Market Overview

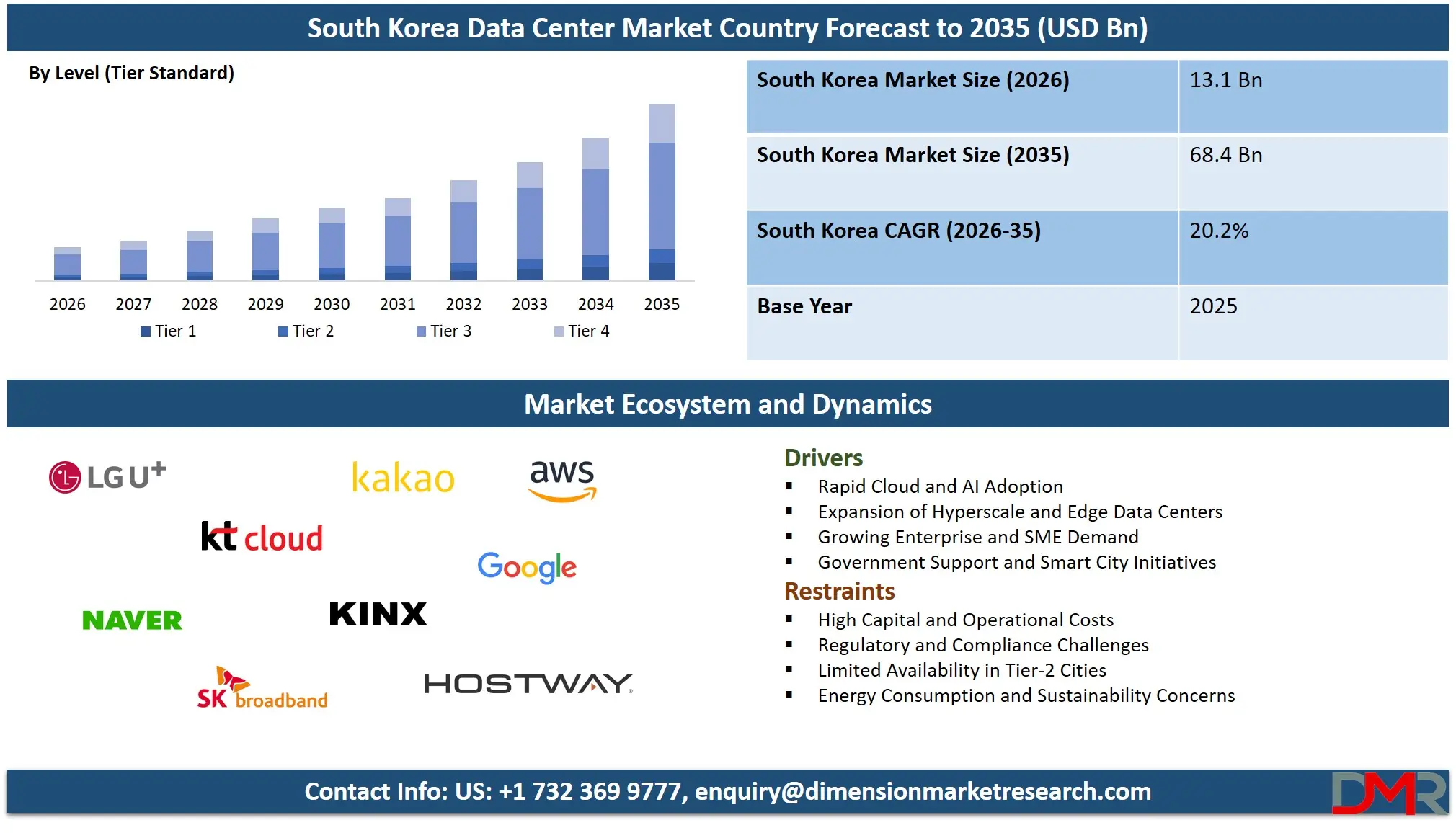

The South Korea data center market is expected to reach USD 13.1 billion by 2026 and expand at a robust CAGR of 20.2% to hit USD 68.4 billion by 2035, driven by increasing cloud adoption, hyperscale infrastructure investments, and rising demand for colocation, edge computing, and AI-ready facilities.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

A data center is a centralized facility designed to house computer systems and associated components such as servers, storage devices, networking equipment, and power and cooling infrastructure. It serves as the backbone for storing, processing, and managing vast volumes of digital information generated by enterprises, cloud service providers, and digital applications.

Data centers ensure continuous availability and high performance of IT resources by employing advanced monitoring systems, backup power solutions, security measures, and environmental controls. They play a crucial role in supporting cloud computing, big data analytics, artificial intelligence, and enterprise applications, providing reliable and scalable infrastructure for modern business operations and digital transformation initiatives.

The South Korea data center market has witnessed significant growth over the past decade driven by the rapid adoption of cloud computing, artificial intelligence, and digital services. Increasing demand for hyperscale infrastructure, colocation facilities, and edge computing solutions has led both local and international players to invest heavily in the region. The market is characterized by the presence of large telecom operators, technology companies, and cloud service providers developing high-performance computing environments to meet enterprise and government needs. Energy-efficient cooling solutions, resilient power systems, and advanced network connectivity are prioritized to support the rising workloads and ensure uninterrupted service delivery.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Government initiatives promoting smart cities, digitalization, and data localization policies have further accelerated the expansion of South Korea’s data center ecosystem. Colocation services and managed infrastructure offerings have become increasingly popular among enterprises seeking to optimize operational efficiency and reduce IT complexity. The growing penetration of internet services, e-commerce platforms, and digital content consumption has created a steady demand for secure and scalable facilities. Investments in next-generation infrastructure, including liquid cooling systems, high-capacity servers, and automation tools, are enabling the market to handle large-scale data processing and storage requirements, positioning South Korea as a strategic hub for regional and global data operations.

South Korea Data Center Market: Key Takeaways

- Rapid Growth Driven by Cloud and AI Adoption: The South Korea data center market is growing rapidly due to increasing cloud adoption, AI workloads, and hyperscale infrastructure investments. Enterprises and cloud providers are migrating workloads to cloud and hybrid environments, driving demand for scalable and secure facilities.

- Dominance of Colocation and Cloud-Based Infrastructure: Colocation and cloud-based data centers are preferred for their cost-efficiency, flexibility, and support for hybrid IT strategies. Enterprises leverage these facilities for AI workloads, disaster recovery, and virtualization, while SMEs benefit from managed services to reduce operational complexity.

- Tier 3 Data Centers Lead with Operational Efficiency: Tier 3 data centers dominate due to their balance of uptime, redundancy, and cost efficiency. They support critical enterprise applications, AI workloads, big data analytics, and hybrid cloud deployments, while Tier 4 centers cater to ultra-critical operations.

- Government Initiatives Accelerate Market Expansion: Policies promoting smart cities, national AI computing initiatives, and funding allocations to the Ministry of Science and ICT are driving investments in next-generation data centers, positioning South Korea as a strategic hub for regional and global data operations.

- SMEs and Emerging Technologies Present Growth Opportunities: SMEs are increasingly adopting colocation, hybrid cloud, and managed services, creating market opportunities. Edge computing, IoT integration, and AI-enabled infrastructure expand the market scope, enabling faster data processing, lower latency, and improved operational efficiency.

South Korea Data Center Market: Use Cases

- Cloud Adoption for Enterprises: South Korean enterprises are increasingly migrating workloads to cloud-based platforms to improve scalability and operational efficiency. Data centers provide secure colocation, hybrid cloud, and virtualization solutions that support business continuity, disaster recovery, and digital transformation initiatives. This enables companies to optimize IT infrastructure while managing large volumes of enterprise data effectively.

- Hyperscale Data Centers for IT and Telecom: Hyperscale facilities in South Korea cater to telecom operators, technology providers, and cloud platforms requiring high-performance computing and large-scale storage. These data centers deliver low-latency connectivity, redundant power systems, and advanced cooling solutions to support 5G deployment, AI workloads, and big data analytics, ensuring uninterrupted services and scalable infrastructure.

- Edge Computing for Retail and Media: Data centers enabling edge computing allow retail, e-commerce, and media companies to process real-time data close to end users. This reduces latency, improves content delivery, and enhances customer experience. Edge-enabled facilities also support Internet of Things integration, fast transaction processing, and high-speed connectivity for digital content and omnichannel operations.

- Managed Data Center Services for SMEs: Managed services in South Korea help small and medium enterprises optimize IT infrastructure without large capital investment. These services include server monitoring, backup and disaster recovery, network security, and virtualization. Leveraging managed data center solutions improves reliability, ensures compliance, and allows SMEs to focus on core business operations while scaling digital initiatives.

South Korea Data Center Market: Stats & Facts

- Ministry of Science and ICT (MSIT) Announcements

- In the 2025 government budget, KRW 19 trillion was allocated to the Ministry of Science and ICT, marking an increase from KRW 17.9 trillion in 2024.

- MSIT’s R&D budget for 2025 is KRW 9.7 trillion, up from KRW 8.4 trillion in 2024.

- Within the MSIT R&D budget, KRW 4.32 trillion in 2025 is earmarked for pioneering technology R&D, up from KRW 3.64 trillion in 2024.

- South Korean Presidential Office / Government Investment Announcements

- The presidential office announced AWS will invest at least USD 5 billion in South Korea by 2031 to build new AI data centers.

- Government Data Center Incident Statistics (Official Reports / Government Statements)

- A fire at the National Information Resources Service (NIRS) data center in September 2025 disrupted 647 government online systems nationwide.

- Following the same incident, only around 30 systems were restored by the latest update after the outage.

- National AI Computing and Digital Infrastructure Goals (Government Policy Announcements)

- The South Korean government announced plans in February 2025 to secure 10,000 high‑performance GPUs within the year for a national AI computing center initiative.

South Korea Data Center Market: Market Dynamic

Driving Factors in the South Korea Data Center Market

Rapid Cloud and Digital Transformation Adoption

South Korean enterprises are increasingly adopting cloud computing, hybrid IT environments, and virtualization solutions to support digital transformation initiatives. The demand for scalable infrastructure, secure storage, and high-performance computing is driving investments in colocation, hyperscale, and edge data centers. Companies are also leveraging these facilities to enable AI workloads, big data analytics, and disaster recovery strategies, boosting the overall market growth.

Expansion of Hyperscale and Edge Data Centers

The proliferation of hyperscale and edge data centers is accelerating market growth by providing low-latency connectivity, redundant power systems, and advanced cooling technologies. Telecom operators, cloud service providers, and technology companies are investing heavily in next-generation infrastructure to support 5G networks, IoT applications, and AI-driven services, enabling high-speed data processing and reliable uptime across the country.

Restraints in the South Korea Data Center Market

High Capital Expenditure and Operational Costs

Building and maintaining data centers in South Korea requires substantial investment in servers, storage, networking equipment, power supply, and cooling systems. Operational expenses, including energy consumption and maintenance, can be prohibitive for smaller enterprises, slowing adoption of advanced facilities. High costs also limit the deployment of edge and hyperscale data centers in tier-2 cities.

Regulatory and Compliance Challenges

Strict government regulations on data sovereignty, cybersecurity, and privacy impose challenges for operators and enterprises. Compliance with local standards requires investment in secure storage, monitoring systems, and disaster recovery solutions. Non-adherence risks legal penalties, reputational damage, and reduced trust, which can slow market expansion and limit cross-border data management opportunities.

Opportunities in the South Korea Data Center Market

Rising Demand for AI, Big Data, and IoT Infrastructure

The increasing adoption of artificial intelligence, big data analytics, and IoT applications is creating opportunities for high-performance and energy-efficient data centers. Enterprises and cloud providers require GPU-enabled servers, fast storage solutions, and low-latency networks to process large volumes of real-time data. These emerging workloads encourage investment in advanced computing and colocation facilities.

Growth of Managed Services and Colocation Solutions

Enterprises in South Korea are increasingly outsourcing IT infrastructure management to managed service providers. Services such as server monitoring, virtualization, network security, and disaster recovery allow companies to reduce operational complexity and optimize costs. This trend supports the growth of colocation data centers and enables small and medium enterprises to leverage enterprise-grade infrastructure without heavy upfront investment.

Trends in the South Korea Data Center Market

Integration of Green Energy and Energy-Efficient Cooling

Sustainability is a growing trend in South Korea’s data center market, with operators adopting renewable energy sources, energy-efficient cooling solutions, and environmentally friendly power management systems. This reduces operational costs, enhances sustainability credentials, and supports compliance with government environmental initiatives.

Adoption of Hybrid Cloud and Multi-Cloud Strategies

Companies are increasingly deploying hybrid and multi-cloud strategies to improve flexibility, scalability, and resilience. Data centers are evolving to support seamless integration between on-premise systems, private clouds, and public cloud platforms. This trend enables enterprises to optimize workload distribution, enhance data security, and improve overall IT agility.

South Korea Data Center Market: Research Scope and Analysis

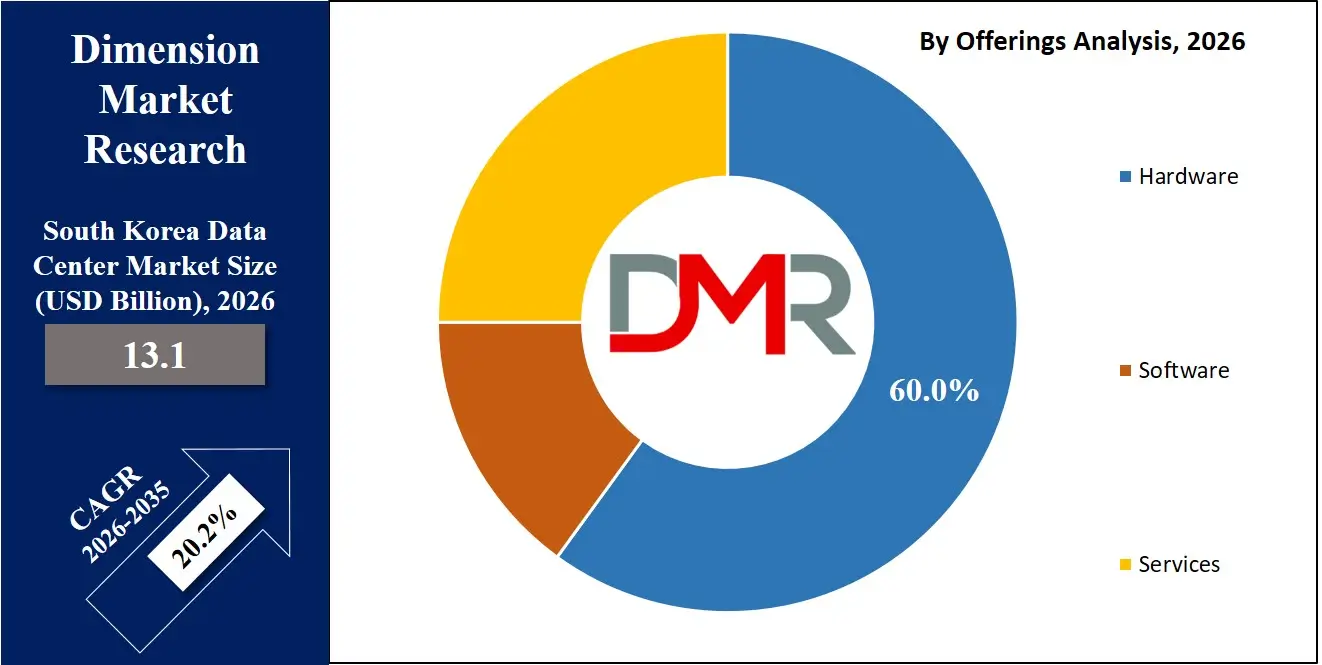

By Offering Analysis

Hardware is expected to dominate the offering segment in the South Korea data center market, accounting for approximately 60.0% of the total market share in 2025. This strong position is fueled by the growing need for servers, storage systems, and networking equipment that can handle increasing enterprise workloads, cloud migration, hyperscale operations, and AI-driven applications. Organizations are investing heavily in high-performance computing infrastructure to support virtualization, big data analytics, and real-time processing.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Advanced power solutions, such as redundant UPS systems and energy-efficient power distribution units, along with precision cooling systems, are becoming critical components to ensure operational reliability, reduce downtime, and maintain optimal performance. The rise of edge computing and the expansion of hyperscale facilities further drive demand for robust and scalable hardware that can accommodate low-latency requirements and high-volume data processing.

Services also hold a significant share in the South Korea data center market, covering design and consulting, integration and deployment, managed services, and continuous support and maintenance. These offerings enable enterprises to deploy complex IT infrastructure efficiently, optimize operational performance, and reduce risk and complexity associated with data management. Managed services have gained particular importance, allowing small and medium enterprises to leverage enterprise-grade infrastructure without heavy capital investment. These services include monitoring, backup, disaster recovery, network security, and virtualization management, ensuring business continuity and compliance with local regulatory requirements. Additionally, service providers support hybrid and multi-cloud integration, automation, orchestration, and energy-efficient operations, helping organizations scale effectively while adapting to evolving digital transformation needs and AI-driven workloads.

By Deployment Model Analysis

Cloud-based deployment is expected to dominate the South Korea data center market, capturing around 45.0% of the total market share in 2026. This growth is driven by the increasing adoption of cloud computing solutions among enterprises, telecom operators, and technology providers seeking scalable, flexible, and cost-effective IT infrastructure. Cloud-based data centers enable organizations to migrate workloads from on-premise servers, support hybrid IT environments, and leverage advanced services such as virtualization, AI workloads, and big data analytics. These facilities provide high availability, disaster recovery capabilities, and secure storage solutions, allowing businesses to reduce capital expenditure while maintaining operational efficiency. The growing demand for Software-as-a-Service, Platform-as-a-Service, and Infrastructure-as-a-Service offerings further accelerates the expansion of cloud-based deployments, positioning them as the preferred model for enterprises undergoing digital transformation.

Hybrid deployment models are also playing a significant role in the South Korea data center market by combining the benefits of on-premise infrastructure with cloud-based solutions. This approach allows enterprises to maintain critical workloads on private data centers while leveraging public cloud resources for scalable, flexible, and high-performance operations. Hybrid models support workload balancing, disaster recovery, and multi-cloud integration, enabling organizations to optimize cost, performance, and security simultaneously. Enterprises increasingly adopt hybrid strategies to ensure compliance with data localization regulations, enhance network efficiency, and manage AI, big data, and real-time analytics workloads effectively. By providing a mix of control, flexibility, and scalability, hybrid deployments are becoming an essential component of South Korea’s evolving data center landscape.

By Data Center Type Analysis

Colocation data centers are expected to dominate the South Korea data center market, capturing approximately 79.0% of the total market share in 2026. This dominance is driven by the growing preference of enterprises and technology providers for carrier-neutral facilities that offer shared infrastructure, high security, and reliable power and cooling systems. Colocation centers allow organizations to house their IT equipment in third-party facilities while benefiting from scalable space, advanced network connectivity, and redundant power and cooling solutions. They support hybrid and multi-cloud strategies, disaster recovery, and virtualization, enabling businesses to reduce capital expenditure while maintaining operational efficiency and high availability. The rising demand from telecom operators, IT service providers, and enterprises undergoing digital transformation further reinforces the adoption of colocation services as a cost-effective and flexible solution.

Cloud data centers are also gaining traction in the South Korea market, providing enterprises with fully managed infrastructure and on-demand computing resources. These facilities enable businesses to access high-performance servers, storage systems, and networking components without investing in physical on-premise infrastructure. Cloud data centers support scalable workloads, AI and big data analytics, and remote operations, allowing organizations to optimize IT resources and reduce maintenance costs. They are particularly advantageous for businesses looking to implement Infrastructure-as-a-Service, Platform-as-a-Service, and Software-as-a-Service solutions, offering flexibility, rapid deployment, and enhanced disaster recovery capabilities while meeting the growing demand for digital services and cloud-native applications.

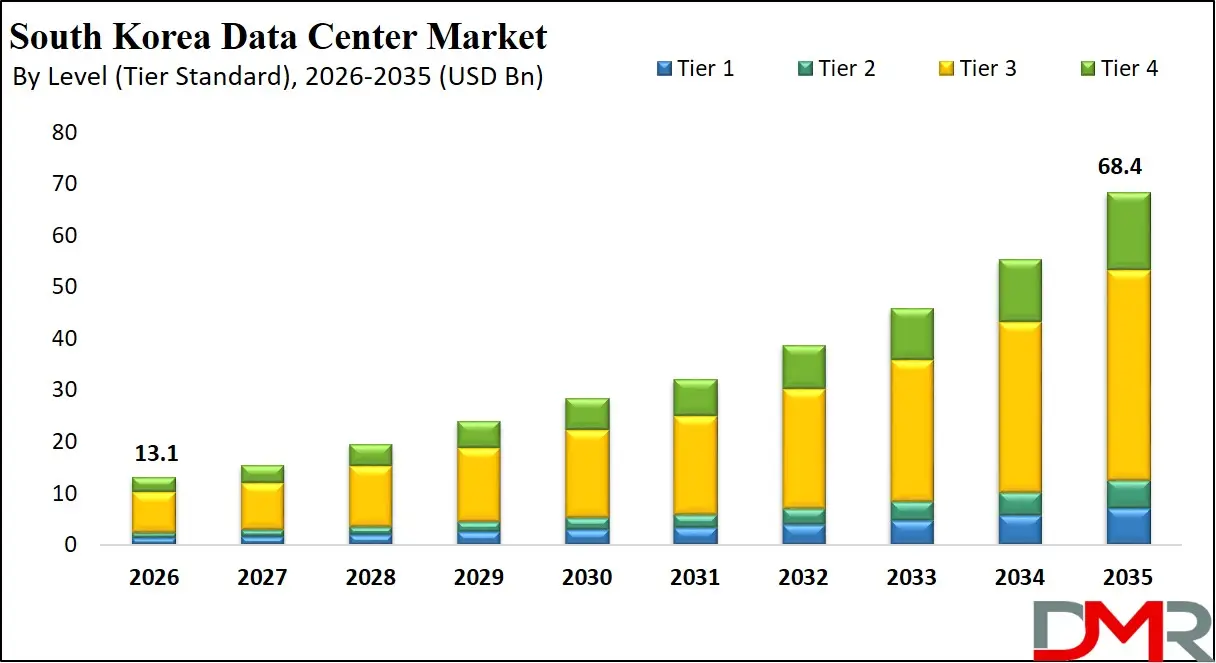

By Level (Tier Standard) Analysis

Tier 3 data centers are expected to dominate the South Korea data center market, capturing around 60.0% of the total market share in 2026. These facilities offer a balanced combination of high availability, redundancy, and cost efficiency, making them the preferred choice for enterprises, cloud service providers, and technology companies. Tier 3 data centers are designed with multiple power and cooling distribution paths, allowing maintenance without downtime and ensuring 99.982% uptime. They support virtualization, hybrid cloud deployments, AI workloads, and big data analytics, providing reliable infrastructure for mission-critical applications while optimizing operational efficiency and minimizing business disruption.

Tier 4 data centers, while less prevalent due to higher costs, are increasingly adopted for ultra-critical operations requiring maximum redundancy and fault tolerance. These facilities provide fully fault-tolerant infrastructure, including dual power sources, advanced cooling systems, and comprehensive monitoring tools, ensuring 99.995% uptime. Tier 4 data centers are ideal for hyperscale cloud providers, financial institutions, and enterprises handling sensitive data or high-volume transactions. They enable uninterrupted operations, advanced disaster recovery, and seamless support for AI, IoT, and big data analytics workloads, making them suitable for organizations that prioritize resilience and operational continuity above all else.

By Enterprise Size Analysis

Large enterprises are expected to dominate the South Korea data center market, capturing around 60.0% of the total market share in 2026. This dominance is driven by the high demand from multinational corporations, telecom operators, and technology providers that require robust, scalable, and secure IT infrastructure to manage large volumes of data. Large enterprises invest heavily in high-performance servers, storage systems, networking equipment, and advanced cooling and power solutions to support virtualization, cloud computing, AI workloads, and big data analytics. Their focus on business continuity, disaster recovery, and regulatory compliance further reinforces the adoption of enterprise-grade data center facilities that ensure high availability and operational efficiency across multiple locations.

Small and medium enterprises (SMEs) also contribute to the market growth by increasingly adopting colocation, cloud-based, and managed data center services to optimize IT operations without significant capital expenditure. These organizations leverage scalable infrastructure, backup solutions, and managed services to improve reliability, reduce operational complexity, and ensure data security. SMEs benefit from hybrid and multi-cloud deployments, allowing them to access enterprise-grade computing and storage resources while focusing on core business operations and digital transformation initiatives. The growing adoption of AI, IoT, and analytics among SMEs is further driving demand for flexible and cost-effective data center solutions.

By End User Analysis

Cloud service providers are expected to dominate the South Korea data center market, capturing around 50.0% of the total market share in 2026. This dominance is driven by the rapid growth of cloud computing services, digital transformation initiatives, and increasing demand for scalable, high-performance infrastructure. Data centers enable cloud service providers to host large volumes of enterprise and consumer workloads, deliver Infrastructure-as-a-Service, Platform-as-a-Service, and Software-as-a-Service solutions, and ensure reliable uptime, disaster recovery, and secure storage. The adoption of AI, big data analytics, and virtualization further drives investment in robust and energy-efficient infrastructure, allowing cloud providers to meet the evolving needs of enterprises, technology companies, and hyperscale platforms.

BFSI providers also contribute significantly to the South Korea data center market by leveraging data center infrastructure to manage sensitive financial data, support digital banking platforms, and ensure regulatory compliance. Banks, insurance companies, and financial institutions rely on high-performance servers, secure storage, and advanced network connectivity to handle real-time transactions, fraud detection, and risk management applications. Managed services, hybrid cloud deployments, and disaster recovery solutions enable BFSI organizations to maintain business continuity, optimize operational efficiency, and protect critical data while supporting AI-driven analytics, customer experience platforms, and emerging digital financial services.

The South Korea Data Center Market Report is segmented on the basis of the following:

By Offering

- Hardware

- IT Modules

- Servers

- Storage Systems

- Networking Equipment

- Power Modules

- UPS Systems

- Power Distribution Units

- Backup Power Systems

- Cooling Modules

- Air-Based Cooling

- Liquid Cooling

- Precision Cooling Systems

- Software

- Monitoring & Management Tools

- Automation & Orchestration Software

- Backup & Disaster Recovery Software

- Security Software

- Virtualization Software

- Analytics & Optimization Software

- Services

- Design & Consulting

- Integration & Deployment

- Support & Maintenance

- Managed Data Center Services

By Deployment Model

- On-Premise

- Hybrid

- Cloud-Based

By Data Center Type

- Enterprise Data Center

- Colocation Data Center

- Retail Colocation

- Wholesale Colocation

- Cloud Data Center

- Hyperscale Data Center

- Edge Data Center

By Level (Tier Standard)

- Tier 1

- Tier 2

- Tier 3

- Tier 4

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End User

- Cloud Service Providers

- Technology Providers

- Telecom

- BFSI

- Healthcare

- Retail & E-commerce

- Entertainment & Media

- Energy & Utilities

Impact of Artificial Intelligence in the South Korea Data Center Market

- AI-Driven Workload Optimization: Artificial intelligence enables data centers to optimize workloads by predicting resource requirements, balancing server utilization, and automating task scheduling. This improves operational efficiency, reduces energy consumption, and enhances performance for cloud services, hyperscale facilities, and enterprise applications, allowing South Korean data centers to manage large-scale AI and big data workloads effectively.

- Predictive Maintenance and Infrastructure Monitoring: AI-powered monitoring systems analyze sensor data in real time to predict equipment failures, optimize cooling and power usage, and detect anomalies. Predictive maintenance reduces downtime, minimizes operational costs, and ensures high availability for critical services, enhancing reliability across colocation, cloud-based, and hybrid data center infrastructures in South Korea.

- Enhanced Security and Threat Detection: Artificial intelligence strengthens data center security by detecting cyber threats, intrusions, and abnormal network behavior in real time. Advanced AI algorithms enable proactive threat mitigation, automated response, and compliance monitoring, ensuring secure storage, uninterrupted operations, and protection of sensitive enterprise and BFSI data across South Korea’s growing digital ecosystem.

South Korea Data Center Market: Competitive Landscape

The South Korea data center market is highly competitive, characterized by a mix of domestic and international players offering colocation, cloud-based, and managed services. Companies compete on infrastructure reliability, energy-efficient operations, low-latency connectivity, and advanced power and cooling solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Market growth is driven by rising demand for hyperscale facilities, edge computing, AI workloads, and hybrid cloud deployments. Providers differentiate through managed services, automation, and compliance support, while strategic investments in next-generation hardware, scalable storage, and high-performance networking create a dynamic environment focused on innovation, operational efficiency, and meeting the evolving digital transformation needs of enterprises and service providers.

Some of the prominent players in the South Korea Data Center Market are:

- LG Uplus Corp

- KT Corporation / KT Cloud

- Naver Corporation (Naver Cloud)

- SK Broadband / SK Telecom

- Kakao

- KINX Inc.

- Hostway Korea

- Amazon Web Services (AWS)

- Google LLC

- Microsoft Azure

- Oracle

- Alibaba Cloud

- Tencent Cloud

- Equinix

- Telehouse (KDDI)

- Digital Realty

- Digital Edge DC

- Macquarie Group / Macquarie Asset Management

- Arista Networks

- Cisco Systems

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- IBM

- Lenovo

- NVIDIA

- Other Key Players

Recent Developments in the South Korea Data Center Market

- February 2026: A consortium led by global investment firm KKR and Singapore’s Singtel Group agreed to acquire the remaining 82 % stake in a major Asian data center operator valued at USD 10.0 billion, marking one of the largest colocation infrastructure transactions amid rising demand for AI and cloud services infrastructure globally (ST Telemedia Global Data Centres).

- January 2026: Gruve, an AI infrastructure startup focused on addressing data center power constraints for inference workloads, raised USD 50 million in a Series A follow‑on round, bringing its total funding to USD 87.5 million and targeting expansion of distributed AI compute capacity across major U.S. cities and future markets.

- November 2025: Australian AI infrastructure project Firmus, backed by Nvidia and other investors, announced plans to raise AUD 500 million (~USD 325 million USD) for expanding its AI data center “AI factories,” including development of large‑capacity facilities and energy procurement to support high compute demand.

Report Details

| Report Characteristics |

| Market Size (2026) |

USD 13.1 Bn |

| Forecast Value (2035) |

USD 68.4 Bn |

| CAGR (2026–2035) |

20.2% |

| Historical Data |

2021 – 2025 |

| Forecast Data |

2027 – 2035 |

| Base Year |

2025 |

| Estimate Year |

2026 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offering (Hardware, Software, Services), By Deployment Model (On-Premise, Hybrid, Cloud-Based), By Data Center Type (Enterprise Data Center, Colocation Data Center, Cloud Data Center, Hyperscale Data Center, Edge Data Center), By Level (Tier Standard) (Tier 1, Tier 2, Tier 3, Tier 4), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By End User (Cloud Service Providers, Technology Providers, Telecom, BFSI, Healthcare, Retail & E-commerce, Entertainment & Media, Energy & Utilities) |

| Country Coverage |

South Korea |

| Prominent Players |

LG Uplus Corp, KT Corporation / KT Cloud, Naver Corporation (Naver Cloud), SK Broadband / SK Telecom, Kakao, KINX Inc., Hostway Korea, Amazon Web Services (AWS), Google LLC, Microsoft Azure, Oracle, Alibaba Cloud, Tencent Cloud, Equinix, Telehouse (KDDI), Digital Realty, Digital Edge DC, and many others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the South Korea Data Center Market?

▾ The South Korea Data Center Market size is estimated to have a value of USD 13.1 billion in 2026 and is expected to reach USD 68.4 billion by the end of 2035.

What is the growth rate in the South Korea Data Center Market in 2026?

▾ The market is growing at a CAGR of 20.2 percent over the forecasted period of 2026.

Who are the key players in the South Korea Data Center Market?

▾ Some of the major key players in the South Korea Data Center Market are LG Uplus Corp, KT Corporation / KT Cloud, Naver Corporation (Naver Cloud), SK Broadband / SK Telecom, Kakao, KINX Inc., Hostway Korea, Amazon Web Services (AWS), Google LLC, Microsoft Azure, Oracle, Alibaba Cloud, Tencent Cloud, Equinix, Telehouse (KDDI), Digital Realty, Digital Edge DC, and many others.