Solid-state technology includes LEDs, OLEDs, or PLEDs for illumination, leveraging semiconductors to convert electricity into light. This progressive approach yields many advantages, including extended lifespan, energy efficiency, minimal power usage, and a compact, versatile design.

The adaptability of solid-state technology has driven its integration into many industry applications, effectively meeting the need for efficient & flexible lighting solutions. As adoption grows, integration with

Smart Homes Systems technologies further boosts demand, creating connected, energy-optimized lighting environments.

Further, the growth of the market can be said due to the growing requirement for environmentally sustainable & energy-efficient lighting technology. Ongoing development in the lighting sector focuses on delivering improved lighting output with less power consumption, aligning with the more essential sustainable energy practices.

The global solid state lighting market is poised for significant expansion as lighting companies place increased emphasis on improving white LED performance, pricing and fixture designs using these energy saving lights. Rising adoption of high brightness (HB) LEDs for various lighting applications has contributed significantly to this growth.

Notable advances were seen over time including higher lumen output and efficiency from these high brightness (HB) LEDs as an industry driver. Solid state lighting using LEDs as illumination is growing thanks to their cost cutting properties as demand for energy saving lighting solutions among various applications drives growth within this industry sector.

Key Takeaways

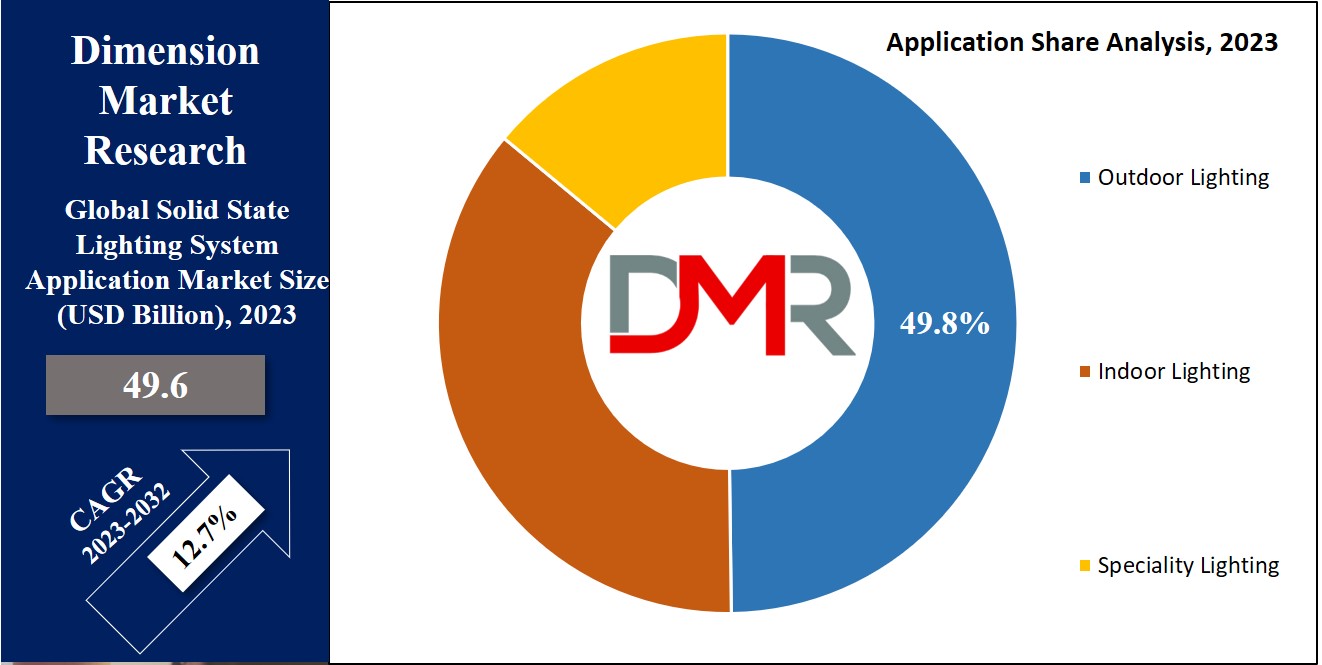

- Market Size & Share: Solid-State Lighting System Application Market is expected to reach a value of USD 49.6 billion in 2023, and it is further anticipated to reach a market value of USD 145.1 billion by 2032 at a CAGR of 12.7%.

- Technology Analysis: In 2023, LED technology emerged as the dominant driving technology within the global solid-state lighting system application market.

- Application Analysis: The solid-state lighting system application market, outdoor lighting emerged as a major application segment in 2023.

- End-user Analysis: The end-user segment, the residential sector took a major share of the market.

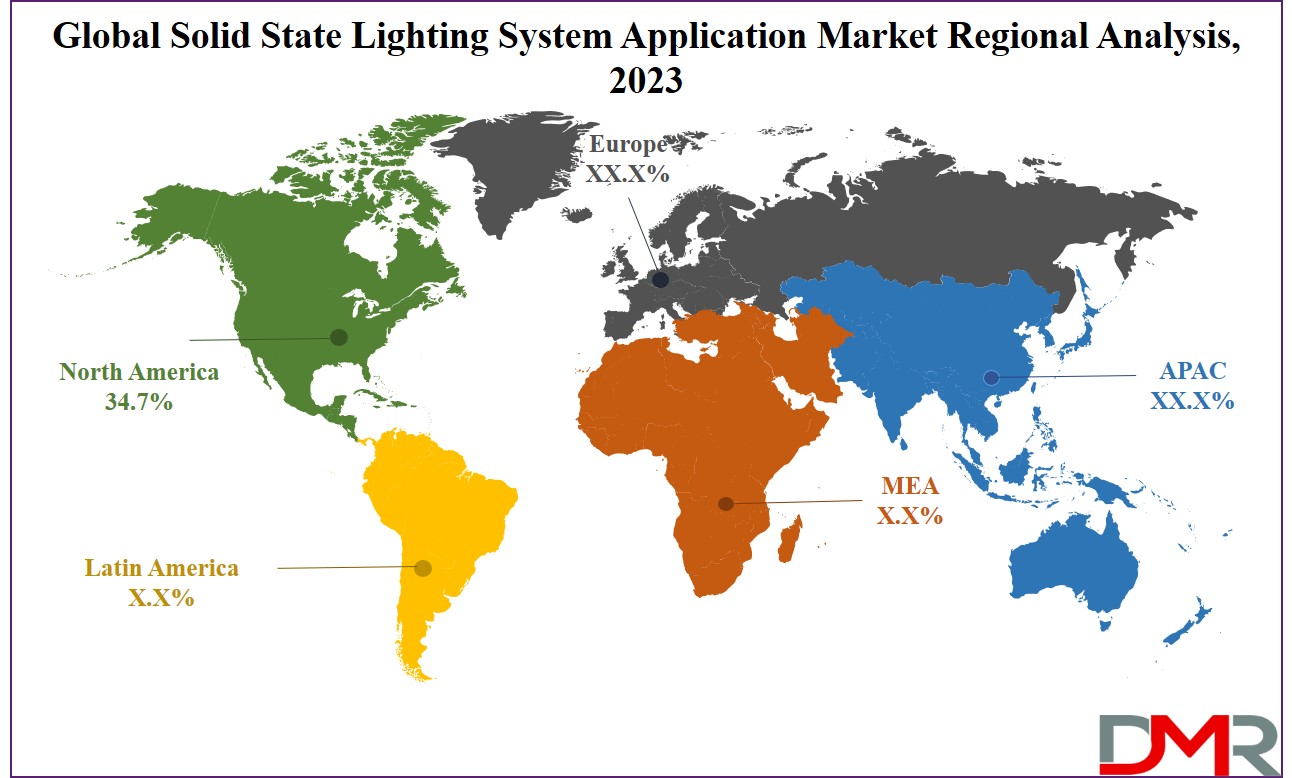

- Regional Analysis: In 2023, North America emerged as the dominant force in the solid-state lighting system application market accounting for 34.7% of the total market revenue in 2023.

Use Cases

- Smart Cities & Street Lighting – SSL technology is widely used in smart city infrastructure for energy-efficient LED streetlights, reducing power consumption and maintenance costs while improving public safety.

- Automotive Lighting – SSL is integrated into vehicle headlights, taillights, and interior lighting, enhancing visibility, longevity, and energy efficiency in electric and autonomous vehicles.

- Commercial & Residential Lighting – Used in offices, homes, and retail spaces for enhanced energy efficiency, customizable ambiance, and improved productivity with smart lighting controls.

- Healthcare & Medical Lighting – SSL is employed in hospitals and clinics for circadian lighting systems, surgical lighting, and therapeutic applications to improve patient well-being and recovery. This aligns closely with innovation in Medical Devices, where advanced lighting is crucial in precision healthcare solutions.

- Horticulture & Agricultural Lighting – LED-based SSL systems support indoor farming, greenhouses, and vertical farming by optimizing light wavelengths for improved plant growth and higher crop yields.

Market Dynamic

The global solid-state lighting system application market is growing due to rising awareness of energy-efficient LED lights, driven by LED technology's clear energy-saving benefits. The market growth in sectors such as automotive, medical, and outdoor lighting is due to solid-state lighting's efficiency. Also, smart city technology's rise boosts the market, as energy-efficient lighting becomes important for sustainable urban development.

However, a notable restraint or challenge in the growth of solid-state lighting is its high costs. This financial barrier can discourage adoption, especially in price-sensitive markets. Additionally, the limited efficiency of solid-state lighting in heat-sensitive applications acts as a restraint factor. The generation of excess heat can compromise performance & longevity, restricting its viability in scenarios where temperature control is essential.

The dynamics of cost & efficiency are connected, as addressing heat-related inefficiencies often comes with added expenses. This complex relationship leads to the need for comprehensive solutions to overcome challenges and facilitate broader acceptance of solid-state lighting technologies.

Driving Factors

Energy efficiency is one of the primary drivers behind solid state lighting (SSL) system application markets. LEDs and OLEDs use significantly less power compared to traditional lighting solutions, thus cutting energy costs and carbon emissions while simultaneously improving lighting quality.

Governments around the world actively support SSL adoption via subsidies, tax benefits, or energy efficiency mandates, making these long lasting fixtures appealing choices for residential, commercial and industrial settings alike. As sustainable infrastructure initiatives advance into smart cities more frequently incorporating SSL solutions become essential components in modern lighting solutions.

Trending Factors

A key trend in the solid state lighting system market is the rise of smart lighting solutions. Advanced SSL systems increasingly feature IoT functionality that enables remote control, automation and energy optimization through smartphones or smart home devices giving users remote control, automation and energy optimization at their fingertips via remote controls, smartphones or smart home devices.

Smart SSL technologies are widely adopted across residential, commercial and outdoor applications especially smart city projects with AI/ML systems for predictive maintenance management becoming ever more integral parts of energy management solutions.

Restraining Factors

Restraint Initial costs associated with SSL systems pose a substantial barrier to market growth. Advanced systems with smart lighting features require higher initial investments compared with conventional lighting solutions; installation processes and components, such as LEDs, OLEDs and sensors may further delay adoption in price sensitive markets.

While long term energy savings and durability benefits of these solutions offer long term cost benefits, their high entry barrier remains a hurdle to widespread implementation; manufacturers must strive to lower production costs and offer cost effective solutions in order to expand market penetration.

Opportunities

Solid state lighting's rising adoption in automotive and industrial settings represents huge growth opportunities. Solid state systems are becoming more widely employed for headlights, taillights, interior lighting and design flexibility applications in cars; in industrial settings.

However, solid state is employed for high bay outdoor lighting to save energy while cutting maintenance costs; additionally this technology accelerates safety and visibility initiatives within sectors where security concerns exist further accelerating adoption. As innovations within SSL continue, these industries represent lucrative markets for innovative lighting solutions tailored specifically for their needs.

Research Scope and Analysis

By Technology

In 2023, LED technology emerged as the dominant driving technology within the global solid-state lighting system application market, owing to its remarkable energy efficiency, strength, and adaptability. Operating as the major light source, LEDs' compact dimensions & ability to emit diverse colors catered fluently to a range of lighting needs.

Through the conversion of electrical energy into light through semiconductor materials, LEDs outperformed conventional filament-based bulbs, excelling in energy savings & longevity. Instantaneous on-off functionality & dimming capabilities added to LEDs' versatility in both residential & commercial scenarios. Anticipating the future, the continuous growth of LED technology is expected to boost the solid-state lighting market over the forecasted period.

By Application

With respect to the application segment of the solid-state lighting system application market, outdoor lighting emerged as a major application segment in 2023 contributing towards the global revenue of the market. Its significance is due to its ability to efficiently & effectively illuminate outdoor spaces. With applications ranging from street lighting to architectural illumination, outdoor lighting addresses diverse needs.

The energy efficiency & extended lifespan of solid-state lighting, particularly LEDs, make them ideal for outdoor environments. LED technology's capacity to provide bright illumination with lower energy consumption aligns with the need for sustainable outdoor lighting solutions.

As urbanization & infrastructural development continue, the need for efficient outdoor lighting is anticipated to drive the solid-state lighting market, particularly within the outdoor lighting application segment, throughout the projected period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End-user Industry

In the solid-state lighting system application market's end-user segment, the residential sector took a major share of the market. This elevation was driven by its effective response to several residential lighting demands, spanning indoor and outdoor applications.

Solid-state lighting, mainly LED technology, gained prominence due to its energy efficiency & durability, aligning well with residential settings. LEDs' capacity to provide bright illumination while conserving energy fits with the demand for sustainable lighting solutions at homes. With ongoing urbanization and housing development, the residential segment is anticipated to drive the solid-state lighting market within the end-user category across the projected period.

The Global Solid-State Lighting System Application Market Report is segmented on the basis of the following:

By Technology

- Light Emitting Diodes (LEDs)

- Organic Light Emitting Diodes (OLEDs)

- Polymer Light Emitting Diodes (PLEDs)

By Application

- Indoor Lighting

- Outdoor Lighting

- Specialty Lighting

By End-user Industry

- Residential

- Industrial and Commercial

- Healthcare

- Automotive

- Others

How Does Artificial Intelligence Contribute To Improve Solid-State Lighting System Application Market ?

- Smart & Adaptive Lighting – AI-driven SSL systems adjust brightness, color temperature, and intensity based on occupancy, daylight availability, and user preferences, optimizing energy consumption and comfort.

- Predictive Maintenance & Fault Detection – AI-powered analytics monitor SSL systems in real time, detecting potential failures or inefficiencies early, reducing maintenance costs and extending lifespan.

- Energy Optimization & Cost Savings – AI integrates SSL with IoT and smart grids, analyzing data patterns to reduce energy consumption in smart buildings, cities, and industrial applications.

- Horticultural & Agricultural Enhancements – AI-driven SSL systems optimize light wavelengths and intensity for different plant growth stages, increasing crop yields in vertical farming and greenhouse applications.

- Human-Centric & Healthcare Lighting – AI-based SSL adjusts lighting conditions to support circadian rhythms, improve sleep patterns, and enhance patient recovery in healthcare environments.

Regional Analysis

In 2023, North America emerged as the dominant force in the solid-state lighting system application market, primarily due to the growing demand for horticulture products over traditional agriculture offerings. This region contributes significantly, accounting for

34.7% of the total market revenue in 2023. Moreover, the growing adoption of urban farming & the increasing need for healthier and safer food products are set to further propel the growth of the solid-state lighting system market in North America during the forecast period.

Further, significant growth is anticipated in the Asia-Pacific solid-state lighting system market during the forecasted period as well. This projection can be seen from the increasing demand for smart cities & the rising population in the region. The ongoing construction of power plants & energy substations is also anticipated to act as a catalyst, boosting the solid-state lighting system market's expansion in the Asia-Pacific area in the coming future.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The solid-state lighting source market demonstrates strong competitive dynamics among its key players. Moving forward, the expansion of the market is expected to be driven by innovative strategies pursued by both established industry giants and new startups. This environment of strategic innovation sets the stage for continuous advancements and growth in the sector.

For instance, in October 2022, ETi Solid State Lighting Inc., a prominent manufacturer of LED lighting systems and luminaires, unveiled a novel series of LED light fixtures with proven efficacy in eradicating bacteria and viruses, including SARS-Cov-2, the pathogen responsible for COVID-19.

Some of the prominent players in the Global Solid-State Lighting System Application Market are:

- Royal Philips Electronics N.V.

- Osram Licht AG

- Samsung Electronics Co. Ltd.

- Eaton Corporation PLC

- GE Lighting

- Automotive Lighting LLC

- NICHIA CORPORATION

- AIXTRON

- Energy Focus

- Bridgelux Inc

- Other Key Players

Recent Developments

- Jun 2025: Signify unveiled its new Interact Emergency Lighting System, a wireless, cloud-based control and monitoring solution for emergency lighting—including remote testing and compliance reporting capabilities.

- Aug 2025: ams OSRAM announced it had doubled the efficiency of its UV-C LED technology, marking a notable advancement in germicidal LED performance for disinfection purposes.

- Apr 2025: Fusion Optix, a U.S. lighting-components maker, acquired LEDdynamics, a Vermont-based LED modules and driver specialist, including its three brands—LEDdynamics, Prolume, and LEDSupply—to bolster its domestic sourcing and product offerings.

- Jun 2025: Wolfspeed entered a prepackaged Chapter 11 bankruptcy restructuring supported by a takeover plan with Apollo Global Management. This move would relieve the company of $4.6 billion in debt and allow for restructuring under managed ownership.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 49.6 Bn |

| Forecast Value (2032) |

USD 146.1 Bn |

| CAGR (2023-2032) |

12.7% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Technology (Light Emitting Diodes, Organic light Emitting Diodes and Polymer Light Emitting Diodes), By Application (Indoor Lighting, Outdoor Lighting and Specialty Lighting), By End-user Industry (Residential, Industrial & Commercial, Healthcare, automotive and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Osram Licht AG, Samsung electronics Co. Ltd., Eaton corporation PLC, GE Lighting, Automotive Lighting LLC, NICHIA CORPORATION, AIXTRON, Royal Philips Electronics N.V., Energy Focus, Bridgelux Inc and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |