Market Overview

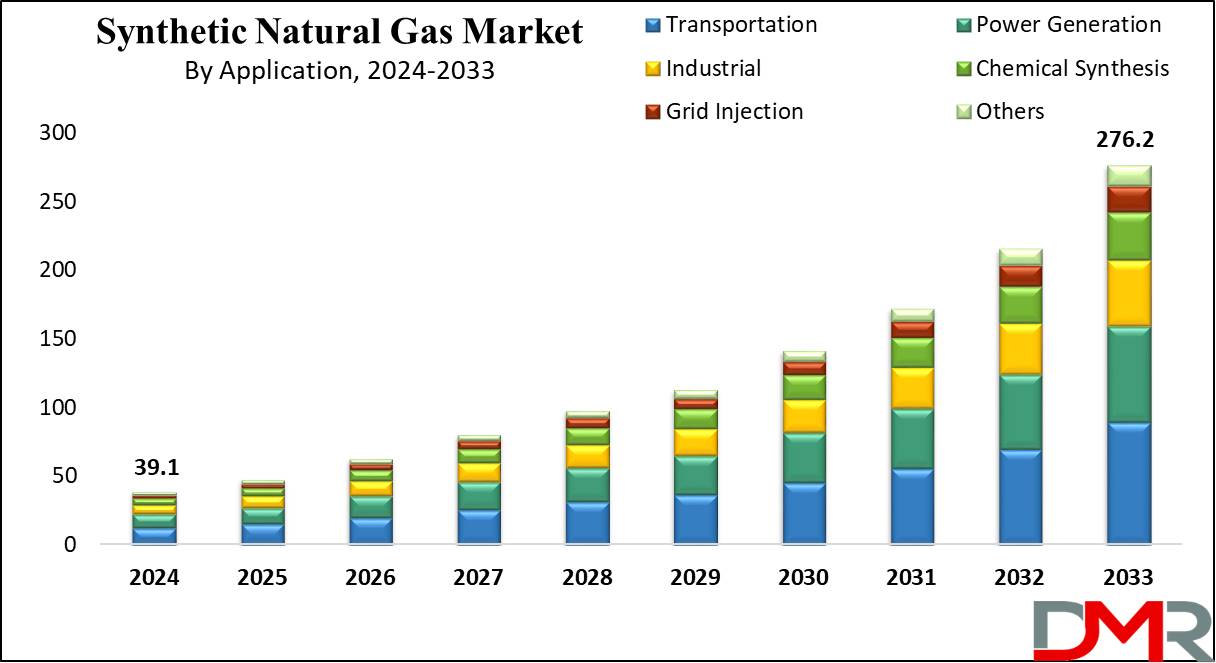

The Global Synthetic Natural Gas Market size is expected to reach a value of USD 39.1 billion in 2024, which is further expected to reach USD 276.2 billion in 2033 at a CAGR of 24.2% for the forecast period.

The market for Global Synthetic Natural Gas (SNG) is experiencing a gradual expansion, powered by several reasons, including the surge in focus on environment-friendly solutions, growing demand for clean fuels, and new technological advancements in gasification technologies.

SNG, synthesized from coal, biomass, and municipal solid waste under the deployment of advanced energy and gasification technologies, can be used as an alternative to natural gas with enhanced energy security and reduced greenhouse gas emissions. Integration with industrial gases and specialty gas networks is further strengthening its industrial applications.

This market is distinct in the fact that it comprises a wide range of players such as oil and gas majors, technology providers, and government organizations, that contribute to the global development and deployment of SNG technologies.

The role of energy storage technologies, CNG powertrain systems, and micro combined heat and power (Micro-CHP) solutions is also becoming more prominent in strengthening the adoption of SNG across diverse sectors.

Key Takeaways

- Market Size: The global Synthetic Natural Gas (SNG) marketplace is experiencing extensive growth, with a projected value of USD 39.1 billion in 2024, which is further projected to reach USD 276.2 billion through 2033, at a CAGR of 24.2%.

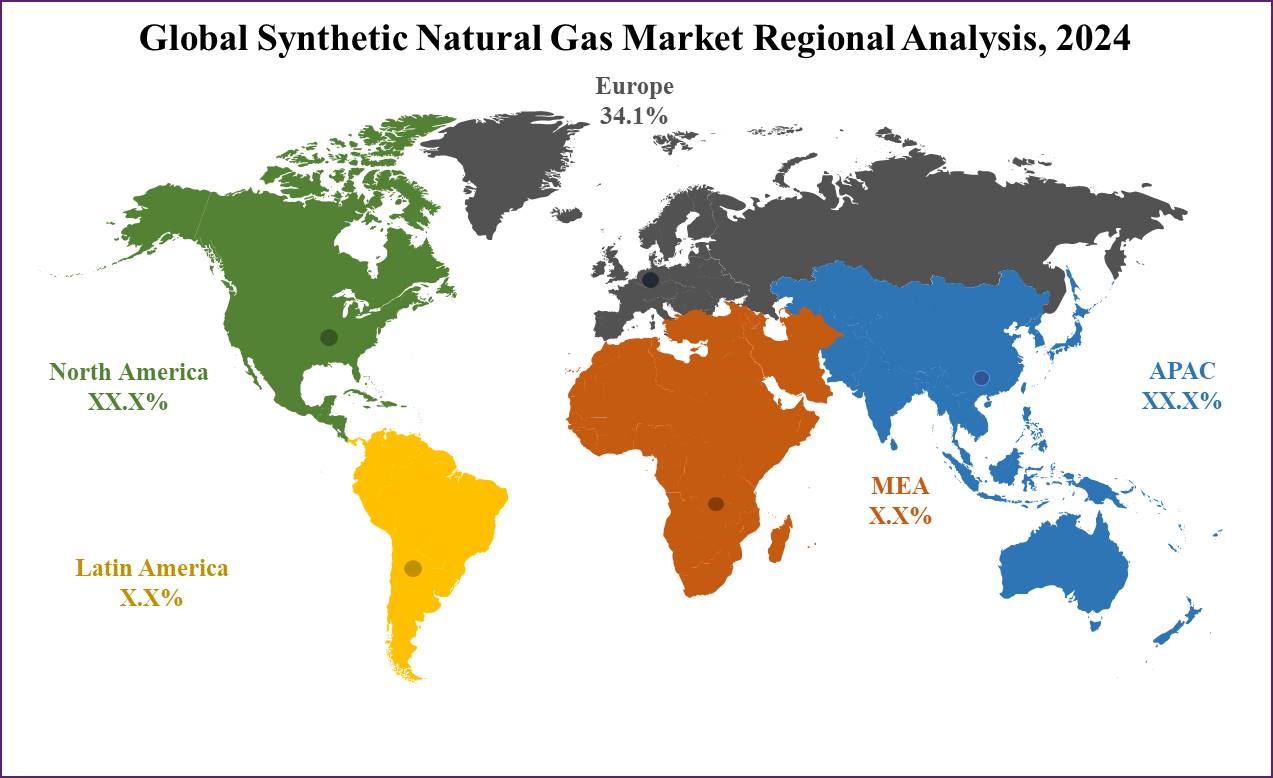

- Dominance of Europe: Europe emerges as the leading region within the SNG market, predicted to keep the largest market share of approximately 34.1% in 2024. The vicinity's superior infrastructure, dedication to sustainability, and strategic partnerships drive its dominance.

- Source Segment Analysis: Coal is projected to dominate the synthetic natural gas market with the highest market share in 2024.

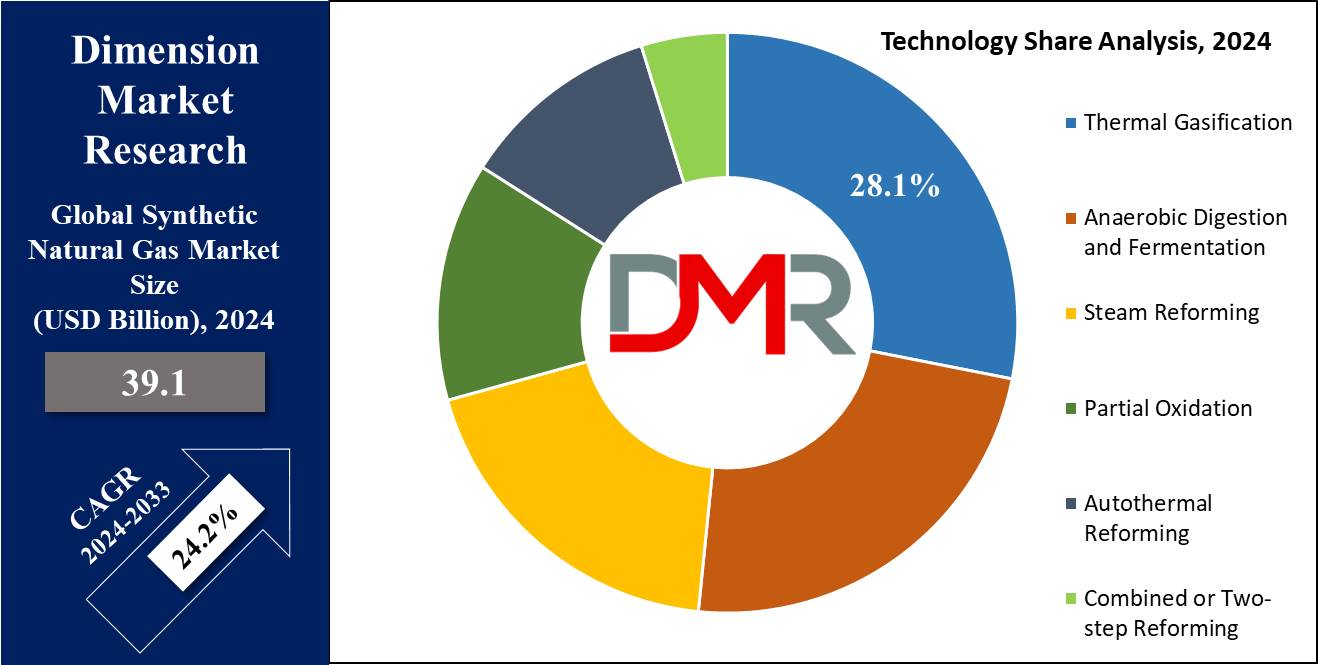

- Technology Segment Analysis: Thermal Gasification is projected to dominate the synthetic natural gas market in the source segment with a 28.1% market share in 2024.

- Application Segment Analysis: Transportation is expected to dominate the application segment in the synthetic natural gas market with a 32.2% market share in 2024.

- Technological Innovation: Companies like BASF SE, Shell, and Air Products and Chemicals Inc. Are at the leading edge of innovation within the SNG market, introducing new technology to improve manufacturing efficiency and environmental sustainability.

- Diverse Applications: Synthetic natural gas finds packages across various sectors, inclusive of transportation, energy technology, industrial strategies, and grid injection, providing flexible solutions for reducing emissions and improving energy security.

Use Cases

- Transportation Fuel: Synthetic natural gas is used as a clean and efficient fuel for buses, trucks, and vehicles, decreasing emissions and enhancing air quality in urban areas. Government-backed power purchase agreements in Europe and Asia-Pacific also support the integration of SNG in mobility projects.

- Power Generation: SNG is utilized in gas turbines, steam turbines, and combined-cycle power plants to generate electricity, supplying a reliable and sustainable energy supply alongside wind power generators and diesel generators for grid balancing.

- Industrial Processes: SNG serves as a feedstock for applications such as green ammonia, refining, oilfield chemicals, and industrial filtration, helping reduce reliance on fossil fuels.

- Grid Injection: Injecting SNG into natural gas pipelines enhances stability and reliability, complementing distribution transformer and power transformer infrastructure for uninterrupted energy supply.

- Waste-to-Energy: Synthetic natural gas derived from biomass and waste materials supports waste management, solar panel recycling, and biorefinery initiatives by converting organic waste into valuable energy resources.

Market Dynamic

Trends

Shift towards Waste-to-Energy

There is a noticeable trend toward waste-to-electricity initiatives, driven by means of environmental concerns and the need for sustainable energy sources. As synthetic natural gas production from landfill gas and agricultural residues is more and more utilized, the circular economy principles, as well as waste management strategies, correspond with the application of this method.

Focus on Methane Emissions Reduction

While the latest research reveals the high greenhouse effect of methane, more attention is focused on methane leakage mitigation throughout the SNG generation as a whole. Stringent measures have been put in motion to avoid fugitive methane emissions in order to make sure that SNG maintains its environmental advantages on top of the methane emissions on conventional natural gas.

Growth Drivers

Renewable Energy Production

Recognizing the importance of natural energy sources, the increasing demand for renewables is triggering the growth of the synthetic natural gas market across the regions that are currently focused on carbon emissions mitigation as well as sustainable energy solutions.

Government Investment in Renewable Energy

Renewable energies and sustainable transportation systems made possible through government incentives or investments have the potential of significantly broadening the prospects for the SNG market. These investments strive to increase energy security, cut carbon emissions, and encourage innovations in waste management technologies.

Growth Opportunities

Technology for Underground Coal Gasification

The technologies for underground coal gasification bring up the chances for the synthetic natural gas market to develop consistently. This novel method for the removal of gas from coal seams underground could open new reserves of feedstock and improve the availability of natural gas for SNG production.

Government Measures for Renewable Energy

The expansion of government acceptance and policy measures such as a heavy capital allocation for renewables is a major positive factor for the synthetic natural gas market to spread further. These initiatives do not only strengthen the row against environmental issues but also seek to develop waste management innovations and eventually lead to the establishment of sustainable energy solutions.

Restraints

High Startup Costs

The high startup costs associated with SNG plants and the rising prices of fossil fuels pose significant restraints on market growth. These costs can avert funding in SNG manufacturing facilities, especially within the medium- to long-term, no matter the capability blessings of renewable SNG derived from biomass.

Restricted Supply and Composition Challenges

Challenges related to the restricted supply of feedstock and the composition of synthetic gas present additional constraints on the synthetic natural gas market. Issues that include variations in gasifier inputs and the composition of syngas can affect the efficiency and overall performance of SNG production processes, posing operational challenges for industry stakeholders.

Research Scope and Analysis

By Source

Coal is projected to dominate the source segment in the global synthetic natural gas (SNG) market with the highest market share in 2024 because of several key elements.

Firstly, coal reserves are plentiful and widely distributed across diverse regions globally, providing a dependable and consistent source for SNG production. This abundance ensures a consistent and stable supply of feedstock for SNG production, mitigating concerns about resource scarcity or supply chain disruptions.

Additionally, coal gasification, a prominent technology for SNG manufacturing from coal, offers excessive performance and scalability, making it economically viable for massive-scale manufacturing facilities. This efficiency interprets competitive production costs for coal-derived SNG compared to different feedstock resources.

Moreover, coal-to-SNG conversion processes can utilize existing coal mining infrastructure and understanding, minimizing the need for big capital funding in new infrastructure development. This advantage in addition reduces production costs and complements the competitiveness of coal-derived SNG in the market.

Furthermore, technological improvements in coal gasification technologies, coupled with stringent environmental policies and emissions controls, have stepped forward the environmental performance of coal-derived SNG, making it an extra sustainable choice as compared to conventional coal combustion for energy generation. Overall, those factors make contribute to coal's dominance in the source section of the global SNG market.

By Technology

Thermal gasification is projected to be a dominant technology in the global synthetic natural gas (SNG) marketplace with 28.1% of market share in 2024. Thermal gasification gives a flexible and efficient approach for converting diverse feedstocks, such as biomass, coal, and municipal solid waste, into synthesis gasoline (syngas), a key precursor to SNG production.

This flexibility in feedstock selection permits thermal gasification to conform to exclusive regional resource availability and waste management needs, making it an especially adaptable technology globally.

Additionally, thermal gasification technologies, along with moving bed gasifiers, fluidized bed gasifiers, and entrained flow gasifiers, provide excessive conversion efficiencies and process intensification as compared to different SNG manufacturing methods. This performance translates into better yields of syngas, which can be in addition processed into SNG with decreased energy consumption and operational costs.

Moreover, thermal gasification has garnered major attention and funding because of its potential to mitigate environmental worries associated with conventional fossil fuel extraction and combustion.

By changing waste materials and biomass into SNG, thermal gasification contributes to reducing greenhouse gas emissions and reliance on finite fossil fuel resources, aligning with global sustainability targets and climate change mitigation efforts.

Furthermore, ongoing advancements and research in thermal gasification technology continue to enhance its efficiency, scalability, and cost-effectiveness, driving its dominance within the SNG market.

As governments and industries worldwide seek cleaner and more sustainable energy solutions, thermal gasification emerges as a leading technology for meeting the growing demand for synthetic natural gas for various reasons.

By Application

Transportation is expected to dominate the application segment in the global synthetic natural gas (SNG) market with a 32.2% market share in 2024, due to numerous compelling reasons as reducing carbon emissions and transitioning in the direction of cleaner energy sources.

Transportation emerges as a major sector in which SNG gives a viable solution. With concerns approximately air pollutants and greenhouse gas emissions escalating, there is a growing emphasis on adopting alternative fuels in the transportation industry.

SNG presents itself as an appealing option for transportation due to its compatibility with current infrastructure, especially natural gas pipelines and refueling stations. This infrastructure considerably lowers the limitations to entry for SNG adoption in the transportation sector compared to other alternative fuels.

Moreover, SNG offers several advantages over traditional fossil fuels, including lower emissions of pollution and greenhouse gases, making it an environmentally friendly alternative for automobiles.

Additionally, improvements in SNG production technologies, such as biomethane from organic waste or renewable sources, make contributions to its sustainability credentials, similarly driving its adoption in transportation.

Furthermore, government regulations and incentives aimed toward promoting cleaner transportation fuels offer a favorable regulatory environment for SNG adoption.

Incentives, including tax credits, subsidies, and emissions guidelines, incentivize automobile manufacturers and consumers to transition towards SNG-powered vehicles, similarly fueling its dominance in the transportation sector of the global SNG marketplace.

The Synthetic Natural Gas Market Report is segmented based on the following

By Source

- Coal

- Biomass

- Solid Waste

- Others

By Technology

- Thermal Gasification

- Moving Bed Gasifier

- Fluidized Bed Gasifier

- Entrained Flow Gasifier

- Anaerobic Digestion and Fermentation

- Steam Reforming

- Partial Oxidation

- Autothermal Reforming

- Combined or Two-step Reforming

By Application

- Transportation

- Power Generation

- Industrial

- Chemical Synthesis

- Grid Injection

- Others

Regional Analysis

Europe is expected to dominate the global synthetic natural gas market with 34.1% of the market share in 2024. Europe dominates the synthetic natural gas (SNG) marketplace because of several key elements it is anticipated to be the largest growing region within the SNG market from 2024 to 2023.

European countries form partnerships with countries like Japan and South Korea, which are heavily investing in synthetic natural gas technology, and are accelerating the improvement of global SNG supply chain networks. Moreover, Europe's superior commercial infrastructure and commitment to environmental sustainability drive the adoption of SNG as a cleaner alternative to conventional fuels.

Additionally, Europe's strategic geographical position and set up alternate relations make it a critical hub for SNG production and distribution, in addition to bolstering its dominance within the marketplace. The region's strong consciousness of renewable energy sources aligns with the increasing demand for SNG, specifically in commercial and industrial sectors.

Furthermore, Europe's stringent environmental regulations and incentives for renewable energy adoption incentivize the development and deployment of SNG technologies. This regulatory framework creates conducive surroundings for investment and innovation within the SNG marketplace, cementing Europe's leading position.

Overall, Europe's combination of technological advancement, supportive policies, and collaborative partnerships positions it because of the dominant force in the global synthetic natural gas marketplace.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global Synthetic Natural Gas (SNG) Market is characterized by the dominance of key gamers along with Basin Electric Power Cooperative (US), Air Liquide (France), EnviTec Biogas AG (Germany), Verbio SE (Germany), and Kinder Morgan (US). These groups leverage their great regional presence, numerous product services, and advanced technologies to hold leadership positions within the market.

Over the length of 2020 to 2024, they appoint numerous strategies inclusive of new product launches, partnerships, agreements, acquisitions, and expansions to solidify their marketplace presence and seize large market stocks.

Notably, Air Liquide (France) and Shell (Netherlands) are at the leading edge of innovation, introducing new technologies aimed at enhancing the synthetic natural gas market. The competitive panorama of the global SNG marketplace is characterized by the aid of dynamic marketplace forces and evolving consumer preferences, driving non-stop innovation and strategic maneuvering amongst industry players.

Some of the prominent players in the global Synthetic Natural Gas Market are

- BASF SE

- Shell

- Air Products and Chemicals, Inc

- Air Liquide

- The Linde Group

- Synthesis Energy Systems, Inc.

- Yankuang Group

- Methanex

- Yara International

- HELM AG

- Dakota Gasification Company

- ZSW

- Other Key Players

Recent Developments

- In April 2024, Air Liquide continues expanding its Renewable Natural Gas (RNG) capacities in the U.S. with the establishment of two new production units in Center Township, Pennsylvania, and Holland Township, Michigan. These units will process waste from dairy farms.

- In April 2024, Brightmark RNG Holdings, a collaboration between Chevron USA Inc. and Brightmark, inaugurates its Eloy Renewable Natural Gas (RNG) center. Situated at the Caballero Dairy farm in Arizona, the center utilizes anaerobic digesters to capture methane from dairy operations, producing RNG for pipeline fuel.

- In April 2024, AMERESCO, a prominent cleantech integrator specializing in energy efficiency and renewable energy, completes the development and construction of an advanced technology biogas cogeneration facility for the Sacramento Area Sewer District. Located at the EchoWater Resource Recovery Facility, this project amounts to nearly USD 140 million.

- In March 2024, Electrochaea and Erik Thun AB initiated negotiations regarding the off-take of e-methane produced by Electrochaea’s subsidiary BioCAT Roslev Aps in Denmark. This e-methane will be utilized as maritime fuel in vessels operated by Erik Thun AB.

- In December 2023, Hanseatic Energy Hub GmbH completes permitting and marketing for its zero-emission terminal in Hamburg. Shareholders are preparing for the final investment decision, with operations transitioning to ammonia by 2043.

- In January 2022, Wärtsilä and Vantaa Energy plan Finland's largest Power-to-Gas plant, aiming for carbon neutrality by 2035. Scheduled for 2025, the plant produces synthetic methane to reduce CO₂ emissions and advance renewable energy integration.

- In June 2021, Baker Hughes invested in Electrochaea GmbH, a startup focusing on producing synthetic natural gas from hydrogen and carbon dioxide, aligning with efforts to capture emissions.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 39.1 Bn |

| Forecast Value (2033) |

USD 276.2 Bn |

| CAGR (2024-2033) |

24.2% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Source (Coal, Biomass, Solid Waste, and Others), By Technology (Thermal Gasification, Anaerobic Digestion and Fermentation, Steam Reforming, Partial Oxidation, Autothermal Reforming, and Combined or Two-step Reforming), By Application (Transportation, Power Generation, Industrial, Chemical Synthesis, Grid Injection, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

BASF SE, Shell, Air Products and Chemicals Inc., Air Liquide, The Linde Group, Synthesis Energy Systems Inc., Yankuang Group, Methanex, Yara International, HELM AG, Dakota Gasification Company, ZSW, and Other Key Players |

| Purchase Options |

Physio-Control Inc., Schiller, Medtronic, Abbott, Boston Scientific Corporation, Koninklijke Philips N.V., Zoll Medical Corporation, BIOTRONIK, Progetti Srl, LivaNova Plc, and Other Key Players |

Frequently Asked Questions

The Global Synthetic Natural Gas Market size is estimated to be valued at USD 39.1 billion in 2024 and is expected to reach USD 276.2 billion by the end of 2033.

Europe is expected to have the largest market share in the Global Synthetic Natural Gas Market with a share of about 34.1% in 2024.

Some of the major key players in the Global Synthetic Natural Gas Market are BASF SE, Shell, Air Products and Chemicals Inc, Air Liquide, and many others.

The market is growing at a CAGR of 24.2 percent over the forecasted period.