Market Overview

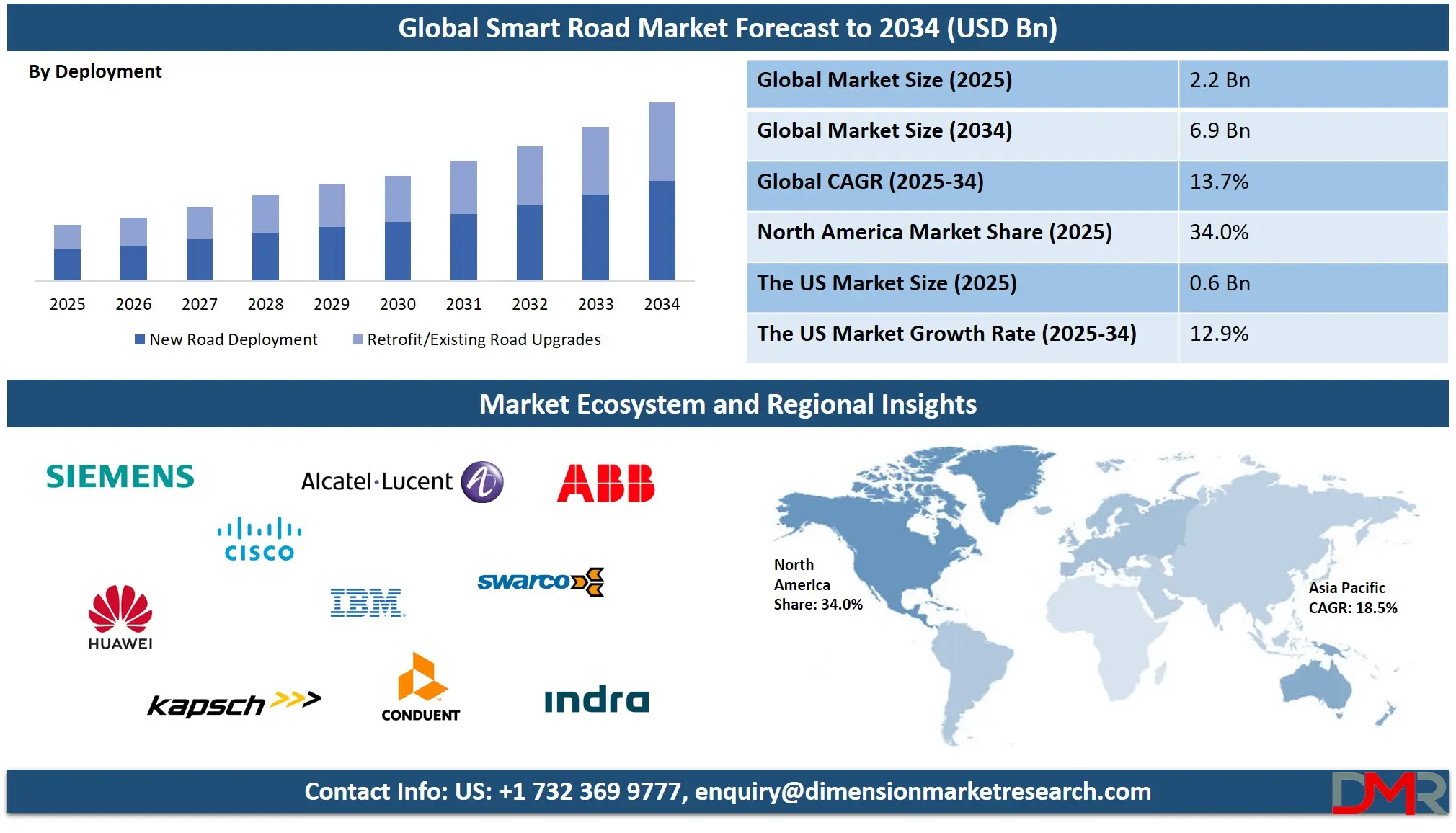

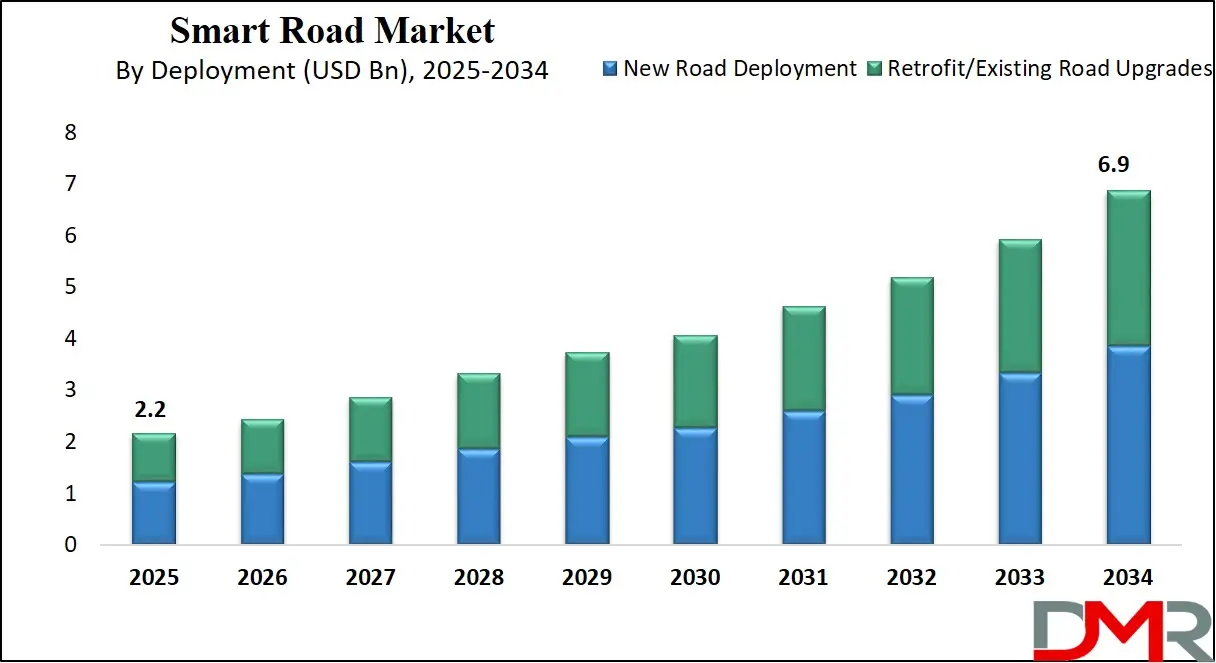

The Global Smart Road Market size is projected to reach USD 2.2 billion in 2025 and is expected to grow to USD 6.9 billion by 2034, registering a robust CAGR of 13.7%. This accelerated growth is driven by rising investments in intelligent transportation systems, connected vehicle infrastructure, IoT enabled road networks, smart traffic management, and next generation mobility solutions across smart cities and modern highway ecosystems.

A smart road refers to an advanced roadway system equipped with digital technologies that enable real time communication, data driven traffic management, and enhanced mobility experiences for vehicles and road users. It integrates IoT sensors, smart streetlights, connected signage, V2X communication units, AI based analytics, environmental monitoring devices, and cloud platforms to continuously collect and analyze road conditions, traffic flow, and safety parameters. Smart roads support predictive traffic control, automated incident detection, dynamic navigation updates, autonomous vehicle readiness, and energy efficient operations, enabling safer, cleaner, and more efficient transportation across highways, urban corridors, and smart city mobility networks.

The global Smart Road Market represents the next phase of intelligent mobility infrastructure where digital technologies integrate with physical road networks to improve safety, traffic flow, energy management, and real-time road communication. Powered by IoT sensors, AI analytics, smart streetlighting, connected vehicle systems, V2X communication, and cloud-based mobility platforms, smart roads enable predictive traffic control, automated incident detection, dynamic navigation updates, and enhanced driver awareness. This market is expanding rapidly due to urban congestion, rising connected vehicle adoption, smart city investments, and the demand for safe and sustainable mobility infrastructure.

The market ecosystem is evolving as governments, transportation agencies, and technology vendors collaborate to upgrade highways and urban corridors with digital intelligence, data-driven operations, and smart mobility solutions. Growth is further supported by advancements in 5G connectivity, autonomous vehicle readiness, environmental monitoring, and renewable energy integration in road infrastructure. As cities modernize transportation networks, the Smart Road Market is becoming a foundational pillar of future mobility, enabling efficient traffic management, enhanced road safety, reduced emissions, and seamless connected mobility experiences on a global scale.

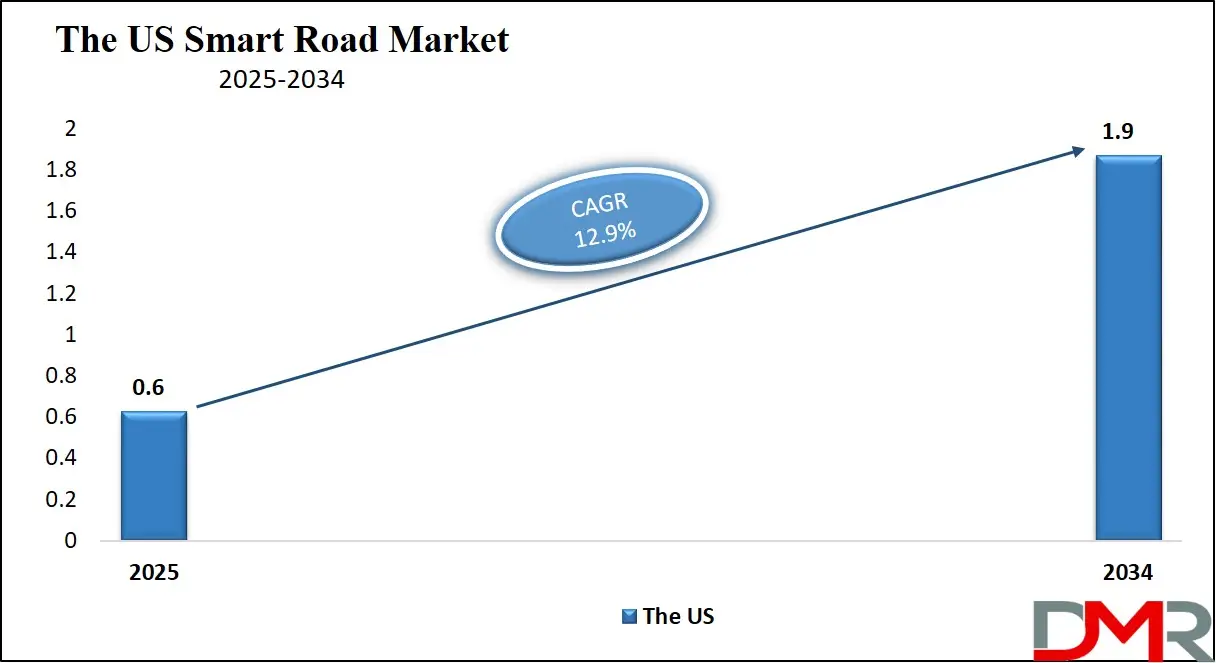

The US Smart Road Market

The U.S. Smart Road market size is projected to be valued at USD 0.6 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1.9 billion in 2034 at a CAGR of 12.9%.

The US smart road market is evolving rapidly as federal and state transportation agencies accelerate investments in intelligent mobility infrastructure, connected highway systems, and data driven traffic management solutions. Growing adoption of IoT enabled road sensors, adaptive traffic control, V2X communication, and AI powered mobility analytics is transforming the operational efficiency of urban roads, interstate corridors, and logistics routes.

The expansion of 5G networks, rising deployment of smart streetlighting systems, and integration of real time environmental and pavement monitoring technologies are further strengthening the country’s shift toward predictive traffic operations and safer mobility environments. Increasing smart city initiatives, integrated with the push for autonomous vehicle readiness, are positioning the United States as a global leader in next generation transportation innovation.

In addition, the US market is benefiting from strong public private partnerships, large scale federal funding programs, and strategic collaborations between technology providers, infrastructure developers, and automotive OEMs. Major states such as California, Texas, Michigan, and New York are deploying smart signage, automated incident detection systems, connected vehicle pilot zones, and digital tolling networks to reduce congestion, enhance safety, and optimize energy consumption across major roadways.

The rising emphasis on sustainable transportation, climate resilient infrastructure, and advanced mobility ecosystems is creating new opportunities for smart road solutions including intelligent pavement systems, roadway energy harvesting, cloud based traffic analytics, and integrated mobility platforms. As demand for efficient, connected, and future ready road networks continues to grow, the US smart road market is set for substantial expansion over the coming decade.

Europe Smart Road Market

The Europe smart road market is expected to reach around USD 600 million in 2025, driven by increasing government investments in intelligent transportation systems and connected infrastructure. Major initiatives across countries such as Germany, France, and the United Kingdom are focused on upgrading highways, urban corridors, and smart city projects with IoT-enabled sensors, AI-powered traffic management, V2X communication, and real-time monitoring systems. These deployments are designed to enhance traffic efficiency, improve road safety, and support autonomous and connected vehicle ecosystems, making Europe one of the leading regions in smart road adoption.

The market is anticipated to grow at a robust CAGR of 17.1% over the forecast period, fueled by rising demand for sustainable and efficient mobility solutions. The expansion of smart city programs, integration of predictive maintenance systems, and deployment of cloud-based traffic analytics are further accelerating growth. Additionally, collaborations between technology providers, infrastructure developers, and government agencies are driving large-scale implementation of intelligent road networks, positioning Europe as a critical hub for next-generation smart road infrastructure in the global market.

Japan Smart Road Market

The Japan smart road market is projected to reach approximately USD 11.0 million in 2025, supported by the country’s focus on intelligent transportation systems, connected mobility infrastructure, and autonomous vehicle readiness. The Japanese government and private sector are investing in V2X communication, IoT-enabled sensors, AI-powered traffic analytics, and smart streetlighting to enhance road safety, optimize traffic flow, and improve overall urban mobility. Initiatives in major cities such as Tokyo, Osaka, and Nagoya are prioritizing real-time monitoring, predictive maintenance, and integration with smart city programs, positioning Japan as a growing adopter of advanced smart road technologies.

The market is expected to expand at a CAGR of 13.9% during the forecast period, driven by increasing demand for connected vehicle ecosystems and sustainable transportation solutions. Investments in digital infrastructure, energy-efficient road systems, and cloud-based traffic management platforms are further propelling growth. Collaboration between technology providers, automotive OEMs, and government agencies is enabling large-scale deployment of intelligent road networks, making Japan a key contributor to the Asia-Pacific smart road market and a strategic region for next-generation mobility solutions.

Global Smart Road Market: Key Takeaways

- Market Value: The global Smart Road market size is expected to reach a value of USD 6.9 billion by 2034 from a base value of USD 2.2 billion in 2025 at a CAGR of 13.7%.

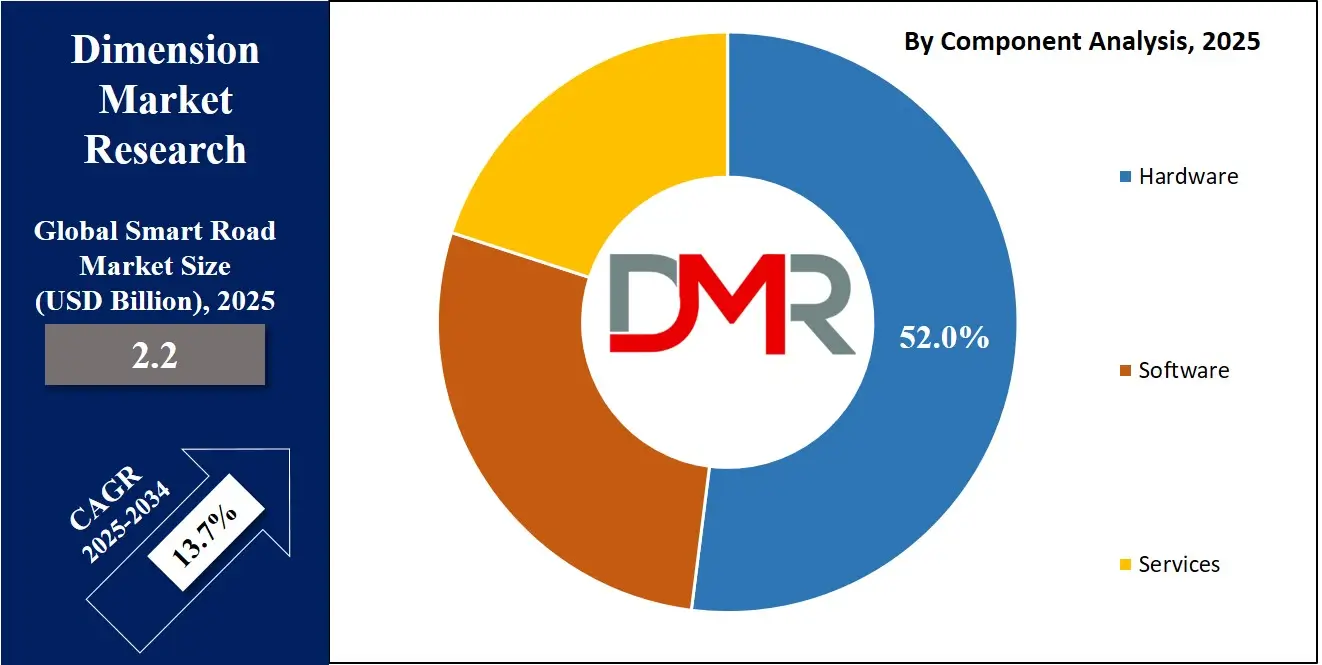

- By Component Analysis: Hardware components are anticipated to dominate the component segment, capturing 52.0% of the total market share in 2025.

- By Solution Segment Analysis: Traffic Monitoring & Management is expected to maintain its dominance in the solution segment, capturing 30.0% of the total market share in 2025.

- By Deployment Segment Analysis: New Road Deployment will account for the maximum share in the deployment segment, capturing 56.0% of the total market value.

- By Connectivity Segment Analysis: Vehicle-to-Infrastructure (V2I) will dominate the connectivity segment, capturing 38.0% of the market share in 2025.

- By Application Segment Analysis: Traffic & Infrastructure Management will dominate the application segment, capturing 30.0% of the market share in 2025.

- By End User Segment Analysis: Government & Public Sector will capture the maximum share in the end user segment, capturing 62.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global Smart Road market landscape with 34.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Smart Road market are Siemens, Cisco, Huawei, Kapsch TrafficCom, Alcatel-Lucent Enterprise, IBM, ABB, Swarco, Xerox (Conduent Transportation), Indra Sistemas, Atkins (SNC-Lavalin), Thales Group, Cubic Corporation, LG CNS, Fujitsu, NEC Corporation, Hitachi, Honeywell, and Others.

Global Smart Road Market: Use Cases

- Smart Traffic Flow Optimization: Smart roads enable real time traffic flow optimization by using IoT sensors, adaptive signal control, and AI based analytics to manage congestion across highways and urban corridors. These systems monitor vehicle density, speed variations, lane usage, and accident patterns to dynamically adjust signal timings and reroute traffic. This improves road capacity, reduces travel delays, enhances fuel efficiency, and supports connected mobility ecosystems. With integrated V2X communication and cloud based traffic platforms, smart roads transform traditional traffic control into predictive and automated mobility management.

- Connected Vehicle and V2X Communication Support: Smart roads act as a digital backbone for connected vehicles by enabling seamless V2X communication between vehicles, infrastructure, and cloud systems. Roadside units, smart poles, and wireless networks support real time data exchange that enhances driver awareness, improves road safety, and enables autonomous vehicle readiness. Use cases include hazard alerts, collision warnings, dynamic speed advisories, and cooperative lane management. This strengthens intelligent transportation systems and accelerates next generation mobility in smart city environments.

- Predictive Road Safety and Incident Response: Smart roads improve road safety through AI powered monitoring that detects accidents, vehicle breakdowns, and hazardous road conditions in real time. Embedded cameras, pavement sensors, and environmental monitoring devices identify anomalies such as ice formation, low visibility, or sudden slowdowns. The system sends instant alerts to traffic control centers, emergency responders, and connected vehicles, enabling faster incident response and reduced crash severity. This proactive safety approach enhances overall road resilience and operational reliability.

- Smart Tolling and Automated Revenue Management: Smart road infrastructure supports digital tolling using RFID, ANPR, and GPS based systems that automate toll collection and eliminate manual barriers. This reduces congestion at toll plazas, improves revenue accuracy, and enables dynamic pricing based on traffic demand. Integrated payment platforms, cloud analytics, and vehicle recognition technologies create seamless mobility experiences for commuters. Smart tolling also allows transportation authorities to optimize operational efficiency and manage financial sustainability of highway networks.

Impact of Artificial Intelligence on the global Smart Road market

Artificial intelligence is reshaping the global smart road market by transforming how roads sense, communicate, and respond to real-time mobility conditions. AI powered traffic analytics enable predictive congestion management, dynamic routing, and automated signal control, allowing transportation agencies to reduce delays and optimize capacity across highways and urban corridors. Machine learning algorithms process continuous data from IoT sensors, cameras, and V2X systems to detect accidents, infrastructure damage, weather hazards, and unusual traffic behavior far faster than human operators. This supports proactive road safety, faster emergency response, and higher operational reliability for smart mobility networks.

AI also enhances connected and autonomous vehicle readiness by enabling real time object detection, cooperative driving assistance, lane coordination, and adaptive speed advisories. With cloud based AI platforms, smart roads can analyze vehicle telemetry, environmental data, and road surface conditions to deliver intelligent mobility services and support next generation transportation systems. Additionally, AI strengthens energy efficiency by optimizing smart streetlighting, predictive maintenance, and road asset management. As governments accelerate smart city programs and autonomous mobility pilots, artificial intelligence has become a central driver of innovation, scalability, and long term value creation in the global smart road market.

Global Smart Road Market: Stats & Facts

- OECD / ITF (International Transport Forum)

- In 2023, the transport sector accounted for 23% of the world’s energy‑related CO₂ emissions.

- The ITF emphasizes that clean, digitized transport is critical for sustainable development and decarbonization.

- Japan – Ministry of Land, Infrastructure, Transport & Tourism (MLIT)

- In 2023, 295 cyberattacks on vehicles were reported globally, with 95% being remote attacks.

- Of those cyberattacks in 2023, 43% came via cloud‑computing, while telematics systems were also a significant attack vector.

- The increase in EVs in Japan also raises cybersecurity risks across charging infrastructure, according to MLIT.

- Japan’s MLIT has revised its safety standards and guidelines for automated vehicles as part of its 2024–2025 regulatory push.

- European Union – European Commission / TEN‑T (Trans-European Transport Network)

- Under the revised TEN‑T regulation (2023), the EU has committed to a fully digital and connected transport network by 2030 for its core network.

- The binding timeline for deployment of the European Rail Traffic Management System (ERTMS) is 2030 for the TEN‑T Core network.

- The 2023 provisional TEN‑T agreement targets a 90% reduction in emissions from transport infrastructure in the long run, emphasizing sustainable and smart connectivity.

- According to the EU’s SDG Voluntary Review, ITS (Intelligent Transport Services) deployment is part of its 2030 smart mobility strategy.

- 5GAA / Cellular V2X (Government-Industry Collaboration)

- The 5G Automotive Association reported 126 global members in 2023, including major automakers and telecom operators, indicating strong cross-sector government-industry alignment.

- According to 5GAA, there were over 200 million network‑connected vehicles globally as of 2022, with a growing number using LTE‑V2X communication.

Global Smart Road Market: Market Dynamics

Global Smart Road Market: Driving Factors

Rapid Urbanization and Smart City Initiatives

The expansion of urban areas and rising population density are increasing traffic congestion, road accidents, and environmental pollution, prompting governments to adopt intelligent transportation systems and connected infrastructure. Investments in smart city programs are accelerating the deployment of IoT enabled sensors, adaptive traffic control systems, V2X communication, and AI powered analytics to optimize traffic flow, improve mobility efficiency, and enhance road safety. The growing emphasis on predictive traffic management and sustainable urban mobility is driving strong demand for smart road solutions across highways, metropolitan corridors, and logistic networks.

Integration of Connected and Autonomous Vehicle Technologies

The rise of connected vehicles and autonomous driving technologies is fueling the adoption of smart road infrastructure. Smart roads equipped with real time data collection, vehicle-to-infrastructure communication, and AI driven analytics provide the backbone for autonomous vehicle navigation, hazard detection, and adaptive routing. This synergy enhances traffic efficiency, reduces accident risks, and enables seamless integration of electric vehicles, mobility as a service platforms, and intelligent transportation networks, reinforcing market growth globally.

Global Smart Road Market: Restraints

High Implementation and Maintenance Costs

The deployment of smart roads involves significant upfront investment in sensors, communication networks, AI platforms, and infrastructure retrofitting. High installation and ongoing maintenance costs, along with limited budgets in developing regions, restrict large scale adoption. Additionally, integrating legacy road systems with advanced digital infrastructure poses technical challenges, slowing market penetration despite growing demand for connected mobility solutions.

Cybersecurity and Data Privacy Concerns

Smart roads rely heavily on real time data from vehicles, sensors, and traffic management platforms, raising concerns over cyberattacks, data breaches, and misuse of sensitive mobility information. Ensuring robust encryption, secure communication protocols, and compliance with privacy regulations is complex and costly. These cybersecurity risks can deter stakeholders from fully adopting connected road solutions and limit the scalability of intelligent transportation networks.

Global Smart Road Market: Opportunities

Expansion of Smart Highway and Expressway Projects

Governments globally are prioritizing the modernization of highways and expressways with digital intelligence, predictive traffic analytics, and connected vehicle support. These projects offer opportunities for IoT hardware providers, AI software developers, and infrastructure integrators to deploy large scale smart road solutions that improve safety, reduce congestion, and enable real time mobility services.

Integration of Renewable Energy and Sustainable Road Technologies

Smart road initiatives increasingly incorporate energy harvesting systems, solar road panels, and intelligent street lighting to enhance sustainability. Companies offering green infrastructure, smart energy management solutions, and low carbon mobility technologies can capitalize on this trend, aligning with environmental regulations and growing demand for energy efficient road networks.

Global Smart Road Market: Trends

Adoption of IoT and AI Driven Predictive Analytics

The use of IoT enabled sensors and AI algorithms is becoming mainstream in smart road projects to monitor traffic, detect hazards, and manage infrastructure in real time. Predictive analytics allows authorities to optimize traffic flow, reduce congestion, and maintain road assets proactively, driving operational efficiency across urban and highway networks.

Deployment of V2X Communication and Connected Mobility Platforms

Vehicle-to-everything communication is increasingly integrated into smart road infrastructure to facilitate seamless interaction between vehicles, road sensors, and cloud platforms. This trend enhances autonomous driving support, cooperative lane management, hazard warnings, and real time navigation updates, positioning smart roads as a critical component of future mobility ecosystems.

Global Smart Road Market: Research Scope and Analysis

By Component Analysis

In the smart road market, hardware components are expected to account for the largest share of the component segment, representing approximately 52.0% of the total market in 2025. This dominance is driven by the critical role that physical infrastructure plays in enabling intelligent road functionality, including IoT sensors, cameras, smart streetlights, traffic counters, roadside units, and V2X communication devices.

These hardware elements provide the foundation for real-time data collection, monitoring, and transmission, allowing smart roads to deliver predictive traffic management, automated incident detection, and enhanced road safety. Governments, transportation authorities, and infrastructure developers are increasingly investing in advanced hardware to support connected vehicle systems, autonomous mobility readiness, and energy-efficient road operations, making hardware the primary driver of market growth in this segment.

Software also represents a significant part of the component segment, facilitating the intelligent management and analysis of data collected from smart road hardware. Traffic management platforms, AI and machine learning analytics, IoT connectivity systems, and cloud-based monitoring tools enable real-time decision-making for traffic flow optimization, congestion reduction, and predictive maintenance. By integrating software with sensors and communication devices, smart roads can provide dynamic route guidance, environmental monitoring, and enhanced safety alerts for vehicles and pedestrians. The growing adoption of connected vehicle ecosystems, autonomous mobility solutions, and smart city initiatives further amplifies the demand for software solutions that can process vast amounts of traffic and road data, making it an essential component of the overall smart road market.

By Solution Analysis

Traffic monitoring and management is expected to remain the leading solution in the smart road market, accounting for approximately 30.0% of the total market share in 2025. This dominance is due to the essential role it plays in ensuring smooth traffic flow, reducing congestion, and enhancing road safety across urban and highway networks. The solution leverages IoT sensors, AI-based analytics, real-time monitoring systems, and adaptive signal control to collect and process traffic data, detect incidents, and optimize routing for vehicles. By enabling predictive traffic management, smart roads equipped with these solutions can reduce travel time, minimize fuel consumption, and prevent accidents, making traffic monitoring and management a cornerstone of intelligent transportation infrastructure.

Smart mobility and connected vehicle solutions are also a critical part of the smart road market, focusing on the integration of vehicles with road infrastructure to enable safer, more efficient, and autonomous transportation. These solutions utilize vehicle-to-everything communication, cloud-based analytics, and AI-driven systems to support connected vehicles, autonomous navigation, and dynamic route optimization. By providing real-time alerts, hazard warnings, and cooperative lane management, smart mobility solutions enhance driver experience and reduce traffic incidents. The rising adoption of electric vehicles, autonomous driving technologies, and mobility-as-a-service platforms further drives the demand for connected vehicle solutions, making them a key growth area within the smart road solution segment.

By Deployment Analysis

New road deployment is expected to dominate the deployment segment in the smart road market, accounting for approximately 56.0% of the total market value. This is largely because constructing new roadways allows governments and infrastructure developers to integrate smart technologies from the ground up without the limitations of existing structures. New roads can be designed with embedded IoT sensors, smart lighting systems, V2X communication units, and advanced traffic management platforms, enabling real-time monitoring, predictive maintenance, and enhanced road safety. The ability to implement fully connected and future-ready infrastructure on newly constructed highways, expressways, and urban corridors makes new road deployment the preferred choice for large-scale smart road projects, supporting the growing demand for intelligent transportation systems.

Retrofit and existing road upgrades also represent a significant portion of the deployment segment, focusing on enhancing current road networks with smart technologies. This approach involves installing sensors, adaptive traffic management systems, smart streetlights, and connected communication devices on pre-existing highways and urban roads. While more challenging due to structural and integration limitations, retrofit projects allow authorities to modernize critical corridors without constructing entirely new roads. Upgrading existing infrastructure improves traffic efficiency, enhances safety, and supports connected vehicle operations, making retrofit and upgrade projects an essential strategy for expanding smart road coverage, particularly in densely populated urban areas where new road construction is limited.

By Connectivity Analysis

Vehicle-to-Infrastructure (V2I) communication is expected to dominate the connectivity segment in the smart road market, capturing around 38.0% of the total market share in 2025. V2I enables real-time interaction between vehicles and roadside infrastructure, such as traffic signals, smart streetlights, sensors, and roadside units, allowing for dynamic traffic management, hazard warnings, and adaptive signal control. This connectivity improves road safety, reduces congestion, and supports predictive maintenance of road assets by providing transportation authorities with continuous data on traffic flow, vehicle density, and road conditions. The growing adoption of connected vehicles, intelligent transportation systems, and autonomous mobility platforms further strengthens the role of V2I as the backbone of smart road networks.

Vehicle-to-Cloud (V2C) communication also plays a vital role in the smart road ecosystem by connecting vehicles to cloud-based platforms for data storage, analysis, and mobility management. V2C enables real-time navigation updates, traffic predictions, and remote monitoring of vehicle and road conditions, enhancing route optimization and driving efficiency. Cloud connectivity also supports fleet management, predictive maintenance, and integration with smart city applications, allowing transportation authorities and mobility service providers to analyze large-scale traffic patterns and improve overall operational efficiency. The increasing demand for cloud-enabled mobility solutions and data-driven transportation analytics is driving the adoption of V2C in smart road deployments globally.

By Application Analysis

Traffic and infrastructure management is expected to lead the application segment in the smart road market, accounting for approximately 30.0% of the total market share in 2025. This application focuses on optimizing traffic flow, reducing congestion, and enhancing the operational efficiency of road networks using IoT sensors, adaptive traffic signals, AI-based analytics, and real-time monitoring systems. By continuously collecting and analyzing data on vehicle movement, road conditions, and traffic density, smart roads can provide dynamic route management, predictive maintenance, and seamless coordination between highways and urban corridors. The adoption of intelligent transportation systems and connected mobility platforms further strengthens the effectiveness of traffic and infrastructure management as a primary application, supporting safer, faster, and more efficient transportation networks.

Public safety and security is another critical application of smart road technology, aimed at reducing accidents, managing emergencies, and ensuring overall road safety. Embedded cameras, environmental sensors, and AI-powered monitoring systems detect incidents such as collisions, breakdowns, or hazardous weather conditions in real time, sending alerts to traffic control centers, emergency responders, and connected vehicles. This proactive approach enables faster response times, minimizes accident severity, and enhances driver awareness. Additionally, integration with V2X communication and predictive analytics allows authorities to implement preventive safety measures, making public safety and security a key focus area in the deployment of smart road solutions.

By End User Analysis

Government and public sector entities are expected to capture the largest share in the end user segment of the smart road market, accounting for approximately 62.0% of the total market share in 2025. This dominance is driven by the critical role that federal, state, and municipal authorities play in planning, funding, and managing transportation infrastructure. Governments are investing heavily in intelligent transportation systems, connected highways, smart streetlighting, and V2X communication networks to enhance traffic management, improve road safety, and support urban mobility initiatives. Public sector adoption also includes large-scale smart city projects, predictive maintenance programs, and highway modernization initiatives, positioning government agencies as the primary drivers of smart road deployment globally.

Private mobility providers are also significant participants in the smart road market, focusing on leveraging connected infrastructure to support fleet operations, autonomous vehicle navigation, ride-sharing platforms, and logistics optimization. These providers integrate smart road data with cloud-based analytics, vehicle telematics, and mobility-as-a-service platforms to enhance route efficiency, safety, and overall operational performance. The adoption of IoT sensors, predictive traffic models, and V2X communication by private companies allows them to deliver more reliable and intelligent mobility services, creating opportunities for collaboration with technology vendors and infrastructure developers in expanding smart road networks.

The Smart Road Market Report is segmented on the basis of the following:

By Component

- Hardware

- Software

- Services

By Solution

- Traffic Monitoring & Management

- Smart Mobility & Connected Vehicles

- Smart Parking

- Road Weather & Environmental Monitoring

- Smart Signage & Smart Street Lighting

- Energy Harvesting Roads

By Deployment

- New Road Deployment

- Retrofit/Existing Road Upgrades

By Connectivity

- Vehicle-to-Infrastructure (V2I)

- Vehicle-to-Cloud (V2C)

- IoT-Based Road Connectivity

- Vehicle-to-Vehicle (V2V)

- Vehicle-to-Pedestrian (V2P)

By Application

- Traffic & Infrastructure Management

- Public Safety & Security

- Smart Navigation & Mobility

- Environmental & Weather Monitoring

- Smart Tolling & Revenue Systems

- Smart Road Energy & Sustainability

By End User

- Government & Public Sector

- Private Mobility Providers

- Infrastructure Developers

Global Smart Road Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global smart road market, accounting for approximately 34.0% of the total market revenue in 2025. The region’s dominance is driven by extensive investments in intelligent transportation systems, connected vehicle infrastructure, and smart city initiatives across the United States and Canada. Widespread adoption of IoT-enabled sensors, AI-powered traffic management, V2X communication, and advanced roadway monitoring technologies is enhancing road safety, optimizing traffic flow, and supporting autonomous and connected vehicle ecosystems. Additionally, strong government funding, public-private partnerships, and the presence of major technology providers are accelerating the deployment of smart roads, making North America a key hub for innovation and large-scale implementation in the global market.

Region with significant growth

The Asia-Pacific region is expected to witness significant growth in the global smart road market over the coming years, driven by rapid urbanization, increasing vehicle adoption, and extensive government initiatives focused on smart city and intelligent transportation projects. Countries such as China, Japan, India, and South Korea are investing heavily in IoT-enabled road sensors, AI-based traffic management systems, V2X communication, and autonomous vehicle infrastructure to enhance mobility, reduce congestion, and improve road safety. Rising demand for sustainable transportation solutions, renewable energy integration in road infrastructure, and advancements in connected vehicle technologies are further accelerating the adoption of smart roads in the region, positioning Asia-Pacific as a high-growth market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Smart Road Market: Competitive Landscape

The global smart road market is highly competitive, driven by rapid technological advancements, strategic collaborations, and continuous innovation in intelligent transportation systems and connected mobility solutions. Key players are focusing on developing integrated hardware and software solutions, including IoT sensors, AI-based traffic analytics, V2X communication platforms, and cloud-enabled management systems, to enhance road safety, optimize traffic flow, and support autonomous and connected vehicles. Companies are also investing in research and development to introduce energy-efficient smart lighting, predictive maintenance tools, and scalable infrastructure solutions, while forming partnerships with government agencies and urban planners to expand smart road deployments across highways, urban corridors, and smart city projects globally.

Some of the prominent players in the global Smart Road market are:

- Siemens

- Cisco

- Huawei

- Kapsch TrafficCom

- Alcatel-Lucent Enterprise

- IBM

- ABB

- Swarco

- Xerox (Conduent Transportation)

- Indra Sistemas

- Atkins (SNC-Lavalin)

- Thales Group

- Cubic Corporation

- LG CNS

- Fujitsu

- NEC Corporation

- Hitachi

- Honeywell

- ENECO Energy Roads

- Sensys Networks

- Other Key Players

Global Smart Road Market: Recent Developments

- August 2025: DENSO unveiled its MobiQ™ V2X Roadside and On‑Board units and keyless access solution, emphasizing smarter, safer vehicle‑to‑infrastructure connectivity.

- August 2025: DENSO and AT&T announced a collaboration to deploy C‑V2X capable ITS hardware and Intelligent Transportation Platform for scalable road‑to-vehicle connectivity.

- July 2025: IFC committed a USD 19.2 million convertible bond to a digital tolling operator to expand electronic toll collection and transport‑payment services.

- March 2025: The Smart Traffic Fund approved two projects focused on motorcycle safety algorithms and bus travel‑time prediction for complex road conditions.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2.2 Bn |

| Forecast Value (2034) |

USD 6.9 Bn |

| CAGR (2025–2034) |

13.7% |

| The US Market Size (2025) |

USD 0.6 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, Services), By Solution (Traffic Monitoring & Management, Smart Mobility & Connected Vehicles, Smart Parking, Road Weather & Environmental Monitoring, Smart Signage & Smart Street Lighting, Energy Harvesting Roads), By Deployment (New Road Deployment, Retrofit/Existing Road Upgrades), By Connectivity (Vehicle-to-Infrastructure V2I, Vehicle-to-Cloud V2C, IoT-Based Road Connectivity, Vehicle-to-Vehicle V2V, Vehicle-to-Pedestrian V2P), By Application (Traffic & Infrastructure Management, Public Safety & Security, Smart Navigation & Mobility, Environmental & Weather Monitoring, Smart Tolling & Revenue Systems, Smart Road Energy & Sustainability), and By End User (Government & Public Sector, Private Mobility Providers, Infrastructure Developers). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Siemens, Cisco, Huawei, Kapsch TrafficCom, Alcatel-Lucent Enterprise, IBM, ABB, Swarco, Xerox (Conduent Transportation), Indra Sistemas, Atkins (SNC-Lavalin), Thales Group, Cubic Corporation, LG CNS, Fujitsu, NEC Corporation, Hitachi, Honeywell, and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global Smart Road market size is estimated to have a value of USD 2.2 billion in 2025 and is expected to reach USD 6.9 billion by the end of 2034.

The US Smart Road market is projected to be valued at USD 0.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1.9 billion in 2034 at a CAGR of 12.9%.

North America is expected to have the largest market share in the global Smart Road market, with a share of about 34.0% in 2025.

Some of the major key players in the global Smart Road market are Siemens, Cisco, Huawei, Kapsch TrafficCom, Alcatel-Lucent Enterprise, IBM, ABB, Swarco, Xerox (Conduent Transportation), Indra Sistemas, Atkins (SNC-Lavalin), Thales Group, Cubic Corporation, LG CNS, Fujitsu, NEC Corporation, Hitachi, Honeywell, and Others.

The market is growing at a CAGR of 13.7 percent over the forecasted period.