Market Overview

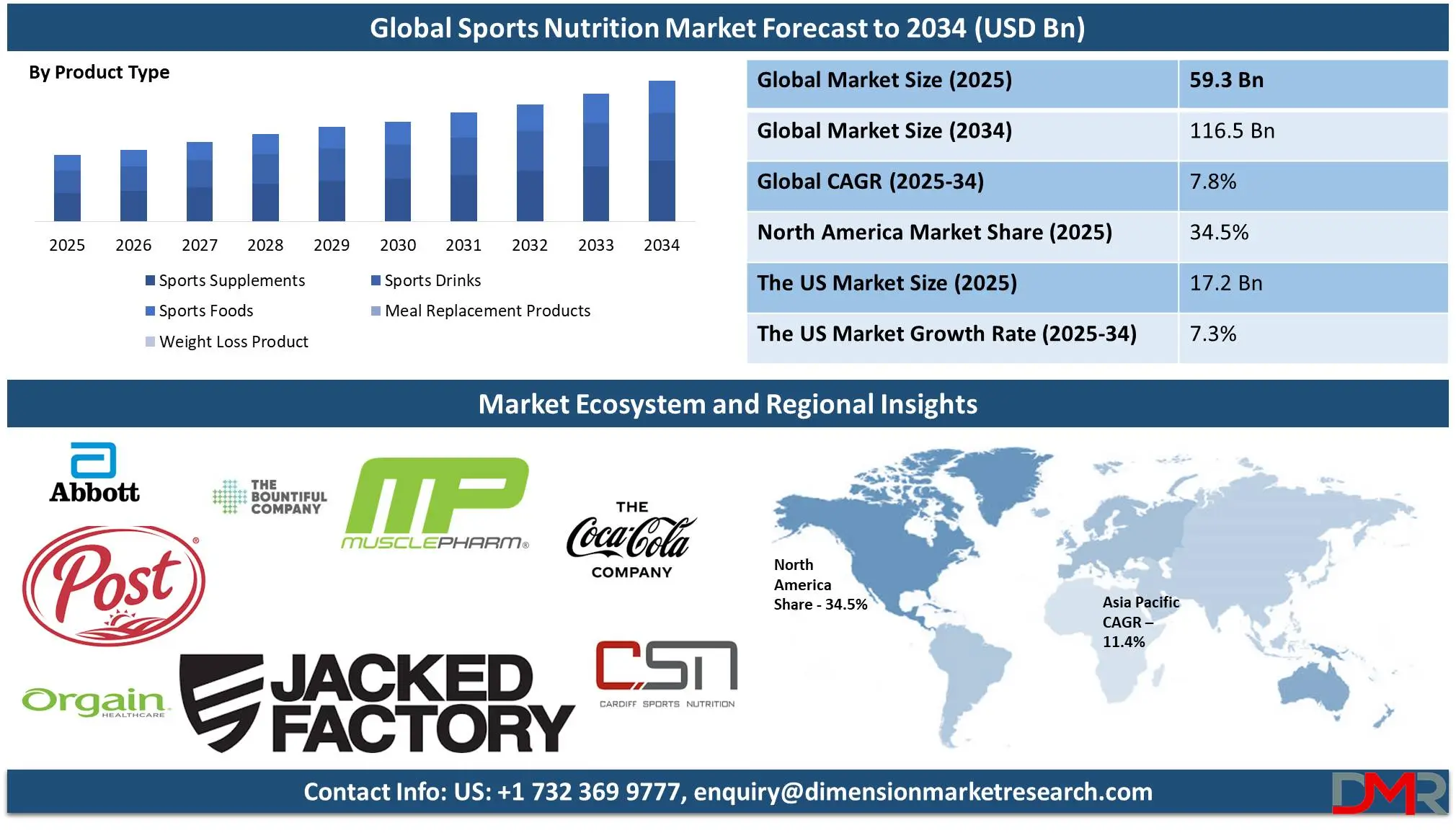

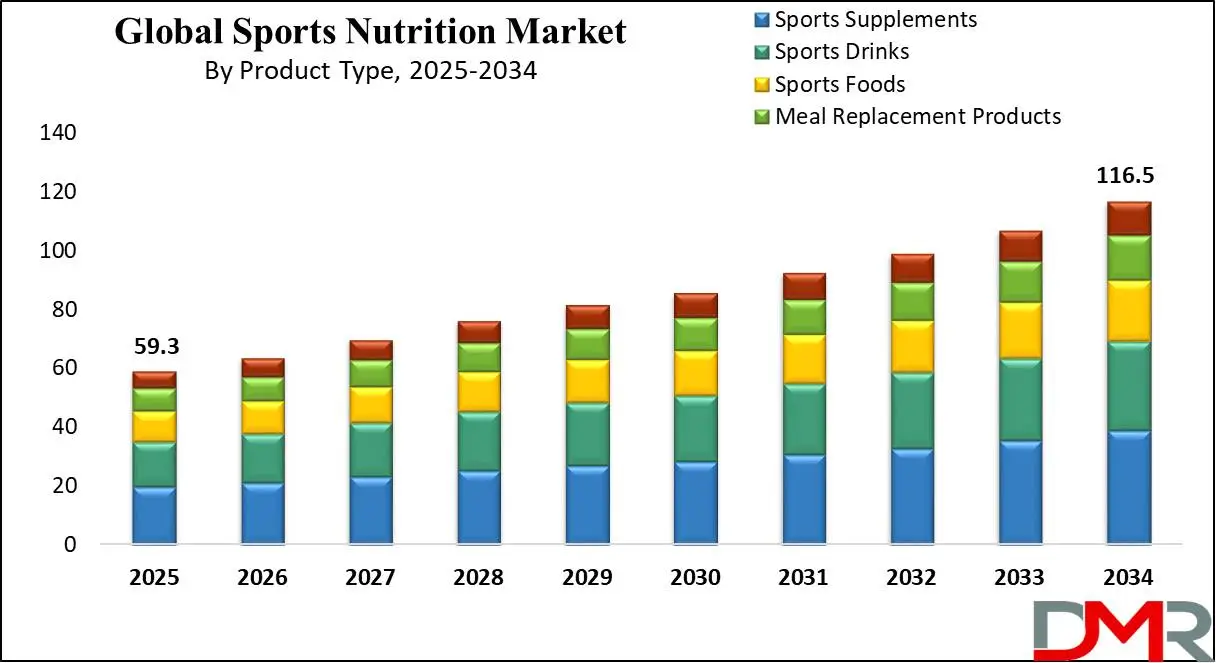

The Global

Sports Nutrition Market size is estimated at

USD 59.3 billion in 2025 and is expected to reach

USD 116.5 billion by 2034, at a

CAGR of 7.8% during the forecast period of 2026 to 2034.

Sports nutrition focuses on providing the right balance of nutrients to enhance athletic performance, recovery, and overall health. It involves consuming the appropriate amount of carbohydrates for energy, protein for muscle repair and growth, fats for long-term fuel, and vitamins and minerals to support metabolic functions. Proper hydration is also crucial for maintaining performance and preventing dehydration. The timing of nutrition, such as pre- and post-workout meals, plays a vital role in optimizing energy and recovery. A well-rounded sports nutrition plan supports endurance, strength, and injury prevention, tailored to the athlete's specific needs and training intensity.

The global sports nutrition market is primarily driven by a rising focus on healthy lifestyles, prompting more individuals to seek products that improve athletic performance and aid in recovery. Innovations in the industry, such as plant-based supplements, protein bars, and ready-to-drink shakes, have broadened consumer options. The rapid expansion of e-commerce platforms has also made these products more accessible globally, further boosting market demand. Additionally, the growing prevalence of obesity worldwide has highlighted the importance of proper nutrition, leading to an increased demand for sports supplements. These trends present numerous opportunities for continued growth and innovation in the sports nutrition market.

The US Sports Nutrition Market

The US Sports Nutrition market is projected to be valued at

USD 17.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds

USD 32.5 billion in 2034 at a

CAGR of 7.3%.

The US sports nutrition market is experiencing strong growth due to a rising focus on healthy lifestyles, as more individuals seek products that enhance athletic performance and recovery. The increasing prevalence of obesity has emphasized the importance of proper nutrition, driving demand for sports supplements. Innovations in products like plant-based supplements, protein bars, and ready-to-drink shakes have further attracted consumers.

Protein supplements, such as bars and shakes, remain in high demand, with a focus on convenience

and functional benefits. The rise of e-commerce is reshaping how consumers purchase sports nutrition products, offering direct access to a broad range of options.

Key Takeaways

- Market Growth: The global Sports Nutrition market is anticipated to expand by USD 53.1 billion, achieving a CAGR of 7.8% from 2026 to 2034.

- Product Type Analysis: Sports supplements are predicted to dominate the global market based on type by the end of 2025.

- Formulation Analysis: The powder segment is predicted to dominate the global market based on formulation by the end of 2025.

- Distribution Channel Analysis: Brick-and-mortar stores are projected to dominate the global market with the highest revenue share by 2025 in terms of distribution channels.

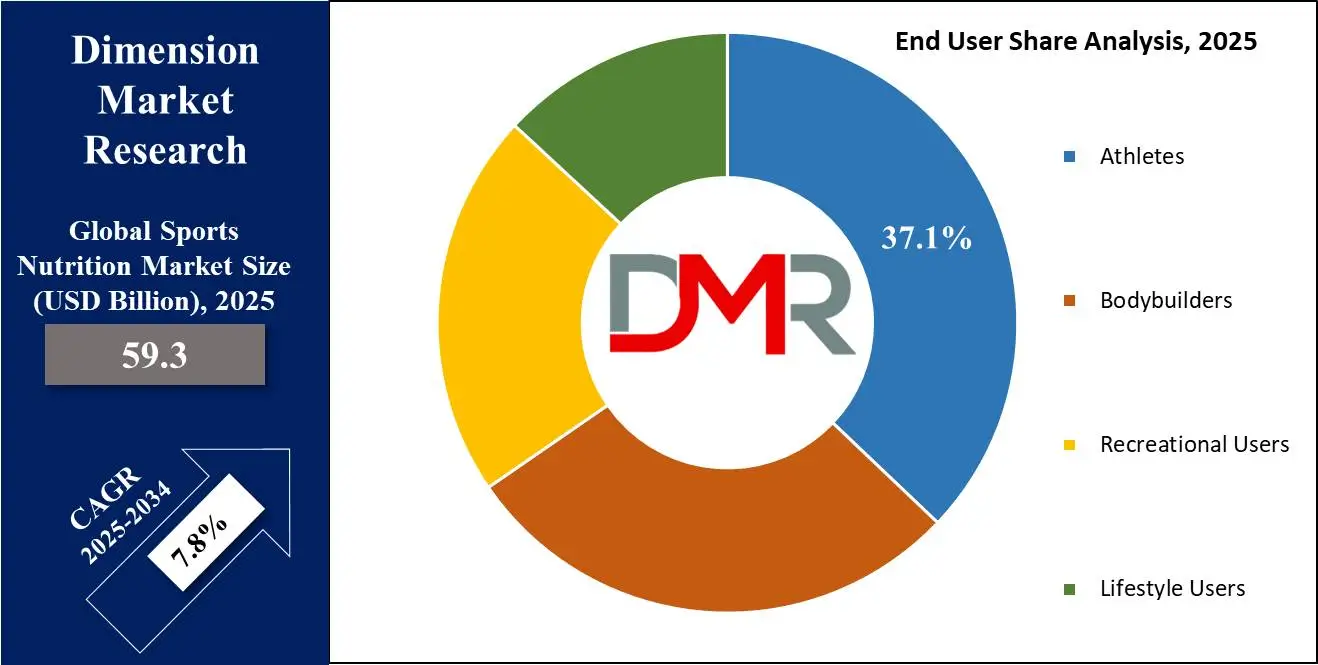

- End User Analysis: Athletes is likely to lead the market based on end users with the largest revenue share by 2025.

- Regional Analysis: North America is projected to dominate the global sports nutrition market, holding a market share of 34.5% by 2025.

Use Cases

- Enhancing Performance: Proper nutrition fuels energy levels, endurance, and stamina during exercise, helping athletes perform at their best.

- Promoting Recovery: Consuming protein and carbohydrates post-workout aids muscle repair, reduces soreness, and supports faster recovery.

- Maintaining Hydration: Hydration with water and electrolytes prevents fatigue and cramps, ensuring optimal performance during physical activity.

- Preventing Nutritional Deficiencies: A balanced diet helps prevent deficiencies in vitamins and minerals, supporting overall health and energy levels.

Stats & Facts

- GNC has more than 4,800 retail stores, while Vitamin Shoppe has around 785 stores across the U.S. Consumer trust is another major factor contributing to this channel's growth.

- In 2018, Amazon launched its privately labeled brand-OWN PWR-which consisted of 11 products, including 3 elite pre-workout formulations and 8 general sports nutrition products.

- The U.S. Census Bureau reported that in 2021, about 14.6% of food and beverages, including sports supplements, were sold online.

- The U.S. Department of Agriculture (USDA) reports an 11% surge in plant-based protein consumption from 2021 to 2023.

Market Dynamic

Driving Factors

Rising Health Awareness and Fitness ParticipationThe global sports nutrition market is being driven by rising awareness and participation in health and fitness. Gym membership rose 12% year over year in 2022 with 15,000 new fitness enthusiasts joining worldwide according to WHO figures. More individuals are adopting fitness routines into their daily lives resulting in the increased need for products like protein powders, pre-workout supplements, and recovery solutions to enhance physical performance as well as overall well-being - such as protein powders. Government initiatives such as the UK's "Better Health, Every Mind Matters," encourage healthier lifestyles which further amp up demand for tailored sports nutrition solutions aligning with consumer health goals.

Product Innovation and Strategic Collaborations

Product formulation innovation and strategic collaborations play a pivotal role in driving the global sports nutrition market forward. Companies are creating cutting-edge nutrition products tailored specifically for both elite athletes and casual fitness enthusiasts, meeting diverse consumer demands for advanced nutrition solutions. Collaborations between fitness centers, sporting events, and athlete endorsements help increase market exposure and build consumer trust. Extending retail distribution channels ensures products reach more people. Through innovation and partnerships, industry stakeholders can tap into the rising demand for holistic health solutions, positioning themselves competitively within an evolving market characterized by performance enhancement and wellness trends.

Restraints

High Consumer Sensitivity to Premium Pricing

The global sports nutrition market faces significant impediments due to consumer sensitivity towards premium pricing products in emerging regions like Asia-Pacific, South America, and the Middle East. Many potential customers consider premium-priced items unaffordable as benefits are perceived to not justify lower-cost alternatives; combined with competing pressures and diverging economic circumstances this affects market penetration as a whole and limits customer bases.

Perceived Specialization of Sports Nutrition Products

A key restraint on the sports nutrition market is a perception that these products are intended exclusively for elite athletes or serious fitness enthusiasts, which restricts its reach beyond these demographics and hinders growth. To overcome this obstacle, companies need to emphasize inclusive sports nutrition by providing education on its benefits for general health and fitness - shifting perceptions can expand customer bases while creating sustainable market expansion.

Opportunities

An Increase in Consumer Demand for Clean Label Products

Rising consumer preference for non-GMO or clean-label sports nutrition products presents an invaluable opportunity in the global sports nutrition market. Athletics and health-conscious individuals are seeking supplements with minimal processing, organic ingredients, and clear labeling; brands offering products free from synthetic additives, preservatives, or artificial sweeteners have gained widespread traction among customers. Companies looking for ways to expand their product lines by adding organic and sustainably sourced sports nutrition options may take note, and expand accordingly in response to consumer demands in regions like North America and Europe. Meeting these consumer expectations not only builds trust but can help companies capture a larger market share.

Technological Advancements

Technological advances in the processing and formulation of organic ingredients provide significant opportunities for innovation within sports nutrition markets. Utilizing new science-based technologies that increase the bioavailability and effectiveness of organic ingredients, companies can enhance the performance benefits of their products while meeting increasing demands for natural supplements that deliver maximum performance benefits. Leveraging these developments, brands can leverage these advancements to offer products that fulfill athletes' performance requirements while meeting their desire for healthier, cleaner nutrition. Partnerships with research institutions and continued investments in technology will enable companies to stay abreast of this burgeoning market segment.

Trends

Rising Demand for Plant-Based Supplements

Consumer demand for plant-based supplements has seen significant increases, due to ethical and environmental considerations. The rising shift towards plant-based nutrition highlights a larger shift toward sustainable options like those provided by companies like Vega and Garden of Life that prioritize sustainable solutions over ethical alternatives; companies like these respond by creating innovative sports supplements incorporating plant ingredients. This trend represents the market's growing focus on health, sustainability, and cruelty-free offerings creating opportunities for brands catering to an eco-conscious consumer base.

Growing Trend Toward Online Shopping

The global sports nutrition market is evolving as more consumers opt for the convenience of home delivery, making online shopping increasingly the norm. MyProtein has taken full advantage of this trend by expanding direct-to-consumer (D2C) channels, expanding growth and visibility. By taking advantage of popular e-commerce platforms like Amazon to leverage customer engagement and retention programs they not only reach a wider audience but also strengthen relationships that support long-term market expansion. This shift towards online shopping enables brands to provide increased product accessibility while building strong relationships that promote long-term market expansion as a result.

Research Scope and Analysis

By Product Type

Sports supplements are likely to hold the largest market revenue in the global market by 2025 because of the various products in its category that address the particular needs of sportsmen workout freaks and health-conscious people. Protein powders, amino acids, vitamins, and omega-3 fatty acids are some of these supplements, which are relished for their actions to help muscles recover as well as optimize performance.

Increased awareness of fitness and health also increasing participation in sports and other gym activities have helped to boost demand for other products. Also, changes in product differentiation, especially concerning plant-based and allergen-free proteins, have increased customer reach. Sports foods, the second dominating segment of the global economy depend on their convenience and focus on energy providing. Products such as protein, energy, and special types of bars or protein gels are easy to use during activities hence popular among the sporting world. To deliver rapid energy and nutrition has sealed their place within the rising category of sports nutrition.

By Formulation

The powder segment is likely to lead the sports nutrition market with the largest revenue share in 2025 due to its widespread adoption among fitness enthusiasts and athletes, driven by its convenience and functional benefits. Powdered supplements are highly favored for their ease of consumption, stable ingredient profile, and extended shelf-life, making them a reliable choice for long-term use. Their popularity is further bolstered by the increasing number of sporting events and the rapid growth of health and fitness centers. These factors contribute to heightened demand, particularly among adults focused on muscle building and physique enhancement. Additionally, innovations such as powders that create thick shakes provide a practical and energy-boosting solution for athletes, further strengthening the segment’s market leadership.

Meanwhile, the capsule segment is expected to register the fastest growth due to ongoing advancements in formulation and enhanced product bioavailability. Capsules are becoming increasingly popular among adolescents and others seeking convenient, precise dosing with superior results, driving their rapid adoption and market expansion.

By Distribution Channel

Brick-and-mortar stores are expected to lead the sports nutrition market with revenue share in 2025 due to their ability to provide a tangible and personalized shopping experience. The presence of numerous specialty stores and fitness institutes plays a significant role in driving this segment's growth. These stores cater to a health-conscious customer base by offering tailored product recommendations, interactive services, and in-store promotions that enhance customer engagement. Additionally, retail outlets create opportunities for direct interaction with knowledgeable staff, allowing customers to make informed decisions. This personalized approach builds trust and loyalty, contributing to the sustained dominance of brick-and-mortar channels in the market.

Meanwhile, e-commerce has emerged as the fastest-growing segment in the sports nutrition market, driven by attractive discounts and the convenience of shopping from home. Online platforms actively compete with retail stores by adopting innovative strategies, such as subscription plans, personalized offers, and rapid delivery services. These factors position e-commerce as the second most influential channel in the market.

By End User

Sports nutrition market growth will likely be driven primarily by athletes in 2025 based on end-user classifications, due to rigorous training regimens, intense physical demands, and the desire for optimal performance. Athletic performance relies heavily on sports nutrition products like protein powders, energy bars, and recovery drinks to increase stamina, strength, and endurance while helping with muscle recovery and injury prevention. Professionalization of sports, coupled with greater awareness of nutrition's role in reaching peak performance has further cemented athletes as key consumers within this market.

Endorsements by prominent athletes and organizations further establish credibility for products designed for this group and facilitate adoption among them. The second dominant segment in the sports nutrition market is bodybuilders. Bodybuilders prioritize muscle growth, strength, and recovery, making them significant consumers of high-protein and performance-enhancing supplements. Products like whey protein, creatine, and branched-chain amino acids are integral to their regimen.

The segment’s growth is driven by the proliferation of bodybuilding as both a professional sport and a recreational activity, supported by an active online fitness community and social media influencers. Moreover, the emphasis on aesthetic appeal and the pursuit of lean muscle mass among this group aligns well with the offerings of the sports nutrition market.

The Global Sports Nutrition Market Report is segmented based on the following

By Product Type

- Sports Supplements

- Protein Supplements

- Egg Protein

- Soy Protein

- Pea Protein

- Lentil Protein

- Hemp Protein

- Casein

- Quinoa Protein

- Whey Protein

- Vitamins

- Minerals

- Amino Acids

- Probiotics

- Omega-3 Fatty Acids

- Carbohydrates

- Detox Supplements

- Electrolytes

- Others

- Sports Drinks

- Isotonic

- Hypotonic

- Hypertonic

- Sports Foods

- Protein Bars

- Energy Bars

- Protein Gel

- Meal Replacement Products

- Weight Loss Product

By Formulation

- Tablets

- Capsules

- Powder

- Soft gels

- Liquid

- Others

By Distribution Channel

- Brick & Mortar

- Direct Selling

- Chemist/Pharmacies

- Health Food Shops

- Hyper Markets

- Super Markets

- E-commerce

By End User

- Athletes

- Bodybuilders

- Recreational Users

- Lifestyle Users

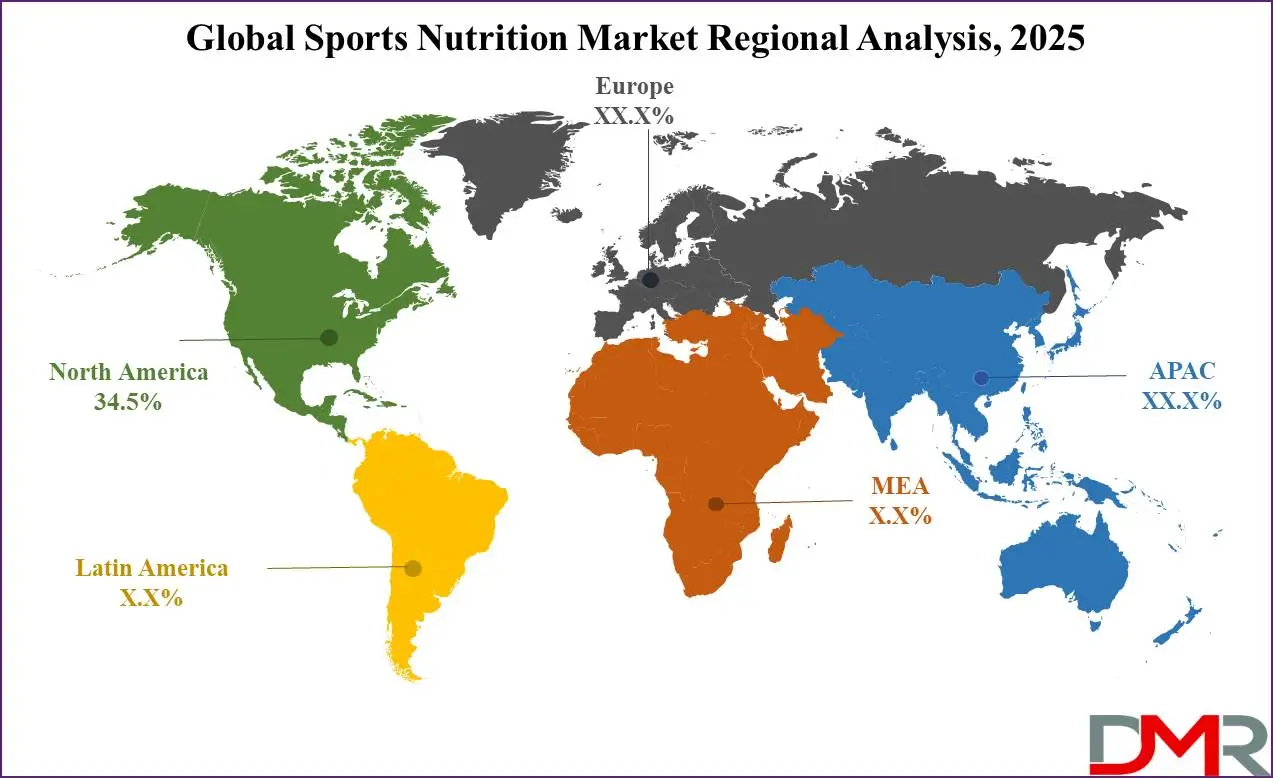

Regional Analysis

North America is likely to dominate the sports nutrition market with a revenue

share of 34.5% due to its well-established fitness culture and a high prevalence of health-conscious consumers who actively seek nutritional supplements to enhance performance and wellness. The region benefits from robust marketing strategies, extensive product availability, and a strong emphasis on sports and fitness activities. Additionally, higher disposable incomes and increasing awareness of the importance of active lifestyles drive the demand for sports nutrition products.

Continuous innovation in product formulations and the presence of major market players further strengthen North America's leading position in the market. Asia-Pacific is the second dominating region, fueled by a rapidly growing population, rising disposable incomes, and increasing awareness of health and fitness among consumers. Urbanization and the influence of Western fitness trends have significantly shaped consumer behavior. The expansion of e-commerce platforms and product availability has further bolstered growth. Additionally, the adoption of active lifestyles in countries like China, India, and Japan is driving demand in this dynamic region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

In the highly competitive sports nutrition market, the steady stream of new product launches serves as a crucial strategy for companies looking to stay relevant. These innovations not only meet the changing preferences of consumers but also highlight progress in scientific research and technology. By offering unique formulations, improved ingredients, and solutions for specific performance needs, sports nutrition brands contribute to a dynamic market that continuously captures consumer interest. In the highly competitive sports nutrition market, the steady stream of new product launches serves as a crucial strategy for companies looking to stay relevant.

These innovations not only meet the changing preferences of consumers but also highlight progress in scientific research and technology. By offering unique formulations, improved ingredients, and solutions for specific performance needs, sports nutrition brands contribute to a dynamic market that continuously captures consumer interest.

Some of the prominent players in the global sports nutrition market are

- Iovate Health Sciences

- Abbott

- Quest Nutrition

- PepsiCo

- Cliff Bar

- The Coca-Cola Company

- MusclePharm

- The Bountiful Company

- Post Holdings

- BA Sports Nutrition

- Cardiff Sports Nutrition

- Jacked Factory

- Orgain

- Other Key Players

Recent Developments

- In January 2024, Abbott Laboratories launched a new protein shake under the brand Protality, targeting adults who aim to lose weight while maintaining muscle mass. This launch is part of Abbott's strategy to capitalize on the rising demand for GLP-1 weight-loss drugs.

- In March 2023, PepsiCo introduced Gatorade Fast Twitch, a new non-carbonated energy drink designed for athletes. This launch represents a shift in PepsiCo’s sports nutrition strategy, combining elements from its acquisition of CytoSport, which is known for Muscle Milk. Positioned as a performance energy drink, Gatorade Fast Twitch contains 200mg of caffeine, B vitamins, and electrolytes, catering to consumers seeking pre-workout beverages without carbonation.

- In March 2024, Nestlé Health Science expanded its Garden of Life supplement line with a new skin health product. Garden of Life Sport Whey+ Younger, Healthier Looking Skin is a protein powder with a full amino acid profile designed to enhance skin radiance, elasticity, and smoothness after exercise. The vanilla-flavored product is easy to mix.

- In January 2024, Robot Food successfully rebranded ESN, the leading sports nutrition brand in Germany. Through a collaboration with the brand studio Robot Food, ESN updated its image while reinforcing its brand evolution.

- In April 2023, Sirio Europe announced plans to unveil two new collagen-based gummies aimed at the sports nutrition market during the Vitafoods Europe trade show.

- In February 2023, Olly introduced two new products: Post-Game Recovery Gummy Rings and Pre-Game Energize Gummy Rings, catering to the fitness community.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 59.3 Bn |

| Forecast Value (2034) |

USD 116.5 Bn |

| CAGR (2025-2034) |

7.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 17.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Sports Supplements, Sports Drinks, Sports Foods, Meal Replacement Products, and Weight Loss Products), By Formulation (Tablets, Capsules, Powder, Soft gels, Liquid, and Others), By Distribution Channel (Brick & Mortar, and E-commerce), By End User (Athletes, Bodybuilders, Recreational Users, and Lifestyle Users) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Iovate Health Sciences, Abbott, Quest Nutrition, PepsiCo., Cliff Bar, The Coca-Cola Company, MusclePharm, The Bountiful Company, Post Holdings, BA Sports Nutrition, Cardiff Sports Nutrition, Jacked Factory, Orgain, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Sports Nutrition Market size is estimated to have a value of USD 59.3 billion in 2024 and is expected to reach USD 116.5 billion by the end of 2033.

North America is expected to be the largest market share for the Global Sports Nutrition Market with a share of about 34.5% in 2024.

Some of the major key players in the Global Sports Nutrition Market are PepsiCo., The Coca-Cola Company, Abbott, and many others.

The market is growing at a CAGR of 7.5 percent over the forecasted period.

The US Sports Nutrition Market size is estimated to have a value of USD 17.2 billion in 2024 and is expected to reach USD 32.5 billion by the end of 2033.