Market Overview

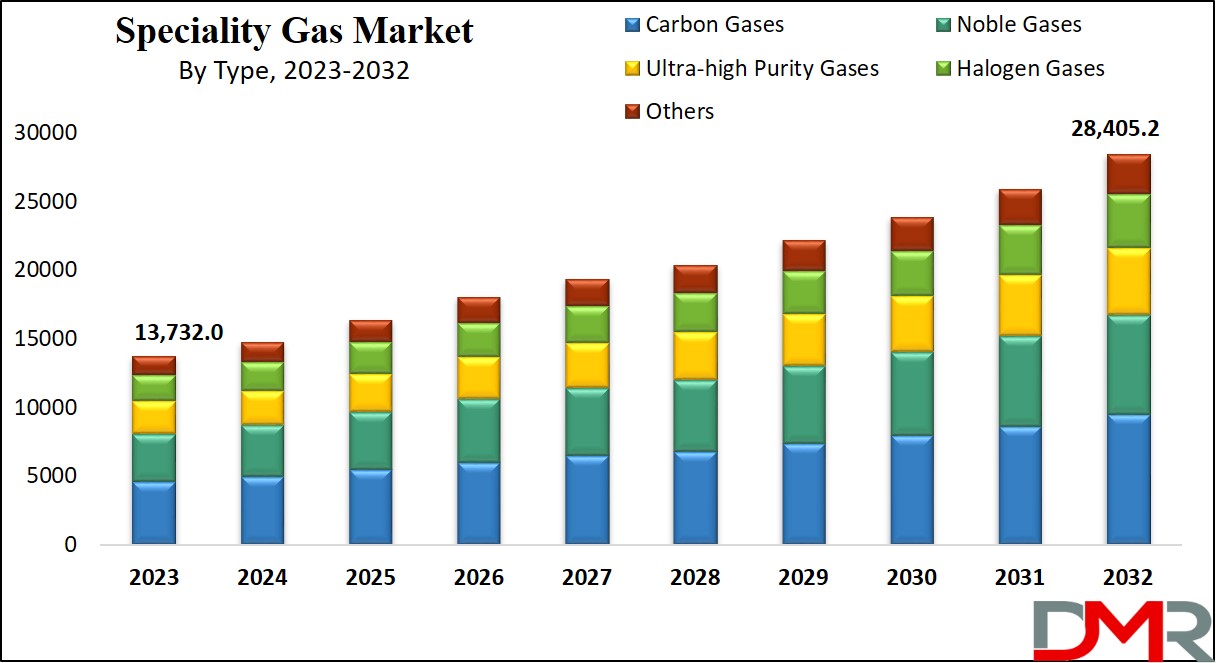

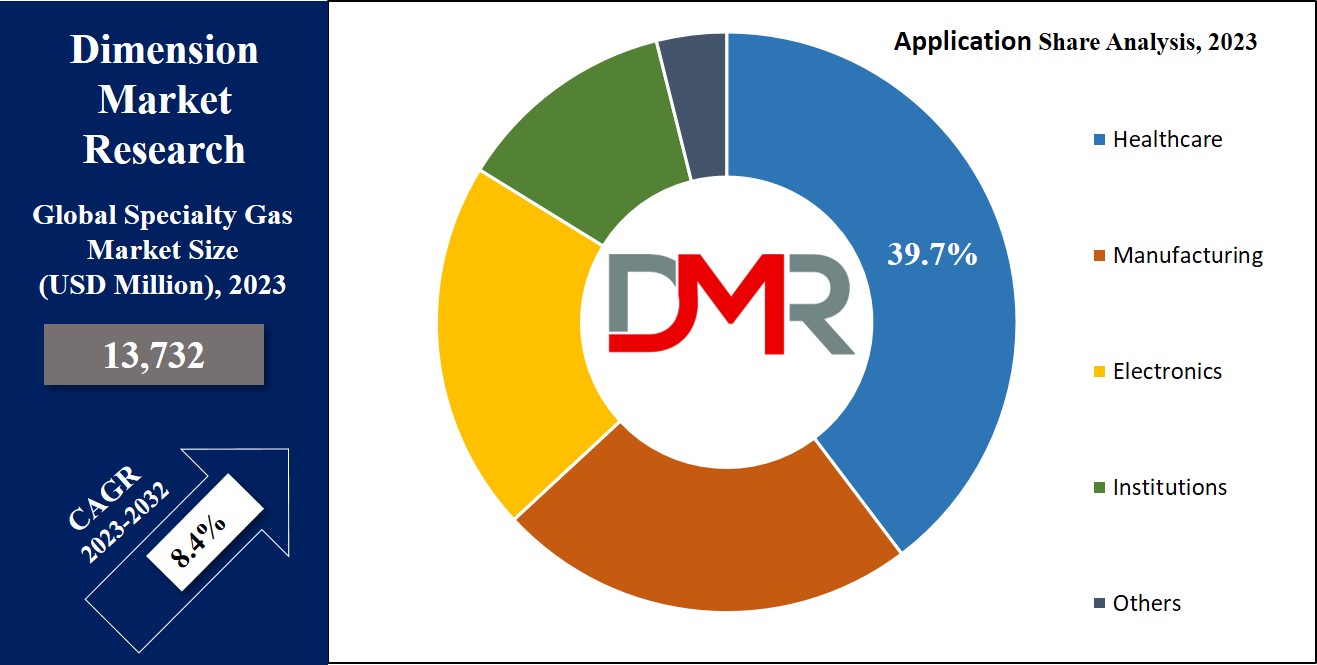

The Global Specialty Gas Market is estimated to hit a value of USD 13,732 million in 2023, and it is projected to exhibit a CAGR (compounded annual growth rate) of 8.4% from 2023 to 2032 (forecast period).

Specialty gases represent a group of highly pure gases that are tailored for specific applications, distinguishing them from common

industrial gases due to their specialized properties and high purity levels.

These gases are crucial in various industries, including electronics, healthcare, and chemicals, where precise and consistent results are imperative. The specialty gas market itself is characterized by its provision of these gases, encompassing both standard and custom mixtures tailored to meet the exact needs of various sectors.

In 2024, significant growth opportunities are anticipated within the specialty gas market. Factors driving this growth include technological advancements, increasing demands from emerging sectors such as specialty chemicals and synthetic natural gas, and the expanding electronics market, especially in semiconductor manufacturing. Both established players like Linde, which reported chemical sales exceeding $30.69 billion in 2023, and new entrants stand to benefit.

For smaller or entry-level businesses, the evolving landscape presents a unique opportunity to carve niches in specialized segments such as ultra-high-purity gases, leveraging innovations to compete against larger corporations.

Notably, the United States, holding the second-largest share of specialty chemical sales globally, underscores the vast potential for market expansion and the strategic importance of targeting North American markets.

Key trends shaping the specialty gas market include the rising importance of green and sustainable gases, driven by global environmental policies, and the increasing use of specialty gases in innovative medical therapies. Moreover, market dynamics are influenced by price fluctuations; for instance, the price of krypton in Japan increased significantly from $1.72 per liter to $8.60 per liter by the end of January, highlighting the volatility and the potential for strategic stockpiling or long-term supply agreements.

Understanding these elements can provide a competitive edge. For businesses looking to enter or expand within this market, focusing on specialized applications that require high-purity products, such as in the development of pharmaceuticals or in high-tech manufacturing, can be particularly lucrative.

Additionally, aligning with sustainability trends not only meets regulatory demands but also resonates with the growing consumer preference for environmentally responsible suppliers. Offering solutions that cater to green ammonia or blue hydrogen markets can open new doors for companies that are forward-thinking in their approach.

By offering insights into these areas, our goal is to assist clients in navigating the specialty gas market more effectively, ensuring they are positioned to capitalize on emerging opportunities and trends. Engaging with this market now, especially given the anticipated growth and the evolving technological landscape, could result in substantial benefits for both established entities and new market entrants.

Key Takeaways

- The Global Specialty Gas Market is projected to reach USD 13,732 million in 2023, growing at a CAGR of 8.4% until 2032.

- Carbon Gases lead the market in terms of type segmentation, achieving the highest share in 2023.

- The healthcare segment dominates the market revenue in 2023, anticipated to continue leading due to growing global healthcare investments and advanced medical technology adoption.

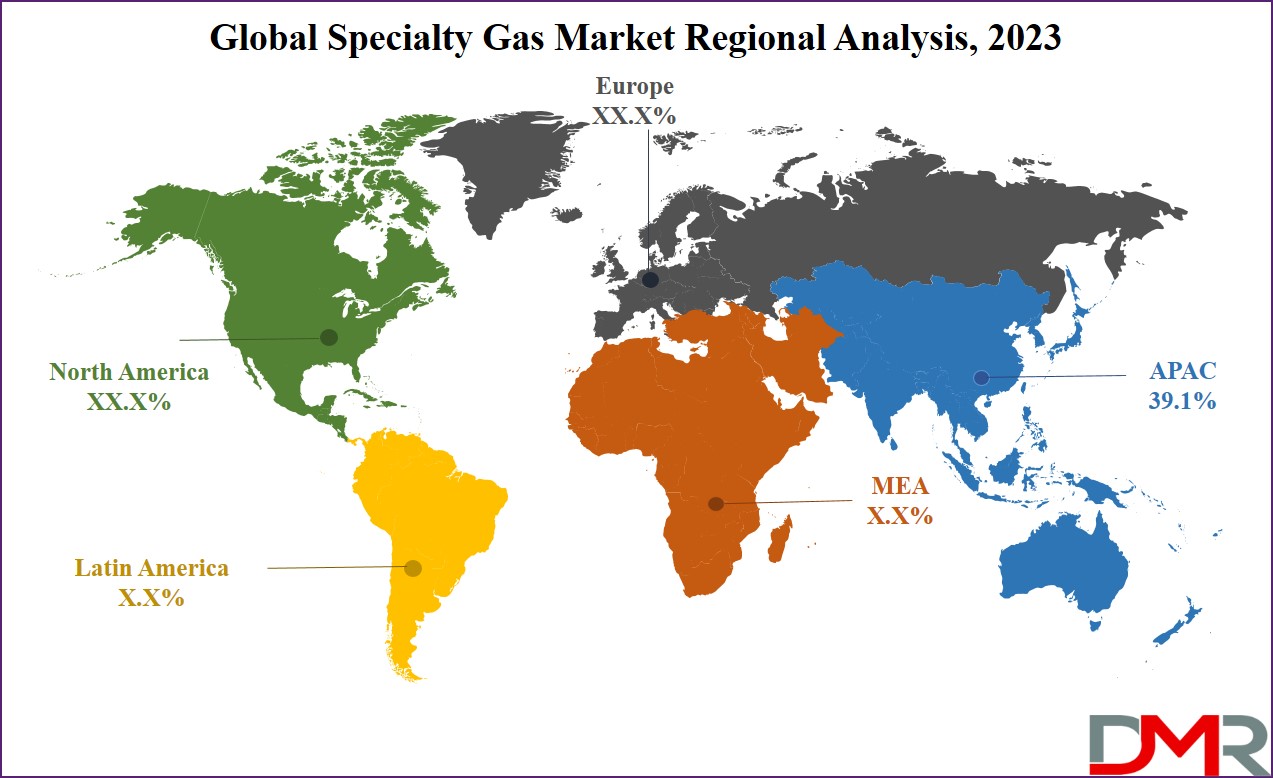

- Asia Pacific emerges as the top revenue-contributing region with a 39.1% share in 2023 and is expected to grow at the fastest rate during the forecast period.

Market Dynamic

Specialty gas is extensively utilized in the production of semiconductor chips, with nitrogen holding a significant role in the manufacturing of semiconductors. Nitrogen serves multifunctional roles, such as purging vacuum pumps in abatement systems & acting as an important process gas. The Global Specialty Gas Market is poised for growth driven by factors including the thriving expansion of end-user sectors & the rising demand for plasma display panels & photovoltaic products.

Anticipated to gain prominence in the sector of healthcare, specialty gas is finding increasing application because of the growing adoption & acceptance of high-purity & noble gases in several medical contexts. These include reanimation processes, anesthesia, mechanical ventilation, and MRI (Magnetic Resonance Imaging). Specialty gas mixtures & medical gases play indispensable roles in pathology, patient care, medical processes, & research, being provided via hospital pipelines or portable cylinders.

However, the growth of the market might face several challenges due to the stringent regulations & policies governing the production & quality control of specialty gas, as well as the presence of available alternatives. However, a contrasting prospect arises in the form of eco-friendly products & technologies, as well as the potential opportunities showcased by emerging markets, which are anticipated to contribute to the expansion of the Specialty Gas Market.

Research Scope and Analysis

By Type

Under the segmentation, by Type, the Global Specialty Gas Market is categorized into Carbon Gases, Noble Gases, halogens, and Ultra-high Purity Gases. The Carbon Gases sub-segment dominates the market, attaining a maximum share in 2023.

Carbon dioxide & CO, because of their wide range of applicability in numerous industrial contexts, are observing rising demand. Within the healthcare domain, carbon gases are widely employed in major devices such as NMR (nuclear magnetic resonance) imaging, MRI (magnetic resonance imaging), & ophthalmology.

The burgeoning demand from several sectors such as electronics, healthcare, manufacturing, & chemicals, along with the expanding scope of applications for analytical purposes & instrument calibration, is driving this trend. Moreover, the growing requirement for noble gases in the manufacturing & electronics sectors is poised to act as a catalyst for this industry’s growth.

By Application

Categorized by application, the Global Specialty Gas market is segmented into healthcare, electronics, institutions, manufacturing, & others. Remarkably, the segment of healthcare holds the largest revenue share in 2023 and is expected to maintain its dominance throughout the forecast period, driven by increased expenditure on the healthcare domain globally & the increased adoption & acceptance of advanced medical technologies.

The segment of electronics is projected to grow at a significant CAGR, propelled by the utilization of specialty gases such as nitrogen trifluoride & tungsten hexafluoride in producing electronic components, like LED panels, semiconductors, & solar panels, along with the anticipated surge in demand from advanced technologies like wearables and connected systems

The Specialty Gas Market Report is segmented on the basis of the following:

By Type

- Noble Gases

- Carbon Gases

- Halogen Gases

- Ultra-high Purity Gases

- Others

By Application

- Healthcare

- Manufacturing

- Electronics

- Institutions

- Others

Regional Analysis

The

Asia Pacific region holds the largest revenue share at

39.1% in 2023, and it is foreseen to exhibit the most rapid CAGR (Compound Annual Growth Rate) for the forecast period of 2023 to 2032. This region harbors key electronic manufacturing hubs such as Japan, China, & India.

Additionally, local governments are actively involved in the expansion of diverse end-use sectors including oil & gas, consumer electronics, manufacturing, & healthcare through incentives such as PLI (Production-Linked Incentives), subsidies, & favorable FDI (Foreign Direct Investment) norms. These combined factors collectively contribute to the rapid advancement & predominance of the specialty gas sector in the Asia Pacific area.

Europe is all set to experience the second-highest CAGR in the forthcoming years. This region is directing its efforts toward enhancing production capabilities via capacity building, to cater to rising demands from several end-use sectors. Furthermore, heightened investments in the healthcare & pharmaceutical domains are projected to amplify product requisites in the European landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The landscape of the market is marked by a strong competitive nature, encompassing a diverse array of both global and regional participants. Foremost enterprises on a global scale are actively engaging in strategies like partnerships, collaborations, acquisitions, mergers, and agreements to effectively navigate the rigorous competition and enhance their foothold in the market.

For instance, Meritus Gas Partners ("Meritus") has disclosed the latest collaboration with Applied Gas, Inc. ("Applied Gas"), a prominent autonomous producer and supplier of specialty gases headquartered in Danbury, Texas.

Applied Gas holds a notable position as a provider of tailored specialty gas blends, with a specific focus on intricate hydrocarbon gas mixtures. These mixtures are particularly employed for calibrating analytical devices within petrochemical facilities engaged in the production of olefins like ethylene, propylene, and related derivatives.

Some of the prominent players in the Global Market are:

- Messer Group GmbH

- Air Liquide S.A.

- Air Products Inc.

- Showa Denko K.K

- Taiyo Nippon Sanso Corporation

- Norco Inc.

- Weldstar, Inc.

- MESA International Technologies, Inc.

- Airgas, Inc.

- Linde plc

- Other Key Players

Recent Developments

- In December 2024, Hyosung TNC acquired a specialty gas division for 920 billion won, despite industry criticism over the deal's valuation and timing.

- In September 2024, Adani Total Gas secured $375 million from global lenders to enhance its infrastructure and expand operations.

- In October 2024, Meritus Gas Partners acquired gas distributors in California, Texas, and Oklahoma to strengthen its U.S. market presence.

- In February 2023, INEOS invested $1.4 billion in U.S. onshore oil and gas assets, aiming to increase its production capabilities and market reach.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 13,732 Mn |

| Forecast Value (2032) |

USD 28,405.2 Mn |

| CAGR (2023-2032) |

8.1% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Noble Gases, Carbon Gases, Halogen Gases, Ultra-high Purity Gases, and Others), and By Application (Healthcare, Manufacturing, Electronics, Institutions, and Others). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Messer Group GmbH, Air Liquide S.A., Air Products Inc., Showa Denko K.K, Taiyo Nippon Sanso Corporation, Norco Inc., Weldstar, Inc., MESA International Technologies, Inc., Airgas, Inc, Linde plc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Specialty Gas Market is estimated to hit a value of USD 13,732 million in 2023.

The Global Specialty Gas Market is expected to grow with a CAGR of 8.4% from 2023 to 2032.

The Asia Pacific region holds the largest revenue share at 39.1% in 2023.

Some of the prominent players in the Global Specialty Gas Market include Messer Group GmbH, Air

Liquide S.A., Air Products Inc., Showa Denko K.K, Taiyo Nippon Sanso Corporation, Norco Inc., Weldstar,

Inc., MESA International Technologies, Inc., Airgas, Inc., etc.