The Production of surface disinfectant products involves various essential raw materials, like surfactants, active ingredients, stabilizers, chelating agents, & fragrances. Active ingredients are the major components responsible for killing or deactivating the microbes that cause infections.

Commonly used active ingredients in surface disinfectants are

hydrogen peroxide, Quaternary Ammonium Compounds (QACs), alcohol, & sodium hypochlorite. These active ingredients play an important role in ensuring the effectiveness of the disinfectant in eliminating harmful germs.

Surfactants are another critical component used in surface disinfectants. They enhance the spreading of the disinfectant on the surface being treated. Additionally, surfactants help in solubilizing & emulsifying dirt or any kind of organic matter, making it easier to remove during the cleaning process.

This ensures a more effective disinfection process, affecting the efficiency of the product. Stabilizers, Chelating agents, & fragrances are other important raw materials used in the production of surface disinfectant products to improve their performance & enhance user experience. The market's growth can be accredited to the rising consciousness regarding hygiene, driven by the increasing chances of diseases or infections.

Key Takeaways

- Growing Demand for Hygiene & Infection Control: Increased awareness of hygiene, especially post-pandemic, is driving the demand for surface disinfectants in healthcare, residential, and commercial sectors.

- Rising Use in Healthcare & Public Spaces: Hospitals, clinics, and public facilities rely heavily on disinfectants to prevent the spread of infections and ensure compliance with safety standards.

- Shift Toward Eco-friendly & Non-toxic Formulations: Manufacturers are developing biodegradable and alcohol-free disinfectants to meet environmental and safety regulations.

- Technological Advancements & Product Innovation: The market is seeing innovations like long-lasting antimicrobial coatings and AI-driven disinfection robots for automated cleaning.

- Stringent Regulatory Standards: Government regulations on chemical safety and efficacy are influencing product development and market competition.

Use Cases

- Healthcare & Hospitals: Used for disinfecting surgical tools, patient rooms, and high-touch surfaces to prevent hospital-acquired infections (HAIs).

- Food & Beverage Industry: Applied in food processing plants and restaurants to sanitize equipment, countertops, and dining areas to ensure food safety compliance.

- Commercial & Public Spaces: Utilized in offices, airports, schools, and shopping malls to maintain hygiene and reduce the spread of infections.

- Household Cleaning: Commonly used in homes for disinfecting kitchens, bathrooms, and frequently touched surfaces like doorknobs and light switches.

- Transportation & Automotive: Used in public transport (buses, trains, airplanes) and ride-sharing vehicles to sanitize seats, handles, and control panels for passenger safety.

Market Dynamic

The COVID-19 pandemic has further heightened consumer consciousness about keeping hygienic & germ-free environments in homes & workplaces, with the utilization of sanitizer, particularly, skin wipes becoming more popular. Public areas, such as schools, offices, & hospitals, have an increased demand for measures to control diseases.

In hospitals, surface disinfection plays a critical role in controlling infection, as healthcare-related spaces such as clinics, hospitals, etc. are more prone to the spread of infectious diseases due to the presence of vulnerable patients & more traffic of visitors.

While surface disinfectants can be effective in reducing the spread of infectious diseases, it is important to use them correctly & safely to prevent health & environmental hazards. Choosing the right disinfectants for specific use & keeping in mind, their potential ecological impact, are crucial steps to ensure the proper utilization of these products.

Due to the rise in demand for surface disinfectants, numerous firms have increased their production capabilities & are actively exploring the avenues for the development of new products. Moreover, several other factors are contributing to the market's expansion. These include the increasing events of infections that are acquired from hospitals, the substantial growth in the occurrence of chronic diseases, & increasing cases of surgical processes.

According to a study, 50% of infections that are received from hospitals happen in the care units. Surface disinfectants help mitigate these infections & thereby play a vital role in the prevention of infections in healthcare settings. As the burden of hospital-acquired infections continues to grow, the market is expected to witness significant growth in upcoming years.

Driving Factors

The surface disinfectant market is driven by heightened awareness of infection prevention and control in healthcare, hospitality, and public spaces. The COVID 19 pandemic underscored the significance of maintaining clean environments, prompting increased demand for disinfectants to combat pathogens.

Global health authorities such as CDC and WHO, mandate regular disinfection practices which drive product adoption. Furthermore, public concern over antimicrobial resistance has led to innovative yet eco friendly solutions being developed all factors which ensure sustained demand for surface disinfectant products across residential, commercial, and industrial sectors.

Trending Factors

One notable trend in the surface disinfectant market is a move toward eco friendly and sustainable formulations. Consumers and businesses alike increasingly prioritize products that reduce environmental impact while maintaining efficacy. Innovations include biodegradable disinfectants, alcohol free solutions and products using natural ingredients such as plant oils with antimicrobial properties.

Manufacturers have also begun adopting green packaging solutions to complete eco conscious formulations. This trend reflects consumer preferences for sustainability driven by increasing environmental awareness. Furthermore, advanced technologies like nanotechnology for prolonged microbial protection emphasize this focus on innovation and environmental responsibility in the market.

Restraining Factors

Although growing rapidly, the surface disinfectant market still faces obstacles related to potential health risks and chemical exposure. Prolonged use of certain disinfectants containing chlorine or ammonia may cause respiratory issues, skin irritation or allergic reactions and regulatory restrictions on volatile organic compounds (VOCs).

Furthermore, improper application can lead to microbial resistance, lessening efficacy. Regulatory compliance requirements pose further constraints for manufacturers looking to balance performance with safety.

Opportunities

Emerging markets present immense growth prospects for surface disinfectant products, driven by expanding urbanization, healthcare infrastructure development and increased hygiene awareness. Rapid economic expansion across regions like Asia Pacific, Latin America and Africa has spurred investments in healthcare facilities, hospitality businesses and public infrastructure driving demand for effective disinfection solutions.

Educational campaigns promoting hygiene practices in these regions further drive product adoption, while local manufacturers entering the market with cost effective solutions tailored to regional needs allow greater accessibility. By capitalizing on such opportunities, companies can expand their market footprint while reaching uncharted segments through tailored offerings.

Research Scope and Analysis

By Raw Material

The synthetic segment dominates the segment of raw materials with a maximum share of the market. This can be accredited to their broad range of efficiency as compared to other disinfectants. However, it is essential to note that synthetic disinfectants may pose risks to the health of a human & the environment due to their toxic nature.

On the other hand, bio-based disinfectants, derived from natural & non-toxic ingredients, are gaining prominence and are projected to witness a higher Compound Annual Growth Rate in upcoming years. While bio-based disinfectants may require longer contact times for maximum efficacy compared to their synthetic counterparts, they offer a safer and more environmentally friendly alternative for those concerned about the potential impacts of chemicals. It is worth mentioning that bio-based products may have limited efficacy against certain types of microbes.

An upcoming trend in the market is the blending of bio-based ingredients with chemical disinfectants. These blended products are meant to strike a balance between sustainability & effective disinfection. By incorporating bio-based substances, these blends reduce dependency on petrochemicals & encourage the utilization of renewable resources, leading to an eco-friendlier approach. This blending method represents an effective option for those looking for both efficacy & reduced ecological effects, showcasing the rising desire for environment-friendly & sustainable solutions worldwide.

By Products

The liquid segment dominates with a maximum share in 2023. This can be accredited to the versatility of liquid disinfectants, making them a perfect choice for several sectors, such as walls, & cleaning floors. Liquid disinfectants provide ease of application using cloths, mops, or sprayers and can be effectively combined with other cleaning products to achieve higher levels of cleanliness. As a result, they have become a popular choice among consumers looking for more efficient & effective disinfection solutions.

On the other hand, the wipes segment is anticipated to witness a higher Compound Annual Growth Rate in the upcoming years. Wipes provide easy or friendly options, as they do not require additional equipment or tools. Customers can simply spray the surface disinfectant onto the surface and allow it to air dry, providing even coverage over surfaces. Surface disinfectant wipes are known for their quick kill times and, effectively & efficiently discarding pathogens on surfaces.

This characteristic plays an important role in reducing the chances of cross-contamination & promoting a clean & hygienic environment. Moreover, surface disinfectant sprays are available in easy-to-use spray bottles encouraging convenience & safe application, further fostering the rising popularity among customers.

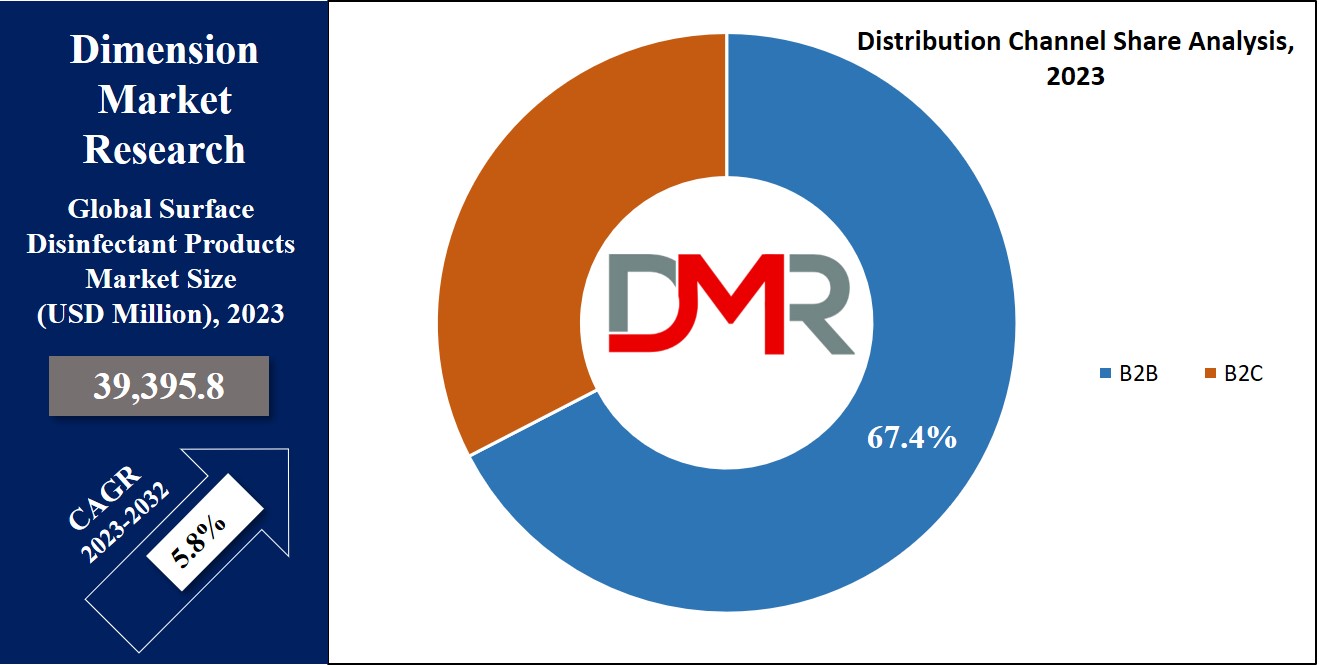

By Distribution Channel

The B2B distribution channel shows its dominance in the market, with a maximum share in the market in 2023. This can be accredited to the rising desire for disinfection products from medical laboratories, hospitals, & nursing centers, especially following the COVID-19 outbreak. These healthcare centers play a crucial role in identifying & managing the spread of infectious diseases, making fast & effective surface disinfection necessary in containing the spread of germs & safeguarding people.

According to the Centers for Disease Control, American hospitals see around 1.7 million infections acquired from hospitals, annually, resulting in around 99,000 casualties. These infections occur across several healthcare places, such as hospitals, surgical centers, rehabilitation facilities & ambulatory clinics, undermining the necessary requirement for efficient disinfection solutions in the healthcare sector.

Meanwhile, the B2C segment is anticipated to experience a significant Compound Annual Growth Rate in upcoming years, by 2032.

This growth can be accredited to the increasing utilization of disinfectant products, driven by rising awareness regarding health among customers globally. Hypermarkets & supermarkets come out to be the most preferred channels for B2C sales, as they provide a wide range of products & brand options.

Consumers can choose from a diverse range of scents, formulations, sizes, & price ranges to cater to their specific requirements. The easy availability and variety of disinfectant products in these retail outlets contribute to their popularity, further fueling the growth of the B2C segment.

The Global Surface Disinfectant Products Market Report is segmented on the basis of the following:

By Raw Materials

- Biobased

- Synthetic

- Blends

By Products

By Distribution Channel

- B2B

- Hospitals

- Medical Laboratories

- Nursing Homes

- others

- B2C

- Supermarkets & Hypermarkets

- Convenience stores

- Online

- Others

Impact of Artificial Intelligence on Surface Disinfectant Products Market

- Automated Disinfection Systems: AI-powered robots and UV disinfection devices automate surface cleaning in hospitals, airports, and public spaces, ensuring consistent and efficient sanitation.

- Smart Monitoring & Quality Control: AI-driven sensors detect contamination levels on surfaces, optimizing disinfectant usage and reducing waste.

- Formulation & Product Development: Machine learning accelerates the discovery of advanced disinfectant formulations with improved efficacy, safety, and eco-friendliness.

- Predictive Demand & Supply Chain Management: AI analyzes market trends and usage patterns to optimize inventory, preventing shortages and reducing costs.

- Regulatory Compliance & Safety Assessment: AI (Artificial Intelligence) helps manufacturers ensure compliance with safety standards by analyzing ingredient compositions and predicting potential health risks.

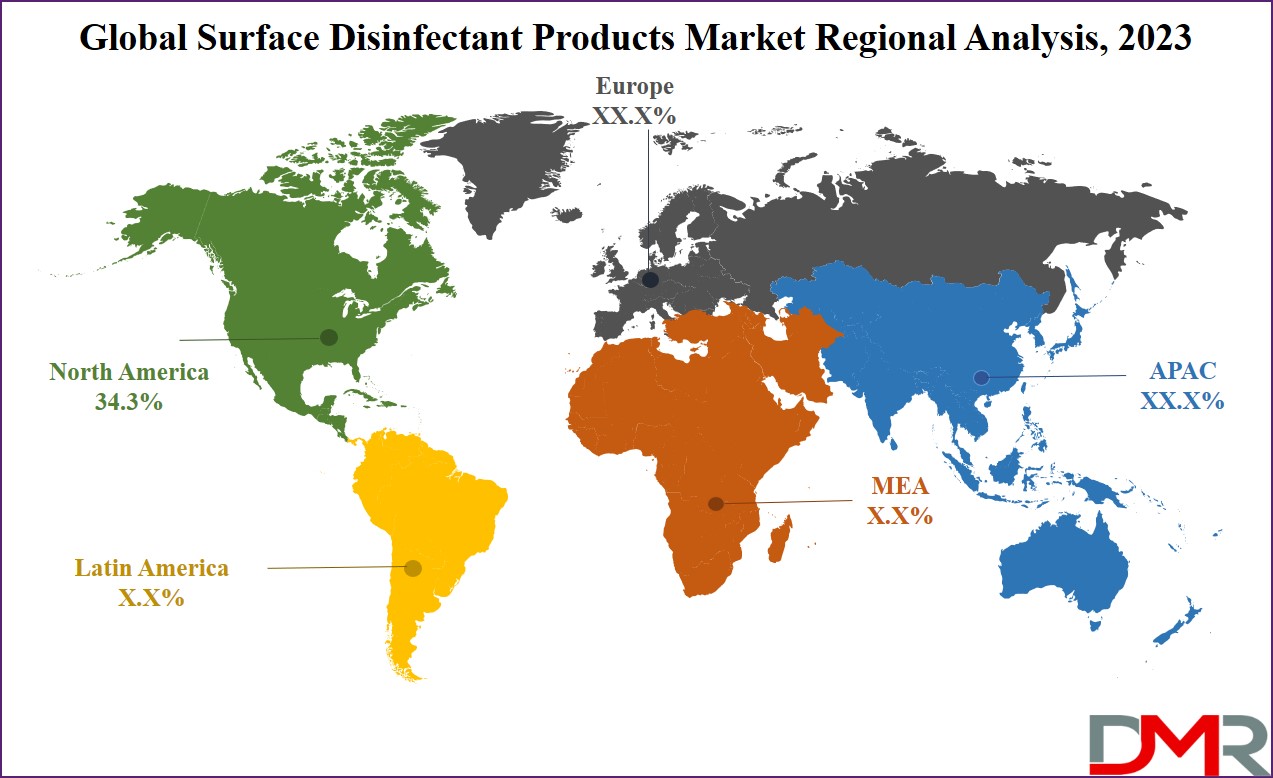

Regional Analysis

North America dominates the market, with a significant share of 34.3% in 2023. The region's growth can be accredited to rising health-related spending and the presence of a substantial number of surface disinfectant manufacturers. While the usage of these products is prominent in healthcare settings, businesses and households in North America also widely adopt them to maintain clean and hygienic environments.

In the United States, the EPA (Environmental Protection Agency) oversees surface disinfectants as pesticides under the Federal Insecticide, Fungicide, and Rodenticide Act. The EPA maintains a list of registered disinfectants that have been extensively tested & proven effective against specific pathogens, such as viruses & bacteria, etc.

On the other hand, the Asia Pacific region is expected to witness a higher Compound Annual Growth Rate (CAGR) over the forecast period. This growth is attributed to the increasing awareness among individuals & institutions about the significance of maintaining a clean & hygienic atmosphere. In response, various hospitals & clinics across the region have incorporated surface disinfectants as an integral part of their standard infection prevention & control protocols.

For example, in India, the Ministry of Health and Family Welfare has issued guidelines & directions for the use of disinfectants in healthcare sectors to ensure a safe & sanitized environment. As awareness about hygiene & infection prevention continues to grow in the Asia Pacific region, the demand for surface disinfectants is expected to witness significant expansion in the coming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The market demonstrates a proactive approach toward gaining a competitive advantage through the implementation of diverse strategic initiatives, including investments and new product developments. For example, PDI introduced three innovative products in 2022, namely Sani-24 germicidal disposable wipes, sani-hypercide germicidal spray, and sani-hypercide germicidal disposable wipes. These offerings are designed to prevent infections and promote wellness among consumers.

A noteworthy example is Unilever's collaboration with LanzaTech and India Glycols in April 2021 to produce a surfactant derived from industrial carbon emissions rather than relying on fossil fuels. This move highlights a commitment to sustainability and environmental consciousness in the manufacturing process.

Similarly, SC Johnson made significant contributions to the market by launching the FamilyGuard disinfectant spray and FamilyGuard disinfectant cleaner in April 2023. These products are specifically formulated to effectively eliminate 99.9% of germs on various types of surfaces, further emphasizing the industry's commitment to enhancing hygiene and safety measures.

These initiatives reflect the industry's dedication to meeting consumer demands and staying ahead in the competitive landscape through continuous innovation and the development of effective solutions.

Some of the prominent players in the Global Surface Disinfectant Products market are:

- 3M

- Procter & Gamble

- Reckitt Benckiser Group PLC

- Ecolab

- Steris

- GOJO Industries, Inc.

- BODE Chemie GmbH

- The Clorox Company

- Whiteley Corporation

- Lonza

- Evonik industries, AG

- Other Key Players

Recent Developments

- In August 2025, ready-to-use disinfectant wipes outpaced traditional liquid formats, with major brands launching new portable surface cleaning solutions for healthcare and airport usage.

- In June 2025, a wave of mergers and acquisitions consolidated leading Indian companies, such as Reckitt Benckiser (India), P&G Hygiene, and 3M India, as they expanded portfolios and market presence through strategic deals.

- In April 2025, North American market leaders CloroxPro and Diversey rolled out new hydrogen peroxide-based, low-toxicity disinfectants compliant with New York’s Green Cleaning Law.

- In March 2025, increased competition led to new product launches and strategic mergers in the global surface disinfectant space, with firms seeking market leadership in liquid and wipe categories.

- In February 2025, global market leaders invested in upgraded plant-based and biodegradable antimicrobial sprays, targeting green-certified buildings and childcare facilities.

- In October 2024, ITC launched a multi-purpose surface disinfectant, claiming to kill 99.99% of household germs, addressing rising post-pandemic hygiene needs.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 39,395.8 Mn |

| Forecast Value (2032) |

USD 65,533.5 Mn |

| CAGR (2023–2032) |

5.8% |

| Historical Data |

2017 – 2022 |

| Forecast Data |

2023 – 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Raw Materials (Biobased, Synthetic, Blends), and By Products (Liquid, Sprays, and Wipes), By Distribution Channel (B2B, and B2C). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

3M, Procter & Gamble, Reckitt Benckiser Group PLC, Ecolab, Steris, GOJO Industries, Inc., BODE Chemie GmbH, The Clorox Company, Whiteley Corporation, Lonza, Evonik Industries, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |