Market Overview

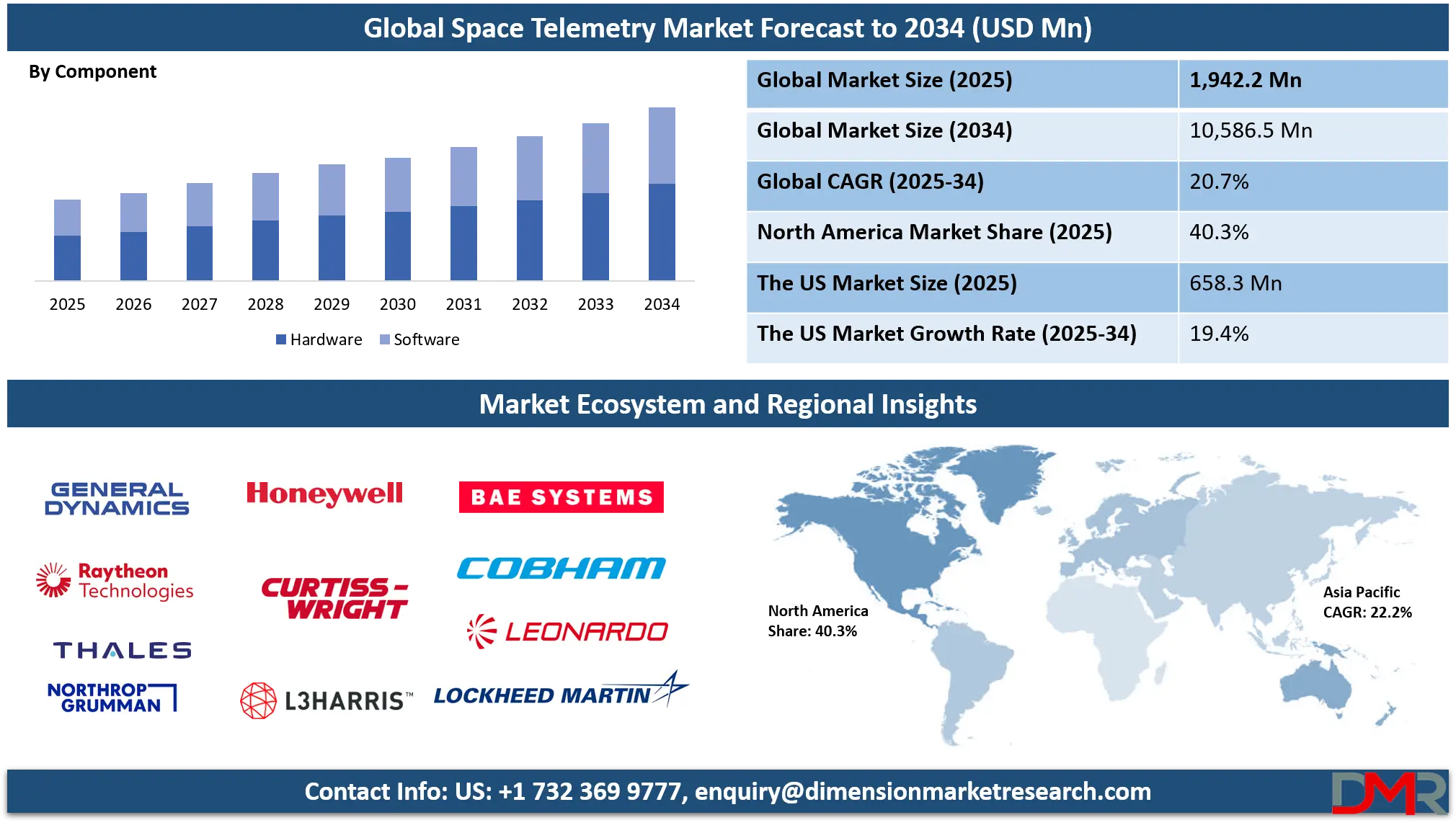

The Global Space Telemetry Market is projected to reach USD 1,942.2 million in 2025 and grow at a compound annual growth rate of 20.7% from there until 2034 to reach a value of USD 10,586.5 million.

The global space telemetry market is witnessing a transformative evolution, largely driven by the increasing complexity of space missions and the exponential rise in data dependency. With space exploration extending beyond Earth’s orbit to Mars, asteroids, and beyond, there is a growing demand for advanced telemetry systems that can provide reliable real-time data collection, tracking, and transmission capabilities.

The emergence of small satellites (CubeSats), reusable launch systems, and AI-driven mission analytics is reshaping the telemetry ecosystem. These technologies are enhancing automation and reducing mission turnaround time, allowing space agencies and private entities to streamline operations and improve system responsiveness.

Opportunities for growth are strongly supported by the ongoing miniaturization of electronic components, enabling telemetry hardware to be lighter, more power-efficient, and cost-effective. The rapid commercialization of space, particularly the increase in private space launches, constellations for Earth observation, and low-Earth orbit (LEO) internet connectivity projects, continues to open new revenue streams. Innovations in wireless telemetry and long-range transmission systems further drive market expansion.

Nevertheless, market growth is somewhat constrained by the high development and deployment costs of space-grade telemetry infrastructure. Additionally, issues related to signal interference, bandwidth limitations, and increasing cyber vulnerabilities require stringent mitigation strategies. Regulatory complexities and satellite frequency management across international jurisdictions further add to deployment hurdles.

Despite these challenges, the market’s growth trajectory remains robust. Governments and private stakeholders are heavily investing in next-generation telemetry frameworks to support deep space missions, space station logistics, and defense communications, positioning telemetry as an indispensable pillar of the future space economy.

The US Space Telemetry Market

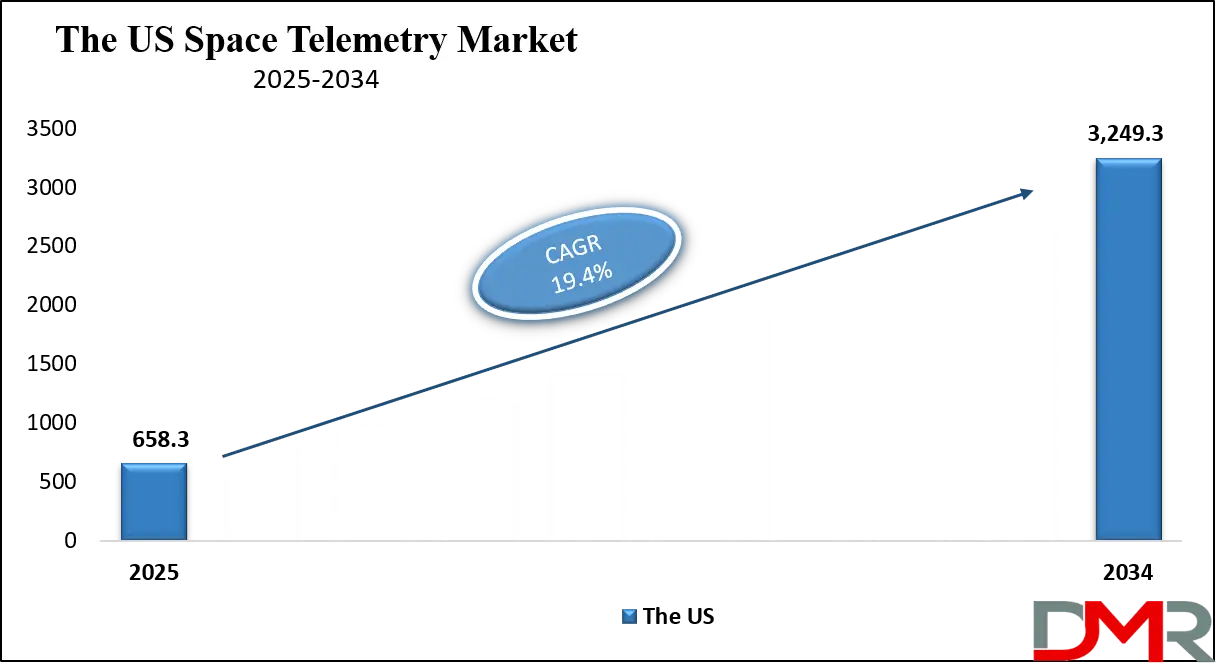

The US Space Telemetry Market is projected to reach USD 658.3 million in 2025 at a compound annual growth rate of 19.4% over its forecast period.

The United States is the global leader in space telemetry, benefiting from an extensive network of government agencies, private aerospace firms, and university-led research institutions. Agencies such as NASA, the Department of Defense (DoD), and the National Oceanic and Atmospheric Administration (NOAA) are at the forefront of space telemetry applications, operating numerous satellites, launch vehicles, and exploratory missions that rely on robust data transmission systems. NASA’s telemetry capabilities, especially via the Deep Space Network (DSN), enable communication with interplanetary probes and rovers, while NOAA satellites support real-time environmental data collection using secure telemetry channels.

The U.S. government continues to expand its space infrastructure with initiatives like the Artemis program, Commercial Lunar Payload Services (CLPS), and private launch contracts through the Space Force and NASA partnerships. Telemetry plays a critical role in enabling these multi-orbit missions by ensuring safe launch, operation, and reentry through continuous data streaming.

Demographically, the U.S. enjoys a significant advantage due to its large pool of STEM graduates, defense-focused universities, and space engineering specialists. A network of aerospace hubs across states like California, Texas, Colorado, and Florida facilitates knowledge transfer, R&D, and system integration. Policies encouraging space innovation, combined with a favorable regulatory framework, ensure sustained growth in telemetry development.

Additionally, initiatives around space traffic management and orbital debris mitigation are expected to further necessitate telemetry enhancements. As the private sector becomes increasingly involved, with players like SpaceX, Blue Origin, and Boeing leading the charge, the U.S. space telemetry market is poised for continued technological dominance and global influence.

The European Space Telemetry Market

The European Space Telemetry Market is estimated to be valued at USD 341.83 million in 2025 and is further anticipated to reach USD 1,516.16 million by 2034 at a CAGR of 18.0%.

The European space telemetry market is evolving rapidly, driven by a strong institutional framework and cross-border collaboration through agencies like the European Space Agency (ESA). ESA’s growing portfolio of Earth observation, navigation, and exploration missions depends heavily on sophisticated telemetry systems to ensure accurate data collection and mission control. Satellite programs such as Galileo for navigation and Copernicus for environmental monitoring rely on telemetry for orbit correction, health diagnostics, and data transfer to ground stations.

Europe’s advantage lies in its ability to pool expertise and infrastructure among member states. Telemetry ground stations located in Spain, Germany, Italy, and France serve as vital nodes in the continent’s space communication network. The European Data Relay System (EDRS), known as the “SpaceDataHighway,” is a significant leap in telemetry performance, enabling near-instantaneous data relay from orbit to Earth for high-priority missions.

Europe’s demographic edge stems from a highly educated population with strong backgrounds in aerospace, robotics, and embedded systems. Public investment in space science education and access to multinational research programs continues to build a pipeline of skilled telemetry engineers and system developers. Moreover, a rising number of NewSpace startups and integration with digital twin technology are creating new telemetry use cases beyond defense, such as disaster response, smart agriculture, and air traffic monitoring.

Although the European market faces challenges related to launch capability dependence and fragmented commercial activity, ongoing efforts toward strategic autonomy and secure satellite communication systems will continue to propel telemetry innovation across the region.

The Japan Space Telemetry Market

The Japan Space Telemetry Market is projected to be valued at USD 116.53 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 610.36 million in 2034 at a CAGR of 20.2%.

Japan is a critical player in the space telemetry ecosystem, bolstered by its technical precision, automation expertise, and government-backed aerospace programs. The Japan Aerospace Exploration Agency (JAXA) leads national efforts in space exploration, with missions involving satellite launches, space probes, and participation in the International Space Station (ISS). Telemetry is central to these operations, enabling seamless data transfer between orbiting systems and terrestrial command centers.

Japan’s Quasi-Zenith Satellite System (QZSS) and the recent H3 rocket launch with the Michibiki-6 satellite illustrate its commitment to bolstering regional satellite navigation infrastructure. Each launch leverages telemetry systems for real-time tracking of propulsion, navigation, payload status, and environmental conditions. Telemetry also plays an essential role in asteroid missions like Hayabusa2, which required millisecond-precise commands and navigation data to collect samples from distant celestial bodies.

Japan’s demographic strength lies in its highly skilled workforce specializing in mechatronics, aerospace engineering, and satellite communication. Universities like the University of Tokyo and Kyoto University partner closely with JAXA and industry players to advance telemetry software and onboard system architecture. Japan’s corporate sector, including Mitsubishi Electric and NEC, develops mission-critical telemetry components for both domestic and international missions.

In recent years, the Japanese government has increased funding for space startups and small satellite initiatives, enabling broader participation in satellite telemetry applications. The country’s emphasis on dual-use technologies for defense and civil purposes, coupled with its precision-oriented manufacturing culture, ensures Japan remains a top-tier innovator in the global space telemetry market.

Global Space Telemetry Market: Key Takeaways

- Global Market Size Insights: The Global Space Telemetry Market size is estimated to have a value of USD 1,942.2 million in 2025 and is expected to reach USD 10,586.5 million by the end of 2034.

- The US Market Size Insights: The US Space Telemetry Market is projected to be valued at USD 658.3 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3,249.3 million in 2034 at a CAGR of 19.4%.

- Regional Insight: North America is expected to have the largest market share in the Global Space Telemetry Market with a share of about 40.3% in 2025.

- Key Players: Some of the major key players in the Global Space Telemetry Market are Lockheed Martin, L3Harris, Honeywell, General Dynamics, BAE Systems, Raytheon, Thales, Safran, Cobham, Northrop Grumman, Airbus, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 20.7 percent over the forecasted period of 2025.

Global Space Telemetry Market: Use Cases

- Satellite Fleet Monitoring: Telemetry enables continuous health diagnostics and status monitoring for satellite fleets. Operators receive real-time data on thermal conditions, battery performance, propulsion status, and payload integrity, allowing rapid anomaly detection and adaptive mission control.

- Rocket Launch Telemetry: During a rocket launch, telemetry transmits critical real-time data such as velocity, pressure, vibration, fuel levels, and stage separation timing. Engineers use this data to verify mission integrity and safety protocols at every flight stage.

- Deep Space Probes: Telemetry allows communication with distant space probes millions of kilometers away. It enables command uplink, systems status reporting, trajectory corrections, and transmission of scientific data collected from planets, moons, or comets during long-duration missions.

- Space Station Operations: Telemetry systems on space stations monitor air pressure, humidity, CO₂ levels, power flow, water systems, and structural stresses. This ensures life support continuity, early failure detection, and safety for astronauts living in microgravity environments.

- Defense Reconnaissance Satellites: Military satellites equipped with telemetry provide real-time intelligence, surveillance, and reconnaissance (ISR). These systems send encrypted data regarding terrain, enemy movement, and missile tracking back to command centers with minimal latency.

Global Space Telemetry Market: Stats & Facts

European Space Agency (ESA) – Space Activity and Debris Monitoring

- The European Space Agency estimates that over 20,650 satellites have been launched into Earth’s orbit since 1957, reflecting the accelerating pace of global space activities.

- Among these, approximately 13,660 satellites remain in orbit, with nearly 11,000 still actively functioning, illustrating the growing density of active satellite infrastructure.

- The total mass of space objects currently orbiting Earth exceeds 13,500 tonnes, showcasing the immense physical footprint of space-based assets and debris.

- Space surveillance systems around the world currently track more than 39,340 orbital objects, a number that continues to rise due to both intentional launches and debris fragmentation.

- Estimates suggest that space debris includes around 40,500 fragments larger than 10 cm, 1.1 million objects between 1 and 10 cm, and a staggering 130 million particles between 1 mm and 1 cm, posing increasing risks to telemetry and communications systems.

- In 2023, global satellite launch activity reached a record high, with the majority of new deployments contributing to commercial communications and Earth observation constellations.

- Over 6,000 active satellites—roughly two-thirds of the global total—are currently operating within 500–600 km altitudes in Low Earth Orbit (LEO), emphasizing this region’s importance for telemetry coverage.

- Collision avoidance maneuvers performed by LEO satellites have surged due to heightened orbital congestion and debris threats, placing a greater demand on telemetry systems for real-time monitoring and control.

United States Space Force – Modernization and Resilience of Satellite Networks

- The United States Space Force has initiated the development of a next-generation satellite architecture that focuses on deploying distributed satellite swarms for enhanced resilience and agility.

- The first operational step, termed “Tranche 0,” includes 28 satellites intended for testing telemetry coordination, data relay, and resilience under simulated attack or system failure conditions.

- Future plans involve launching over 160 satellites by the end of 2024, with capabilities including missile detection, encrypted data transfer, and space-based communications support.

- To maintain and expand this distributed satellite capability, the U.S. Space Force has earmarked an annual budget of around $5 billion for satellite and telemetry system development through 2028.

NASA – Legacy and Technological Evolution of Telemetry Control

- NASA’s Mission Control Center, inaugurated in 1965, remains one of the most iconic telemetry and operations hubs in the world, having supported missions such as Apollo, Skylab, and ISS operations.

- Originally developed at a cost of $100 million in the 1960s (approximately $750 million today adjusted for inflation), the control center has undergone multiple modernizations to support real-time telemetry for multi-orbit missions.

Argos Satellite System – Global Reach in Scientific and Environmental Telemetry

- The Argos satellite system, a long-standing global satellite-based telemetry solution, currently supports over 22,000 active transmitters deployed in over 100 countries worldwide.

- Of these, nearly 8,000 transmitters are specifically used for tracking wildlife and marine species, providing real-time telemetry for ecological and scientific monitoring initiatives.

Global Space Telemetry Market: Market Dynamic

Driving Factors in the Global Space Telemetry Market

Rising Commercialization of Space and Satellite Deployment

The growing commercialization of space exploration and satellite deployment has significantly driven the growth of the global space telemetry market. With private sector companies like SpaceX, Blue Origin, and Amazon's Project Kuiper entering the space industry, there is a noticeable increase in satellite launches. These companies are developing mega-constellations of low Earth orbit (LEO) satellites for broadband internet, Earth observation, and other services.

As the number of operational satellites increases, there is an escalating need for robust telemetry systems to manage, monitor, and communicate with these satellites. Furthermore, as satellite-based services become a crucial part of global communications and data transmission, maintaining satellite health and performance through accurate telemetry becomes a fundamental requirement. These factors are prompting both governmental and private players to invest heavily in telemetry systems, creating a substantial growth driver for the market.

Advances in Space Exploration and Deep-Space Missions

Another significant growth driver for the global space telemetry market is the ongoing advancements in space exploration, particularly the increased focus on deep-space missions. Space agencies, such as NASA, ESA, and China’s CNSA, are pushing the boundaries of space exploration, sending missions to the Moon, Mars, and beyond. Telemetry systems play an essential role in these missions, enabling real-time communication and data transmission between spacecraft and ground stations. As these missions become more complex and ambitious, there is an increasing need for more advanced telemetry technology to handle the vast amounts of data being transmitted over long distances.

Additionally, deep-space telemetry requires robust systems that can operate in extreme conditions and ensure continuous communication. These advancements in space exploration, coupled with the desire to explore other planets and celestial bodies, are driving significant growth in the telemetry market.

Restraints in the Global Space Telemetry Market

High Costs of Satellite Telemetry Systems

One of the major challenges for the global space telemetry market is the high cost associated with developing and deploying telemetry systems. Advanced telemetry systems require significant investment in infrastructure, software, and technology. This can be a substantial financial burden, particularly for smaller companies or countries with limited space budgets. While miniaturization of satellites has helped reduce the cost of satellite manufacturing, telemetry systems for these satellites remain expensive due to the complexity of data transmission, real-time monitoring, and integration with space operations.

Additionally, the need for ground stations and communication infrastructure further adds to the financial burden. The high costs associated with the development, installation, and maintenance of telemetry systems may limit market access for some potential players, particularly in developing regions. This could slow down the pace of satellite launches and space missions, limiting overall growth in the telemetry market.

Challenges with Space Debris and Signal Interference

As the number of satellites in orbit increases, the problem of space debris becomes more pressing. Satellites and space debris share the same orbital space, which poses a risk to both telemetry systems and satellite operations. Collisions with space debris can lead to the loss of critical telemetry data, damage to satellite components, or even satellite failure.

Additionally, the growing congestion in space can lead to signal interference, which can disrupt communication and telemetry systems, making it more difficult to ensure continuous monitoring. The challenge of managing space debris and mitigating interference presents a major obstacle to the growth of the space telemetry market. The development of debris mitigation technologies and more efficient signal management systems will be crucial to overcoming these challenges and ensuring the reliability of space telemetry systems in the future.

Opportunities in the Global Space Telemetry Market

Integration of AI and Machine Learning for Predictive Analytics

The integration of artificial intelligence (AI) and machine learning (ML) technologies into space telemetry systems presents a major growth opportunity for the market. AI and ML algorithms can enhance the capabilities of telemetry by enabling predictive analytics for satellite health, maintenance, and failure prevention. Instead of relying solely on human operators to monitor telemetry data, AI systems can analyze large volumes of data in real-time, identifying potential issues before they become critical problems.

This can significantly reduce downtime, optimize satellite performance, and improve mission success rates. For example, AI can predict fuel consumption, potential hardware malfunctions, or the optimal trajectory adjustments needed to maintain a satellite’s orbit. The adoption of AI-driven telemetry solutions not only improves operational efficiency but also reduces costs for space agencies and private companies. As AI and ML technologies continue to advance, their integration into telemetry systems will drive further growth opportunities in the market.

Expansion of Satellite-Based Internet Services

The growing global demand for high-speed internet, particularly in remote and underserved regions, offers a significant growth opportunity for the space telemetry market. Satellite-based internet services, powered by large constellations of LEO satellites, are rapidly expanding. Companies like SpaceX's Starlink, Amazon’s Project Kuiper, and OneWeb are at the forefront of this revolution. These satellite constellations require efficient and reliable telemetry systems to manage and monitor thousands of satellites simultaneously.

The expansion of satellite-based internet is expected to fuel demand for advanced telemetry systems capable of handling large volumes of data and ensuring optimal satellite performance. Furthermore, as satellite networks evolve to provide global internet coverage, there will be a greater emphasis on ensuring that these networks are secure, reliable, and maintain optimal operational conditions. This creates an expanding market opportunity for telemetry providers to offer solutions that address these needs.

Trends in the Global Space Telemetry Market

Miniaturization of Satellite Systems

One of the key trends influencing the global space telemetry market is the growing miniaturization of satellite systems. Small satellites, or "smallsats," are becoming increasingly popular due to their cost-effectiveness, rapid deployment, and ability to provide the same level of performance as larger satellites. These smaller satellites are being deployed in constellations, allowing for better data coverage, faster communication, and enhanced operational efficiencies.

As these satellites require real-time telemetry to function effectively, their growth is expected to drive demand for advanced telemetry systems. The adoption of smallsats is particularly visible in commercial and governmental sectors, with companies like SpaceX and Planet Labs leading the charge. This trend is expected to increase telemetry traffic and the need for more advanced space-based tracking systems capable of managing multiple satellites simultaneously.

Integration of Artificial Intelligence in Telemetry Systems

The integration of Artificial Intelligence (AI) into space telemetry systems is a transformative trend that is gaining momentum. AI enables telemetry systems to process vast amounts of data, learn from patterns, and predict potential issues before they occur. This predictive capability is crucial in ensuring the smooth operation of space missions, particularly in areas like satellite health monitoring and mission control.

AI-powered telemetry systems can automatically adjust communication protocols, optimize data transfer, and ensure that satellites remain operational in changing environmental conditions. As AI technologies advance, they will continue to enhance the efficiency and reliability of telemetry systems, making them an essential part of future space missions. Additionally, the AI-driven autonomous operations will minimize human intervention, reducing operational costs and enhancing mission success rates.

Global Space Telemetry Market: Research Scope and Analysis

By Component Analysis

Hardware components are anticipated to form the backbone of any space telemetry system, encompassing sensors, transducers, antennas, signal conditioners, and onboard transceivers. These components are crucial for collecting, transmitting, and receiving real-time data from spacecraft to ground stations. Hardware dominance is driven by its irreplaceable role in facilitating continuous monitoring of satellite health, onboard systems, and environmental conditions in space. Unlike software, which can be updated remotely, hardware elements must be designed with extreme reliability and radiation tolerance for sustained operation in the harsh environment of space.

The growing number of satellite launches, including CubeSats and mega-constellations, has further amplified the demand for scalable and robust hardware solutions. Additionally, mission-critical operations such as launch vehicle monitoring and deep-space exploration rely heavily on high-performance telemetry transceivers and antennas capable of maintaining secure, uninterrupted communication links. Hardware solutions are also required for spaceborne telemetry processing before transmission to Earth, making them indispensable for both near-Earth and deep-space missions.

With the rise in investments by commercial and government space programs, procurement of telemetry hardware has scaled up dramatically, accounting for a significant portion of mission budgets. Furthermore, advances in miniaturization and modular design have made hardware systems more efficient and accessible, even for smaller organizations and research institutions. The necessity of redundant systems to ensure mission success adds to hardware volume, bolstering its market share. This physical infrastructure, being essential, high-value, and mission-specific, firmly establishes hardware as the dominant segment in the component category of the global space telemetry market.

By Transmission Mode Analysis

Wired telemetry is expected to hold a dominant position in the global space telemetry market due to its reliability, signal integrity, and immunity to electromagnetic interference especially during launch and early orbit phases. Unlike wireless systems, wired telemetry provides a direct, stable connection between subsystems, which is critical for high-fidelity data transmission under high-vibration, high-acceleration environments such as rocket launches. Launch vehicles and spacecraft are heavily reliant on wired telemetry to monitor propulsion, navigation, structural integrity, and other real-time parameters before and during lift-off.

Wired systems also dominate pre-launch operations, where spacecraft and payloads are monitored via ground-based wired connections to ensure optimal performance and system integrity. The use of shielded twisted-pair cables, coaxial cables, and fiber optics enables high-speed data transfer with minimal latency and low error rates, essential for time-critical telemetry like thrust vectoring, temperature gradients, or fuel tank pressures.

In spacecraft, particularly during integration and testing phases, wired telemetry is preferred for its robustness and minimal signal degradation. This segment continues to dominate due to its ability to provide continuous, secure data transmission without the bandwidth constraints and interference challenges that sometimes affect wireless systems. Additionally, wired telemetry solutions are often more secure and less prone to jamming or interception, an important consideration in both civilian and defense space missions.

Given the stringent operational requirements of aerospace missions and the growing complexity of payload instrumentation, the demand for advanced wired telemetry systems remains high. Even as wireless grows in orbital applications, the irreplaceable benefits of wired solutions during critical mission phases ensure their continued dominance in this market segment.

By Orbit Analysis

Low Earth Orbit (LEO), ranging from 160 to 2,000 kilometers above the Earth's surface, is expected to dominate the orbit segment in the global space telemetry market due to its cost-effectiveness, low latency, and increasing satellite density. The LEO region supports a vast array of commercial, scientific, and military satellites, making it the most crowded and dynamically growing orbital zone. The proximity to Earth allows for reduced launch costs, faster communication links, and simplified telemetry systems, driving preference among private companies, academic institutions, and governmental agencies.

Mega-constellations from companies such as SpaceX (Starlink), OneWeb, and Amazon (Kuiper) are rapidly populating LEO with thousands of satellites, all requiring continuous, high-speed telemetry for tracking, health monitoring, and data transmission. LEO’s low altitude supports lower power consumption for telemetry systems, enabling the use of smaller, less expensive antennas and transceivers, which is particularly advantageous for nanosatellites and CubeSats.

Moreover, LEO’s shorter orbital periods (approximately 90-120 minutes) demand frequent telemetry handoffs and ground station interactions, creating sustained demand for advanced telemetry infrastructure. The orbit is also favored for Earth observation, remote sensing, and real-time communication applications, all of which rely heavily on accurate, uninterrupted telemetry data.

The increasing militarization and commercialization of space, combined with shorter mission turnaround times in LEO, further amplify telemetry needs. These missions often involve precise tracking of orbital adjustments and satellite health status, which are only possible with dependable telemetry solutions. Given its economic and technical benefits, LEO continues to dominate the orbit segment in space telemetry applications globally.

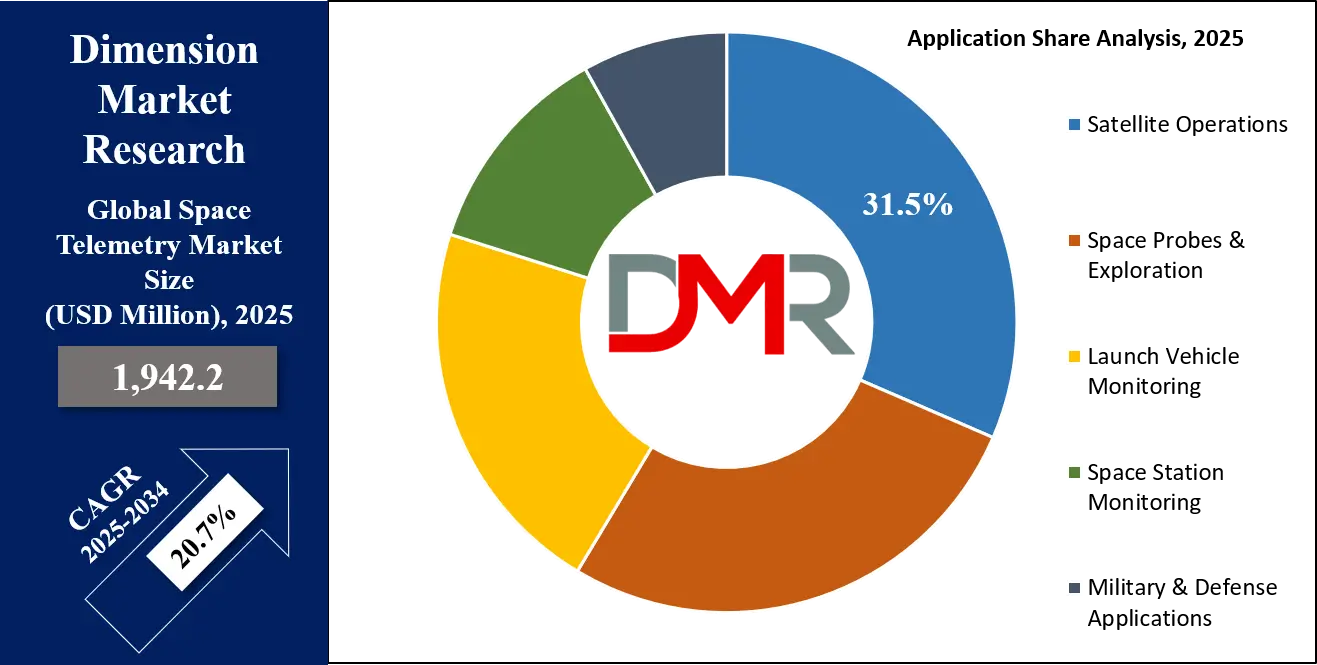

By Application Analysis

Satellite operations are projected to dominate this segment as they form the core of space telemetry, as continuous monitoring and control are fundamental to a satellite’s performance and longevity. From launch to deorbit, satellites rely on telemetry to communicate critical data such as power levels, thermal conditions, propulsion status, subsystem functionality, and payload performance. This constant stream of data ensures mission integrity and enables operators to respond promptly to anomalies or unexpected behaviors.

The rise in commercial satellite deployments for telecommunications, weather monitoring, Earth observation, and internet services has expanded the scope of satellite operations, leading to a higher dependency on telemetry systems. Telemetry plays a key role in ground control systems, facilitating real-time adjustments, orbital corrections, and system diagnostics. It also supports mission planning and operational analytics, allowing for predictive maintenance and automated system tuning.

Moreover, advanced satellites now carry increasingly complex payloads, requiring more intricate telemetry frameworks to support diversified operations such as imaging, signal relay, and scientific measurement. In defense and intelligence missions, telemetry ensures encrypted and uninterrupted command and control links, making it indispensable.

Satellite telemetry is not just essential for in-orbit functions but also for pre-launch and post-mission analysis, helping organizations to assess performance and refine future missions. As satellite constellations scale up and space becomes more congested, effective telemetry becomes even more crucial for collision avoidance and coordinated traffic management. The diversity, frequency, and mission-critical nature of satellite operations firmly position this application as the dominant driver within the global space telemetry market.

By End User Analysis

Space agencies such as NASA, ESA, ISRO, Roscosmos, and CNSA are projected to represent the largest and most influential end users in the global space telemetry market. These agencies operate extensive satellite fleets, launch vehicles, and interplanetary missions, all of which depend heavily on telemetry systems for real-time data transmission, system monitoring, and command execution. Their sophisticated infrastructure, including global networks of tracking stations and mission control centers, is designed around telemetry-driven communication and decision-making.

Unlike commercial operators, space agencies engage in deep-space exploration, manned spaceflight, and long-duration missions, requiring telemetry systems that can operate reliably over vast distances and for extended periods. Their missions often involve highly complex spacecraft systems, necessitating multi-channel, redundant telemetry systems capable of handling vast data streams.

Space agencies are also pioneers in developing new telemetry standards and technologies, often setting benchmarks adopted by the commercial sector. They allocate substantial budgets toward telemetry R&D, including advancements in antenna design, transceiver reliability, and signal processing. Additionally, their emphasis on mission success and public accountability means that telemetry remains a non-negotiable priority, leading to sustained investment and innovation.

Government funding and international collaborations further empower space agencies to maintain leadership in this domain. They are also primary contractors for launching and monitoring satellites for other organizations, further extending their telemetry reach. Given their technological capabilities, infrastructure scale, and central role in national space programs, space agencies continue to dominate the end-user segment of the space telemetry market.

The Global Space Telemetry Market Report is segmented on the basis of the following:

By Component

- Hardware

- Sensors

- Antennas

- Transmitters

- Receivers

- Data Acquisition Systems (DAS)

- Software

- Data Processing Software

- Visualization Tools

- Analytics Platforms

- Real-Time Telemetry Software

- Aerospace Communication Software

- Mission Control Software

By Transmission Mode

- Wired Telemetry

- Coaxial Cable

- Fiber Optic Cable

- Wireless Telemetry

- Radio Frequency (RF)

- Microwave

- UAV Wireless Links

- Aircraft-to-Ground Communication

- Satellite Communication (SATCOM)

By Orbit

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geostationary Orbit (GEO)

- Deep Space

By Application

- Satellite Operations

- Telecommand & Telemetry (TT&C)

- Payload Monitoring

- Space Probes & Exploration

- Scientific Data Collection

- Environmental & Astrobiological Monitoring

- Launch Vehicle Monitoring

- Real-Time Rocket Status Tracking

- Booster Stage Telemetry

- Space Station Monitoring

- Life Support Systems

- Crew Health Telemetry

- Military & Defense Applications

- Strategic Surveillance

- Missile Flight Telemetry

By End User

- Space Agencies

- Commercial Space Companies

- Defense Organizations

- Research Institutions & Universities

- Aerospace OEMs & Airlines

- UAV Manufacturers & Operators

- Government Space & Defense Bodies

Global Space Telemetry Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global space telemetry market as it holds 40.3% of the total revenue share by the end of 2025, due to its well-established space ecosystem, technological supremacy, and the presence of prominent space agencies and private firms. The United States, in particular, is home to NASA, the U.S. Space Force, and commercial giants like SpaceX, Lockheed Martin, and Northrop Grumman organizations that collectively account for a substantial number of global satellite launches and interplanetary missions. These entities heavily invest in advanced telemetry infrastructure for both civilian and defense operations, ensuring continuous innovation and deployment of cutting-edge telemetry systems.

The region’s extensive ground station network, coupled with access to high-performance computing, cloud telemetry integration, and AI-powered analytics, supports seamless data transmission from spacecraft across varied orbits.

Additionally, defense initiatives like missile warning systems, satellite reconnaissance, and space situational awareness further drive telemetry demand. Favorable government policies, significant federal funding, and inter-agency collaboration have positioned North America as the global hub for space-based telemetry solutions. The region also benefits from academic and industrial R&D partnerships that accelerate telemetry advancements. Collectively, these factors secure North America's dominance in the space telemetry market.

Region with the Highest CAGR

Asia-Pacific exhibits the highest compound annual growth rate (CAGR) in the space telemetry market, fueled by rapid space program expansion, technological investments, and emerging private space startups. Countries like China, India, Japan, and South Korea are aggressively scaling their space capabilities with increasing satellite launches, deep-space missions, and lunar exploration goals. China’s CNSA and India’s ISRO are heavily investing in robust telemetry systems to support missions ranging from Earth observation to Mars exploration.

The region also benefits from growing collaboration between national agencies and the private sector, encouraging the development of indigenous telemetry solutions. Japan’s advancements in space robotics and lunar communication infrastructure further boost demand for sophisticated telemetry systems. Meanwhile, ASEAN countries are beginning to develop national satellite programs, expanding the market’s reach. The high growth trajectory is supported by favorable policies, academic research, and public-private partnerships, creating a fertile ground for innovation. As regional ambitions grow, so does the demand for reliable, scalable telemetry infrastructure, positioning Asia-Pacific as the fastest-growing region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Space Telemetry Market: Competitive Landscape

The global space telemetry market is highly competitive, with a mix of government-backed agencies, established aerospace giants, and innovative private players. Major participants include Northrop Grumman Corporation, L3Harris Technologies, BAE Systems, and Honeywell Aerospace, all of which offer advanced telemetry hardware and software solutions for launch vehicles, satellites, and interplanetary missions. These companies focus on miniaturization, radiation-hardened systems, and next-generation antenna technologies to meet the complex demands of modern missions.

Private firms such as SpaceX and Blue Origin have disrupted the landscape with their reusable launch systems and integrated telemetry frameworks, pushing the boundaries of affordability and scalability. In Europe, companies like Airbus Defence and Space and Thales Alenia Space contribute significantly to regional advancements, often collaborating with ESA to develop cross-border telemetry capabilities.

Asian players, including China Aerospace Science and Technology Corporation (CASC) and Mitsubishi Electric, are rapidly gaining ground, supported by robust national programs and export-driven manufacturing. The competitive landscape is marked by frequent collaborations between commercial operators and space agencies, focused on mission-specific telemetry designs, encrypted data transmission, and AI-based diagnostics. The market’s innovation-driven nature and globalized supply chains ensure continuous evolution and strategic competition across regional and functional lines.

Some of the prominent players in the Global Space Telemetry Market are:

- Lockheed Martin Corporation

- L3Harris Technologies, Inc.

- Honeywell International Inc.

- General Dynamics Corporation

- BAE Systems plc

- Raytheon Technologies Corporation

- Thales Group

- Safran S.A.

- Cobham Limited

- Northrop Grumman Corporation

- Airbus SE

- Leonardo S.p.A.

- Curtiss-Wright Corporation

- Teledyne Technologies Incorporated

- Kratos Defense & Security Solutions, Inc.

- Ultra Electronics Holdings plc

- Kongsberg Gruppen ASA

- Maxar Technologies

- Spire Global, Inc.

- NanoAvionics Corp

- Other Key Players

Recent Developments in the Global Space Telemetry Market

March 2025

- Mergers & Acquisitions: Rocket Lab announced plans to acquire Mynaric, a leader in laser communication systems, enhancing its capabilities in optical space communication.

- Collaborations: Sidus Space and Warpspace formed a joint venture to develop optical space communication technologies, aiming to improve data transmission rates and reliability.

January 2025

- Investments: Stoke Space secured $260 million in Series C funding to advance its reusable launch vehicle technology, which includes integrated telemetry systems.

- Investments: Loft Orbital raised $170 million to expand its satellite infrastructure, focusing on enhancing telemetry and data services.

December 2024

- Investments: ICEYE partnered with SATIM to develop AI-powered SAR imagery analysis products, enhancing geospatial intelligence capabilities.

November 2024

- Mergers & Acquisitions: BlackSky acquired LeoStella, a satellite design and manufacturing company, to bolster its real-time geospatial intelligence offerings.

- Mergers & Acquisitions: AeroVironment announced the acquisition of BlueHalo for $4.1 billion, enhancing its capabilities in space superiority technologies, including telemetry systems.

September 2024

- Mergers & Acquisitions: Gogo Business Aviation acquired Satcom Direct for $636 million, aiming to strengthen its in-flight connectivity solutions.

July 2024

- Collaborations: Sidus Space partnered with Lulav Space to develop advanced Event-based Star Trackers (EBST) for improved spacecraft orientation and telemetry.

June 2024

- Conferences: SATShow 2024 featured key industry players discussing advancements in satellite technology and telemetry systems.

May 2024

- Investments: Lumen Orbit raised $2.4 million to develop a 300-satellite constellation in VLEO, aiming to enhance real-time data downlink capabilities.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1,942.2 Mn |

| Forecast Value (2034) |

USD 10,586.5 Mn |

| CAGR (2025–2034) |

20.7% |

| The US Market Size (2025) |

USD 658.3 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software), By Transmission Mode (Wired, Wireless Telemetry), By Orbit (LEO, MEO, GEO, Deep Space), By Application (Satellite Operations, Space Probes & Exploration, Launch Vehicle Monitoring, Space Station Monitoring, Military & Defense Applications), and By End User (Space Agencies, Commercial Space Companies, Defense Organizations, Research Institutions & Universities, Aerospace OEMs & Airlines, UAV Manufacturers & Operators, Government Space & Defense Bodies).

|

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Lockheed Martin, L3Harris, Honeywell, General Dynamics, BAE Systems, Raytheon, Thales, Safran, Cobham, Northrop Grumman, Airbus, Leonardo, Curtiss-Wright, Teledyne, Kratos, Ultra Electronics, Kongsberg, Maxar, Spire Global, and NanoAvionics., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Space Telemetry Market size is estimated to have a value of USD 1,942.2 million in 2025 and is expected to reach USD 10,586.5 million by the end of 2034

The US Space Telemetry Market is projected to be valued at USD 658.3 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3,249.3 million in 2034 at a CAGR of 19.4%.

North America is expected to have the largest market share in the Global Space Telemetry Market, with a share of about 40.3% in 2025.

Some of the major key players in the Global Space Telemetry Market are Lockheed Martin, L3Harris, Honeywell, General Dynamics, BAE Systems, Raytheon, Thales, Safran, Cobham, Northrop Grumman, Airbus, and many others.

The market is growing at a CAGR of 20.7 percent over the forecasted period of 2025.