Market Overview

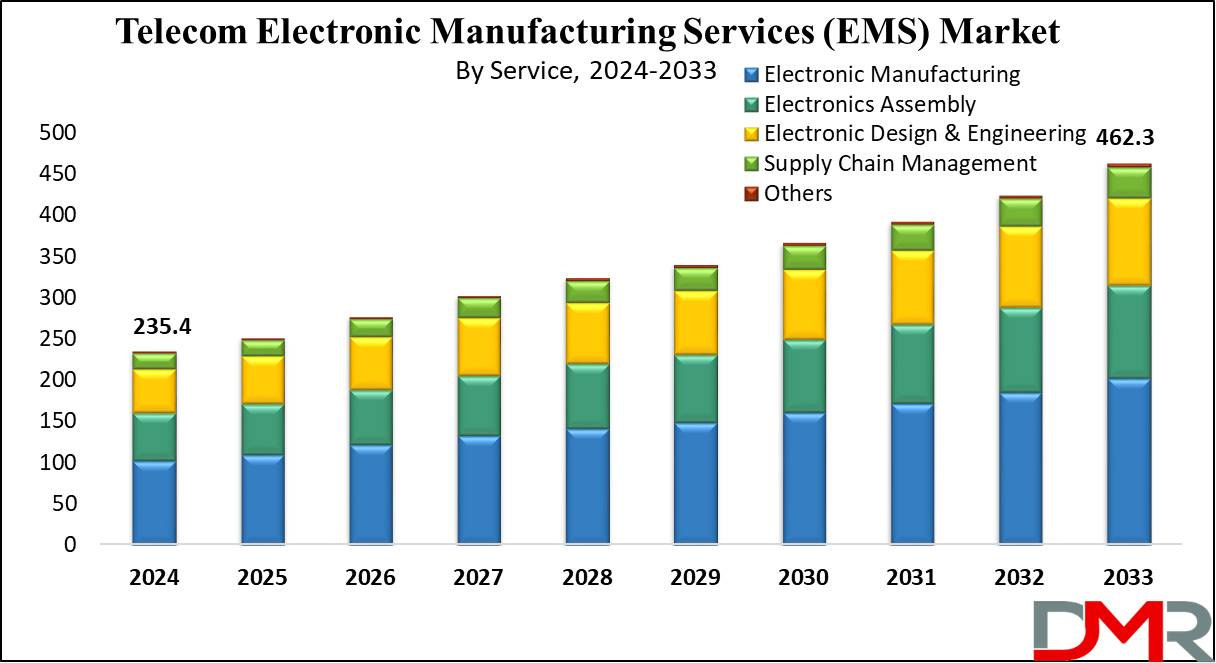

The Global Telecom Electronic Manufacturing Services (EMS) Market is expected to reach a value of USD 235.4 billion by the end of 2024, and it is further anticipated to reach a market value of USD 462.3 billion by 2033 at a CAGR of 7.8%.

EMS, or Electronics Manufacturing Services are specialized companies offering engineering, manufacturing, & additional value-added services to Original Equipment Manufacturers (OEMs). They are also known as Contract Manufacturing Services (CMS) or Contract Electronics Manufacturing (CEM), EMS providers offer to various industries, providing services ranging from design & manufacturing to quality control, supply chain management, logistics, and after-sales support, which helps OEMs to focus on core functions like R&D, marketing, and sales.

Further, in the telecom electronic manufacturing services market, specialized companies support the development, creation, and oversight of electronic components for the telecommunications sector. These offerings include assembling and testing printed circuit board assemblies (PCBAs) used in telecom devices. For example, an aviation company may outsource its PCBA production to an EMS partner to expand its product range without additional manufacturing infrastructure.

These service providers adhere to industry standards such as AS9100 and handle complex requirements like multiple Ball Grid Arrays (BGAs) and advanced PCB designs. Similarly, in emerging areas such as the

Electronic Skin Patches , EMS providers play a crucial role in producing miniaturized, reliable, and high-performance electronic components tailored for healthcare and wearable applications.

Also, subcontracting provides benefits like quick time to market, access to advanced manufacturing tech, logistical support, & lesser capital investments, driving market growth. Economic expansion, growing demand for communication services, tech developments, & wireless communication expansion are the main growth trends. Telecommunication equipment vendors highly adopt technology-driven business models, outsourcing to focus on core competencies at times of rapid technological changes.

Key Takeaways

- The Global Telecom Electronic Manufacturing Services (EMS) Market is expected to grow by 210.5 billion, at a CAGR of 7.8% during the forecasted period of 2025 to 2033.

- By Service, electronic manufacturing is expected to lead in 2024 with a share of 43.7% & is anticipated to dominate throughout the forecasted period.

- Further, the electronics assembly segment is also expected to get a major revenue share in 2024 in the telecom electronics manufacturing services market.

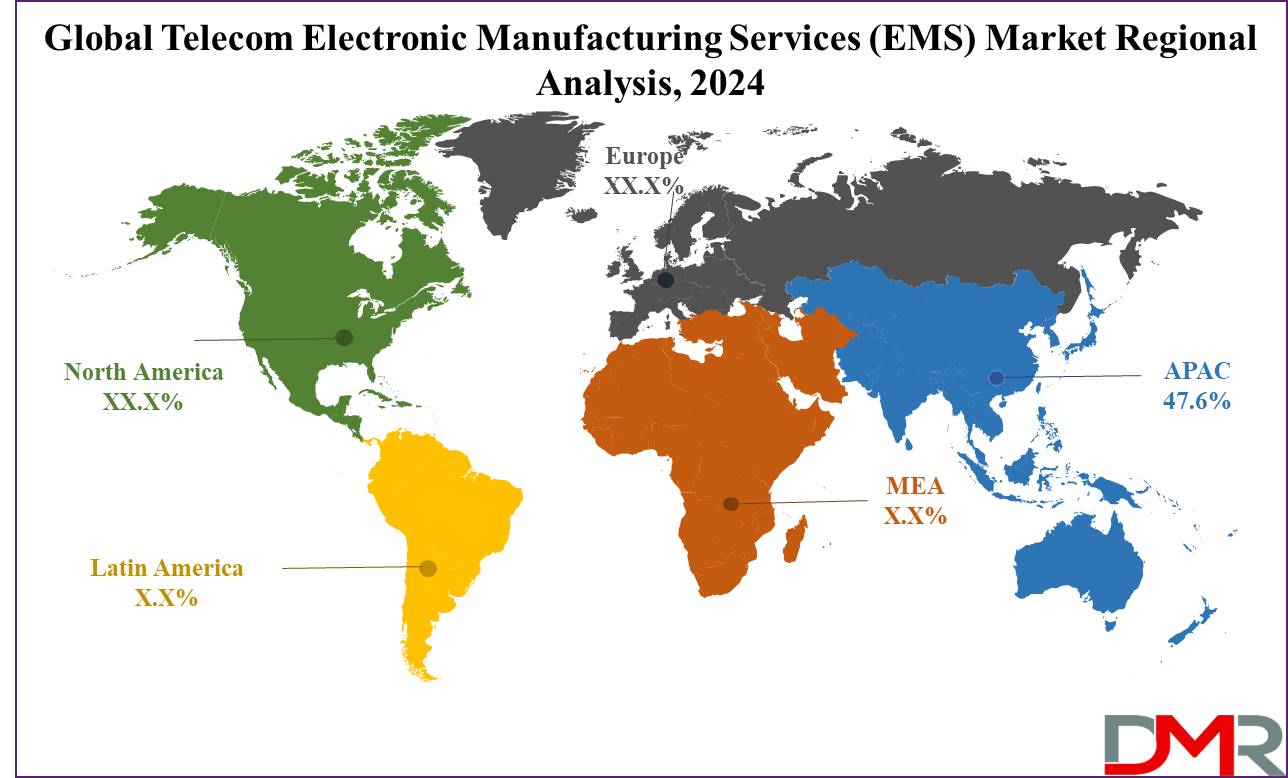

- Asia Pacific is expected to hold a 47.6% share of revenue in the Global Telecom Electronic Manufacturing Services (EMS) Market in 2024.

- North America is also expected to show quick growth in the telecom electronic manufacturing services market during the forecasted period from 2025 to 2033.

- Some of the use cases of Telecom Electronic Manufacturing Services (EMS) include access to advanced technologies, cost-efficient production, and more.

Use Cases

- Accelerated Time-to-Market: Telecom EMS providers allow fast development & production of electronic components, minimizing the time needed to launch new products & services.

- Access to Advanced Technologies: These services grant access to advanced manufacturing technologies, confirming that telecom equipment stays competitive in terms of performance & features.

- Scalable Logistics Capabilities: EMS partners provide scalable logistics solutions, assisting efficient supply chain management to meet fluctuating demand and allow timely delivery of telecom products.

- Cost-Efficient Production: By outsourcing manufacturing to EMS providers, telecom companies can minimize capital investments in production facilities & benefit from low-cost manufacturing processes, improving overall profitability.

Market Dynamic

The telecom EMS market is experiencing growth driven by higher demand for mobile phones, products, and intelligent electronic devices, as fast-evolving technology fosters collaborations between original service providers and equipment manufacturers. In addition, the rising focus on

mobile security is influencing EMS providers to integrate advanced safety features into devices and manufacturing processes. These developments are enabling EMS participants to create more efficient equipment and service delivery facilities, thereby supporting overall market growth.

In addition, the increase in the trend of OEMs outsourcing manufacturing, testing, & logistics operations creates opportunities for new players. With high global supply networks and advanced technological capabilities, EMS companies are well-positioned to assist and thrive in the telecom industry, anticipating higher growth prospects.

However, high labor costs create a potential challenge to the telecom electronic manufacturing service market. While higher payments and employee benefits may improve labor productivity, they can also lead to less job availability & lower company profits.

Many regulations like minimum wage laws, hiring incentives, overtime pay, payroll taxes, & hiring subsidies impact labor costs, influencing the economy & employment dynamics within specific firms. These factors enhance the cost of labor, which largely affects profitability and the ability of companies to expand their operations in the telecom EMS market.

Research Scope and Analysis

By Services

The electronic manufacturing segment is expected to dominate the telecom electronics manufacturing services market with a significant revenue share of 43.7% in 2024. OEMs are mostly switching to outsourcing for product design & development, focusing on shifting from fixed to variable costs and reducing overall expenses, which is driving telecommunication electronic contract manufacturers to expand their service offerings, looking on higher-profit-margin services, thus driving segment growth over the forecast period.

Further, the electronics assembly segment is also anticipated to get a notable revenue share in the telecom electronics manufacturing services market in 2024. Using economies of scale, electronics assembly supports mass production, creating less per-unit production costs. Also, modern assembly processes mostly use automation, improving speed & efficiency. Automation allows quick and accurate completion of repetitive tasks, thereby enhancing overall productivity. In addition, adopting environmentally friendly practices like lead-free soldering is becoming standard in modern electronics assembly, contributing to less environmental impact.

Moreover, the electronic design and engineering segment is expected to exhibit the fastest growth over the forecast period in the global telecom electronic manufacturing services market, as advancements in wireless communication sensor technologies and big data capabilities are reshaping the technology landscape, particularly with the rise of IoT. With increasing consumer expectations and needs, electronic innovations are permeating product engineering and design processes, further fueling the segment’s growth. Additionally, the integration of

Wireless Display technologies is enhancing connectivity and user experience, creating new opportunities for EMS providers to deliver advanced solutions across telecom and consumer electronics.

The Telecom Electronic Manufacturing Services (EMS) Market Report is segmented on the basis of the following:

By Services

- Electronic Manufacturing

- Electronics Assembly

- Electronic Design & Engineering

- Supply Chain Management

- Others

Regional Analysis

Asia Pacific is expected to dominate the global telecom electronic manufacturing services market, commanding a major

47.6% revenue share in 2024, and is projected to achieve high growth over the forecast period. The region experiences a rising trend among OEMs towards outsourcing product design processes, enabling them to concentrate on core competencies, which further drives market growth. In addition, the region also serves as an important electronic production hub for nearly a decade due to low labor costs.

However, recent growth in labor costs allowed countries like China and other Southeast Asian nations to transform themselves as manufacturers of complex products. Vietnam, backed by funding from industry giants like Samsung Electronics & LG Electronics, emerges as a major hub for electronics component production, improving the region's dominance in the supply chain.

Further, North America is expected to show rapid growth in the telecom electronic manufacturing services market, due to factors like rising demand for advanced telecom infrastructure, higher adoption of 5G technology, & increase in outsourcing by telecom companies. Also, the region's technological developments & strong regulatory framework further contribute to its growth. With telecom companies looking for specialized manufacturing expertise, North America's EMS providers are well-positioned to meet these needs, driving significant growth in the dynamic telecom electronics manufacturing sector.

Further, Europe is also set to experience notable growth in the telecom electronic manufacturing services market, driven by several factors, like its strong focus on 5G technology deployment & rise in demand for connected devices drives the need for specialized electronic components.

Further, supportive government policies & incentives for electronics manufacturing also contribute to the growth of EMS providers. In addition, the trend of outsourcing by telecom companies in Europe, looking for affordable and efficient solutions, further drives the market growth, establishing the region as one of the major regions in the global telecom EMS industry.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

In the global telecom electronic manufacturing services market intense competition is being there among many players providing a range of services like product design, manufacturing, & logistics support. The main factors driving competition like technological expertise, production capacity, and supply chain efficiency. As the need for telecom equipment grows, companies look to secure contracts with original equipment manufacturers (OEMs) by showcasing reliability, innovation, and affordability, thereby shaping a dynamic and competitive landscape within the industry.

Some of the prominent players in the global Telecom Electronic Manufacturing Services (EMS) Market are

- Plexus Corp

- Fabrinet

- Jabil Inc

- FLEX Ltd

- Foxconn Technology

- Sanmina Corp

- Wistron Corp

- Compal Inc

- SMTC Corp

- Celestica Inc

- Other Key Players

Recent Developments

- In November 2023, Intel announced a strategic partnership with eight Electronics Manufacturing Services (EMS) companies & Original Design Manufacturers (ODMs) to improve the production of laptops in India, using Intel's global expertise in the IT industry to provide vital technological & operational insights, creating a path for an advanced laptop manufacturing sector in the country, which aligns with the company's commitment to drive technology-driven growth in conjunction with the Make in India initiative.

- In November 2023, Tata Electronics announced that the company signed a Share Purchase Agreement with SMS InfoComm (Singapore) & Wistron Hong Kong to acquire complete equity in Wistron InfoComm Manufacturing (India), which is valued at about USD 125 million, following Wistron's board approval. Tata focuses on producing iPhones for global & domestic markets, becoming the first indigenous firm in the iPhone supply chain.

- In April 2023, XLR8 EMS LLC announced today that the company received a high equity investment from American Pacific Group of USD 1.2 billion AUM private equity fund partnering with leading businesses across technology, industrial, business services, consumer, and healthcare verticals, which reflects its intention to continue to meet & exceed the needs of its customers and to remain at the lead of technical solutions and high-quality, high-reliability service.

- In May 2022, Astrata unveiled that the company signed a 5-year partnership with automotive industry giant, Bosch Group. Transferring its production from Malaysia to France allows the company to enhance its delivery performance in Europe & reduce its environmental impact and logistical risks.

- In March 2022, Sanmina Corporation & Reliance Strategic Business Ventures Limited unveiled that the companies agreed on creating a joint venture through investment in Sanmina’s existing Indian entity, which will use Sanmina’s 40 years of advanced manufacturing experience & Reliance’s expertise and leadership in the Indian business ecosystem., as the joint venture will build a world-class electronic manufacturing hub in India, in line with the country's “Make in India” vision, which will prioritize high technology infrastructure hardware, for growth markets, and across industries like medical and healthcare systems, communications networking, industrial & cleantech, and defense and aerospace

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 235.4 Bn |

| Forecast Value (2033) |

USD 462.3 Bn |

| CAGR (2023-2032) |

7.8% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Services (Electronic Manufacturing, Electronics Assembly, Electronic Design & Engineering, Supply Chain Management, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Plexus Corp, Fabrinet, Jabil Inc, FLEX Ltd, Foxconn Technology, Sanmina Corp, Wistron Corp, Compal Inc, SMTC Corp, Celestica Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Telecom Electronic Manufacturing Services (EMS) Market size is estimated to have a value of USD 235.4 billion in 2024 and is expected to reach USD 462.3 billion by the end of 2033.

Asia Pacific is expected to have the largest market share in the Global Telecom Electronic Manufacturing Services (EMS) Market with a share of about 47.6% in 2024.

Some of the major key players in the Global Telecom Electronic Manufacturing Services (EMS) Market are Plexus Corp, Fabrinet, Jabil Inc., and many others.

The market is growing at a CAGR of 7.8 percent over the forecasted period.