Market Overview

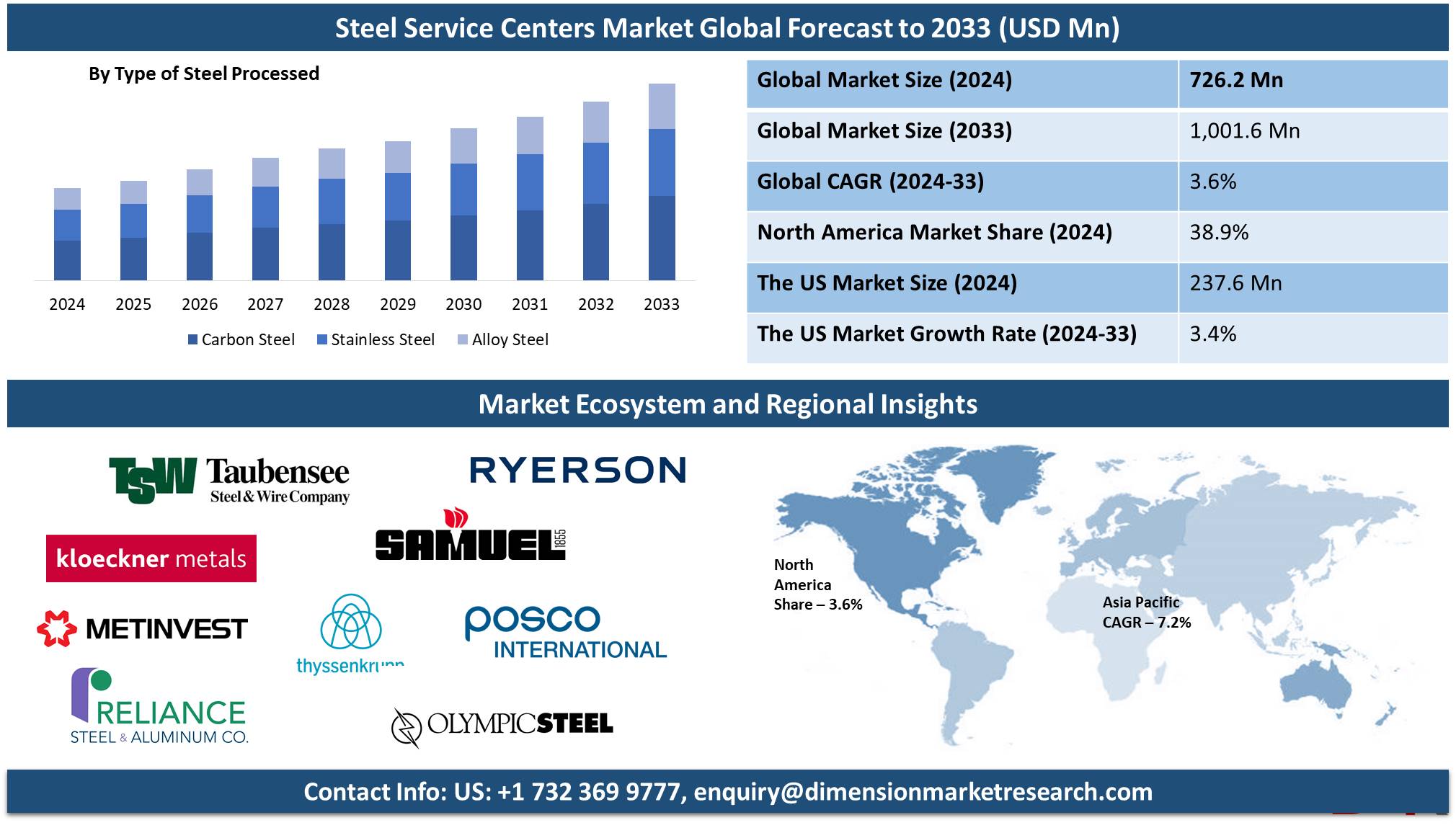

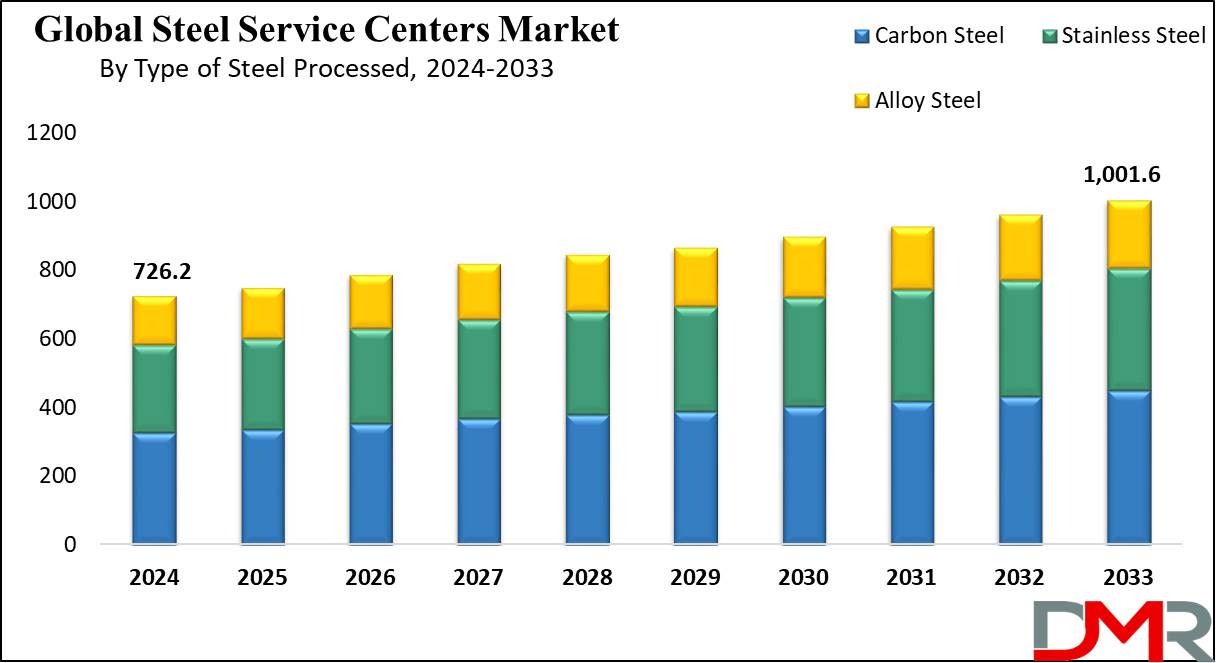

The Global

Steel Service Centers Market size is expected to reach a value of

USD 726.2 million in 2024, and it is further anticipated to reach a market value of

USD 1,001.6 million by 2033 at a

CAGR of 3.6%.

The global steel service center market has grown remarkably within the last few years due to many factors that are now revolutionizing the industry. The steel service centers form a very vital part of supplying customized steel products to several industries, including automotive, construction, and manufacturing. Processing, storage, and distribution of steel products come under the duties of a steel service center, adding value to these by cutting, slitting, and shearing. In turn, good-quality and precision steel parts have warranted an increase in demand that is currently being witnessed for these centers of steel service.

Market trends point toward a greater demand for automation and advanced technologies in steel service centers. Companies are increasingly adopting digital tools to optimize operations, enhance efficiency, and reduce production costs. This trend is likely to continue during the forecast period, as service centers will continue to invest in smart manufacturing solutions and digital transformation to meet the increased demand for steel products.

Another factor contributing to the growth of the market is the rising importance of customized steel solutions, as service centers offer value-added products that meet specific needs in various industries, including automotive, aerospace, and construction.

There is enormous scope for development in the steel service center market. Due to the rise in demand for steel and its products globally, developing an efficient network of distribution or processing has become crucial. In addition, emerging markets like Asia-Pacific and Latin America will provide further opportunities for the establishment of steel service centers, driven by increasing industrialization and infrastructure development in these regions. Other factors that contribute to good market prospects include the increasing green building initiatives and the adoption of high-strength steel in the construction and automotive sectors.

However, several factors will restrain the growth of the market. Price volatility for steel and the raw material base brings complexity to the service centers. It means fluctuating profit margins for them because any change in the price reduces the profit margins of the firm. Besides, complex regulatory processes, especially in the European Union and North America, have significant potential for non-compliance issues to come up from service center operations, hindering business growth. Competition within the service centers is getting more aggressive, with major players investing aggressively in improving technologies and supply chains to be able to hold their current market positions.

The segmentation of the global steel service centers market is based on types of steel processed, services provided, applications, and end-users. Carbon steel has a bigger market share owing to tremendous demand in various industries like automotive and construction. The prominent types of cutting services for personalized steel products include laser cutting, flame cutting, and waterjet cutting. This demand is growing because of the need in industries for pre-fabricated steel components to lower production time and costs. The largest end-user industries for steel service centers have remained automotive, due to greater demands within vehicle manufacturing for lightweight yet durable steel components.

The market size of the steel service centers is anticipated to show stable growth in the forecast period, while North America will continue holding the major market share. The US steel service centers market is likely to stay buoyant with key players like Reliance Steel and Voestalpine investing in expanding their service offerings and operational efficiency.

The market growth is further encouraged by the increasingly high demand for steel products, specifically in the automotive, building, and other manufacturing industries. Statistics have shown that the steel service center market is developing at a stable pace. The growth is foreseen to be driven ahead by factors such as technological advancement, expanding industrial sectors, and increasing demand for steel products.

This global demand for improved and customized quality steel through industries such as construction, automotive, and white goods is expected to drive growth in the global steel service center market. Many players operating in the market are investing aggressively in automating production processes and using advanced technologies and optimized supply chain processes to capture leading positions and ensure total fulfillment of the growing demand for steel products. Thus, while the market presents great opportunities for key expansion, probable challenges include volatile steel price conditions, regulatory hurdles, and emerging markets.

The US Steel Service Centers Market

The US Steel Service Centers Market is projected to be valued at USD 237.6 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 320.5 million in 2033 at a CAGR of 3.4%. The U.S. steel service centers market is an extremely important part of the whole steel supply chain that avails its services to large industries like automotive, aerospace, construction, and manufacturing.

Demand for processed and customized steel products has driven the market since such products are highly crucial to be able to meet the specific requirements of various sectors. Major players in the market, such as Reliance Steel and Voestalpine, are focusing on operational efficiency through

automation and technological advancement to remain competitive in the market.

The automotive industry of the U.S. is considered the largest end-user of steel service centers, which elevates demand for high-strength, low-weight steel components. The trend for growing infrastructure development and an increasing trend toward green building projects further contribute to the growth of the market. This is because industries try to cut production time and consequently costs by demanding more and more steel products of good quality, as well as services such as cutting, slitting, and shearing.

The U.S. market for steel service centers is expected to experience stable growth in the forecast period due to increasing industrialization and technological advancement in the steel industry. Moreover, the demand for localized distribution networks and value-added steel products in the U.S. further supports the growth of steel service centers. Notwithstanding some challenges related to fluctuating steel prices, the U.S. market is very well positioned to retain an enviable market position in the global market.

Key Takeaways

- Global Market Share: The Global Steel Service Centers Market size is estimated to have a value of USD 726.2 million in 2024 and is expected to reach USD 1,001.6 million by the end of 2033.

- The US Market Share: The US Steel Service Centers Market is projected to be valued at USD 237.6 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 320.5 million in 2033 at a CAGR of 3.4%.

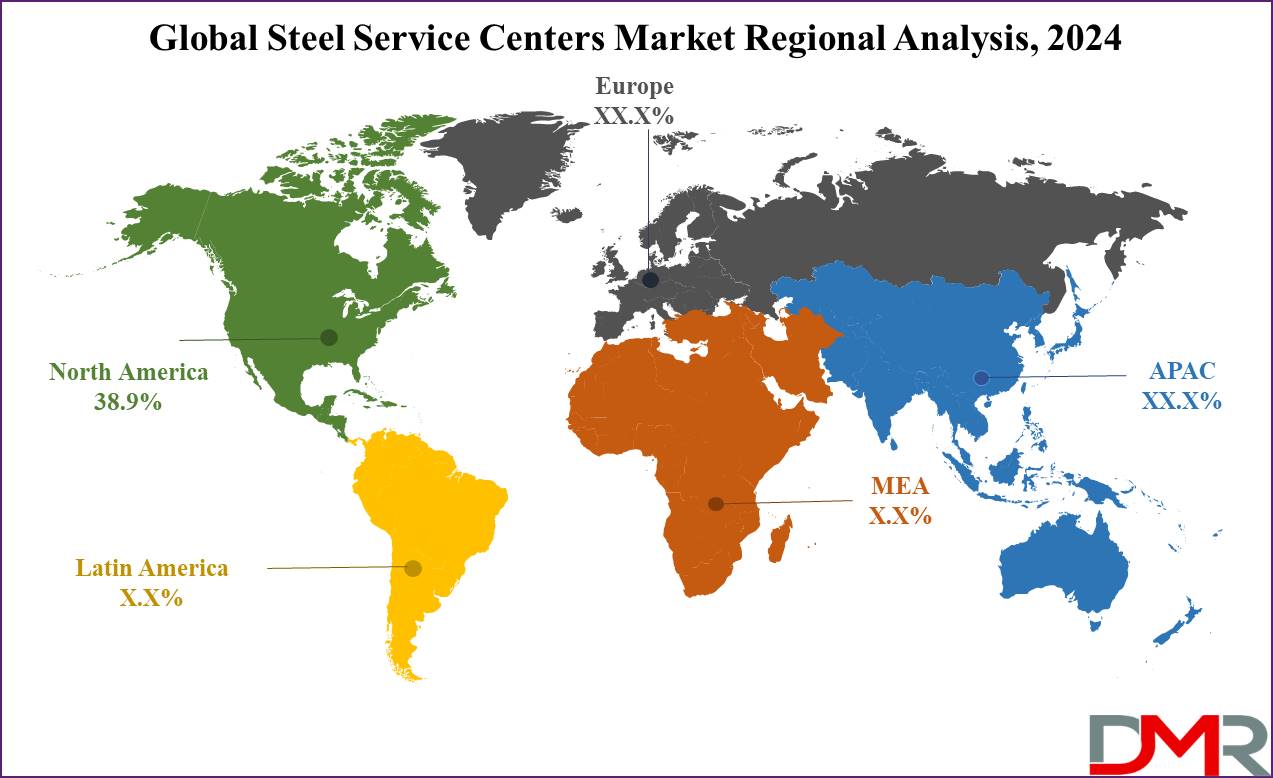

- Regional Analysis: North America is expected to have the largest market share in the Global Steel Service Centers Market with a share of about 38.9% in 2024.

- Key Players: Some of the major key players in the Global Steel Service Centers Market are Steel & Aluminum Co., Samuel, Son & Co., Limited, Ryerson Holding Corporation, Tata Steel Processing and Distribution Limited, Steel Warehouse Company LLC, and many others.

- Global Growth Rate: The market is growing at a CAGR of 3.6 percent over the forecasted period.

Use Cases

- Automotive Industry: Steel service centers offer custom steel products to automotive manufacturers by way of cutting, slitting, and processing, with the industry's need for high-strength, lightweight components in mind.

- Construction: It provides fabricated steel to construction through steel service centers; these also extend ancillary services for cutting, shearing, and bending to suit exactly the needs of builders and contractors for the development of infrastructures.

- Aerospace: Steel service centers provide this industry with unique and particular types of steel. Besides the required quality, cutting, or processing, steel service center processing has a place among aircraft and spacecraft construction.

- Heavy Machinery Manufacturing: Steel service centers provide for heavy machinery manufacturers, steel parts for construction, and mining equipment. Services include slitting, processing, and the delivery of high-quality and enduring products.

Market Dynamic

Trends in the Global Steel Service Centers Market

Automation and Digital TransformationThe increasing reliance on automation and digital tools is transforming the operations of steel service centers. Advanced manufacturing technologies such as AI-driven systems, robotics, and IoT devices enable the centers to improve production speed, accuracy, and operational efficiency as a whole.

Automation reduces human error, optimizes resource allocation, and enables service centers to meet the rising demand for high-quality, customized steel products. Besides, digitalization helps track inventory, production processes, and quality control more precisely to deliver consistently to industries dealing with the automotive, construction, or energy sectors.

Sustainability Initiatives

The development of sustainability initiatives has taken center stage for steel service centers amid increasing environmental considerations and pressures from regulatory bodies. Integration of energy-efficient technologies with recyclable steel is helping these companies in reducing their footprints. Many centers optimize energy use during production through the adoption of renewable energy sources, minimizing waste to ensure environmental friendliness in practice.

This trend goes hand in hand with the general trend in the world toward sustainable manufacturing, addressing the need and desire of both consumers and regulators for greener industrial processes. Moving toward sustainable practices helps organizations address compliance matters and also appeals to environmentally conscious customers.

Growth Drivers in the Global Steel Service Centers Market

Rising Demand for Steel Products

The increasing demand for steel products, fueled by industries such as the automotive, construction, infrastructure, and manufacturing sectors, has acted as a major growth factor for the service centers in steel. Rapid urbanization, infrastructural development, and industrialization are some of the major factors responsible for an increased requirement of steel products throughout the world for producing various durable and quality components.

In turn, the role of steel service centers becomes very important given processing and customizing the steel products to meet those specific requirements. As more projects and industries depend on specialized steel, the demand for efficient and reliable processing services is continuously growing.

Technological Advancements

Tremendous growth in technology for processing steel has been observed. The advances include more sophisticated ways of cutting, shearing, and welding to perform various functions, while rapid automation and precision manufacturing of laser cutting, high-definition plasma, and water jet cutting have made service centers produce for the rise in demand for quality and custom-manufactured steel parts.

In addition, artificial intelligence and machine learning integrated into the quality control processes result in improved accuracy in the production of manufactured components. Besides efficiency in operation, technological advancement lets steel service centers meet the requirements of particular industry sectors needing very precisely and complicatedly produced steel.

Growth Opportunities in the Global Steel Service Centers Market

Expansion into Emerging Markets

As many developing economies, particularly from the Asia-Pacific, Latin America, and parts of Africa, embark on industrialization, opportunities for steel service centers have increased a lot. This is due to the growing demand for steel products in these regions, which are recording infrastructural development and growth in their industrial sectors.

Service centers in steel will be able to set up operations, especially in such locations where growth in the customer base will develop from automotive, and construction to energy, among other sections. Further, low labor costs and friendly trade policies allow further benefits in scaling up service operations to such regions.

Integration of Additive Manufacturing

In this regard, 3D printing and additive manufacturing also give additional advantages to service centers dealing in steel. It enables very complicatedly designed pieces of steel components to a high degree of accuracy and specific industries such as aerospace, automotive, and medical devices.

Additive manufacturing allows the making of prototypes, small batches, and even geometries that might be very hard or impossible in traditional ways. As the demand for tailored solutions increases in ever-more industries, those steel service centers that adapt to this change will find themselves meeting the evolving needs of their customers.

Restraints in the Global Steel Service Centers Market

Fluctuating Steel Prices

Fluctuating steel prices, due to variables such as changes in the costs of raw materials, chain disruptions, and changes in international demand for finished products, are always present. Such fluctuations introduce the presence of uncertainty in the performance of a steel service center through inconsistent profit margins and make pricing strategy more difficult to implement.

This volatility might turn into an inability to stay competitive for customers and, simultaneously, provide profitability for the service. Besides, cost uncertainty may dampen the investment in new technology or expansion plans and, therefore, affect the long-run growth prospects of the industry.

Regulatory Compliance

Steel service centers, particularly those operating in regions such as North America and Europe, are under strict environmental and safety regulations. Compliance with laws related to emissions, waste management, and occupational health and safety can add to operational costs and complexity.

These can further lead to increased expenses related to the implementation of necessary equipment, training of staff, and compliance with ever-evolving environmental standards. Furthermore, the failure to meet the standards laid down by regulators could imply sanctions, legal liabilities, and a loss of reputation, thereby making it a serious challenge to the companies concerned.

Research Scope and Analysis

By Type of Steel Processed Analysis

Carbon steel is projected to dominate the global steel service centers market in this segment as it will hold 44.9% of the market share by the end of 2024 carbon steel serves a variety of industries in more ways, the global steel service centers market is predominantly dominated by the use of the same.

Additionally, because sectors such as automotive and construction exert overwhelming demand for products made from carbon steel, the commodity has greater exposure to all forms of manufacture. To strike an optimal balance on strength and durability without driving up cost unnecessarily, the element of carbon steel seems so far, the best that generally meets all of the specific tastes of such clients.

In particular, the demand for carbon steel has been driven by automotive industries, with this material being widely utilized in car components such as chassis, body panels, and structural parts. The demand for high-strength carbon steels ordered custom and processed according to individual specifications has grown with the trend for making lighter vehicles.

Besides, carbon steel is also preferred by steel service centers due to its ease of processing through various services such as cutting, slitting, and shearing. In this case, the wide application, versatility, and easy processing make carbon steel the dominant type of steel being processed in a steel service center. From manufacturing reinforcement bars and structural beams to the making of pipes, the uses of carbon steel vary in construction and thus are an essential part of infrastructure projects. Its resistance to bad environmental conditions and cost-effectiveness make it dominant in the market.

By Type Analysis

Cutting is projected to dominant service in the steel service center market as it holds the highest market share in 2024. Cutting remains a dominant service in the steel service center market because it is an important aspect of making customized steel products that can meet the various requirements of different industries. Steel service centers employ several cutting techniques in processing steel to the correct dimensions, including laser cutting, flame cutting, and waterjet cutting.

Such services are highly essential in the automotive, construction, and manufacturing industries that have various needs for steel components of different shapes and sizes. The automotive industry is another driver for cutting services since lightweight but high-strength components have to be precisely fitted according to the design requirements of modern vehicles. Cutting services help automotive manufacturers to go through the production cycle with ease while reducing material wastages; hence, it is an essential offering on the part of the steel service center.

In construction, too, the service of cutting is a highly essential one, where steel components are being used for buildings, bridges, and infrastructure projects that require cuts according to unique designs and specifications. Thus, the facilities of cutting services have been utilized at steel service centers to achieve components that meet structural integrity and safety.

Efficiency and cost savings are also assured by cutting services to the manufacturers. Processing steel into required sizes and shapes eliminates extensive on-site processing, hence reducing lead times and lowering production costs. This continues to drive the dominance of cutting services in the steel service centers market due to the growing demand for customized, high-quality steel products.

By Service Analysis

Processing services are anticipated to command the service segment with the major market share in 2024. Because of this, the need for processing services by steel service centers is high to convert raw steel into finished products to meet specific customer requirements. The importance of the processing services arises from their very nature of providing value-added solutions to industries to economize the usage of material and to rationalize the production processes.

Cutting, slitting, shearing, bare an ending, and coating are the services included in most of the processing orders; all these add value to steel in preparing materials for different applications. Since their use is critical in such highly demanding industries as automotive and aerospace, construction also bases its building on the necessary quality of processed steel.

This ensures that components currently under manufacture are made according to highly specific specifications, thus adding to the overall productivity and quality of the finish or manufactured good. For example, when this aspect applies to manufacturing within the automotive industry, high-quality and safe end products result. In construction, the uses of processed steel include beams, structural components, and reinforcement bars, for which customization and precision are highly needed.

This sector, by carrying loads of advantages concerning cost saving, is also a result of processing services. By offering the processing of steel before its delivery, service centers help customers reduce waste, minimize inventories of excess material, and avoid on-site processing costs.

The increased emphasis on just-in-time manufacturing and lean production techniques has served to heighten demand for processing services as industries pursue ways to reduce lead times while improving overall operational efficiency. The versatility and importance of processing services to specific industrial needs sustain their dominance in the market, thereby making them the key offering for steel service centers globally.

By Application Analysis

Steel service center companies are primarily dominated by metal fabrication and machine shops due to the high demand for processed and customized steel and related materials according to very precise specifications. These industries are heavily dependent on steel service centers for their supply of processed and fabricated steel that will be transformed into finished products.

Metal fabrication deals with shaping, cutting, and assembling steel into parts and structures. Service centers offer many services for fabricating metal, such as laser cutting, slitting, and shearing. The fabrication of metal calls for a huge amount of steel components with very high accuracy and specific specifications.

These service centers provide a wide array of value-added steel products, such as beams, plates, and tubes for use in machinery, structural frames, and equipment. The versatility of steel in the fabrication process makes it a vital material in many industries, including manufacturing, aerospace, and construction.

Machine shops, too, have their part in driving consumption of processed steel, for by definition they are involved in the machining of semi-finished metal parts into finished good products. They place orders for steel products available without delay pre-cut into sizes appropriate for their eventual use, and ready for added machining.

Steel service center processing and fabrication provide immediately available supplies of steel so that machine shops can use steel meeting industry standards relating to performance and durability in their product applications. Generally, the dominance in applying steel service centers has come from metal fabrication and machine shops, driven by specific needs for customized steel parts to meet the particularities of many industrial segments.

By End User Analysis

The automotive industry is the dominant end-user of steel service centers, accounting for the highest demand for processed and customized steel products. In vehicle manufacturing, steel is one of the most important materials used in making structural components, chassis, body panels, and other vital parts. The automotive sector is the major end-user of various precision steel processing services provided by service centers. This contributes towards meeting the growing demand from the industry for a high strength-to-weight ratio, durable materials that contribute to safety and performance, and even better fuel economy.

The dominating position of AHSS in automotive can be attributed to one of the major ongoing trends in the automotive sector, lightweight vehicle manufacturing. The application of AHSS among automakers has gained major traction to achieve less weight with maintained structural strength. Material service centers support tailored solutions about AHSS to ensure that components meet the required safety standards and performance requirements. It also provides customized cutting, slitting, and shearing to support automakers with smooth production and minimum waste of material.

The trend of the automotive sector toward electric vehicles and autonomous vehicles is further raising demand for special steel products. EV, in particular, requires lightweight steel solutions to improve energy efficiency and range. As automakers continue to innovate, adapting to changing consumer tastes and preferences, demand will continue to rise for special steel components, making the automotive sector the leading end-user of the steel service centers.

Consequently, due to constant efforts related to innovation, safety, and efficiency by the automotive industry, this is certainly an ongoing scenario wherein the contribution of service centers supplying steel becomes significant for continuously updated material and process demands.

The Steel Service Centers Market Report is segmented on the basis of the following:

By Type of Steel Processed

- Carbon Steel

- Stainless Steel

- Alloy Steel

By Type

- Cutting

- Miller Cutting

- Plasma Cutting

- Laser Cutting

- Plate Processing

- Plate Burning

- Tee-Splitting

- Cambering

- Forming

- Finishing

- Others

By Service

- Processing Services

- Slitting

- Shearing

- Cutting-to-Length

- Blanking

- Pickling

- Distribution Services

- Inventory Management

- Warehousing

- Logistics

By Application

- Metal Fabrication and Machine Shops

- Heavy Machinery and Equipment

- Consumer Appliances and Electronics

- HVAC Systems

- Food Processing and Agriculture Equipment

- Oil and Gas Infrastructure

- Other Application

By End-User

- Automotive

- Construction and Infrastructure

- Energy (Oil & Gas, Renewable Energy)

- Industrial Machinery

- Consumer Goods and Appliances

- Aerospace and Defense

- Transportation and Logistics

Regional Analysis

The North American region is projected to dominate the global steel service center market to dominate

38.9% of market share by 2024, due to several factors contributing to its strong industrial base, advanced manufacturing capability, and large-scale demand for steel products. The U.S. is home to a highly developed manufacturing and automotive industry, both of which are major consumers of processed steel.

The automotive industry, being one of the largest steel-consuming sectors, ensures demands for value-added steel products with high qualitative specifications. This has positioned steel service centers across North America to offer tailored solutions to cater to the needs of such sectors through precision cutting, slitting, and other associated processing services.

The domination of North America in other industries such as aerospace, construction, and the making of heavy machinery is complementing the growth of the automotive industry. Advanced steel processing techniques in the region have supported its industrial strength with state-of-the-art technology for processing such as laser cutting and advanced automation systems which enable steel service centers to deliver quality and custom value products.

A good infrastructure in place, wherein a proper network of supply chains and distribution channels are in place, ensures that the North American steel service center market is in a position to deliver efficiently to its clients. This can also be attributed to the high demand for high-strength, lightweight, and environmentally friendly steel products in the region, due to its growing emphasis on sustainability and green building initiatives, which continues to drive the market.

It also sets up a competitive advantage for North America, especially as key industry players, including Reliance Steel and SSAB, invest heavily in automation and other technological innovations, besides expanding geographically to keep ahead.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global steel service center market is competitive and hosts several players who have joined the competition based on technological advancement, strategic partnership, and geographical expansion. The prominent players in the market include companies such as Reliance Steel & Aluminum Co., Voestalpine AG, and SSAB which drive innovation and excellence within their operations.

Reliance Steel is one of the major players in the US market with a significant global presence. They have an extensive network of steel service centers in North America and Europe. Its product quality has earned its position as one of the largest quality steel companies, hence helping retain its position within the market. Besides, Reliance Steel has invested heavily in automation and digital technologies to enhance operational efficiency and customer satisfaction.

Voestalpine AG is one of the leading European players and an important factor in the market for steel service centers, especially for automotive and construction applications. Advanced techniques of steel processing and adherence to sustainability practices are some of the reasons contributing to competitive advantage.

Its strategic acquisitions and partnerships allow it to expand its service offerings and geographical reach. The leading Swedish manufacturer, SSAB, has made its name in producing high-strength steels with advanced processing. It holds a strong position in the automotive and construction sectors and tries to achieve a differentiation factor in the market by pursuing sustainable steel production.

Also, competition continues to be very aggressive, since there is the presence of regional players with a focus on key markets. The players in general gain localized know-how and advantage of costs to meet customer requirements at home. All in all, competition is going to grow along with the growing demand for value-added steel products.

Some of the prominent players in the Global Steel Service Centers Market are

- Reliance Steel & Aluminum Co.

- Samuel, Son & Co., Limited

- Ryerson Holding Corporation

- Thyssenkrupp Materials Services GmbH

- Tata Steel Processing and Distribution Limited

- Steel Warehouse Company LLC

- Kloeckner Metals Corporation

- POSCO International Corporation

- Metinvest Group

- Olympic Steel, Inc.

- Taubensee Steel & Wire Company

- Alro Steel Corporation

- Other Key Players

Recent Developments

- SSAB’s Sustainability Commitment: In 2024, SSAB announced its commitment to achieving carbon-neutral steel production by 2035, further solidifying its position in the market as a leader in sustainable steel manufacturing.

- Reliance Steel’s Expansion: In 2023, Reliance Steel expanded its footprint by acquiring several steel service centers in Asia and Latin America, aiming to enhance its presence in emerging markets.

- Voestalpine’s Technological Upgrades: In 2022, Voestalpine AG invested in advanced cutting technologies to improve processing accuracy and speed, reducing lead times and increasing customer satisfaction.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 726.2 Mn |

| Forecast Value (2033) |

USD 1,001.6 Mn |

| CAGR (2024-2033) |

3.6% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 237.6 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type of Steel Processed (Carbon Steel, Stainless Steel, Alloy Steel), By Type (Cutting, Plate Processing, Forming, Finishing, Others), By Service (Processing Services, Distribution Services), By Application (Metal Fabrication and Machine Shops, Heavy Machinery and Equipment, Consumer Appliances and Electronics, HVAC Systems, Food Processing and Agriculture Equipment, Oil and Gas Infrastructure, Others), By End-User (Automotive, Construction and Infrastructure, Energy, Industrial Machinery, Consumer Goods and Appliances, Aerospace and Defense, Transportation and Logistics) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Reliance Steel & Aluminum Co., Samuel, Son & Co., Limited, Ryerson Holding Corporation, Thyssenkrupp Materials Services GmbH, Tata Steel Processing and Distribution Limited, Steel Warehouse Company LLC, Kloeckner Metals Corporation, POSCO International Corporation, Metinvest Group, Olympic Steel, Inc., Taubensee Steel & Wire Company, Alro Steel |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Steel Service Centers Market size is estimated to have a value of USD 726.2 million in 2024 and is expected to reach USD 1,001.6 million by the end of 2033.

The US Steel Service Centers Market is projected to be valued at USD 237.6 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 320.5 million in 2033 at a CAGR of 3.4%.

North America is expected to have the largest market share in the Global Steel Service Centers Market with a share of about 38.9% in 2024.

Some of the major key players in the Global Steel Service Centers Market are Reliance Steel & Aluminum Co., Samuel, Son & Co., Limited, Ryerson Holding Corporation, Thyssenkrupp Materials Services GmbH, Tata Steel Processing and Distribution Limited, Steel Warehouse Company LLC, and many others.

The market is growing at a CAGR of 3.6 percent over the forecasted period.