Market Overview

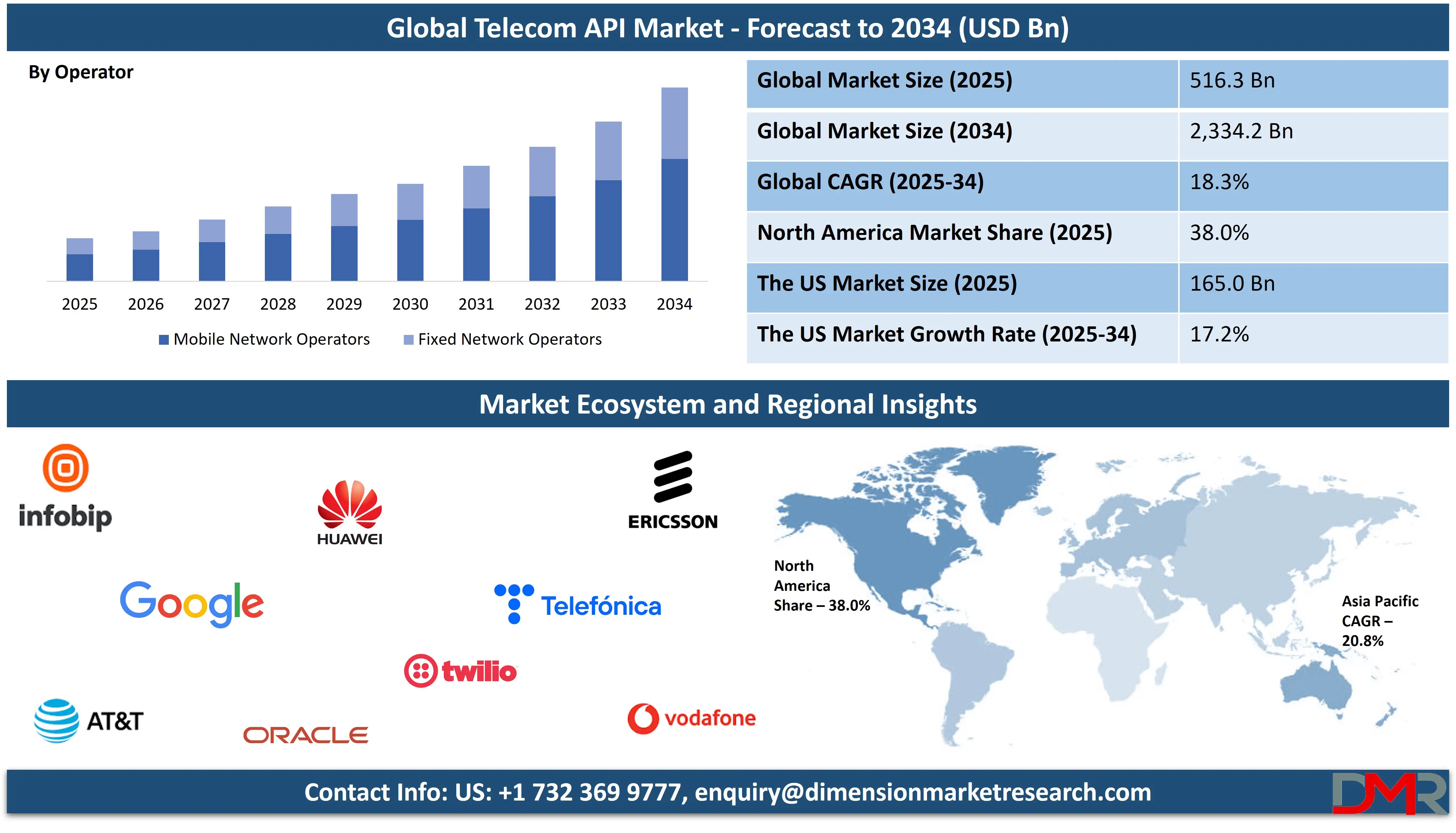

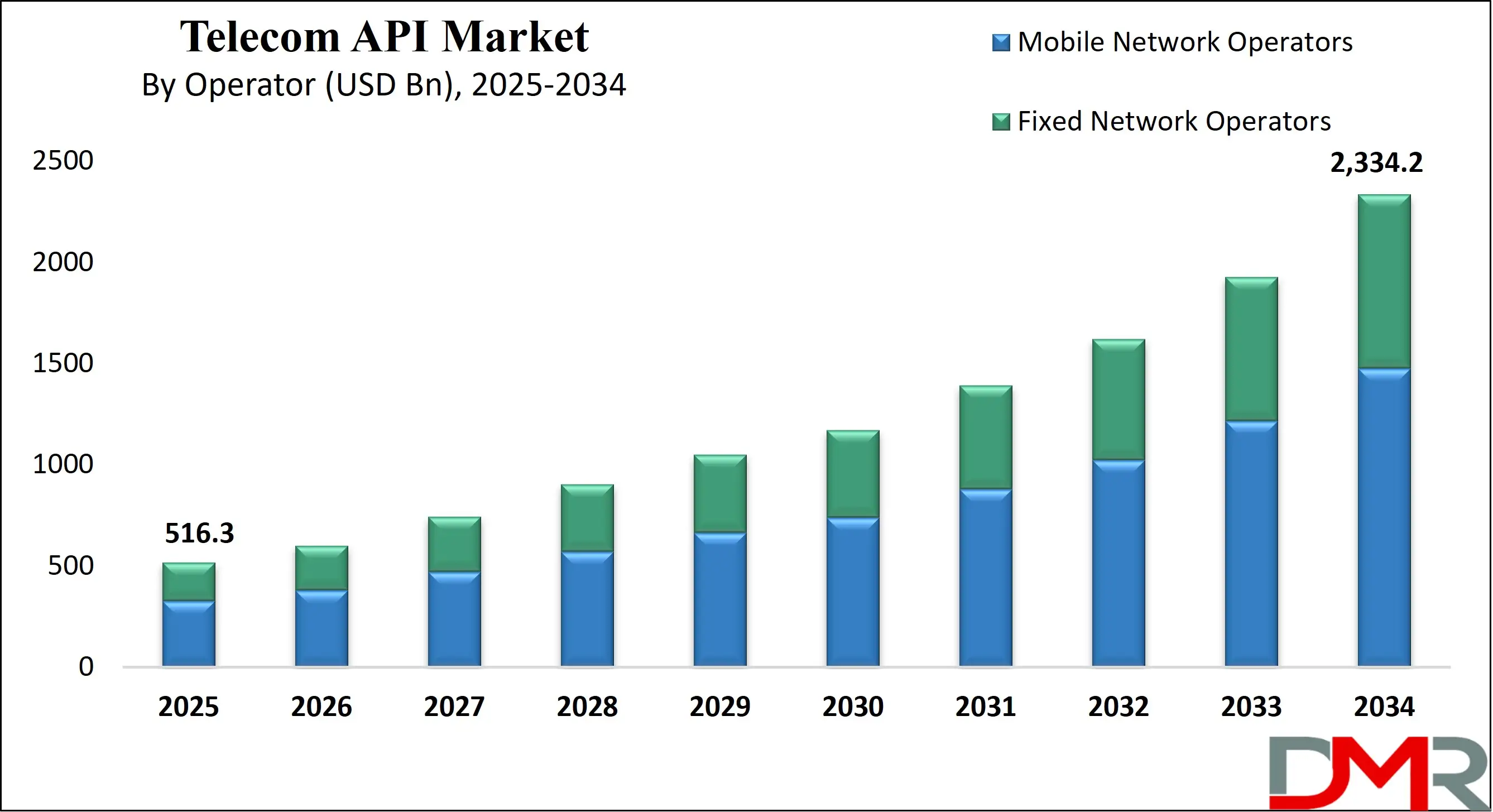

The Global Telecom API Market size is projected to reach USD 516.3 billion in 2025 and grow at a compound annual growth rate of 14.3% to reach a value of USD 2,334.2 billion in 2034.

The telecom API market represents a dynamic ecosystem where telecommunications operators expose key network capabilities — including messaging, voice, and identity, payment, location, and WebRTC services— as programmable interfaces that developers and enterprises can embed into their applications. This shift redefines telecom operators from traditional connectivity providers into digital enablers, driving innovation through seamless integration of network services within enterprise workflows and consumer platforms. By doing so, telecom APIs enable enhanced customer engagement, automation, and interoperability across diverse digital ecosystems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Further, telecom APIs are becoming essential not only for core functions like SMS and user verification but also for accessing advanced network features such as 5G slicing, low latency, and on-demand quality of service. The integration of APIs allows operators to monetize existing infrastructure more effectively, leveraging capabilities that were once limited to internal network management. The emergence of open ecosystem initiatives has also encouraged telecom companies to establish developer portals, shared marketplaces, and revenue-sharing frameworks that expand accessibility and foster third-party innovation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Moreover, industry-wide efforts toward API standardization and collaboration among global telecom operators are helping to overcome fragmentation and streamline integration across different networks and regions. This alignment supports interoperability, accelerates digital transformation, and facilitates the development of new, scalable business models. As telecom APIs evolve into service-enabling platforms, they are driving cross-industry adoption in sectors such as finance, logistics, and healthcare — establishing themselves as a cornerstone of the modern digital economy.

The US Telecom API Market

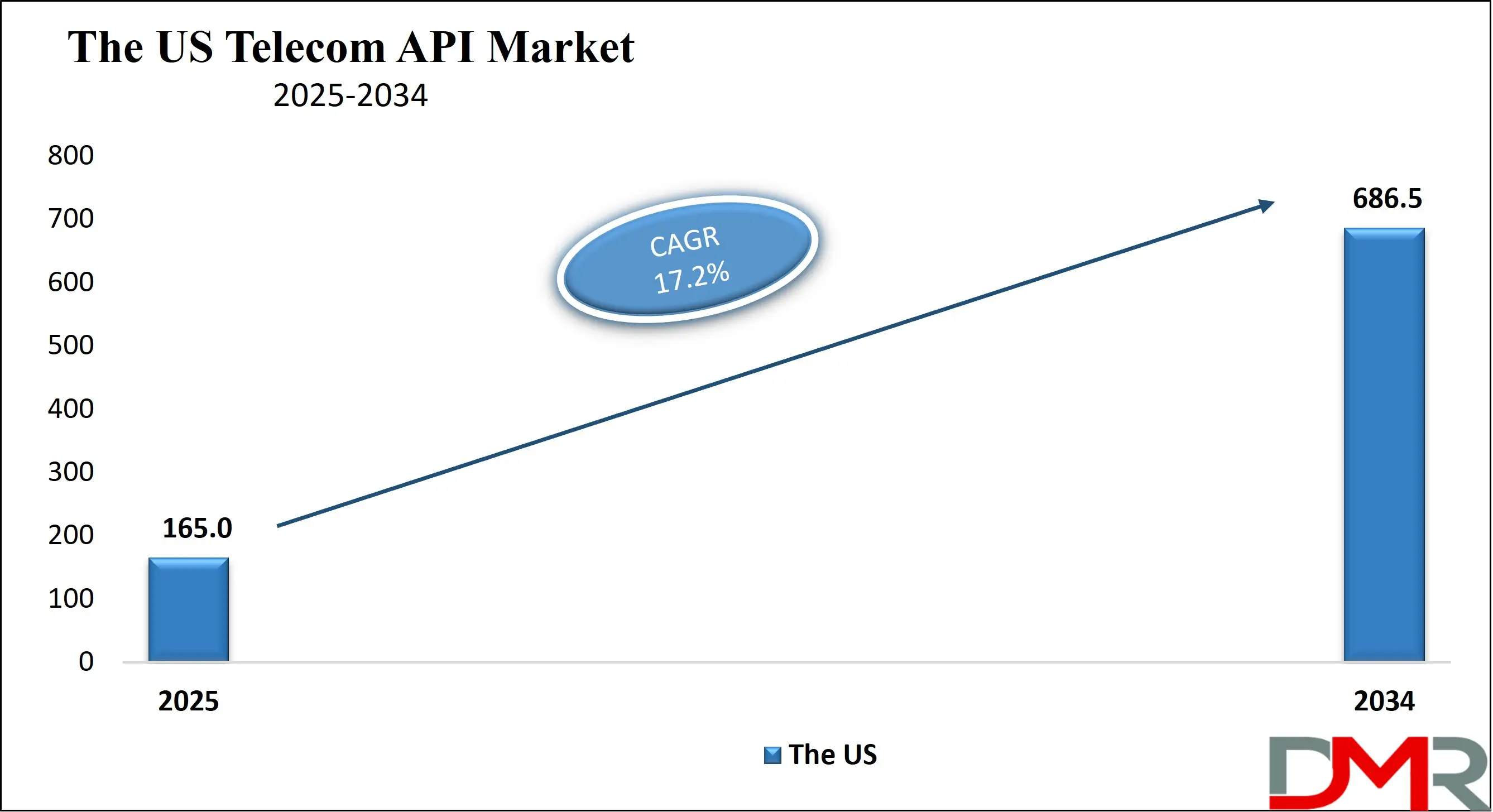

The US Telecom API Market size is projected to reach USD 165.0 billion in 2025 at a compound annual growth rate of 17.2% over its forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In the United States, the telecom API market is characterized by mature telecom infrastructure, strong developer ecosystems and rapid adoption of programmability in network services. The market is driven by high smartphone penetration, growing enterprise demand for embedded communications, and telos seeking to monetize their network assets beyond connectivity. Regulatory and competitive factors push operators to open up APIs via developer portals and marketplace models. Overall, the US serves as a testing ground for advanced API use-cases (e.g., authentication, location-based services, real-time communications) and leads in integrating telecom APIs into enterprise workflows and CPaaS (Communications Platform-as-a-Service) offerings.

Europe Telecom API Market

Europe Telecom API Market size is projected to reach USD 129.1 billion in 2025 at a compound annual growth rate of 17.4% over its forecast period.

The European telecom API market is shaped by regulatory frameworks that emphasize interoperability, data protection, and open networks, as well as by operator collaborations across borders. With initiatives such as standardized APIs and cross-operator marketplaces gaining traction, Europe is evolving into a region where telecom APIs support smart-city projects, e-government, and enterprise digitalization. The region’s heterogeneous telecom market (multiple operators, varying national rules) means that standardization and developer-friendly integration are pivotal. Growth is propelled by demand from verticals such as manufacturing, automotive, logistics and healthcare, where location, identity and network‐capability APIs play increasing roles.

Japan Telecom API Market

Japan Telecom API Market size is projected to reach USD 36.0 billion in 2025 at a compound annual growth rate of 17.8% over its forecast period.

Japan’s telecom API market is marked by its advanced digital infrastructure, early roll-out of 5G and focus on high-performance applications (e.g., low-latency edge computing, autonomous systems). Telecom operators in Japan are increasingly exposing APIs for capabilities such as network slicing, device provisioning, fleet tracking and edge orchestration. While the market is more mature and competitive, growth is driven by advanced IoT deployments, industrial automation and the push towards Industry 4.0. The telecom API ecosystem in Japan is moving beyond basic communications towards tightly integrated network-services platforms that serve enterprise and industrial customers.

Telecom API Market: Key Takeaways

- Market Growth: The Telecom API Market size is expected to grow by USD 1,817.9 billion, at a CAGR of 18.3%, during the forecasted period of 2026 to 2034.

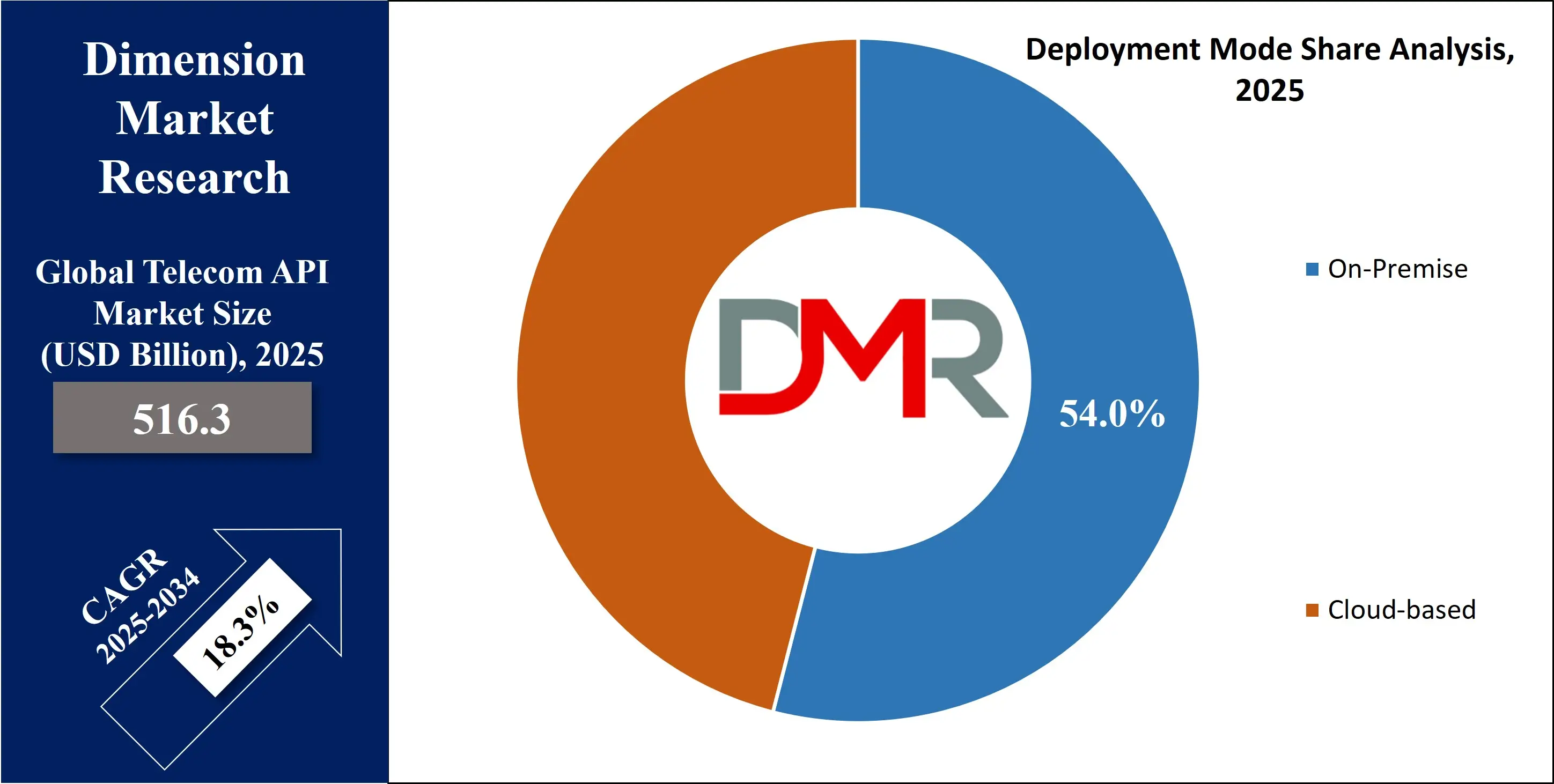

- By Deployment Mode: The On-Premises segment is anticipated to get the majority share of the Telecom API Market in 2025.

- By Operator: The mobile network operators segment is expected to get the largest revenue share in 2025 in the Telecom API Market.

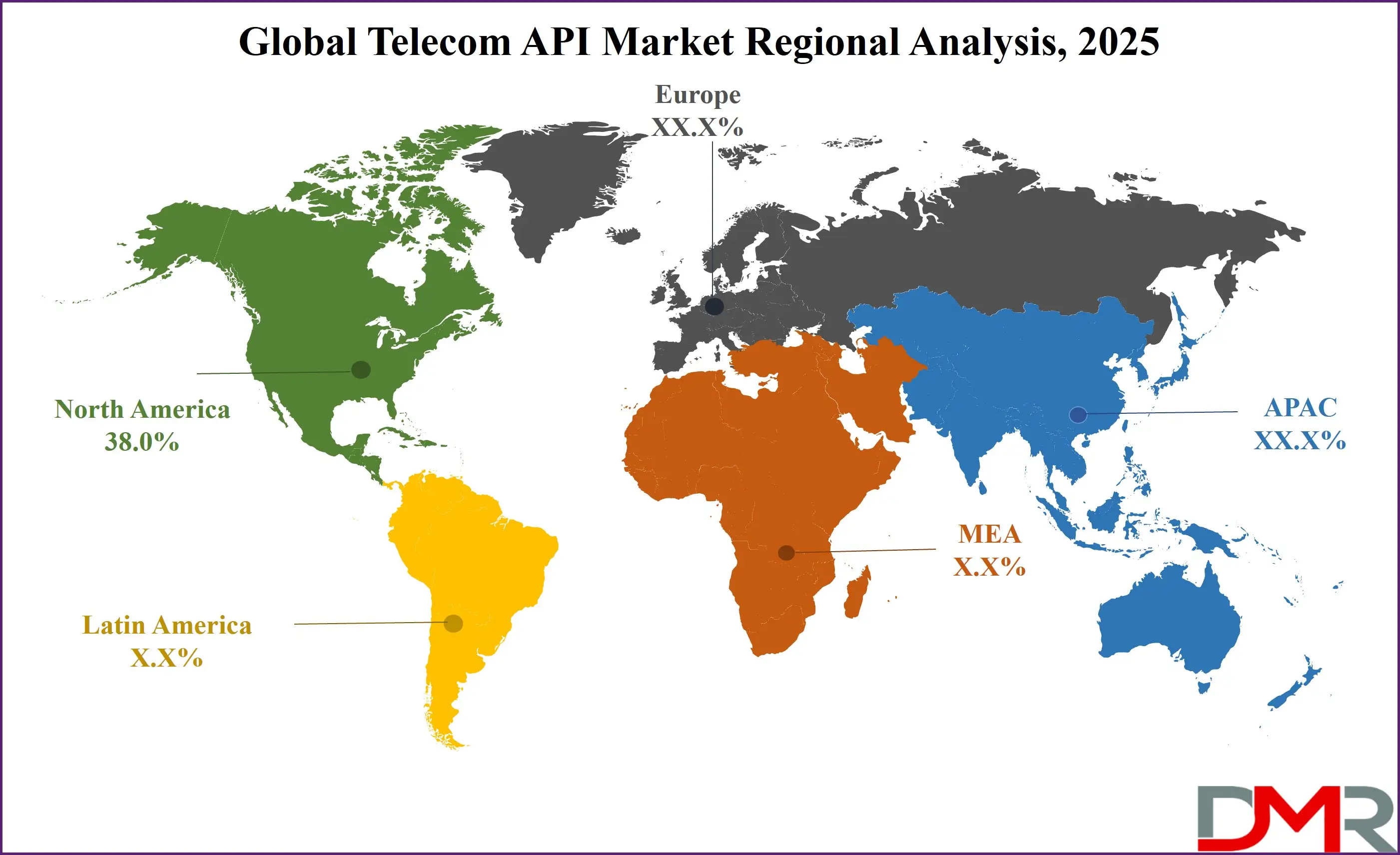

- Regional Insight: North America is expected to hold a 38.0% share of revenue in the Global Telecom API Market in 2025.

- Use Cases: Some of the use cases of Telecom API include Messaging API, Payment API, and more

Telecom API Market: Use Cases

- Messaging API: Enables applications to send SMS, MMS, RCS or chat-based notifications directly via network operator infrastructure.

- Payment API: Allows developers to integrate carrier-billing or mobile payment capabilities via telecom operator networks.

- Location API: Provides geolocation, positioning or mobile-device tracking capabilities exposed via operator network APIs.

- Identity Management API: Permits applications to perform mobile number verification, SIM-swap detection or subscriber identity checks via telecom APIs.

Stats & Facts

- According to the CTIA 2024 U.S. survey, there were 432,469 cell-sites in operation across the U.S., representing a 24 % increase since 2018 as the wireless industry scaled 5G infrastructure.

- The GSMA reports that mobile-cellular subscriptions in the United States reached about 386 million in 2023.

Market Dynamic

Driving Factors in the Telecom API Market

Expansion of 5G, IoT and Edge-Computing Applications

The rollout of 5G networks and growth in IoT devices are creating new demands for programmable network capabilities. Telecom APIs enable features like network slicing, low-latency connectivity, location intelligence and device-orchestration services. This drives operators to expose APIs to developers and enterprises, opening new monetization paths beyond traditional connectivity.

Platformization and Developer Ecosystem Growth

Telecom operators are increasingly building developer-friendly portals, API marketplaces and revenue-share models to tap into external innovation. By packaging network functions (e.g., messaging, identity, location) as APIs, they can reach new verticals (finance, logistics, healthcare) and turn network capabilities into products, thereby accelerating digital-service growth.

Restraints in the Telecom API Market

Data-Privacy, Security and Regulatory Complexity

Opening telecom network functions—whether traditional or virtualized through Network Function Virtualization (NFV) via APIs introduces significant risks related to data exposure, an expanded cyber-attack surface, and regulatory compliance. Strict requirements under frameworks such as GDPR, consumer-data protection laws, and sector-specific regulations (e.g., finance, healthcare) impose substantial constraints. As a result, operators must invest in advanced authentication, encryption, isolation for virtualized functions, and robust governance mechanisms. These measures improve security but can slow API rollout and increase overall costs.

Legacy Infrastructure, Fragmentation and Interoperability Challenges

Many telecom operators operate legacy OSS/BSS systems, proprietary network functions and heterogeneous platforms across geographies. Exposing these as standard APIs and ensuring global interoperability across operators, regions and networks is complex. Fragmentation of API standards and lack of uniform developer experience can hamper adoption and slow ecosystem growth.

Opportunities in the Telecom API Market

Vertical-Industry Integration and Custom Use-Cases

As enterprises in sectors such as manufacturing, automotive, healthcare and logistics adopt digitalization, there is opportunity for telecom APIs to be embedded into domain-specific workflows (e.g., telemedicine, remote diagnostics, fleet tracking, and autonomous vehicles). Operators that tailor API offerings to vertical-specific business models can capture new revenue streams.

Monetization of Network Assets and New Business Models

Telecom operators can transform under-utilized network capabilities (e.g., roaming, identity, location) into revenue-generating API products. With developer ecosystems, white-labelling of APIs by partners/CPaaS providers, and subscription/usage-based pricing, operators can build new business models and bypass stagnating connectivity revenue growth.

Trends in the Telecom API Market

Open API Initiatives and Standardization

More operators and industry bodies are adopting open API frameworks and developer-portals to reduce fragmentation, enable cross-operator integration and accelerate innovation. This trend fosters marketplaces where third-party developers can integrate network services with minimal custom work.

Cloud-Native, Real-Time & Low-Latency Offerings

With growth in WebRTC, real-time communications and edge-computing use-cases (such as AR/VR, remote control systems, autonomous systems), telecom APIs are evolving from simple endpoints (e.g., SMS) to sophisticated real-time network-capability interfaces. This demands scalable cloud-native architectures, hybrid-cloud deployments and APIs supporting stringent SLAs.

Impact of Artificial Intelligence in Telecom API Market

- Artificial Intelligence is used to optimise routing, load-balancing and selection of network API paths for voice or messaging streams, improving performance and cost-efficiency.

- Fraud-detection APIs — e.g., SIM swap detection or identity verification — increasingly embed AI models to analyse patterns and flag anomalies.

- AI-powered developer tools (such as auto-documentation generation, SDK suggestion engines) are accelerating API onboarding and reducing time-to-market for third-party integrations.

- Network-analytics APIs leverage AI to provide predictive insights (e.g., forecasting traffic, QoS degradation) and enable dynamic API provisioning or QoS-on-demand services.

- AI-driven orchestration of edge and network functions enables APIs to support complex real-time use-cases (e.g., autonomous vehicle tele-control, live video analytics) by optimizing API latency and resource allocation.

Research Scope and Analysis

By Type Analysis

Messaging API remains the leading segment in the telecom API market, accounting for approximately 36% share in 2025. It plays a critical role in enabling SMS, MMS, RCS, and chat-based communications across enterprise and consumer applications. Businesses rely heavily on messaging APIs for customer engagement, marketing notifications, authentication codes, and service alerts, making them an integral part of enterprise communication strategies.

The dominance of this segment is attributed to the massive volume of Application-to-Person (A2P) traffic, established telecom infrastructure, and broad developer adoption. Moreover, as organizations continue integrating multi-channel messaging for omnichannel experiences, the demand for reliable and programmable messaging APIs remains robust across industries such as banking, e-commerce, logistics, and healthcare.

Identity Management API is emerging as the fastest-growing segment in the telecom API market, fueled by rising demand for mobile number verification, secure authentication, SIM swap detection, and Know Your Customer (KYC) compliance. As digital transactions, remote onboarding, and online service access expand, businesses are prioritizing secure and seamless identity verification. Telecom APIs provide a trusted mechanism for validating subscriber data in real-time, reducing fraud and improving user experience.

Enterprises across finance, fintech, insurance, and e-commerce are adopting identity APIs to strengthen cybersecurity frameworks and meet regulatory requirements. The scalability, accuracy, and trust embedded in operator networks make identity APIs a key component of digital identity infrastructure, driving exponential growth and strategic importance in enterprise ecosystems.

By Deployment Mode Analysis

On-premise deployment remains significant, accounting for 54% share in 2025, as large telecom operators and enterprises prioritize full control, security, and compliance. This model suits organizations that require strict data governance, low latency, and integration with legacy telecom systems. Industries such as banking, healthcare, and government continue to favor on-premise telecom API platforms for mission-critical applications.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Hosting APIs within private data centers ensures reliability, sovereignty, and alignment with national data regulations. While it demands higher capital investment and maintenance, on-premise deployment provides unmatched stability and regulatory assurance, making it the preferred option for institutions managing sensitive data and operating within highly regulated environments. Cloud-based deployment is the fastest-growing mode of the telecom API market in 2025, driven by scalability, agility, and cost efficiency.

Operators and developers are increasingly adopting cloud-native API platforms to deploy, test, and scale services globally. These environments offer rapid integration, sandbox testing, and seamless distribution across multiple networks and regions. Cloud-based telecom APIs support continuous updates, automated provisioning, and flexible pricing, appealing to businesses seeking innovation and quick time-to-market. As enterprises shift toward digital transformation, hybrid-cloud models are bridging telecom infrastructure with AI, edge computing, and IoT services. This momentum cements cloud-based APIs as the preferred model for future-ready telecom operations and global digital service delivery.

By End User Analysis

Enterprise developers dominate the telecom API market with 45% share in 2025, reflecting strong adoption across industries like finance, healthcare, retail, and logistics. These developers integrate telecom APIs to enhance communication, authentication, and location-based services within enterprise applications. APIs enable streamlined workflows, secure transactions, and real-time connectivity with customers and supply chains.

As digital transformation accelerates, enterprises are embedding telecom APIs to automate operations, personalize customer experiences, and reduce dependency on third-party communication systems. With growing emphasis on security, compliance, and reliability, enterprise developers continue to be the primary users driving consistent demand for advanced telecom APIs across global digital ecosystems.

Partner developers represent the fastest-growing end-user segment in the telecom API market. This category includes CPaaS providers, system integrators, and telecom solution partners that aggregate and repackage APIs for specialized applications. Partner developers extend telecom capabilities to smaller businesses and niche markets by offering white-labeled and vertical-specific API solutions.

Their intermediary role accelerates innovation, simplifies integration, and expands the customer base for telecom operators. As API marketplaces mature, partner ecosystems are vital in enhancing accessibility and monetization of telecom APIs. The rise of low-code platforms and API-as-a-service models further drives growth, empowering partner developers to scale telecom-enabled applications globally.

By Operator Analysis

Mobile Network Operators lead the operator segmentation with 63% share in 2025, owing to their vast infrastructure, subscriber databases, and direct control over mobile networks. MNOs provide the majority of telecom APIs, including messaging, identity, and location services, leveraging their established assets for new revenue streams. They ensure reliability, authentication, and compliance, making them the preferred API providers for enterprises and developers alike. With 5G rollout and IoT proliferation, MNOs are expanding their portfolios to include APIs for network slicing, QoS management, and edge orchestration. Their strategic shift from pure connectivity to platform enablement reinforces their dominant role in the global telecom API market.

Fixed Network Operators are the fastest-growing operator segment in the telecom API market, driven by network convergence and digital service expansion. Traditionally focused on broadband and voice, FNOs are now launching APIs for fixed-line communications, IoT device connectivity, and home automation. Collaborations with MNOs and CPaaS providers are enabling integrated service offerings across fixed and mobile infrastructures. This convergence enhances customer experience and supports enterprise solutions such as unified communications and smart infrastructure. As FNOs modernize their networks and adopt API frameworks, they are evolving from static service providers to digital enablers, positioning themselves as key contributors to telecom innovation and API-driven growth.

The Telecom API Market Report is segmented on the basis of the following

By Type

- Messaging API

- Payment API

- Location API

- Identity Management API

- WebRTC API

- M2M and IoT API

- Others

By Deployment Mode

By End User

- Enterprise Developers

- Partner Developers

- Internal Telecom Developers

- Long Tail Developers

By Operator

- Mobile Network Operators

- Fixed Network Operators

Regional Analysis

Leading Region in the Telecom API Market

North America leads the telecom API market, with approximately 38% market share in 2025, supported by the United States’ mature ecosystem of telcos, strong developer communities, and early adoption of advanced telecom-API use-cases. Operators in North America are at the forefront of exposing network capabilities via APIs, developing developer portals, marketplaces and monetization models. The substantial enterprise-integration demand and robust cloud/CPaaS environment mean North America remains the most advanced region in terms of telecom API deployment, revenue scale and ecosystem depth.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Telecom API Market

The Asia Pacific region is the fastest-growing market for telecom APIs, owing to its many mobile-first populations, high growth in digital payments, large scale of IoT and mobile-device penetration, and operator willingness to innovate. Countries such as India, Indonesia and Vietnam are leap-frogging older infrastructure, enabling rapid adoption of telecom APIs for super-apps, mobile wallet integration, logistics tracking and developer ecosystems — thus delivering above-average growth rates compared with more mature regions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the telecom API market is evolving rapidly. Traditional telecom operators are partnering with or acquiring cloud/CPaaS and developer-platform players to build end-to-end API ecosystems — shifting from connectivity-only models to platform-oriented strategies. Key players include established telcos, CPaaS providers and network-equipment vendors that are expanding into API-exposure and monetisation. The differentiators are developer experience (ease of integration, documentation, sandbox), global reach (multi-operator, multi-region coverage), monetisation models (revenue-share, subscription, pay-per-use) and the ability to support advanced network capabilities (5G-enabled, low-latency, edge-computing). As the market matures, consolidation through acquisitions, ecosystem partnerships and platform expansions is observed.

Some of the prominent players in the global Telecom API are

- Twilio

- Vodafone

- AT&T

- Orange

- Telefonica

- Verizon Communications

- Google

- Cisco Systems

- Ericsson

- Huawei Technologies

- Nokia

- Infobip

- Syniverse Technologies

- Ribbon Communications

- Route Mobile

- Telenor Group

- China Mobile

- Bharti Airtel

- Deutsche Telekom

- Telstra

- Other Key Players

Recent Developments

- In July 2025, Twilio launched a new global developer portal that expands its telecom-API catalogue to include advanced location and identity-verification services, enabling enterprises to integrate multi-operator telecom APIs with simplified billing and developer sandbox access.

- In June 2025, Bharti Airtel introduced a cloud-platform and AI-powered telecom-API suite targeting enterprise and operator clients, including modules for workforce optimization and real-time customer-engagement, expanding its API offerings into business-platform services.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 516.3 Bn |

| Forecast Value (2034) |

USD 2,334.2 Bn |

| CAGR (2025–2034) |

18.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 165.0 Bn |

| Forecast Data |

2025 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Messaging API, Payment API, Location API, Identity Management API, WebRTC API, M2M and IoT API, and Others), By Deployment Mode (On-Premise and Cloud-Based), By End User (Enterprise Developers, Partner Developers, Internal Telecom Developers, and Long Tail Developers), By Operator (Mobile Network Operators and Fixed Network Operators) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Twilio, Vodafone, AT&T, Orange, Telefonica, Verizon Communications, Google, Cisco Systems, Ericsson, Huawei Technologies, Nokia, Infobip, Syniverse Technologies, Ribbon Communications, Route Mobile, Telenor Group, China Mobile, Bharti Airtel, Deutsche Telekom, Telstra, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Telecom API Market?

▾ The Global Telecom API Market size is expected to reach a value of USD 516.3 billion in 2025 and is expected to reach USD 2,334.2 billion by the end of 2034.

Which region accounted for the largest Global Telecom API Market?

▾ North America is expected to have the largest market share in the Global Telecom API Market, with a share of about 38.0% in 2025.

How big is the Telecom API Market in the US?

▾ The Telecom API Market in the US is expected to reach USD 165.0 billion in 2025.

Who are the key Telecom API Market?

▾ Some of the major key players in the Global Telecom API Market include AT&T, Google, Vodafone and others

What is the growth rate in the Global Telecom API Market?

▾ The market is growing at a CAGR of 18.3 percent over the forecasted period.