Switchgear Monitoring Market Overview

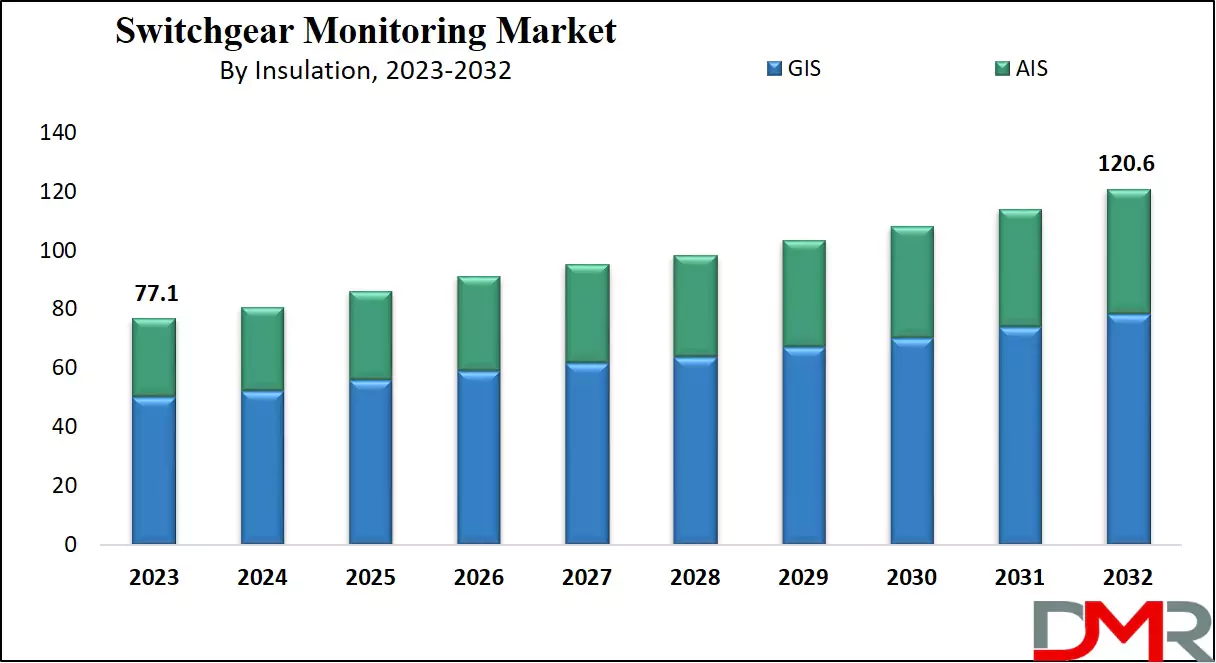

The Global Switchgear Monitoring Market is expected to reach a value of USD 77.1 billion in 2023, and it is further anticipated to reach a market value of USD 120.6 billion by 2032 at a CAGR of 5.1%.

Switchgear, an apparatus integral to power systems, regulates & switches electrical circuits on and off. Positioned between the transformer's high & low-voltage sides, it directly connects to the power supply system. Essential for testing and maintenance, switchgear de-energizes equipment to control damage during significant current flows, preventing service interruptions.

The global switchgear monitoring market is propelled by increasing power demand, the need for secure electrical distribution systems and increasing investments in renewable energy. Expanding transmission and distribution networks significantly boost switchgear demand within the power industry. Moreover, the growing application of intelligent monitoring technologies across sectors such as Crop Monitoring and Remote Health Monitoring underscores the broader trend toward digitized infrastructure and data-driven decision-making.

According to estimates by OECD cumulative investments from 2017-2040 are estimated at USD 5.9 trillion for transmission networks alone and USD 2.1 trillion for distribution networks - creating a growing need for switchgear monitoring systems that are predicted to experience exponential growth during their respective forecast periods in order to meet industry requirements.

Switchgear Monitoring Market Key Takeaways

- By Voltage, the Medium Voltage takes the lead in 2023 & is anticipated to dominate throughout the forecasted period.

- In addition, the High Voltage is expected to have significant growth over the forecasted period.

- By End User, T&D Utilities takes the lead & drive the market in 2023.

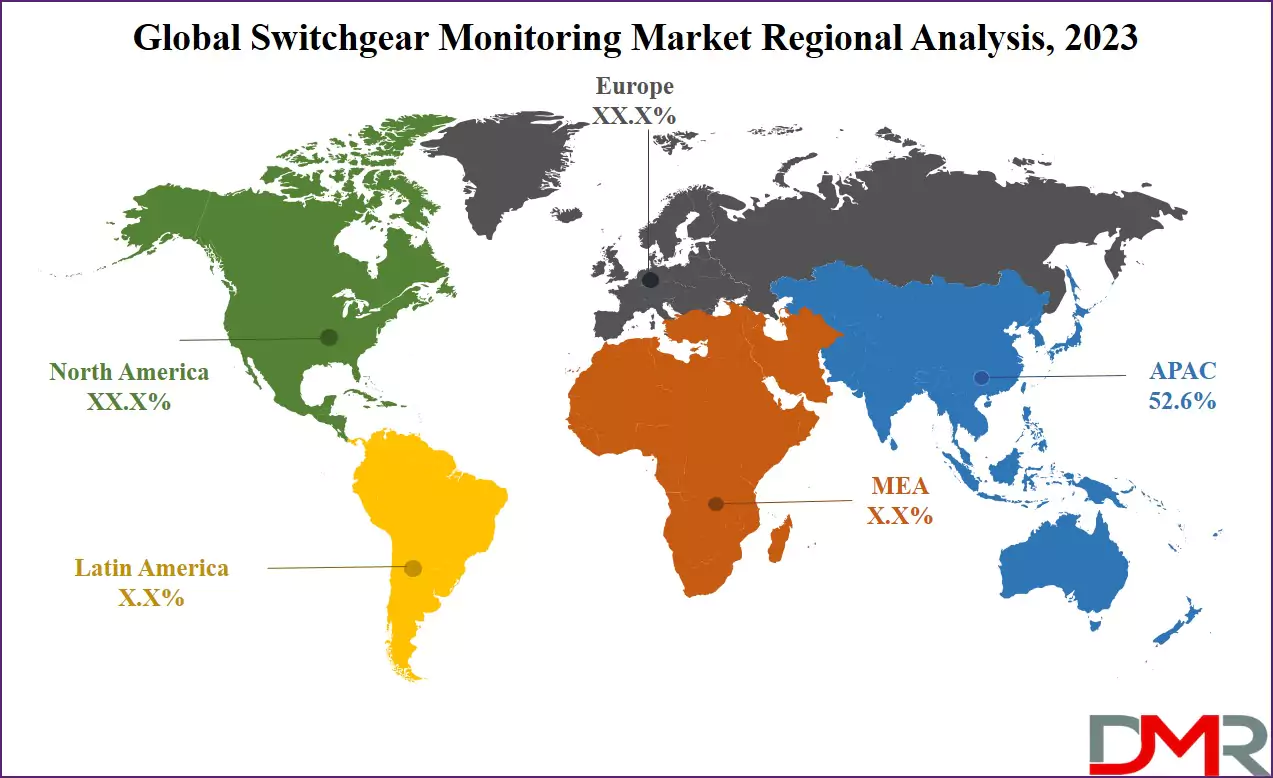

- Asia Pacific has a 52.6% share of revenue in the Global Switchgear Monitoring Market in 2023.

- Continuous monitoring helps detect potential faults early, reducing the risk of electrical failures, fires, or hazardous conditions.

- By analyzing real-time data, switchgear monitoring systems help schedule maintenance proactively, preventing unexpected breakdowns and reducing downtime.

- Remote monitoring and automation optimize system performance, minimize manual inspections, and enhance overall energy management.

- Early fault detection prevents costly emergency repairs and extends the lifespan of switchgear components, leading to lower operational expenses.

Switchgear Monitoring Market Use Cases

- Predictive Maintenance: Switchgear monitoring systems can detect early signs of equipment failure, such as temperature fluctuations, electrical imbalances, or wear. This allows for predictive maintenance, reducing downtime and preventing costly repairs or failures.

- Real-time Monitoring: Continuous real-time monitoring helps in tracking the status of switchgear equipment like circuit breakers and transformers. It enables operators to make informed decisions on system adjustments and detect any issues in the network promptly.

- Fault Detection and Diagnostics: Monitoring systems can identify faults such as short circuits or ground faults within the switchgear. Once a fault is detected, the system can trigger an alarm and provide diagnostic information to resolve the issue quickly.

- Remote Control and Automation: With remote monitoring capabilities, operators can control and adjust switchgear equipment remotely. This enhances the operational flexibility and speed in responding to system changes or failures without physical presence at the location.

- Energy Management: By monitoring the performance of switchgear, these systems can optimize energy usage by detecting load imbalances or inefficiencies, helping companies reduce energy consumption and improve sustainability efforts.

Switchgear Monitoring Market Dynamic

The global Switchgear Monitoring Market is driven by the growing demand from the energy & utility sectors, focusing on preserving & safeguarding electrical grid distribution systems. Further switchgear monitoring provides various advantages for grid distribution, like reduced energy consumption, better customer service, accurate billing, fraud detection, & reduction of technical losses.

Further, the increasing need for consistent monitoring across different business verticals fuels the market's growth, as smart switchgear monitoring contributes to growing efficiency & reduced industrial downtime, driving the market across different industrial sectors. Industries related to

Veterinary Monitoring Equipment and agriculture-based technologies are also beginning to adopt similar monitoring solutions to manage field equipment and livestock health more efficiently.

However, challenges like the high cost of smart monitoring devices & strict government regulations on SF6 switchgear pose concerns that could partially restrain the market's expansion.

Driver

Rising Focus on Energy Efficiency and Reliability

Rising attention on energy efficiency and grid reliability are primary drivers of the switchgear monitoring market. Urbanization, industrialization and renewable energy source integration all demand robust and efficient power systems. Switchgear monitoring helps utilities prevent power outages, minimize downtime and optimize maintenance schedules by providing real-time information about equipment

performance.

Government initiatives supporting smart grid adoption and infrastructure upgrades also serve to drive market expansion. With modern power grids becoming ever more complex, demand for advanced monitoring solutions in commercial, industrial, and residential settings is expected to skyrocket significantly over time.

Trend

Integration of IoT and Advanced Analytics

Merging IoT with Advanced Analytics The adoption of Internet of Things (IoT) technology and advanced analytics is dramatically altering the switchgear monitoring market. IoT-enabled switchgear systems deliver real-time temperature, humidity, and operational parameter information to increase predictive maintenance capabilities. Advanced analytics and

machine learning algorithms are being utilized to predict failures and enhance asset management practices.

Cloud-based platforms are increasingly utilized to manage and analyze this data remotely. Integration of smart sensors and wireless communications within switchgear systems has gained increasing momentum, reflecting a global shift toward digitization and intelligent infrastructure, creating highly efficient power distribution networks.

Restraint

High Initial Investment Costs

A major constraint of the switchgear monitoring market is its high initial investment costs for installation and integration of advanced systems, which include not only hardware but also software, sensors, and ongoing data management infrastructure. Many small and medium-sized enterprises (SMEs) find it challenging to adopt these solutions due to limited budgets or due to lack of awareness regarding long-term benefits or technical complexities involved with using such solutions; this barrier is especially apparent in developing regions due to infrastructure and funding restrictions that limit market penetration.

Opportunity

Rising Adoption in Renewable Energy Systems

With renewable energy integration on power grids becoming ever more prevalent, switchgear monitoring market players see an array of opportunities unfold before them. Switchgear monitoring ensures the stability and reliability of renewable energy grids like wind and solar. Renewable energy investments worldwide, supported by government subsidies and regulations, have driven an unprecedented rise in investments into advanced switchgear solutions.

Furthermore, remote and off-grid renewable installations create a lucrative market for monitoring systems tailored to renewable energy applications. Businesses investing in innovative solutions geared toward these renewable installations stand to experience explosive growth.

Switchgear Monitoring Market Research Scope and Analysis

By Insulation

Segmented by insulation type the market consists of AIS and GIS, among which the market is primarily driven by the GIS segment, as it also holds the largest share of revenue in 2023. The increasing demand for gas-insulated switchgear (GIS) is a key driver within this market, mainly fueled by the rise in the need for monitoring high-voltage electrical assets. The emphasis on GIS is driven by its ability to effectively minimize unplanned outages & cut down on maintenance costs.

Further, the GIS technology provides a more enhanced solution for monitoring and maintaining electrical assets, making it a preferred choice in the market. As industries prioritize reliability & cost-efficiency in power distribution, the GIS segment is anticipated to lead the Switchgear Monitoring Market, addressing critical concerns related to outage prevention & maintenance optimization.

By Installation

In 2023, outdoor installation emerged as the dominant segment in the Switchgear monitoring market, driven by large demand in the utilities & industrial sectors. The outdoor switchgears finds extensive use in distribution substations & transmission lines, playing a vital role in efficiently managing power distribution across expansive networks.

Further, the durable construction of the outdoor switchgear is customized to withstand challenging environmental conditions, lowering the need for elaborate housing structures & thereby minimizing overall installation costs, which makes outdoor switchgears an affordable choice, mainly for large-scale power distribution systems.

In addition, their accessibility advantage simplifies maintenance and repairs in comparison to indoor counterparts. Also, outdoor switchgears facilitates easier inspections and repairs, as they don't require complex maneuvers in confined spaces, making them a pragmatic option for improving operational efficiency in power distribution networks.

By Voltage

The medium-voltage segment stands as the largest in the market in 2023, serving as a vital bridge between high and low-voltage applications. Known for their versatility, medium-voltage switchgears find large applications in industrial, commercial, & utility sectors.

As industries expand, the need for strong power distribution systems grows, driving the increase in the adoption of medium-voltage variants. Further, their effectiveness in control & protection makes them instrumental in safeguarding electrical equipment from potential damage.

In addition, as the global need for reliable & sustainable energy rises, medium-voltage systems play an important role in the infrastructure of renewable energy generation. They assist in the integration of renewable sources to manage fluctuating loads, power grids, and ensure grid stability, supporting their indispensability in the changing energy landscape. In essence, the height of medium-voltage switchgears is twisted with their adaptability across different sectors and their essential role in advancing both traditional and renewable energy infrastructures.

By End User

The global switchgear monitoring market is categorized by end-use into transmission & distribution utilities, industries, commercial & residential, and others. Further, the transmission & distribution utilities (T&D Utilities) emerged as a substantial market segment in 2023, holding a significant market share, which is attributed to a growth in electricity demand & the large adoption of smart grids, strengthening segmental growth.

Also, the current development in transmission & distribution infrastructure further drives the need for switchgear products. Population growth, urbanization, & the rise in the need for energy drive an increased adoption of renewable sources worldwide, which trend aligns with efforts to meet energy demands sustainably, the deployment of smart cities, along with the modernization of aging infrastructure & the integration of automation & intelligent systems in electric power distribution, serves as a catalyst for growth in the demand within this segment.

The Switchgear Monitoring Market Report is segmented on the basis of the following:

By Insulation

By Installation

By Voltage

By End User

- T&D Utilities

- Industries

- Commercial & Residential

- Others

How Does Artificial Intelligence Contribute To Improve Switchgear Monitoring Market ?

- Predictive Maintenance: AI-powered analytics predict potential failures in switchgear components, reducing downtime and maintenance costs.

- Real-time Condition Monitoring: AI continuously analyzes sensor data to detect anomalies in switchgear performance, ensuring early fault detection.

- Energy Efficiency Optimization: AI-driven algorithms optimize power distribution, reducing energy wastage and improving overall efficiency.

- Fault Diagnosis & Root Cause Analysis: AI identifies and classifies faults with high accuracy, enabling faster troubleshooting and minimizing outages.

- Automation of Inspections: AI-enabled computer vision automates switchgear inspections, reducing the need for manual checks and improving safety.

- Load Forecasting & Demand Management: AI predicts power demand fluctuations, helping in better load management and grid stability.

- Cybersecurity Enhancement: AI strengthens security by detecting and mitigating cyber threats in smart switchgear systems.

- Asset Lifecycle Management: AI helps in planning the replacement or maintenance of switchgear components based on usage patterns and wear analysis.

- Data-driven Decision Making: AI provides actionable insights from large datasets, enabling informed decision-making for grid operators.

Switchgear Monitoring Market Regional Analysis

Asia Pacific region asserts its dominance, holding the largest share of the switchgear market at

52.6% in 2023, which is fueled by the quick urbanization & industrialization witnessed across countries like India, China, & Southeast Asian nations. Also, the strong growth in infrastructure development requires resilient power distribution systems, benefiting the large range of industries provided in the region, from manufacturing to power generation, thus expanding the industrial landscape and significantly driving the market forward.

Further, growth in environmental concerns drives a major focus on renewable energy in these countries, advancing market growth as the region highly adopts & implements renewable energy projects. In addition, government initiatives for rural electrification & grid modernization act as a vital catalyst, expanding & upgrading power networks, thereby increasing the demand for switchgear.

In essence, Asia Pacific's commanding position in the switchgear market is complicatedly linked to its dynamic economic development, industrial diversification, & a concerted push towards sustainable energy solutions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Switchgear Monitoring Market Competitive Landscape

The switchgear market experiences fragmentation, and major players apply strategic approaches like partnerships, innovations, & acquisitions to strengthen their product portfolios & secure a lasting competitive edge, which reflects a commitment to staying at the lead of technology & industry trends. Further, through collaborative ventures, continuous innovations, & targeted acquisitions, these key players focus to solidify their positions & meet the evolving demands of the market.

In October 2023, Siemens Smart Infrastructure widened its lineup of eco-friendly & digitally advanced medium-voltage switchgear to facilitate the decarbonization of contemporary power grids. In addition, the introduction of the F-gas-free blue GIS primary switchgear enables an early switch toward sustainable grids in anticipation of upcoming regulations, while particularly targeting industrial & high-end applications with ratings up to 24kV and 2500A, Siemens also unveiled the 8DAB 24 & enhanced the NXPLUS C 24 models.

Some of the prominent players in the global Switchgear Monitoring Market are

- ABB

- Siemens

- Schneider Electric

- Emerson

- General Electric

- Eaton

- Switchgear Company

- Hitachi

- Havells India

- KONCAR Group

- Other Key Players

Switchgear Monitoring Market Recent Development

- In September 2023, ABB announced plans to introduce the 500 mm panel variant of UniGear ZS1, its advanced air-insulated medium-voltage switchgear, at the Abu Dhabi International Petroleum Exhibition & Conference (ADIPEC) 2023, where ABB will showcase its comprehensive & sustainable switchgear, featuring asset health solutions, alongside innovations like the Electric Vehicle Charger. UniGear ZS1, mainly the 500mm panel version, comes out as a significant advancement in high reliability, quality, & sustainability, addressing critical challenges across industries like refineries, oil and gas, utilities, & high-rise buildings, highlighting ABB's dedication to pushing industry boundaries with state-of-the-art solutions.

- In April 2023, Toshiba announced the AEROXIA, an SF6-free switchgear operating at 72.5Kv, which includes natural gas & a vacuum circuit breaker, aligning with global environmental regulations restricting SF6 use. Also, addressing ease of handling & environmental concerns, Toshiba expands its range of electric power equipment under the "AEROXIATM" brand, assisting digitalized substations with options for monitoring & diagnostics in compliance with the IEC61850 standard, both in Japan & other parts of the world.

- In November 2022, Schneider Electric announced a partnership with ARDECO for the production of advanced power & energy technology solutions in the UAE, which involved Schneider Electric taking the lead in manufacturing a range of advanced energy automation solutions, including integrated power solutions, switchgear, and control panel integrations. Further, the partnership also included expertise in energy automation design & engineering, showcasing a strategic move towards comprehensive offerings in the expanding energy sector.

Switchgear Monitoring Market Report Details

| Report Characteristics |

| Market Size (2023) |

USD 77.1 Bn |

| Forecast Value (2032) |

USD 120.6 Bn |

| CAGR (2023-2032) |

5.1% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Insulation (AIS and GIS), By Installation (Indoor and Outdoor), By Voltage (High, Low, and Medium), By End User (T&D Utilities, Industries, Commercial & Residential, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

ABB, Siemens, Schneider Electric, Emerson, General Electric, Eaton, Switchgear Company, Hitachi, Havells India, KONCAR Group, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Switchgear Monitoring Market size is estimated to have a value of USD 77.1 billion in 2023

and is expected to reach USD 120.6 billion by the end of 2032.

Asia Pacific has the largest market share for the Global Switchgear Monitoring Market with a share of

about 52.6% in 2023.

Some of the major key players in the Global Switchgear Monitoring Market are ABB, Siemens, Schneider

Electric, and many others.

The market is growing at a CAGR of 5.1 percent over the forecasted period.