costs.

The market is expected to grow at a compound annual growth rate (CAGR) of 9.2%, supported by the rising integration of cloud-based platforms and data analytics tools for remote monitoring and predictive maintenance. European organizations are increasingly leveraging intelligent monitoring systems to enhance operational visibility, improve safety standards, and comply with regulatory requirements related to environmental sustainability and workplace safety. The focus on digital transformation, automation, and data-driven decision-making is expected to sustain long-term growth and reinforce Europe’s position as a significant regional player in the global smart monitoring system market.

Japan Smart Monitoring System Market

The Japan smart monitoring system market is projected to reach approximately USD 3.0 billion in 2025, driven by rapid industrial automation, advanced manufacturing practices, and widespread adoption of IoT-enabled monitoring solutions. Japanese industries, including automotive, electronics, energy, and healthcare, are increasingly implementing real-time monitoring systems to optimize equipment performance, reduce operational downtime, and enhance safety and compliance. Government initiatives supporting smart infrastructure, energy-efficient facilities, and Industry 4.0 adoption are further accelerating the demand for connected monitoring platforms across commercial and industrial sectors.

The market is expected to grow at a robust compound annual growth rate (CAGR) of 17.8%, reflecting strong technological adoption and innovation in AI-based analytics, edge computing, and cloud-integrated monitoring systems. Companies in Japan are focusing on predictive maintenance, data-driven operational insights, and remote monitoring capabilities to improve efficiency and competitiveness. The convergence of smart city projects, sustainable energy initiatives, and high-speed connectivity, including 5G networks, is expected to drive substantial market expansion, positioning Japan as a high-growth regional market within the global smart monitoring system landscape.

Global Smart Monitoring System Market: Key Takeaways

- Market Value: The global Smart Monitoring System market size is expected to reach a value of USD 162.4 billion by 2034 from a base value of USD 54.2 billion in 2025 at a CAGR of 13.0%.

- By Component Segment Analysis: Hardware components are expected to maintain their dominance in the component segment, capturing 45.0% of the total market share in 2025.

- By Connectivity Technology Segment Analysis: Cellular Networks (4G/5G) will dominate the connectivity technology segment, capturing 30.0% of the market share in 2025.

- By Functionality Segment Analysis: Real-Time Monitoring and Alerting systems are anticipated to dominate the functionality segment, capturing 60.0% of the total market share in 2025.

- By Technology Segment Analysis: IoT Sensors and Edge Devices will dominate the technology segment, capturing 35.0% of the market share in 2025.

- By Deployment Mode Segment Analysis: Cloud-based deployment mode will account for the maximum share in the deployment mode segment, capturing 60.0% of the market share in 2025.

- By Application Segment Analysis: Industrial Monitoring applications will account for the maximum share in the application segment, capturing 30.0% of the market share.

- By End-User Segment Analysis: Large Enterprises will dominate the end-user segment, capturing 50.0% of the market share in 2025.

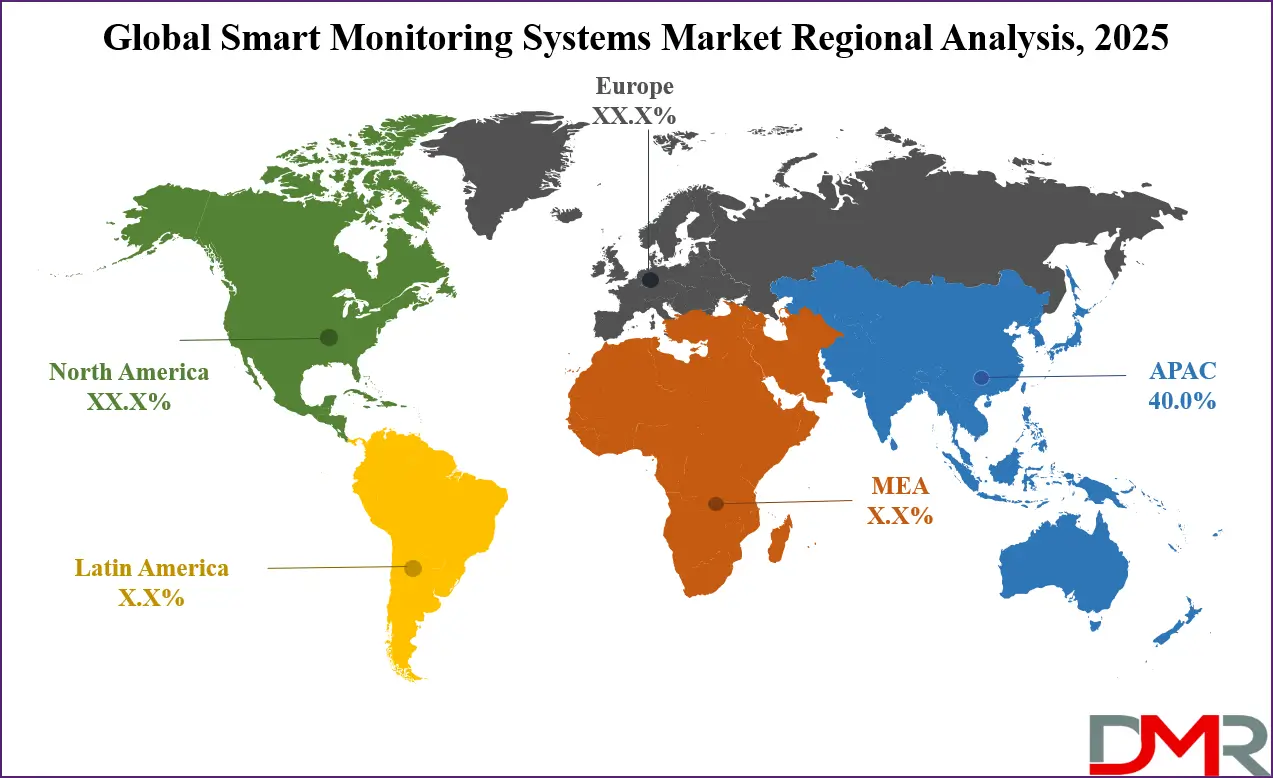

- Regional Analysis: Asia Pacific is anticipated to lead the global Smart Monitoring System market landscape with 40.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Smart Monitoring System market include Siemens AG, Honeywell International Inc., Schneider Electric SE, ABB Ltd., General Electric Company, IBM Corporation, Cisco Systems Inc., Emerson Electric Co., Rockwell Automation Inc., Bosch Sensortec GmbH, Mitsubishi Electric Corporation, Huawei Technologies Co. Ltd., Samsung Electronics Co. Ltd., Intel Corporation, Panasonic Corporation, and Others.

Global Smart Monitoring System Market: Use Cases

- Industrial Equipment Monitoring: Smart monitoring systems are increasingly used in industrial environments to ensure equipment reliability, optimize production processes, and reduce unplanned downtime. IoT-enabled sensors continuously track parameters such as vibration, temperature, and energy consumption, while AI-based analytics predict potential failures before they occur. Manufacturers leverage these insights for predictive maintenance and to improve overall equipment efficiency (OEE). This use case is pivotal in sectors like oil & gas, automotive, and manufacturing, where real-time monitoring enhances operational productivity and cost efficiency.

- Smart Energy and Utility Management: In the energy and utilities sector, smart monitoring systems play a critical role in optimizing grid performance, reducing energy losses, and supporting sustainable operations. Utilities use connected sensors and cloud platforms to monitor electricity flow, transformer health, and renewable energy integration. Advanced analytics enable load balancing, fault detection, and demand forecasting, leading to improved power distribution efficiency. This application supports the transition toward smart grids, renewable energy adoption, and energy conservation initiatives.

- Healthcare and Remote Patient Monitoring: Smart monitoring systems are transforming healthcare by enabling continuous remote patient observation, real-time diagnostics, and proactive health management. Connected medical devices and wearable sensors collect vital data such as heart rate, blood pressure, and glucose levels, transmitting it securely to healthcare providers. AI-driven analytics assist in early detection of anomalies, reducing hospital readmissions and improving patient outcomes. The integration of IoT and telemedicine technologies is fostering a patient-centric care model across hospitals, clinics, and home healthcare settings.

- Smart Building and Infrastructure Monitoring: Building operators are adopting smart monitoring systems to enhance energy efficiency, safety, and sustainability within facilities. Integrated sensors and automation platforms track lighting, HVAC performance, occupancy patterns, and air quality in real time. These insights help reduce energy consumption, optimize space utilization, and ensure regulatory compliance. In addition, predictive analytics detect potential system failures, enabling proactive maintenance and improved tenant comfort. This use case is integral to the growing demand for smart cities and green building initiatives globally.

Impact of Artificial Intelligence on the global Smart Monitoring System market

The integration of artificial intelligence (AI) has significantly transformed the global smart monitoring system market, enhancing its efficiency, accuracy, and decision-making capabilities. AI enables predictive analytics and machine learning algorithms to process massive volumes of real-time data generated by IoT sensors, identifying hidden patterns and anomalies that traditional systems often miss. This predictive intelligence allows industries to shift from reactive to proactive maintenance, reducing equipment downtime and operational costs. By continuously learning from data, AI-driven monitoring systems can optimize asset utilization, improve energy efficiency, and ensure higher safety standards across industrial and commercial applications.

Moreover, AI enhances the automation and scalability of smart monitoring platforms by enabling advanced features such as adaptive control, intelligent alerting, and self-diagnosis. In sectors like manufacturing, healthcare, and smart cities, AI algorithms are used to analyze sensor data for fault detection, environmental changes, and behavioral insights. Integration with edge computing further strengthens real-time decision-making, minimizing latency and bandwidth usage. As organizations embrace digital transformation, AI-powered monitoring systems are becoming a critical enabler of Industry 4.0, delivering smarter, data-driven, and sustainable operational ecosystems globally.

Global Smart Monitoring System Market: Stats & Facts

United Kingdom Government (UK)

- Q1 2025 Smart Meter Installations: Large energy suppliers installed 720,000 smart and advanced meters across Great Britain, marking a 3.0% increase from the previous quarter.

- Q2 2025 Smart Meter Installations: A total of 740,000 smart and advanced meters were installed by large energy suppliers, representing a 3.3% increase from the previous quarter.

- Smart Meter Coverage: By the end of Q2 2025, nearly 40 million smart and advanced meters were in operation across Great Britain, accounting for 69% of all meters.

- Smart Mode Operation: At the end of Q2 2025, 91% of all smart meters were operating in smart mode, with the remainder operating in traditional mode.

- Domestic Smart Meters: As of June 2025, there were 24.1 million gas meters and 29.6 million electricity meters operated by large energy suppliers in domestic properties across Great Britain.

- Non-Domestic Smart Meters: At the end of June 2025, there were 1.2 million smart meters operating in smart mode or advanced meters, representing 58% of all non-domestic meters in operation by large suppliers.

- Non-Domestic Smart Meter Installations: During Q2 2025, large energy suppliers installed 28,000 smart and advanced meters in smaller non-domestic sites, a 2.0% increase from the previous quarter.

- Smart Meter Rollout Start: The first statistical report on the Smart Meter roll-out was published in Q2 2013 for large energy suppliers.

- Smart Meter Data Tables: The Department for Energy Security & Net Zero provides accompanying tables showing unrounded statistics on smart meter installations and operations.

- Local Authority Data: The department provides data on the proportion of domestic electricity smart meters operated by all energy suppliers by local authority.

United States Government (US)

- SMART Grants Program: On December 16, 2024, the U.S. Department of Transportation announced USD 54 million in grant awards for 34 projects across 21 states in the third and final round of the SMART Stage 1 Grants.

- SMART Grantee Summit: On July 10th and 11th, 2024, the USDOT held its second SMART Grantee Summit for the Strengthening Mobility and Revolutionizing Transportation (SMART) Grants program, with over 220 participants in attendance.

- IoT Advisory Board Report: The National Institute of Standards and Technology (NIST) released the IoT Advisory Board (IoTAB) Report in October 2024, outlining recommendations for the integration of IoT technologies in various sectors.

- IoT System Waivers: The U.S. Department of Agriculture reported one waiver on an IoT system in its quarterly FISMA submissions from July 2023 to January 2024.

- IoT Inventory Plans: Agency officials stated plans to fund and acquire an IoT and medical IoT monitoring tool in early 2025 for inventorying medical devices.

- EPA IoT Inventory: The Environmental Protection Agency conducted an initial inventory of its covered IoT devices, with efforts to ensure all IoT assets across the agency are included.

- GSA IoT Inventory: The General Services Administration is working on assessing and defining critical functions for IoT devices and systems as part of its inventory efforts.

- NASA IoT Inventory: The National Aeronautics and Space Administration is in progress with its IoT inventory, concentrating on smart controllers and embedded devices.

- IoT in Education: The IoTAB Report highlights the role of smart classrooms in providing educational access across the United States.

- IoT in Environmental Monitoring: The IoTAB Report discusses the use of smart environmental monitoring systems to identify and address pollution in marginalized communities.

- IoT and AI Integration: The IoTAB Report emphasizes the importance of integrating IoT with AI to enhance data analysis, automation, and decision-making across various sectors.

- IoT Infrastructure Modernization: The IoTAB Report recommends modernization of infrastructure to support the growing adoption of IoT technologies.

- IoT Security and Trust: The IoTAB Report identifies security and trust as key enabling themes for the adoption of IoT technologies.

- IoT Government Leadership: The IoTAB Report calls for strategic government leadership to facilitate the adoption of IoT technologies.

- IoT Policy Recommendations: The IoTAB Report provides policy recommendations to enhance the integration of IoT technologies in various sectors.

- IoT in Smart Cities: The IoTAB Report discusses the role of IoT in smart city initiatives, focusing on areas such as energy, mobility, and environmental monitoring.

- IoT in Healthcare: The IoTAB Report highlights the use of IoT technologies in healthcare for applications like remote monitoring and patient care.

- IoT in Transportation: The IoTAB Report explores the application of IoT in transportation systems to enhance mobility and safety.

- IoT in Agriculture: The IoTAB Report examines the use of IoT technologies in agriculture for precision farming and resource management.

- IoT in Manufacturing: The IoTAB Report discusses the implementation of IoT in manufacturing for predictive maintenance and operational efficiency.

Global Smart Monitoring System Market: Market Dynamics

Global Smart Monitoring System Market: Driving Factors

Growing Adoption of IoT and Connected Devices

The growing deployment of IoT-enabled sensors, edge devices, and connected platforms is a primary growth driver for the smart monitoring system market. Businesses are leveraging real-time data collection, cloud analytics, and predictive maintenance solutions to optimize industrial operations, energy management, and facility monitoring. The convergence of IoT, cloud computing, and AI technologies allows organizations to enhance operational efficiency, reduce unplanned downtime, and improve asset performance.

Rising Focus on Energy Efficiency and Sustainability

Global emphasis on reducing carbon footprints and improving energy management is fueling demand for smart monitoring systems. Industries, smart buildings, and utilities are implementing connected monitoring platforms to track energy consumption, automate lighting and HVAC systems, and optimize resource utilization. These systems enable data-driven decisions for energy conservation, regulatory compliance, and sustainability initiatives, making them critical for long-term operational efficiency.

Global Smart Monitoring System Market: Restraints

High Implementation and Maintenance Costs

The initial investment required for deploying smart monitoring systems, including sensors, software platforms, and cloud infrastructure, remains significant for many small and medium enterprises. Additionally, ongoing maintenance, software updates, and integration with existing IT and OT networks can be costly. These financial barriers can slow adoption, especially in price-sensitive sectors or emerging economies.

Data Security and Privacy Concerns

With the extensive collection and transmission of sensitive operational and personal data, cybersecurity and privacy challenges pose a major restraint. Vulnerabilities in cloud-connected platforms, IoT devices, and wireless networks can lead to data breaches, system manipulation, or operational disruptions. Companies must invest in advanced encryption, secure network protocols, and regulatory compliance measures to mitigate these risks.

Global Smart Monitoring System Market: Opportunities

Integration with Artificial Intelligence and Machine Learning

The integration of AI and machine learning into smart monitoring systems offers immense opportunities for predictive analytics, anomaly detection, and autonomous operations. Industries can use AI-driven insights to optimize production, forecast equipment failures, and implement automated control mechanisms. This capability enhances operational efficiency, safety, and cost savings, opening new markets across manufacturing, healthcare, and smart infrastructure.

Expansion of Smart Cities and Connected Infrastructure

The rapid development of smart city initiatives globally presents significant opportunities for market growth. Governments and municipalities are increasingly adopting intelligent monitoring solutions for traffic management, environmental monitoring, energy-efficient buildings, and public safety. These applications enable real-time data-driven governance, improve citizen services, and support sustainable urban development.

Global Smart Monitoring System Market: Trends

Shift Toward Cloud-Based and Edge Computing Solutions

The market is witnessing a growing preference for hybrid monitoring architectures that combine cloud platforms with edge computing capabilities. This approach reduces latency, enables real-time analytics, and minimizes bandwidth consumption while maintaining centralized data storage. Enterprises are increasingly adopting these solutions to support scalable, efficient, and cost-effective monitoring ecosystems.

Emphasis on Predictive Maintenance and Data-Driven Decision Making

Industries are moving from reactive monitoring to predictive and prescriptive analytics, leveraging data from sensors, AI algorithms, and advanced analytics platforms. This trend allows organizations to detect anomalies early, reduce operational downtime, and enhance overall productivity. The focus on data-driven decision-making is transforming maintenance strategies, energy management, and operational planning across multiple sectors.

Global Smart Monitoring System Market: Research Scope and Analysis

By Component Analysis

In the component segment of the global smart monitoring system market, hardware continues to play a pivotal role, accounting for an estimated 45.0% of the total market share in 2025. This dominance is driven by the growing deployment of IoT sensors, edge devices, gateways, and other physical monitoring instruments that form the backbone of real-time data collection and system functionality.

Hardware components are essential for capturing accurate operational parameters, environmental conditions, and performance metrics across industrial, energy, transportation, and building infrastructure applications. Their reliability, durability, and compatibility with diverse industrial standards make them a critical investment for enterprises aiming to enhance asset performance, reduce downtime, and implement predictive maintenance strategies.

Software, on the other hand, is a crucial enabler of intelligent monitoring within this market segment, accounting for a substantial portion of the overall market value. Monitoring software provides platforms for data aggregation, visualization, and analytics, allowing organizations to transform raw sensor data into actionable insights.

AI-driven analytics, cloud integration, and predictive algorithms embedded in software solutions enable remote monitoring, anomaly detection, and automated alerting, enhancing operational efficiency and decision-making. As industries increasingly focus on digital transformation and smart infrastructure, software solutions are evolving to offer advanced analytics, customizable dashboards, and seamless integration with enterprise resource planning and industrial control systems, making them an indispensable part of the smart monitoring ecosystem.

By Connectivity Technology Analysis

In the connectivity technology segment of the global smart monitoring system market, cellular networks, including 4G and 5G, are expected to dominate with a 30.0% market share in 2025. The widespread adoption of these networks is driven by their ability to provide high-speed, reliable, and wide-area coverage, which is essential for real-time data transmission from sensors and IoT devices across industrial, commercial, and urban applications.

Cellular connectivity enables seamless remote monitoring, rapid data exchange, and integration with cloud-based analytics platforms, supporting smart manufacturing, energy management, transportation, and smart city initiatives. The rollout of 5G further enhances this segment by offering ultra-low latency, higher bandwidth, and the capacity to connect massive numbers of devices, making it ideal for next-generation smart monitoring systems that require instantaneous data processing and predictive insights.

Low Power Wide Area Networks (LPWAN) represent another critical connectivity solution in this market segment, providing long-range communication for IoT devices while consuming minimal power. Technologies such as NB-IoT and LoRaWAN allow sensors and monitoring devices to operate efficiently over extended periods without frequent battery replacements, making them suitable for remote or hard-to-reach installations.

LPWAN is particularly valuable for industrial monitoring, environmental sensing, agricultural applications, and utility management, where continuous data collection is required without the infrastructure costs associated with cellular networks. Its low power consumption, long-range capabilities, and cost-effectiveness make LPWAN an increasingly preferred choice for scalable smart monitoring deployments.

By Functionality Analysis

In the functionality segment of the global smart monitoring system market, real-time monitoring and alerting systems are expected to lead with a 60.0% share of the total market in 2025. These systems are critical for continuously tracking operational parameters, environmental conditions, and asset performance across industries such as manufacturing, energy, healthcare, and transportation. By providing instant alerts and notifications when anomalies or deviations are detected, real-time monitoring enables organizations to take immediate corrective actions, reduce downtime, and prevent costly equipment failures. The integration of AI and machine learning further enhances these systems by analyzing data patterns, predicting potential risks, and automating decision-making processes, thereby improving overall operational efficiency and safety.

Remote monitoring and visualization solutions complement real-time alerting by allowing stakeholders to access performance data and insights from any location through cloud-based platforms and intuitive dashboards. These solutions consolidate data from multiple sensors and devices, providing a clear and actionable overview of assets, environmental conditions, and operational trends. By enabling remote oversight, organizations can optimize resource allocation, track maintenance requirements, and make data-driven decisions without being physically present on-site. This functionality is particularly valuable for distributed operations, smart buildings, energy grids, and healthcare facilities, where continuous visibility and analysis of system performance are essential for operational efficiency and strategic planning.

By Technology Analysis

In the technology segment of the global smart monitoring system market, IoT sensors and edge devices are projected to dominate, capturing 35.0% of the market share in 2025. These devices form the foundation of smart monitoring systems by collecting real-time data from equipment, environments, and processes across industrial, commercial, and urban applications.

IoT sensors measure parameters such as temperature, pressure, vibration, and energy consumption, while edge devices process data locally to enable faster decision-making and reduce latency. This combination allows organizations to implement predictive maintenance, optimize operational efficiency, and enhance safety and reliability. The growing adoption of Industry 4.0 practices, connected factories, and smart infrastructure is further driving the demand for advanced IoT sensors and edge computing solutions.

Cloud platforms and data storage solutions play a complementary role by providing centralized infrastructure to aggregate, analyze, and store the vast volumes of data generated by IoT sensors and edge devices. These platforms enable real-time analytics, machine learning, and visualization tools that transform raw data into actionable insights. Cloud-based monitoring systems allow remote access to performance metrics, predictive analytics, and reporting dashboards, enhancing operational visibility and decision-making across geographically distributed assets. The scalability, flexibility, and cost-effectiveness of cloud solutions make them essential for enterprises seeking to implement intelligent monitoring at a large scale while ensuring secure storage, compliance, and seamless integration with existing IT and operational networks.

By Deployment Mode Analysis

In the deployment mode segment of the global smart monitoring system market, cloud-based deployment is expected to dominate, capturing 60.0% of the market share in 2025. Cloud-based solutions offer scalability, flexibility, and cost-efficiency, allowing organizations to deploy smart monitoring systems without heavy upfront infrastructure investments. These platforms enable real-time data aggregation, advanced analytics, and remote accessibility, which are critical for industries such as manufacturing, energy, healthcare, and smart buildings. By leveraging cloud computing, enterprises can integrate AI and machine learning algorithms for predictive maintenance, operational optimization, and automated alerting, while also ensuring seamless collaboration and centralized monitoring across multiple locations.

On-premises deployment, in contrast, involves installing monitoring hardware and software within the organization’s local IT infrastructure. This mode provides greater control over data security, customization, and compliance with industry regulations, making it suitable for sectors with strict privacy or regulatory requirements such as defense, critical infrastructure, and healthcare. While on-premises solutions require higher initial investments and ongoing maintenance, they allow organizations to tailor the monitoring system to specific operational needs and maintain complete control over sensitive operational data. This deployment mode remains important for businesses that prioritize data sovereignty and low-latency processing within their internal networks.

By Application Analysis

In the application segment of the global smart monitoring system market, industrial monitoring is expected to lead, capturing 30.0% of the market share. This application is critical for manufacturing plants, energy facilities, and process industries where continuous monitoring of equipment, machinery, and production lines is essential. Smart monitoring systems in industrial settings utilize IoT sensors, edge devices, and AI-driven analytics to track parameters such as temperature, vibration, pressure, and energy consumption. Real-time data collection and predictive maintenance capabilities help reduce unplanned downtime, optimize operational efficiency, enhance worker safety, and lower maintenance costs. The growing adoption of Industry 4.0 practices and connected factory solutions further reinforces the dominance of industrial monitoring applications.

Smart buildings and facility management represent another key application of smart monitoring systems, focusing on improving operational efficiency, energy management, and occupant comfort. These systems integrate sensors, automation platforms, and cloud-based analytics to monitor lighting, HVAC performance, air quality, occupancy levels, and energy consumption.

Building managers can use real-time insights to optimize resource utilization, reduce energy costs, ensure compliance with environmental standards, and maintain a safe and comfortable environment for occupants. The rise of smart city initiatives and sustainable construction practices is driving the adoption of intelligent monitoring solutions in commercial buildings, offices, and residential complexes, making this application increasingly significant in the global market.

By End-User Analysis

In the end-user segment of the global smart monitoring system market, large enterprises are expected to dominate, capturing 50.0% of the market share in 2025. These organizations, operating across industries such as manufacturing, energy, transportation, and healthcare, require advanced monitoring solutions to manage complex operations, distributed assets, and large-scale infrastructure.

Smart monitoring systems enable large enterprises to optimize equipment performance, implement predictive maintenance, reduce operational downtime, and enhance safety and compliance. The ability to integrate IoT sensors, cloud platforms, and AI-driven analytics across multiple facilities allows these organizations to achieve greater operational efficiency, data-driven decision-making, and cost savings at scale.

Small and medium enterprises (SMEs) are also increasingly adopting smart monitoring systems, albeit at a smaller share of the market. SMEs leverage these solutions to enhance operational visibility, improve energy management, and maintain equipment reliability without the need for large IT infrastructure investments.

Cloud-based and subscription-based monitoring platforms are particularly appealing to SMEs due to their scalability, lower upfront costs, and ease of deployment. By adopting intelligent monitoring systems, SMEs can achieve higher productivity, reduce maintenance costs, and gain competitive advantages, making this segment a growing contributor to the overall market.

The Smart Monitoring System Market Report is segmented on the basis of the following:

By Component

- Hardware

- Software

- Services

- Integration

- Maintenance

- Consulting

By Connectivity Technology

- Cellular Networks (4G/5G)

- Low Power Wide Area Networks

- Wi-Fi

- Bluetooth and Zigbee

- Wired Connections

- Satellite Communications

By Functionality

- Real-Time Monitoring and Alerting

- Remote Monitoring and Visualization

- Predictive Maintenance and Diagnostics

By Technology

- IoT Sensors and Edge Devices

- Cloud Platforms and Data Storage

- Artificial Intelligence and Machine Learning Analytics

- Edge Computing and Gateways

- Wireless Sensor Networks

By Deployment Mode

- Cloud-Based

- On-Premises

- Hybrid

By Application

- Industrial Monitoring

- Smart Buildings and Facility Management

- Energy and Utilities Monitoring

- Healthcare Monitoring

- Transportation and Logistics Monitoring

- Agricultural Monitoring

- Environmental Monitoring

- Retail Monitoring

By End-User

- Large Enterprises

- Small and Medium Enterprises (SMEs)

- Government and Public Sector

- Residential Sector

Global Smart Monitoring System Market: Regional Analysis

Region with the Largest Revenue Share

The Asia Pacific region is anticipated to lead the global smart monitoring system market, accounting for 40.0% of total market revenue in 2025. Rapid industrialization, the expansion of smart city initiatives, and growing adoption of IoT-enabled monitoring solutions are driving growth in countries such as China, India, Japan, and South Korea.

The region benefits from significant investments in digital infrastructure, cloud computing, and 5G connectivity, enabling real-time monitoring, predictive maintenance, and energy-efficient operations across manufacturing, energy, transportation, and commercial sectors. Additionally, growing government support for smart infrastructure projects and sustainability initiatives is further accelerating the deployment of advanced monitoring systems, making the Asia Pacific a dominant contributor to the global market.

Region with significant growth

The Middle East and Africa region is expected to witness significant growth in the global smart monitoring system market over the coming years. Increasing investments in smart city projects, renewable energy infrastructure, and industrial automation are driving the adoption of IoT-enabled monitoring solutions across key countries such as the United Arab Emirates, Saudi Arabia, and South Africa. The rising focus on energy efficiency, predictive maintenance, and sustainable urban development is encouraging enterprises and government bodies to deploy advanced monitoring systems. Coupled with growing digital infrastructure and cloud connectivity, this region is emerging as a high-growth market for smart monitoring solutions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Smart Monitoring System Market: Competitive Landscape

The global smart monitoring system market is highly competitive, characterized by continuous innovation in IoT sensors, edge computing, AI-driven analytics, and cloud-based monitoring platforms. Key players focus on developing advanced, scalable, and customizable solutions to meet diverse industrial, commercial, and infrastructure requirements. Strategic initiatives such as partnerships, technology collaborations, and regional expansions are being employed to enhance market presence and address the growing demand for predictive maintenance, energy management, and smart city applications. The competitive landscape is further shaped by investments in research and development, adoption of next-generation connectivity technologies, and the push toward integrated, data-driven monitoring ecosystems.

Some of the prominent players in the global Smart Monitoring System market are:

- Siemens AG

- Honeywell International Inc.

- Schneider Electric SE

- ABB Ltd.

- General Electric Company

- IBM Corporation

- Cisco Systems, Inc.

- Emerson Electric Co.

- Rockwell Automation, Inc.

- Bosch Sensortec GmbH

- Mitsubishi Electric Corporation

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- Intel Corporation

- Panasonic Corporation

- Yokogawa Electric Corporation

- Advantech Co., Ltd.

- PTC Inc.

- Hitachi, Ltd.

- Dell Technologies Inc.

- Other Key Players

Global Smart Monitoring System Market: Recent Developments

- October 2025: Prisma Photonics, an Israeli startup specializing in AI-powered optical fiber sensing technology, secured USD 30 million in funding to enhance its infrastructure monitoring solutions for power grids and security applications.

- September 2025: Philips launched a smart telemetry platform aimed at improving cardiac monitoring across hospital networks, providing continuous enterprise-wide connectivity beyond the bedside.

- September 2024: BD (Becton, Dickinson and Company) completed its USD 4.2 billion acquisition of Edwards Lifesciences' Critical Care product group, which now operates as BD Advanced Patient Monitoring, expanding BD's portfolio of smart connected care solutions.

- June 2024: BD announced a definitive agreement to acquire Edwards Lifesciences' Critical Care product group for USD 4.2 billion in cash, aiming to enhance its portfolio of advanced monitoring solutions.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 54.2 Bn |

| Forecast Value (2034) |

USD 162.4 Bn |

| CAGR (2025–2034) |

13.0% |

| The US Market Size (2025) |

USD 13.7 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, Services), By Connectivity Technology (Cellular Networks 4G/5G, Low Power Wide Area Networks, Wi-Fi, Bluetooth and Zigbee, Wired Connections, Satellite Communications), By Functionality (Real-Time Monitoring and Alerting, Remote Monitoring and Visualization, Predictive Maintenance and Diagnostics), By Technology (IoT Sensors and Edge Devices, Cloud Platforms and Data Storage, Artificial Intelligence and Machine Learning Analytics, Edge Computing and Gateways, Wireless Sensor Networks), By Deployment Mode (Cloud-Based, On-Premises, Hybrid), By Application (Industrial Monitoring, Smart Buildings and Facility Management, Energy and Utilities Monitoring, Healthcare Monitoring, Transportation and Logistics Monitoring, Agricultural Monitoring, Environmental Monitoring, Retail Monitoring), and By End-User (Large Enterprises, Small and Medium Enterprises SMEs, Government and Public Sector, Residential Sector) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Siemens AG, Honeywell International Inc., Schneider Electric SE, ABB Ltd., General Electric Company, IBM Corporation, Cisco Systems Inc., Emerson Electric Co., Rockwell Automation Inc., Bosch Sensortec GmbH, Mitsubishi Electric Corporation, Huawei Technologies Co. Ltd., Samsung Electronics Co. Ltd., Intel Corporation, Panasonic Corporation, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |