Space logistics refers to the transportation, management, and storage of goods in outer space. It supports various space activities, including satellite launches, spacecraft refueling, and maintenance of space equipment. Space logistics ensures efficient supply chains for both government space programs and commercial missions. As the space sector expands, logistics has become essential to enabling long-term space exploration and satellite communications.

The Space Logistics market is growing rapidly, driven by advancements in space technology and an increase in private sector participation. The commercial space sector now accounts for 77% of the global space economy, indicating the rising role of private companies in space exploration.

Major players such as SpaceX and Blue Origin are scaling up, while new businesses can tap into opportunities like satellite servicing, in-orbit refueling, and automated payload delivery. These advancements will contribute significantly to the growth of the market in 2025.

In 2025, the space logistics market will benefit from technological innovations, including reusable rocket technology, which reduces space mission costs. Private-public partnerships and government space programs will also help facilitate growth, opening doors for new entrants. There is a growing demand for satellite services, and companies offering cost-effective logistics solutions will be in high demand. With space exploration efforts expanding, the need for efficient logistics will only increase.

Key trends include the integration of artificial intelligence in space logistics. AI can enhance mission planning, streamline operations, and improve satellite communications. Reusable launch vehicles are also revolutionizing the market by reducing costs. Furthermore, the development of spaceports will support the launch and landing of spacecraft, creating a more efficient logistics ecosystem.

Another trend is the growth in demand for space infrastructure. As seen in the terrestrial logistics sector, the leasing of industrial spaces is set to rise, with demand reaching 50-53 million square feet in 2025. Similarly, space infrastructure such as space stations and satellite servicing facilities will become more prominent, further driving the demand for space logistics. As these developments unfold, the space logistics market will continue to grow and evolve, with new opportunities for both established players and newcomers.

Key Takeaways

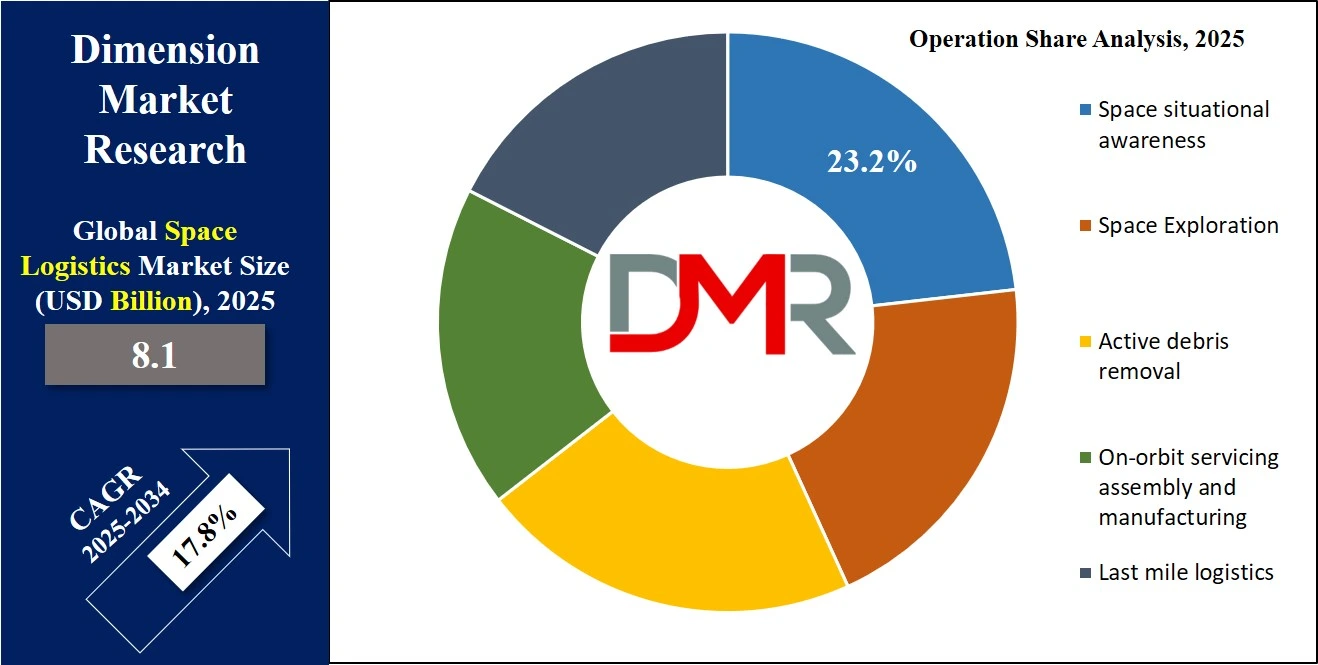

- The global Space Logistics Market is projected to grow from $8.1 billion in 2025 to $37.2 billion by 2034, at a CAGR of 17.8%.

- The Space Situational Awareness segment is projected to lead the market with 23.2% market share.

- Payloads' spacecraft & satellite systems segment is currently the market leader, holding 43.3% market share.

- Market expansion is driven by increasing satellite deployment, an increase in-orbit servicing demand, and the development of space tourism infrastructure.

- Major contributors to market expansion are private investments, government space programs, and satellite constellation growth.

- North America leads the market, accounting for 40.1%. Europe and Asia Pacific follow closely behind, as Latin America andthe Middle East/Africa offer opportunities.

Use Cases

- Satellite Deployment and Maintenance: Space logistics facilitate the efficient transport and servicing of satellites to ensure optimal positioning while prolonging operational lifespans.

- Space Station Resupply: Essential supplies such as food, equipment, and fuel are delivered directly to space stations for long-term missions and research activities.

- Space Tourism Infrastructure: Space logistics enable safe travel for both passengers and materials in support of space tourism by guaranteeing safe journeys and station maintenance.

- Space Mining Operations: Moving mining equipment and materials between Earth and asteroids or the Moon becomes possible thanks to advanced space logistics systems.

- Orbital Debris Management: Space logistics services offer orbital debris management to remove or relocate space debris safely, thus decreasing collision risks and assuring safer orbital operations.

Driving Factors

Increased Private Sector Investments: Fostering Market Expansion through Innovation and Experimentation

Private investments from major players like SpaceX and Blue Origin as well as emerging space firms is driving growth of the Space Logistics Market. These companies are making strides toward significantly lowering the costs associated with space access through innovations in reusable rocket technology and efficient space transport services. SpaceX's reusable Falcon rockets have drastically cut launch costs, making space more available and accessible to commercial as well as government missions alike.

Private capital has also proven critical in speeding the creation of logistics services like in-orbit servicing, satellite deployment and space debris management. As commercial space race becomes ever more intense, investments into space logistics should continue driving advancements that propel its market exponentially forward over time.

Expansion of Satellite Constellations Drives Demand for Efficient Space Operations

Increased satellite constellation deployment - particularly for communications, navigation and earth observation purposes - has contributed greatly to the expansion of Space Logistics Market. Starlink and OneWeb have taken the initiative in developing large satellite constellations.

Starlink plans on deploying up to 42,000 satellites to cover global internet coverage. Services provided to maintain, refuel, and service these constellations will increase demand for advanced space logistics services.

Furthermore, expanding satellite constellations are increasing orbital debris removal requirements which emphasizes how critical such infrastructure can be in maintaining operational safety in ever more congested orbits.

Government Space Programs: Fostering Market Growth With Strategic Funding and Collaborations

Government space programs like NASA and ESA play an essential part in driving growth of the Space Logistics Market. Increased government funding and strategic collaborations with private industry are driving innovations in space transportation and logistics services.

NASA's Artemis Program, to return humans to the Moon by 2025 and create a sustainable presence by 2028, requires significant logistic support ranging from material transport and servicing of spacecraft in orbit.

Governments are teaming up with private companies to design reusable rockets, space stations and other logistical infrastructure that not only enhances space agencies' capabilities but also creates opportunities within the space logistics ecosystem. This partnership not only strengthens capabilities at these agencies but opens doors for private firms within this ecosystem.

Rise in Space Tourism Demand Spurring Opportunity for Logistics Infrastructure Development: Providing New Opportunities

Commercial space tourism offered by Virgin Galactic and Blue Origin will likely exacerbate the need for efficient space logistics infrastructure. As space travel becomes more accessible to non-professional astronauts, their logistics support requirements will become ever greater - including transportation between space stations as well as handling of consumables and waste in orbit.

As space tourism flights proliferate, logistics services will also increase with them to service, refuel and maintain spacecraft regularly. With commercial space travel anticipated to generate billions in revenues by 2030, space logistics stands to gain significantly from this growing industry segment.

Growth Opportunities

Expanded Lunar and Martian Missions Unlock New Frontiers for Advanced Logistics Solutions

NASA's Artemis program and private ventures' increased attention on lunar exploration and Mars missions represents significant opportunities for the Space Logistics Market in 2025. Establishing sustainable lunar bases or supporting Mars missions require advanced logistic infrastructure - cargo transport systems, habitat resupply services and managing resources in space - for sustainable operations to take place successfully.

Specialized solutions, including carrying building materials or scientific equipment between destinations offer companies new avenues to develop innovative technologies to support long-term extraterrestrial missions.

Space Debris Management Services: Addressing Orbital Safety Concerns

Space debris presents an increasingly serious risk to satellites and spacecraft, creating opportunities for space debris management services. With over 36,000 tracked objects currently orbiting earth, debris removal services could experience explosive growth as more companies specialize in capture, removal and mitigation to keep space assets safe while supporting future missions.

Autonomous Space Transport: Enhancing Efficiency and Lowering Costs

AI-driven autonomous spacecraft provide tremendous potential to reduce labor costs and enhance operational efficiencies for space logistics operations. Autonomous systems can transport goods, equipment and supplies autonomously without human interaction enabling more frequent missions at reduced costs. Artificial Intelligence will play a crucial role in driving this trend going forward with 2025 advancements opening new avenues for companies seeking efficient space transport strategies to capitalize on it.

On-Orbit Refueling and Maintenance Capability Enabling Long Term Space Operations: Achieve Success Now

Infrastructure to facilitate on-orbit refueling and maintenance of satellites and spacecraft represents an attractive opportunity in space logistics. Such infrastructure can extend the operational lifespan of space assets, reduce launch costs, and enable flexible mission planning - three capabilities which private companies and governments are seeking out to leverage long-term space operations more sustainably and less expensively. With continued emphasis placed upon sustainable long-term space operations by private firms and governments alike, demand for in-orbit servicing solutions will only grow by 2025 - creating new market for innovative logistics solutions!

Key Trends

Growth of Commercial Launch Providers and How It Transformed the Space Logistics Landscape

Commercial launch providers such as SpaceX, Rocket Lab, and Blue Origin offer more cost-effective launch services that further democratize space access for various industries; creating demand for logistics services including satellite deployment, in-orbit servicing and cargo transportation services. In 2025 alone, this trend could prove transformative.

Spaceports Are Transforming Space Logistics Operations : Establishing Hubs

Global spaceport development is creating new logistical hubs and revolutionizing the space transportation ecosystem. Spaceports in regions like the US, EU and ASIA are quickly emerging as strategic locations for both government and commercial launches; further expanding space logistics markets through providing infrastructure such as fueling services, maintenance checks and payload integration services.

Reusable Rocket Technologies: Cutting Costs and Expanding Launch Frequencies

Advancements in reusable rocket technologies remain a trend in 2025, driving costs per launch down while increasing frequency of space missions. Companies like SpaceX are setting the bar when it comes to cost-efficient launches using reuse rocket technology such as their Falcon 9s; making space logistics services more accessible while driving market growth in this way.

Miniaturization of Satellites Fueling Need for Small Payload Logistics

As more cost-efficient CubeSat satellites enter orbit, companies are creating logistics services tailored specifically for smaller payloads. By 2025, companies will need more agile and cost-efficient options available for deployment and servicing satellites in space.

Restraining Factors

High Initial Capital Costs Can Be an Obstacle To Market Entry and Expansion: A Potential Roadblock

Space Logistics Market growth can be curtailed by its prohibitively expensive initial capital requirements for space missions and infrastructure expansion, making initial capital outlays prohibitively high. Launch vehicles, satellites and other space systems require immense investments; with estimates for satellite development reaching upwards of $290 Million for larger missions. Establishing the infrastructure necessary for space logistics services - in-orbit refueling stations and debris removal systems, for example - also necessitates substantial financial resources.

Small companies and startups often struggle with high upfront costs that prevent entry to markets or slow their expansion, restricting market entry opportunities. Even established players face difficulties reaching profitability as lengthy return on investment cycles inhibit rapid scaling strategies.

Limited Infrastructure Space Is an Obstacle to Scalability and Operating Efficiency

Refueling, maintenance and cargo handling remain major roadblocks to growth in the Space Logistics Market. At present, no large-scale systems for in-orbit refueling or repair exist, while current space stations like the International Space Station (ISS) offer limited capacity for cargo operations and logistic operations.

Space logistics services have limited scalability due to infrastructure limitations; missions depend on Earth-based systems for maintenance and refueling services, thus restricting long-term sustainability initiatives such as satellite servicing, debris management or future space tourism missions.

Without an in-space logistics network capable of supporting long-term sustainable operations - be they satellite servicing missions, debris clearing missions or future space tourism missions - sustainability potential becomes severely diminished.

Research Scope and Analysis

By Operation

Space Situational Awareness was the clear market leader in the Operation segment of the Space Logistics Market for 2025, taking over 23.2% market share. This success can be attributed to real-time tracking and monitoring of space assets as well as managing increasing levels of debris; something essential for safe space operations.

Space Exploration continues its steady increase due to ambitious lunar and Mars exploration programs, seeing increased investments from both government and private sources aiming at creating human presence on both these bodies. This trend has created substantial demand for space logistics services such as cargo transportation, resource management and in-orbit servicing to support long-duration missions - this segment playing an instrumental role in driving overall expansion of space logistics infrastructure.

Active Debris Removal has emerged as an attractive growth area due to space debris's increasing presence in orbit - currently over 36,000 tracked objects! As space operations depend on safe operations for their continued success and sustainability, this segment's importance increases exponentially.

By 2025, advanced debris capture and removal technologies had elevated it as a substantial contributor to overall market. Regulatory bodies now prioritize space environmental protection measures.

On-Orbit Servicing, Assembly and Manufacturing (OSAM) services have seen growing interest within the Space Logistics Market over time, offering essential satellite refueling, repair and infrastructure assembly in space services such as satellite refueling.

OSAM services represent an eco-friendly strategy to extend lifespans while simultaneously cutting costs for modular infrastructure development in space - OSAM has quickly become a cornerstone of long-term space operations.

Last Mile Logistics plays an essential role in ensuring efficient and timely deliveries of cargo, equipment and resources to space stations, satellites and lunar bases. With increasingly complex missions underway and space tourism expanding at an incredible rate, last mile logistics' importance only continues to increase - seeing significant gains thanks to advances in autonomous spacecraft development as well as demand for reliable cargo handling solutions in space.

In 2025 this segment experienced notable expansion as autonomous spacecraft technology advanced further and cargo handling solutions proved reliable enough for reliable operations within space environments.

By Payloads

Spacecraft and Satellite Systems held an overwhelming market share of 43.3% for Payloads within the Space Logistics Market in 2025, due to growing demands for satellite constellations, space-based communications, navigation systems and servicing needs - driving considerable increases in deployment and servicing requirements across commercial and government satellite programs alike.

Space Logistics Market trends: Spacecraft & Satellite Systems' market dominance can be explained by this demand trend as more is invested into satellite constellations for constellation management, communications with space assets or navigation needs driving satellite deployment and servicing needs; further highlights its importance within its overall space logistics landscape.

Cargo and Material Logistics play an essential part of Space Logistics Market, particularly as more missions to International Space Station (ISS), lunar exploration, commercial space activities, space tourism activities, research initiatives, exploration missions as well as tourism increase in 2025.

Space tourism activities as well as research initiatives fuelled an increased need for efficient cargo handling solutions for tourism initiatives as well as exploration missions; therefore this segment becomes ever more crucial to maintaining supply chains at space stations, providing critical materials needed for manufacturing in-space production processes, supporting human spaceflight missions as well as human spaceflight missions in 2025.

The Space Logistics Market Report is segmented based on the following:

By Operation

- Space situational awareness

- Space Exploration

- Active debris removal

- On-orbit servicing assembly and manufacturing

- Last mile logistics

By Payloads

- Spacecraft and Satellites Systems

- Cargo and Material

- Others

Regional Analysis

North America held 40.1% of the Global Space Logistics Market by 2025, due to strong governmental and private investments; companies like SpaceX, Blue Origin and Boeing being at the forefront of space logistics innovations.

Furthermore, NASA and DOD continue to dedicate substantial funds towards space exploration programs, satellite programs and defense initiatives, further solidifying North America's dominance. Europe closely follows America when it comes to space logistics market development, supported by organizations like European Space Agency (ESA), Airbus, Arianespace and Thales Alenia Space as key contributors.

Europe's commitments in sustainability, constellation expansion and debris removal solidifies their place as major players on this global space logistics market; growth should increase steadily as new spaceports emerge and collaboration between member nations of European Union boost space-related innovations.

Asia Pacific space logistics capabilities have experienced extraordinary expansion over recent years due to increased investments from agencies and companies from countries like China, Japan and India.

China's ambitious space programs such as lunar exploration and satellite deployment plans as well as Mitsubishi Heavy Industries of Japan and ISRO of India are driving these growth trends forward - further cementing Asia Pacific space market's potential growth potential due to both private sector interest as well as government initiatives.

Latin America and Middle East/Africa are emerging markets in space logistics, with increasing investments into satellite communications networks as well as early space exploration programs. Both regions are gradually building their space infrastructure which could present potential growth opportunities to further their space business endeavors.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

2025's global Space Logistics Market is heavily shaped by several key players who all offer unique technologies and services that drive it forward.

Airbus Defense and Space and Boeing remain leaders with extensive expertise in space systems deployment for satellite deployment as well as related defense-related space logistics requirements, while Northrop Grumman and Dynetics play key roles in providing in-orbit servicing and cargo transport - essential services needed during long-duration missions or satellite maintenance activities.

SpaceX remains at the top of the commercial launch sector, taking advantage of its reusable rocket technology to significantly cut costs and expand launch frequency. Blue Origin also continues its impressive track record, especially when it comes to space tourism and heavy lift launch services, contributing towards commercializing space logistics services as a result. Virgin Galactic's suborbital space tourism market expansion drives additional logistics demands.

Rocket Lab and Arianespace have become essential partners in providing cost-effective satellite deployment. Mitsubishi Heavy Industries and RUAG Space remain at the forefront of aerospace manufacturing by producing key components used on launch vehicles and satellites.

Some of the prominent players in the Global Space Logistics Market are:

- Airbus Defense and Space

- Boeing

- Northrop Grumman

- Dynetics

- Virgin Galactic

- Rocket Lab

- Arianespace

- Beyond Gravity

- Mitsubishi Heavy Industries

- Thales Alenia Space

- Honeywell International

- NanoRacks

- Bigelow Aerospace

- Astrobotic Technology

- Lockheed Martin

- Orbital ATK

- Blue Origin

- Space Exploration Technologies (SpaceX)

- Sierra Nevada Corporation

Recent developments

- In February 2025, ATMOS Space Cargo secured €13.1 million in funding to accelerate the development of its re-entry technology, advancing the company's capabilities in space logistics and improving spacecraft return operations.

- In September 2024, D-Orbit extended its Series C funding round, successfully raising €150 million to scale its space logistics services and expand its orbital transport solutions for satellite deployment.

- In January 2024, D-Orbit raised \$110 million in its Series C round to further enhance its space logistics business, focusing on increasing satellite delivery efficiency and reducing the cost of satellite deployment.

- In March 2025, SpaceWERX selected eight companies for a \$440 million public-private partnership initiative aimed at advancing space logistics and fostering innovative solutions for national space infrastructure needs.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 8.1 Bn |

| Forecast Value (2034) |

USD 37.2 Bn |

| CAGR (2025-2034) |

17.8% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2025 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Operation(Space situational awareness, Space Exploration, Active debris removal, On-orbit servicing assembly and manufacturing, Last mile logistics), By Payloads(Spacecraft and Satellites Systems, Cargo and Material, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Airbus Defense and Space, Boeing, Northrop Grumman, Dynetics, Virgin Galactic, Rocket Lab, Arianespace, RUAG Space, Mitsubishi Heavy Industries, Thales Alenia Space, Honeywell International, NanoRacks, Bigelow Aerospace, Astrobotic Technology, Lockheed Martin, Orbital ATK, Blue Origin, Space Exploration Technologies (SpaceX), Sierra Nevada Corporation |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |