Market Overview

The Global

Specialty Chemicals Market is expected to be valued at

USD 307.0 billion in 2025, and it is further anticipated to reach a market value of

USD 501.7 billion by 2034 at a

CAGR of 5.6%.

The global specialty chemicals market is a significant segment of the overall chemicals sector that encompasses a wide range of chemicals that are made to cater to specific applications of various end-use industries. These chemicals are made in small quantities with premium pricing due to their value-added properties and the process involved in their manufacturing.

Continuous innovations, the need to adapt to stricter regulation requirements, and evolving customer requirements are the significant drivers of the growth of this market. Due to rapid industrialization and urbanization, the specialty chemicals market has experienced remarkable expansion across emerging economies.

China and India have become significant global players due to their strong manufacturing capacities, abundant raw material sources, and increasing investments in research and development. Rising demand for performance-enhancing chemicals used in industries like automotive coatings, water treatment, and adhesives has spurred market expansion.

Furthermore, an emphasis on environmentally friendly formulations like bio-based polymers and green surfactants has fueled the innovations with reduced environmental impact while still meeting product efficiency goals. One of the defining characteristics of the specialty chemicals industry is its dependence on technological innovations and customized solutions.

Manufacturers invest heavily in research to develop products with superior performance that address industry-specific challenges, such as increasing fuel efficiency in lubricants, durability improvement for construction materials, or increasing yield for agricultural chemicals. Digitalization and automation have played a pivotal role in revolutionizing production processes, increasing supply chain efficiency, and providing real-time monitoring of product performance. Furthermore, collaborations between chemical producers and end-use industries have resulted in solutions customized specifically for specific applications.

Regulation and environmental concerns have created an impact on the specialty chemicals market, leading to companies adopting cleaner production technologies and adhering to rigorous safety standards. Governments globally have implemented stringent policies designed to curb pollution while encouraging sustainable chemicals like green chemistry or bio-based alternatives. Consumer awareness has further driven demand for products with reduced toxicity levels and enhanced biodegradability, this trend has encouraged companies to focus on sustainable product development while upholding performance requirements from their industries.

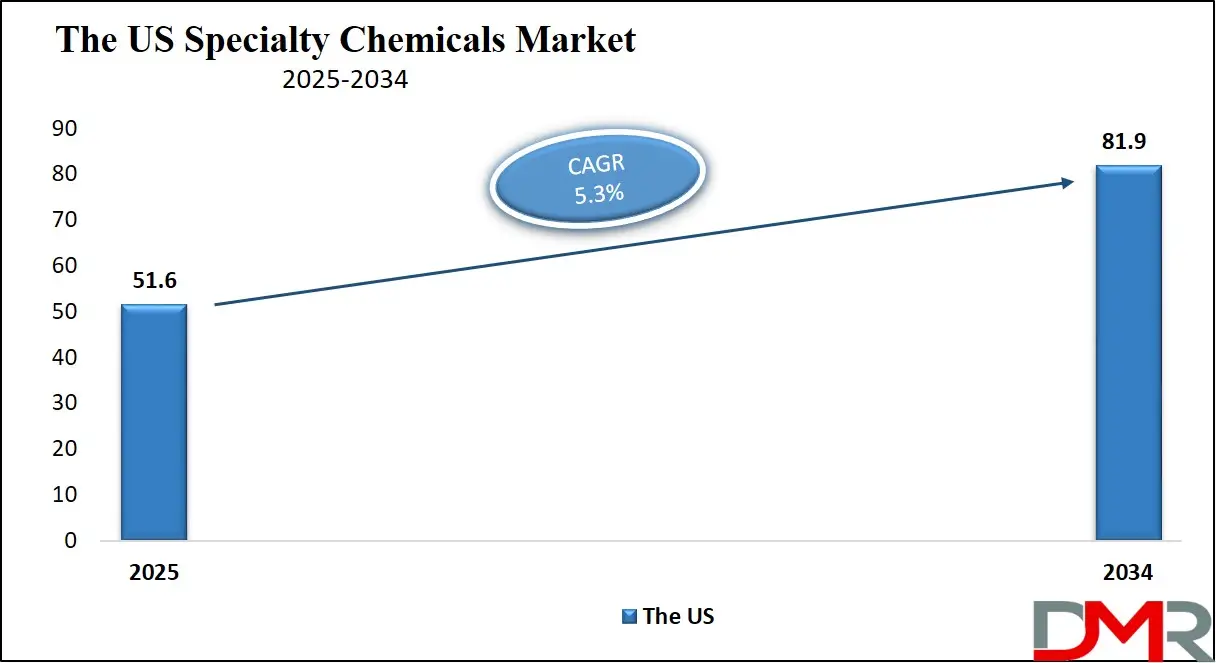

The US Specialty Chemicals Market

The US Specialty Chemicals Market is projected to be valued at USD 51.6 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 81.9 billion in 2034 at a CAGR of 5.3%.

The US specialty chemicals market is one of the most advanced and established markets within the global chemical industry. The US market stands out for its strong innovation, mature regulatory framework, and diverse industrial base, making it one of the main contributors to driving global demand for specialty chemicals.

US manufacturers specialize in developing high-value formulations with performance-driven formulations to serve diverse industries, including automotive, aerospace, healthcare, electronics, and construction. This market is supported by an expansive research ecosystem where major chemical companies invest heavily in R&D to produce cutting-edge products that enhance efficiency, sustainability, and functionality across various applications.

US specialty chemicals industry growth is supported by its robust industrial and manufacturing sectors. As industries strive for higher performance standards and regulatory compliance, demand for advanced materials such as coatings, adhesives, and specialty polymers continues to surge. Automotive industries rely heavily on specialty coatings and lubricants to increase vehicle efficiency, while electronics firms require high-purity chemicals for semiconductor production.

Furthermore, increasing water pollution concerns have necessitated water treatment solutions requiring flocculants, coagulants, and corrosion inhibitors for treatment, driving further growth of the specialty chemicals market. Regulatory bodies such as the Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA) have implemented stringent guidelines to ensure chemical products meet safety and sustainability criteria.

Global Specialty Chemical Market: Key Takeaways

- Market Value: The global specialty chemicals market size is expected to reach a value of USD 501.7 billion by 2034 from a base value of USD 307.0 billion in 2025 at a CAGR of 5.6%.

- By Type Segment Analysis: Plastic Additives are anticipated to lead in the type segment, capturing 30.0% of the market share in 2025.

- By Application Type Segment Analysis: Institutional & Industrial Cleaners are poised to consolidate their market position in the application type segment capturing 27.0% of the total market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global specialty chemicals market landscape with 50.2% of total global market revenue in 2025.

- Key Players: Some key players in the global specialty chemicals market are Solvay, Evonik Industries AG, Clariant AG, Akzo Noble N.V., DuPont, Kemira Oyj, Lanxess, Croda International Plc, Huntsman International LL, The Lubrizol Corporation, Albemarle Corporation, and Other Key Players.

Global Specialty Chemical Market: Use Cases

- Electronics & Semiconductor Manufacturing: Specialty chemicals play a vital role in the production of semiconductors, printed circuit boards (PCBs), and advanced electronic components. High-purity chemicals such as photoresists, specialty gases, and conductive polymers are essential for precision manufacturing in the electronics industry. The rapid growth of consumer electronics, 5G technology, and artificial intelligence (AI) applications has increased the demand for specialty chemicals that enhance the performance, durability, and miniaturization of electronic devices.

- Sustainable Packaging & Biodegradable Plastics: With increasing environmental concerns and regulatory pressures, specialty chemicals are widely used in developing sustainable packaging solutions. Plastic additives like biodegradable stabilizers, nucleating agents, and bio-based plasticizers help create eco-friendly packaging materials that maintain strength and flexibility while reducing environmental impact. Companies in the food and beverage, consumer goods, and logistics industries are investing in specialty chemicals to develop compostable and recyclable packaging alternatives.

- Enhanced Oil Recovery (EOR) & Oilfield Chemicals: The oil and gas sector relies on specialty chemicals to optimize drilling, production, and refining processes. Chemicals such as demulsifiers, corrosion inhibitors, rheology modifiers, and specialty biocides improve extraction efficiency and extend the lifespan of oilfield equipment. With fluctuating oil prices and increasing global energy demands, specialty oilfield chemicals help enhance operational efficiency and ensure compliance with environmental regulations in offshore and onshore drilling projects.

- Personal Care & Cosmetics Formulations: Specialty chemicals are extensively used in the formulation of skincare, hair care, and cosmetic products to improve texture, stability, and performance. Ingredients such as emollients, surfactants, conditioning polymers, and rheology modifiers help create high-quality products that meet consumer expectations for effectiveness and safety. The rise of natural and organic cosmetics has also driven the demand for bio-based specialty chemicals that offer sustainability without compromising product performance.

Global Specialty Chemicals Market: Stats & Facts

- According to the US Census Bureau, the chemical manufacturing sector, which includes specialty chemicals, contributed approximately USD 800.0 billion to the US economy in 2023.

- Eurostat reported that the European Union's chemical industry generated revenues of around USD 676.0 billion in 2023. These figures encompass the broader chemical industry, within which specialty chemicals represent a significant segment.

- According to Cefic, Europe is the second largest chemical producer in the world.

- According to the Indian Brand Equity Foundation (IBEF), India is the fourth-largest producer of agrochemicals after the US, Japan, and China. India accounts for 16-18% of the world's production of dyestuffs and dye intermediates.

Global Specialty Chemicals Market: Market Dynamic

Global Specialty Chemicals Market: Driving Factors

Growing Demand for High-Performance and Customized Chemical Solutions

The global specialty chemicals market is driven by rising consumer demand for advanced and customized chemical solutions specifically for particular industrial applications. Unlike commodity chemicals, specialty chemicals are designed specifically to deliver particular functions, including increased durability, increased efficiency, and superior performance which are the essential features in industries like automotive, electronics, healthcare, and construction that depend on them to keep up with evolving regulatory standards, technological advances, and customer expectations.

Specialty chemicals play an indispensable role in automotive manufacturing, contributing to lightweight materials, high-performance coatings, and fuel-efficient lubricants. With the rise in the adoption of electric vehicles (EVs), manufacturers rely heavily on adhesives, thermal management solutions, and conductive polymers as battery performance enhancers and ensure vehicle safety.

Rapid Industrialization and Infrastructure Development

With emerging economies expanding their manufacturing, construction, and industrial sectors rapidly, demand for high-performance chemicals has surged significantly, these materials help extend material durability while optimizing manufacturing processes to increase production efficiencies across various industrial applications.

Specialty chemicals used in construction projects including concrete admixtures, waterproofing agents, sealants, and flame retardants play an essential role in improving the strength, longevity, and safety of modern infrastructure projects. With investments into smart cities, commercial buildings, large transportation networks, and sustainability-driven government initiatives demanding energy-efficient infrastructure solutions globally the demand has spurred for these advanced construction chemicals.

Automation technologies like Industry 4.0 have further amplified this use as well as providing an avenue to utilize customized polymer solutions such as specialty lubricants or anticorrosion agents for meeting technological challenges.

Global Specialty Chemicals Market: Restraints

Fluctuating Raw Material Prices and Supply Chain Disruptions

Many specialty chemicals use petrochemical derivatives, rare earth metals, and specialty compounds which are susceptible to price fluctuations. Instability in crude oil prices, regulatory changes, and trade restrictions frequently lead to increased production costs making it hard for manufacturers to maintain steady pricing and profitability. Companies must manage this uncertainty either through internal cost reduction measures or passing them onto consumers which may lead to diminished demand.

Geopolitical tensions and economic policies also play a key role in market instability. Restrictions on exports, tariffs on essential raw materials, and trade conflicts among major economies all present barriers for manufacturers sourcing materials globally. Relying heavily on China as an international supplier of rare earth elements and specialty chemicals exposes markets to supply chain concentration risks, any disruptions in these networks may cause production delays, and reduced output levels, which may lead to the need for alternative suppliers.

Stringent Regulatory Compliance and Environmental Restrictions

Compliance with evolving safety, environmental, and health regulations has become a significant challenge for manufacturers, often leading to higher operational costs, product approval delays, or restrictions on certain raw materials. Authorities globally continue enforcing tighter policies regarding emissions, hazardous substances, and waste disposal.

Regulative agencies like the Environmental Protection Agency (EPA), the European Chemicals Agency (ECHA), and China's Ministry of Ecology and Environment impose stringent guidelines for chemical production, usage, and disposal.

Laws like REACH (Registration, Evaluation Authorization Restriction of Chemicals) mandate extensive testing and documentation costs that increase compliance costs for manufacturers. Failing to adhere to these regulations could result in serious penalties as well as product recalls that affect profitability and market reputation negatively.

Global Specialty Chemicals Market: Opportunities

Growing Demand for Sustainable and Bio-Based Specialty Chemicals

Bio-based specialty chemicals derived from renewable sources, including plant-based polymers, biodegradable surfactants, and natural emulsifiers are quickly gaining ground across different applications. Personal care and cosmetics industries in particular are seeing increased interest in natural plant-derived emollients, bio-surfactants, and preservatives that meet consumer preferences for organic ingredients.

Packaging companies are replacing traditional plasticizers and stabilizers with bio-based alternatives that meet regulatory and environmental standards while maintaining performance goals for product performance requirements. Industries focused on reducing carbon emissions are turning to specialty chemicals as sustainable solutions. Automotive production requires special adhesives, lightweight composite materials, and high-performance lubricants that help improve fuel efficiency while simultaneously decreasing emissions levels.

Advancements in High-Performance Materials for Emerging Technologies

Rapid technological development across industries offers specialty chemicals manufacturers an immense growth opportunity. As more industries adopt electric vehicles (EVs), 5G communications, advanced healthcare solutions, and renewable energy systems, there is an increasing need for high-performance specialty chemicals that enhance material properties and efficiency and enable next-generation innovations.

As artificial intelligence (AI), quantum computing, and miniaturized electronic components proliferate, there has been an unprecedented demand for ultra-pure specialty chemicals such as high-performance photoresists, conductive polymers, and specialty gases in electronics and semiconductor industries. Furthermore, the global deployment of 5G networks necessitates special coatings and dielectric materials with enhanced signal transmission properties, heat dissipation capabilities, and component longevity to optimize signal transmission, heat dissipation, and longevity.

Global Specialty Chemicals Market: Trends

Rising Adoption of Green Chemistry and Sustainable Manufacturing

The specialty chemicals industry is experiencing an unprecedented transformation towards green chemistry and sustainable manufacturing practices as companies strive to reduce environmental impact, comply with stricter regulations, and meet consumer demand for eco-friendly products. This trend has driven bio-based, biodegradable, and non-toxic specialty chemicals for use across various industries such as packaging, personal care products, agriculture, and industrial applications.

Chemical manufacturers have turned towards greener production processes to reduce waste, energy usage, and emissions. Technologies like catalytic green synthesis, enzymatic bioprocessing, and carbon capture utilization (CCU) are being implemented into more sustainable production cycles. Businesses have taken steps towards lowering their carbon footprint by optimizing supply chains, using eco-friendly solvents, and adopting closed-loop systems that promote circular economy principles.

Digitalization and Smart Manufacturing in the Specialty Chemicals Industry

Digitalization in specialty chemicals includes the utilization of AI and machine learning (ML) technologies for product development and predictive analytics. These technologies allow manufacturers to efficiently sift through large volumes of data, spot trends, and optimize chemical formulations for improved performance and sustainability and speed up research and development by eliminating costly trial and error experiments faster, speeding the pace of innovation faster for market release.

Real-time monitoring of chemical processes helps ensure precision, reduce waste, enhance safety, detect issues before they worsen, and automate maintenance schedules for predictive maintenance purposes thereby minimizing downtime while cutting production costs overall.

Companies may even leverage virtual models of physical assets known as digital twins to optimize production workflows and enhance plant efficiencies. Supply chain digitalization has become popular as manufacturers utilize blockchain technology and cloud-based platforms to increase transparency and traceability. These solutions allow manufacturers to better track raw material sourcing, logistics management, and regulatory compliance.

Global Specialty Chemicals Market: Research Scope and Analysis

By Type

Plastic additives are expected to dominate the type segment in the specialty chemicals market, capturing a significant 30.0% market share in 2025. This growth will be fuelled by rising demand for high-performance plastics across various industries such as packaging, automotive, construction, electronics, and consumer goods. With an increasing preference for flexible and rigid plastic packaging solutions in food and beverage, pharmaceutical, and e-commerce sectors as well as online marketplaces such as eBay and Amazon, there has been a need for plastic additives like stabilizers, impact modifiers, and nucleating agents that improve durability, prevent degradation, and extend shelf life of packaged products thereby providing essential protection to their integrity and quality.

Specialty oilfield chemicals are poised for significant expansion due to rising exploration activities in oil and gas exploration as well as their need in drilling, refining, and production processes. Oilfield operators are investing in high-performance specialty chemicals that enhance operational efficiencies, boost well productivity, and ensure environmental compliance.

One key driver of this growth is the increase in enhanced oil recovery (EOR) techniques, where specialty chemicals such as demulsifiers, scale inhibitors, and corrosion inhibitors play an integral part. EOR techniques help optimize extraction processes while also preventing pipeline blockages and prolonging equipment lifespan, thus improving productivity in the oil and gas sector.

By Application

Institutional and industrial cleaners are expected to dominate the application-type segment in the specialty chemicals market, capturing a 27.0% market share in 2025. This growth can be attributed to rising demand for high-performance cleaning and sanitation solutions across industries including healthcare, hospitality, food processing, manufacturing, and more. Strict hygiene standards as well as regulatory compliance have led to an upsurge in specialty cleaning chemicals designed specifically towards industry requirements.

Due to an increase in awareness about infection control and disease prevention, healthcare institutions have witnessed an upsurge in institutional cleaner use. Hospitals, pharmaceutical facilities, and laboratories require disinfectants, sterilants, and antimicrobial coatings with advanced antimicrobial and antiviral properties to meet strict hygiene protocols. Hospital-associated infection (HAI) prevention efforts have further propelled demand for cleaning solutions with antibacterial, and antimicrobial properties.

Construction chemicals are projected to experience significant growth, driving overall expansion in the specialty chemicals market. With infrastructure development accelerating globally and urbanization on the rise, demand for high-performance construction chemicals like cleaning agents, surface treatment solutions, and protective coatings is growing quickly. Such solutions play an integral role in maintaining buildings, bridges, roads, and industrial facilities with longevity, aesthetics, and structural integrity.

Industrial-grade acid-based or biodegradable alkaline cleaners help remove efflorescence, oil stains, and mold growth from concrete surfaces to prepare them for coatings, sealants, or painting applications. With increasing investments into infrastructure development projects and restoration works the demand for effective construction cleaning chemicals is expected to surge even further.

Countries like China, India, Japan, and South Korea stand out with strong government policies, foreign investments, advanced supply chain networks as well as competitive advantages like cost-effective labor and abundant raw materials that make the Asia Pacific an attractive market for specialty chemical production and consumption. Asia Pacific's rapid urbanization and infrastructure growth have increased demand for specialty construction chemicals like concrete admixtures, waterproofing agents, sealants, and coatings.

Governments are investing heavily in smart cities, commercial complexes, transportation networks, and industrial zones creating the need for high-performance chemical solutions that improve durability, safety, sustainability, and energy efficiency. Furthermore, eco-friendly building practices have driven interest in chemicals meeting green building standards and complying with green building practices.

The region with the highest CAGR

Europe is expected to register the highest compound annual growth rate (CAGR) in the global specialty chemicals market propelled by rising demand for sustainable and high-performance chemical solutions across various industries. Europe's robust regulatory framework, emphasis on environmental sustainability, and commitment to innovation have positioned it as an innovative hub.

European governments and regulatory bodies such as ECHA/EU have implemented stringent policies encouraging eco-friendly specialty chemicals with biodegradability properties while encouraging manufacturers to create advanced sustainable formulations.

Europe's market growth has been greatly stimulated by its move toward sustainable and bio-based chemicals. Companies across industries like automotive, construction, and consumer goods are making major investments in environmentally friendly alternatives to meet the European Union's carbon neutrality and sustainability targets.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Specialty Chemicals Market: Competitive Landscape

The global specialty chemicals market is highly competitive, with major players investing in research and development to offer cutting-edge chemical solutions to meet industry requirements. Companies also focus on sustainability, regulatory compliance, and technological innovation ways to differentiate their offerings.

Businesses strive to meet the demand for environmentally friendly specialty chemicals while expanding product portfolios and manufacturing capacities to keep pace with rising global demand. Large multinational corporations such as BASF SE, Dow Inc., Clariant AG, Evonik Industries, Solvay SA, and Huntsman Corporation dominate the market with their vast distribution networks and technological innovations.

These companies take advantage of economies of scale, strong R&D investments, and strategic partnerships to maintain a competitive advantage. Market consolidation through mergers and acquisitions is becoming a trend, this allows companies to expand their global footprint while simultaneously expanding production technologies.

Sustainability has emerged as a competitive edge in the specialty chemicals market, with companies adopting green chemistry principles, investing in circular economy initiatives, and reducing carbon footprints during production. Companies prioritizing eco-friendly innovations and regulatory adherence are gaining an edge as industries shift toward sustainable chemical solutions.

Technological advances, digitalization, and smart manufacturing processes are revolutionizing market competition. Artificial Intelligence (AI), machine learning, and data analytics are being integrated into specialty chemical production to increase efficiency, optimize formulations, and anticipate market trends. Furthermore, digital transformation enables companies to improve supply chain management, lower operational costs, and offer customized solutions.

Some of the prominent players in the global Specialty Chemicals are:

- Solvay

- Evonik Industries AG

- Clariant AG

- Akzo Nobel N.V.

- DuPont

- Kemira Oyj

- Lanxess

- Croda International Plc

- Huntsman International LL

- The Lubrizol Corporation

- Albemarle Corporation

- Other Key Players

Global Specialty Chemicals Market: Recent Developments

- February 2025: Reaxis, a specialty chemicals company, announced the acquisition of TIB Chemicals AG. This strategic move aims to expand Reaxis's product portfolio and enhance its market presence in the specialty chemicals sector.

- January 2025: OMV and Abu Dhabi National Oil Company (ADNOC) announced considerations for a joint acquisition of Nova Chemicals, a Canadian company. This strategic move aims to create a global polyolefin group by integrating Nova Chemicals with Borealis and Borouge, enhancing their combined market presence.

- April 2024: Clariant, a sustainability-focused specialty chemical company, signed an agreement to acquire Lucas Meyer Cosmetics, a leading provider of high-value ingredients for the cosmetics and personal care industry. This acquisition aims to enhance Clariant's portfolio in the personal care sector, offering innovative solutions for high-value personal care brands.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 307.0 Bn |

| Forecast Value (2034) |

USD 501.7 Bn |

| CAGR (2025-2034) |

5.6% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 51.6 Bn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Institutional & Industrial Cleaners, Rubber Processing Chemicals, Construction Chemicals, Food & Feed Activities, Cosmetic Chemicals, Oilfield Chemicals, Specialty Pulp & Paper Chemicals, Specialty Textile Chemicals, Water Treatment Chemicals, Electronic Chemicals, Mining Chemicals, Mining Chemicals, Pharmaceutical & Nutraceutical Additives, CASE, and Others), and By Application (Plastic Additives, Specialty Oilfield Chemicals, Lubricating Oil Additives, Water Treatment Chemical, Electronic Chemicals, Hair spray, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Solvay, Evonik Industries AG, Clariant AG, Akzo Noble N.V., DuPont, Kemira Oyj, Lanxess, Croda International Plc, Huntsman International LL, The Lubrizol Corporation, Albemarle Corporation, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The global specialty chemicals market size is estimated to have a value of USD 307.0 billion in 2025 and is expected to reach USD 501.7 billion by the end of 2034.

The US specialty chemicals market is projected to be valued at USD 51.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 81.9 billion in 2034 at a CAGR of 5.3%.

Asia Pacific is expected to have the largest market share in the global specialty chemicals market with a share of about 50.2% in 2025.

Some of the major key players in the global specialty chemicals market are Solvay, Evonik Industries AG, Clariant AG, Akzo Noble N.V., DuPont, Kemira Oyj, Lanxess, Croda International Plc, Huntsman International LL, The Lubrizol Corporation, Albemarle Corporation, and many others.

The market is growing at a CAGR of 5.6 percent over the forecasted period.