A major medical tool, a surgical suture is highly used by doctors during surgeries to sustain the structural integrity of tissues post-injury or surgery, which involves the use of a needle & attached thread to hold tissues together as needed. Modern surgical sutures come in various sizes, shapes, & thread materials, enabling

practitioners to choose based on the complexity of the surgical procedure they are performing.

Surgical Sutures Market Dynamic

The surge in lifestyle diseases, propelled by the widespread adoption of sedentary lifestyles, is a key driver of the expanding Surgical Sutures Market. Conditions like cerebrovascular disease, ischemic heart disease, orthopedic ailments, cancer, & mental illness are on the rise globally, increasing the need for surgical procedures. The rise in the frequency of lifestyle-related illnesses, along with advancements in

healthcare, drive the demand for surgical sutures in the medical sector. Further, advancements in treatment approaches, particularly in countries like the UK, Germany, the US, Canada, & Japan, contribute to the need for convenient surgical sutures for both surgeons & patients. In addition, the growth in the elderly population & the rise in fatal road accidents are anticipated to further fuel market growth, supported by factors like urbanization & rising disposable income.

However, the market experiences challenges, like competition from alternative wound care products like topical skin adhesives, hemostatic & sealing agents, and wound closure devices. The shortage of skilled professionals & high product costs are expected to create hindrances to the growth of the surgical sutures market.

Surgical Sutures Market Research Scope and Analysis

By Type

The absorbable segment holds the major revenue share in 2023 due to its ability to deliver temporary support to wounds till they heal & can tolerate normal stress. Further, the need for absorbable sutures is constantly growing, which can be due to their ability to degrade naturally. Owing to this, major players in the market are investing in R&D activities, which is further anticipated to assist the absorbable segment growth in the future.

However, Non-absorbable sutures account for a lower market share than absorbable sutures due to their inability to degrade or break down. These sutures are highly utilized in stressful internal environments where absorbable sutures are not able to fulfill the requirement, as these sutures are utilized for slow-healing tissues or long-term closures.

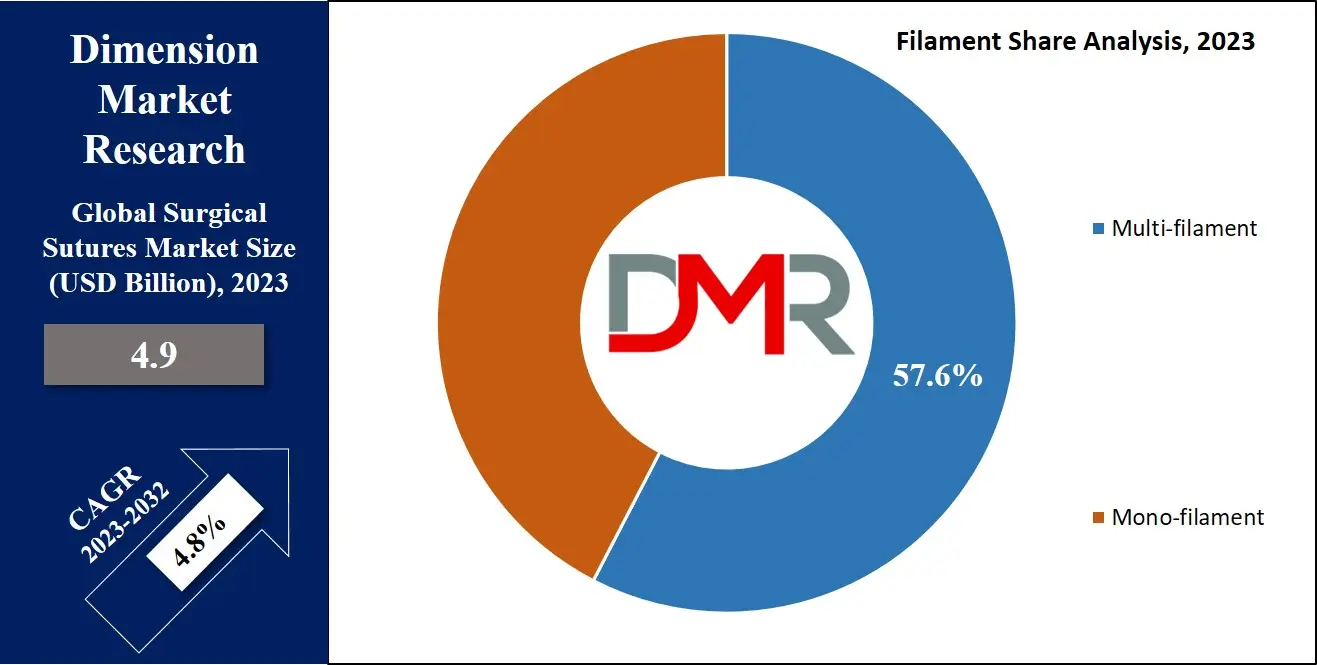

By Filament

The Surgical Sutures Market is categorized into Mono-filament and Multi-filament based on Filament. In 2023, the Multi-filament sutures segment dominates the market for surgical suture threads, which can be attributed to the growing number of complex surgical procedures, a rise in the population entering advanced age, & favorable healthcare reimbursement policies. The need for Multi-filament sutures is driven by the need for strong & reliable thread materials in complex surgeries. The growth in complicated surgical interventions, along with an aging demographic globally, highlights the importance of advanced suturing solutions. Moreover, the appeal of healthcare reimbursements further drives the adoption of Multi-filament sutures, contributing to their substantial market presence in the contemporary healthcare landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Application

In terms of application, cardiovascular surgeries hold the largest market share in 2023, driven by the large global volume of surgical procedures. The number of cardiovascular disorders has grown due to an increase in work stress & rising obesity rates across the world. Further, unhealthy modern lifestyle practices have highly impacted heart health. In addition, individuals highly opt for advanced surgical suturing options to improve the wound healing process, particularly in cardiovascular surgeries.

Moreover, advanced suturing materials find high utilization in ophthalmic surgeries, focusing on expediting the healing process. In addition, orthopedic & gynecological surgeries use diverse suturing materials customized to specific procedural needs, which reflects on major trend in addressing health challenges associated with different surgical interventions across cardiovascular, ophthalmic, orthopedic, & gynecological domains.

The Surgical Sutures Market Report is segmented on the basis of the following:

By Type

- Absorbable

- Non-Absorbable

By Filament

- Mono-filament

- Multi-filament

By Application

- Cardiovascular surgery

- Orthopedic surgery

- Gynecological surgery

- Ophthalmic surgery

- Cosmetic & plastic surgery

- General surgery

- Others

Surgical Sutures Market Regional Analysis

North America dominates the market for surgical sutures in 2023 with a market share of 44.3% in revenue, due to the presence of local & key players, the high expense of sutures in comparison to other regions, supportive reimbursement scenario, expanding government programs, & advanced healthcare infrastructure. In addition, technological developments & high regional income are also the major factors that contribute to the significant revenue share of the region.

Further, the Asia Pacific is anticipated to experience a rapid expansion during the forecast period, which is owing to the rise in the geriatric population base that is likely to go under surgery & more government funding for healthcare infrastructure to meet the demands in the region. In addition, China, India, & Japan are among the key markets in the region. Also, growth in medical tourism in countries like India, Singapore, & Malaysia is another key factor that is driving the market towards high growth in this region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Surgical Sutures Market Competitive Landscape

The market is a bit concentrated, with a handful of key players dominating the majority of revenue. These key players are constantly introducing new products to solidify their market standing & are engaging in strategic actions like partnerships, product introductions, & collaborations to expand their reach across different regions. Also, their focus depends on strengthening their position through innovation & strategic initiatives to stay competitive in the market.

In August 2023, Healthium Medtech introduced TRUMASTM, a line of sutures developed to tackle challenges in minimal access surgeries (MAS). MAS, widely adopted in surgeries over the past two decades, is considered as the gold standard, as even after technological advancement in improving surgical precision, suturing in MAS has lacked specialized attention, often depending on surgeons' skills. TRUMASTM focuses on filling the gap, promising advancements in suturing techniques for enhanced surgical outcomes in different medical specialties.

Some of the prominent players in the global Surgical Sutures Market are:

- Johnson & Johnson

- Medtronic

- Smith & Nephew

- Mellon Medical BV

- CONMED Corp

- B Braun Melsungen AG

- Teleflex Incorp

- Covidien

- Sutures India Pvt Ltd

- Peter Surgical

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Surgical Sutures Market:

The COVID-19 pandemic & following economic recession have significantly impacted the global surgical sutures market. The pandemic-induced disturbance in healthcare systems, elective surgery cancellations, & supply chain challenges led to a reduction in surgical procedures, affecting the need for surgical sutures. Hospitals aimed to manage the growth of COVID-19 cases, redirecting resources away from non-essential surgeries, which has further reduced the market growth. In addition, the recessionary economic environment has caused cost-conscious healthcare spending, affecting the purchasing patterns of medical supplies, including surgical sutures. As the world recovers from the dual impact of the pandemic & economic downturn, the surgical sutures market is expected to gradually rebound, but uncertainties persist, requiring adaptation & resilience in the healthcare sector.

Recent Developments

- In May 2023, MIT engineers developed innovative "smart" sutures effective at not just securing tissue but also detecting inflammation & dispensing drugs. These sutures, inspired by ancient Roman "catgut" sutures, are made from animal tissue. In a contemporary approach, the MIT team coated them with hydrogels, allowing the integration of sensors, drugs, or cells that release therapeutic substances, which marks a significant step in creating intelligent sutures with potential applications in personalized medicine & enhanced post-surgical care.

- In September 2023, Genesis MedTech, a prominent medical device company based in Singapore, announced approval from China's National Medical Products Administration (NMPA) for the release of its absorbable sutures with antibacterial protection, which are coated with triclosan, a potent antimicrobial agent, have demonstrated effectiveness against different bacteria, including MRSA & MRSE, which represents a significant step in enhancing surgical safety by reducing the risk of surgical site infections through advanced antibacterial sutures.

- In December 2022, Stryker introduced Citrefix, a suture anchor system developed for foot & ankle surgeries, which features a biomimetic anchor body made from Citregen, an elastomeric material derived from a citrate polymer, mimicking bone chemistry for controlled resorption without causing chronic inflammation. The unique chemical & mechanical properties focus on supporting tissue graft healing & healthy bone growth in orthopedic surgical applications, which include a preloaded implant, drill bit, drill guide, & inserter.

Surgical Sutures Market Report Details