The global sports medicine market is witnessing a strong upward trajectory, driven by the rising incidence of sports-related injuries, growing participation in fitness and professional sports, and advancements in medical technologies. Increasing awareness about injury prevention and early treatment, along with the growing demand for minimally invasive procedures, is contributing to market expansion.

Technological innovation plays a central role, with advancements in arthroscopic procedures, biologics like platelet-rich plasma (PRP) and stem cell therapy, and smart wearable devices enhancing both diagnosis and rehabilitation processes. These innovations not only improve clinical outcomes but also help athletes return to activity faster and safer.

A major opportunity lies in the growing integration of

digital health tools in sports injury management. Wearable sensors, remote rehabilitation tools, AI-powered diagnostics, and virtual physiotherapy are transforming care delivery by making it more personalized and accessible, especially in underserved areas. There is also an increasing shift toward preventive care, with training regimens and sports equipment now incorporating data analytics to predict and prevent injuries before they occur.

However, the market faces certain restraints. The high cost of advanced sports medicine devices and procedures often limits access in developing economies. Regulatory hurdles also slow the entry of innovative products, particularly biologics and regenerative therapies. Limited reimbursement in some regions further hampers widespread adoption.

Despite these challenges, the long-term growth prospects remain positive. A growing aging population staying active longer, the increasing number of sports clubs and recreational leagues, and the expanding youth athlete base worldwide provide a steady pipeline of demand. The convergence of sports science, biotechnology, and digital health is reshaping the sports medicine landscape into a highly specialized, data-driven industry poised for continuous growth over the next decade.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

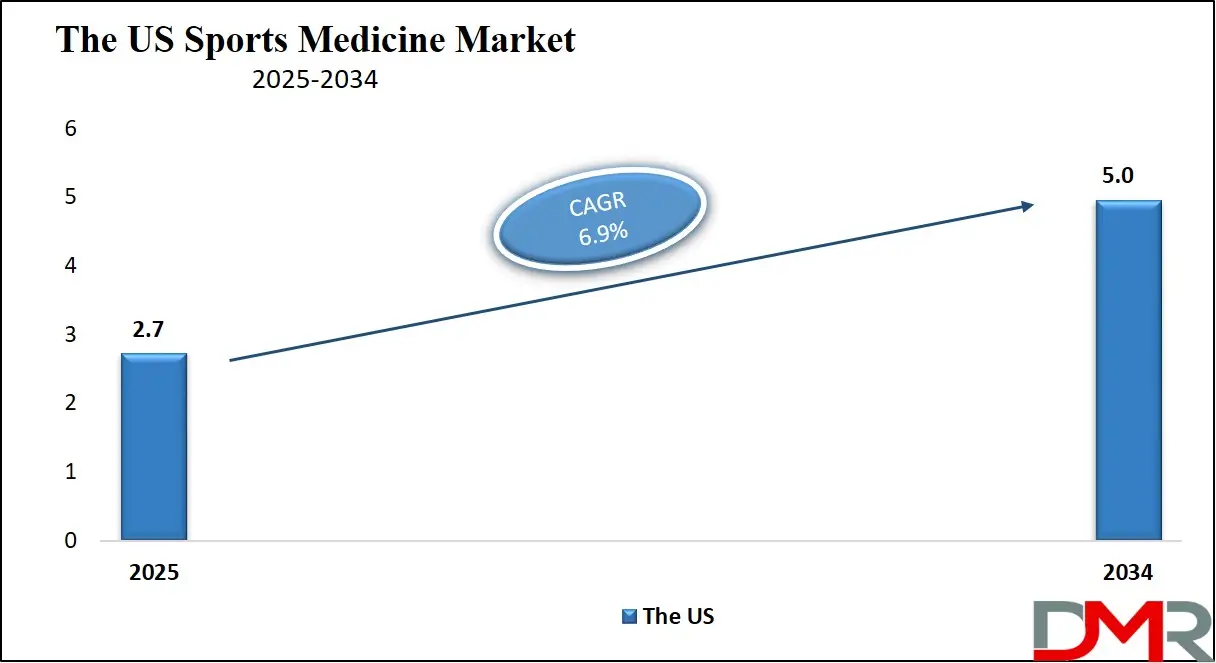

The US Sports Medicine Market

The US Sports Medicine Market is projected to reach

USD 2.7 billion in 2025 at a compound annual growth rate of

6.9% over its forecast period.

The United States sports medicine market is well-developed, with strong support from public health initiatives and a massive athlete base. According to federal agencies, over 30 million children and adolescents participate in organized sports annually. This level of participation results in approximately 3.5 million sports-related injuries each year among youth alone. The Centers for Disease Control and Prevention (CDC) identifies sports injuries, particularly concussions, sprains, and fractures, as a significant concern for young athletes.

Federal programs like the CDC’s HEADS UP campaign and the National Institutes of Health’s injury prevention initiatives help raise awareness and fund research in youth concussion management, musculoskeletal injury prevention, and physical rehabilitation. The U.S. Bureau of Labor Statistics reports consistent growth in the number of athletic trainers and physical therapists, reinforcing the medical infrastructure needed to support recovery.

In addition, veterans and active military populations benefit from federally funded orthopedic and rehabilitative care, which overlaps with the sports medicine ecosystem. The U.S. also leads in innovation, with universities and private sector companies continuously developing new arthroscopic tools, wearables, and regenerative therapies.

The country's demographic profile, comprising a large base of youth athletes, fitness-conscious adults, and aging but active older adults, ensures strong ongoing demand. Urban centers house highly specialized sports medicine clinics, while telehealth adoption helps bridge access gaps in rural areas. Although disparities remain in insurance coverage and cost barriers, the synergy of demand, innovation, and policy support ensures that the U.S. remains a global leader in the sports medicine field.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Sports Medicine Market

The European Sports Medicine Market is estimated to be valued at

USD 1.1 billion in 2025 and is further anticipated to reach

USD 1.7 billion by 2034 at a

CAGR of 5.0%.

Europe’s sports medicine market benefits from a strong public healthcare system, widespread sports culture, and supportive governmental policies. Across the region, over 6 million people receive hospital care annually for sports-related injuries, with nearly half a million requiring hospital admission. The European Commission and national health bodies allocate significant resources to promote injury prevention, including funding for training, research, and equipment upgrades in public hospitals and sports institutions.

Demographically, Europe has a mix of young athletes and an aging population increasingly engaged in fitness activities. Countries like Germany, France, and the UK have national injury surveillance systems that inform evidence-based practices for sports safety and rehabilitation. Eurostat data highlights that accidental injuries, especially musculoskeletal trauma, remain among the top causes of hospitalization in the 15–34 age group, underlining the critical need for high-quality sports medicine services.

Public health agencies are increasingly investing in remote rehab technologies, especially following lessons learned during the pandemic. Tele-rehabilitation, AI-assisted diagnostics, and motion analysis tools are being integrated into national health systems. Moreover, many European universities lead in research on regenerative therapies and sports-related injury prevention, supported by Horizon Europe funding.

Despite these strengths, reimbursement differences and administrative complexities across EU member states can delay product approval and access. Nevertheless, Europe's focus on preventive medicine, advanced research infrastructure, and health-conscious population provides a fertile environment for sustained growth in sports medicine solutions.

The Japan Sports Medicine Market

The Japan Sports Medicine Market is projected to be valued at USD 450 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 786 million in 2034 at a CAGR of 6.6%.

Japan’s sports medicine market is shaped by a unique combination of cutting-edge medical innovation, government support, and a highly active aging population. The country’s universal healthcare system provides broad access to orthopedic and rehabilitative care, including coverage for advanced procedures such as arthroscopy and soft tissue repair. Japan is globally recognized for its leadership in regenerative medicine. Institutions like Kyoto University’s Center for iPS Cell Research and Application (CiRA) are pioneering treatments that are now being explored for sports-related spinal cord injuries and joint regeneration.

While Japan’s youth sports participation remains high, particularly in school-based athletics, the fastest-growing segment of demand comes from older adults who pursue active lifestyles well into their 60s and 70s. The government’s emphasis on musculoskeletal health and fall prevention has led to nationwide screening programs, supported by the Japan Sports Agency and the Ministry of Health, Labor and Welfare.

Advanced hospitals in Tokyo, Osaka, and other major cities are equipped with robotic-assisted surgical systems and offer minimally invasive sports injury treatment. Furthermore, universities collaborate with elite sports organizations to develop wearable technologies, motion analysis tools, and AI-driven injury prediction software.

However, Japan does face a challenge with a declining youth population, which could affect long-term sports participation trends. Additionally, the slow pace of regulatory approval for novel therapies slightly hampers innovation deployment. Still, with a strong emphasis on rehabilitation, preventative care, and continuous R&D, Japan stands out as a highly specialized and forward-looking market for sports medicine.

Global Sports Medicine Market: Key Takeaways

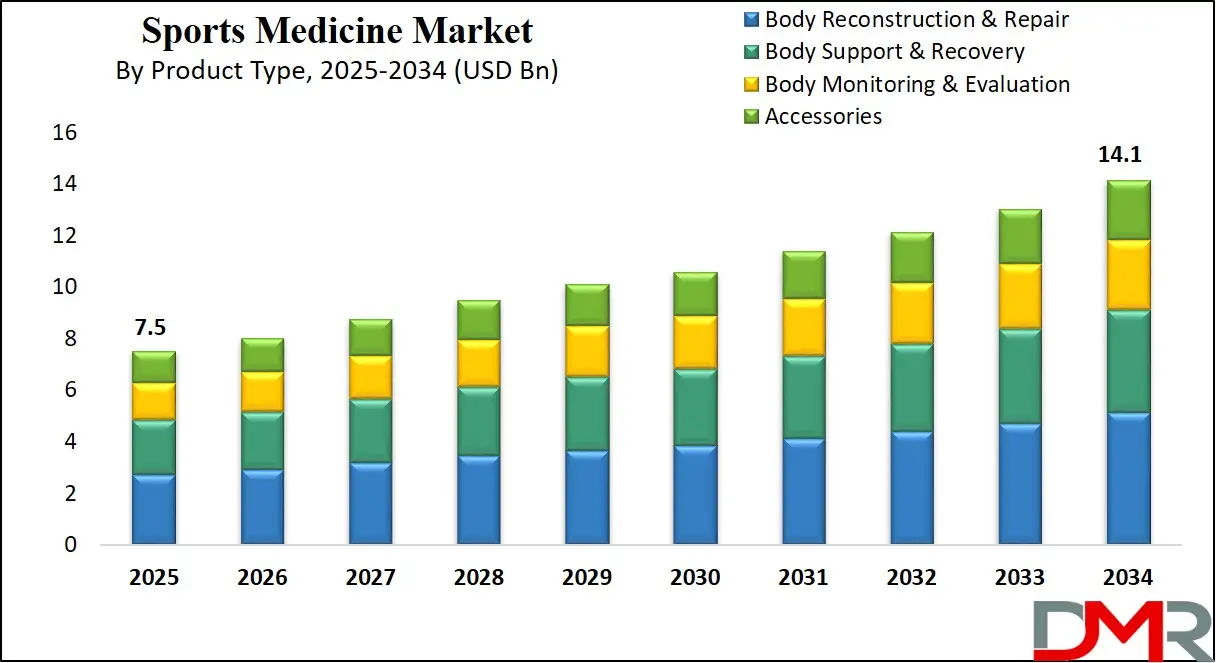

- Global Market Size Insights: The Global Sports Medicine Market size is estimated to have a value of USD 7.5 billion in 2025 and is expected to reach USD 14.1 billion by the end of 2034.

- The US Market Size Insights: The US Sports Medicine Market is projected to be valued at USD 2.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 5.0 billion in 2034 at a CAGR of 6.9%.

- Regional Insights: North America is expected to have the largest market share in the Global Sports Medicine Market, with a share of about 43.3% in 2025.

- Key Players: Some of the major key players in the Global Sports Medicine Market are Arthrex Inc., Smith & Nephew plc, Stryker Corporation, Zimmer Biomet Holdings Inc., Johnson & Johnson (DePuy Synthes), CONMED Corporation, DJO Global Inc. (Enovis), Medtronic plc, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 7.3 percent over the forecasted period of 2025.

Global Sports Medicine Market: Use Cases

- ACL Post-Surgery Rehab: An injured college athlete recovering from ACL reconstruction uses a smart brace integrated with sensors. The device monitors knee movement, range of motion, and load distribution in real-time, sending data to a physical therapist. This helps customize therapy sessions, reduce re-injury risk, and track progress remotely, enabling a safer, faster return to sport.

- Youth Concussion Monitoring: In school soccer tournaments, athletes wear headbands embedded with impact sensors. When a high-force collision is detected, the device flags the need for neurological evaluation. Coaches and medical staff use connected dashboards to follow protocols and track symptoms, ensuring safety and compliance with return-to-play guidelines.

- Remote Physiotherapy for Rural Areas: Athletes in remote or rural regions often lack access to specialized care. Wearable bands and a mobile app allow for remote physiotherapy, with guided exercises and live feedback. Therapists in urban hospitals monitor metrics like joint angle and muscle activation, ensuring high-quality care and progress without travel.

- Thermal Therapy for Sprains: Recreational athletes use smart hot-and-cold wraps post-injury for joint inflammation. These wraps automatically adjust temperature based on real-time skin feedback and inflammation levels. Paired with an app, users can follow guided protocols and log healing metrics, making home recovery more effective and data-driven.

- Biomechanical Injury Prevention in Teams: Professional football clubs use motion capture platforms and force mats to analyze player biomechanics. Data identifies imbalances, stress points, or improper load distribution during training. Coaches then create personalized conditioning programs that reduce injury risk, improve performance, and extend athletic careers.

Global Sports Medicine Market: Stats & Facts

Centers for Disease Control and Prevention (CDC, USA)

The CDC highlights the significant public health impact of sports injuries across the United States:

- Over 8.6 million sports and recreation-related injuries are reported annually, highlighting the urgent demand for specialized orthopedic and rehabilitation services.

- The highest injury incidence occurs among individuals aged 5 to 24, accounting for nearly 60% of all sports injury cases.

- 1.35 million injuries among youth stem from sports activities, especially in contact sports like football and basketball.

- Basketball, football, and soccer are consistently among the top three sports contributing to emergency room visits due to acute or overuse injuries.

- Annually, more than 2.6 million children aged 0–19 are treated in emergency departments for sports and recreation injuries, underlining the role of pediatric sports medicine.

National Federation of State High School Associations (NFHS, USA)

The NFHS provides insight into youth athletic participation trends:

- During the 2022–23 academic year, 7.8 million students participated in high school sports, underscoring the scale of organized school-based athletic programs.

- Football, track and field, and basketball remain the most enrolled sports, which are also associated with high injury rates requiring orthopedic attention.

- Notably, girls’ wrestling participation surged by 55%, increasing the need for gender-specific sports medicine protocols and injury prevention measures.

U.S. Department of Health and Human Services (HHS)

Through national physical activity guidelines, HHS emphasizes health benefits and injury risks:

- Only 1 in 3 children in the U.S. meet the recommended daily physical activity levels, suggesting a growing need for structured and injury-safe athletic environments.

- Physical inactivity is associated with 1 in 10 premature deaths, making exercise promotion and safe rehabilitation critical public health goals.

- Increased physical activity is linked to significant reductions in depression, cardiovascular diseases, and musculoskeletal disorders, reinforcing the importance of sports medicine in overall wellness strategies.

President's Council on Sports, Fitness & Nutrition (USA)

The Council plays a key role in encouraging safe sports participation:

- Annually, 60 million children and adolescents in the U.S. take part in organized sports, representing a substantial portion of the sports medicine patient base.

- Implementation of structured injury prevention programs has been shown to reduce injury rates by up to 50%, validating the economic and clinical value of preventive interventions.

National Institutes of Health (NIH, USA)

The NIH supports biomedical research that benefits sports injury care:

- ACL tears, rotator cuff injuries, and shoulder dislocations rank among the most common surgically treated sports injuries.

- The volume of sports injury-related orthopedic surgeries is growing at a rate of 2–4% per year, driven by rising athletic participation.

- Overuse injuries account for about 50% of all sports injuries among adolescents, reflecting the need for early intervention and load management education in training environments.

Eurostat (European Union)

Eurostat provides key insights into activity levels and injury patterns:

- Around 40% of adults in the EU engage in physical activity at least once per week, a trend contributing to both musculoskeletal health and occasional injury.

- Northern European countries, including Sweden, Denmark, and the Netherlands, report the highest physical activity rates, correlating with a higher demand for injury treatment services.

- Musculoskeletal issues, such as back pain and joint injuries, are among the leading causes of physical therapy referrals across the continent, many of which arise from recreational or competitive sports.

European Commission – Sport Unit

The EU’s regulatory and funding body for sports development notes:

- One in three Europeans participates in some form of sport at least weekly, supporting a high baseline demand for sports health infrastructure.

- Through Erasmus+ Sport, the EU has invested over €1 billion in projects that promote physical activity and injury prevention education across schools and communities.

- Injury rates in youth sports are notable, with an average of 25% of children and adolescents reporting injuries during organized sporting events.

Japan Sports Agency (MEXT, Japan)

The agency guides national sports policies and tracks participation:

- More than 70% of Japanese adults participate in some form of regular physical activity, particularly walking, jogging, and traditional sports like martial arts.

- School sports participation in Japan exceeds 75%, driven by the widespread presence of after-school clubs and community leagues.

- Following the Tokyo 2020 Olympics, the government allocated over ¥60 billion (approx. $550 million) to improve national sports facilities and enhance injury prevention systems.

Japan Orthopaedic Association (JOA)

As a leading clinical body, the JOA monitors orthopedic trends:

- Roughly 50% of all orthopedic visits by youth in Japan are linked to sports-related injuries such as knee sprains and shoulder instability.

- Anterior cruciate ligament (ACL) injuries and rotator cuff damage are among the most frequently treated conditions in sports-active youth.

- Over the past five years, the number of sports surgeries performed in Japan has grown by 12%, emphasizing the need for skilled sports surgeons and modern techniques.

World Health Organization (WHO)

Global health data underlines the need for preventive sports medicine:

- 25% of adults and 75% of adolescents globally fail to meet the recommended physical activity levels set by WHO, raising concerns about sedentary lifestyles and overuse injuries when people resume activity suddenly.

- Physical inactivity ranks as the fourth leading global mortality risk, underscoring the dual role of sports medicine in promoting activity and preventing harm.

- WHO guidelines suggest 150 to 300 minutes of moderate aerobic activity per week, along with strength training, for optimal joint and muscle health.

Public Health England / UK Health Security Agency (UKHSA)

Data from the UK shows injury and rehab service demand:

- One in six injuries among UK children aged 5–15 are related to sports, including rugby, football, and gymnastics.

- Engaging in regular activity reduces the risk of developing musculoskeletal conditions by up to 40%, a key motivator behind NHS exercise prescriptions.

- The NHS physiotherapy referral rate for sports injuries has increased by 15% annually, driven by a mix of adult recreational sports and school-based athletics.

Australian Institute of Health and Welfare (AIHW)

AIHW monitors injury rates and outcomes across Australia:

- Each year, about 60,000 Australians are hospitalized due to sports injuries, a significant burden on emergency and orthopedic services.

- Contact sports such as rugby and Australian rules football account for 35% of these injuries, often resulting in concussions, dislocations, and ligament tears.

- Fractures and sprains remain the most frequent reasons for hospitalization, with youth and male athletes being the most affected.

Sport New Zealand

Sport NZ supports mass participation in active lifestyles:

- More than 95% of New Zealanders aged 5–17 engage in at least one form of sport or physical recreation per year.

- Approximately 10,000 hospital admissions annually in New Zealand are due to sports injuries, primarily among youth and contact sport athletes.

- National injury prevention programs have contributed to an 8% reduction in long-term disability costs, validating the economic value of sports medicine outreach.

Health Canada

Canada’s public health authority captures sports injury data:

- 67% of Canadian children aged 5–17 participate in organized sports programs each year, a key demographic for injury prevention.

- There are over 3 million sports injury-related consultations recorded annually in Canada, impacting both primary care and specialized orthopedic clinics.

- Among youth, sports injuries are the second-leading cause of injury-related emergency visits, underlining the importance of timely access to physiotherapy and orthopedic care.

Global Sports Medicine Market: Market Dynamic

Driving Factors in the Global Sports Medicine Market

Rising Global Sports Participation and Injury Incidence

The surge in global participation in recreational and professional sports is a primary driver fueling demand for sports medicine. As per the CDC, over 8.6 million sports injuries occur annually in the U.S. alone, with over

3.5 million in youth sports. Simultaneously, data from the European Commission indicates over

4.5 million hospitalizations annually due to sports-related injuries.

The popularity of high-impact sports such as football, basketball, and skiing continues to grow, particularly in emerging economies like India, China, and Brazil. With this growth comes a proportionate increase in injuries such as ligament tears, tendonitis, and stress fractures, driving demand for surgical and non-surgical treatment devices. Rising awareness of physical health post-pandemic has also led to a spike in amateur athletic activities globally, further intensifying the need for injury management solutions across multiple demographics and geographies.

Aging Population and Rise in Orthopedic Disorders

With the global aging population rising over 1 in 6 people projected to be over 60 by 2030 (UN), the incidence of degenerative joint conditions is climbing steeply. Older adults are increasingly engaging in physical activity to maintain mobility and health, leading to more injuries related to overuse, joint degeneration, and muscle strain. Moreover, age-related musculoskeletal disorders such as osteoarthritis, meniscus tears, and spinal injuries often require interventions synonymous with sports medicine, including arthroscopy and physical therapy. Sports medicine thus overlaps with geriatric orthopedics, expanding the market beyond athletes. This demographic shift is prompting innovation in joint-support braces, post-operative mobility aids, and minimally invasive surgical devices, enhancing the global growth potential for sports medicine technologies.

Restraints in the Global Sports Medicine Market

High Treatment and Equipment Costs Limiting Access

The high cost of sports medicine treatments, surgeries, and advanced rehabilitation tools remains a major barrier, particularly in low- and middle-income regions. For instance, arthroscopic procedures and biologic injections can cost thousands of dollars without insurance, limiting their availability to elite athletes or high-income individuals. Even in developed countries, access is often constrained by out-of-pocket expenses and limited reimbursement policies.

Physical therapy, custom orthotics, and wearable monitoring devices further add to the total burden on patients. This economic barrier is hindering adoption in public healthcare systems and community clinics, which are where most amateur athletes seek care. Despite the presence of government initiatives, the high cost of setting up advanced sports medicine centers with skilled personnel, imaging equipment, and surgical instruments remains a challenge for many healthcare providers.

Regulatory Complexity and Approval Delays

Sports medicine products, particularly biologics and implantable devices, face stringent regulatory scrutiny. In the U.S., the FDA requires extensive clinical trials for new regenerative therapies and device approvals, which can delay market entry by years. Similarly, in the EU and Japan, MDR compliance and PMDA review processes involve costly documentation, testing, and quality verification. This is particularly burdensome for startups and smaller med-tech companies that often lead innovation in this space.

Additionally, the lack of harmonization between global regulatory bodies creates hurdles for international expansion. For example, a biologic treatment approved in Europe may face extended delays in receiving U.S. or Japanese approval. These regulatory challenges not only slow innovation but also limit patient access to cutting-edge therapies, impacting overall market growth.

Opportunities in the Global Sports Medicine Market

Expansion of Sports Infrastructure in Emerging Economies

Emerging markets in Asia-Pacific, Latin America, and the Middle East are investing heavily in developing sports infrastructure. Countries like India are launching athlete training academies and stadiums under public-private partnerships. Events such as the Asian Games and increased participation in the Olympics are encouraging government-backed investment in sports injury treatment facilities. With increased athlete participation comes the demand for specialized medical care, rehabilitation centers, and sports physiologists, opening lucrative avenues for sports medicine companies.

Moreover, rising insurance coverage and disposable income in urban centers make advanced treatments more accessible, especially in tier 1 and 2 cities. Multinational sports medicine brands have a strong opportunity to tap into these markets through educational partnerships, direct sales, and localized manufacturing.

Technological Innovation in Minimally Invasive Procedures

Technological advancements in arthroscopy and minimally invasive surgeries are unlocking new frontiers in sports medicine. Developments in 3D visualization, robotics-assisted surgery, and bioengineered implants are enabling precise repairs with reduced recovery times. Innovations such as biodegradable screws, meniscus scaffolds, and bioresorbable anchors are being increasingly adopted by sports orthopedic surgeons. These technologies are not only improving patient outcomes but are also making surgery a viable option for a wider population, including amateur athletes and the elderly.

Additionally, the integration of augmented reality in surgical planning and virtual reality in physical therapy is creating a new ecosystem of high-performance recovery. Startups and major med-tech firms investing in these areas can expect long-term growth, particularly as regulatory frameworks adapt to approve cutting-edge treatments faster.

Trends in the Global Sports Medicine Market

Integration of Regenerative Medicine and Biologics in Sports Therapies

The sports medicine market is undergoing a transformative shift with the adoption of regenerative medicine techniques such as Platelet-Rich Plasma (PRP) and stem cell therapy. These biologics are increasingly being integrated into treatment regimens to accelerate healing in musculoskeletal injuries and chronic joint conditions. PRP therapy, for instance, promotes cellular repair by using the patient’s blood components to stimulate tissue regeneration. This trend is gaining traction due to its minimally invasive nature, reduced recovery time, and growing clinical validation.

Biologics are now being used not just for professional athletes but also in general orthopedic practice, signaling a widespread acceptance. Academic institutions and orthopedic associations across the U.S., Europe, and Japan are conducting extensive trials to formalize their use in standard care. This shift is reshaping treatment protocols and increasing demand for supportive infrastructure and expertise.

Digital Rehabilitation and Wearable Technology AdoptionThere is a rising trend in incorporating wearables and remote patient monitoring (RPM) tools into sports medicine. Devices that track joint movement, muscle fatigue, heart rate variability, and gait are enabling clinicians to provide data-driven care for injury prevention and post-op recovery. The growth in

telehealth and home-based rehabilitation post-COVID-19 further accelerated digital care adoption.

AI-powered gait analysis tools, mobile apps for physiotherapy, and sensor-equipped braces are now key components in athlete monitoring. This trend is particularly pronounced in North America and Asia-Pacific, where tech-savvy populations and sports organizations are investing in smart recovery systems. The growing consumer interest in self-tracking and performance optimization is reinforcing this movement, blurring lines between consumer health tech and clinical-grade rehab tools.

Global Sports Medicine Market: Research Scope and Analysis

By Product Type Analysis

Body Reconstruction & Repair is projected to dominates the sports medicine market due to its central role in addressing severe musculoskeletal injuries that require surgical or device-based intervention. These products such as soft tissue repair devices, bone reconstruction implants, and surgical equipment are essential for restoring anatomical function in athletes who suffer from ligament tears, tendon ruptures, fractures, or cartilage damage. Unlike support or monitoring products that focus on recovery or prevention, reconstruction devices actively restore structural integrity, allowing athletes to regain full mobility and performance levels.

The increasing prevalence of ACL injuries, rotator cuff tears, and meniscal damage, particularly in contact sports, drives demand for surgical repairs. For instance, according to the American Orthopaedic Society for Sports Medicine, nearly 250,000 ACL reconstructions are performed annually in the U.S. alone. Furthermore, advancements in bioengineered implants, resorbable anchors, and minimally invasive techniques make reconstruction surgeries safer and more accessible, even for aging populations or amateur athletes.

The higher cost and clinical complexity of these procedures also make them a significant revenue driver within the sports medicine ecosystem. Hospitals and orthopedic centers invest more heavily in reconstruction products due to their critical need in surgical departments. Moreover, the rising adoption of outpatient arthroscopic surgeries and the expansion of orthopedic surgical centers globally reinforce this dominance. As sports injuries become more complex and athletes demand faster, more reliable recovery, the demand for advanced body reconstruction and repair solutions continues to lead the market, especially in North America, Europe, and Japan.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Injury Type Analysis

Knee injuries are expected to dominate the sports medicine market due to their high frequency, complex treatment needs, and prevalence across nearly all athletic disciplines. The knee is one of the most vulnerable joints in the human body, susceptible to ligament tears (especially ACL and MCL), meniscus injuries, and patellar dislocation conditions that are common in high-impact and pivot-heavy sports such as soccer, basketball, football, and skiing. According to the American Academy of Orthopaedic Surgeons (AAOS), ACL injuries alone account for over 50% of sports-related knee surgeries annually in the United States.

Knee injuries often require a broad spectrum of interventions from arthroscopic surgeries to physical therapy, bracing, and sometimes total reconstruction. This diversity in treatment options fuels the demand for a wide range of sports medicine products, including body reconstruction implants, soft tissue fixation systems, and post-operative rehabilitation equipment. The chronic nature of many knee conditions, such as patellofemoral pain syndrome and degenerative cartilage wear, also necessitates long-term care and ongoing monitoring.

Additionally, knee injuries are not confined to professional athletes; they are also highly prevalent among youth, amateur players, and aging individuals engaging in recreational physical activity. With the rise in global sports participation and increased awareness of injury management, the demand for evidence-based, minimally invasive knee treatments has surged. The technological evolution of knee arthroscopy, ligament augmentation, and patient-specific implants has further solidified this injury type as the highest contributor to revenue within the sports medicine field, making it a central focus for orthopedic innovation and healthcare investment.

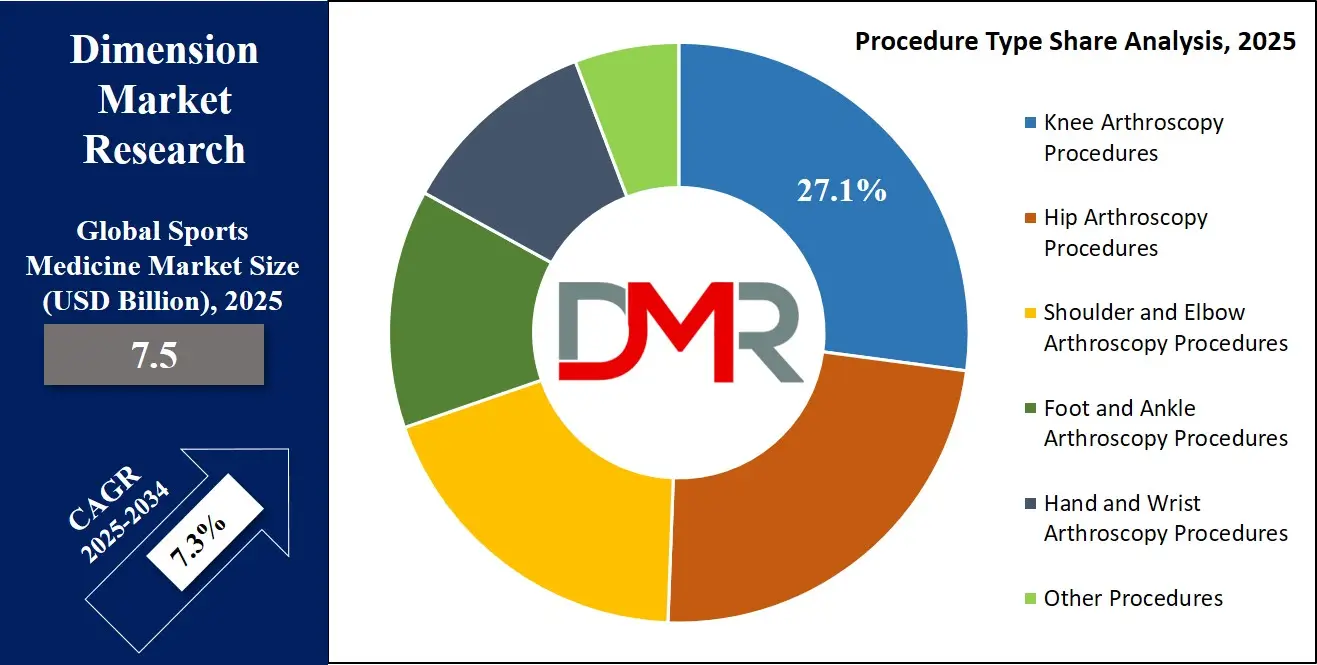

By Procedure Type Analysis

Knee arthroscopy procedures are poised to dominate the sports medicine market due to their wide application, minimally invasive nature, and effectiveness in diagnosing and treating a broad range of knee injuries. As the most commonly performed arthroscopic surgery in sports medicine, knee arthroscopy is used for managing meniscus tears, ACL reconstruction, cartilage damage, and synovial inflammation. Its popularity stems from the fact that it allows orthopedic surgeons to visualize, diagnose, and treat internal joint conditions using small incisions, reducing the risk of complications and significantly shortening recovery time.

According to data from the National Center for Biotechnology Information (NCBI), over 700,000 knee arthroscopies are performed annually in the United States alone. The procedure’s efficiency, cost-effectiveness, and favorable clinical outcomes make it a preferred choice not just for elite athletes but also for active older adults and amateur sports participants. These procedures are increasingly being performed in ambulatory surgical centers, reducing the burden on hospital infrastructure and enabling quicker patient turnaround.

Technological innovations such as high-definition arthroscopic cameras, fluid management systems, and specialized instrumentation have further improved surgical precision and outcomes. Additionally, the integration of regenerative medicine, such as PRP or stem cell injections post-arthroscopy, is enhancing recovery, encouraging more patients and physicians to opt for this approach.

Due to the high injury rate of the knee, especially in sports like football, basketball, and skiing, and the relative ease and accessibility of arthroscopic techniques, knee arthroscopy remains the cornerstone of procedural revenue in sports medicine, driving consistent growth and investment in tools and training worldwide.

By End User Analysis

Hospitals are anticipated to dominate the sports medicine market as the primary treatment centers offering comprehensive diagnostic, surgical, and rehabilitative care. Their dominance stems from their ability to manage complex, multi-stage treatment plans from emergency care for acute injuries to post-operative rehabilitation for chronic or overuse conditions. Hospitals are equipped with specialized orthopedic departments, advanced surgical theaters, and multidisciplinary teams comprising surgeons, sports medicine physicians, physiotherapists, and radiologists. This holistic care model makes them the first choice for both elite and non-professional athletes.

Furthermore, most high-risk and invasive sports medicine procedures, such as ligament reconstructions, cartilage grafting, and fracture repairs, require hospital-based surgical infrastructure and post-operative monitoring. According to the American Hospital Association, U.S. hospitals conduct over 2 million orthopedic surgeries annually, with sports-related procedures making up a significant share.

Hospitals also tend to be affiliated with academic or research institutions, fostering the adoption of cutting-edge treatments such as robotics-assisted surgery, regenerative biologics, and personalized rehab protocols. These facilities often lead clinical trials and innovation efforts, reinforcing their status as primary centers for sports injury care.

Another factor contributing to their market dominance is insurance coverage. In most countries, insurance providers prefer hospital-based treatments for reimbursement due to better clinical documentation and standardized protocols. Additionally, hospitals serve as referral centers for smaller clinics and sports physiotherapy centers, consolidating patient flow. With growing sports injury awareness, higher surgical volumes, and access to skilled medical personnel, hospitals are expected to maintain their lead in sports medicine service delivery across developed and emerging markets alike.

The Global Sports Medicine Market Report is segmented on the basis of the following.

By Product Type

- Body Reconstruction & Repair

- Surgical Equipment

- Soft Tissue Repair

- Bone Reconstruction Devices

- Body Support & Recovery

- Braces and Other Support Devices

- Compression Clothing

- Hot & Cold Therapy

- Body Monitoring & Evaluation

- Cardiac Monitoring

- Respiratory Monitoring

- Hemodynamic Monitoring

- Musculoskeletal Monitoring

- Others

- Accessories

- Bandages

- Tapes

- Disinfectants

- Wraps

- Other Accessories

By Injury Type

- Knee Injuries

- Hip Injuries

- Shoulder and Elbow Injuries

- Foot and Ankle Injuries

- Hand and Wrist Injuries

- Back and Spine Injuries

- Other Injuries

By Procedure Type

- Knee Arthroscopy Procedures

- Hip Arthroscopy Procedures

- Shoulder and Elbow Arthroscopy Procedures

- Foot and Ankle Arthroscopy Procedures

- Hand and Wrist Arthroscopy Procedures

- Other Procedures

By End User

- Hospitals

- Orthopedic Clinics

- Ambulatory Surgical Centers (ASCs)

- Others

Global Sports Medicine Market: Regional Analysis

Region with the Largest Revenue Share

North America, led by the U.S., is expected to hold over 43.3% of the global sports medicine market share in 2025, due to several key factors. First, the region has a highly developed healthcare infrastructure, with specialized sports medicine clinics and advanced surgical facilities. The U.S. alone has more than 5,000 sports medicine centers, many affiliated with professional sports teams and universities. Second, the high prevalence of sports injuries, with over 8.6 million sports-related injuries annually, drives demand for advanced treatments. Third, strong insurance coverage and reimbursement policies support expensive procedures like biologics and arthroscopic surgeries.

Additionally, North America is a hub for medical innovation, with major players like Stryker, Arthrex, and Smith & Nephew headquartered there, investing heavily in R&D. The region also benefits from high sports participation rates, with nearly 60% of Americans engaging in regular physical activity, further fueling market growth. Lastly, the presence of professional sports leagues (NFL, NBA, MLB) ensures continuous demand for cutting-edge injury treatments and rehabilitation technologies.

Region with the Highest CAGR

The Asia-Pacific (APAC) sports medicine market is projected to grow at the highest CAGR of 8.0%, driven by rising healthcare expenditure, increasing sports participation, and government initiatives. Countries like China, India, and Japan are investing heavily in sports infrastructure, with programs like China’s National Fitness Plan and India’s Khelo India scheme. The region’s burgeoning middle class is adopting fitness trends, leading to higher injury rates and demand for treatments.

Additionally,

medical tourism in Thailand, Malaysia, and India offers cost-effective sports medicine procedures at

60-70% lower costs than Western countries, attracting international patients. Local manufacturers are also emerging, producing affordable arthroscopy and rehabilitation devices, making treatments more accessible. Furthermore, rising awareness about sports injuries and preventive care is boosting market growth. With increasing professional sports leagues and corporate wellness programs, APAC is poised to become a key growth engine for the global sports medicine industry.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Sports Medicine Market: Competitive Landscape

The global sports medicine market features intense competition among established players and emerging challengers, with industry leaders like Stryker, Arthrex, Smith & Nephew, CONMED, and Zimmer Biomet maintaining dominance through continuous innovation, strategic acquisitions, and key partnerships. These major corporations concentrate their efforts on developing cutting-edge arthroscopic equipment, advanced biologics, and next-generation regenerative therapies to solidify their market positions. Arthrex has established itself as a frontrunner in minimally invasive surgical instruments, while Stryker has made significant investments in robotic-assisted sports medicine technologies.

Meanwhile, Asian-based companies such as Trivitron Healthcare and DJO Global are disrupting the market by providing more affordable alternatives, challenging the traditional Western stronghold. Market participants are employing various strategies to gain a competitive advantage, including frequent product innovations like Smith & Nephew's REGENETEN Bioinductive Implant, strategic mergers and acquisitions exemplified by Zimmer Biomet's purchase of Relign Corporation, and high-profile collaborations with professional sports organizations such as CONMED's partnership with NBA teams.

Price competition has become particularly fierce in developing markets, where domestic manufacturers are offering cost-effective implants and biologic solutions. Additionally, the growing emphasis on digital health solutions has led companies to invest heavily in tele-rehabilitation platforms and remote patient monitoring systems as key differentiators. This dynamic competitive environment continues to be driven primarily by technological advancements and aggressive geographic expansion strategies as players vie for greater market share in this rapidly evolving sector.

Some of the prominent players in the Global Sports Medicine Market are:

- Arthrex, Inc.

- Smith & Nephew plc

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Johnson & Johnson (DePuy Synthes)

- CONMED Corporation

- DJO Global, Inc. (Enovis)

- Medtronic plc

- Breg, Inc.

- Mueller Sports Medicine, Inc.

- Wright Medical Group N.V. (now part of Stryker)

- Össur hf

- RTI Surgical

- Bauerfeind AG

- BSN Medical (Essity)

- Cramer Products, Inc.

- Performance Health (owner of TheraBand, Biofreeze)

- 3M Company

- Medi GmbH & Co. KG

- Nihon Kohden Corporation

- Other Key Players

Recent Developments in the Global Sports Medicine Market

- May 2024 - The FIFA-Arthrex partnership will establish 12 regional training centers worldwide by 2026, offering standardized courses in sports trauma management and surgical techniques using Arthrex's latest instrumentation.

- April 2024 - DJO's AI rehab platform analyzes patient movement patterns through smartphone cameras, automatically adjusting therapy protocols. Early trials show 30% faster recovery times for ACL reconstruction patients versus traditional methods.

- March 2024 - Zimmer's Indiana facility will specialize in robotic-assisted surgical systems for sports medicine, with first products expected by Q4 2025. The investment creates 200 high-tech jobs in the region.

- February 2024 - CONMED's symposium featured live cadaver labs demonstrating new suture anchor techniques and showcased their latest biodegradable implants that dissolve within 18 months post-surgery.

- January 2024 - Boston Scientific's acquisition gives them Intracept, a minimally invasive treatment for chronic back pain in athletes. The technology uses radiofrequency to disable pain-transmitting nerves.

- December 2023 - J&J's summit revealed a smart knee implant prototype with embedded sensors that wirelessly transmit load data to clinicians, currently in FDA trials.

- November 2023 - Arthrex's Singapore center includes a virtual reality surgical simulator and will train over 1,000 APAC surgeons annually in advanced arthroscopic procedures.

- October 2023 - The REGENETEN Flex patch incorporates growth factors that recruit stem cells to injury sites, showing 92% healing rates in mid-stage rotator cuff tears.

- September 2023 - The NBA partnership will utilize Stryker's analytics to study 500+ players' biomechanics, developing personalized injury prevention programs based on movement patterns.

- August 2023 - Trivitron's new 50,000 sq ft facility can produce 15,000 arthroscopes annually, reducing costs by 40% for emerging markets.