Market Overview

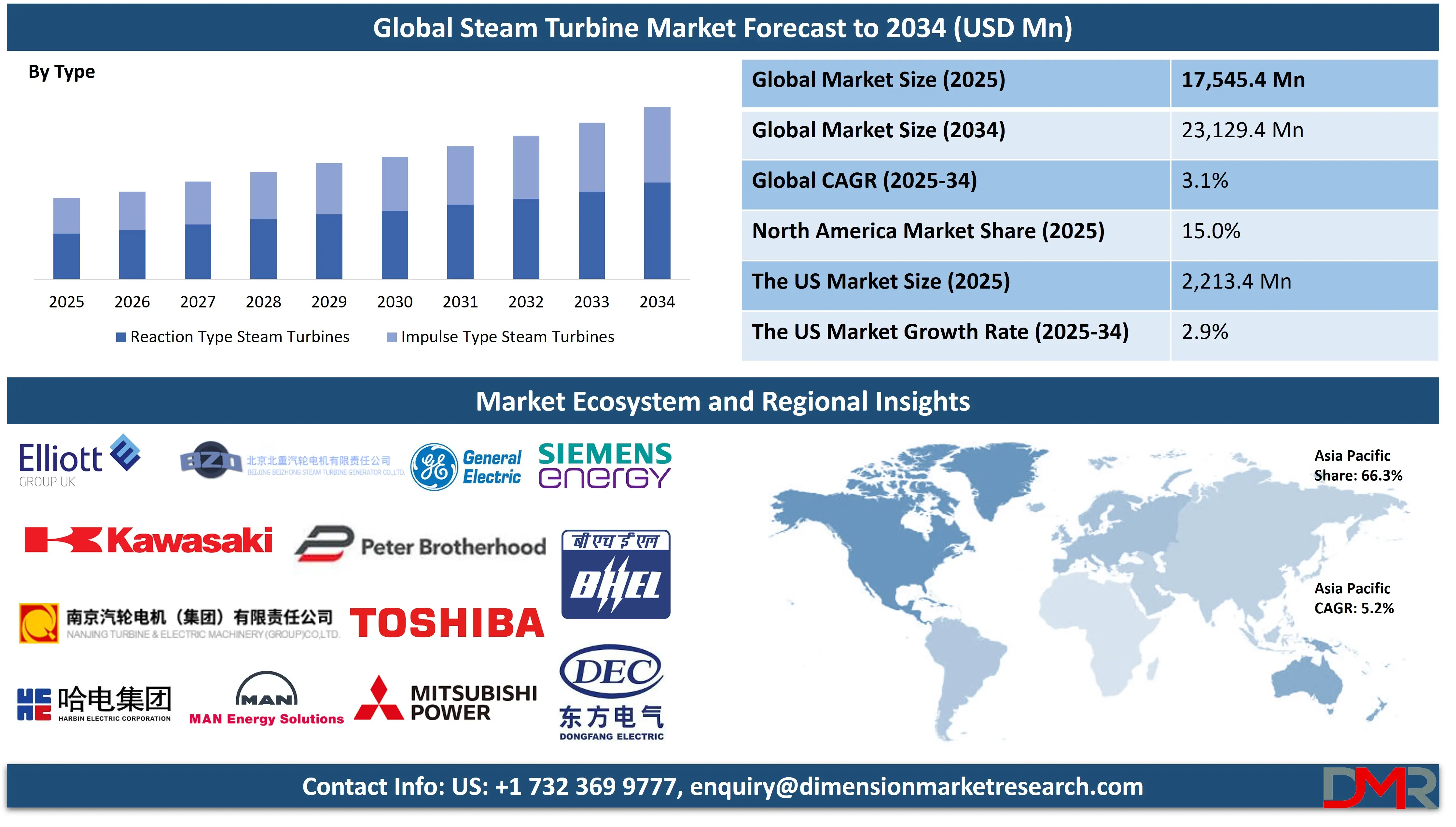

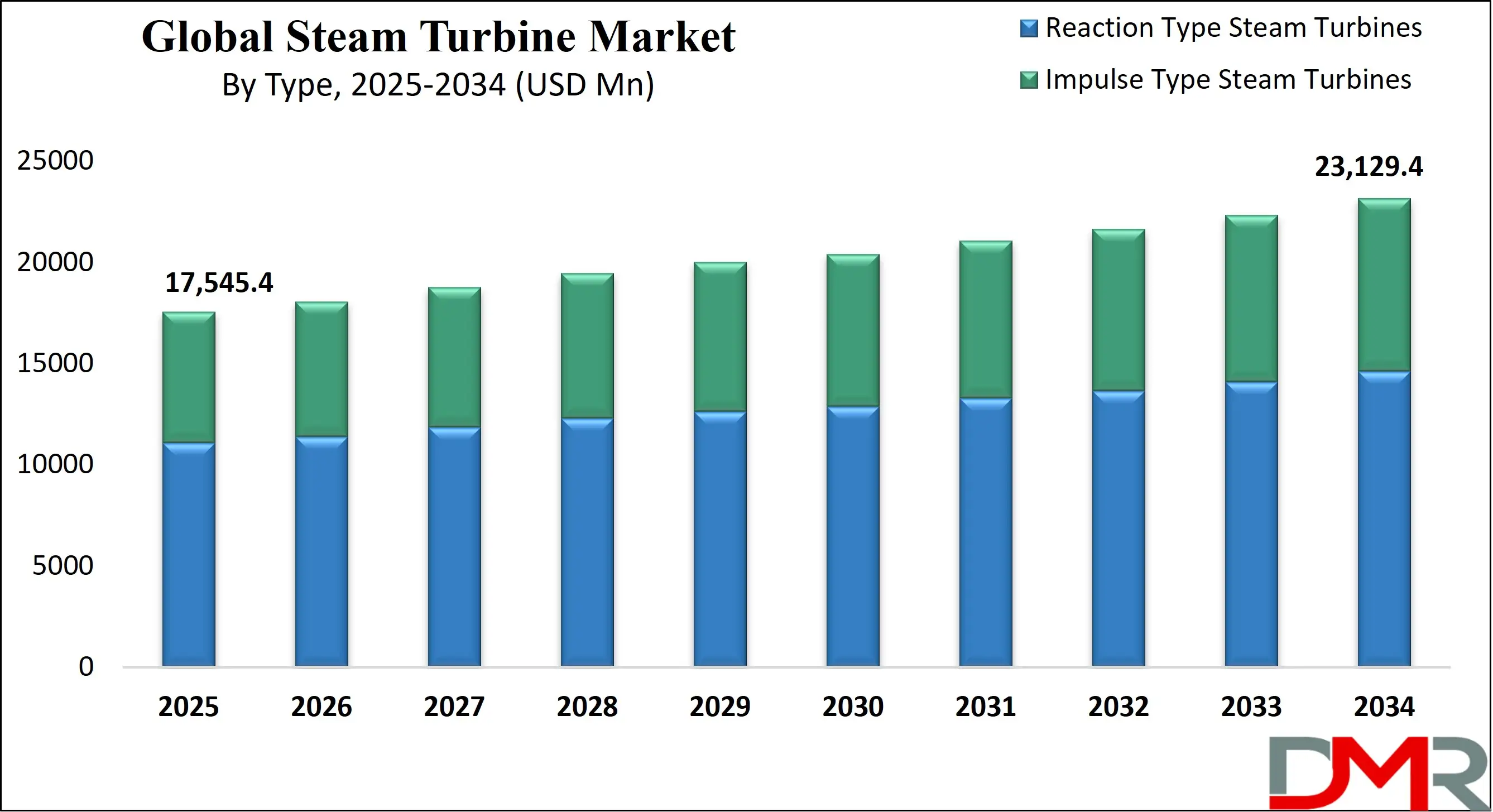

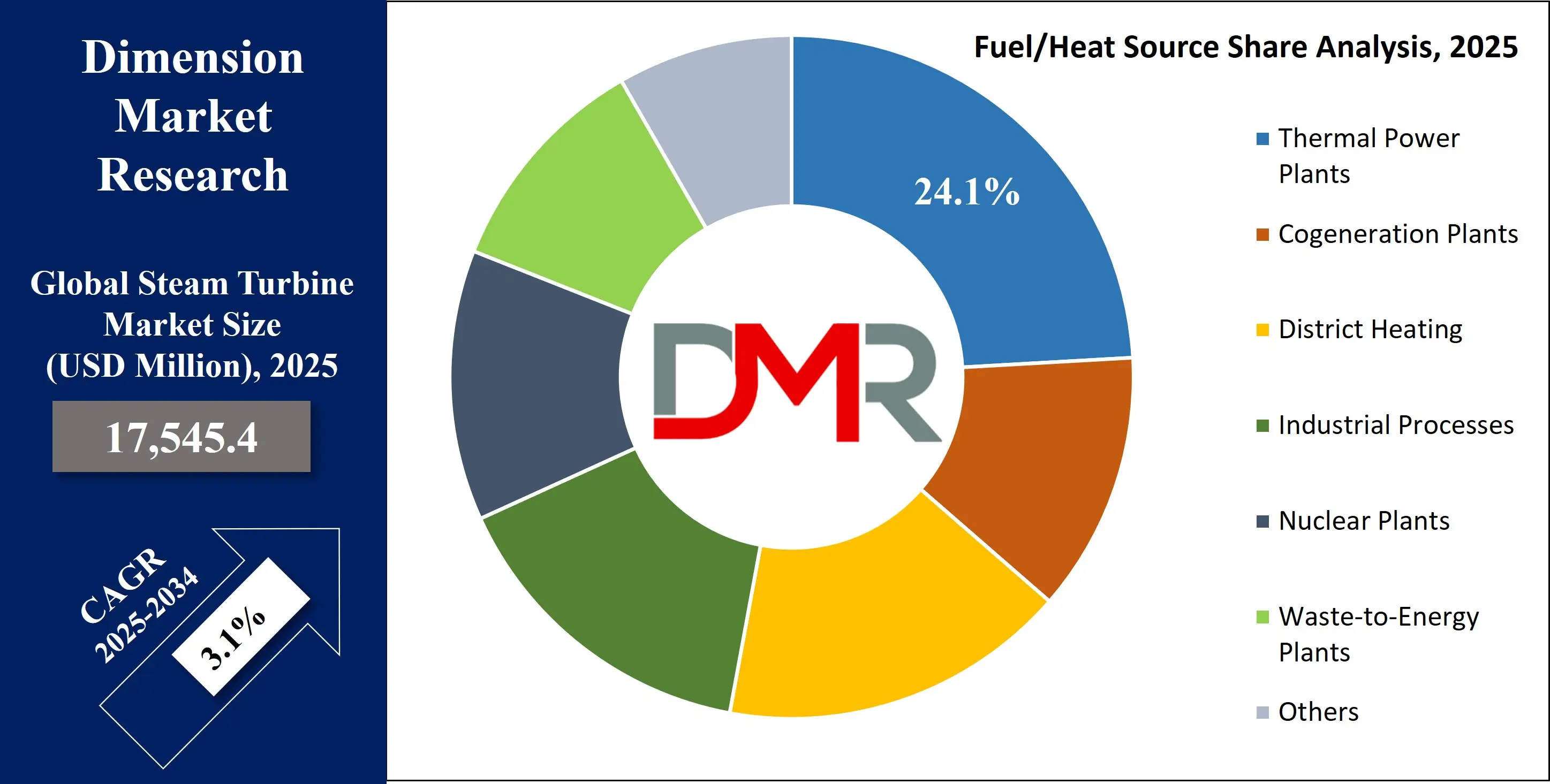

The Global Steam Turbine Market is projected to reach USD 17,545.4 million in 2025 and grow at a compound annual growth rate of 3.1% from there until 2034 to reach a value of USD 23,129.4 million.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global steam turbine market is undergoing a technological and strategic transformation amid evolving energy transition goals. Despite the increasing penetration of renewable energy, steam turbines continue to serve as the backbone of baseload electricity generation, especially in thermal, nuclear, biomass, and waste-to-energy power plants. These turbines convert thermal energy into mechanical energy with exceptional efficiency, making them vital in scenarios that demand continuous power supply, process heat, or grid stability. Their long operational lifespan, ability to handle high-pressure steam, and adaptability to a wide range of fuels from coal and biomass to nuclear heat and even geothermal sources ensure sustained demand across diverse applications.

A visible trend across the market is the modernization of legacy turbine systems. Governments and utilities worldwide are investing in retrofitting aging infrastructure with smart sensors, predictive maintenance software, and high-performance turbine blades to boost thermal efficiency and reduce operational downtime. Moreover, the integration of steam turbines into combined-cycle systems and hybrid renewable-thermal plants is enhancing energy conversion rates while lowering emissions.

The market is witnessing promising opportunities in emerging economies where coal and biomass remain important due to energy accessibility challenges. At the same time, regions with cold climates are ramping up deployment of steam turbines in cogeneration and district heating systems to meet dual demands of power and heat.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

However, challenges remain. Environmental regulations, rising fuel volatility, and competition from gas turbines and decentralized energy systems pose key restraints. Nevertheless, the adaptability, reliability, and efficiency of steam turbines ensure they will remain an indispensable technology in global energy architecture.

The US Steam Turbine Market

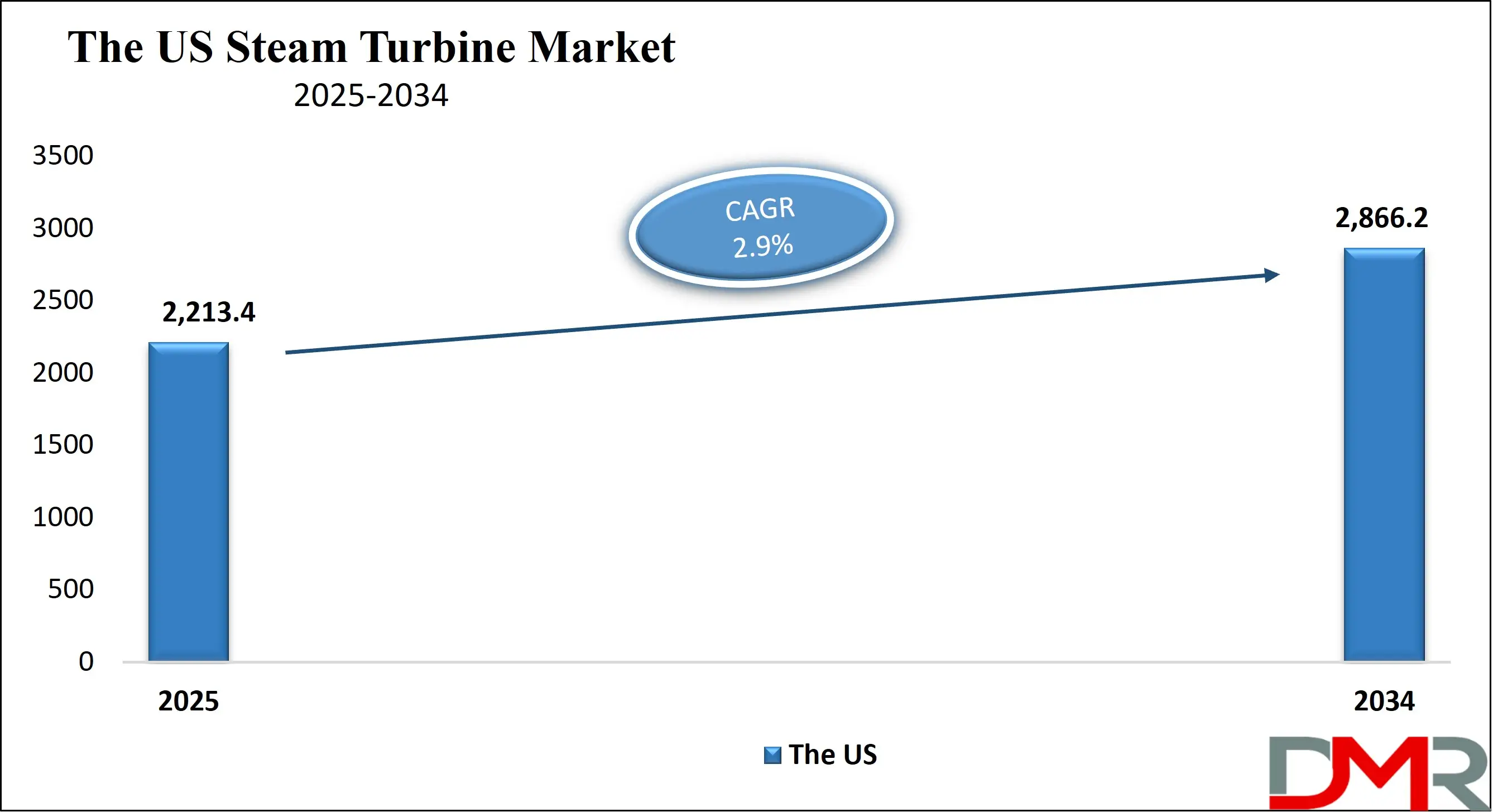

The US Steam Turbine Market is projected to reach USD 2,213.4 million in 2025 at a compound annual growth rate of 2.9% over its forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The United States steam turbine market plays a crucial role in maintaining grid resilience and supporting industrial operations across a wide array of sectors. According to the U.S. Energy Information Administration (EIA), steam turbine generators are integral to the nation’s thermal power infrastructure, especially in nuclear, coal, and biomass-fueled facilities. These turbines are heavily deployed in base-load power plants, ensuring uninterrupted electricity in high-demand regions such as the Midwest, Gulf Coast, and Northeast.

Beyond utility-scale power, steam turbines find widespread use in cogeneration and combined heat and power (CHP) applications. The Department of Energy’s CHP Technical Assistance Partnerships (CHP TAPs) promote adoption of steam turbines in critical infrastructure such as hospitals, manufacturing units, and university campuses to improve energy efficiency and reliability. Additionally, steam turbines are pivotal in refineries, chemicals, and paper manufacturing, where excess thermal energy is recycled into usable electricity.

The U.S. benefits from a mature supply chain, a highly skilled technical workforce, and robust manufacturing capabilities, especially in states like Pennsylvania, Ohio, and Texas. Government agencies such as the National Renewable Energy Laboratory (NREL) and ARPA-E are investing in R&D for advanced turbine materials, carbon capture integration, and hydrogen readiness, further enhancing the market's long-term sustainability.

Demographically, the U.S. features dense industrial zones, long-established energy infrastructure, and policy-driven innovation ecosystems that support steam turbine deployment. Even as the country moves toward renewables, the stable output, thermal integration, and grid-support functions of steam turbines ensure their continued relevance.

The Europe Steam Turbine Market

The Europe Steam Turbine Market is estimated to be valued at USD 2,631.8 million in 2025 and is further anticipated to reach USD 3,246.0 million by 2034 at a CAGR of 2.4%.

Europe’s steam turbine market is deeply integrated into the continent’s energy modernization and decarbonization strategies. While the European Union continues to shift toward renewables, steam turbines remain essential in baseload and process heat applications particularly in nuclear energy, industrial cogeneration, and waste heat recovery. The European Environment Agency notes that steam-based systems still provide a significant portion of electricity and heating in countries such as France, Germany, and Poland.

District heating is a core driver of turbine deployment in Northern and Eastern Europe. According to Euroheat & Power, countries like Denmark, Sweden, and Finland use centralized cogeneration systems for up to 70% of residential heating, often powered by back-pressure steam turbines. These systems integrate waste heat from power production into municipal heating, reducing overall emissions and improving thermal efficiency.

Europe’s leadership in waste-to-energy is also noteworthy. Municipal waste incineration plants in Germany, the Netherlands, and Switzerland use steam turbines to generate electricity and district heat from otherwise landfilled refuse. Additionally, steam turbines are embedded in Europe’s growing biomass energy initiatives, with support from programs like the EU Innovation Fund and Horizon Europe, which fund advanced CHP projects and material innovations.

The region's demographic and technological advantages include a skilled engineering workforce, stringent emissions regulations, and strong public-private R&D networks. This encourages continual turbine innovation in areas such as hydrogen compatibility, ultra-supercritical cycles, and digital monitoring. Even as new coal plants decline, Europe’s steam turbine market is bolstered by modern nuclear upgrades, municipal energy projects, and industrial efficiency mandates.

The Japan Steam Turbine Market

The Japan Steam Turbine Market is projected to be valued at USD 552.7 million in 2025. It is further expected to witness subsequent growth of 3.4% CAGR over the forecast period.

Japan’s steam turbine market reflects the country’s focus on resilient, efficient, and decarbonized thermal power systems. The Agency for Natural Resources and Energy reports that thermal power remains a cornerstone of Japan’s electricity mix, particularly following the Fukushima nuclear crisis. Steam turbines are vital components in this setup, deployed across coal, biomass, LNG, and nuclear installations to ensure continuous and reliable power supply.

Advanced thermal plants using supercritical and ultra-supercritical technologies dominate new-build trends in regions like Kansai and Chubu, where space is constrained and efficiency is paramount. The Ministry of Economy, Trade, and Industry (METI) supports modernization of existing turbines with enhanced materials, digital controls, and co-firing capabilities to meet 2050 carbon neutrality targets. Moreover, steam turbines are being adapted to support Japan’s strategic hydrogen and ammonia fuel pathways, including integration with co-firing demonstration projects.

Japan’s industrial sector especially chemicals, cement, and steel relies on captive cogeneration units powered by steam turbines for both electricity and process steam. The widespread use of industrial CHP systems is a byproduct of Japan’s high energy costs and land scarcity, making energy efficiency a national priority. Public-private initiatives through NEDO (New Energy and Industrial Technology Development Organization) are advancing turbine R&D in areas such as additive manufacturing, high-temperature alloys, and remote diagnostics.

With a demographically aging yet highly skilled labor force and a deeply entrenched culture of precision engineering, Japan continues to be a global leader in turbine innovation. Steam turbines will remain foundational to Japan’s dual goals of energy security and low-carbon industrial development.

Global Steam Turbine Market: Key Takeaways

- Global Market Size Insights: The Global Steam Turbine Market size is estimated to have a value of USD 17,545.4 million in 2025 and is expected to reach USD 23,129.4 million by the end of 2034.

- The US Market Size Insights: The US Steam Turbine Market is projected to be valued at USD 2,213.4 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2,866.2 million in 2034 at a CAGR of 2.9%.

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Steam Turbine Market with a share of about 66.3% in 2025.

- Key Players: Some of the major key players in the Global Steam Turbine Market are General Electric, Siemens Energy, Mitsubishi Power, Toshiba Energy Systems, BHEL, Doosan Škoda Power, MAN Energy Solutions, Harbin Electric, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 3.1 percent over the forecasted period of 2025.

Global Steam Turbine Market: Use Cases

- Cogeneration in Petrochemical Complexes: Steam turbines are extensively used in petrochemical plants to recover excess process heat for on-site electricity generation, enhancing plant energy efficiency and reducing operational costs in high-thermal-load environments.

- Nuclear Power Conversion: In nuclear facilities, steam turbines convert pressurized steam from reactors into grid electricity, enabling zero-emission baseload energy with high reliability and minimal fuel dependence.

- District Energy Systems: Urban district heating networks in Europe and Asia use steam turbines to simultaneously generate electricity and capture thermal energy for residential and municipal heating, maximizing energy utilization.

- Pulp and Paper Biomass Utilization: Steam turbines enable pulp and paper mills to convert biomass residues like black liquor into steam and power, fostering circular economy models and reducing reliance on fossil fuels.

- Geothermal Energy Harnessing: Steam turbines operate at high temperatures and pressures in geothermal plants, converting natural underground steam into electricity in volcanic regions like Indonesia, Iceland, and the U.S. West Coast.

Global Steam Turbine Market: Stats & Facts

U.S. Energy Information Administration (EIA)

- Steam turbines accounted for 28.5% of total U.S. utility-scale electricity generation capacity as of 2023.

- In 2022, the U.S. had over 184 GW of steam turbine capacity in operation across all thermal plants.

- Steam turbines are used in 99% of all U.S. nuclear power plants to convert reactor heat into electricity.

- The average efficiency of U.S. coal-fired plants with steam turbines was approximately 33.5%, while combined-cycle plants with steam stages reached 50-60% efficiency.

U.S. Department of Energy (DOE)

- The DOE reports that combined heat and power (CHP) using steam turbines generates around 7% of total U.S. electricity.

- Steam turbine-based CHP systems have an overall efficiency of 60–80%, compared to 45% for conventional generation.

- Over 4,400 CHP systems are operating in the U.S., with a significant portion using steam turbines in industrial sites.

- The DOE’s “Better Plants Program” shows steam turbine retrofits can reduce energy intensity by 15–25% in manufacturing.

International Atomic Energy Agency (IAEA)

- 100% of nuclear power plants globally use steam turbines for power conversion.

- As of 2023, 410 nuclear reactors were operational worldwide, with nearly all using multi-stage condensing steam turbines.

- The average output capacity of turbines in modern nuclear plants is between 900–1,600 MW per unit.

International Energy Agency (IEA)

- Steam turbines are used in >65% of the world’s thermal electricity generation, including coal, biomass, and waste heat.

- Supercritical and ultra-supercritical steam turbine plants reduce CO₂ emissions by 30–40% compared to subcritical units.

- Combined heat and power (CHP) systems, often using steam turbines, provide 12% of Europe’s total electricity output.

- In China, coal-fired plants using advanced steam turbines generate more than 50% of total electricity.

European Environment Agency (EEA)

- Steam turbines contribute to over 70% of thermal electricity generation in the EU, including nuclear, coal, and biomass.

- The average age of steam turbine plants in Europe is over 30 years, highlighting the need for modernization.

- Waste-to-energy plants using steam turbines help process more than 97 million tons of municipal waste annually in the EU.

Eurostat

- 66% of all heat produced for district heating in the EU comes from cogeneration plants, many powered by steam turbines.

- Steam-based CHP plants in Europe contribute 11.2% of electricity and 16% of heat consumed in industrial and residential sectors.

Japan Ministry of Economy, Trade and Industry (METI)

- Over 75% of Japan’s thermal power generation (coal, biomass, LNG) is handled by steam turbines.

- Japan operates more than 20 supercritical and ultra-supercritical plants, all relying on high-efficiency steam turbines.

- METI aims to implement ammonia co-firing in steam turbines across 100% of new coal plants by the early 2030s.

New Energy and Industrial Technology Development Organization (NEDO – Japan)

- NEDO's turbine development projects have achieved 5–10% gains in turbine efficiency using ceramic coatings and 3D-printed blades.

- Japan’s turbine innovation programs target a 30% reduction in CO₂ emissions from thermal plants by 2030 through hybrid steam-gas systems.

International Renewable Energy Agency (IRENA)

- Biomass plants using steam turbines produce 10% of global renewable electricity.

- Waste-to-energy facilities utilizing steam turbines have a potential global capacity of 400 TWh/year, especially in urban regions.

National Energy Administration of China (NEA)

- China leads globally with over 1,100 GW of installed coal capacity, most of which use multi-stage steam turbines.

- As of 2022, >80% of China’s new coal plants are ultra-supercritical, requiring advanced steam turbine technology.

- China aims to replace over 30% of older steam turbines by 2030 under its industrial decarbonization plan.

International Finance Corporation (IFC) – World Bank Group

- Steam turbines in industrial CHP systems can reduce fuel consumption by 20–25% over separate heat and power generation.

- IFC projects in Southeast Asia show steam turbine-based biomass plants achieving 90% capacity factors due to process heat integration.

Global Steam Turbine Market: Market Dynamic

Driving Factors in the Global Steam Turbine Market

Continuous Dependence on Baseload and Industrial Process Power

Despite the surge in renewable energy deployment, global power systems continue to depend on steam turbines for reliable baseload generation and industrial cogeneration. Baseload power ensures continuous grid stability and meets demand during off-peak renewable performance. Steam turbines, especially those in nuclear, coal, and biomass plants, provide uninterrupted, high-efficiency electricity essential for urban and industrial consumption. In nations with high industrial activity like the U.S., China, and Germany, steam turbines play a pivotal role in supporting energy-intensive sectors such as petrochemicals, cement, pulp and paper, and metallurgy. These industries require both electricity and process steam, which steam turbines deliver efficiently through cogeneration.

Additionally, industries with captive power requirements increasingly prefer turbine-driven systems due to their fuel versatility and long operational life. The criticality of energy security and grid reliability in developing nations also accelerates steam turbine deployment. Utilities prefer turbine-based thermal generation for its predictable output, ramping capability, and grid inertia, which are vital for balancing variable renewable sources. Therefore, the continuous need for stable baseload electricity and integrated industrial power remains a powerful driver of steam turbine market growth, especially amid global electrification efforts and urbanization trends in emerging economies.

Global Nuclear Energy Resurgence and Policy Support

Nuclear energy is experiencing a policy-driven revival globally, directly fueling demand for high-capacity steam turbines. Governments across Asia, Europe, and the Middle East are revisiting nuclear strategies to meet carbon neutrality targets while ensuring energy reliability. Steam turbines are indispensable in nuclear power plants, as they convert reactor-generated heat into mechanical and electrical energy. Each nuclear plant typically relies on large multi-stage condensing steam turbines rated between 900 MW and 1,600 MW. Countries like India, China, the UAE, and the U.K. have committed to new reactor construction, small modular reactors (SMRs), and advanced pressurized water reactors (PWRs), all of which require custom-built steam turbine systems.

For example, China’s Hualong One and India’s PHWR units rely on indigenous turbine design and manufacturing, backed by state support. Furthermore, western countries are developing next-generation reactors under public-private initiatives such as the U.S. DOE’s Advanced Reactor Demonstration Program and France’s Nuward SMR project. These reactors emphasize modularity and grid responsiveness but continue to depend on steam turbines for thermal-to-electric energy conversion. As nuclear energy regains geopolitical and climate relevance, turbine manufacturers will benefit from a stable pipeline of high-capacity, government-backed infrastructure projects that ensure long-term demand.

Restraints in the Global Steam Turbine Market

Stringent Emission Regulations and Fossil Fuel Phase-Out Policies

One of the most pressing challenges facing the steam turbine market is the global movement toward decarbonization, which has resulted in stricter environmental regulations and the planned phase-out of coal-based generation. Many OECD countries, including Germany, the U.K., and Canada, have implemented timelines to retire coal-fired power plants between 2030 and 2040. Given that a significant portion of steam turbines operate in coal- and oil-fired facilities, this trend puts downward pressure on new installations and retrofits in traditional markets. Regulatory bodies like the U.S. Environmental Protection Agency (EPA) and the European Commission have also set rigorous emission performance standards that restrict the operation of older thermal units.

Complying with these standards requires costly upgrades such as carbon capture systems, ultra-low NOx burners, and flue gas desulfurization, which many utilities may find financially unfeasible. In emerging markets, financing for new fossil-fueled plants is becoming increasingly scarce due to pressure from global financial institutions and ESG mandates. While there is potential for biomass and hydrogen co-firing, many older turbine systems lack the flexibility to transition economically. This evolving regulatory environment challenges the steam turbine industry to innovate faster or risk obsolescence in carbon-constrained economies.

Increasing Competition from Gas Turbines and Renewable Alternatives

Steam turbines are facing mounting competition from gas turbines, which offer faster ramp-up capabilities, lower capital costs, and reduced environmental impact. Combined-cycle gas turbine (CCGT) systems, in particular, have gained substantial ground due to their high thermal efficiency (up to 62%) and compatibility with decarbonized fuels like hydrogen and biogas. Moreover, the global shift toward intermittent renewable energy sources such as solar PV and wind is reducing the reliance on large centralized thermal plants historical strongholds of steam turbines. Utilities now prioritize flexible generation systems capable of responding quickly to grid fluctuations, a trait more aligned with aero-derivative gas turbines or battery energy storage.

In addition, modular and containerized microgrid solutions are being deployed in developing nations, bypassing the need for heavy steam-based infrastructure. From an economic standpoint, steam turbines also have longer commissioning timelines and more complex auxiliary requirements (cooling, water treatment), making them less attractive in time-sensitive projects. As power markets liberalize and reward flexibility and decentralization, steam turbines risk being sidelined unless they are redesigned for multi-fuel operation, integrated with smart controls, and competitively priced. This competitive landscape necessitates aggressive innovation to defend and diversify steam turbine applications.

Opportunities in the Global Steam Turbine Market

Decentralized Cogeneration in Emerging Markets

Rapid urbanization and industrialization in regions like Southeast Asia, Sub-Saharan Africa, and Latin America present untapped opportunities for steam turbine deployment in decentralized cogeneration systems. Unlike centralized grid systems, decentralized energy solutions provide localized power and heat, which are vital for remote industrial parks, agribusinesses, and municipal heating networks. Steam turbines offer unmatched reliability and efficiency in such applications, often running on biomass, waste heat, or coal where natural gas infrastructure is lacking. Countries like Vietnam, Indonesia, and Kenya are investing in industrial zones with embedded CHP (Combined Heat and Power) units to enhance energy independence and reduce transmission losses.

Development finance institutions (e.g., IFC, ADB) are increasingly supporting biomass-based cogeneration in sugar, palm oil, and food processing industries to foster low-carbon development. Steam turbines in these contexts are usually in the 5–120 MW range, tailored for modular and fuel-flexible operations. Additionally, government subsidies and climate financing for biomass and clean cooking transitions further incentivize steam turbine adoption in rural and peri-urban settings. The ability of these systems to deliver both thermal energy and electricity simultaneously gives them a competitive edge, making them crucial components in the distributed energy transition of developing economies.

Waste-to-Energy Expansion and Urban Sustainability Goals

With global urban waste generation expected to rise to over 3.4 billion tons annually by 2050 (World Bank), cities are turning to waste-to-energy (WTE) systems that convert municipal solid waste (MSW) into electricity and heat. Steam turbines are integral to these systems, converting steam generated from incineration into mechanical energy. Europe leads in WTE adoption, with over 500 plants using condensing and back-pressure steam turbines. Countries like Japan, South Korea, and Singapore also operate highly efficient WTE facilities integrated with district heating networks. In North America, regulatory shifts and landfill diversion mandates are catalyzing investment in waste combustion with energy recovery.

Steam turbines in WTE plants must handle fluctuating steam pressures and corrosive environments, driving demand for robust and customized designs. Modern WTE plants also integrate emissions control systems, heat recovery steam generators (HRSGs), and advanced automation areas where turbine manufacturers can offer value-added solutions. Moreover, international financing from bodies like the Global Environment Facility (GEF) and Green Climate Fund (GCF) supports municipal WTE development in Africa and Asia. As urban centers prioritize circular economy and climate adaptation strategies, steam turbines will play a pivotal role in converting waste into sustainable energy.

Trends in the Global Steam Turbine Market

Rise of Advanced Steam Cycle Technologies (Supercritical & Ultra-Supercritical Units)

The global steam turbine market is witnessing a sharp shift toward supercritical (SC) and ultra-supercritical (USC) technologies to enhance plant efficiency and reduce carbon emissions. These steam cycles operate at much higher pressures and temperatures above 22.1 MPa and 600°C respectively significantly increasing thermal conversion rates compared to subcritical systems. Countries like China, Japan, and India have adopted USC and SC technologies in new thermal plant projects to meet their emission mandates without compromising base-load electricity generation. This trend is also prominent in Eastern Europe and Southeast Asia where energy security and grid reliability are top priorities. Major OEMs are investing in advanced materials such as nickel-based alloys and ceramic coatings for turbine blades to withstand these elevated conditions.

These upgrades also improve turbine longevity and reduce maintenance frequency. Furthermore, integrating these technologies with AI-driven monitoring tools ensures performance optimization and predictive maintenance. As global pressure intensifies on decarbonization, advanced steam cycles provide a technically viable path to operate legacy coal assets at higher efficiencies. This trend positions steam turbines as critical transitional assets while complementing renewables in a hybridized grid. Consequently, demand is shifting from traditional turbines to high-efficiency variants, reflecting a broader industry-wide emphasis on performance optimization, regulatory compliance, and low-carbon outcomes.

Integration of Steam Turbines in Hybrid and Multi-Fuel Systems

The integration of steam turbines within hybrid generation systems is gaining momentum, especially in regions pursuing decarbonization without destabilizing grid reliability. Steam turbines are increasingly paired with gas turbines, solar thermal fields, and even hydrogen-based systems to form combined-cycle or hybrid thermal plants. This configuration enhances overall plant efficiency and ensures a continuous energy supply by compensating for the intermittency of renewables. In gas-steam combined-cycle plants, the exhaust heat from the gas turbine is used to generate steam, which then powers a steam turbine raising efficiency to above 60%. In solar thermal applications, steam turbines convert solar-heated fluids into mechanical energy, especially in Concentrated Solar Power (CSP) plants in arid regions like the Middle East and North Africa.

Furthermore, steam turbines are being modified to accommodate green hydrogen as a co-fuel in boilers, allowing existing infrastructure to be repurposed for cleaner generation. Japan and the EU are actively exploring ammonia and hydrogen co-firing strategies to decarbonize thermal fleets. This trend is further supported by digital integration technologies like SCADA and IoT-based turbine controls that allow seamless coordination between various fuel sources. As utilities pursue fuel flexibility and regulatory compliance, hybridization will become a defining trend, placing steam turbines at the heart of next-generation, fuel-agnostic power infrastructure.

Global Steam Turbine Market: Research Scope and Analysis

By Capacity Analysis

The 121–350 MW capacity segment is projected to dominates the global steam turbine market due to its optimal balance between power generation scale, operational efficiency, and versatility across utility and industrial applications. Turbines in this range are ideally suited for medium-scale thermal power plants, combined heat and power (CHP) facilities, and captive generation units for large industrial complexes such as steel, cement, chemical, and refining sectors. These capacities allow for efficient base-load operation without the logistical and capital-intensive constraints of larger (>350 MW) units.

In developing regions like Southeast Asia, Africa, and South America, rapid industrialization and urbanization demand reliable, grid-connected power in mid-tier ranges. Power plants in this capacity bracket can be deployed faster and are more modular, making them ideal for regional grids and industrial parks. Moreover, national electrification programs and industrial corridor developments in India, Vietnam, and Indonesia often center around 150–300 MW units to balance demand growth and capital investment.

From a technical perspective, turbines in this capacity offer better thermal efficiency and load-following capabilities compared to smaller units. They are easier to retrofit with emission-reducing technologies and digital automation systems, making them attractive for modernization programs under government-backed low-emission thermal initiatives.

Additionally, this range aligns well with flexible fuel systems, including coal, biomass, waste heat, and natural gas. Given the growing demand for decentralization, energy security, and low-carbon dispatchable power, the 121–350 MW range presents a highly scalable solution. Its ability to serve both industrial and utility-scale needs ensures continued dominance in new installations and retrofitting projects globally.

By Type Analysis

Condensing steam turbines is expected to dominate the global steam turbine market due to their unmatched ability to convert thermal energy into mechanical power with high efficiency in utility-scale electricity generation. These turbines operate by expanding high-pressure steam to sub-atmospheric pressures in a condenser, maximizing the energy extracted from the steam cycle. This makes them the preferred choice for base-load power generation in coal-fired, nuclear, biomass, and combined-cycle thermal power plants.

Their widespread adoption is driven by the global demand for uninterrupted, large-scale electricity production particularly in regions where renewables cannot yet fully replace dispatchable energy. Condensing turbines are standard in nearly all nuclear power stations, which contribute significantly to the power mix in countries like the U.S., France, Russia, and China. Additionally, ultra-supercritical and supercritical coal-fired plants, which operate at extremely high temperatures and pressures to reduce emissions, depend on condensing turbines to optimize output and efficiency.

Moreover, condensing steam turbines offer superior thermal efficiency compared to non-condensing types, especially when integrated with high-efficiency boilers or combined heat recovery systems. They are also favored in waste-to-energy plants where the goal is maximum power extraction rather than heat recovery.

In evolving power systems that prioritize flexible and efficient baseload energy, condensing turbines are being upgraded with smart digital controls, variable-speed drives, and real-time diagnostics for performance optimization. Their compatibility with advanced emission control technologies and future-ready fuels such as hydrogen and ammonia ensures their continued relevance. Given their efficiency, scalability, and adaptability, condensing turbines remain central to long-term thermal power strategies worldwide.

By Design Analysis

Reaction-type steam turbines is poised to dominate the global steam turbine market due to their ability to deliver high efficiency at both partial and full loads, making them especially suitable for large-scale utility and nuclear applications. In a reaction turbine, the steam expands across both stationary and rotating blades, causing continuous acceleration and pressure drop, which leads to smoother energy transfer and enhanced thermal efficiency.

This design is preferred for high-pressure and high-temperature operations typical of supercritical and ultra-supercritical thermal plants, where maintaining efficiency and performance consistency is critical. It allows for a gradual energy extraction process, reducing mechanical stress and improving durability attributes that are vital for large base-load power stations that operate continuously. Reaction turbines also exhibit lower blade loading and better aerodynamic performance, resulting in lower maintenance requirements and higher lifecycle reliability.

Major power producers globally, particularly in Europe, Russia, and Asia-Pacific, favor reaction turbines for their stable operational profile and adaptability to multiple steam conditions. Their multistage architecture makes them particularly effective in large steam flow applications such as nuclear and advanced coal-fired power plants, where output ranges exceed 300 MW.

Furthermore, this design allows for modularity and integration with advanced control systems, enabling precise load adjustments and real-time condition monitoring. OEMs have also improved the design through computational fluid dynamics (CFD) to enhance blade profiles and steam flow paths, driving further performance gains.

As power systems evolve to prioritize grid stability and efficient base-load capacity, the ability of reaction turbines to deliver sustained, high-efficiency output under diverse conditions ensures their ongoing dominance in new installations and turbine retrofits.

By Fuel / Heat Source Analysis

Thermal power plants is anticipated to dominate the steam turbine market due to their global ubiquity, mature infrastructure, and essential role in meeting consistent base-load electricity demand. These facilities use a variety of heat sources including coal, biomass, natural gas, oil, and waste to generate steam that drives turbines. Their widespread deployment across both developed and developing nations underscores the foundational role of thermal generation in national power grids.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Despite growing renewable penetration, thermal power remains the backbone of energy security in countries like China, India, Indonesia, South Africa, and parts of Eastern Europe, where it contributes significantly to electricity generation. Steam turbines in thermal plants are valued for their capacity to produce large-scale, dispatchable electricity with high operational availability. This reliability is critical for maintaining grid frequency and stability, especially when renewable output is variable.

Thermal plants have also become focal points for technological innovation. The integration of supercritical and ultra-supercritical steam conditions, flue gas treatment systems, and co-firing of low-carbon fuels like biomass and ammonia is transforming traditional plants into cleaner, more efficient energy sources. In parallel, digital retrofits, real-time diagnostics, and predictive maintenance technologies have increased the operational efficiency and lifespan of existing steam turbines in thermal facilities.

Moreover, the centralized infrastructure of thermal plants supports district heating, desalination, and industrial cogeneration applications where steam turbines offer unmatched energy efficiency. As long as grid stability, energy affordability, and fuel flexibility remain key policy concerns, steam turbines in thermal power plants will continue to dominate, especially in regions balancing electrification goals with energy resilience.

The Global Steam Turbine Market Report is segmented on the basis of the following

By Capacity

- Upto – 120 MW

- 121 – 350 MW

- 351 – 750 MW

- Above 750 MW

By Type

- Condensing Steam Turbines

- Non-condensing Steam Turbines

By Design

- Reaction Type Steam Turbines

- Impulse Type Steam Turbines

By Fuel / Heat Source

- Thermal Power Plants

- Cogeneration Plants

- District Heating

- Industrial Processes

- Nuclear Plants

- Waste-to-Energy Plants

- Others

Global Steam Turbine Market: Regional Analysis

Region with the Largest Revenue Share

Asia-Pacific is expected to hold the dominant share in the global steam turbine market as it command over 66.3% of the total market revenue by the end of 2025, due to its extensive reliance on thermal and nuclear power for base-load electricity generation. Countries such as China, India, Japan, and South Korea operate large fleets of coal-fired and nuclear power plants, most of which are powered by steam turbines. According to the International Energy Agency (IEA), China alone accounts for over 50% of global coal consumption, and its electricity grid is underpinned by ultra-supercritical steam turbine technology. India, the world’s second-largest coal producer, continues to commission medium and large-capacity thermal plants to meet its growing urban and industrial power demand.

Moreover, strong government support for nuclear energy expansion in China, India, and South Korea fuels additional demand for high-capacity condensing steam turbines. Asia-Pacific is also a global manufacturing hub for steel, cement, chemicals, and paper industries that require industrial cogeneration using steam turbines. The region benefits from lower manufacturing costs, skilled labor, and local turbine manufacturing capabilities, making it a production base for both domestic use and export. These factors firmly establish Asia-Pacific as the global leader in steam turbine deployment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

Asia-Pacific is projected to witness the highest CAGR in the global steam turbine market due to a combination of industrial expansion, energy infrastructure upgrades, and supportive government energy policies. Rapid urbanization and industrialization in Southeast Asian nations such as Indonesia, Vietnam, and the Philippines are driving demand for medium-capacity steam turbines for captive and decentralized power generation. These emerging economies are increasingly investing in coal, biomass, and waste-to-energy plants to ensure energy security and affordability.

Additionally, China and India are aggressively modernizing their aging thermal power assets by deploying ultra-supercritical technology and upgrading existing turbines for improved efficiency and reduced emissions. These large-scale retrofit and brownfield projects are further boosting turbine demand. National clean energy targets in the region include expanding high-efficiency coal plants and co-firing with ammonia and biomass, which require advanced steam turbine systems. As these countries aim to balance decarbonization with economic growth, the flexibility, scalability, and adaptability of steam turbines make them a cornerstone of future energy strategies, ensuring sustained growth in the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Steam Turbine Market: Competitive Landscape

The global steam turbine market is characterized by the presence of a mix of multinational corporations, regionally dominant players, and specialized engineering firms offering customized turbine solutions. Key industry leaders such as General Electric (GE), Siemens Energy, Mitsubishi Power, Toshiba Energy Systems, and Doosan Enerbility maintain significant market shares through their expansive global project portfolios, proprietary turbine technologies, and lifecycle service offerings. These companies compete on performance efficiency, heat rate optimization, fuel flexibility, and integration with advanced control systems.

Asia-based manufacturers like Harbin Electric, Shanghai Electric, BHEL (India), and Dongfang Electric cater extensively to domestic and emerging markets with cost-competitive, mid-capacity turbines tailored to coal, biomass, and nuclear applications. Many vendors are focusing on the development of high-efficiency supercritical and ultra-supercritical turbines, digital twin-based diagnostics, and retrofitting solutions for aging thermal assets.

Strategic collaborations are increasing across regions, with players partnering on hydrogen-readiness, modular turbine designs, and hybrid fuel applications. Several OEMs are also investing in R&D to align turbines with carbon capture and ammonia co-firing systems. The competitive landscape is further shaped by long-term service agreements (LTSA), public-private nuclear projects, and national energy reforms, making adaptability and innovation crucial for maintaining market position in the evolving energy ecosystem.

Some of the prominent players in the Global Steam Turbine Market are:

- General Electric (GE)

- Siemens Energy

- Mitsubishi Power

- Toshiba Energy Systems & Solutions Corporation

- Bharat Heavy Electricals Limited (BHEL)

- Doosan Škoda Power

- MAN Energy Solutions

- Harbin Electric Corporation

- Dongfang Electric Corporation

- Fuji Electric Co., Ltd.

- Ansaldo Energia

- Shanghai Electric Group

- Elliott Group

- Kawasaki Heavy Industries, Ltd.

- Peter Brotherhood Ltd.

- Triveni Turbine Ltd.

- Beijing Beizhong Steam Turbine Generator Co., Ltd.

- Hangzhou Steam Turbine Co., Ltd.

- Nanjing Turbine & Electric Machinery Group Co., Ltd.

- Other Key Players

Recent Developments in Global Steam Turbine Market

June 2025

- Siemens Energy & Eaton Collaboration at DataCloud Global Congress: Siemens Energy teamed up with Eaton to unveil an integrated gas‑and‑steam turbine power solution tailored for hyperscale data centers. The joint demonstration showcased real‑time AI‑based load balancing, modular turbine skids, and advanced grid‑support features that can be rapidly deployed at edge sites.

- ASME Turbo Expo 2025 (Memphis, June 16–20): The annual conference drew over 2,100 attendees representing manufacturers, utilities, and research institutions. Highlights included presentations on next‑generation blade coatings, multi‑fuel combustion rigs (including hydrogen co‑firing), digital twin performance modeling, and additive‑manufactured turbine components. Siemens Energy, GE Vernova, and Mitsubishi Power led special sessions on decarbonization pathways.

May 2025

- MEGAWatt Expo & Conference (Milan, May): More than 130 exhibitors displayed innovations in high‑pressure steam turbine materials, advanced monitoring sensors, and low‑NOx burner retrofits. A dedicated track examined ultra‑supercritical cycle optimization and the economics of brownfield repowering.

- Fusion Inc. Joins RMS Repair Network: Fusion Inc. was appointed as an authorized service partner within the RMS global repair infrastructure. Their thermal‑spray coating and laser‑cladding capabilities enhance the durability of turbine blades, especially for operators seeking extended overhaul intervals.

March 2025

- IMechE Steam Turbine User Group Conference (London, March 12–13): Hosted by the Institution of Mechanical Engineers, this event convened OEMs, plant operators, and maintenance specialists to share best practices in reliability enhancement, vibration analysis, and digital condition monitoring.

- Goi Thermal Plant Modernization (Japan): GE Vernova and Toshiba Energy completed the retrofit of the Goi Power Station with high‑efficiency H‑Class steam turbines and new heat‑recovery steam generators, boosting the plant’s output by 10% and reducing unit heat rate by 5%.

June 2024

- 17th Thermal Waste Treatment Conference (Poznań): Triveni Turbines showcased its latest back‑pressure turbine modules designed specifically for municipal waste‑to‑energy facilities. The company also unveiled an emissions‑control package integrating SCR and wet‑scrubber systems.

- EDF–GE Steam Power Merger Finalization: EDF concluded its acquisition of GE’s Arabelle steam turbine business, creating a unified nuclear turbine subsidiary. The merger consolidates R&D in high‑capacity reactor turbines and strengthens Europe’s strategic supply chain for new nuclear builds.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 17,545.4 Mn |

| Forecast Value (2034) |

USD 23,129.4 Mn |

| CAGR (2025–2034) |

3.1% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Capacity (Up to 120 MW, 121–350 MW, 351–750 MW, and Above 750 MW), By Type (Condensing Steam Turbines and Non-condensing Steam Turbines), By Design (Reaction Type and Impulse Type Steam Turbines), By Fuel/Heat Source (Thermal Power Plants, Cogeneration Plants, District Heating, Industrial Processes, Nuclear Plants, Waste-to-Energy Plants, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

General Electric, Siemens Energy, Mitsubishi Power, Toshiba Energy Systems, BHEL, Doosan Škoda Power, MAN Energy Solutions, Harbin Electric, Dongfang Electric, Fuji Electric, Ansaldo Energia, Shanghai Electric, Elliott Group, Kawasaki Heavy Industries, Peter Brotherhood, Triveni Turbine, Siemens AG, Beijing Beizhong, Hangzhou Steam Turbine, and Nanjing Turbine & Electric Machinery., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Steam Turbine Market?

▾ The Global Steam Turbine Market size is estimated to have a value of USD 17,545.4 million in 2025 and is expected to reach USD 23,129.4 million by the end of 2034.

What is the size of the US Steam Turbine Market?

▾ The US Steam Turbine Market is projected to be valued at USD 2,213.4 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2,866.2 million in 2034 at a CAGR of 2.9%.

Which region accounted for the largest Global Steam Turbine Market?

▾ Asia Pacific is expected to have the largest market share in the Global Steam Turbine Market with a share of about 66.3% in 2025.

Who are the key players in the Global Steam Turbine Market?

▾ Some of the major key players in the Global Steam Turbine Market are General Electric, Siemens Energy, Mitsubishi Power, Toshiba Energy Systems, BHEL, Doosan Škoda Power, MAN Energy Solutions, Harbin Electric, and many others.

What is the growth rate in the Global Steam Turbine Market in 2025?

▾ The market is growing at a CAGR of 3.1 percent over the forecasted period of 2025.