Additionally, the market is witnessing several collaborations between defense contractors and tech firms aimed at innovating and accelerating development, thereby ensuring that the US maintains its competitive edge in global defense technology.

Further, the US stealth technology market is driven by high defense spending and constant innovation in advanced military capabilities. However, it faces challenges due to the high costs associated with the research, development, and maintenance of stealth systems. Also, growing developments in detection technologies by adversaries create a challenge, necessitating current investment to maintain stealth effectiveness and superiority.

Key Takeaways

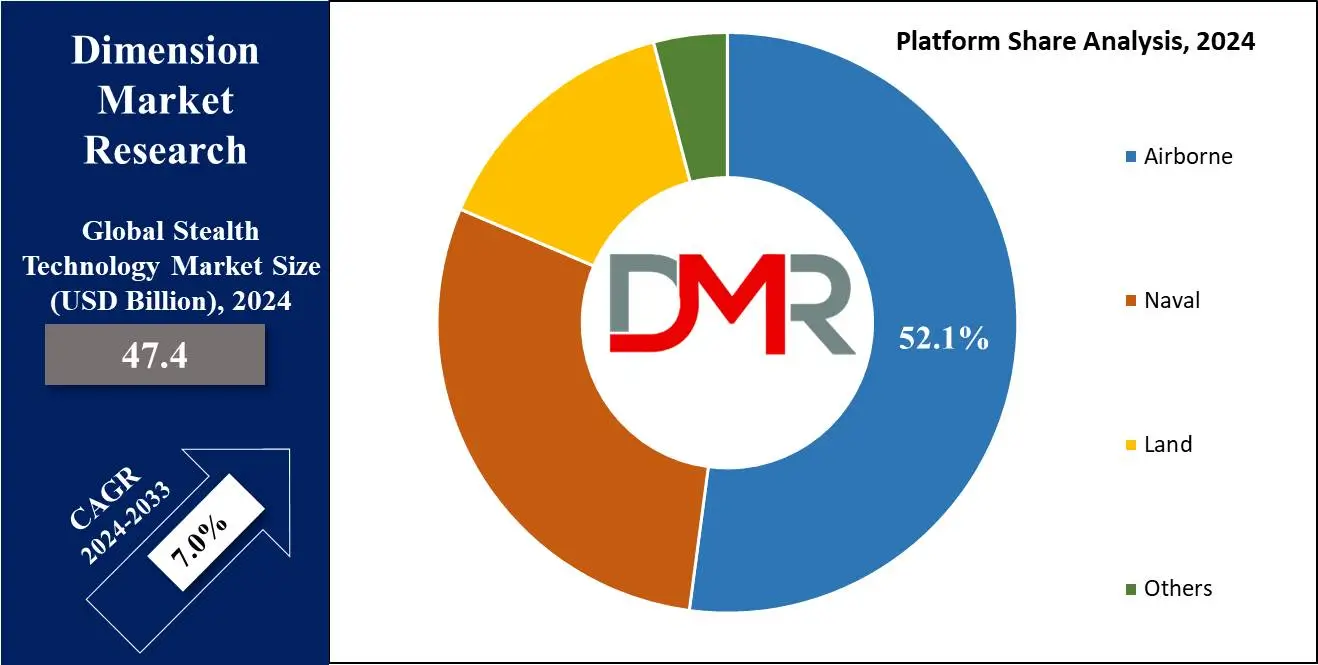

- Market Growth: The Stealth Technology Market size is expected to grow by 36.5 billion, at a CAGR of 7.0% during the forecasted period of 2025 to 2033.

- By Platform: The Airborne segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Technology: Radar Emission is expected to lead the Stealth Technology market in 2024.

- By Application: The defense segment is expected to get the largest revenue share in 2024 in the Stealth Technology market.

- Regional Insight: North America is expected to hold a 39.2% share of revenue in the Global Stealth Technology Market in 2024.

- Use Cases: Some of the use cases of Stealth Technology include naval vessels, military aircraft, and more.

Use Cases

- Military Aircraft: Stealth technology is used in military aircraft such as the B-2 Spirit & F-35 Lightning II to minimize radar visibility and improve survivability in hostile environments.

- Naval Vessels: Stealth features are integrated into naval ships like the Zumwalt-class destroyer to decrease radar cross-section and acoustic signatures, making them harder to detect.

- Unmanned Aerial Vehicles (UAVs): Stealth technology is applied to drones like the RQ-170 Sentinel to allow covert surveillance and reconnaissance missions by evading enemy radar detection. Modern drone systems increasingly use foldable drones and deployable UAV parachutes to ensure mission flexibility, improved safety, and rapid deployment in tactical operations.

- Missiles and Weapons Systems: Stealth techniques are used in the design of certain missiles & weapons systems to lower infrared and radar signatures, increasing the likelihood of successful mission completion without detection.

Market Dynamic

Driving Factors

Increasing Defense Budgets

Countries are allocating more funds to defense, driving demand for advanced stealth technologies to improve the capabilities & survivability of military assets in modern warfare scenarios.

Technological Advancements

Constant innovations in materials science, radar-absorbing coatings, and stealth design techniques are driving the development and adoption of more effective and affordable stealth solutions across many defense platforms. The integration of nanotechnology and aerospace carbon fiber composites has significantly improved stealth performance, while

advanced robotics is supporting precision manufacturing processes that enhance structural efficiency and radar evasion capabilities.

Restraints

High Development and Maintenance Costs

The development, production, and maintenance of stealth technology are costly, which can limit its adoption, mainly among countries with smaller defense budgets.

Technological Countermeasures

Development in detection technologies, like better radar systems and infrared tracking, can minimize the efficiency of stealth technology, creating a challenge to its continued dominance and requiring constant innovation.

Opportunities

Rising Demand in Emerging Markets

Emerging economies are highly investing in modernizing their defense capabilities, creating new opportunities to adopt & sell stealth technologies in these regions.

Commercial Aviation Applications

Beyond its military use, stealth technology has potential applications in commercial aviation, enabling the minimization of noise pollution and improvement in fuel efficiency, which in turn opens up new markets and revenue streams. Integration with

aerospace parts manufacturing and

aircraft health monitoring systems enhances design optimization, resulting in better aerodynamic performance and energy efficiency across commercial and defense fleets.

Trends

Integration with Unmanned Systems

There is a major trend toward integrating stealth technology with unmanned systems, like drones and autonomous vehicles, to improve their operational capabilities and survivability in contested environments. The emergence of

unmanned ground vehicles (UGVs) and

smart weapons technology, combined with artificial intelligence (AI), is enabling real-time decision-making, adaptive threat responses, and reduced human exposure in high-risk missions.

Advanced Materials Development

The development of new materials, like metamaterials & nanocomposites, is trending as these materials provide better stealth characteristics by absorbing and deflecting radar and infrared signals.

Research Scope and Analysis

By Material

Radar absorbent materials are set to dominate the stealth technology market in 2024, as they play a crucial role in the growth of the market by mostly enhancing the ability of military assets to avoid detection. The use of

protective coatings and

flame retardants for aerospace plastics in these materials ensures enhanced safety, thermal resistance, and durability, which are critical for stealth performance in extreme combat conditions.

Their efficiency in decreasing radar cross-section makes them important for modern stealth applications. Constant development in these materials drives innovation, creating more efficient and affordable stealth solutions, thereby driving market growth and expanding their adoption across various defense platforms.

Further, radar-reflecting materials, while less common in stealth technology, play a supportive role by helping to look into and address weaknesses in stealth design. It is also expected to show steady growth over the forecast period.

By studying how radar waves interact with these materials, engineers can refine stealth technologies to reduce detection. Their role in testing & improving stealth capabilities drives innovation and contributes to the market’s growth by improving the effectiveness and reliability of stealth systems.

By Technology

Radar emissions are expected to dominate the stealth technology market in 2024 by pushing the need for advanced countermeasures. As radar technology transforms with better emissions that improve detection capabilities, stealth technologies must constantly adapt to stay effective. This has led to the use of RF filters, semiconductor, and compound semiconductor components in radar absorption systems, improving stealth adaptability against evolving radar emission techniques.

The current development and refinement of stealth systems to counteract new radar emission technologies allow their relevance & effectiveness in modern defense applications.

Further, RF emissions are vital to the growth of the stealth technology market as they drive the development of stealth countermeasures. As radar and RF technology enhance, stealth systems must transform to effectively manage or reduce RF emissions to avoid detection, which promotes innovation in stealth materials and design, driving market growth and ensuring more effective defense solutions.

By Platform

The Global Stealth Technology Market, based on the platform, is categorized into airborne, naval, land, and others. Among these, airborne platforms play a major role in the growth of the stealth technology market by driving the need for advanced stealth solutions. Stealth technology improves the effectiveness of aircraft by lowering their radar visibility, which is important for successful missions in contested environments.

The need for stealthy airborne platforms, like fighter jets and reconnaissance aircraft, drives ongoing innovation and development in stealth materials and designs, which in turn, accelerates market growth as defense forces look to maintain superiority and operational advantage in the air.

Further, land platforms are expected to grow significantly over the forecast period and show the growth of the stealth technology market by integrating stealth features into military vehicles and equipment.

Stealth technology improves the survivability of ground assets by minimizing their radar and infrared signatures, which is important for modern warfare. The need for stealthy land vehicles, like tanks and armored personnel carriers, drives innovation & development in stealth technology, enhancing the market expansion.

By Application

Defense applications are anticipated to drive the growth of the stealth technology market in 2024 by driving the need for advanced stealth solutions across many military platforms. Stealth technology is vital for enhancing the survivability & effectiveness of aircraft, naval vessels, and ground vehicles in combat scenarios.

As nations give importance to modernizing their defense capabilities to address evolving threats, investment in stealth technology increases, which encourages constant innovation and development, driving the market forward and ensuring the development of cutting-edge stealth systems.

Further, aerospace applications are projected to show growth in the stealth technology market by demanding advanced stealth capabilities for aircraft. Stealth technology improves the operational effectiveness and survivability of military & commercial aircraft by minimizing detection, which is contributing significantly to the market's expansion and technological advancement.

The Stealth Technology Market Report is segmented based on the following

By Material

- Radar Absorbent Materials

- Radar Reflecting Materials

By Technology

- Radar Emission

- IR Signature Emission

- Radar Cross Section

- RF Emission

- Acoustic Emission

- Plasma Cloud

- Others

By Platform

- Airborne

- Naval

- Land

- Others

By Application

- Military

- Defense

- Aerospace

- Others

Regional Analysis

North America is expected to play a major role by contributing 39.2% of the market share in the stealth technology market in 2024, mainly driven by higher defense spending and advanced R&D capabilities.

The region is also investing in military communication and aerospace communication system infrastructure to enhance coordination between stealth platforms. With growing cyber threats, cybersecurity integration has become an essential part of stealth operations and defense modernization programs.

Government support, through defense contracts and funding, promotes the continuous development and deployment of advanced stealth systems. Further, North America's strategic focus on maintaining military superiority allows for ongoing investment in next-generation stealth technologies, making it a key region in setting industry standards and driving global market growth.

Further, the Asia Pacific is anticipated to grow at the highest rate in the stealth technology market over the forecast period, driven by high defense budgets and regional security concerns. Countries in this region are investing largely in modernizing their military capabilities, like stealth technology, to improve national security.

The increase in the focus on indigenous defense production and technological advancements is supporting the development and adoption of stealth systems, positioning Asia Pacific as a major contributor to the global stealth technology landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The stealth technology market is highly competitive and driven by constant innovation and advancement. Key players focus on developing cutting-edge materials and design techniques to improve stealth capabilities while balancing cost-effectiveness. Adoption of

industrial automation, electronic chemicals and materials, and specialty chemicals in the manufacturing process ensures consistent quality and supports the mass production of advanced stealth systems.

Companies are also exploring dual-use applications in both the military and civilian sectors, further expanding the market. In addition, strategic partnerships and collaborations are common ways to use expertise and accelerate development.

Some of the prominent players in the Global Stealth Technology are:

- Raytheon Technologies Corporation

- BAE Systems

- General Dynamics Corporation

- Northrop Grumman Corporation

- Sukhoi

- Baykar Tech

- Boeing

- Thales

- RTX

- Lockheed Martin Corporation

- Other Key Players

Recent Developments

- In June 2024, The US Air Force (USAF) unveiled the first official photos of the B-21 Raider stealth bomber in flight. The B-21 manufacturer Northrop Grumman thereafter released more pictures of the bomber taking off, in the air, and in a hangar at Edwards Air Force Base. Further, it is the only other stealth bomber flying.

- In March 2024, India announced that it had joined forces with the race to develop a fifth-generation stealth combat aircraft, which will need to catch up to the likes of Turkey and South Korea, which have a major lead, even as the US, China, and Russia already operate and bolster their stealth jet fleets.

- In November 2023, China's newly launched Type-039C Yuan Class submarine features an angled sail, indicating sonar stealth technology. While other countries are exploring this technique, China is the first to implement it. Building submarines rapidly, it surpasses all others in production capacity. The Yuan class is the world's most significant AIP submarine, which is uniquely shaped sails, suggesting advanced technological advancements.

- In May 2023, the launch of the B-21 ‘Raider’ at Air Force Plant 42 in Palmdale, California, marked a major stride in the ongoing battle between stealth and counter-stealth technologies. Developed as part of the US Air Force’s Long-Range Strike Bomber Program, which provides a major leap forward in aviation technology, focused at countering the A2AD strategy adopted by rival nations.

Report Details