Market Overview

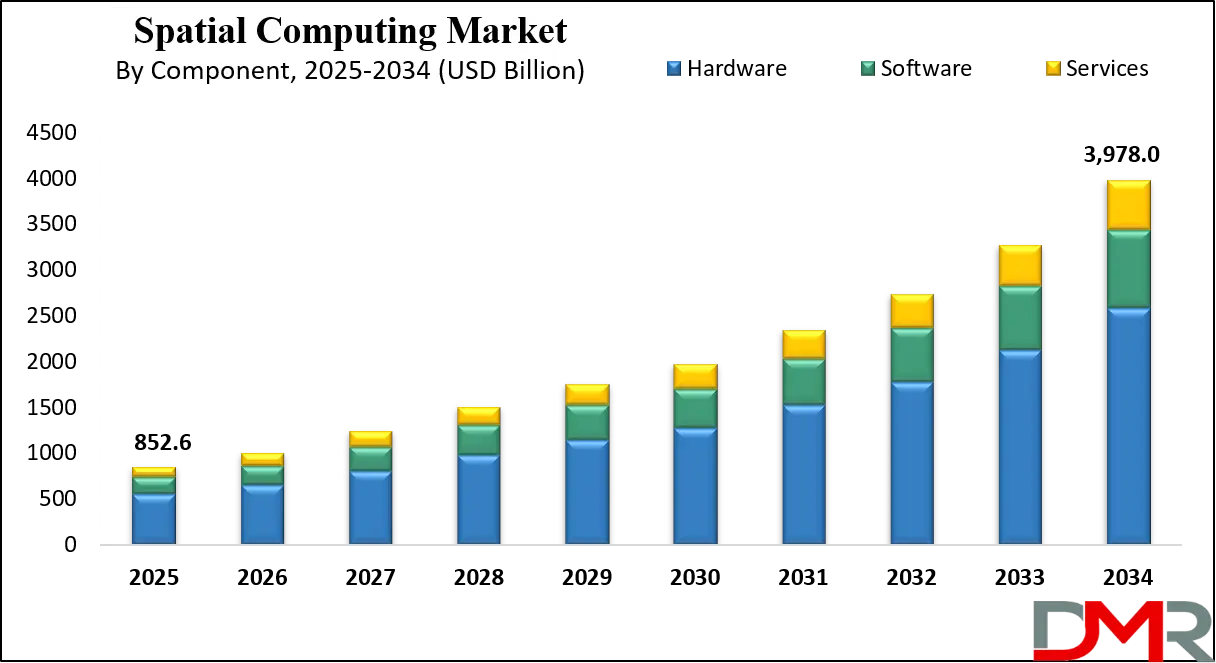

The Global Spatial Computing Market is expected to grow from USD 852.6 billion in 2025 to USD 3,978.0 billion by 2034, at a CAGR of 18.7%, driven by rising demand for AR, VR, digital twins, 3D mapping, and geospatial analytics across key industries.

Spatial computing refers to the technological ecosystem that enables computers to interact with the physical world using spatial data, sensors, and real-time environmental understanding. It blends components of augmented reality, virtual reality, computer vision, AI, and Internet of Things (IoT) to let digital systems process and respond to spatial inputs like position, motion, depth, and environment. Devices like smart glasses, VR headsets, smartphones with depth sensors, and even autonomous robots utilize spatial computing to understand and navigate the real world. By mapping the physical environment, interpreting gestures, tracking objects, and enabling real-time data overlays, spatial computing is redefining how humans and machines collaborate in digitally enriched spaces.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global spatial computing market is witnessing rapid acceleration driven by the rising integration of 3D sensing and AI technologies across sectors like healthcare, defense, manufacturing, automotive, and retail. With the adoption of LiDAR systems, spatial mapping tools, and real-time data modeling, enterprises are leveraging spatial computing to enable immersive training, precision navigation, and smart factory operations.

Cloud platforms and edge computing further enhance the real-time responsiveness of spatial applications, creating vast opportunities for industrial digital twins, predictive maintenance, and intelligent automation. The demand for spatially aware systems is intensifying due to the growing interest in metaverse platforms and context-aware AR experiences.

Advancements in mobile hardware, 5G connectivity, and edge AI are significantly boosting the scalability and deployment of spatial computing solutions. From indoor navigation in airports and hospitals to hands-free maintenance in aerospace, spatial intelligence is enabling practical use cases with measurable operational efficiency. The gaming industry is also at the forefront of adoption, where immersive worlds and player tracking are built using spatial awareness and environmental interactivity. With smart glasses becoming more accessible and real-world applications diversifying, spatial computing is evolving from niche innovation to a mainstream computing paradigm.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Governments and enterprises are investing heavily in spatial computing to support smart city development, autonomous transportation, and public safety systems. National digital infrastructure plans in countries like the US, China, South Korea, and the UAE are emphasizing spatial data platforms, real-time geospatial analytics, and AR-based civic applications. The convergence of geospatial data, computer vision, and mixed reality is transforming how humans interact with machines and digital content. This shift signals a major technological transition where spatial computing will become foundational to next-generation user interfaces, workforce automation, and data visualization across industries.

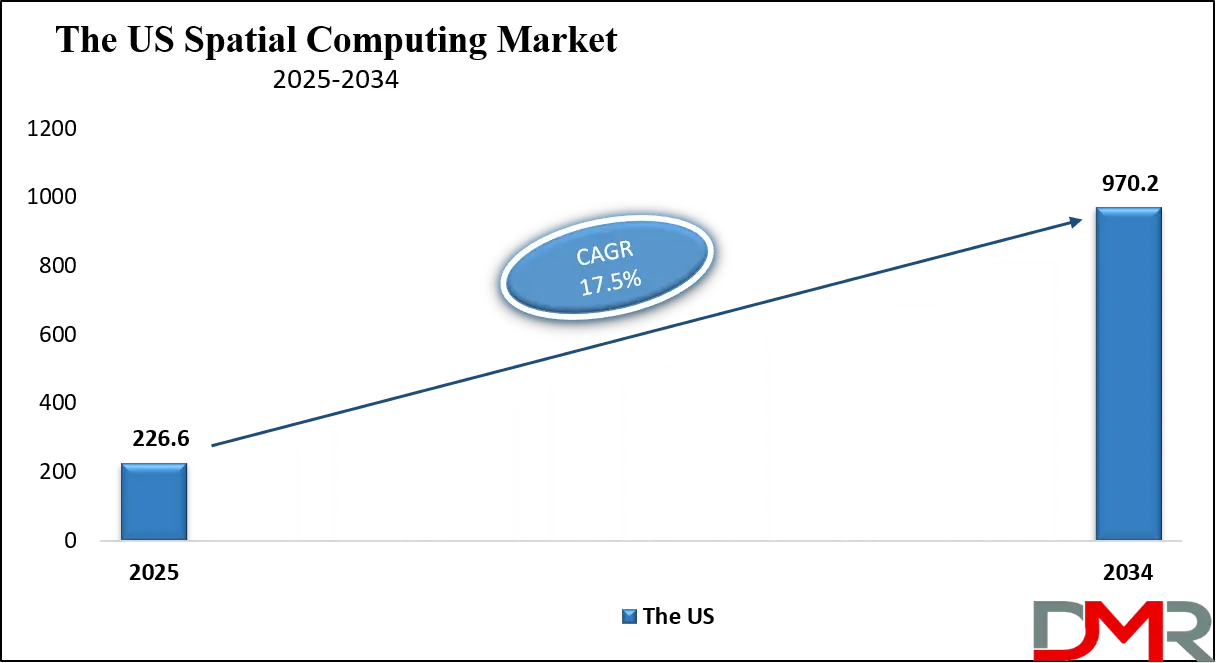

The US Spatial Computing Market

The U.S. spatial computing market size is projected to be valued at USD 226.6 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 970.2 billion in 2034 at a CAGR of 17.5%.

The United States spatial computing market is at the forefront of global innovation, fueled by robust investments in augmented reality, virtual reality, mixed reality, and artificial intelligence. With leading tech giants like Apple, Google, Meta, and Microsoft headquartered in the region, the US serves as a major hub for the development and deployment of spatial technologies.

The integration of spatial computing across healthcare, defense, retail, and advanced manufacturing is accelerating rapidly, supported by a mature digital infrastructure and strong public-private partnerships. The Department of Defense and NASA are actively leveraging spatial data systems, autonomous simulations, and digital twins for mission-critical operations and training, while hospitals and research institutions adopt spatially aware technologies for surgical planning, remote collaboration, and rehabilitation therapies.

In the commercial space, industries are embracing spatial computing to enhance customer engagement and operational efficiency. Retailers deploy AR for virtual try-ons and immersive shopping, while logistics companies optimize warehouse operations through real-time spatial tracking. Urban development initiatives in smart cities are increasingly adopting geospatial analytics, IoT-driven mapping, and sensor integration to improve traffic flow, infrastructure monitoring, and emergency response.

The combination of 5G networks and edge computing enables real-time spatial data processing, supporting everything from immersive entertainment experiences to autonomous navigation systems. With a strong regulatory environment focused on innovation and digital safety, the US continues to lead spatial computing adoption, pushing boundaries in immersive technology, location intelligence, and machine-environment interaction.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Spatial Computing Market

Europe spatial computing market is projected to reach a substantial valuation of USD 315.4 billion in 2025, reflecting its growing prominence within the global technology landscape. This impressive market size is fueled by the region’s strong industrial base, widespread adoption of advanced augmented reality (AR) and virtual reality (VR) technologies, and increasing investment in digital transformation initiatives across key sectors such as manufacturing, automotive, healthcare, and entertainment.

Europe’s robust infrastructure, combined with supportive government policies promoting innovation and smart city projects, further accelerates the deployment of spatial computing solutions. The presence of leading technology firms and a thriving startup ecosystem also contributes significantly to the rapid expansion and technological advancement of the market.

The region is expected to maintain a steady compound annual growth rate (CAGR) of 11.3% over the forecast period, indicating sustained momentum despite global market fluctuations. This growth is driven by continuous improvements in hardware components like sensors, processors, and wearable devices, alongside evolving software platforms that enable immersive and interactive spatial experiences.

Additionally, the integration of emerging technologies such as artificial intelligence (AI), edge computing, and 5G connectivity enhances the capabilities and applications of spatial computing, particularly in sectors focused on Industry 4.0, healthcare diagnostics, and education. As Europe leverages its technological expertise and strategic initiatives, it is well-positioned to remain a key player in the evolving spatial computing market landscape.

The Japan Spatial Computing Market

Japan spatial computing market is forecasted to reach an estimated value of USD 20.9 billion in 2025, highlighting its growing significance in the Asia-Pacific technology landscape. The market expansion is driven by Japan’s strong focus on advanced robotics, precision manufacturing, and smart infrastructure development, where spatial computing technologies such as augmented reality (AR) and virtual reality (VR) play critical roles.

Major Japanese corporations and technology innovators are actively investing in spatial computing hardware, including high-performance processors and wearable devices, as well as software platforms that enhance industrial automation, healthcare applications, and immersive training programs. Government initiatives aimed at promoting digital innovation and Industry 4.0 adoption further support this robust market growth.

The market is expected to grow at a steady compound annual growth rate (CAGR) of 8.2% during the forecast period, reflecting consistent demand across diverse end-use sectors such as healthcare, automotive, and education. Advancements in AI integration, edge computing capabilities, and 5G connectivity are driving more sophisticated spatial computing applications, enabling real-time data processing and immersive user experiences.

Japan’s emphasis on technological precision and innovation ensures that the spatial computing market will continue to evolve, catering to both enterprise needs and consumer demands while maintaining its position as a key contributor to the global spatial computing ecosystem.

Global Spatial Computing Market: Key Takeaways

- Market Value: The global spatial computing market size is expected to reach a value of USD 3,978.0 billion by 2034 from a base value of USD 852.6 billion in 2025 at a CAGR of 18.7%.

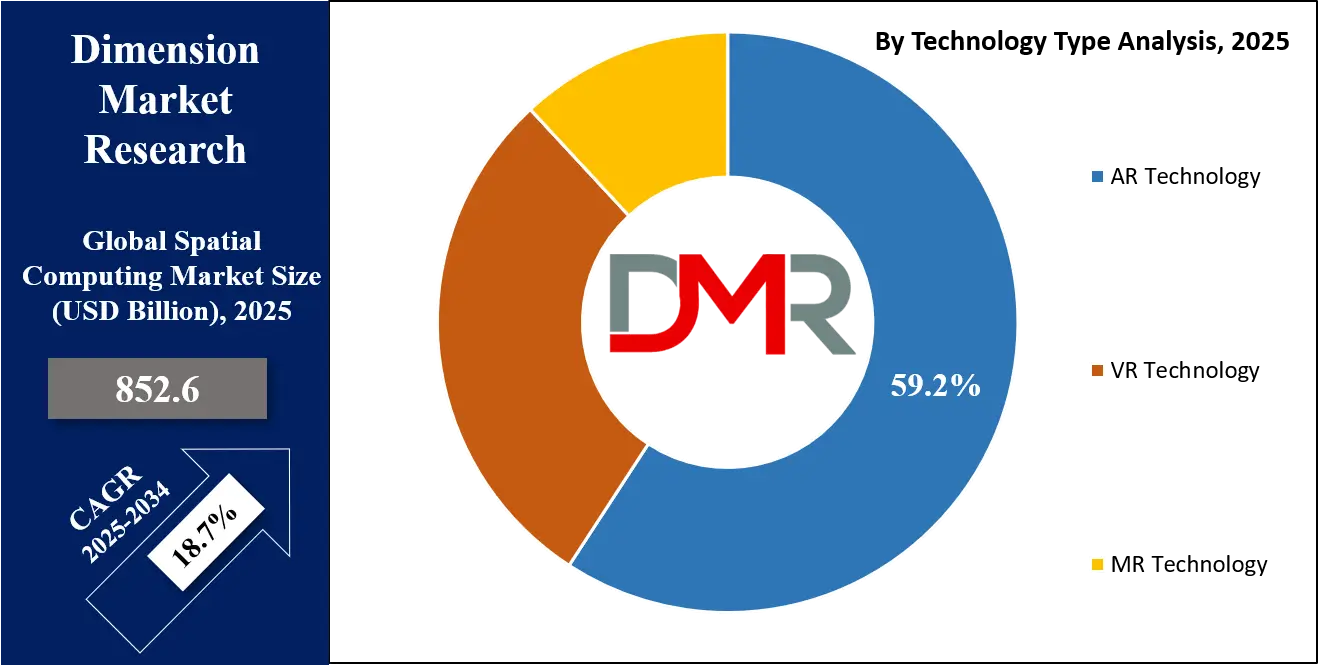

- By Technology Type Segment Analysis: AR Technology is expected to maintain its dominance in the technology type segment, capturing 59.2% of the total market share in 2025.

- By Component Segment Analysis: Hardware components are poised to consolidate their dominance in the component segment, capturing 65.0% of the total market share in 2025.

- By End-Use Industry Segment Analysis: The Healthcare industry is expected to maintain its dominance in the end-use industry segment, capturing 15.3% of the market share in 2025.

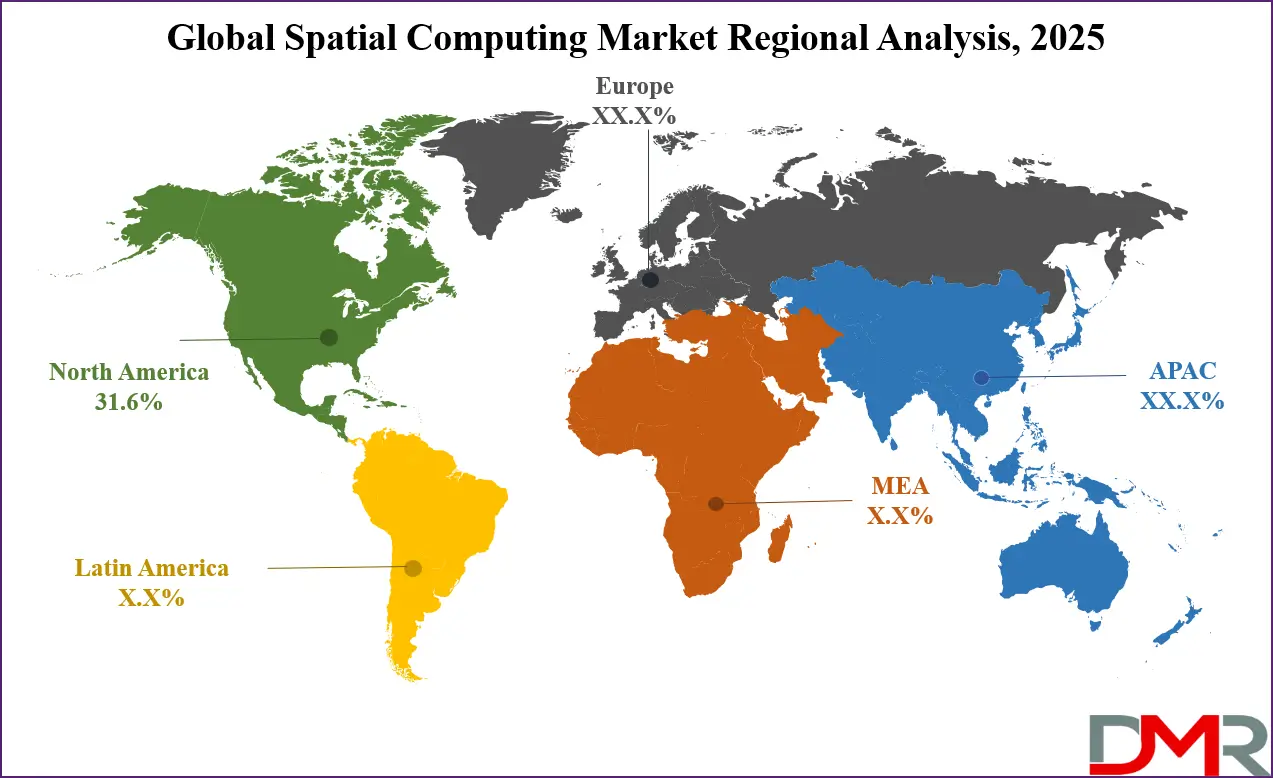

- Regional Analysis: North America is anticipated to lead the global spatial computing market landscape with 31.6% of total global market revenue in 2025.

- Key Players: Some key players in the global spatial computing market are Apple Inc., Microsoft Corporation, Google LLC, Meta Platforms Inc., Magic Leap Inc., Niantic Inc., Snap Inc., Unity Technologies, Unreal Engine (Epic Games), NVIDIA Corporation, Qualcomm Technologies Inc., Lenovo Group Ltd., HTC Corporation, Vuzix Corporation, PTC Inc., Amazon Web Services (AWS), Trimble Inc., Matterport Inc., Ultraleap Ltd., Varjo Technologies, and Other Key Players.

Global Spatial Computing Market: Use Cases

- Industrial Digital Twins and Predictive Maintenance: Spatial computing enables manufacturers and utility companies to create real-time digital twins of physical assets such as turbines, engines, production lines, and entire facilities. These digital replicas use 3D spatial data, sensor integration via IoT networks, and edge processors such as NVIDIA Jetson or Qualcomm Snapdragon to simulate, monitor, and optimize asset performance. Using machine learning and geospatial analytics, digital twins help detect anomalies and predict failures before they occur. Spatial intelligence also supports remote inspections using AR headsets like Microsoft HoloLens 2, improving safety and reducing downtime. This use case significantly boosts efficiency in industries like aerospace, oil & gas, and automotive manufacturing.

- Smart Cities and Urban Mobility Solutions: Municipalities and urban planners are leveraging spatial computing to develop intelligent infrastructure systems for traffic management, public safety, and environmental monitoring. Real-time 3D mapping combined with LiDAR sensors and GPU-accelerated edge processing enables accurate spatial analysis of urban environments. Technologies like GIS software, AI-powered cameras, and spatial data visualization platforms assist in optimizing city planning and emergency response routes. Qualcomm processors and 5G connectivity facilitate ultra-low latency communication between autonomous vehicles and smart traffic systems, while AR overlays help workers in field services navigate complex city layouts. Spatial computing also aids in citizen engagement through mixed reality urban simulations.

- Immersive Retail and Customer Experience: Retailers are integrating spatial computing to revolutionize in-store and online customer engagement through interactive AR applications. Using smartphone-based AR powered by Apple’s A-series chips or Android devices with Snapdragon processors, consumers can virtually try on clothes, preview furniture in their space, or interact with personalized holograms. Spatial anchors and real-world mesh tracking allow products to remain fixed in physical space, enhancing realism. Retailers also employ computer vision and spatial AI to study shopper behavior, optimize store layouts, and create hyper-personalized campaigns. These immersive technologies are transforming e-commerce, brand storytelling, and experiential marketing strategies.

- Healthcare Training and Remote Surgery Assistance: Spatial computing is driving major innovation in medical training, diagnostics, and surgical planning. VR-based anatomy platforms, powered by graphics-intensive processors like NVIDIA RTX or Apple M-series chips, offer medical students immersive, interactive learning environments. Mixed reality devices allow surgeons to visualize complex anatomy through real-time holograms overlaid onto the patient, improving surgical accuracy. AR-assisted remote surgery uses high-resolution spatial data, real-time communication, and AI-based image recognition to enable expert guidance across geographies. Hospitals also deploy indoor spatial navigation systems to improve patient flow, reduce wait times, and enhance emergency responsiveness, leveraging indoor GPS, 3D location mapping, and spatial sensors.

Global Spatial Computing Market: Stats & Facts

United States — National Institute of Standards and Technology (NIST) & U.S. Department of Commerce

- The U.S. government invested over USD 300 million in augmented reality (AR) and virtual reality (VR) research programs in 2023.

- NIST reported that AR technology adoption in manufacturing increased productivity by 25% in U.S. factories using spatial computing tools.

- The Department of Commerce estimates the U.S. spatial computing industry contributed over USD 15 billion to the GDP in 2024.

- Federal grants allocated to spatial computing startups reached USD 120 million in 2023, focusing on defense and healthcare applications.

- The U.S. government forecasts a 35% annual growth rate in enterprise adoption of spatial computing technologies through 2030.

- Research funded by the Department of Defense highlighted that AR-assisted maintenance reduced equipment downtime by 40%.

European Union — European Commission & Eurostat

- The European Commission committed €2 billion under Horizon Europe to support spatial computing innovation from 2021 to 2027.

- Eurostat data shows that 22% of EU manufacturing firms adopted spatial computing solutions by 2024.

- The EU’s Digital Europe Programme reports that investments in immersive technologies grew by 28% annually between 2020 and 2024.

- Public funding for smart city spatial computing projects in Europe exceeded €500 million in 2023.

- The European Space Agency integrates spatial computing with satellite data for geospatial analytics, increasing accuracy by 30%.

- EU workforce training programs saw a 15% increase in AR/VR skill development courses in 2023.

Japan — Ministry of Economy, Trade and Industry (METI) & Ministry of Internal Affairs and Communications

- METI allocated USD 450 million to accelerate spatial computing R&D for manufacturing and healthcare sectors between 2022-2025.

- Japan’s Ministry of Internal Affairs and Communications reported that 18% of enterprises used spatial computing for operational efficiency in 2024.

- The government’s robotics integration program uses spatial computing to improve automation, reducing labor costs by 12%.

- Japan’s public research institutes developed AR-based training systems adopted by 35% of vocational schools by 2023.

- METI estimates a 9% annual increase in spatial computing deployment within automotive manufacturing.

China — Ministry of Science and Technology (MOST) & National Bureau of Statistics of China

- MOST allocated RMB 5 billion (approx. USD 770 million) for spatial computing and AI convergence research from 2021-2024.

- The National Bureau of Statistics reports that spatial computing applications in industrial IoT increased by 40% in Chinese factories in 2023.

- Government-backed smart city initiatives will implement spatial computing in over 120 cities by 2024.

- China’s public funding for AR/VR hardware manufacturing surged by 35% annually from 2020 to 2023.

- Educational institutions using spatial computing-based interactive learning tools grew by 25% year-over-year since 2021.

South Korea — Ministry of Science and ICT & Korea Institute of Industrial Technology

- The Ministry of Science and ICT invested over USD 350 million in spatial computing and mixed reality projects in 2023.

- South Korea’s industrial sector reported a 20% boost in productivity through spatial computing-enabled smart factory initiatives.

- The Korea Institute of Industrial Technology states that 30% of manufacturing enterprises will adopt spatial computing solutions by 2024.

- Government-funded R&D increased spatial computing processing power by 15% through new processor development in 2022.

International Telecommunication Union (ITU)

- ITU data shows global 5G rollout, a critical enabler of spatial computing, reached 60 countries by the end of 2023.

- ITU estimates the spatial computing user base will surpass 500 million globally by 2025, driven by AR and VR mobile applications.

- The ITU recognizes spatial computing as a key technology for digital inclusion programs in emerging markets.

- ITU research indicates that latency reductions in 5G networks enhance spatial computing real-time interactivity by up to 50%.

Global Spatial Computing Market: Market Dynamics

Global Spatial Computing Market: Driving Factors

Integration of Spatial Computing with AI, IoT, and 5G Networks

One of the primary growth drivers is the seamless convergence of spatial computing with artificial intelligence, the Internet of Things (IoT), and 5G connectivity. These technologies collectively enable real-time spatial data processing, low-latency communication, and context-aware computing. AI enhances the interpretation of geospatial intelligence, while 5G ensures seamless performance of applications like augmented reality and autonomous navigation. Industrial automation, autonomous drones, and AR-powered field services are expanding rapidly due to this integration, reshaping operational models across logistics, defense, and smart city ecosystems.

Rising Demand for Immersive User Interfaces across Sectors

As user expectations shift toward more intuitive and natural interfaces, industries are adopting spatial computing to deliver immersive and spatially aware experiences. In sectors like healthcare, education, and retail, technologies such as mixed reality, 3D visualization, and spatial audio are enabling more engaging user interactions. From remote surgeries using holographic overlays to immersive classroom environments and virtual retail try-ons, spatial computing is enhancing efficiency, personalization, and engagement through real-time digital-physical integration.

Global Spatial Computing Market: Restraints

High Hardware Costs and Infrastructure Limitations

Despite growing demand, the high cost of advanced spatial computing hardware such as AR headsets, LiDAR systems, and spatial processors remains a significant restraint, especially for small to mid-sized enterprises. Furthermore, the need for high-speed connectivity, robust spatial mapping infrastructure, and edge computing setups limits adoption in regions lacking digital infrastructure. These barriers slow down deployment in developing markets and restrict innovation to digitally advanced geographies.

Data Privacy and Security Challenges

Spatial computing applications frequently involve real-time data capture from physical environments, which raises substantial concerns around user privacy, surveillance, and data security. Technologies that rely on facial recognition, location tracking, and environmental scanning must navigate complex regulatory landscapes, particularly in regions with strict data protection laws. Ensuring compliance while maintaining a seamless user experience is a persistent challenge, affecting adoption in sensitive sectors like finance, defense, and public administration.

Global Spatial Computing Market: Opportunities

Growth of Digital Twins in Industrial and Urban Planning

The rising adoption of digital twins presents a significant opportunity for spatial computing, especially in smart infrastructure and industrial automation. Governments and enterprises are increasingly deploying spatially enabled digital replicas of factories, cities, and utility grids to simulate operations, optimize maintenance, and plan large-scale interventions. Combining real-time sensor data with spatial analytics and AI algorithms allows stakeholders to monitor asset health, predict failures, and simulate emergency scenarios. This trend supports large-scale transformation in energy, construction, and transportation systems.

Expansion in Consumer and Wearable AR Devices

With major players like Apple, Meta, and Google developing consumer-friendly AR wearables, the market is primed for mainstream adoption of spatial computing in daily life. Smart glasses, spatially aware earbuds, and mobile AR apps are set to redefine navigation, communication, and entertainment. These devices, powered by spatial mapping, gesture recognition, and AI-based contextual awareness, offer untapped potential in gaming, virtual tourism, and fitness coaching. As costs decline and hardware becomes lighter and more ergonomic, consumer-facing applications are expected to skyrocket.

Global Spatial Computing Market: Trends

Spatial Computing in Autonomous Vehicles and Mobility Solutions

A key emerging trend is the integration of spatial computing into autonomous driving systems and intelligent transport networks. Autonomous vehicles rely on high-definition 3D mapping, real-time object recognition, and LiDAR-based environment modeling to navigate safely. These spatial technologies are also used in smart traffic management and last-mile delivery solutions, supporting more efficient urban mobility ecosystems. Companies are embedding spatial awareness in navigation software to ensure context-sensitive route planning and situational adaptability.

Enterprise Adoption of Mixed Reality for Workforce Training

Organizations are increasingly using mixed reality tools powered by spatial computing to train employees in complex, high-risk environments. By overlaying real-time data, visual instructions, and 3D models into the user's field of vision, industries like aviation, manufacturing, and emergency services are enhancing learning outcomes and reducing training costs. The trend is supported by enterprise-ready devices such as Microsoft HoloLens, Varjo XR headsets, and immersive simulation platforms, which deliver spatially contextualized training in real-world environments.

Global Spatial Computing Market: Research Scope and Analysis

By Technology Type Analysis

Augmented Reality (AR) is projected to maintain a commanding position in the spatial computing market, accounting for 59.2% of the total market share in 2025. This dominance is driven by AR’s versatility and seamless integration into real-world environments without the need for full immersion. AR technology overlays digital content such as 3D models, instructions, and spatial data onto the physical world using devices like smartphones, smart glasses, and head-mounted displays. It is widely used across sectors, including healthcare, retail, manufacturing, and field services.

Apple’s Vision Pro, Microsoft HoloLens 2, and various AR SDKs from platforms like Google ARCore and Apple ARKit have accelerated enterprise and consumer adoption. AR's ability to provide spatially aware, real-time assistance makes it ideal for applications such as remote maintenance, indoor navigation, and immersive shopping, where spatial intelligence enhances user experience and productivity without replacing the real-world view.

In contrast, Virtual Reality (VR) technology represents a more immersive segment of the spatial computing landscape. While AR enhances the real world, VR fully replaces it with computer-generated environments, often using high-performance hardware powered by NVIDIA GPUs or Qualcomm XR processors. VR is gaining traction in areas like training simulations, design visualization, education, and therapy, where full immersion supports deeper focus and realism.

Enterprises use VR to simulate complex operational scenarios such as pilot training, emergency response drills, and product prototyping in virtual spaces. Although VR’s market share is smaller compared to AR, its adoption is steadily rising due to advancements in motion tracking, 6DoF (six degrees of freedom) interactivity, and falling headset costs. Devices like Meta Quest, HTC Vive, and Varjo XR headsets are pushing the boundaries of immersive VR environments within the broader spatial computing ecosystem.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Component Analysis

Hardware components are set to dominate the spatial computing market in 2025, capturing 65.0% of the total market share. This stronghold is primarily attributed to the foundational role hardware plays in enabling immersive spatial experiences. Key hardware includes AR and VR headsets, LiDAR sensors, depth cameras, spatial processors, motion tracking units, and edge computing modules. Devices from leading companies such as Apple (Vision Pro), Microsoft (HoloLens), Meta (Quest series), and Vuzix are built with high-performance chipsets like the Apple M-series, Qualcomm Snapdragon XR, and NVIDIA Jetson, offering real-time spatial awareness, low-latency rendering, and high-resolution 3D visualization.

LiDAR and depth sensing technologies provide critical spatial data to accurately map and interpret the physical world, while inertial measurement units (IMUs) and haptic feedback systems enhance the interactivity of spatial environments. The ongoing miniaturization and performance improvement of hardware are driving widespread adoption across industrial, commercial, and consumer sectors.

While hardware dominates, software remains an essential and rapidly evolving component of the spatial computing ecosystem. Software platforms handle spatial data processing, application development, 3D modeling, environment mapping, and immersive content creation. Leading solutions include Unity and Unreal Engine for XR content development, PTC’s Vuforia for industrial AR, and Matterport for spatial visualization.

These software systems often integrate with AI algorithms, cloud computing platforms, and spatial analytics tools to deliver context-aware, interactive experiences. Software also supports interoperability between hardware components, spatial databases, and real-world user environments, enabling seamless cross-device functionality.

Although it holds a smaller market share than hardware, software is crucial for unlocking the full potential of spatial computing through innovation in user interfaces, development frameworks, digital twin simulation, and enterprise workflow integration. As spatial computing matures, software is expected to gain further traction, especially in SaaS-based models for industrial and commercial applications.

By End-User Industry Analysis

The healthcare industry is projected to dominate the spatial computing market by end-use in 2025, accounting for 15.3% of the total market share. This leadership is driven by the transformative applications of spatial computing in medical training, diagnostics, surgery, and patient care. Surgeons are leveraging AR and mixed reality headsets, such as Microsoft HoloLens 2 and Magic Leap, to visualize patient anatomy through holographic overlays in real-time, improving precision in complex procedures.

Spatial computing enables the use of digital twins for simulating human organs and predicting treatment outcomes based on spatial data and physiological modeling. In medical education, VR platforms powered by high-performance GPUs like NVIDIA RTX or Apple’s M-series chips are used to train students in a fully immersive 3D environment, simulating surgeries and emergency scenarios with high fidelity.

Remote collaboration and spatial telepresence also allow specialists to assist in operations or consultations across geographies, which is revolutionizing access to healthcare expertise. The integration of spatial computing with AI and imaging tools is further enhancing diagnostics, rehabilitation, and personalized patient experiences, making it a cornerstone for next-generation digital healthcare infrastructure.

In the education sector, spatial computing is redefining traditional learning models through immersive, interactive, and experiential pedagogy. Mixed reality tools are being deployed to convert static curricula into dynamic, 3D spatial experiences that improve engagement and knowledge retention. AR applications allow students to explore historical landmarks, dissect virtual organs, or visualize scientific phenomena in real-world environments, using smartphones or tablets powered by ARKit, ARCore, or lightweight XR wearables.

VR headsets and platforms like Unity or Unreal Engine are being used to build virtual classrooms and collaborative environments where students from different locations can interact in real-time. This spatially immersive learning is particularly beneficial in STEM education, vocational training, and special education, where hands-on practice and engagement are critical.

The education sector, though still emerging in terms of spatial computing adoption, is gaining traction due to falling hardware costs, growing digital literacy, and the demand for hybrid learning models post-pandemic. With support from cloud-based content management and 5G connectivity, spatial computing in education is poised for significant expansion.

The Spatial Computing Market Report is segmented on the basis of the following:

By Technology Type

- AR Technology

- Marker-based AR

- Markerless AR

- VR Technology

- Semi-Immersive VR

- Fully Immersive VR

- MR Technology

- Object Interaction MR

- Digital Overlay MR

By Component

- Hardware

- AR Devices

- Smartphone-based AR

- AR Glasses

- AR Headsets

- Other AR Devices

- VR Devices

- Tethered VR Headsets

- Standalone VR Headsets

- Smartphone-based VR Headsets

- Other VR Devices

- MR Devices

- MR Glasses

- MR Headsets

- Other MR Devices

- Software

- Software Development Kit (SDK)

- Game Engine

- Modeling & Visualization Software

- Content Management System (CMS)

- Training Simulation Software

- Other Software

- Services

- Professional Services

- Consulting

- System Integration & Implementation

- Support & Maintenance

By End-Use Industry

- Healthcare

- Education

- Architecture, Engineering, and Construction (AEC)

- Aerospace & Defense

- Automotive

- Gaming

- Consumer Electronics

- Government and Public Sector

- Information Technology

- Energy and Utilities

- Others

Global Spatial Computing Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global spatial computing market in 2025, capturing 31.6% of the total market revenue. This leadership is driven by the region’s strong technological infrastructure, presence of key industry players like Apple, Microsoft, and NVIDIA, and significant investments in research and development. The widespread adoption of advanced AR and VR hardware, coupled with rapid integration of AI, IoT, and 5G networks, fuels innovation in sectors such as healthcare, defense, manufacturing, and entertainment.

Additionally, supportive government initiatives and a well-established startup ecosystem contribute to accelerating market growth. The region’s focus on enhancing immersive user experiences and digital transformation across enterprises positions North America at the forefront of spatial computing advancements.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia-Pacific region is projected to register the highest compound annual growth rate (CAGR) in the spatial computing market over the forecast period. Rapid digital transformation across countries like China, Japan, South Korea, and India is driving increased adoption of AR and VR technologies, fueled by expanding 5G infrastructure and growing investments in smart city projects, industrial automation, and immersive entertainment.

The region’s burgeoning consumer electronics market, combined with rising government initiatives to promote innovation and technology adoption, is accelerating demand for spatial computing solutions. Additionally, the proliferation of affordable hardware and increasing integration of AI and edge computing technologies further bolster this rapid growth trajectory, positioning Asia-Pacific as the fastest-growing market globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Spatial Computing Market: Competitive Landscape

The global spatial computing market is characterized by intense competition among leading technology giants, innovative startups, and specialized solution providers, creating a dynamic and rapidly evolving landscape. Major players such as Apple, Microsoft, Google, Meta Platforms, and NVIDIA dominate through continuous investments in research and development, strategic partnerships, and product innovation in AR, VR, and mixed reality hardware and software. These companies are actively expanding their ecosystems by integrating spatial computing with AI, cloud computing, and 5G networks to enhance performance and user experience.

Meanwhile, emerging players like Magic Leap, Niantic, and Varjo Technologies focus on niche applications and cutting-edge technologies such as digital twins, spatial analytics, and immersive enterprise solutions to carve out market share. The competitive environment is further intensified by mergers, acquisitions, and collaborations aimed at accelerating technological advancements and broadening market reach. As spatial computing continues to penetrate diverse industries, from healthcare and education to manufacturing and entertainment, companies are leveraging proprietary platforms, developer tools, and scalable solutions to differentiate themselves and capitalize on the growing demand for immersive, spatially intelligent experiences worldwide.

Some of the prominent players in the global spatial computing are:

- Apple Inc.

- Microsoft Corporation

- Google LLC

- Meta Platforms Inc.

- Magic Leap Inc.

- Niantic Inc.

- Snap Inc.

- Unity Technologies

- Unreal Engine (Epic Games)

- NVIDIA Corporation

- Qualcomm Technologies Inc.

- Lenovo Group Ltd.

- HTC Corporation

- Vuzix Corporation

- PTC Inc.

- Amazon Web Services (AWS)

- Trimble Inc.

- Matterport Inc.

- Ultraleap Ltd.

- Varjo Technologies

- Other Key Players

Global Spatial Computing Market: Recent Developments

Product Launches

- May 2025: Sightful launched its Spacetop for Windows, a spatial computing solution that transforms augmented reality glasses into a multi-monitor workspace. Priced at USD 899, the system includes Xreal’s Air 2 Ultra AR glasses and Spacetop software, offering a 3D environment for productivity tasks.

- January 2025: Apple released VisionOS 2, an update to its mixed reality operating system, introducing features like converting 2D photos to spatial photos and enhanced navigation options for the Vision Pro headset.

Mergers & Acquisitions

- October 2024: Siemens AG announced plans to acquire Altair Engineering Inc. for USD 10.6 billion, aiming to enhance its industrial software and AI capabilities. The acquisition is expected to close by mid-2025.

- March 2024: Cadence Design Systems, Inc. acquired BETA CAE Systems International AG for USD 1.24 billion, expanding its system analysis portfolio and aligning with its Intelligent System Design™ strategy.

Funding Announcements

- January 2025: Swave Photonics secured €27 million ($28.27 million) in Series A funding to advance its Holographic eXtended Reality (HXR) platform, aiming to enhance augmented reality experiences.

- March 2025: Rerun raised USD 17 million in seed funding to develop an open-source platform for managing and visualizing spatial and embodied AI data, supporting large-scale data handling and interactive visualizations.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 852.6 Bn |

| Forecast Value (2034) |

USD 3,978.0 Bn |

| CAGR (2025–2034) |

18.7% |

| The US Market Size (2025) |

USD 226.6 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Technology (AR Technology, VR Technology, and MR Technology), By Component (Hardware, Software, and Services), By End-Use Industry (Healthcare, Education, AEC, Aerospace & Defense, Automotive, Gaming, Consumer Electronic, Government and Public Sector, Information Technology, Energy and Utilities, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

TCS, Target, Salesforce, Nike, Nationwide, Klarna, J.P. Morgan, IBM, General Motors Co., Ford Motor Co., Flipkart, Citigroup, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global spatial computing market?

▾ The global spatial computing market size is estimated to have a value of USD 852.6 billion in 2025 and is expected to reach USD 3,978.0 billion by the end of 2034.

What is the size of the US spatial computing market?

▾ The US spatial computing market is projected to be valued at USD 226.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 970.2 billion in 2034 at a CAGR of 17.5%.

Which region accounted for the largest global spatial computing market?

▾ North America is expected to have the largest market share in the global spatial computing market, with a share of about 31.6% in 2025.

Who are the key players in the global spatial computing market?

▾ Some of the major key players in the global spatial computing market include Apple Inc., Microsoft Corporation, Google LLC, Meta Platforms Inc., Magic Leap Inc., Niantic Inc., Snap Inc., Unity Technologies, Unreal Engine (Epic Games), NVIDIA Corporation, Qualcomm Technologies Inc., Lenovo Group Ltd., HTC Corporation, Vuzix Corporation, PTC Inc., Amazon Web Services (AWS), Trimble Inc., Matterport Inc., Ultraleap Ltd., Varjo Technologies, and Other Key Players.

What is the growth rate of the global spatial computing market?

▾ The market is growing at a CAGR of 18.7 percent over the forecasted period.