Market Overview

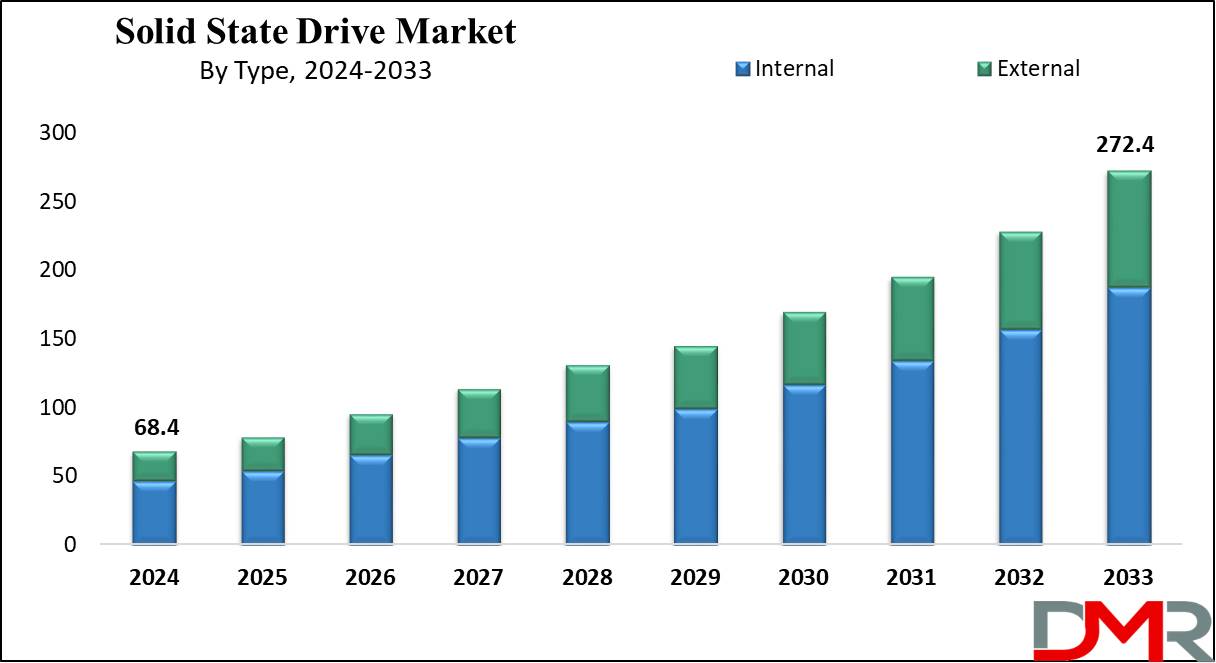

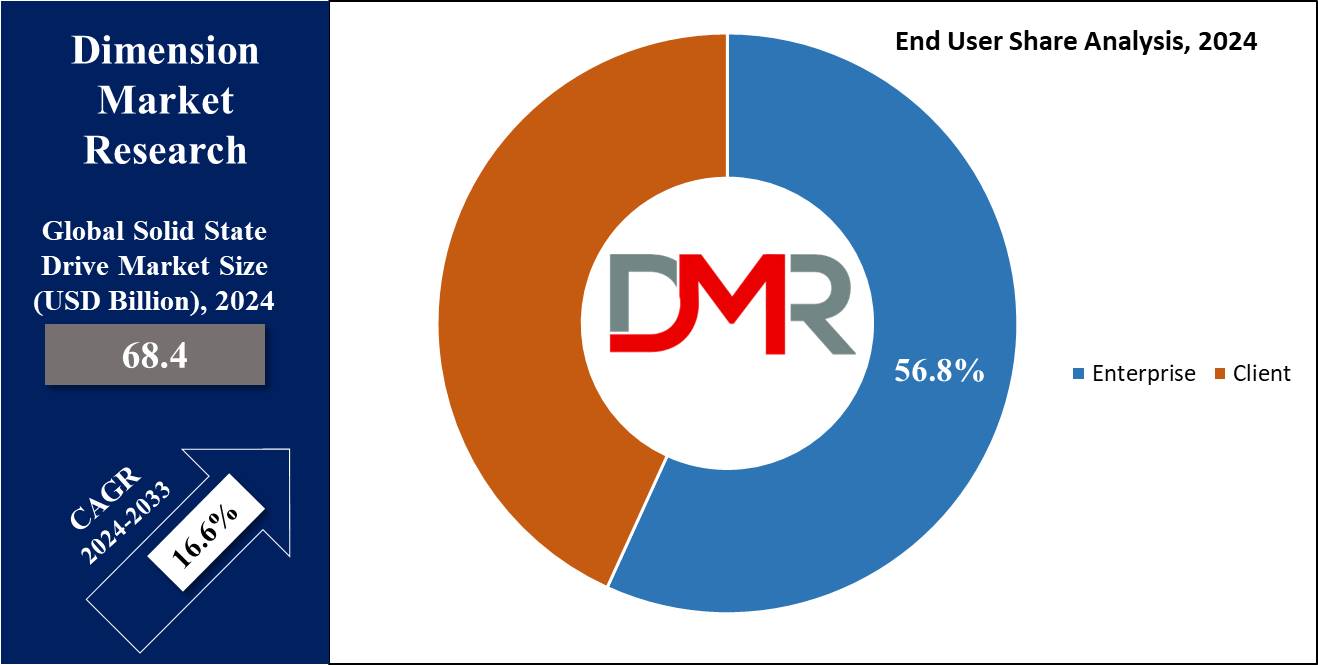

The Global Solid State Drive (SSD) Market is expected to reach a value of USD 68.4 billion by the end of 2024, and it is further anticipated to reach a market value of USD 272.4 billion by 2033 at a CAGR of 16.6%.

Solid State Drive also known as SSDs have transformed data storage with their nonvolatile nature, depending on Semiconductor Memory instead of standard magnetic or optical media. Their various advantages, like better speed, durability, portability, efficiency, & lower power consumption, have made them indispensable in both personal & business settings.

The transition from public clouds to personal clouds at home is driven by the benefits offered by SSDs, like enhanced operation, simplified installation, & support for video-on-demand services. As Cloud Computing constantly dominates data storage, the market for SSDs has experienced major growth.

Further, the expansion of high-resolution media, such as photographs & videos, has made an exponential increase in digital data production, as the growth in need for storage capacity has driven the SSD market forward, with users looking for larger-capacity drives to assist their expanding data needs. In addition, the broader adoption of smartphones & tablets has further driven the demand for storage solutions, as users generate significant amounts of digital content on these devices.

Although the expectations for solid-state drive capabilities continue to grow, manufacturers experience challenges in meeting these demands. The market requires various features and functions from SSDs, creating a challenge for manufacturers to innovate & keep pace with changing consumer needs. Even after these challenges, the SSD market remains strong, due to the constant growing demand for faster, more efficient, and higher-capacity storage solutions.

Key Takeaways

- Market Growth: The Global Solid State Drive (SSD) Market is expected to grow by 193.8 billion, at a CAGR of 16.6% during the forecasted period of 2025 to 2033.

- By Type: Internal SSDs are expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Interface: The SATA segment is expected to get the largest revenue share in 2024 in the solid-state drive market.

- By Storage: Less than 500 GB find high utilization in entry-level consumer devices like ultrabooks, laptops, & gaming consoles, and are expected to lead the market in 2024

- By End User: Enterprises are expected to get the largest revenue share in 2024 in the solid state drive market.

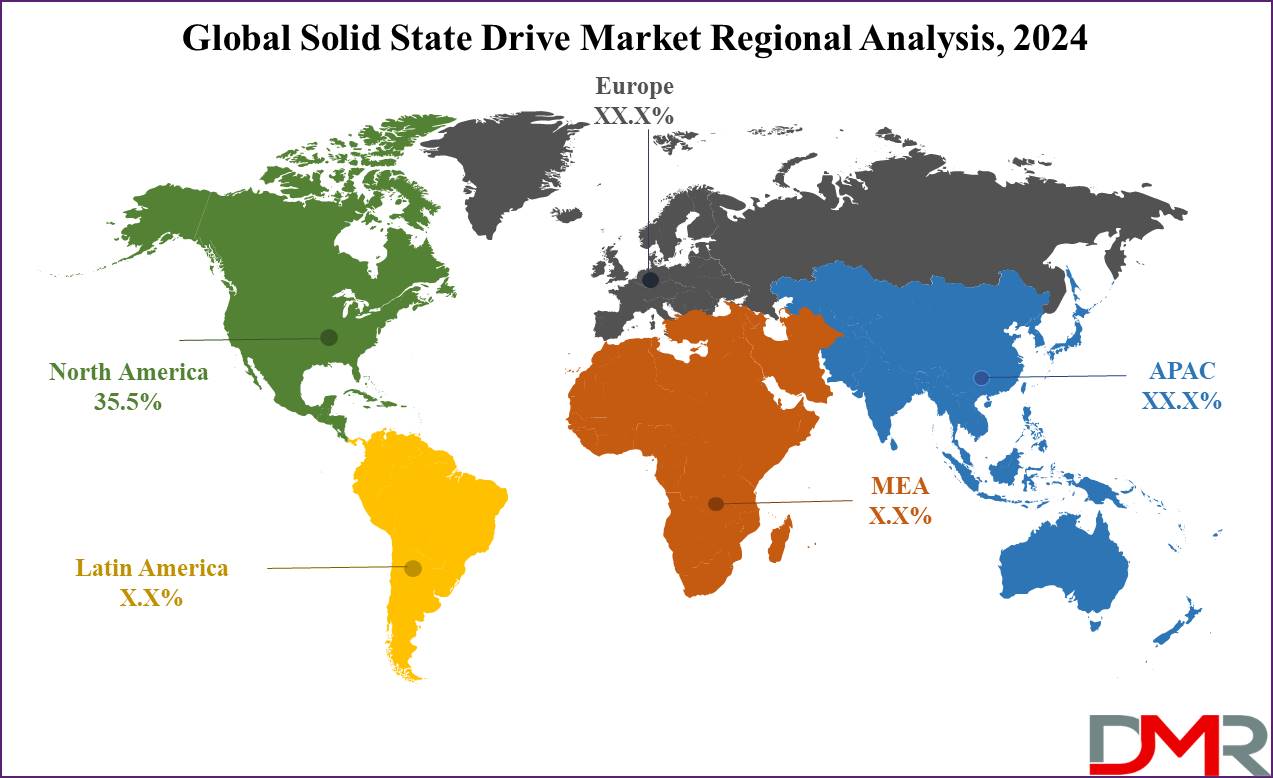

- Regional Insight: Asia Pacific is expected to hold a 35.5% share of revenue in the Global Solid State Drive (SSD) Market in 2024.

- Use Cases: Some of the use cases of solid state drive include boosting productivity in professional workstations, reliable data storage for enterprise servers, and more.

Use Cases

- Enhanced Performance in Gaming Consoles: Solid-state drives highly enhance the gaming experience in consoles by lowering load times and improving overall system responsiveness. With quick data read & write speeds, SSDs allow smoother gameplay, faster level loading, and easier transitions between game environments.

- Boosting Productivity in Professional Workstations: Professionals working with large datasets, like video editors, designers, and engineers, benefit mostly from SSDs' better performance. SSDs provide faster file access & data transfer speeds, resulting in fast execution times, easy multitasking, and overall improved productivity in demanding work environments.

- Reliable Data Storage for Enterprise Servers: Solid-state drives provide reliable & high-performance data storage solutions for enterprise servers & data centers. Their nonvolatile nature & durability make them ideal for handling large workloads and mission-critical applications, making uninterrupted access to data and low downtime for businesses.

- Efficient Operating Systems in Thin and Light Laptops: SSDs are the main components in thin &light laptops, making faster boot times and faster application launches. With their compact size & low power consumption, SSDs contribute to the efficiency & portability of these devices, giving users a responsive & energy-efficient computing experience, whether they're on the go or working remotely.

Market Dynamic

The adoption of solid-state drives (SSDs) is gaining momentum across many sectors, due to performance & energy efficiency in comparison to standard spinning disks. In Data Center applications, SSDs allow server consolidation & rack space optimization, driving market growth as data center players aim to build large-scale colocations &-scale data centers to meet the growing demand for storage capacity.

In addition, the shift towards

cloud storage systems & the growing volume of consumer data stored in the cloud drive demand for SSDs in high-end cloud segments, further driving the market expansion. Moreover, the automotive sector is experiencing a growth in demand for SSDs, mainly for infotainment systems and autonomous driving applications, as these systems need fast & reliable storage solutions to handle multimedia content and large volumes of data generated by autonomous driving components.

However, challenges like SSD lifespan concerns & higher costs in comparison to traditional hard disk drives (HDDs) create challenges to market growth. The lifespan of an SSD is due to factors like drive age & usage, which may limit its viability over time.

In addition, the higher cost per gigabyte of SSDs versus HDDs provides a financial barrier for some businesses considering SSD implementation. Also, market players are addressing these challenges by designing innovative solutions with higher capacity and lower prices, which are expected to support market growth despite these hindrances.

Research Scope and Analysis

By Type

The solid-state drive (SSD) market, includes internal and external SSDs type, which are either integrated into computers, laptops, and tablets or used as standalone devices for data storage. Internal SSDs consist of superior speed &efficiency when enclosed within a USB, contrasting with external SSDs whose use is growing due to better mobility.

The increasing global storage capacity per household, driven by higher social media engagement, large data transmission, and the proliferation of media content, is making smartphone manufacturers incorporate SSDs directly into mobile devices.

While internal SSDs offer quick performance and cost efficiency, their portable use needs additional interfaces for conversion & a power source. Further, external SSDs, although slower & pricier, afford portability & connectivity to systems or devices through USB or FireWire, even if potentially compromising system performance due to lesser speed.

As the need for storage solutions escalates, the market accommodates changing needs, with internal SSDs prioritizing performance and affordability while external SSDs prioritize portability &connectivity, meeting diverse user preferences & requirements.

By Interface

The SSD Interface market is segmented into SATA, SAS, PCIe, and Other SSD Interface categories, with SATA anticipated to lead the global solid-state market in the forecast period, which is driven by the higher demand for SATA SSD products due to higher reliability standards sought after by many sectors like federal agencies, financial institutions, & healthcare.

Obedience to international standards is becoming important to ease deployment, mainly as the need for securing large amounts of data grows across these sectors, indicating strong growth potential for the SATA segment.

In addition, the SAS segment is expected to significant growth, due to the growing adoption of serial-attached small SSDs, mainly in servers & processing-intensive computer workstations demanding high write/read speeds.

Further, the key players are responding to the trend by launching new SAS interface-based SSDs, for instance, Kioxia Corporation launched a new generation of SAS SSD devices in its PM6 Series, developed on 24G SAS technology enabled through the PCIE 4.0 ecosystem, which aligns with the changing demands of enterprises for efficient and high-performance storage solutions, further propelling the growth prospects of the SAS segment in the coming future.

By Form Face

The 1.8"/2.5" form factor SSDs are expected to be the largest segment in terms of revenue in 2024, customized to smoothly fit into traditional hard drive bays, ensuring compatibility with existing systems like laptops, desktops, and enterprise storage solutions.

Their broader adoption across consumer & business environments drives market growth, due to their versatility and ease of integration. Further, 3.5" form factor SSDs find main utility in enterprise storage systems & servers demanding higher capacities &performance levels, meeting data-intensive applications and contributing largely to market expansion within the enterprise segment.

In addition, M.2 form factor SSDs emerge as compact solutions popularly used in ultra-thin laptops, tablets, and small form factor devices, providing both space efficiency &high performance, ideal for portable & space-constrained applications.

Furthermore, U.2 (SFF 8639), FHHL, & HHHL form factors mainly lead to the data center & enterprise environments, developed to deliver high-capacity & high-performance storage solutions. These form factors, optimized for server-based caching &data-intensive applications, play an important role in meeting the strong storage demands of modern enterprises, further driving market growth within the data center and enterprise sectors.

By Technology

Clients are expected to majorly use TLC 3D & TLC Planar technologies in coming years, mainly due to their large storage capacities, driving their need for consumer applications like notebooks & tablets. The price per gigabyte of SSDs is reducing time by time as the market transitions from Single-Level Cell (SLC) to Multi-Level Cell (MLC) and vice versa, further driving the popularity of TLC-based SSDs in consumer electronics.

However, small & medium-sized businesses use MLC-based SSDs due to their large lifespan, while acknowledging that TLC-based SSDs typically offer slower speeds compared to SLC or MLC counterparts. Conversely, SLC-based SSDs excel in industrial settings and high-intensity read/write cycles, such as server operations, thanks to their exceptional durability, accuracy, and superior overall performance.

Additionally, MLC-based SSDs find widespread adoption among everyday users, enthusiasts, and gamers due to their reliability and cost-effectiveness, as manufacturers often pass on lower production costs to customers, which meets a variety of user needs and industry requirements, ensuring reliable & efficient storage solutions across many sectors and applications.

By Storage

SSDs with capacities below 500 GB find vast use in entry-level consumer devices like ultrabooks, laptops, and gaming consoles, and are expected to lead the market in 2024 as they outperform traditional hard drives and meet the storage needs of everyday computing tasks. Further, the 500 GB–1 TB segment serves a wide spectrum of applications, spanning from consumer laptops to professional workstations & small-scale servers.

SSDs in this range strike a balance between performance & storage capacity, attracting both mainstream users and professionals looking for efficient storage solutions. Moreover, the 1 TB–2 TB segment looks into the rising demand for higher-capacity SSDs in gaming, content creation, and data-intensive tasks, providing large storage for large files & multimedia content while ensuring quick performance & responsiveness.

In addition, SSDs of more than 2 TB focus on data centers, enterprise storage, and high-capacity computing environments, and provide distinct storage capabilities for large-scale data processing, cloud storage, & mission-critical applications.

Across these capacity segments, SSDs play an important role in improving computing experiences, whether in consumer electronics or enterprise-grade infrastructure, by delivering reliable & high-performance storage solutions customized to meet diverse user needs and industry demands.

By End User

The solid-state drive market is segmented by end-use into enterprise & client categories, further dividing the enterprise segment by size into small, medium, and large enterprises. Enterprises across the spectrum require storage solutions that offer high reliability, consistent uptime, superior performance, energy efficiency, and high throughput, all of which SSDs deliver effectively.

The increasing volume of digital data generation, and transfer, and the imperative for dependable and quick data storage solutions have driven the demand for SSDs in both personal & professional spheres. In the client segment, there's a major growth in demand as users prioritize fast & large storage options, mainly evident in the growth integration of SSDs into personal computers, laptops, tablets, and smartphones, which is paralleled by a current adoption of SSDs in data centers, driven by factors like their better efficiency compared to traditional HDD storage, the growing need for advanced storage infrastructure, and constant development in enterprise-grade SSD technology, mainly in terms of reliability & performance.

Enterprises favor SSDs not only for their energy efficiency but also for their capacity to streamline operations, lower sprawl, and contribute to a smaller environmental footprint, aligning with contemporary sustainability goals & operational efficiencies.

The Solid State Drive Market Report is segmented on the basis of the following

By Type

By Interface

By Form Factor

- 1.8”/2.5”

- 3.5”

- M.2

- U.2 (SFF 8639)

- FHHL and HHH

By Technology

- TLC Planar

- TLC 3D

- SLC

- MLC 3D

- MLC Planar

By Storage

- Under 500 GB

- 500 GB–1 TB

- 1 TB–2 TB

- Above 2 TB

By End User

Regional Analysis

The Asia Pacific region is expected to lead the global solid state drive market in

2024 with a share of 35.5% as a fast-expanding market for SSDs, driven by the flourishing consumer electronics sector, increased by rising disposable incomes and an ongoing trend of digitalization. The proliferation of smartphones, along with the growing popularity of gaming & the higher adoption of cloud services, contributes largely to the region's SSD market growth.

Moreover, the increasing demand for high-capacity & high-performance storage solutions in data centers and enterprise computing environments further fuels market expansion across the Asia Pacific region, showcasing a high growth driven by evolving technological trends and consumer preferences.

Further, North America is also expected to command a prominent stance in the global SSD market, supported by its robust technology infrastructure, growing consumer purchasing power, and a strong demand for top-notch storage solutions. The region benefits from the presence of major technology conglomerates, improved data centers, and thriving cloud service providers, which collectively drive market growth.

In addition, the current adoption of advanced technologies like

artificial intelligence,

machine learning, & big data analytics expands the need for quick & dependable storage solutions, driving the SSD market's growth trajectory in North America, which highlights the region's importance in shaping the future of SSD adoption & innovation, positioning it as a key driver of market expansion and technological development in the global market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global solid state drive market provides a competitive landscape characterized by strong rivalry among key players looking for market dominance. Companies compete for market share through strategies like product innovation, strategic partnerships, and mergers & acquisitions to strengthen their positioning in the industry.

In addition, strong competition comes in pricing strategies & technological development focused on improving product performance & meeting changing consumer demands. The market experiences constant growth driven by the growing need for high-speed & reliable storage solutions across many sectors.

Some of the prominent players in the global Solid State Drive Market are

- Western Digital

- Toshiba

- Samsung Electronics

- Intel Corp

- Microsemi

- Kingston

- Bitmicro Networks

- Digital Corporation

- Adata

- NetApp

- Other Key Players

Recent Developments

- In November 2023, Samsung Electronics launched the T5 EVO, a lightweight portable Solid-State Drive (SSD) that offers up to 8 terabytes (TB) of capacity, which is the largest capacity size currently provided by portable SSDs available on the market. Further, it delivers ultra-fast speeds in a compact, durable design as an advanced, versatile SSD solution. Based on USB 3.2 Gen 1, the T5 EVO transfers data up to 3.8 times faster than external HDDs and delivers maximum performance through sequential read & write speeds of up to 460 megabytes per second (MB/s), making it smooth to transfer large files.

- In November 2023, Seagate Technology Holdings plc launched the Seagate Nytro 4350 NVMe solid-state drive (SSD), the latest addition to its Seagate Nytro drive portfolio. Developed in partnership with Phison, it offers consistent performance, low latency, and lower power consumption for data centers. With PCIe Gen 4 technology, it provides over ten times the bandwidth of SATA SSDs while expanding throughput, by having 58K IOPS random write speeds and 800K IOPS random read speeds, to remove data bottlenecks & provides enhanced computing power with a 3.3V power supply.

- In October 2023, Samsung launched its latest portable solid-state drive (SSD) T9 aimed at creators, as it comes with up to 4TB storage, a USB 3.2 Gen 2x2 interface, and about 2,000 MB/s read or write speed. Further, the new SSD comes in 1TB, 2TB, & 4TB storage options & is based on IEC 62368-1 standards. T9 SSD comes with dynamic thermal guard technology that reduces the performance dips caused by overheating, ensuring consistent & speedy transfer rates, and offers a five-year limited warranty & is resistant to drops from heights of up to three meters.

- In August 2023, Kioxia Corporation unveiled the addition of the KIOXIA CD8P Series to its lineup of data center-class solid-state drives (SSDs), which is well-suited to general-purpose server & cloud environments that can take advantage of PCIe 5.0 (32GT/s x4) performance. These data center applications can create complex mixed workloads spread across large-scale virtualized systems in 24x7 operational data centers.

- In July 2023, Solidigm launched the Solidigm D5-P5336, an industry-first quad-level cell (QLC) SSD developed for data centers. With capacities ranging from 7.68 to 61.44 TB, it offers up to 6 times more data storage in the same space as an all-HDD array, having superior read performance in comparison to some cost-optimized triple-level cell (TLC) SSDs, it is customized to handle large volume of data from core to edge.

- In August 2022, Solidigm launched the Solidigm P41 Plus, which is the first branded solid-state storage drive (SSD) from the company since its launch of the company. The P41 Plus is an innovative PCIe 4.0 product that provides the industry’s best combination of performance & value to PC users for daily productivity and gaming. Further, with its capability of delivering up to 4,125 MB/s sequential read speed, it represents a breakthrough in affordability, delivering great PCIe 4.0 performance at a price that won’t break the budget for everyday PC users.

- In July 2022, Innodisk, launched a new edge computing solid-state drive (SSD) product line, including 2.5” SATA 3TS6-P, 3TS9-P, and M.2 (P80) 4TS2-P drives. Innodisk’s new edge AI SSDs feature low latency, high DWPD (drive writes per day), & large capacities. Also, the iCell and AES technologies inclusion protect data from losses & breaches, focusing on smart retail, smart city, smart fleet management, & NAS network storage applications, providing high speeds, reliability, and industrial-grade high quality to respond to the rising market needs.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 68.4 Bn |

| Forecast Value (2033) |

USD 272.4 Bn |

| CAGR (2023-2032) |

16.6% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (External and Internal), By Interface (SATA, SAS, and PCIe), By Form Factor (1.8”/2.5”, 3.5”, M.2, U.2 (SFF 8639), and FHHL and HHH), By Technology (TLC Planar, TLC 3D, SLC, MLC 3D, and MLC Planar), By Storage (Under 500 GB, 500 GB–1 TB, 1 TB–2 TB, Above 2 TB), By End User (Enterprise and Client) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Western Digital, Toshiba, Samsung Electronics, Intel Corp, Microsemi, Kingston, Bitmicro Networks, Digital Corporation, Adata, NetApp, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Solid State Drive Market size is estimated to have a value of USD 68.4 billion in 2024 and is expected to reach USD 272.4 billion by the end of 2033.

Asia Pacific is expected to have the largest market share in the Global Solid State Drive Market with a share of about 35.5% in 2024.

Some of the major key players in the Global Solid State Drive Market are Western Digital, Toshiba, Samsung Electronics, and many others.

The market is growing at a CAGR of 16.6 percent over the forecasted period.