Market Overview

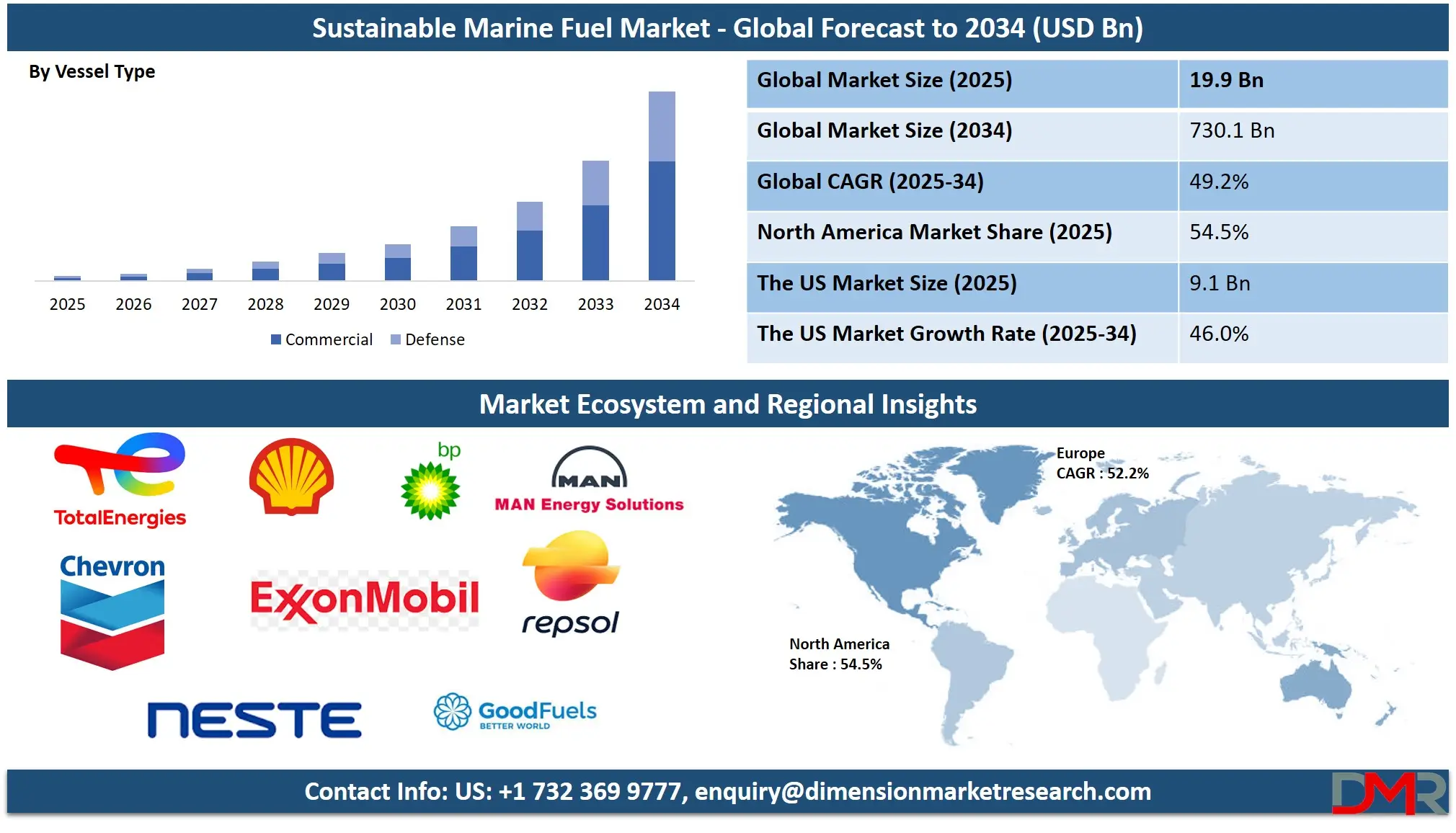

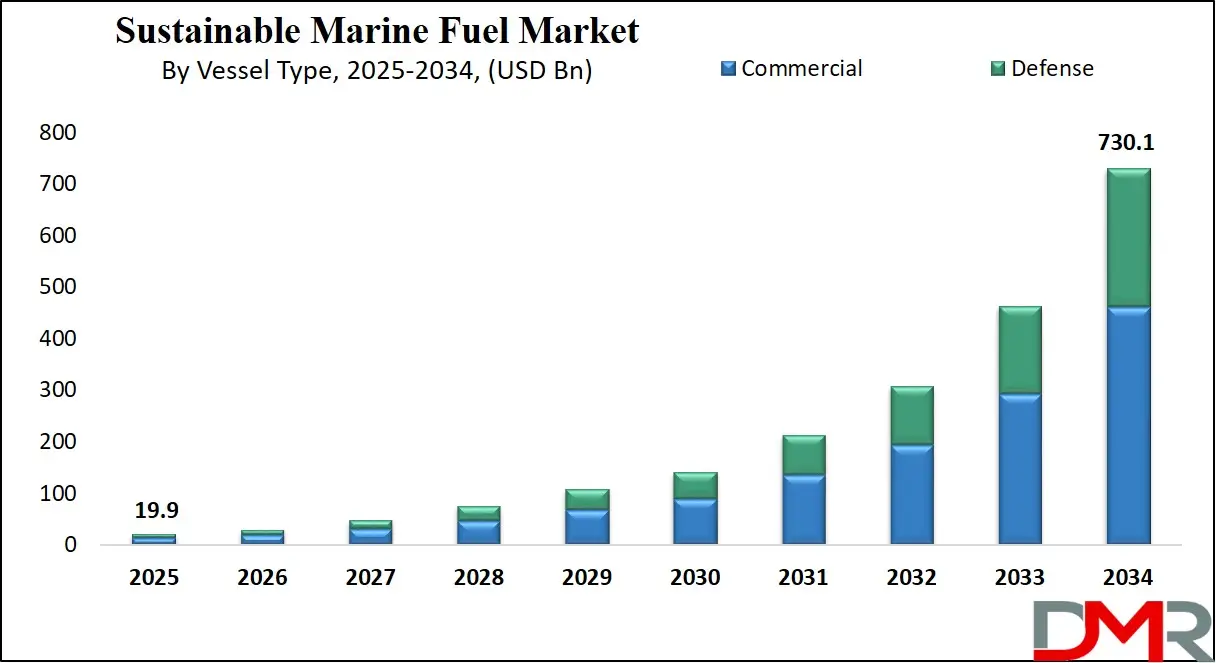

The Global Sustainable Marine Fuel Market is predicted to be valued at USD 19.9 billion in 2025 and is expected to grow to USD 730.1 billion by 2034, registering a compound annual growth rate (CAGR) of 49.2% from 2025 to 2034.

Sustainable Marine Fuel (SMF) refers to environmentally friendly alternatives to traditional marine fuels that significantly reduce greenhouse gas (GHG) emissions and environmental impact in maritime transportation. Derived from renewable sources such as biomass, algae, waste oils, or synthesized using green hydrogen and captured carbon, SMFs include biofuels, renewable diesel, bio-methanol, ammonia, and hydrogen-based fuels.

These fuels support global decarbonization goals, helping the shipping industry meet IMO emission targets. Unlike conventional fossil fuels, sustainable marine fuels are designed to be low-carbon or carbon-neutral throughout their lifecycle, making them a key enabler in achieving cleaner, more energy-efficient, and climate-resilient maritime operations.

The global sustainable marine fuel market is gaining momentum as the maritime industry prioritizes decarbonization and eco-friendly shipping solutions. Driven by tightening international emissions regulations and growing environmental awareness, stakeholders are increasingly shifting from conventional marine fuels to low-emission alternatives such as biofuels, green ammonia, and hydrogen-based fuels.

Technological advancements in fuel conversion processes like Fischer–Tropsch synthesis and hydrothermal liquefaction are enhancing production efficiency and scalability. Shipping companies are investing in cleaner propulsion systems and retrofitting vessels to handle alternative fuels. The adoption of dual-fuel engines and fuel-flexible systems is enabling smoother transitions to sustainable marine energy without compromising operational performance.

Partnerships between fuel producers, port authorities, and shipbuilders are fostering the development of an integrated alternative fuel supply chain. Bunkering infrastructure is evolving to accommodate bio-methanol, biocrude, and renewable diesel, ensuring reliable availability across major maritime trade routes. Collaboration in R&D is further accelerating innovation in low-carbon marine fuel technologies and hybrid propulsion systems.

Sustainable marine fuels are positioned as a key pillar of green shipping and blue economy initiatives. Their use not only helps reduce sulfur oxide and carbon dioxide emissions but also aligns with ESG goals of shipping corporations. As global trade and marine logistics expand, demand for clean marine energy is expected to grow steadily.

Industry players are also focusing on lifecycle emissions assessments and certification standards to promote transparency and trust in sustainable fuel adoption. These efforts are reshaping the maritime fuel ecosystem for long-term environmental and economic viability.

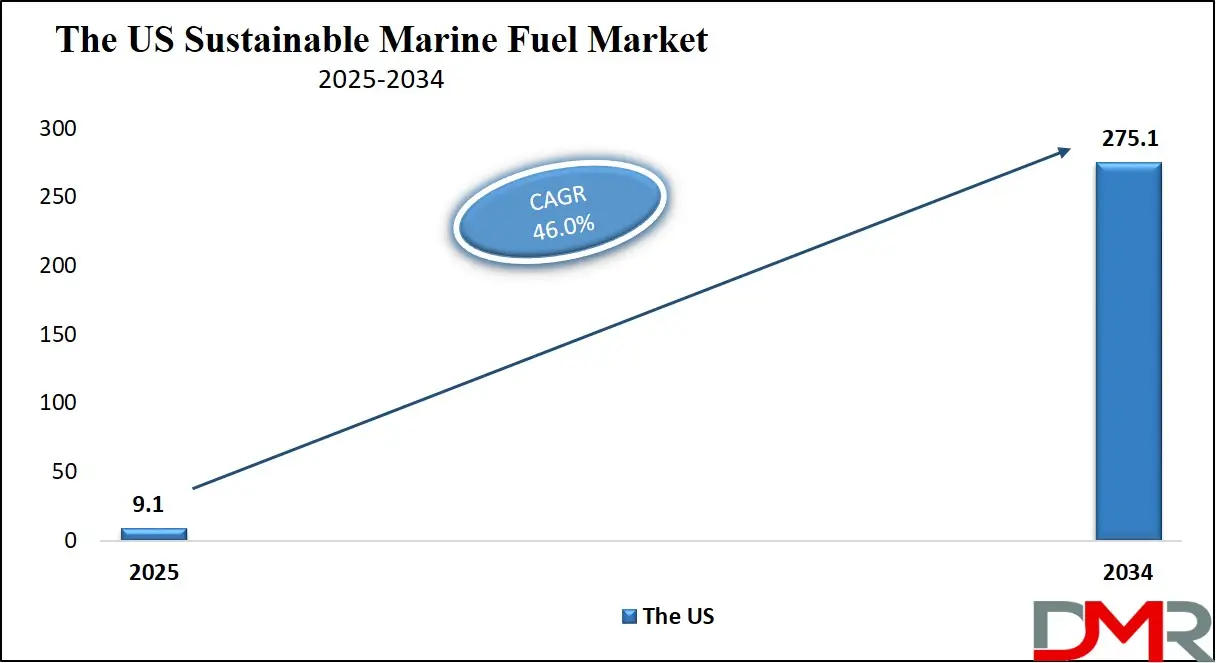

The US Sustainable Marine Fuel Market

The US Sustainable Marine Fuel Market is projected to be valued at USD 9.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 275.1 billion in 2034 at a CAGR of 46.0%.

The US sustainable marine fuel market is driven by stringent environmental regulations and the push to reduce carbon emissions from the shipping sector. The International Maritime Organization’s sulfur cap and domestic clean fuel standards are compelling fleet operators to adopt low-emission alternatives. Government-backed initiatives, including funding for biofuel research and port electrification, support the transition toward sustainable solutions.

In addition, growing collaboration between maritime companies and biofuel producers is accelerating the integration of renewable marine fuels. Increasing awareness of climate change among stakeholders and end-users is further promoting the adoption of sustainable marine fuel in both coastal and inland waterways.

A notable trend in the US sustainable marine fuel market is the increasing use of advanced biofuels, such as renewable diesel and bio-methanol, tailored for maritime compatibility. Shipping giants are entering strategic partnerships to co-develop green shipping corridors and refueling infrastructure. Technological innovations in feedstock conversion and engine compatibility are also gaining traction.

The market is witnessing a shift toward hybrid fuel systems to bridge conventional and renewable sources. Additionally, pilot projects focused on ammonia and hydrogen-based fuels are expanding, supported by private and federal investments. Lifecycle emission analysis is also becoming a key factor in fuel selection.

The Japan Sustainable Marine Fuel Market

The Japan Sustainable Marine Fuel Market is projected to be valued at USD 620.0 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 51,100.0 million in 2034 at a CAGR of 47.0%.

Japan's sustainable marine fuel market is primarily driven by its national goal to achieve carbon neutrality and reduce reliance on imported fossil fuels. The government’s commitment to the International Maritime Organization’s decarbonization targets is fueling investment in next-generation maritime fuel technologies. Major shipping lines and energy firms are collaborating to develop low-emission fuel alternatives such as bio-methanol, ammonia, and hydrogen.

Additionally, Japan's focus on energy security and diversification encourages the integration of domestically-sourced biomass and synthetic fuels. Regulatory support, including subsidies for green vessel development and renewable fuel infrastructure, is further boosting the market's development trajectory.

The Japan sustainable marine fuel market is witnessing key developments such as the growing use of ammonia-fueled vessels and a heightened interest in fuel-cell technology for maritime use. Collaborative research between universities and industry players is advancing innovations in combustion methods and hybrid propulsion systems. Green shipping alliances are emerging to promote shared learning and facilitate broader pilot implementations.

Decarbonization plans by port authorities are prioritizing infrastructure for alternative fuel refueling. Japan is also working to strengthen regional supply chains through strategic fuel collaborations in Southeast Asia. Additionally, digital tools and automation are increasingly being used to monitor emissions and manage the full fuel lifecycle efficiently.

The Europe Sustainable Marine Fuel Market

The Europe Sustainable Marine Fuel Market is projected to be valued at USD 1.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 127.8 billion in 2034 at a CAGR of 45.0%.

Europe’s sustainable marine fuel market is driven by strict regional regulations, such as the EU Emissions Trading System and the FuelEU Maritime initiative, aimed at decarbonizing maritime transport. Government incentives, funding for alternative fuel development, and emissions taxation are compelling shipping companies to switch to low-carbon options. The region’s advanced port infrastructure supports bunkering of diverse biofuels and e-fuels.

Growing environmental advocacy and pressure from green investors are pushing maritime businesses to prioritize sustainability. In addition, regional collaborations between fuel suppliers, shipbuilders, and regulatory bodies are helping scale up production and usage of sustainable marine fuels.

One of the key trends in the Europe sustainable marine fuel market is the rapid development of e-fuels and green ammonia as long-term decarbonization solutions. Ports are being upgraded to accommodate alternative fuel logistics and refueling stations. Several pilot programs using waste-derived fuels and algae-based biodiesel are underway. Maritime companies are exploring carbon capture-ready vessels in parallel with clean fuel adoption.

Blockchain-based fuel tracing is emerging to verify sustainability claims. Collaborative R&D projects across countries are enhancing fuel efficiency and engine adaptability for alternative marine fuels, solidifying Europe’s role as a frontrunner in green maritime innovation.

Sustainable Marine Fuel Market: Key Takeaways

- Market Overview: The global sustainable marine fuel market is projected to reach a valuation of USD 19.9 billion in 2025 and is anticipated to surge to USD 730.1 billion by 2034, growing at a CAGR of 49.2% during the forecast period.

- By Vessel Type Analysis: The commercial vessel category is expected to lead the market by the end of 2025, contributing approximately 68.4% of the overall market share.

- By Fuel Type Analysis: Biodiesel is projected to be the most prominent fuel type in the market by 2025, accounting for nearly 34.6% of the global market share.

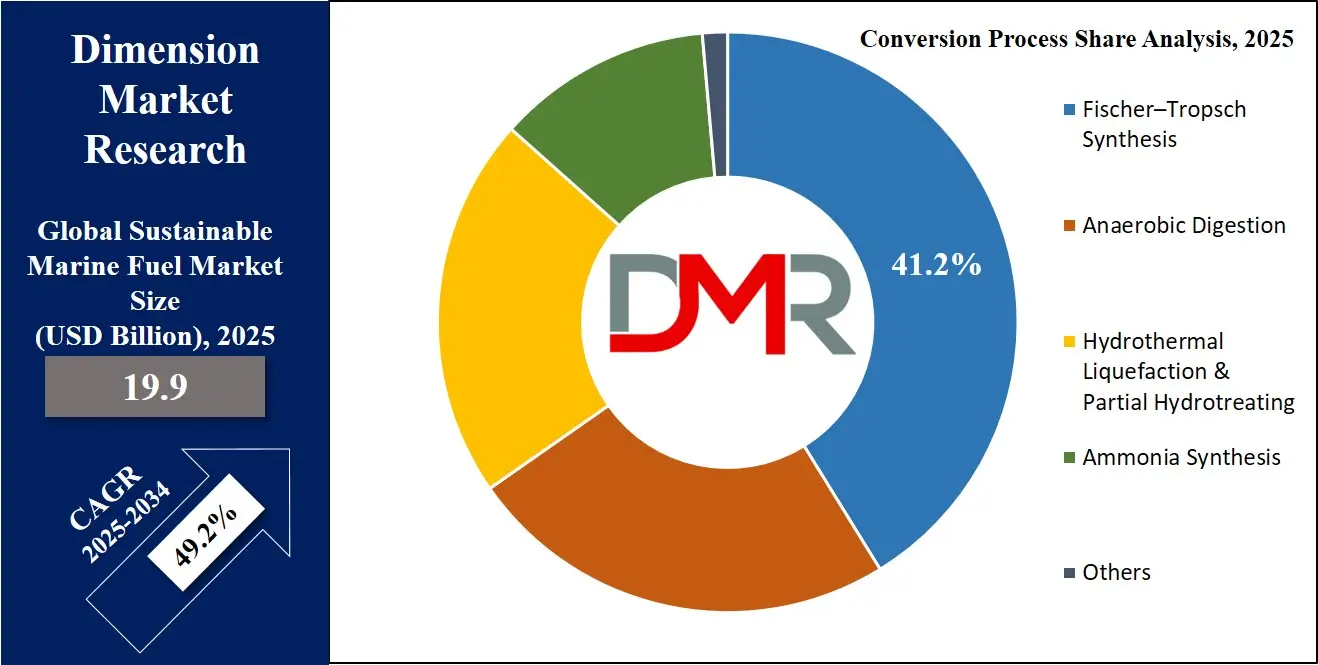

- By Conversion Process Analysis: Fischer–Tropsch Synthesis is set to emerge as the dominant conversion method by 2025, holding about 41.2% of the total market share.

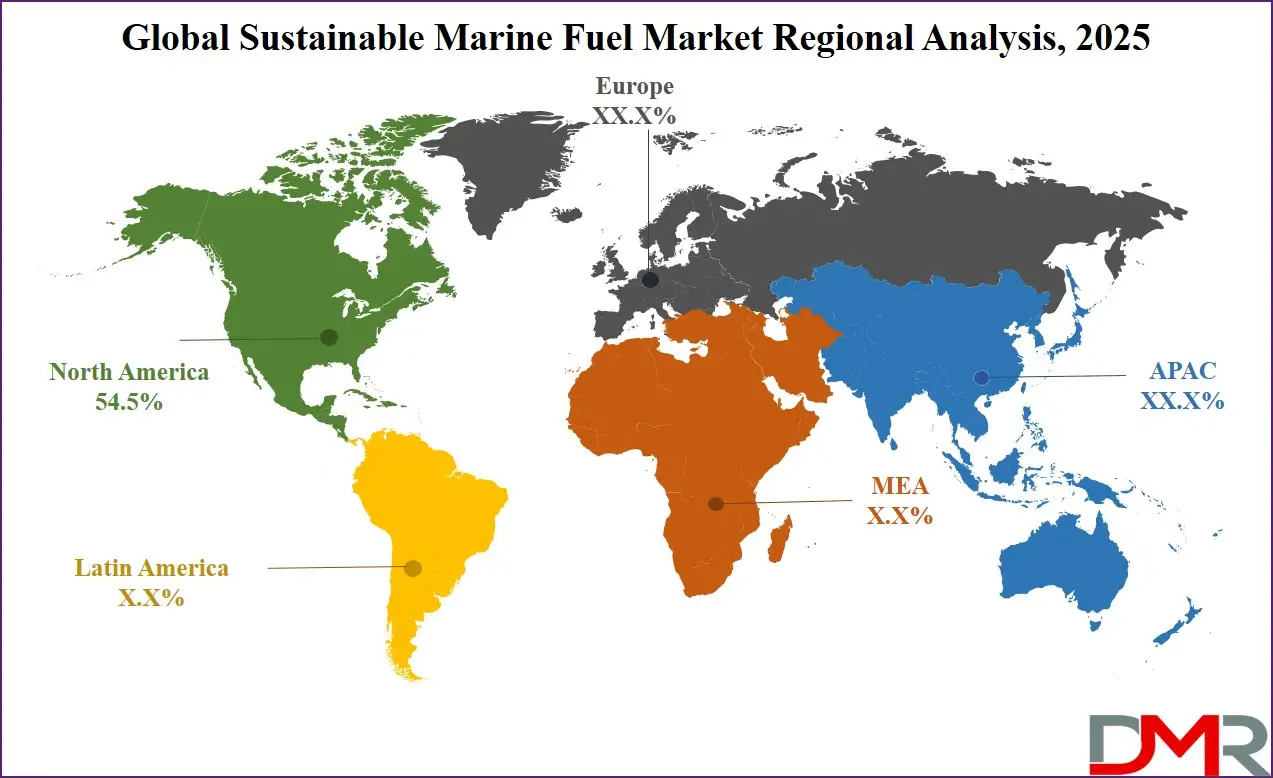

- Region with the Largest Share: North America is anticipated to be the leading regional market, capturing around 54.5% of the global sustainable marine fuel revenue in 2025.

Sustainable Marine Fuel Market: Use Cases

- Green Cargo Shipping: Shipping companies are using sustainable marine fuels like bio-methanol and ammonia to reduce greenhouse gas emissions across transoceanic cargo routes. These fuels support decarbonization goals while maintaining energy efficiency and regulatory compliance under IMO 2023 standards for maritime emissions.

- Short-Sea Passenger Ferries: Passenger ferry operators in coastal regions deploy biofuel blends and renewable diesel to power vessels with reduced NOx and SOx emissions. This enhances local air quality and meets environmental expectations from eco-conscious travelers, especially on routes in Europe and Japan.

- Naval and Defense Operations: Military fleets are incorporating sustainable marine fuels such as hydrotreated vegetable oil (HVO) for tactical ships. These fuels ensure energy security, reduce dependence on fossil imports, and align defense operations with broader government carbon-neutral strategies.

- Offshore Energy Support Vessels: Support vessels servicing offshore oil rigs and wind farms are adopting low-carbon fuels like Fischer–Tropsch diesel. This helps minimize the carbon footprint of offshore operations, especially in environmentally sensitive zones, while ensuring uninterrupted logistical support.

- Port Tugboats and Harbor Crafts: Harbor authorities are fueling tugboats and pilot vessels with sustainable options like biodiesel and hydrogenated fuels to cut emissions during port maneuvers. These short-range applications significantly reduce pollutants in high-traffic maritime zones and support port sustainability initiatives.

Sustainable Marine Fuel Market: Stats & Facts

- International Maritime Organization (IMO): The IMO estimates that international shipping emitted about 833 million metric tons of CO₂ in 2021, accounting for nearly 3% of global greenhouse gas emissions.

- Maersk: According to Maersk, the use of green methanol as marine fuel could help the company cut CO₂ emissions by up to 95% compared to conventional fossil fuels.

- DNV: In DNV’s Alternative Fuels Insight platform, only about 5% of ships ordered in 2023 were capable of running on alternative fuels like biofuels, methanol, or ammonia, showing slow uptake despite climate goals.

- U.S. Department of Energy (DOE): The DOE states that renewable diesel can reduce lifecycle greenhouse gas emissions by up to 80% compared to petroleum diesel when derived from waste feedstocks.

- Port of Rotterdam: In 2022, the Port of Rotterdam reported a 211% increase in the supply of bio-blended marine fuels, from 301,000 tonnes in 2021 to 937,000 tonnes in 2022.

- Royal Belgian Shipowners’ Association: They project that ammonia and hydrogen could meet 40% of maritime fuel demand by 2050, if scalability and safety concerns are addressed.

- International Energy Agency (IEA): The IEA indicates that sustainable biofuels used in the maritime sector must grow from less than 1 million tonnes (2022) to over 30 million tonnes by 2030 to stay on a net-zero pathway.

- European Maritime Safety Agency (EMSA): EMSA highlights that LNG bunkering grew from 0.5 million cubic meters in 2018 to over 2.5 million in 2022, though it’s still considered transitional rather than sustainable.

- CMA CGM: CMA CGM has committed to operating 26 dual-fuel LNG ships by the end of 2025, with plans to transition these to bio-LNG or synthetic methane as availability improves.

- UNCTAD: The UN Conference on Trade and Development estimates that reaching full decarbonization of global shipping could cost up to USD 1.4 trillion by 2050, with fuel costs representing a significant portion.

Sustainable Marine Fuel Market: Market Dynamic

Driving Factors in the Sustainable Marine Fuel Market

Stringent Environmental Regulations and IMO Mandates

One of the key driving factors in the sustainable marine fuel market is the tightening global environmental regulations aimed at reducing maritime carbon emissions. The International Maritime Organization’s (IMO) 2020 Sulphur Cap and the upcoming targets to cut greenhouse gas emissions have pushed ship-owners to adopt alternative fuels.

These mandates are encouraging the shift toward biofuels, renewable diesel, and other low-carbon marine fuels. With increased pressure to decarbonize the maritime sector, stakeholders across the shipping value chain are accelerating investments in sustainable marine fuel technologies. This regulatory environment is fostering innovation and scaling of clean fuel solutions that comply with emissions standards and support climate goals.

Rising Demand for Decarbonization in the Shipping Industry

The growing urgency to combat climate change has intensified demand for decarbonization strategies in global shipping, driving growth in the sustainable marine fuel market. As global trade expands, so does the carbon footprint of the marine transportation sector. Ship-owners and logistics companies are seeking cleaner alternatives such as biodiesel, bio-methanol, and ammonia to reduce emissions without compromising efficiency.

The transition aligns with broader net-zero initiatives and corporate ESG commitments. Furthermore, shipping customers increasingly prefer low-emission logistics partners, further reinforcing the need for sustainable fuel adoption in marine vessels, from bulk carriers to tankers.

Restraints in the Sustainable Marine Fuel Market

High Production and Operational Costs of Sustainable Fuels

One significant restraint in the sustainable marine fuel market is the high cost associated with production, storage, and distribution of bio-based fuels like hydrogenated vegetable oil (HVO) and ammonia. Compared to conventional marine fuels like heavy fuel oil (HFO) or marine gas oil (MGO), sustainable options are often economically uncompetitive due to immature infrastructure, complex refining processes, and limited economies of scale.

These elevated costs deter widespread adoption, especially among small and medium shipping companies. Additionally, the lack of government subsidies or carbon pricing mechanisms in many regions further inhibits investment in green marine fuel technologies.

Limited Availability and Supply Chain Constraints

The underdeveloped global supply chain for sustainable marine fuels represents another key restraint in the market. Ports and bunkering facilities in many regions lack the infrastructure to store, handle, and distribute renewable fuels like bio-LNG, methanol, or bio-oil at commercial scale.

Moreover, feedstock limitations such as restricted access to biomass or waste oils hinder consistent fuel production and availability. This regional disparity in supply restricts international shipping operations from fully adopting low-emission fuels, making it difficult for fleets to comply with fuel-switching mandates across all routes and destinations.

Opportunities in the Sustainable Marine Fuel Market

Technological Advancements in Fuel Production and Conversion

The sustainable marine fuel market is poised to benefit significantly from advances in fuel production and conversion technologies. Emerging processes such as Fischer–Tropsch synthesis, hydrothermal liquefaction, and gas-to-liquid (GTL) technology are improving efficiency in generating bio-crude and synthetic fuels from renewable feedstocks. These innovations can lower the cost of production and boost fuel compatibility with existing ship engines.

Additionally, retrofitting technologies and dual-fuel engine designs are enabling the flexible use of biofuels, ammonia, and methanol, offering long-term growth potential. These developments open new avenues for sustainable fuel adoption and create a favorable investment climate for green maritime solutions.

Growing Investments and Public-Private Collaborations

Rising investments by governments, environmental agencies, and maritime corporations offer substantial growth opportunities for the sustainable marine fuel market. Initiatives such as green port infrastructure, R&D funding, and co-development of renewable energy projects are accelerating market expansion. Public-private partnerships are catalyzing innovation, enabling demonstration projects for bio-methanol, renewable diesel, and ammonia-based propulsion systems.

Furthermore, ESG-focused investors are supporting decarbonization efforts in the maritime industry, promoting scalable and bankable fuel ventures. These collaborations not only enhance fuel accessibility but also contribute to a stronger global supply chain for sustainable marine energy.

Trends in the Sustainable Marine Fuel Market

Increased Adoption of Bio-Based Marine Fuels

A prominent trend in the sustainable marine fuel market is the rising adoption of bio-based fuels such as biodiesel, bio-methanol, and bio-LNG. These fuels are derived from renewable feedstocks like used cooking oil, agricultural waste, and algae, offering lower lifecycle emissions compared to fossil-based alternatives.

Major shipping companies are conducting pilot projects and entering long-term agreements for biofuel supply to meet upcoming carbon intensity reduction goals. As demand grows for carbon-neutral shipping, the scalability and blending compatibility of biofuels make them a popular transitional solution in the global maritime sector.

Integration of Ammonia and Methanol as Future Marine Fuels

Ammonia and methanol are emerging as next-generation sustainable marine fuels due to their zero-carbon or low-carbon combustion profiles. These fuels are gaining traction among vessel manufacturers and energy companies exploring carbon-free propulsion alternatives. With the development of ammonia-ready engines and methanol-powered dual-fuel ships, industry stakeholders are preparing for large-scale commercial deployment.

Additionally, infrastructure upgrades at key global ports are underway to support ammonia and methanol bunkering. This trend is reshaping the future fuel mix in the shipping sector, positioning alternative fuels at the forefront of maritime decarbonization efforts.

Sustainable Marine Fuel Market: Research Scope and Analysis

By Vessel Type Analysis

The commercial segment is predicted to dominate the global sustainable marine fuel market by the end of 2025, accounting for approximately 68.4% of the total market share. This dominance is attributed to the rising deployment of eco-friendly fuel alternatives in global shipping operations, driven by increasing regulatory pressure to cut emissions. The surge in international maritime trade and the demand for cleaner fuels in large fleets, especially in container shipping and passenger transport, are propelling the use of low-carbon marine fuel technologies.

Moreover, investments in sustainable propulsion systems and adoption of renewable fuels are becoming standard across commercial shipping lines, ensuring long-term compliance with emission norms and contributing to the decarbonization of marine logistics globally.

The defense segment is expected to register the highest compound annual growth rate (CAGR) by the end of 2025. This growth is driven by increasing governmental initiatives aimed at decarbonizing naval operations and enhancing energy independence through alternative fuel integration. Defense agencies worldwide are investing heavily in next-generation propulsion systems and carbon-neutral fuel sources to ensure energy efficiency in naval fleets.

The shift toward bio-based and synthetic fuels, supported by advanced R&D in green energy systems, is accelerating adoption in military vessels. Additionally, stringent sustainability targets and modernization of aging fleets are driving defense authorities to transition toward environmentally responsible marine fuel alternatives.

By Fuel Type Analysis

The biodiesel segment is expected to dominate the global sustainable marine fuel market by the end of 2025, capturing around 34.6% of the total market share. Its dominance is driven by its compatibility with existing marine engines, ease of integration, and growing global emphasis on reducing carbon emissions in maritime operations.

Biodiesel’s renewable nature and relatively low production cost make it an attractive alternative in the transition toward cleaner propulsion. As international maritime regulations tighten, shipping companies are increasingly shifting toward low-sulfur, sustainable fuel options like biodiesel to meet carbon intensity requirements, while also improving fuel economy and reducing lifecycle greenhouse gas emissions across diverse vessel categories.

The ammonia segment is projected to witness the highest CAGR in the sustainable marine fuel market by the end of 2025. Its rapid growth is fueled by its zero-carbon emission profile and rising focus on long-term decarbonization in deep-sea shipping. Ammonia is gaining traction as a future-proof marine fuel, supported by technological advancements in ammonia-powered engines and fuel cells.

Global collaborations among shipbuilders, fuel producers, and classification societies are accelerating ammonia’s adoption as a viable green alternative. Additionally, increasing investment in ammonia bunkering infrastructure and favorable policy support for alternative fuels are propelling the segment’s growth trajectory in both commercial and naval maritime sectors.

By Conversion Process Analysis

The Fischer–Tropsch Synthesis segment is anticipated to dominate the global sustainable marine fuel market by the end of 2025, accounting for approximately 41.2% of the market share. This dominance stems from its ability to produce high-quality synthetic fuels compatible with existing marine engines, making it a strategic choice for large-scale shipping operations.

Fischer–Tropsch fuels offer superior energy density and low sulfur content, aligning well with emission control mandates. Moreover, its scalability and compatibility with biomass and waste-derived feedstocks contribute to widespread adoption in the maritime sector. The process supports the production of drop-in fuels that meet international marine fuel specifications, driving its dominance in the push toward decarbonized global shipping networks.

The Ammonia Synthesis segment is expected to register the highest CAGR in the sustainable marine fuel market by the end of 2025. Growing interest in zero-carbon maritime fuels has positioned ammonia synthesis as a crucial conversion technology, especially for ocean-going vessels targeting full decarbonization. With expanding investments in green hydrogen and electrolysis infrastructure, ammonia production from renewable sources is becoming more viable.

The method's potential to produce scalable, carbon-free marine fuel supports its rapid uptake. In addition, international regulatory frameworks and climate agreements are reinforcing the need for ammonia-based propulsion solutions, which enhances the segment's growth momentum in both commercial and defense maritime applications.

The Sustainable Marine Fuel Market Report is segmented on the basis of the following

By Vessel Type

- Commercial

- Passenger Vessels

- Yachts

- Ferries

- Cruise Ships

- Cargo Vessels

- Container Vessels

- Bulk Carrier

- Tankers

- Gas Tankers

- Dry Cargo Ship

- Barges

- Others

- Defense

- Destroyers

- Frigates

- Corvettes

- Amphibious Ships

- Offshore Support Vessels

- Minesweepers

- Missile Carrying Boats & Supply Boats

By Fuel Type

- Renewable Diesel

- Biodiesel

- Bio-oil

- Biocrude

- Ammonia

- Bio-methanol

- Others

By Conversion Process

- Fischer–Tropsch Synthesis

- Anaerobic Digestion

- Hydrothermal Liquefaction & Partial Hydrotreating

- Ammonia Synthesis

- Others

Regional Analysis

Region with the largest Share

North America is predicted to hold the largest share in the global sustainable marine fuel market, accounting for 54.5% of the total revenue share in 2025. This dominance is attributed to strong regulatory support, early adoption of clean fuel technologies, and significant investments in alternative marine energy infrastructure across the United States and Canada. The region is home to major shipping companies and naval fleets that are rapidly transitioning to low-emission fuels.

Government incentives, port decarbonization initiatives, and robust R&D in renewable marine fuel production are further accelerating growth. Additionally, strategic collaborations between fuel producers and shipbuilders are enhancing supply chain readiness, positioning North America as a leader in sustainable maritime transport and eco-friendly shipping operations.

Region with Highest CAGR

Europe is expected to register the highest CAGR in the sustainable marine fuel market by the end of 2025, driven by stringent environmental regulations under the EU Green Deal and Fit for 55 package. The region’s strong focus on reducing carbon emissions in maritime transport is pushing widespread adoption of ammonia, bio-methanol, and other renewable fuels. European ports and shipowners are investing heavily in clean fuel bunkering infrastructure, pilot projects, and vessel retrofitting programs.

Additionally, collaboration between Nordic countries and the European Maritime Safety Agency (EMSA) is fostering the development of next-generation marine fuels. These factors, along with active decarbonization roadmaps, are positioning Europe as a dynamic growth hub for sustainable marine energy solutions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Impact of Artificial Intelligence in the Sustainable Marine Fuel Market

- Enhanced Fuel Optimization and Route Planning: Artificial Intelligence (AI) significantly contributes to optimizing fuel usage in maritime operations by analyzing vast data sets on weather, currents, and vessel performance. AI-driven predictive analytics help shipping companies reduce unnecessary fuel consumption, improving operational efficiency and reducing greenhouse gas emissions. This directly supports the adoption of sustainable marine fuels by minimizing wastage and enhancing fuel economy.

- Accelerated Research and Development: AI accelerates the development of alternative marine fuels by simulating chemical reactions and optimizing biofuel compositions. Machine learning models can predict fuel behavior under various conditions, reducing the time and cost of physical experimentation. This leads to faster innovation in areas like algae-based fuels, bio-methanol, and ammonia-based fuel alternatives.

- Predictive Maintenance and Engine Efficiency: AI enhances the performance of engines using sustainable fuels through predictive maintenance systems. These systems monitor real-time engine conditions and fuel combustion patterns, identifying anomalies and preventing breakdowns. Improved maintenance cycles ensure optimal combustion, thereby improving the effectiveness of cleaner fuels and supporting their long-term adoption.

- Supply Chain and Bunkering Optimization: AI-driven logistics platforms streamline the sustainable fuel supply chain by forecasting demand, managing inventories, and coordinating refueling operations. Smart bunkering strategies powered by AI reduce port waiting times and fuel wastage, creating a more responsive and resilient ecosystem for sustainable marine fuel distribution.

Competitive Landscape

The competitive landscape of the sustainable marine fuel market is characterized by intense innovation, strategic partnerships, and growing investments in renewable propulsion technologies. Key players are focusing on expanding their production capacities and diversifying their fuel portfolios to include bio-methanol, green ammonia, biodiesel, and renewable diesel to meet evolving maritime emission regulations.

Companies such as TotalEnergies, Neste, Repsol, and BP are actively investing in large-scale biofuel refineries and maritime decarbonization projects. Collaboration between shipbuilders, engine manufacturers, and fuel producers is driving the development of compatible low-carbon fuel systems and infrastructure.

Global shipping companies are also forming alliances with fuel technology firms to accelerate the transition toward climate-neutral marine operations. Technological advancements in biomass conversion, carbon-neutral synthesis processes, and modular refueling units are further intensifying competition. In addition, maritime regulatory bodies are playing a pivotal role by offering incentives for clean fuel adoption and tightening sulfur and GHG emissions norms under IMO guidelines.

As demand for low-emission marine transportation increases, companies with a strong focus on sustainability, innovation in bio-refining techniques, and supply chain integration are expected to hold a competitive edge. The race to decarbonize shipping fleets is fostering a dynamic, innovation-driven environment across the global sustainable marine fuel ecosystem.

Some of the prominent players in the Global Sustainable Marine Fuel Market are

- TotalEnergies

- BP

- Shell

- Chevron

- ExxonMobil

- Repsol

- Neste

- GoodFuels

- MAN Energy Solutions

- Wärtsilä

- Maersk

- CMA CGM

- NYK Line

- Hapag-Lloyd

- MOL

- Stena Bulk

- Scorpio Tankers

- Boskalis

- Corvus Energy

- Proman

- Other Key Players

Recent Developments

- January 2025: Maersk launched its second methanol-powered container vessel, intensifying efforts to decarbonize long-haul shipping routes and strengthen the global adoption of green fuels in maritime logistics.

- March 2025: Wärtsilä announced successful sea trials of its 4-stroke ammonia-fueled engine aboard a short-sea vessel, marking a milestone in testing alternative propulsion technologies for sustainable marine transport.

- June 2025: NYK Line partnered with Toyota Tsusho to explore commercial-scale hydrogen bunkering solutions in Japanese ports, targeting the deployment of fuel-cell-powered ships by 2027.

- April 2024: GoodFuels signed a strategic supply agreement with MOL Group to provide biofuels across key European ports, expanding its footprint in the low-carbon bunker fuel segment.

- August 2024: Shell completed the first bunkering operation of renewable diesel for an international cruise ship in the Port of Los Angeles, underlining its commitment to cleaner marine tourism.

- November 2024: Proman and Stena Bulk expanded their methanol-powered fleet with two new dual-fuel tankers, reinforcing their shared ambition to accelerate methanol adoption in commercial shipping.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 19.9 Bn |

| Forecast Value (2034) |

USD 730.1 Bn |

| CAGR (2025–2034) |

49.2% |

| The US Market Size (2025) |

USD 9.1 Bn |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Vessel Type (Commercial, Defense), By Fuel Type (Renewable Diesel, Biodiesel, Bio-oil, Biocrude, Ammonia, Bio-methanol, Others), By Conversion Process (Fischer–Tropsch Synthesis, Anaerobic Digestion, Hydrothermal Liquefaction & Partial Hydrotreating, Ammonia Synthesis, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

TotalEnergies, BP, Shell, Chevron, ExxonMobil, Repsol, Neste, GoodFuels, MAN Energy Solutions, Wärtsilä, Maersk, CMA CGM, NYK Line, Hapag-Lloyd, MOL, Stena Bulk, Scorpio Tankers, Boskalis, Corvus Energy, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Sustainable Marine Fuel Market size is estimated to have a value of USD 19.9 billion in 2025 and is expected to reach USD 730.1 billion by the end of 2034.

North America is expected to be the largest market share for the Global Sustainable Marine Fuel Market with a share of about 54.5% in 2025.

Some of the major key players in the Global Sustainable Marine Fuel Market are Maersk, Shell, TotalEnergies, and many others.

The market is growing at a CAGR of 49.2% over the forecasted period.

The US Sustainable Marine Fuel Market size is estimated to have a value of USD 9.1 billion in 2025 and is expected to reach USD 275.1 billion by the end of 2034.