Market Overview

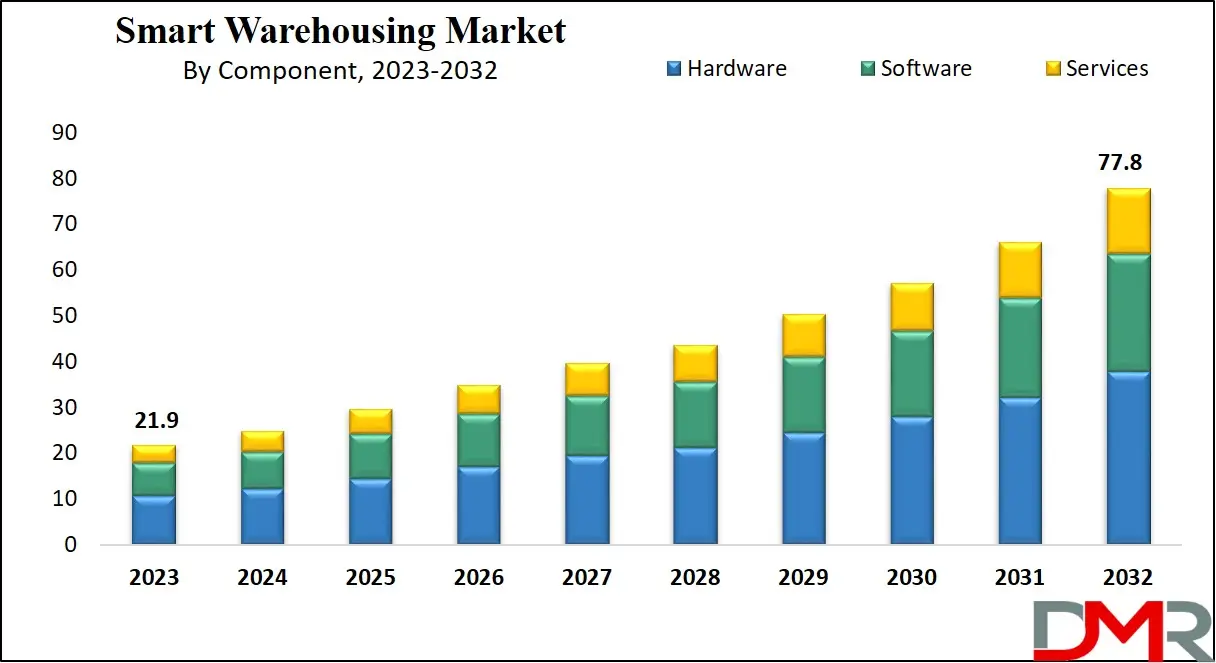

The Global Smart Warehousing Market is expected to reach a value of USD 21.9 billion in 2023, and it is further anticipated to reach a market value of USD 77.8 billion by 2032 at a CAGR of 15.1%. The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

Smart warehouses are large structures designed for storing goods & materials, that include machines & computers to complete tasks like order processing, storage, & inventory management that are traditionally done by humans. These operations are carried out with fewer errors owing to technologies like RFID, AGV, IoT, & analytics. The growing adoption of these technologies is a major driver of the smart warehousing market.

Key Takeaways

- Market Growth: The smart warehousing market is projected to grow from USD 21.9 billion in 2023 to USD 77.8 billion by 2032, with a CAGR of 15.1%.

- Technology Adoption: Increasing use of technologies like RFID, AGV, IoT, and analytics is driving automation and error reduction in warehouse operations.

- Hardware Dominance: Hardware remains the leading component segment due to widespread adoption of automated picking tools and inventory control systems.

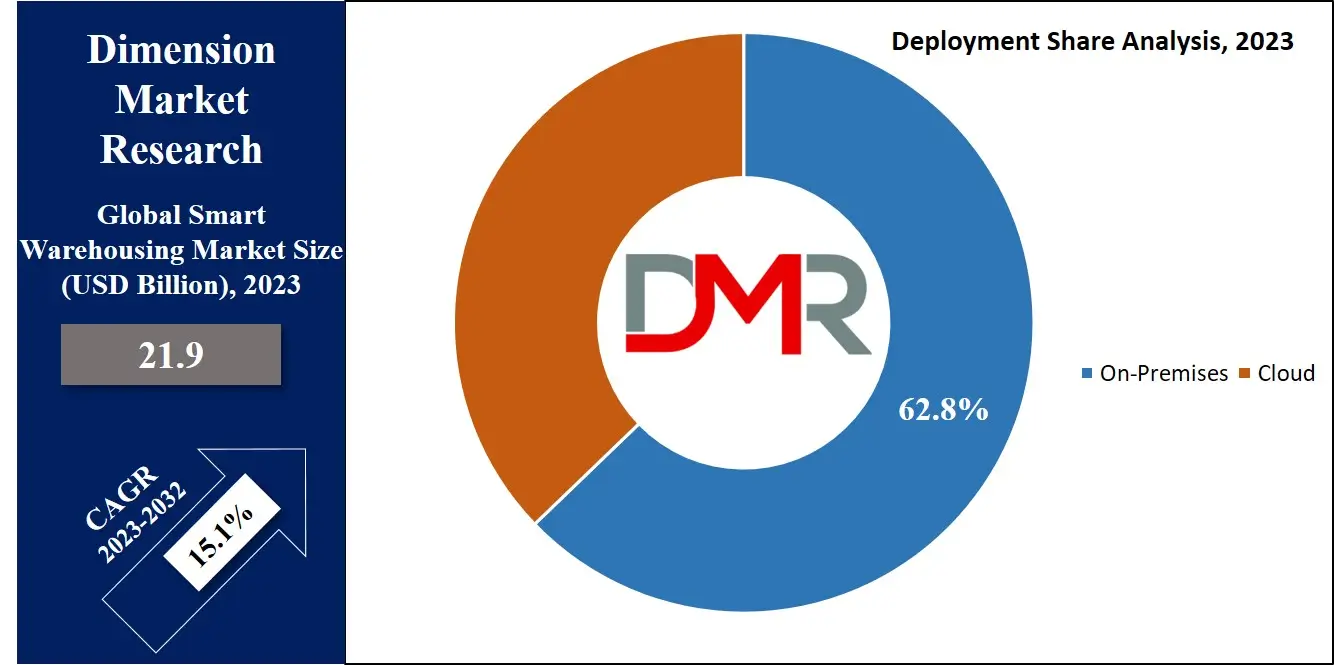

- Deployment Trends: On-premises solutions hold a significant share as businesses in emerging economies prefer strong data protection and control over cloud alternatives.

- IoT Analytics Impact: IoT and analytics technologies enable actionable insights by analyzing large volumes of warehouse data, optimizing processes, and improving efficiency.

- Regional Leadership: North America leads the market with 39.9% revenue share, driven by proactive technology adoption and a favorable business environment for innovation.

- Competitive Strategy: Key players use automation, AI, and IoT to boost efficiency; strategies include collaborations and acquisitions for broader solution portfolios.

Use Cases

- Inventory Automation: Automated picking and tracking systems reduce manual errors, speed up inventory management, and support real-time stock updates for retailers and distributors.

- Transport Optimization: Integrated transport management applications streamline shipping, monitor fleet status, and optimize delivery schedules, enhancing efficiency for logistics companies.

- Order Fulfillment: Smart warehouses enable faster and more accurate order processing, improving customer experience for e-commerce and manufacturing sectors.

- Asset Tracking: RFID and IoT-enabled sensors track assets and equipment throughout warehouse operations, minimizing loss and facilitating preventive maintenance in industrial environments.

- Data-Driven Insights: IoT analytics collect and process operational data, offering actionable recommendations to reduce costs and boost productivity across warehouse functions.

- Remote Operations: Mobile and cloud-based solutions enable managers to monitor and control warehousing activities remotely, ideal for multi-location enterprises and supply chains.

- Pandemic Response: Adoption of robotics and automation minimizes physical contact, supports social distancing protocols, and maintains business continuity in challenging times.

Market Dynamic

Warehouses play an important role in the broader supply chain, yet labor-intensive tasks like order picking, inventory management, & asset tracking can hinder overall efficiency. To address these challenges, mobile-based technologies & applications have emerged as powerful tools, providing warehouse workers & logistics partners to look into a wealth of resources through smartphones & tablets.

These tools contain barcode scanning apps for inventory management, data retrieval, real-time shipment tracking, & streamlined report generation. Further, the concept of Warehouse 4.0 integrates digital & physical systems to optimize the entire warehouse process, from design & planning to supply chain & production, encouraging more efficient training processes, like voice-based & screen-directed inventory picking & restocking. In addition, the integration of

big data, IoT, wearables, data science, AR, AI, sensors, robotics, & high-level computing systems contributes to strong warehouse automation.

However, smaller businesses often lack their warehouses due to limited stock & financial constraints. These businesses may not fully grasp the benefits of smart warehousing solutions & may hesitate to upgrade their existing systems. Moreover, the high initial investments & costs associated with smart warehousing adoption pose barriers for many small &medium-sized organizations thus affecting the market growth.

Research Scope and Analysis

By Component

The Global Smart Warehousing Market is categorized by components into Hardware, Solutions, and Services, among which the hardware sector is the dominant segment in 2023, commanding the largest market share, which is largely driven by the broad adoption of hardware components, highly due to the convenience of usage of automated picking tools & inventory control systems through smartphones.

These technologies simplify inventory management processes & contribute to minimizing labor costs, thus making hardware solutions highly popular. Vendors have responded to the increase in demand for IoT, sensors, & AI technologies to optimize warehouse operations, designing & offering innovative smart warehousing hardware equipment, with the continued growth showcasing the important role hardware plays in enhancing efficiency & automation within the smart warehousing industry.

By Deployment

Based on deployment, the Global Smart Warehousing Market is divided into two primary segments, which are Cloud & on-premises, where, in 2023, the on-premises segment holds a significant share of the market, largely due to the preference of businesses in emerging economies for on-premises software solutions. The choice for on-premises deployment has attained traction in recent years due to the growth in data security & control it offers.

Many businesses in developing countries have looked for on-premises solutions, appreciating the strong data protection & privacy measures associated with such an approach, which aligns with their specific needs & regulatory requirements, making it a major driver of the market's growth in this segment.

By Technology

The Global Smart Warehousing Market is categorized by technology into distinct segments, including AI in Warehouse, IoT and Analytics, Automated Guided Vehicles (AGV), Blockchain in Warehouse, RFID, and other related technologies, where IoT analytics plays a major driving role by harnessing & analyzing the large amount of data collected from IoT devices, transforming this data into actionable insights.

It distantly aligns with Industrial IoT, displaying patterns in sensor data & offering recommendations like optimizing walking routes, efficient restocking of low-stock items, & improving inventory management. Furthermore, AI capabilities allow wearable technology within warehouses, enhancing operational efficiency. These technology segments all together contribute to the advancement of smart warehousing, revolutionizing the industry by leveraging data-driven insights &

intelligent solutions to streamline warehouse operations & enhance overall performance.

By Application

The Global Smart Warehousing Market is divided into various segments based on its applications, including Inventory Management, Transport Management, Yard Management, Order Management, Shipping Management, & other related functions. Transportation Management includes the comprehensive control & optimization of all transportation-related supply chain processes. Inventory Management includes the entire lifecycle of ordering, storing, utilizing, & selling a company's inventory, covering the storage, processing, & management of raw materials, components, & finished products.

Order Management is the process that initiates when an order is placed & entails acquiring, managing, & fulfilling customer orders, concluding when the customer receives their package. These segments play major roles in streamlining operations within the smart warehousing industry, enhancing overall efficiency & customer satisfaction.

The Smart Warehousing Market Report is segmented on the basis of the following

By Component

- Hardware

- Software

- Services

By Deployment

By Technology

- IoT & Analytics

- AI in Warehouse

- Automated Guided Vehicles

- RFID

- Blockchain in Warehouse

- Others

By Application

- Transport Management

- Inventory Management

- Order Management

- Yard Management

- Shipping Management

- Others

Regional Analysis

North America stands as the major driving force in the global smart warehousing market in 2023

contributing about 39.9% of the total revenue share, driven by its proactive adoption of advanced technologies, which is set to be a major catalyst driving the North American smart warehousing sector's growth.

Given its well-established reputation as an innovation hub, companies operating in the smart warehousing domain can anticipate a favorable environment for expansion within the North American market. The region's openness to cutting-edge solutions & a tech-savvy business landscape make it a promising arena for smart warehousing enterprises, fostering their opportunities for development & market success.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

In the Global Smart Warehousing Market, competition is intense, with key players looking to innovative technologies like automation, AI, & IoT to enhance warehouse efficiency & productivity. Market leaders often include acquisition strategies to increase their service portfolios, while emerging companies look into agile solutions targeting specific warehousing challenges. Collaborations with technology providers & logistics partners are common, as businesses seek to deliver comprehensive smart warehousing solutions, meeting the changing needs of diverse industries.

In February 2022, Oracle launched its Oracle Fusion Cloud Supply Chain & Manufacturing (SCM), which integrates with shippers' supply networks via a unified suite of cloud-based business applications, which mainly focuses on subsets within Oracle Fusion Cloud Global SCM, including Oracle Transportation Management (OTM) & Oracle Trade Management (GTM), to assist shippers enhance efficiency, reduce costs, mitigate risks, improve customer experience, & enhance adaptability to business disruptions across their global supply chains.

Some of the prominent players in the global Smart Warehousing Market are:

- SAP

- Oracle

- IBM

- Generix

- Infor

- Korber

- Reply

- Tecsys

- WareIQ

- PTC

- Other Key Players

Recent Developments

- In April 2025, Gorilla Technology Group formed a strategic partnership with Toyota Material Handling Solutions (Thailand) to develop advanced intelligent warehouse automation technologies, rolling out solutions across Toyota’s global network.

- In March 2025, Smart Warehousing was recognized as one of Fulfill.com's Top 50 US 3PL Companies for 2025, highlighting excellence in proprietary smart warehousing systems.

- In January 2024, Mahindra Logistics Limited announced a Rs. 170 crore investment to establish a smart warehousing facility in Phaltan, Maharashtra, serving automotive and engineering clients with advanced technology and sustainability features.

- In April 2024, Smart Warehousing acquired Beyond Warehousing, expanding its footprint to Kansas City and adding three new warehouse facilities to its network, enhancing supply chain solutions in the US Midwest.

- In September 2024, Swisslog showcased its latest smart warehouse automation solutions at the Saudi Logistics Expo, introducing new robotics and AI-driven products to the market.

- In January 2024, Mahindra Logistics expanded its multi-client warehousing capacity in Nashik, Maharashtra, completing a 100,000 sq. ft. extension and announcing a new 300,000 sq. ft. facility for smart logistics clients.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 21.9 Bn |

| Forecast Value (2032) |

USD 77.8 Bn |

| CAGR (2023–2032) |

15.1% |

| Historical Data |

2017 – 2022 |

| Forecast Data |

2023 – 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Hardware, Software, and Services), By Deployment (On-Premises and Cloud), By Technology (IoT & Analytics, AI in Warehouse, Automated Guided Vehicles, RFID, Blockchain in Warehouse, and Others), By Application (Transport Management, Inventory Management, Order Management, Yard Management, Shipping Management, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

SAP, Oracle, IBM, Generix, Infor, Körber, Reply, Tecsys, WareIQ, PTC, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Smart Warehousing Market size is estimated to have a value of USD 21.9 billion in 2023 and

is expected to reach USD 77.8 billion by the end of 2032.

North America has the largest market share for the Global Smart Warehousing Market with a share of

about 39.9% in 2023.

Some of the major key players in the Global Smart Warehousing Market are SAP, Oracle, IBM, and many

others.

The market is growing at a CAGR of 15.1 percent over the forecasted period.