Specialty Fuel Additives Market Overview

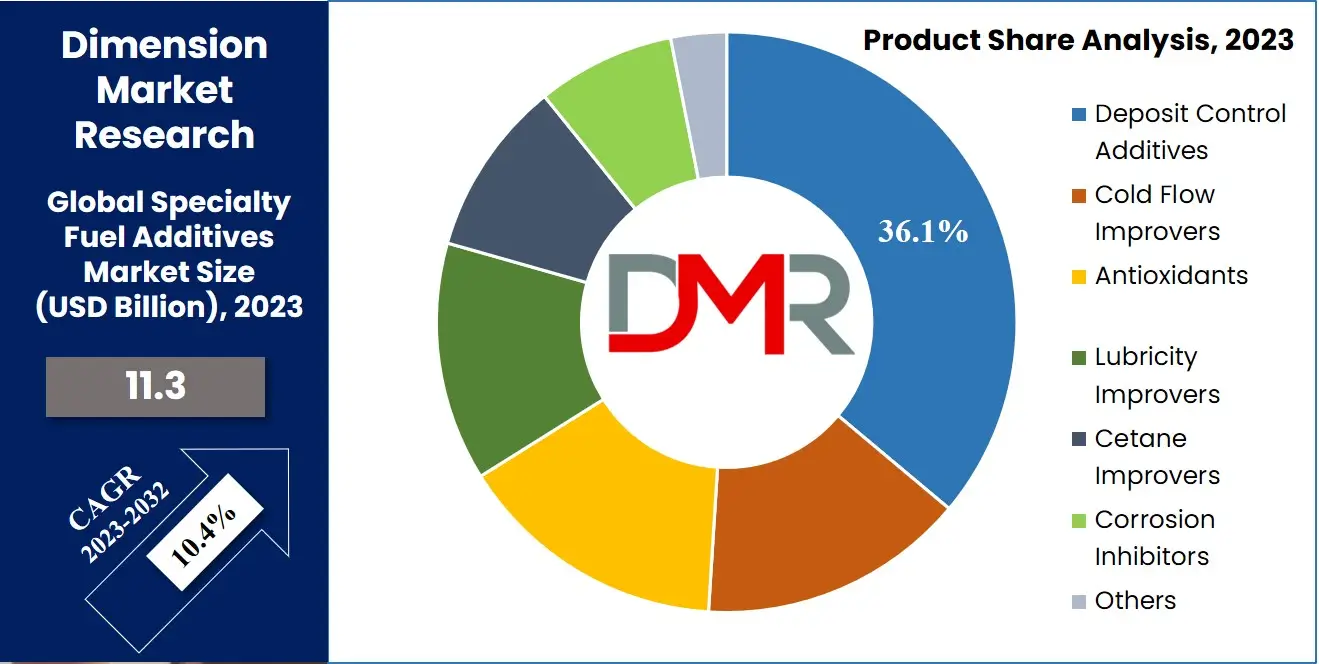

The Global Specialty Fuel Additives Market is expected to stand at a value of USD 11.3 billion in 2023 and is anticipated to grow with a projected Compound Annual Growth Rate (CAGR) of 10.4% for the forecast period (2023-2032).

Specialty fuel additives are advanced chemical compounds designed to improve the efficiency, performance, and environmental impact of fuels. These fuel efficiency additives help in addressing critical challenges such as fuel degradation, emissions reduction, and engine performance optimization.

Widely used across industries like automotive, aviation, and industrial operations, these additives play a vital role in enhancing fuel combustion and meeting regulatory compliance. The specialty fuel additives market encompasses the production, distribution, and consumption of these additives globally, driven by growing fuel demand and stringent environmental standards.

Fuel consumption in the United States alone highlights the potential of this market. According to the U.S. Energy Information Administration (EIA), Americans consumed about 135.73 billion gallons of gasoline in 2022, including 368.63 million gallons daily. Such numbers underscore the crucial need for innovative clean fuel technologies that can optimize performance while adhering to sustainability goals.

For startups and entry-level businesses, the market offers niche opportunities. By focusing on biodiesel or multi-functional fuel additives, smaller players can address specific regional needs or partner with local industries.

Collaborating with automotive manufacturers or regulatory agencies to develop compliance-oriented solutions will help them carve out a competitive edge. With proven reserves of oil estimated to last about 47 years globally, the need for fuel efficiency and optimization becomes even more critical, opening avenues for all market participants to innovate and grow.

The specialty fuel additives market is evolving rapidly, with several trends driving its growth. One significant trend is the shift toward sustainability, as industries and governments push for greener alternatives to reduce carbon emissions. Bio-based additives are gaining traction as they offer reduced environmental impact without compromising performance.

Technological advancements are also playing a vital role, with the development of additives that enable real-time fuel optimization. These advanced combustion solutions cater to industries seeking higher operational efficiency. Additionally, emerging economies, particularly in Asia-Pacific, are witnessing increased fuel consumption, creating a lucrative market for additive manufacturers. With 45% of a crude oil barrel refined into gasoline, the demand for performance-enhancing additives remains strong.

Fuel consumption statistics and oil reserves further emphasize the importance of this market. The United States alone consumes 368.63 million gallons of gasoline daily, highlighting the massive potential for fuel optimization. Moreover, 45% of crude oil is refined into gasoline, which underscores the need for efficiency-enhancing solutions. Globally, proven oil reserves indicate about 47 years of availability at current consumption levels, making the efficient use of fuel an urgent priority.

In this dynamic landscape, the specialty fuel additives market offers immense potential for growth, innovation, and collaboration. Whether you are an established player or a new entrant, opportunities abound to drive sustainable growth while addressing the world’s fuel efficiency challenges.

Key Takeaways

- The Global Specialty Fuel Additives Market was valued at USD 11.3 billion in 2023 and is projected to grow at a CAGR of 10.4% from 2023 to 2032.

- Deposit control additives led the market with a 36.1% share in 2023.

- Gasoline demand has plateaued globally, except in specific regions, due to the rising preference for diesel.

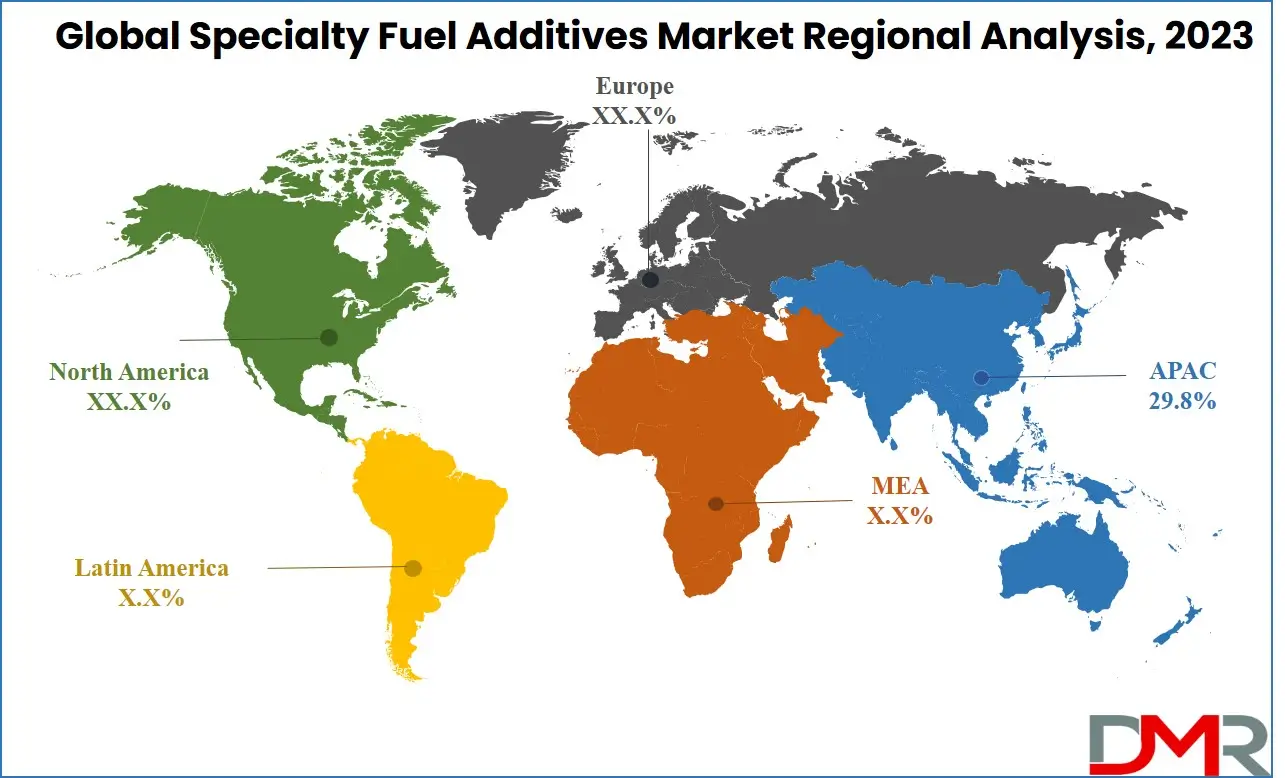

- Asia Pacific dominates the market with a 29.8% global revenue share in 2023.

Use Cases

- Automotive Sector: Specialty fuel additives enhance combustion efficiency, reduce engine deposits, and improve mileage in gasoline and diesel engines, supporting automakers in meeting stringent emissions regulations and performance standards.

- Aviation Industry: Aviation turbine fuels (ATF) are treated with anti-oxidants and performance-enhancing additives to ensure smooth operation at high altitudes, reduce maintenance needs, and maintain engine reliability under extreme conditions.

- Industrial Power Generation: Diesel and gas-powered generators leverage lubricity improvers and corrosion inhibitors to enhance fuel stability, prevent wear and tear, and ensure uninterrupted industrial operations.

- Marine & Shipping Applications: Fuel additives reduce sulfur and particulate emissions in marine engines, optimize combustion efficiency, and extend engine lifespan, supporting compliance with international maritime environmental regulations.

- Research & Sustainable Innovation: Startups and chemical developers focus on bio-based and multi-functional additives to reduce environmental impact, improve cold flow performance, and support the shift toward sustainable fuels in emerging and developed markets.

Specialty Fuel Additives Market Dynamic

The demand for eco-friendly & efficient energy sources in manufacturing, aviation, and automobiles, along with strict environmental regulations, will drive the Global Specialty Fuel Additives Market growth. Harmful emissions from vehicle fuels have led to the global adoption of specialty additives, which reduce emissions & enhance fuel efficiency. These additives work by mitigating pollutant emissions and combustion rates.

Additionally, the use of additives to improve cold flow performance in biodiesel blends in Europe & North America is expected to boost demand for the

Fuel Pump Rebuilding Service, as these formulations often require specialized pump maintenance. However, raw material price inflation may negatively impact the industry's service costs.

Ongoing focus on innovative fuel supplements to minimize emissions & enhance mileage, along with advanced engine technology, will drive future growth in fuel pump refurbishment services. China, U.S., & India are all set to dominate the market due to their commitment to fuel optimization & deposit removal for enhanced engine performance - key factors that increase the need for professional fuel pump rebuilding services to maintain peak efficiency.

Specialty Fuel Additives Market Research Scope and Analysis

By Product

The market is categorized by product into deposit control additives, cetane improvers, antioxidants, corrosion inhibitors, lubricity improvers, cold flow improvers, and other products like dyes & markers, and metal deactivators.

Deposit control additives emerge as the leading segment

commanding the largest market share with 36.1% in 2023. The deposit control segment is set to grow with a high Compound Annual Growth Rate (CAGR) due to the increasing utilization of detergents as fuel supplements. The growing demand for fuel-efficient vehicles is expected to be a key driver for product consumption throughout the forecast period (2023-2032).

By Application

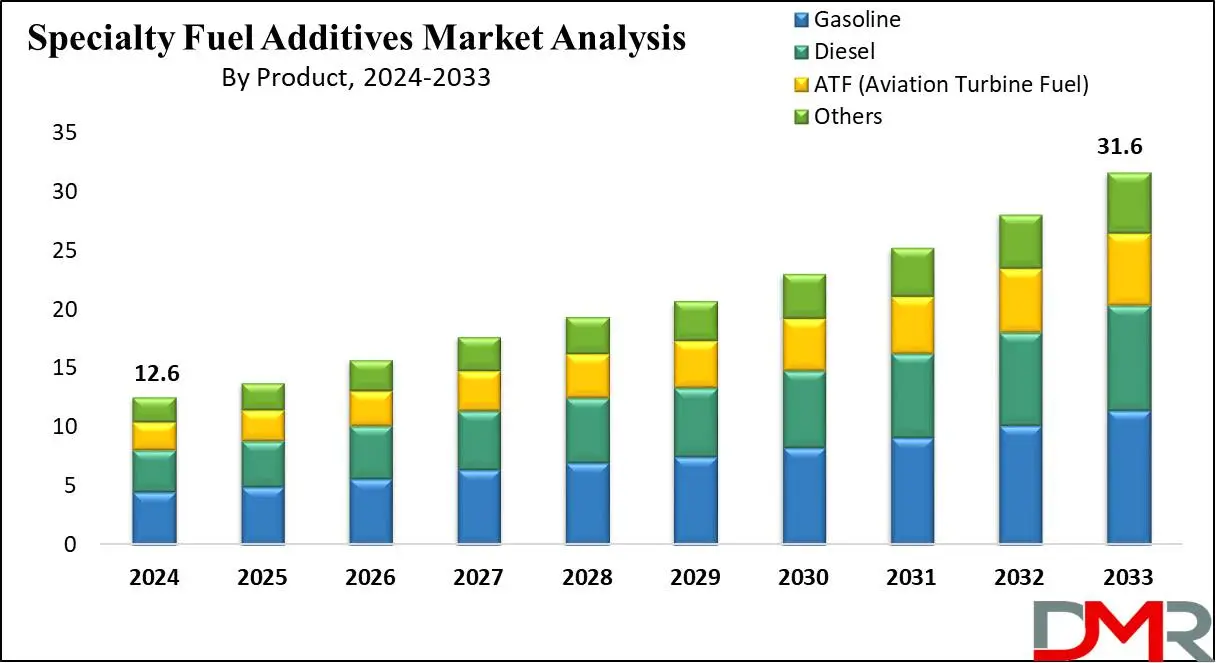

These additives find significant applications in various fuel types, including Gasoline, Diesel, Aviation Turbine Fuels (ATF), and Others. Diesel, known for its higher environmental impact, sees greater use of specialty fuel additives aimed at enhancing vehicle fuel efficiency. In 2023, the diesel segment is estimated to capture the largest market share with the highest Compound Annual Growth Rate (CAGR) by 2032.

The

Diesel Power Engine Market continues to see strong growth, with the diesel segment's prominence particularly driven by emerging economies such as Indonesia, India, China, and Thailand. However, increased gasoline consumption, particularly in China and the U.S., continues to be a significant driver for this market in the gasoline sector.

Conversely, in other regions of the world, the demand for gasoline has plateaued, largely due to the growing popularity of diesel engines in industrial and commercial applications. This shifting dynamic highlights the complex competitive landscape within the power engine sector, where diesel maintains a dominant position in developing markets while facing varied demand patterns globally.

The Global Specialty Fuel Additives Market Report is segmented on the basis of the following:

By Product

- Deposit Control Additives

- Cetane Improvers

- Antioxidants

- Corrosion Inhibitors

- Lubricity Improvers

- Cold Flow Improvers

- Others

By Application

- Gasoline

- Diesel

- ATF (Aviation Turbine Fuel)

- Others

Specialty Fuel Additives Market Regional Analysis

The Asia Pacific region dominates the market, with a maximum share of 29.8% of the global revenue in 2023. The region is set to expand with the highest Compound Annual Growth Rate (CAGR) due to various factors, including rapid industrialization, a growing demand for enhanced efficiency, and the enforcement of stringent policies to control emissions in various countries like India, China & Japan. The growing automotive industry in the Asia Pacific region is expected to have a positive impact on the demand for supplement fuel by 2032.

Following Asia Pacific, North America is expected to stand in second position in terms of share. In Europe, the market is all set to expand due to the rising emphasis on environmental policies & the growing need for biofuels, which are expected to be significant drivers in the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Specialty Fuel Additives Market Competitive Landscape

To maintain a competitive edge, top players in the specialty fuel additives industry are heavily investing in research and development. These industry leaders are strategically expanding their global presence through mergers and acquisitions while diversifying their product portfolios to align with the ever-evolving trends in global industries.

Prominent companies such as Innospec, NewMarket, and BASF, are at the forefront of these efforts. Major manufacturers operating in the specialty fuel additives market are actively broadening the scope of specialty fuel additives and exploring new applications. Given the rapid advancements in technology, these additive manufacturers are also keen on optimizing both pre- and post-production processes to enhance efficiency and effectiveness.

As an example, in June 2020, Altivia Oxide Chemical LLC made a significant move by acquiring KMCO, LLC, a leading provider of high-quality specialty chemical manufacturing and toll processing services. This strategic investment amounting to USD 25 million not only demonstrates the commitment of industry players to expand their capabilities, but also highlights the growing importance of the

Chemical Logistics in supporting such expansions.

The acquisition underscores the need for robust chemical transportation and storage solutions to handle specialized materials, further driving demand for sophisticated logistics services in the chemical sector.

Some of the prominent players in the Global Specialty Fuel Additives Market are:

- Innospec Inc.

- NewMarket Corporation

- BASF SE

- Albemarle Corp

- Infineum International Limited

- Chemtura Corporation

- Baker Hughes Inc.

- Dow Chemical Company

- Lubrizol Corporation

- TOTAL SA

- Clariant Corporation

- Other Key Players

Specialty Fuel Additives Market Report Details

| Report Characteristics |

| Market Size (2024) |

USD 11.3 Bn |

| Forecast Value (2033) |

USD 27.5 Bn |

| CAGR (2024-2033) |

10.4% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Deposit Control Additives, Cetane Improvers, Antioxidants, Corrosion Inhibitors, Lubricity Improvers, Cold Flow Improvers, and Others), By Application (Gasoline, Diesel, ATF, and Others). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Innospec Inc., Newmarket Corporation, BASF SE, Albemarle Corp., Infineum International Limited, Chemtura Corporation, Baker Hughes Inc., Dow Chemical Company, Lubrizol Corporation, TOTAL SA, Clariant Corporation, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Specialty Fuel Additives Market is expected to reach a value of USD 5.1 billion in 2023.

Global Specialty Fuel Additives Market is expected to register a CAGR of 10.4 % over the forecast period (2023-2032).

The Asia Pacific (APAC) region asserts its dominance in the global market with a share of 29.8% in 2023.

Some of the prominent players in the Global Specialty Fuel Additives Market include Innospec Inc., Newmarket Corporation, BASF SE, Albemarle Corp., Infineum International Limited, Chemtura Corporation, Baker Hughes Inc., Dow Chemical Company, Lubrizol Corporation, TOTAL SA, etc,