Market Overview

The Global

Sulfuric Acid Market is projected to value

USD 14.0 billion in 2025 which is further anticipated to cross the threshold and reach a market value of

USD 20.1 billion by the end of 2034 at a

CAGR of 4.2%.

The global sulfuric acid market is witnessing steady growth, driven by its widespread applications in various industries, including fertilizers, chemicals, metal processing, and petroleum refining. The market is expected to expand due to increasing demand for phosphate fertilizers, which heavily rely on sulfuric acid for phosphoric acid production. China and India are key contributors to this growth, as their governments prioritize food security and infrastructure development. The growing focus on sustainable manufacturing, including sulfuric acid recycling from smelters, is also reshaping the industry landscape.

One of the leading sulphuric acid market trends includes the use of spent acid recovery systems that minimize the environment and the cost of production. Most industries are shifting toward the usage of the closed-loop system that maximizes efficiency and adheres to strict emission regulations. The development of sulphuric acid catalyst technology also increases the chemical synthesis yield rates further expanding the scope of the sulphuric acid market. Parallel research in the chemical sector is also driving innovations involving related compounds like malonic acid and

benzoic acid, which often share processing infrastructure and raw material streams with sulfuric acid facilities.

Economies with a large manufacturing sector such as the US and Germany are making investments in cutting-edge methods of production that maximize efficiency and minimize wastage. Higher investment in the green hydrogen sector that has sulphuric acid as a byproduct further increases the long-term growth of the sulphuric acid market. One of the greatest prospects in the market is the growing electric vehicle (EV) sector.

The fast-paced development of battery manufacturing has a crucial application of sulfuric acid in the manufacturing of the widely used commercial and industrial vehicles' batteries of the lead-acid variety. Sulfuric acid demand in the treatment of wastewater also continues to grow with the strict environmental regulations in place in the entire continent of North America and the continent of Europe. In such wastewater treatment, complementary agents like

hypochlorous acid are also employed for disinfection and purification alongside sulfuric acid-based neutralization techniques.

The pharmaceutical sector also has a widening opportunity with the use of sulfuric acid in drug formulation and the making of active pharmaceutical ingredients (API). Those companies that specialize in the provision of high-purity sulfuric acid in the use of electronics and semiconductors stand a good chance of tapping the expanding digitalization drive.

Despite strong demand, the sulfuric acid market faces several challenges, including supply chain disruptions and fluctuating raw material prices. Sulfur, a key feedstock, is mainly sourced from petroleum refining and natural gas processing, making its availability subject to fluctuations in the oil and gas sector.

Additionally, stringent regulations regarding sulfur dioxide emissions have led to increased compliance costs for producers. Geopolitical tensions and trade restrictions also impact global sulfuric acid trade flows, creating supply uncertainties for end-users. Companies are investing in sustainable acid production and circular economy models to counteract these restraints.

Demand will be supported by the growth of industrials in emerging economies and investment in agrochemicals. The push toward the recovery of acid sustainably and the application of state-of-the-art technologies of production will sustain the market. The use of the acid beyond the traditional industries will further enhance the application of the acid in future industries.

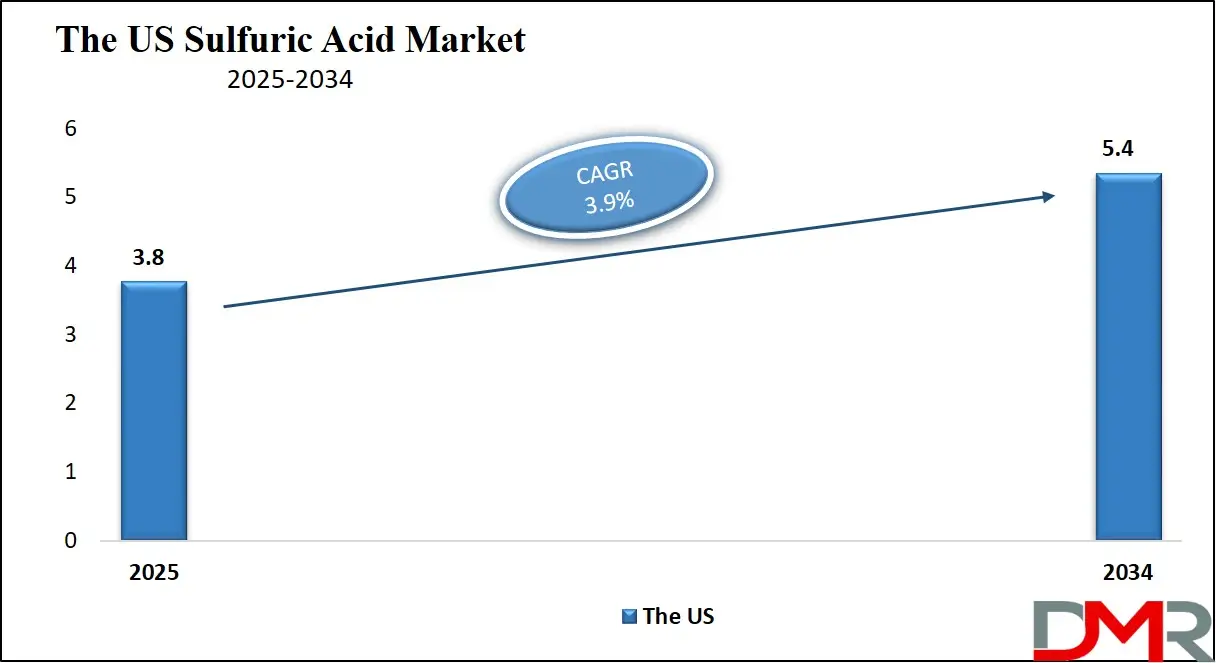

The US Sulfuric Acid Market

The US Sulfuric Acid Market is expected to be valued at USD 5.4 billion in 3034 from a base value of USD 3.8 billion in 2025 at a CAGR of 3.9%.

The US market of sulfuric acid is a major part of the world business, supported by a strong demand in agriculture, chemical manufacturing, and industrial processing. The US is among the largest users of sulfuric acid with a demand of over 40 million metric tons per year. The major driver of demand comes from the fertilizer sector with the US possessing large arable land that needs the use of phosphorus-based fertilizer.

The availability of large chemical companies also increases demand for the use of sulfuric acid in the manufacturing of synthetic chemicals, dyes, and pigments. The petroleum refining sector also plays an integral part in the use of sulfuric acid in alkylation units in the refining of gasoline with a high octane.

One of the strengths of the US sulfuric acid market lies in the highly developed infrastructure and technology of acid recovery systems within the country. The US has several industrious facilities with spent acid regeneration facilities that minimize waste and maximize sustainability. The US also has an abundance of sulfur feedstock with petroleum refining and natural gas processing. The US has a strong regulatory system that maintains the environment and at the same time encourages the development of innovations in green acid manufacturing.

Demographically, the US has a diversified and large industrial base with heavy demand arising in states that include Texas, California, and Louisiana which host large chemical and refining activities. The push toward clean energy sources has also been a factor in the increased use of sulfuric acid in battery recovery and semiconductor manufacturing. Through additional investment in green technologies and the development of the industry, the US sulfuric acid market will be expected to witness steady growth in the upcoming years.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Global Sulfuric Acid Market: Key Takeaways

- Global Market Value Insights: The Global Sulfuric Acid Market size is estimated to have a value of USD 14.0 billion in 2025 and is expected to reach USD 20.1 billion by the end of 2034.

- The US Market Value Insight: The US Sulfuric Acid Market is projected to be valued at USD 3.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 5.4 billion in 2034 at a CAGR of 3.9%.

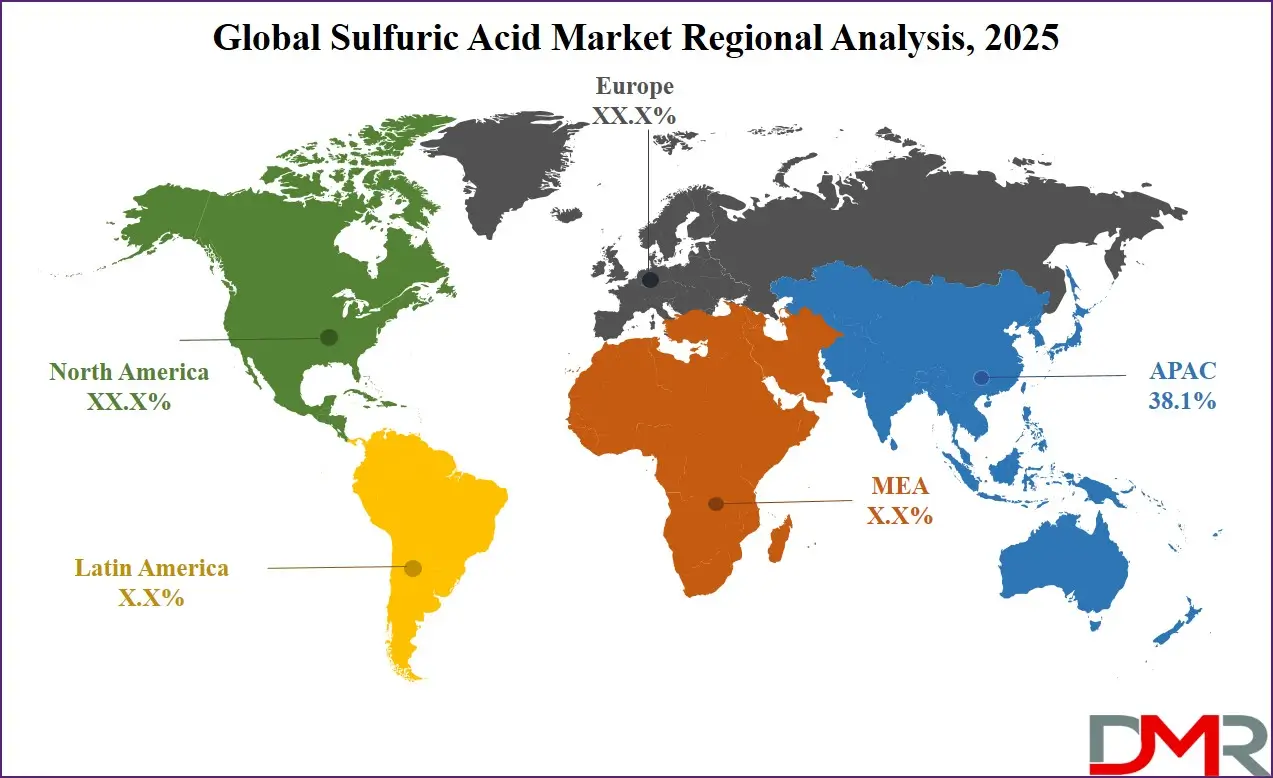

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Sulfuric Acid Market with a share of about 38.1% in 2025.

- Key Players: Some of the major key players in the Global Sulfuric Acid Market are The Mosaic Company, BASF SE, OCP Group, Chemtrade Logistics Income Fund, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 4.2 percent over the forecasted period of 2025.

Global Sulfuric Acid Market: Use Cases

- Fertilizer Production: Sulfuric acid has a major application in phosphorus fertilizer production in the conversion of the rock phosphorus to phosphoric acid. This helps world agriculture output to enhance the fertility of the soil and the ensuing harvest of the cultivated crops.

- Metal treatment: The acid has a large application in the processes of ore leaching and pickling of the non-ferrous and steel metal industries. The acid prevents impurities and rust layers from adhering to metal surfaces and therefore improves the final product quality and performance.

- Petroleum refining: Sulfuric acid has a large application in alkylation, a refining process that raises the octane rating of gasoline. Sulfuric acid also has an application in removing impurities and making the fuel clean and environmentally friendly.

- Wastewater treatment: Sulfuric acid is applied by factories to acidify alkaline wastewater and balance the pH in treatment plants. This ensures the required standards and prevents the emission of toxic chemicals into the source of the water.

- Battery Production: Lead acid batteries that power automobiles and power supplies in the industrial sector use sulfuric acid as an electrolyte. Its use in the field of energy storage is gaining prominence with the development of the demand for green power and electric automobiles.

Global Sulfuric Acid Market: Stats & Facts

- China Sees Sulfuric Acid Production Growth: The National Bureau of Statistics of China estimates China's sulfuric acid production had increased to 95.05 million metric tons by 2022, an increase of 1.3% from 93.83 million tons produced in 2021.

- China Becomes Largest Fertilizer Producer: China's National Bureau of Statistics reported that production of nitrogen, phosphate, and potash fertilizers totaled 55.7 million tons in 2022 compared with 55.44 million tons produced in 2021.

- Indian Fertilizer Production Growth: According to India's Department for Promotion of Industry and Internal Trade (DPIT) report, India's annual fertilizer production growth reached 9.6% last year, one of its highest ever recorded in previous years.

- New Sulfuric Acid Plant in India (2023): Coromandel International, India's premier private phosphatic fertilizer company, inaugurated a new sulfuric acid facility in Visakhapatnam last October at an investment of USD 40.0 Million that will produce 1,650 tonnes per day (MTPD).

- Sulfuric Acid Production for Pharmaceutical Manufacturing: Sulfuric acid plays a pivotal role in the creation of raw materials used by the pharmaceutical industry. According to Japan's Ministry of Health, Labor, and Welfare, Japanese pharmaceutical imports rose to JPY 3.41 trillion (USD 0.023 trillion) in 2022 from JPY 3.0 trillion in 2021.

- Sulfuric Acid in Automotive Production: Lead-acid batteries used in vehicles rely heavily on sulfuric acid; South Korea produced 3.76 million vehicles last year alone and this led to increased demand for sulfuric acid-containing batteries.

- Sulfuric Acid Application in Agriculture & Fertilizers: Around half of global sulfuric acid production is used in agriculture, primarily as fertilizers like superphosphate of lime and ammonium sulfate. According to China's National Bureau of Statistics, China produced 9.84 million metric tons of phosphate fertilizer during 2022.

- Agriculture & Fertilizer Demand in India and the US: Food and Agriculture Organization (FAO) reports that India and the US are both experiencing strong agricultural growth, leading to greater fertilizer demand in coming years.

- Global Ammonia, Phosphoric Acid, and Potash Production Capacity (2022): The Food and Agriculture Organization (FAO) reported that in 2022 global production capacity for ammonia, phosphoric acid, and potash reached 318,652 metric tons, fuelling rising sulfuric acid demand.

- Agriculture Development in Latin America & the Caribbean: According to the OECD and FAO, agricultural and fisheries production in Latin America and the Caribbean is projected to increase by 17.0% between 2018-2028, where 53.0% of this projected increase comes from crop production alone resulting in increased fertilizer demand and sulfuric acid usage.

Global Sulfuric Acid Market: Market Dynamic

Driving Factors in the Global Sulfuric Acid Market

Rising Agricultural Demand for Phosphate FertilizersThe primary driver of sulfuric acid demand is its extensive use in phosphate fertilizer production, particularly in the synthesis of phosphoric acid. As global food demand increases due to population growth, the agricultural sector is under pressure to enhance crop yields through efficient fertilization. Countries such as India, Brazil, and China are investing heavily in phosphate-based fertilizers to improve soil fertility and ensure food security. Additionally, government-backed agricultural initiatives and subsidies in emerging economies are further fueling sulfuric acid consumption. This steady demand from the agrochemical sector continues to be a key catalyst for market expansion.

Expanding Industrialization in Emerging Economies

Developing countries' rapid industrialization in the Asian-Pacific, Latin America, and African nations is significantly impacting the demand for sulfuric acid. The metal processing, chemical synthesis, and petroleum refining activities of the countries of the respective regions are expanding with the growth of the infrastructure and manufacturing facilities and investment boost. Sulfuric acid has a large application in the application of steel and non-ferrous metals in Vietnam, Indonesia, and India with a demand boost in them. Expansion of the countries' industrial estates also stimulates the demand for acid in the treatment of wastewater and further stimulates the growth of the market.

Restraints in the Global Sulfuric Acid Market

Volatility in Sulfur Feedstock Supply and Pricing

The Availability and price of the primary raw material that goes into the making of the acid bear a direct correlation with the petroleum and natural gas industry. Since petroleum refining and natural gas processing produce the bulk of the world's sulfur as a byproduct, the refining and world crude price movements drive the availability of the commodity. Shortages of the sulfur feedstock occur if the output of the oil reduces due to geopolitical factors, green and clean regulations, and economic recession and trigger price volatility of the acid. The volatility becomes an issue with the acid manufacturer and the ultimate users who require a constant availability and economic output of the acid.

Environmental Regulations on Sulfur Dioxide EmissionsStringent environmental regulations aimed at reducing sulfur dioxide emissions pose a significant challenge for sulfuric acid producers. Governments worldwide have implemented strict emission control policies, requiring companies to invest in costly pollution control technologies. Compliance with these regulations increases production costs, which can impact market competitiveness, particularly for small and medium-sized manufacturers. Additionally, restrictions on acid transportation and storage further complicate supply chain logistics. While sustainable production methods, such as acid regeneration and emission capture technologies, offer solutions, their implementation requires significant capital investment, limiting the entry of new market players.

Opportunities in the Global Sulfuric Acid Market

Expansion of Semiconductor and Electronics ManufacturingIncreasing demand for ultra-purified sulfuric acid in the production of semiconductors and electronics also presents a profitable opportunity for business growth. Sulfuric acid plays a large part in the etching and cleaning of wafers during the production of a microchip that goes into an electrical device. Sulfuric acid supplies will benefit from the widening semiconductor manufacturing facilities across the globe, namely the US, Taiwan, and South Korea. In addition, with the exponential increases in demand for consumer electronics, 5G network buildout, and IoT devices, the demand for ultra-purified sulfuric acid will also continue expanding and present a large business opportunity for the manufacturer. Benzoic acid and

malonic acid also play a supporting role in some microelectronic chemical processes and may experience parallel growth.

Growing Adoption of Sulfuric Acid in Water Treatment Applications

With the rising issues of global water shortages, industries and municipalities alike are focusing on wastewater treatment technologies. Sulfuric acid treats alkaline water and purifies it of impurities and therefore becomes a critical part of industrial and municipal treatment facilities. Stringent regulations regarding the discharge of industrial wastewater within the government of North America and the government of Europe are forcing the use of sulfuric acid treatment technologies within the industries. The need for desalination in arid countries of the Middle East and Africa also further increases the demand for the use of sulfuric acid in the treatment of water.

Trends in the Global Sulfuric Acid Market

Increasing Adoption of Spent Acid Regeneration Technologies

The sulfuric acid market is witnessing a growing emphasis on sustainability, with industries increasingly adopting spent acid regeneration technologies. These systems allow industries, particularly those in chemical manufacturing, metal processing, and petroleum refining, to recover and reuse sulfuric acid, significantly reducing waste and production costs. The rising enforcement of stringent environmental regulations regarding sulfur dioxide emissions has driven industries to invest in spent acid regeneration plants, ensuring compliance while maintaining operational efficiency.

Countries such as the United States, Germany, and China are leading the shift toward sustainable acid production by implementing circular economy strategies, which further improve sulfuric acid supply stability. This trend is expected to gain momentum as industries seek to minimize their carbon footprint while enhancing resource efficiency.

Growing Integration of Sulfuric Acid in Electric Vehicle Battery Production

With the rapid development of the electric vehicle (EV) space, demand for the application of sulfuric acid in battery manufacturing has increased. Even with the predominance of use of the lithium-ion batteries in the EV sector, use of the lead-acid batteries remains in commercial and industrial vehicles' auxiliary power and reserve needs.

Sulfuric acid also plays an integral role in the recovery of spent lead-acid batteries, in harmony with the world's move toward green power sources. Capital-spending countries that include the US, China, and a few EU countries also moving toward highly efficient battery recovery processes that use sulfuric acid. The use of sulfuric acid in battery manufacturing and recovery will also expand with the world's move toward electrification at an accelerated rate, and this will be a long-term growth opportunity for the sector.

Global Sulfuric Acid Market: Research Scope and Analysis

By Raw Material

Elemental sulfur is projected to be the dominant raw material in the sulfuric acid market as it holds 36.0% of the market share in 2025 due to its cost-effectiveness, high availability, and lower environmental impact compared to alternative sources like pyrite ore and base metal smelters. More than 80% of global sulfuric acid production relies on elemental sulfur because it is readily available as a byproduct from petroleum refining and natural gas processing. This consistent and large-scale availability ensures a steady supply for sulfuric acid manufacturers, reducing dependency on volatile and less efficient raw materials. Additionally, using elemental sulfur results in fewer impurities in the final product, making it the preferred choice for high-purity applications in fertilizers, chemicals, and battery production.

Another critical factor behind the dominance of elemental sulfur is its lower emissions profile. Unlike pyrite roasting or smelting, which release higher levels of sulfur dioxide (SO₂) and other pollutants, elemental sulfur combustion can be controlled more efficiently, making it environmentally preferable. Many countries, particularly in North America and Europe, have implemented strict emission control regulations, further promoting the use of cleaner raw materials like elemental sulfur. Additionally, advancements in sulfur recovery technologies in oil refineries have increased sulfur availability, ensuring a sustainable supply chain for sulfuric acid production.

The economic advantages of elemental sulfur further solidify its dominance. Due to the continuous demand for refined petroleum products, refineries worldwide produce significant amounts of sulfur as a byproduct. This surplus availability keeps costs stable, allowing manufacturers to maintain competitive pricing. As industrialization and fertilizer demand continue to rise, the reliance on elemental sulfur is expected to persist, reinforcing its leading position in sulfuric acid production.

By Application

Fertilizers are projected to comprise the largest application area of sulfuric acid and utilize more than half of the world’s consumption. The reason behind the fertilizer’s predominance lies in the heavy use of sulfuric acid in the fertilizer-making business of the agriculture sector, including the use of diammonium phosphate (DAP), monoammonium phosphate (MAP), and superphosphate. The use of such fertilizers becomes inevitable in the improvement of soil fertility and the yield of crops in large-scale farming zones such as India, China, Brazil, and the U.S. The population growth and the limited availability of arable land worldwide further escalated the demand for the use of highly efficient fertilizers and subsequently the demand for sulfuric acid in the manufacturing of such fertilizers.

The economic and strategic importance of sulphuric acid in fertilizer production further solidifies its supremacy. Phosphate fertilizer manufacturing receives subsidies and incentives provided by the government of almost every country in the world in the interest of ensuring food security, especially in agrarian countries. India and China have developed large fertilizer factories that utilize sulphuric acid and demand it consistently. Furthermore, the use of precision farming and fertility management of the soil has further escalated the use of fertilizer and further consolidated sulphuric acid consumption.

Another factor contributing to the dominance of fertilizers is the growing adoption of sustainable and sulfur-enriched fertilizers. Sulfur-deficient soils in many regions require sulfur-based fertilizers to maintain agricultural productivity. Sulfuric acid is a key input in producing sulfate-containing fertilizers like ammonium sulfate, which improves soil health and enhances crop quality. As global food demand rises, the dependence on sulfuric acid for fertilizer production is set to increase, solidifying its position as the leading application segment in the sulfuric acid market.

The Global Sulfuric Acid Market Report is segmented on the basis of the following

By Raw Material

- Elemental Sulfur

- Base Metal Smelters

- Pyrite Ore

- Other Raw Materials

By Application

- Fertilizers

- Chemical Manufacturing

- Metal Processing

- Petroleum Refining

- Textile Industry

- Automotive

- Other Applications

Global Sulfuric Acid Market: Regional Analysis

Region with Highest Market Share in Global Sulfuric Acid MarketAsia Pacific is projected to dominate the global sulfuric acid market as it is anticipated to command over

38.1% of the market share in 2025. Asia-Pacific has the largest demand in the world sulphuric acid market based on the continent's large industrial sector, large demand in agriculture, and large chemical and fertilizer manufacturing sector presence. The largest demand for sulphuric acid comes from the continent, dominated mainly by China and India which produce and use large-scale phosphate fertilizer-based consumption. The population boom and demand for food have been leading to the consumption of fertilizer which has further strengthened the position of sulphuric acid in the use of agriculture.

Also aiding demand are the large metal processing and petroleum refining facilities in China, Japan, and South Korea that utilize sulfuric acid in the processes of ore leaching, steel pickling, and chemical synthesis. Support of government policies such as subsidies for fertilizer manufacturing and the development of facilities also stimulates the market further. Access to inexpensive raw materials such as elemental sulfur supplied by the area refineries guarantees a constant availability of supplies for the manufacturers. Growing industrialization and government efforts toward green acid manufacturing will keep the Asia-Pacific region at the forefront of the world market for sulfuric acid.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with Highest CAGR in Global Sulfuric Acid Market

North America is expected to experience the highest CAGR in the sulfuric acid market with the growth of expanding industrial uses, technology development, and mounting environment regulations spurring green production. The refining sector of the region yields a large source of elemental sulfur that maintains stable production of sulfuric acid. The use of spent acid regeneration systems in chemical processing and petroleum refining has further promoted the growth of the market and has diminished the need for the import of raw materials.

Growing demand for chemicals in battery recycling, the manufacturing of semiconductors, and the treatment of water also play an integral role in the chemical’s higher growth rate. The US has been making heavy investments in clean energy projects green fertilizer production and cutting-edge manufacturing processes that contributed toward higher consumption of the chemical. Stringent environmental regulations forcing the emission of sulfur dioxide also fostered acid recovery and purification technologies. The push toward efficiency and green initiatives has prompted the North American industries and the chemical market will witness a higher growth in the upcoming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Sulfuric Acid Market: Competitive Landscape

The global sulfuric acid market is competitive with top firms focusing on expanding capacity, technology enhancement, and alliances in a bid to reinforce their position in the market. The top firms include DuPont, The Mosaic Company, BASF SE, and Sumitomo Chemical with large factories and diversified acid offerings. The firms are also investing in green acid manufacturing and sulfur recovery technologies in a bid to keep abreast of strict environmental regulations.

Regional Asian-Pacific firms including China Petrochemical Corporation (Sinopec) and Hindalco Industries also hold a tight grip on the fertilizer and chemical sector connections. The firms also construct further facilities within the demand-pull zones of the Asian-Pacific and the territories of North America to capitalize on widening industrial and agriculture needs.

Increased mergers acquisitions and alliances further characterize the competitive landscape and allow the players in the market space to maximize operational efficiencies and geographically expand. R&D expenditure in acid regeneration and ultra-pure sulphuric acid for battery and electrical purposes also gains strength. The competition will be further bolstered with the demand spilling over into a multitude of industries with large players shifting attention toward the sustainability and resilience of the supply chain.

Some of the prominent players in the Global Sulfuric Acid Market are

- The Mosaic Company

- BASF SE

- OCP Group

- Chemtrade Logistics Income Fund

- Nouryon

- Aurubis AG

- Glencore

- IFFCO (Indian Farmers Fertiliser Cooperative Limited)

- Ma'aden (Saudi Arabian Mining Company)

- Veolia

- INEOS Group Ltd

- Linde plc

- Boliden Group

- Other Key Players

Recent Developments in the Global Sulfuric Acid Market

In 2025

- February 2025: DuPont announced a major investment in next-generation sulfur recovery technologies, aiming to enhance efficiency, minimize environmental impact, and support the transition toward cleaner sulfuric acid production for industrial and chemical applications.

- January 2025: The Sulfuric Acid & Sulfur Industry Conference in Houston, U.S., gathered global industry leaders, discussing sustainable acid regeneration, supply chain optimization, regulatory trends, and emerging technologies to improve efficiency and environmental compliance in sulfuric acid production.

In 2024

- December 2024: BASF SE partnered with a top Asian semiconductor manufacturer to supply ultra-pure sulfuric acid, ensuring high-quality etching and cleaning processes crucial for producing advanced microchips in the growing semiconductor industry.

- October 2024: The Mosaic Company expanded its fertilizer production facility in Brazil, significantly increasing sulfuric acid demand for phosphate-based fertilizers, supporting regional agriculture, and enhancing food security through improved crop yields.

- September 2024: The Global Fertilizer Summit in Berlin emphasized sulfuric acid’s crucial role in sustainable agriculture, highlighting innovations in phosphate fertilizers, eco-friendly production processes, and strategies for reducing the environmental footprint of fertilizer manufacturing.

- July 2024: Sinopec formed a joint venture with an Indian chemical company to establish a large-scale sulfuric acid production plant, strengthening fertilizer and industrial chemical supply chains across South Asia.

- June 2024: Sumitomo Chemical completed the expansion of its sulfuric acid production capacity in Japan to meet rising demand in semiconductor manufacturing, ensuring a steady supply of high-purity acid for advanced electronic applications.

In 2023

- November 2023: Hindalco Industries acquired a strategic stake in a regional sulfuric acid plant, securing a stable supply for its metal processing operations and strengthening its position in the non-ferrous metals industry.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 14.0 Bn |

| Forecast Value (2033) |

USD 20.1 Bn |

| CAGR (2024-2033) |

4.2% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2024) |

USD 3.8 Bn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Raw Material (Elemental Sulfur, Base Metal Smelters, Pyrite Ore, And Other Raw Materials), And By Application (Fertilizers, Chemical Manufacturing, Metal Processing, Petroleum Refining, Textile Industry, Automotive, And Other Applications) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

The Mosaic Company, BASF SE, OCP Group, Chemtrade Logistics Income Fund, Nouryon, Aurubis AG, Glencore, IFFCO, Ma'aden, Veolia, INEOS Group Ltd, Linde plc, and Boliden Group., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Sulfuric Acid Market?

▾ The Global Sulfuric Acid Market size is estimated to have a value of USD 14.0 billion in 2025 and is

expected to reach USD 20.1 billion by the end of 2034.

Which region accounted for the largest Global Sulfuric Acid Market?

▾ Asia Pacific is expected to have the largest market share in the Global Sulfuric Acid Market with a share

of about 38.1% in 2025.

Who are the key players in the Global Sulfuric Acid Market?

▾ The Mosaic Company, BASF SE, OCP Group, Chemtrade Logistics Income Fund, and many others are the

major key players in the Global Sulfuric Acid Market.

What is the growth rate in the Global Sulfuric Acid Market in 2025?

▾ The market is growing at a CAGR of 4.2 percent over the forecasted period of 2025.