Market Overview

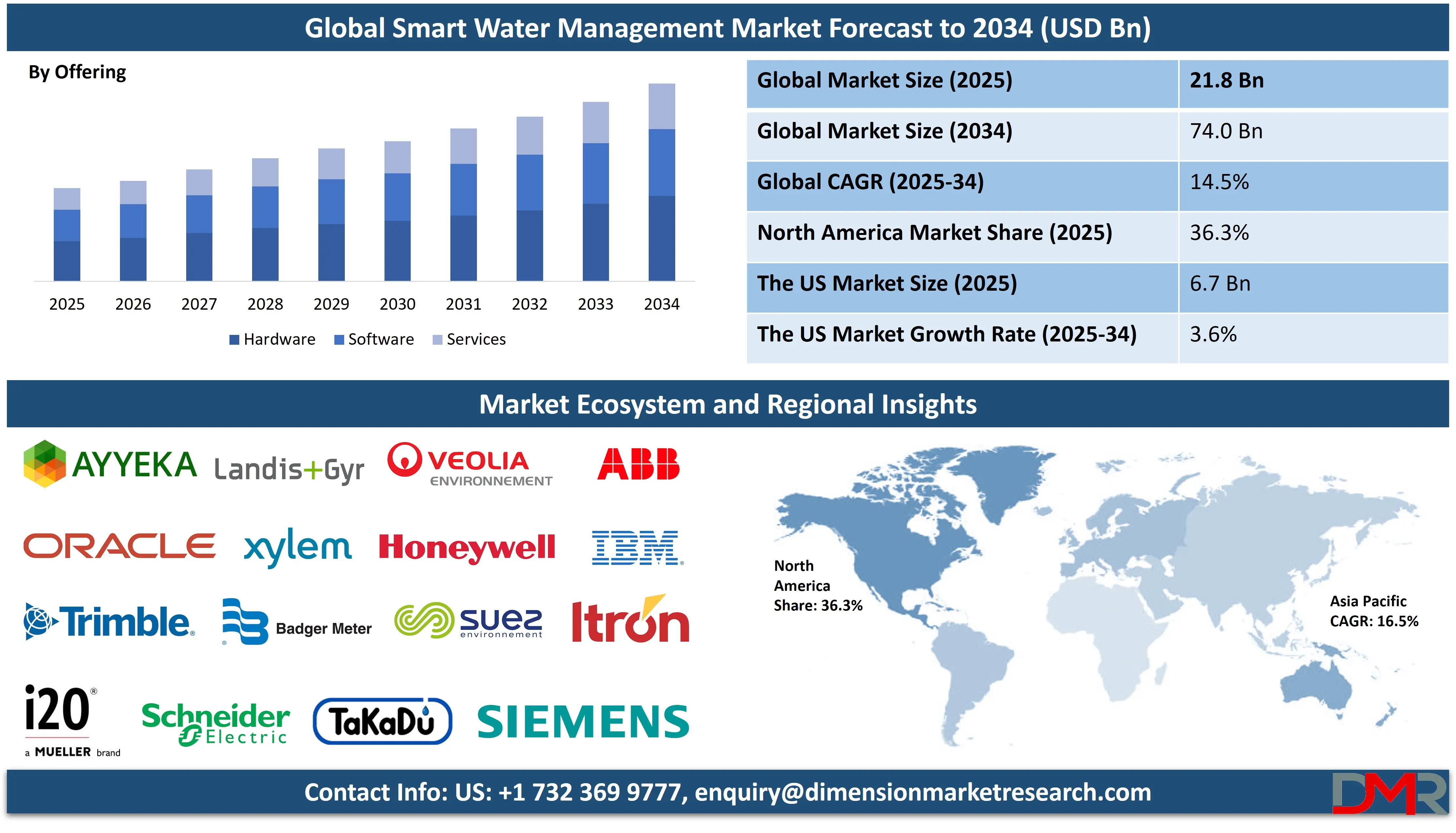

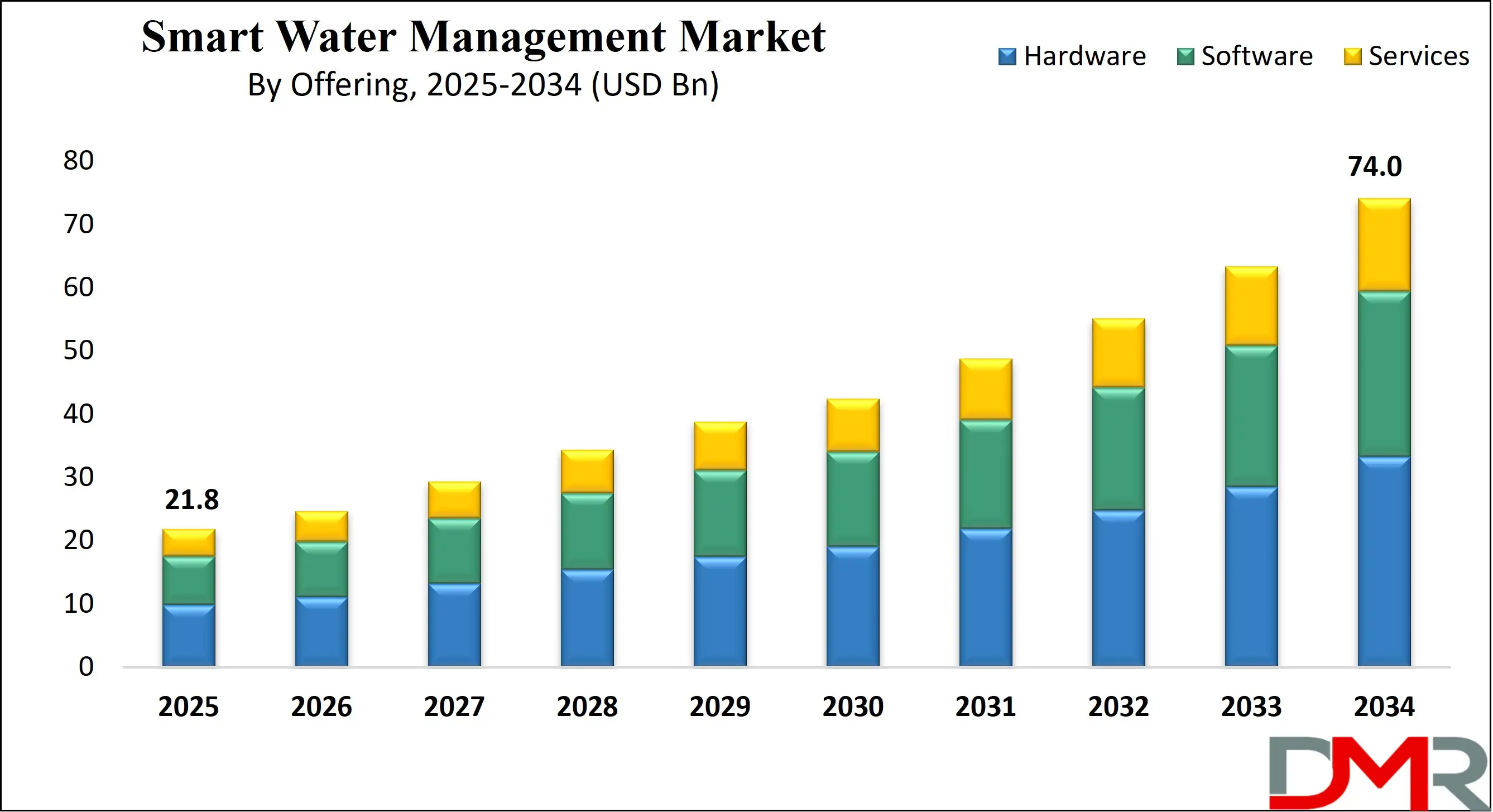

Global Smart Water Management Market size is projected to reach USD 21.8 billion in 2025 and is projected to reach USD 74.0 billion by 2034 at a CAGR of 14.5%.This strong growth trajectory underscores rising investments in digital water infrastructure, IoT-enabled monitoring systems, and AI-powered analytics that enhance water efficiency, resource optimization, and sustainability.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Increasing global focus on

smart city initiatives,

leak detection,

pressure management, and

real-time data analytics is driving the market’s expansion. Moreover, utilities are prioritizing

cloud-based water management,

predictive maintenance, and

automated metering infrastructure (AMI) to modernize legacy systems. Government incentives,

climate resilience policies, and

industrial digital transformation further accelerate adoption, positioning smart water management as a key enabler of

sustainable urban water ecosystems worldwide.

The global smart water management market is evolving rapidly, driven by the urgent need to address water scarcity and modernize aging infrastructure. A key trend is the integration of Artificial Intelligence and Machine Learning with data from advanced metering infrastructure. These technologies enable utilities to move beyond simple consumption tracking to predictive analytics, forecasting demand patterns, and identifying potential pipe failures before they occur. This shift from reactive maintenance to a proactive, data-centric approach allows for optimized water distribution, reduced energy consumption for pumping, and significant cost savings. The transformation is fundamentally changing how water networks are managed, making them more resilient and intelligent.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Substantial growth opportunities exist in the developing nations of Asia-Pacific and Latin America, where rapid urbanization and industrial expansion are placing immense strain on existing water resources. Governments in these regions are increasingly investing in smart city initiatives, where efficient water management is a core component. This creates a fertile ground for deploying smart sensors, IoT-based water quality monitoring systems, and data analytics platforms. Furthermore, the agricultural sector, which is the largest consumer of freshwater globally, presents a massive opportunity for the adoption of smart irrigation systems that use soil moisture sensors and weather data to optimize water use, enhancing crop yield while conserving a vital resource.

The US Smart Water Management Market

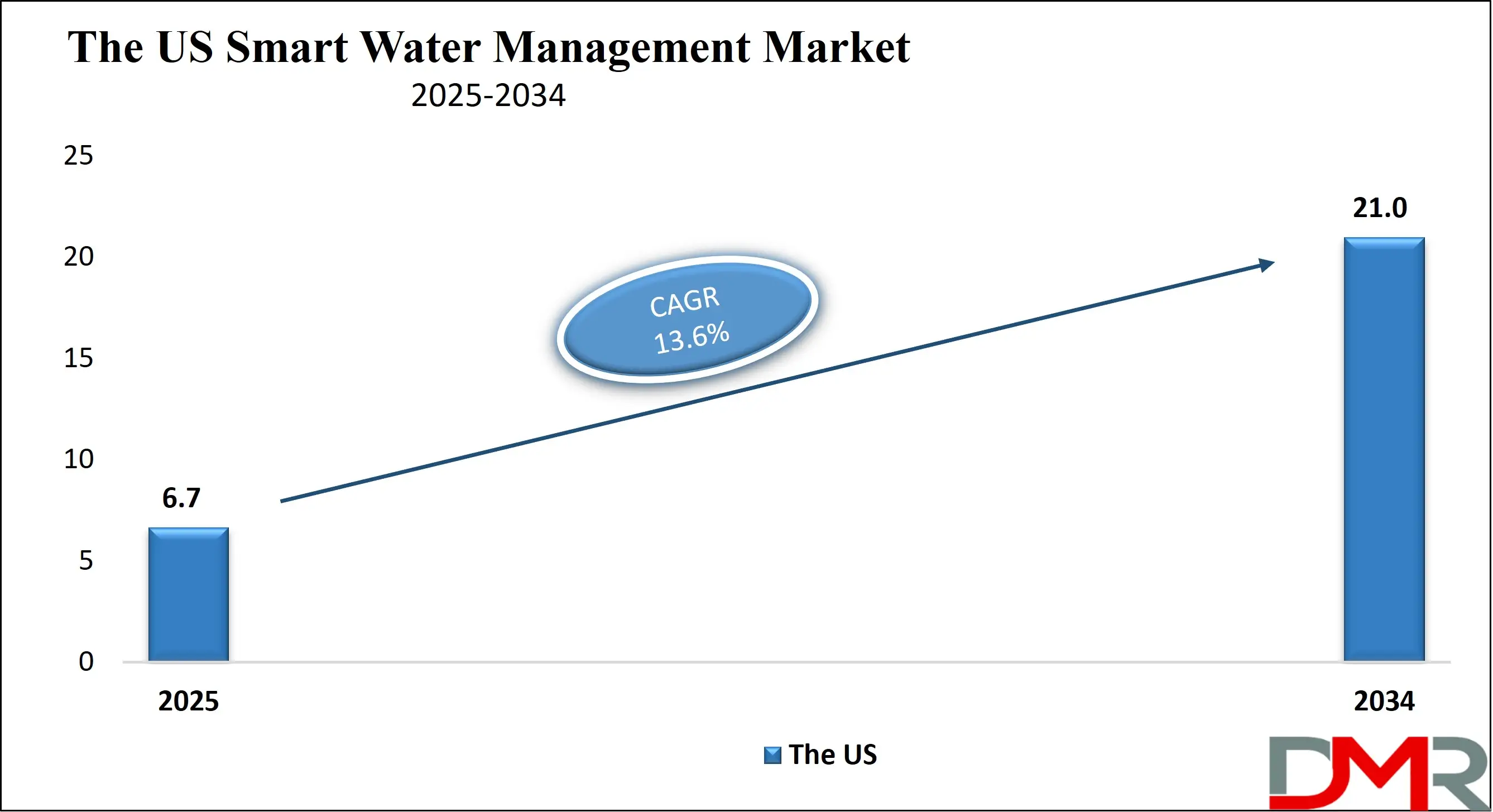

The U.S. Smart Water Management Market is projected to reach USD 6.7 billion in 2025 and expand at a CAGR of 13.6% through 2034, reaching approximately USD 21.0 billion. Growth is driven by aging water infrastructure modernization, increased federal funding for smart utilities, and the deployment of Advanced Metering Infrastructure (AMI) across municipalities.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Utilities are leveraging IoT-enabled sensors, AI-based leak detection, and real-time data analytics to enhance water distribution efficiency and reduce non-revenue water. Rising environmental concerns, climate adaptation policies, and digital transformation in public utilities are propelling market expansion. Key players in the U.S. market are integrating cloud-based platforms, machine learning algorithms, and automated control systems to ensure sustainable water resource management and compliance with EPA water efficiency standards.

The United States Smart Water Management market is propelled by a critical need to address its aging water infrastructure and respond to increasing water stress, particularly in the western states. Federal agencies are actively driving modernization efforts. The Environmental Protection Agency (EPA) highlights that an estimated 6 billion gallons of treated water are lost each day in the U.S. due to leaking pipes, underscoring a massive opportunity for advanced leak detection technologies.

Furthermore, the Bipartisan Infrastructure Law allocates unprecedented funding, including USD 55 billion dedicated to water infrastructure, with a significant portion earmarked for replacing lead service lines and upgrading aging plants and pipes, creating a direct impetus for smart water solutions. The U.S. Geological Survey reports that water withdrawals for public supply have remained relatively stable despite population growth, suggesting a growing need for efficiency, which smart metering and demand management systems can provide. The demographic concentration in urban centers and the agricultural demands of states like California create a diverse testing ground for smart irrigation and urban water management technologies, supported by federal data and funding initiatives.

Europe Smart Water Management Market

The Europe Smart Water Management Market is estimated to reach USD 5.9 billion in 2025 and grow at a CAGR of 14.1% to attain a value of USD 20.3 billion by 2034. Growth is underpinned by stringent EU Water Framework Directive regulations, increased investment in climate-resilient infrastructure, and the adoption of AI-driven predictive analytics for network optimization.

European utilities are implementing SCADA systems, smart meters, and digital twins to manage water flow, reduce leakage, and improve operational transparency. Countries like Germany, the U.K., and France are leading in IoT integration, cloud-based water monitoring, and data interoperability frameworks. Growing emphasis on sustainability, carbon neutrality, and circular water economy initiatives positions Europe as a pioneer in next-generation smart water governance.

The European Smart Water Management market is heavily influenced by stringent environmental regulations and a strong policy framework aimed at sustainability and circular economy principles. The European Commission's European Green Deal, particularly its Zero Pollution Action Plan, sets ambitious targets for improving water quality and efficiency, directly encouraging the adoption of smart monitoring and control systems. Legislation like the Water Framework Directive mandates member states to achieve 'good status' for all water bodies, which requires sophisticated networks of sensors to monitor pollution in real-time.

The European Environment Agency consistently reports on water scarcity conditions in southern Europe, with countries like Spain, Italy, and Greece experiencing high water stress, driving investment in smart irrigation and water reuse technologies. Demographic factors, including the high percentage of population connected to urban water supply networks, create a concentrated demand for advanced water distribution management. Initiatives funded through EU programs like Horizon Europe support innovation in areas such as digital water management, positioning the region as a leader in regulatory-driven technological adoption for resource preservation and infrastructure resilience.

Japan Smart Water Management Market

The Japan Smart Water Management Market is expected to be valued at USD 2.1 billion in 2025 and grow at a CAGR of 15.2%, reaching around USD 7.5 billion by 2034. Rapid urbanization, smart city development, and disaster-resilient water infrastructure drive market growth. Japan’s utilities are adopting IoT-enabled metering systems, AI-based pressure management, and advanced analytics platforms to ensure efficient water allocation and leak prevention.

The country’s strong focus on automation, robotic inspection, and predictive maintenance enhances real-time system responsiveness. Additionally, collaboration between public agencies and private tech firms supports innovation in cloud-based water data management and energy-efficient treatment solutions. Japan’s long-term sustainability agenda and digital water transformation strategy position it as a regional leader in intelligent water infrastructure modernization.

Japan's Smart Water Management market is uniquely shaped by its demographic challenges and vulnerability to natural disasters. The country's rapidly aging population and declining workforce, as documented by the Ministry of Internal Affairs and Communications, create a pressing need for automation in public utility operations to maintain service levels with fewer personnel. This demographic shift is a powerful driver for remote monitoring and automated control systems. Furthermore, Japan's Ministry of Land, Infrastructure, Transport and Tourism (MLIT) actively promotes the renovation and modernization of social infrastructure, including waterworks, to enhance resilience against earthquakes.

The MLIT's policies encourage water utilities to adopt advanced technologies like district metered areas and acoustic sensors for rapid leak detection, crucial in a nation where a significant portion of its water pipes were laid during periods of rapid economic growth and are now nearing the end of their service life. The government's "Society 5.0" initiative, which aims to integrate cyberspace and physical space, also provides a strategic framework for implementing IoT and Big Data analytics in water resource management, making the system more efficient and disaster-resistant.

Global Smart Water Management Market: Key Takeaways

- Strong Market Growth Outlook: The Global Smart Water Management Market is projected to reach USD 74.0 billion by 2034, growing from USD 21.8 billion in 2025, driven by rapid digital transformation, water conservation initiatives, and increasing infrastructure modernization.

- Impressive Compound Annual Growth Rate (CAGR): The market is expanding at a CAGR of 14.5% (2025–2034), underscoring strong demand for IoT-enabled monitoring systems, AI-driven analytics, and automated water management solutions across diverse end-use sectors.

- Robust U.S. Market Expansion: The U.S. Smart Water Management Market is expected to grow from USD 6.7 billion in 2025 to USD 21.0 billion by 2034, at a CAGR of 13.6%, supported by rising government funding, smart infrastructure projects, and adoption of Advanced Metering Infrastructure (AMI).

- North America Leads the Global Market: North America is anticipated to dominate the global landscape with a 36.3% market share in 2025, owing to early adoption of digital water technologies, strong regulatory support, and the modernization of aging water systems.

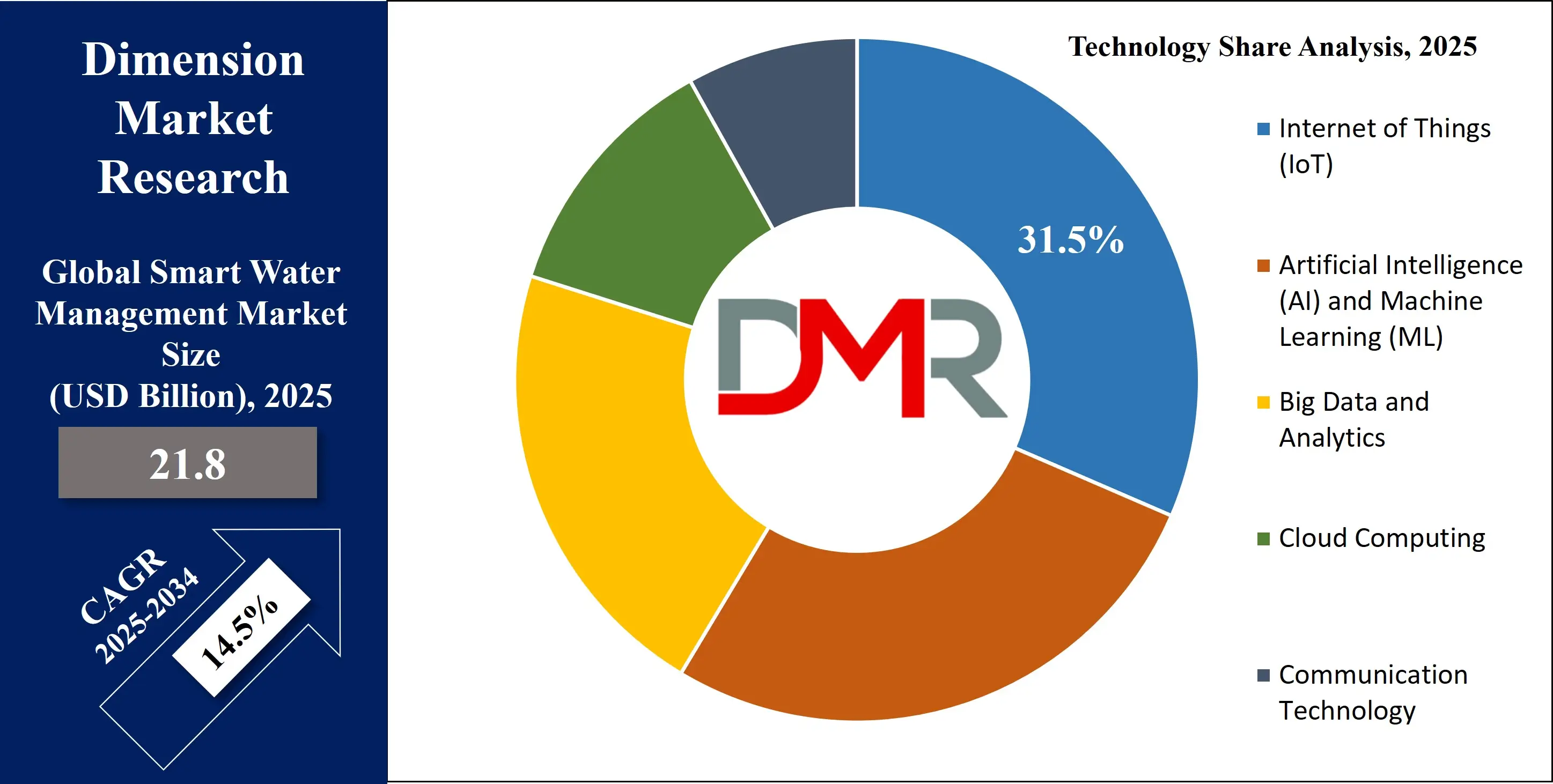

- Technological Integration Driving Growth: Integration of IoT, Artificial Intelligence (AI), Machine Learning (ML), Big Data, and Cloud Computing is revolutionizing water management by enabling real-time monitoring, predictive maintenance, and data-driven decision-making.

- Presence of Prominent Industry Players: Key players such as ABB Ltd., IBM Corporation, Itron Inc., Schneider Electric SE, Siemens AG, SUEZ Group, Veolia Environnement, Honeywell International Inc., Xylem Inc., and Badger Meter Inc. are driving innovation through strategic partnerships, product enhancements, and smart infrastructure deployments.

Global Smart Water Management Market: Use Cases

- Advanced Leak Detection: Utilities deploy acoustic sensors and pressure loggers across distribution networks, using cloud analytics to pinpoint the exact location of hidden leaks in real-time, drastically reducing non-revenue water loss.

- Smart Irrigation: Agricultural producers use in-field soil moisture probes connected to cloud platforms, which automatically adjust irrigation schedules to deliver precise water amounts only when and where needed, optimizing crop health and conserving water.

- Water Quality Monitoring: Municipalities install networked multi-parameter sondes in reservoirs and pipelines, continuously measuring chlorine, pH, and turbidity to ensure regulatory compliance and trigger immediate alerts for contamination events, protecting public health.

- Demand Forecasting for Utilities: Water treatment plants leverage AI models that analyze historical consumption data, weather forecasts, and event calendars to predict daily demand, allowing for optimized pump scheduling and chemical dosing to reduce energy and operational costs.

- Consumer Portal & Alerts: End-users access web portals showing their hourly water use, receive high-usage alerts via text message for potential leaks, and compare their consumption to neighbors, promoting conservation and enabling quick leak resolution.

Impact of Artificial Intelligence on the global Smart Water Management Market

-

- Predictive Maintenance: AI enables predictive analytics to anticipate equipment failures, optimize maintenance schedules, and reduce downtime, improving water infrastructure reliability and lowering operational costs across utilities and industrial facilities.

- Leak Detection and Prevention: AI algorithms analyze sensor data to detect leaks in real time, minimizing water loss, enhancing resource efficiency, and preventing non-revenue water across municipal and industrial networks.

- Demand Forecasting: AI enhances demand prediction by analyzing consumption patterns, weather data, and user behavior, enabling utilities to balance supply and optimize water distribution with greater accuracy.

- Smart Decision-Making: AI-driven insights support data-based decision-making for water quality management, resource allocation, and sustainability planning, ensuring long-term efficiency and compliance with environmental regulations.

- Operational Automation: AI automates control systems for pumps, valves, and pressure zones, streamlining operations, reducing manual intervention, and improving responsiveness to fluctuating water demand and system anomalies.

Global Smart Water Management Market: Stats & Facts

United Nations (UN) / UN-Water

- Approximately 2.2 billion people lack access to safely managed drinking water services.

- Over 80% of the world’s wastewater is released into the environment without adequate treatment.

- Global water demand is projected to increase by 20-30% by 2050.

- Water scarcity already affects every continent on earth.

World Health Organization (WHO)

- Achieving universal coverage by 2030 requires a quadrupling of current rates of progress in drinking water, sanitation, and hygiene.

- In 2022, 2.5 billion people lived in water-stressed countries.

- Every USD 1.0 invested in water and sanitation provides a USD 4.3 return in the form of reduced healthcare costs.

U.S. Environmental Protection Agency (EPA)

- The average U.S. family uses more than 300 gallons of water per day at home.

- An estimated 6 billion gallons of treated water are lost each day in the U.S. due to leaking pipes.

- The Bipartisan Infrastructure Law invests over USD 50 billion in the EPA’s water programs.

U.S. Geological Survey (USGS)

- In 2015, total water withdrawals in the U.S. were 322 billion gallons per day.

- Thermoelectric power and irrigation accounted for 84% of total water withdrawals.

- Public supply withdrawals were 39 billion gallons per day, serving about 87% of the U.S. population.

European Environment Agency (EEA)

- Around 20-40% of Europe's total water abstracted is lost in distribution systems.

- At least 60% of the European river basin districts are unlikely to achieve the 'good status' objective by 2027.

- Water scarcity affects 20% of the European territory and 30% of Europeans on average every year.

Government of Canada

- The average Canadian uses approximately 220 liters of water per day for residential purposes.

- Municipalities account for 12% of water use in Canada, behind manufacturing and thermal power generation.

Australian Bureau of Statistics / Bureau of Meteorology

- In 2019-20, Australia's total water consumption was 14,101 gigaliters, a 25% decrease from the previous year due to drought.

- Agriculture remained the largest consumer of water, accounting for 55% of total water consumption.

Government of India (Ministry of Jal Shakti)

- The average annual per capita water availability in India is projected to reduce to 1,367 cubic meters by 2031.

- The Atal Mission for Rejuvenation and Urban Transformation (AMRUT) has approved water supply projects worth billions of dollars.

Japan Ministry of Health, Labour and Welfare

- The nationwide average water leakage rate in Japan has been reduced to just 3.2% through advanced management.

- The penetration rate of advanced water treatment in Japan reached 99.9% as of 2022.

Singapore Public Utilities Board (PUB)

- Singapore's water demand is projected to almost double by 2060.

- The country aims to collect every drop of water and reuse it endlessly, with NEWater and desalination meeting up to 85% of future demand.

Israel Water Authority

- Over 90% of Israel's wastewater is treated and reused, primarily for agricultural irrigation.

- Drip irrigation, pioneered in Israel, achieves water-use efficiency of up to 95%.

World Bank

- If current trends continue, 1.6 billion people will live in countries or regions with absolute water scarcity by 2050.

- The cost of a drought in an urban economy is, on average, four times greater than that of a flood.

Global Smart Water Management Market: Market Dynamics

Global Smart Water Management Market: Driving Factors

Escalating Global Water Scarcity and Stress

The increasing frequency and severity of droughts, coupled with population growth and economic development, are depleting freshwater resources in many regions. This physical scarcity is a powerful, non-negotiable driver for the adoption of smart water technologies. Systems that enable precise monitoring of water loss, promote demand-side conservation through consumer portals, and optimize the distribution of limited supplies are no longer a luxury but a necessity for urban resilience and agricultural sustainability. This fundamental pressure ensures long-term, sustained demand for solutions that can do more with less water.

Government Regulations and Funding Initiatives

Stringent environmental regulations, such as the EU's Water Framework Directive and SDG 6 globally, mandate improved water quality and efficiency, compelling utilities to invest in monitoring and control systems. More directly, massive public funding programs, like the U.S. Bipartisan Infrastructure Law's USD 55 billion investment in water infrastructure, provide the crucial capital for modernization projects that include smart technologies. These regulatory and financial pushes from governments lower the adoption barrier for utilities and create a stable, policy-driven market for smart water management solutions, accelerating their deployment.

Global Smart Water Management Market: Restraints

High Initial Capital Investment and Budgetary Constraints

The upfront cost of deploying a comprehensive smart water management system is substantial. This includes not only the hardware like smart meters and sensors but also the communication networks, data management software, and cloud computing services. For many municipal water utilities, particularly in developing nations or smaller communities, these capital expenditures are prohibitive within existing budgets. The lengthy process required to demonstrate a clear return on investment to city councils and taxpayers can significantly delay procurement and implementation, acting as a major brake on market growth.

Fragmented Data Systems and Cybersecurity Concerns

The water industry often suffers from legacy infrastructure and siloed data systems that are not easily integrated with new, proprietary smart technologies. This lack of interoperability creates significant technical hurdles for creating a unified, intelligent network. Compounding this issue are growing and valid concerns about cybersecurity. As water systems become more connected and data-driven, they become more vulnerable to cyber-attacks that could disrupt supply or compromise water quality. The perceived risk and the cost of ensuring robust cybersecurity can deter utilities from full-scale adoption of interconnected smart systems.

Global Smart Water Management Market: Opportunities

Expansion in the Agricultural Sector

Agriculture is the largest consumer of freshwater globally, yet its efficiency levels are often low. This represents the single largest growth opportunity for smart water management. The adoption of sensor-based smart irrigation systems, which use soil moisture data and evapotranspiration rates to automate watering, can dramatically reduce water use while improving crop yields. As water rights and availability become more volatile, the economic and sustainability case for these technologies becomes overwhelmingly strong for farmers and large agricultural enterprises, opening up a vast, largely untapped market.

Development of Smart Cities and Urban Resilience Projects

The global smart city movement inherently includes water management as a critical utility. New urban developments and city modernization projects are increasingly embedding smart water grids from the outset. These projects create integrated opportunities for deploying advanced metering infrastructure (AMI), real-time water quality sensors, and centralized data analytics platforms. Furthermore, as cities seek to become more resilient to climate shocks, investing in intelligent water networks that can quickly detect leaks, manage stormwater, and ensure supply during disruptions is a top priority, driving significant public and private investment.

Global Smart Water Management Market: Trends

Integration of AI and Predictive Analytics

The industry is moving beyond simple data collection from IoT sensors towards sophisticated artificial intelligence and machine learning models. These systems analyze vast datasets on flow, pressure, and water quality to predict equipment failures, optimize pump schedules for energy efficiency, and forecast district-level demand with high accuracy. This transforms utility operations from a reactive posture to a proactive, predictive management model, minimizing downtime and operational costs while enhancing service reliability and infrastructure longevity. The ability to anticipate problems before they occur is a game-changer for resource allocation and capital planning.

Rise of Digital Twin Technology

Digital twins, which are dynamic virtual replicas of physical water infrastructure, are becoming a central trend. These models are fed with real-time data from sensors, allowing operators to simulate system behavior under various conditions, from routine operations to extreme weather events. This enables utilities to test intervention strategies, plan infrastructure expansions with greater confidence, and train personnel in a risk-free environment. The technology provides a powerful tool for improving resilience, optimizing asset performance, and de-risking major investment decisions by providing a clear view of potential outcomes before any physical work begins.

Global Smart Water Management Market: Research Scope and Analysis

By Offering Analysis

The hardware segment is expected to hold the largest share in the global Smart Water Management Market due to its essential role in modernizing physical water infrastructure. Components such as Advanced Metering Infrastructure (AMI) meters, Automated Meter Reading (AMR) systems, sensors, controllers, and smart flow meters form the backbone of intelligent water networks.

Governments and utilities worldwide are investing heavily in upgrading legacy pipelines and metering systems to achieve higher operational efficiency, accuracy, and real-time monitoring capabilities. The rapid expansion of IoT-enabled smart meters has fueled the adoption of intelligent devices capable of two-way communication, enhancing data accuracy and billing transparency. Additionally, water utilities are prioritizing infrastructure renewal programs to tackle aging distribution systems and reduce non-revenue water (NRW).

The integration of hardware with digital technologies such as AI and Big Data analytics ensures real-time tracking of pressure, leakage, and consumption, which significantly optimizes performance and reduces losses. As cities transition toward smart urban ecosystems, the demand for connected and automated field devices continues to surge. The hardware segment remains indispensable for enabling data-driven decision-making and sustainable resource management, positioning it as the dominant offering category in the global market.

By Solution Analysis

The SCADA segment is poised to lead the Smart Water Management Market among all solutions and functions, serving as the operational nerve center of modern water utilities. SCADA systems provide centralized, real-time monitoring and control of complex water distribution and wastewater treatment processes. These systems integrate data from sensors, meters, and controllers across vast geographic areas, enabling operators to visualize system performance, detect anomalies, and respond promptly to faults.

Utilities rely on SCADA to maintain optimal water pressure, ensure quality compliance, and minimize energy consumption. The increasing focus on automation, remote management, and resilience against cyber threats has further accelerated SCADA adoption globally. Moreover, the integration of AI-driven analytics and cloud-based SCADA platforms enhances predictive maintenance, allowing utilities to preemptively address potential failures and leakage risks.

In regions facing water scarcity, SCADA supports adaptive management strategies by balancing supply-demand dynamics efficiently. The versatility of SCADA in integrating with Meter Data Management (MDM) and Advanced Pressure Management systems makes it a critical enabler of digital water transformation. Its proven reliability, scalability, and compatibility with advanced IoT networks reinforce SCADA’s dominance as the cornerstone solution for achieving operational excellence and sustainability in the smart water management ecosystem.

By Technology Analysis

The Internet of Things (IoT) is projected to dominates the technology segment of the Smart Water Management Market, serving as the foundation for intelligent data exchange, automation, and system optimization. IoT enables seamless interconnectivity among sensors, meters, controllers, and cloud platforms, transforming traditional water infrastructure into real-time digital ecosystems.

With the proliferation of IoT-enabled devices, utilities can monitor parameters such as flow rate, pressure, leakage, and water quality remotely and continuously. This connectivity empowers decision-makers to act promptly, minimizing losses and improving service reliability. The IoT framework underpins smart water initiatives by supporting predictive maintenance, data-driven forecasting, and dynamic resource allocation. Governments and municipalities across North America, Europe, and Asia-Pacific are increasingly adopting IoT networks such as NB-IoT, LoRaWAN, and Sigfox to enhance urban water resilience.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Furthermore, the synergy between IoT and AI analytics facilitates autonomous water distribution adjustments, reducing human error and operational costs. Cloud-based IoT architectures also ensure scalability, enabling integration with SCADA, MDM, and smart irrigation systems. As the demand for sustainable water solutions intensifies globally, IoT’s ability to deliver transparency, efficiency, and real-time intelligence establishes it as the dominant technology driving the digital evolution of water utilities.

By End-Use Vertical Analysis

The industrial sector is projected to hold the dominant share in the Smart Water Management Market, driven by the urgent need for efficient water utilization, process optimization, and compliance with environmental regulations. Industries such as manufacturing, energy, agriculture, and mining depend heavily on consistent water supply and treatment systems to maintain operational efficiency. Smart water technologies empower industries to track water consumption, detect leaks, and recycle wastewater with precision. Integration of IoT sensors, AI-based analytics, and cloud platforms enables predictive monitoring and optimization of water-intensive operations.

Moreover, rising sustainability mandates and corporate ESG commitments are pushing industries toward adopting smart solutions for resource conservation and carbon footprint reduction. In regions like North America, Europe, and Asia-Pacific, large-scale industrial facilities are deploying SCADA and Enterprise Asset Management (EAM) systems for centralized control, ensuring compliance with water discharge and quality standards. The industrial segment also benefits from government incentives promoting smart manufacturing and water stewardship.

As water scarcity intensifies globally, industries are leveraging advanced pressure management and smart irrigation systems to reduce waste. With strong financial capabilities and rapid digital transformation, the industrial sector continues to dominate the end-use vertical landscape, setting benchmarks for efficiency, innovation, and sustainability in smart water management.

The Smart Water Management Market Report is segmented on the basis of the following

By Offering

- Automated Meter Reading (AMR) meters

- Advanced Metering Infrastructure (AMI) meters

- Sensors

- Water Flow Meters

- Controllers

- System Integration

- Consulting

- Implementation

- Outsourced Operations

- Maintenance

By Solution

- Meter Data Management (MDM)

- Advanced Pressure Management

- Supervisory Control and Data Acquisition (SCADA)

- Advanced Analytics

- Network Monitoring

- Leak Detection

- Smart Irrigation Management

- Enterprise Asset Management (EAM)

By Technology

- Internet of Things (IoT)

- Artificial Intelligence (AI) and Machine Learning (ML)

- Big Data and Analytics

- Cloud Computing

- Communication Technology

By End-Use Vertical

- Industrial

- Residential

- Commercial

Global Smart Water Management Market: Regional Analysis

Region with Highest Market Share

North America is projected to dominates the global Smart Water Management Market as it is poised to hold 36.3% of the market share by the end of 2025, due to its early adoption of digital water infrastructure, advanced IoT integration, and strong regulatory support from agencies such as the EPA promoting sustainable water usage. The region’s aging water infrastructure has prompted massive investments in Advanced Metering Infrastructure (AMI), SCADA systems, and AI-driven analytics for efficient resource management.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

High penetration of cloud-based platforms, predictive maintenance solutions, and automated leak detection systems further enhances operational performance. The U.S. and Canada lead in deploying smart city initiatives and utility modernization programs, driven by public-private partnerships and technological innovation. Additionally, key industry players headquartered in North America such as Xylem, IBM, and Honeywell continuously advance digital water solutions, ensuring the region maintains its dominance through superior innovation, scalability, and infrastructure resilience.

Region with Highest CAGR

Asia-Pacific exhibits the highest CAGR in the global Smart Water Management Market, driven by rapid urbanization, increasing water scarcity, and large-scale smart city projects across countries like China, Japan, India, and South Korea. Governments are investing heavily in IoT-based monitoring, AI-powered analytics, and cloud-integrated water management systems to improve efficiency and address non-revenue water issues.

Rising industrialization and population growth amplify the demand for real-time water quality monitoring and intelligent distribution networks. Additionally, the region benefits from digital transformation initiatives and international collaborations that accelerate technology adoption. Japan leads in automation and disaster-resilient infrastructure, while China and India prioritize sustainability and infrastructure digitization. With supportive government policies, lower deployment costs, and increasing private investments, Asia-Pacific continues to emerge as the fastest-growing market, shaping the future of smart water innovation and urban resilience.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

Global Smart Water Management Market: Competitive Landscape

The Global Smart Water Management Market is highly competitive, characterized by technological innovation, strategic collaborations, and extensive investments in infrastructure modernization. Leading players such as ABB Ltd., IBM Corporation, Schneider Electric SE, Siemens AG, SUEZ Group, Veolia Environnement, Honeywell International Inc., Xylem Inc., Itron Inc., and Badger Meter Inc. dominate through their comprehensive portfolios spanning IoT-enabled sensors, AI-driven analytics, Advanced Metering Infrastructure (AMI), and SCADA systems. These companies leverage advanced data platforms and automation technologies to enhance water efficiency, optimize asset performance, and ensure regulatory compliance.

Market leaders are expanding through mergers, acquisitions, and partnerships with municipal utilities and technology firms to strengthen their digital ecosystems. For instance, integration of cloud-based analytics, machine learning, and predictive maintenance systems has become central to improving operational visibility and minimizing non-revenue water. Emerging companies such as Kamstrup A/S, Arad Group, TaKaDu Ltd., HydroPoint Data Systems, and Ayyeka Technologies are gaining traction by offering specialized smart metering and leak detection solutions with scalable deployment models.

Some of the prominent players in the global Smart Water Management Market are

- ABB Ltd.

- IBM Corporation

- Itron Inc.

- Schneider Electric SE

- Siemens AG

- SUEZ Group

- Veolia Environnement

- Honeywell International Inc.

- Xylem Inc.

- Badger Meter Inc.

- Landis+Gyr AG

- Trimble Inc.

- Oracle Corporation

- Arad Group

- Kamstrup A/S

- HydroPoint Data Systems

- i2O Water Ltd

- TaKaDu Ltd.

- Neptune Technology Group Inc.

- Ayyeka Technologies

- Other Key Players

Global Smart Water Management Market: Recent Developments

- October 2025: Xylem announced the sale of its metering assets outside North America to AURELIUS, aiming to streamline its portfolio and enhance global focus on digital water solutions, smart infrastructure, and next-generation water analytics technologies.

- September 2025: Ayyeka secured new funding and expanded its IoT-based remote monitoring solutions for smart water and environmental systems, supporting broader commercialization, international market entry, and innovation in edge-based sensor communication technologies.

- August 2025: Itron partnered with Fiji’s national water utility to deploy Advanced Metering Infrastructure (AMI) systems, enhancing water efficiency, leak detection, and real-time billing accuracy across the Pacific region through smart metering technology.

- June 2025: Industry research projected significant growth in smart water metering, emphasizing expanding adoption of AMI and analytics solutions in Europe and North America to modernize aging water infrastructure and enhance operational transparency.

- June 2025: Multiple mergers and acquisitions reshaped the global smart water market, as companies pursued scalability, digital innovation, and sustainability to strengthen competitive positioning and address challenges in infrastructure modernization.

- December 2024: Kamstrup showcased smart metering advancements and sustainability initiatives at global expos, emphasizing data-driven water management solutions for municipal utilities to improve efficiency, monitoring, and environmental compliance.

- June 2024: Kamstrup was recognized among Georgia’s Fast 40 companies, highlighting strong growth in its U.S. smart metering operations and rising demand for connected water management technologies.

- March 2024: TaKaDu received global recognition for its predictive analytics and leak detection platforms, reinforcing its leadership in smart water network monitoring and operational optimization for utilities worldwide.

- January 2024: TaKaDu and Syrinix strengthened their collaboration to integrate predictive analytics and sensor technologies, enabling utilities to enhance water distribution visibility, reduce non-revenue water, and optimize infrastructure maintenance.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 21.8 Bn |

| Forecast Value (2034) |

USD 74.0 Bn |

| CAGR (2025–2034) |

14.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 6.7 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Offering (Hardware, Software, and Services), By Solution/Function (Meter Data Management (MDM), Advanced Pressure Management, Supervisory Control and Data Acquisition (SCADA), Advanced Analytics, Network Monitoring, Leak Detection, Smart Irrigation Management, Enterprise Asset Management (EAM)), By Technology (Internet of Things (IoT), Artificial Intelligence (AI) and Machine Learning (ML), Big Data and Analytics, Cloud Computing, and Communication Technology) By End-Use Vertical (Industrial, Residential, and Commercial) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

ABB Ltd., IBM Corporation, Itron Inc., Schneider Electric SE, Siemens AG, SUEZ Group, Veolia Environnement, Honeywell International Inc., Xylem Inc., Badger Meter Inc., Landis+Gyr AG, Trimble Inc., Oracle Corporation, Arad Group, Kamstrup A/S, HydroPoint Data Systems, i2O Water Ltd., TaKaDu Ltd., Neptune Technology Group Inc., Ayyeka Technologies., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Smart Water Management Market?

▾ The global Smart Water Management Market size is estimated to have a value of USD 21.8 billion in 2025 and is expected to reach USD 74.0 billion by the end of 2034.

What is the growth rate of the global Smart Water Management Market?

▾ The market is growing at a CAGR of 14.5 percent over the forecasted period.

What is the size of the US Smart Water Management Market?

▾ The US Smart Water Management Market is projected to be valued at USD 6.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 21.0 billion in 2034 at a CAGR of 13.6%.

Which region accounted for the largest global Smart Water Management Market?

▾ North America is expected to have the largest market share in the global Smart Water Management Market, with a share of about 36.3% in 2025.

Who are the key players in the global Smart Water Management Market?

▾ Some of the major key players in the global Smart Water Management Market are ABB Ltd., IBM Corporation, Itron Inc., Schneider Electric SE, Siemens AG, SUEZ Group, Veolia Environnement, Honeywell International Inc., Xylem Inc., Badger Meter Inc, and Others.