ℹ

To learn more about this report –

Download Your Free Sample Report Here

Tank Cleaning Chemicals are specialized chemical formulations designed to remove contaminants, residues, and deposits from storage tanks, process vessels, and industrial equipment. They effectively dissolve, disperse, or oxidize unwanted substances, such as sludge, scale, grease, and other deposits, ensuring tanks remain safe, hygienic, and efficient. These chemicals may be acidic, alkaline, or neutral, chosen based on the type of residue and material compatibility. They are widely used in petrochemicals, food processing, and water treatment industries. Proper handling, dosage, and neutralization are critical to avoid corrosion and ensure environmental safety during and after cleaning. These formulations optimize operational performance.

The US Tank Cleaning Chemicals Market

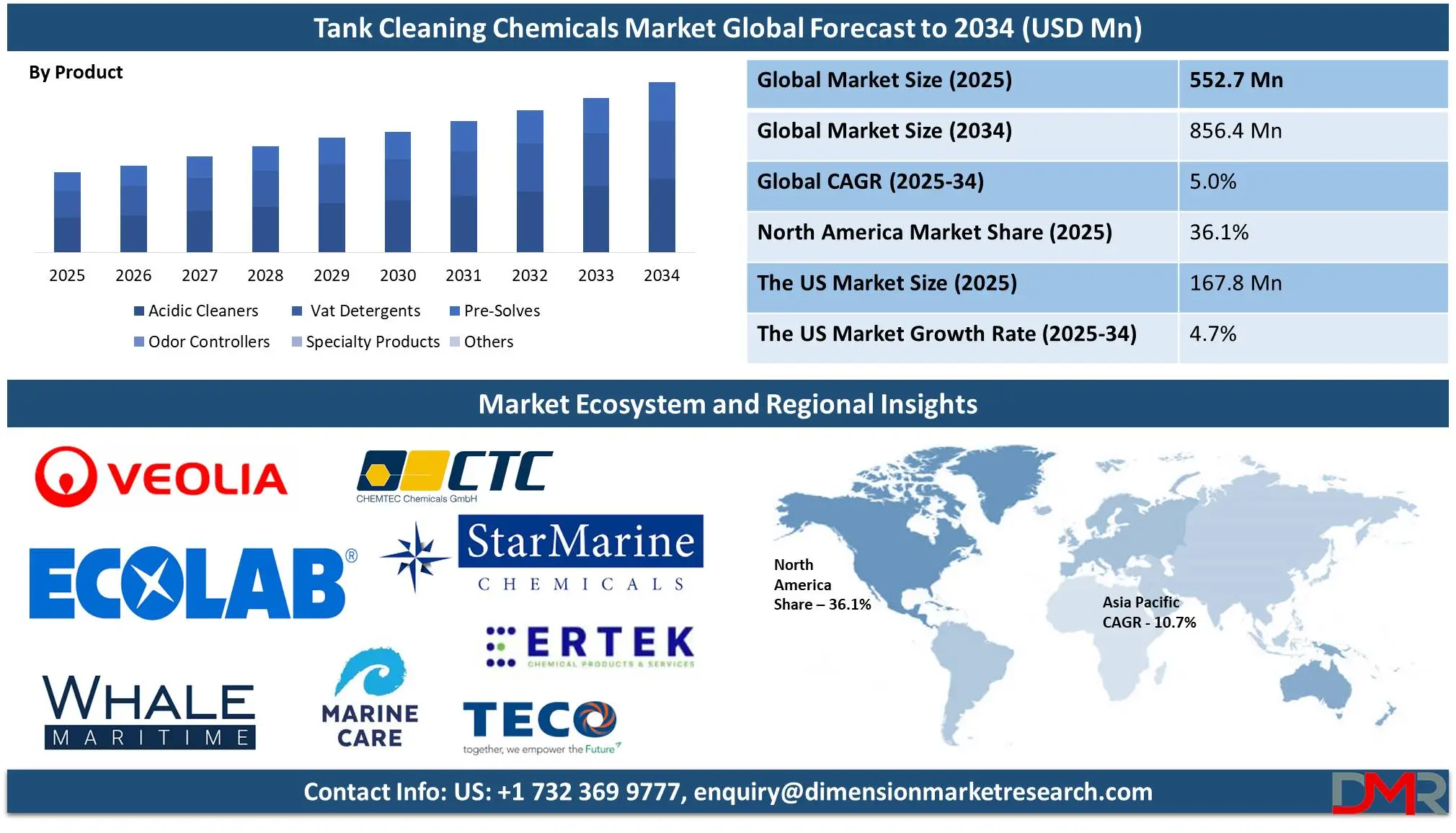

The US Tank Cleaning Chemicals market is projected to be valued at USD 167.8 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 253.7 million in 2034 at a CAGR of 4.7%.

Industrial expansion in petroleum, chemical, and food processing sectors demands efficient cleaning solutions to maintain equipment and prevent contamination. Innovations in formulation and application reduce downtime and improve performance, while increased research investments enhance product efficacy. Emphasis on cost reduction and operational efficiency further propels demand, reinforcing market growth through eco-friendly cleaning alternatives across various industries.

There is a growing adoption of biodegradable and non-toxic formulations driven by environmental concerns. Manufacturers are investing in research to develop specialized solutions for diverse tank materials. Additionally, industry players are focusing on digital integration and real-time monitoring to optimize cleaning processes, enhancing efficiency and safety while reducing operational costs.

Tank Cleaning Chemicals Market: Key Takeaways

- Market Growth: The global tank cleaning chemicals market is anticipated to expand by USD 279.0 million, achieving a CAGR of 5.0% from 2026 to 2034.

- Product Analysis: Acid cleaners are expected to lead the global tank cleaning chemicals market with the highest revenue share of 36.4% by the end of 2025.

- Location Analysis: Marine tanks are projected to dominate the global market, with the largest revenue share of 40.1% in 2025.

- End User Analysis: The marine segment is anticipated to dominate the global market based on end-users, with the highest revenue share of 43.2% by the end of 2025.

- Regional Analysis: North America is projected to dominate the Global Tank Cleaning Chemicals Market, holding a market share of 36.1% by 2025.

- Prominent Players: Some of the major key players in the Global Tank Cleaning Chemicals Market are TECO Chemicals, Wilhelmsen, Ecolab Inc., and many others.

Tank Cleaning Chemicals Market: Use Cases

- Food & Beverage Processing: It is used in cleaning tanks that hold milk, juices, beer, wine, and other consumables, these chemicals help remove organic residues, biofilms, and microbial contaminants while meeting stringent food safety standards.

- Oil & Fuel Storage: In petroleum industries, cleaning chemicals remove sludge, deposits, and water contaminants from fuel storage tanks to prevent corrosion and ensure product quality.

- Chemical Processing Tanks: Tanks used for producing or storing chemicals often require specialized cleaners to eliminate residual chemicals or byproducts that could interfere with future batches or react with new ingredients.

- Wastewater Treatment: Cleaning agents are employed in tanks and clarifiers to remove accumulated biofilms, grease, and sediments. This improves process efficiency and prevents system blockages.

Tank Cleaning Chemicals Market: Stats & Facts

- CEFIC reports that from 2012 to 2022, chemical production in China and India grew on average by 6.9% and 1.8%, respectively, while the EU, Brazil, and the U.S. experienced declines of -0.03%, -0.1%, and -0.8%.

- Invest India highlights that India's food processing sector is among the worlds largest, with its output expected to hit USD 535 million by 2025–2026.

- According to UNCTAD, after a decline in 2020, shipments increased in 2021 by an estimated 3.2%, reaching 11 million tons, which signifies a recovery. Africa recorded an increase of about 5.6%, Latin America and the Caribbean saw a 3% rise, and Asia continued to lead as the primary maritime cargo handling center, accounting for 42% of goods loaded and 64% of goods unloaded in 2021.

Tank Cleaning Chemicals Market: Market Dynamic

Driving Factors in the Tank Cleaning Chemicals Market

Industrial Expansion

Rapid industrialization all over the world is heavily boosting the demand for tank-cleaning chemicals. Oil and gas, chemical manufacturing, and wastewater treatment industries depend heavily upon them for equipment dependability and operating efficiency. New industries being established and the additional capacity by the existing industries make tank cleaning even more essential for the removal of residues and interfering contaminants during the manufacturing processes. Stringent environment and safety regulations also make the adoption of routine cleansing mandatory for the industries, thus ensuring them against non-compliance and equipment longevity. This increased industrial presence, coupled with the need for efficient upkeep processes, creates a strong market demand for specialized cleaners for various industries all over the world.

Sustainable Practices

Companies worldwide are adopting ever-increasing levels of sustainable practice, thus raising the demand for environment-friendly tank cleaning chemicals. Manufacturers now create biodegradable and non-hazardous formulations that cause less impact on the environment and adhere to tough regulations. This transition towards clean, sustainable solutions is indicative of changing consumer demands and corporate social responsibility agendas.

To minimize their carbon prints and improve safety levels, business houses find the motivation to incorporate superior levels of cleansing protocols that safeguard not only equipment but also the environment. With increased demands for environment-friendlier cleansing agents, the level of innovations in the formulations is picking up, energizing the market through innovative, clean practices and pushing the levels for improvements continuously for various industries for the future.

Restraints in the Tank Cleaning Chemicals Market

Environmental regulations

Environmental regulations restricting tank cleaning chemicals markets are majorly detrimental, forcing manufacturers to adapt traditional formulations for safety and ecological purposes. Governments throughout the world enforce policies meant to minimize harmful impacts on ecosystems through laws mandating minimum impact policies, which force manufacturers to adapt traditional formulations in response. As regulations increase pressure for companies to invest in research and development of compliant alternatives, increasing production costs while impeding market entry.

Smaller firms, in particular, find it increasingly complex and costly to fulfill these mandates, hampering innovation and market expansion. Furthermore, changing sustainability requirements have reduced reliance on conventional chemicals, which further challenges industry players while adhering to stringent environmental standards worldwide.

Advanced Cleaning Solutions

Advanced cleaning solutions come with high costs that act as a significant impediment to the tank cleaning chemicals market. Specialized chemicals used for tank cleaning typically entail high production and purchase expenses, making them prohibitively expensive to smaller and mid-sized enterprises. Financial constraints may prevent companies from investing in effective cleaning formulations and thus jeopardize operational efficiency. Because these solutions tend to be costly, their higher end-user prices often force industries to seek cheaper options that may or may not meet performance standards and cost concerns restrict global adoption of superior cleaning technologies. This results in decreased competitiveness for these sectors.

Opportunities in the Tank Cleaning Chemicals Market

Technological Advancements

The tank cleaning chemicals market is being strongly pushed by the opportunities from the recent innovations in the field for greater efficiency and safety during the cleansing process. Environment-friendly compounds and smart additives make up the core of the recent formulations for faster, more even cleansing, reduced downtime, and less waste. Industry players make significant investments in the production of innovative solutions for adapting to stringent environments and industry regulations. Integration of nanotechnology, high-grade surfactants, and automated manufacturing has led to greater residue removal and equipment longevity. These innovations not only enhance competitive edge but also support market growth and decreased operating costs for various industries, contributing towards global sustainable progress.

Expansion into Emerging Markets

The tank cleaning chemicals market is also reporting robust opportunities for growth in emerging economies where industrialization and modernization create the need for high-performance cleaning chemicals. Asia-Pacific, the Middle East, and the rapid industrialization of Latin America have spurred investments in the food and beverage, chemical processes, and refinery industries. Rising awareness about the regulatory norms and regulations has spurred industries towards the use of high-performance cleaning chemicals. Manufacturers are reaching the market through localized chemicals for the regulatory and operating demands. This expanding market potential from under-penetrated markets sets the stage for increased market shares, profitability, and profitable growth.

Trends in the Tank Cleaning Chemicals Market

Automation and Digital Integration

Automation and digital integration are transforming the tank-cleaning chemicals market by streamlining operational processes and enhancing precision. Advanced monitoring systems, sensor-enabled devices, and data analytics enable real-time optimization of cleaning procedures. This trend reduces manual intervention, improves safety, and minimizes chemical waste by accurately dosing and controlling treatment cycles. Moreover, integrated software platforms and IoT technologies facilitate predictive maintenance and boost operational efficiency, resulting in consistent performance, reduced labor costs, and improved regulatory compliance. The digital shift in tank cleaning processes is fostering a new era of smart manufacturing, driving innovation and differentiation across the industrial cleaning sector.

Tank Cleaning Chemicals Market: Research Scope and Analysis

By Product

Acid cleaners are expected to lead the global tank cleaning chemicals market with the highest revenue share of 36.4% by the end of 2025 due to their superior effectiveness at dissolving stubborn deposits from tanks and vessels. These solutions efficiently remove mineral scales, rust, and other contaminants accumulating in industrial tanks for safe and optimal operations. Their powerful formulation allows users to minimize cleaning times while cutting downtime for increased productivity. With rising regulatory standards and greater environmental consciousness, acid cleaners are evolving to become more eco-friendly.

Their adaptability makes them suitable for various tank materials and conditions - further solidifying their market dominance. Their proven record in maintaining system integrity and safety fuels this market position. Vat detergents are predicted to take the second position in the tank-cleaning chemicals market due to their powerful yet gentle cleaning performance, particularly for residual soil and oil deposits. Their formulation offers optimal corrosion prevention with reliable operational results for increased efficiency.

By Tank Type

Marine tanks are projected to dominate the Tank Cleaning Chemicals Market with the largest revenue share of 40.1% in 2025 due to their essential role in the maritime industry. On board ships and vessels, marine tanks store fluids such as fuel, water, and chemicals, which require periodic cleaning to prevent corrosion, leaks, and operational hazards. Stringent regulations and maintenance protocols create demand for specific cleaning formulations designed to remove salt deposits, fuel residues, and contaminants in harsh marine environments. Additionally, global maritime trade expansion and stricter environmental compliance further boost market dominance for marine tanks.

Chemical tanks comprise the second-leading segment in the tank-cleaning chemicals market, necessitating special cleaning solutions to safely handle hazardous substances and effectively avoid cross-contamination. High-performance formulations must remove residues effectively to uphold safety standards as well as comply with industry regulations for regular maintenance purposes.

By End User

The marine segment is anticipated to dominate the global tank-cleaning chemicals market based on end-users, with the highest revenue share of 43.2% by the end of 2025. Marine vessels, including cargo ships and tankers, require advanced chemical cleaning solutions to maintain the integrity of their fuel storage systems. Stringent environmental regulations and growing fleet sizes drive the need for efficient cleaning processes that protect tanks from damage. Furthermore, innovative cleaning formulas tailored specifically for marine applications enhance performance and reduce contamination risks, with effective procedures being an integral component of regulatory compliance, making marine cleaning essential.

Maintenance requirements, as well as cost-cutting practices, reinforce its dominance globally.

Chemical processing facilities are expected to experience the highest CAGR by the end of 2025 due to the demand for effective tank cleaning agents to maintain product purity and equipment longevity, comply with stringent safety standards, and adapt to evolving process requirements. As technology continues its relentless march forward and operational efficiency advances further. This sector should experience tremendous benefits.

The Tank Cleaning Chemicals Market Report is segmented based on the following

By Product

- Vat Detergents

- Acidic Cleaners

- Pre-Solves

- Odor Controllers

- Specialty Products

- Others

By Tank Type

- Marine Tanks

- Chemical Tanks

- Fuel Tanks

- Water Transportation & Storage Tanks

- Oil Tanks

- Others

By End User

- Petrochemical

- Chemical

- Food & Beverages

- Manufacturing

- Marine

- Others

Regional Analysis

Region with the largest Share

North America is predicted to dominate the Tank Cleaning Chemicals Market with a revenue

share of 36.1% in 2025, due to its stringent environmental regulations, mature industrial infrastructure, and high technological adoption. The region’s rigorous environmental safety standards require industries to implement effective and sustainable cleaning solutions, thereby driving demand for advanced tank cleaning chemicals.

Additionally, key sectors such as oil and gas, chemical manufacturing, and food processing invest heavily in innovative cleaning technologies to ensure operational efficiency and regulatory compliance. The established industrial base in North America further supports market growth through continuous modernization and adherence to best practices in maintenance and safety protocols.

Region with Highest CAGR

Asia Pacific is predicted to grow with the highest CAGR in the global market by the end of 2025, driven by rapid industrialization, urbanization, and significant growth in manufacturing and infrastructure. Key economies such as China, India, and Japan are witnessing expanding chemical, food & beverage, and marine industries, which boost demand for efficient cleaning solutions. Increased industrial modernization and technological innovation stimulate market expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global tank-cleaning chemicals market is competitive and fragmented, with numerous regional and international players delivering specialized chemical solutions. Major companies such as Wilhelmsen, Drew Marine, and Unitor leverage robust portfolios, global distribution networks, and extensive maritime expertise to capture significant market share. Emerging players focus on product innovation and strategic collaborations to position themselves effectively against established competitors. Many vendors prioritize eco-friendly formulations to align with tightening regulations and evolving customer sustainability requirements.

Some of the prominent players in the global Tank Cleaning Chemicals are

- CTC Chemtec Chemicals GmbH

- Wilhelmsen

- Star Marine Chemicals

- Ecolab Inc.

- Ertek Chemicals

- TECO

- Veolia

- Marine Care

- Whale Maritime

- FQE Chemicals

- Other Key Players

Recent Developments

- In May 2024, The Cotac group launched a new facility in Ludwigshafen, Germany, through its Multimodal Tank Care joint venture with Contargo. This site offers comprehensive services, including cleaning, repairing, and maintaining tank containers. The facility is notable for its trimodal transport connections, which help reduce the carbon footprint of tank container journeys.

- In January 2024, Startup Beta Tank Robotics, established by the Indian Institute of Technology Guwahati (IITG), successfully developed two robotic solutions that effectively maintain and clean petroleum tanks, thus reducing the necessity for humans to enter these dangerous environments. These robots are a tremendous asset to the Oil sector, enhancing safety, cost-efficiency, and environmental sustainability.

- In February 2023, CTC Chemtec Chemicals GmbH successfully expanded its business fields by venturing into professional cleaning agents for industrial and tanker cleaning. The company secured its first customer in the tanker interior cleaning sector, welcoming TWS Truck Wash GmbH & Co. KG from Hamburg as a valued partner.

- In April 2023, Marine Care, a global leader in tank cleaning solutions, announced today that the construction of its new production facility in Rotterdam has reached a major milestone. The bulk storage tanks, a crucial component of the facility, have been successfully placed, marking a significant step forward in the project's progress.

Report Details

|

Report Characteristics

|

| Market Size (2025) |

USD 552.7 Mn |

| Forecast Value (2034) |

USD 856.4 Mn |

| CAGR (2025-2034) |

5.0% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 167.8 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Vat Detergents, Acidic Cleaners, Pre-Solves, Odor Controllers, Specialty Products, and Others), By Tank Type (Marine Tanks, Chemical Tanks, Fuel Tanks, Water Transportation & Storage Tanks, Oil Tanks, and Others), By End User(Petrochemical, Chemical, Food & Beverages, Manufacturing, Marine, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

CTC Chemtec Chemicals GmbH, Wilhelmsen, Star Marine Chemicals, Ecolab Inc., Ertek Chemicals, TECO, Veolia, Marine Care, Whale Maritime, FQE Chemicals, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |