Market Overview

The Global

Smart Weapons Technology Market is expected to reach a

value of USD 20.8 billion in 2023, and it is further anticipated to reach a market value of

USD 36.5 billion by 2032 at a

CAGR of 6.4%.

Smart weapons technology includes emerging

military innovations like directed energy weapons, railguns, and hypersonic missiles, which aim for greater precision, speed, range, & power in comparison to current weaponry, including advanced science & engineering principles.

Further, major military forces are intensely researching & developing these systems to gain strategic advantages in future conflicts. The introduction of these smart weapons has the potential to revolutionize warfare by pushing the boundaries of capabilities in speed, accuracy, lethality, and more.

The COVID-19 pandemic brought unprecedented challenges to the defense industry, disrupting operations globally. Nationwide shutdowns led to production halts and delayed deliveries of smart weapons by major players. For instance, in March 2020, France halted Rafale jet production, delaying aircraft deliveries to India. Despite these setbacks, the market demonstrated resilience and continued to grow during the pandemic.

In the same month, Raytheon Company secured a $353.3 million contract with the U.S. Navy to provide guided missile gyro packages and spare parts for Block 2A and two mobile airframes. Such contracts by major companies ensured stable market growth amid the crisis.

Key Takeaways

- By Product, Missiles in 2023 & is anticipated to dominate throughout the forecasted period.

- In addition, Guided Firearms are expected to have significant growth over the forecasted period.

- By Technology, the Laser segment takes the lead & drives the market in 2023.

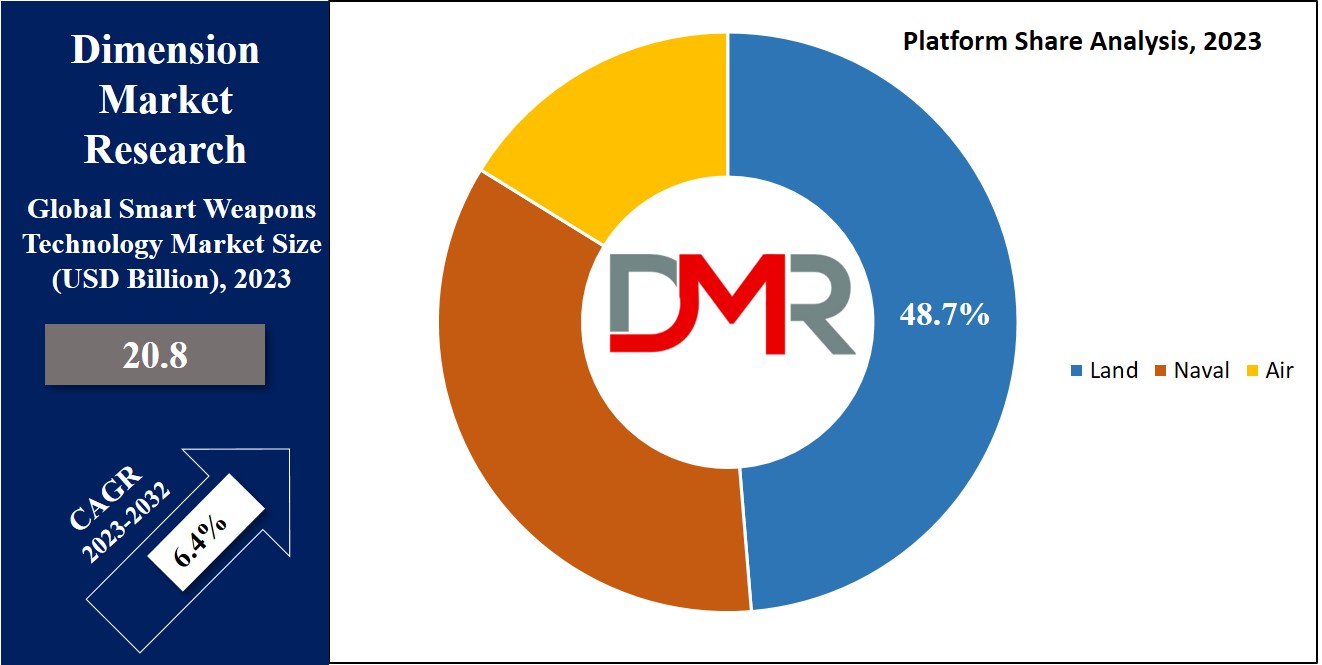

- By Platform, Land segment accounts for a major revenue share in 2023.

- North America has a 39.1% share of revenue in Global Smart Weapons Technology Market in 2023.

Market Dynamic

The growing need for technologically advanced weaponry is driven by the necessity for advanced capabilities, growth in lethality, & improved defense mechanisms. Nations & defense organizations are investing more in smart weapons to gain or maintain a strategic advantage, responding to evolving threats & the constant need for enhanced military effectiveness.

Also, modern warfare needs accurate, minimal collateral damage, and integrated digital capabilities, driving the push for advanced weaponry, which indicates sustained growth in the smart weapons technology market, driven by developments in AI, materials science, & precision engineering, resulting in smarter, more effective, and lethal weaponry.

However, the development & deployment of smart weapons technology faces major moral & legal concerns, restraining market growth. Also, issues surrounding the ethical use of advanced weapons, mainly those with AI & autonomous functionalities, raise questions about accountability, potential civilian harm, & compliance with international laws governing warfare, which may lead to public opposition, regulatory obstacles, & restrictions on development & sales, limiting the market expansion of smart weapons technology.

Driver

The smart weapons technology market is driven by rising defense budgets worldwide and an escalating focus on military modernization. Governments prioritize developing and purchasing advanced weaponry to enhance national security and combat new threats; smart weapons with their precision targeting, reduced collateral damage and operational efficiency are becoming essential weapons in modern warfare strategies; rising geopolitical tensions and cross-border conflicts increase demand.

Even further for these technologies as do ongoing investments by defense contractors and governments into R&D programs which ensure continued innovation for smart weapons which promote their widespread adoption across land, air, and naval forces forces worldwide.

Trend

Artificial intelligence (AI) and the Internet of Things (IoT) integration is a fundamental trend in smart weapons technology markets. AI can enable advanced targeting systems, predictive analytics, and autonomous decision-making capabilities, while the Internet of Things facilitates real-time data sharing for increased situational awareness. Together, these developments enhance the precision and efficiency of smart weapons, enabling remote control and improved coordination during combat scenarios.

Furthermore, developments such as AI-powered drones, loitering munitions, and smart missile systems are revolutionizing military operations; supporting adaptive learning as well as battlefield strategy optimization while making smart weapons increasingly indispensable components of modern defense systems.

Restraint

The smart weapons technology market faces obstacles due to high development, testing, and acquisition costs. Cutting-edge technologies like AI, IoT and precision guidance systems require significant investments in research infrastructure.

Producing weapons requires complex processes and expensive materials, which increases production costs. Small economies may face limited defense budgets that inhibit adoption; maintenance and integration with existing military systems add further expenses that may inhibit widespread deployment or slow market expansion in regions with limited financial resources.

Opportunity

The need for advanced counter-terrorism measures presents tremendous growth potential for the smart weapons technology market. Smart weapons offer precision and effectiveness when targeting terrorist activities while limiting civilian casualties, making these advanced systems ideal for countering insurgencies worldwide and urban combat operations.

Furthermore, compact portable smart weapons developed specifically for urban combat scenarios only increase their utility as counterterrorism weapons; partnership agreements between governments and defense contractors to address security challenges while expanding capabilities of these weapons further create growth prospects in this space.

Research Scope and Analysis

By Product

The missile segment takes a significant share of the smart weapons technology market's revenue in 2023. Missiles, advanced projectiles designed for precision strikes, have vital and versatile roles in defense applications, like surface-to-air, anti-ship, hypersonic, & cruise missiles.

Emerging trends focus on hypersonic missiles known for exceptional speed & agility, driven by artificial intelligence for accurate guidance. Open technology development enhances covert operations, showing significant progress in next-generation weapons technology. Also, missile defense systems evolve to counter emerging threats, creating innovation & investment in this critical warfare segment.

Further, the guided firearms segment is expected to have significant growth in the projected period. These developed weapons, along with technology for accurate targeting & accuracy, use sensors, GPS, & special algorithms to guide projectiles, which lean towards miniaturization and integration of guided systems into conventional firearms, improving accessibility & affordability, also enhancing data connectivity & augmented reality integration provide soldiers with real-time information, improving situational awareness in combat scenarios within the smart weapons technology market.

By Technology

The global smart weapon market is categorized by technology into Laser, Infrared,

Radar, GPS, and Others. Among these, Laser-Guided technology takes the lead in this segment in 2023 and is anticipated to maintain its dominant presence in the forecast period, which is due to its operational efficiency & excellent precision in targeting.

Laser-guided systems demonstrate a high level of accuracy, enabling them to impact their targets with precision, which contributes to their prominence in the market, as they provide a reliable & accurate means of guiding weapons.

As military operations highly require pinpoint accuracy, the operational advantages provided by Laser-Guided technology position it as a leading choice in the market, underscoring its anticipated sustained dominance in the coming forecast period.

By Platform

The Land segment claims the highest market share in 2023, in the smart weapons technology market based on platforms, which primarily comprises ground-based weapon systems, like advanced artillery, tanks, infantry weapons, & associated technologies. Further, major trends in land-based smart weapons technology include the integration of AI for enhanced targeting and the use of autonomous vehicles for logistics & combat support.

Correctly-guided munitions, like smart artillery shells and missiles, take center stage within the land platform, showcasing the quest for enhanced accuracy. In addition, development in armor materials & anti-drone systems is a major focus, aiming on effectively countering evolving threats and aligning with the dynamic nature of modern land-based warfare.

The Smart Weapons Technology Market Report is segmented on the basis of the following

By Product

- Missiles

- Munitions

- Guided Projectiles

- Guided Rockets

- Guided Firearms

- Directed Energy Weapons

By Technology

- Laser

- Infrared

- Radar

- GPS

- Others

By Platform

Regional Analysis

North America leads the smart weapons market with a dominant

39.1% revenue share in 2023. The region stands out for its constant innovation & ongoing military modernization endeavors, with an emphasis on AI, autonomous systems, & hypersonic weapons.

To maintain technological superiority in the middle of global security challenges, North American defense agencies prioritize strong R&D as collaborations with tech giants and emerging startups further strengthen the region's position as a key hub for cutting-edge defense solutions.

Meanwhile, the Asia-Pacific region is expected to rapidly expand in the next-generation weapons technology sector, as increasing geopolitical tensions, especially in the South China Sea & the Korean Peninsula, are urging regional nations like China and India to highly invest in advanced defense technologies.

Further, military modernization efforts, along with more collaboration with international defense contractors & research institutions, are driving the adoption of smart weaponry in the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The smart weapons market is well diverse, with several key players working on innovative systems for global defense operations. These key players emphasize on developing advanced smart weapons & enhancing capabilities for military personnel.

Further, an increase in investment in R&D is creating the way for improved opportunities. Also, manufacturers are integrating technologies like fingerprint recognition to prevent unintended use, fostering the smart weapons market's growth in the coming future.

In March 2023, Raytheon Technologies Corporation unveiled a USD 320 million contract for the production & delivery of 1500 StormBreaker smart weapons, which are air-to-surface, network-enabled munitions that possess the capability to engage moving targets in any weather condition, using a multi-effects warhead & a tri-mode seeker, highlighting the commitment to advancing cutting-edge weaponry for effective and versatile military operations.

Some of the prominent players in the global Smart Weapons Technology Market are:

COVID-19 Pandemic & Recession: Impact on the Global Smart Weapons Technology Market:

The COVID-19 pandemic & following economic recession have highly impacted the global smart weapons technology market. The pandemic disrupted supply chains, creating delays in the production & delivery of smart weapon systems. Defense budget restraints in many nations owing to economic downturns further impeded market growth.

However, the crisis created an increased focus on remote warfare capabilities, enhancing the need for autonomous & smart weapons. The need for improved precision & reduced human involvement in conflict zones became evident. While economic challenges persisted, the pandemic accelerated technological development in smart weapons, with R&D remaining a priority for military modernization. The market witnessed a complex interplay of setbacks and opportunities, with the long-term impact hinging on global economic recovery, geopolitical stability, and continued emphasis on advanced defense capabilities.

Recent Developments

- In January 2022, LodeStar Works company launched their 9mm smart handgun designed for law enforcement agencies, which highlights a step forward in providing advanced firearm technology for law enforcement use. Further, the 9mm smart handgun is customized to meet the specific needs of law enforcement personnel, emphasizing innovation & enhanced features to support their duties effectively.

- In November 2023, General Atomics Aeronautical Systems, Inc. and EDGE announced a partnership aiming to integrate EDGE smart weapons onto GA-ASI’s MQ-9B SkyGuardian RPA, which signifies the first-ever integration of UAE-made smart weapons onto a U.S. unmanned platform, promoting a new era in U.S.-UAE defense cooperation & creating the way for future collaborations.

- In November 2023, Fabrique Nationale Herstal (FN Herstal) launched an innovative less-lethal "AI smart-gun." Known as the Smart ProtectoR-303T, which utilizes AI and imaging sensor technology to reduce the risk of fatal encounters during crowd control & public safety operations, which focuses on addressing concerns over the potential lethality of less-lethal weapons by including advanced AI to prevent projectiles from being fired at a person's head.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 20.8 Bn |

| Forecast Value (2032) |

USD 36.5 Bn |

| CAGR (2023-2032) |

6.4% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Missiles, Munitions, Guided Projectiles,

Guided Rockets, Guided Firearms, and Directed

Energy Weapons), By Technology (Laser, Infrared,

Radar, GPS, and Others, By Platform (Air, Land, and

Naval) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

MBDA, The Boeing Company, Safran, General

Dynamics Corp., BAE Systems, Thales Group, Textron

Inc, Saab AB, Raytheon Technologies Corporation,

Rheinmetall AG, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Smart Weapons Technology Market size is estimated to have a value of USD 20.8 billion in

2023 and is expected to reach USD 36.5 billion by the end of 2032.

North America has the largest market share for the Global Smart Weapons Technology Market with a

share of about 39.1%% in 2023.

Some of the major key players in the Global Smart Weapons Technology Market are MBDA, The Boeing

Company, Safran, and many others.

Smart Weapons Technology Market is growing at a CAGR of 6.4% over the forecasted period.