Market Overview

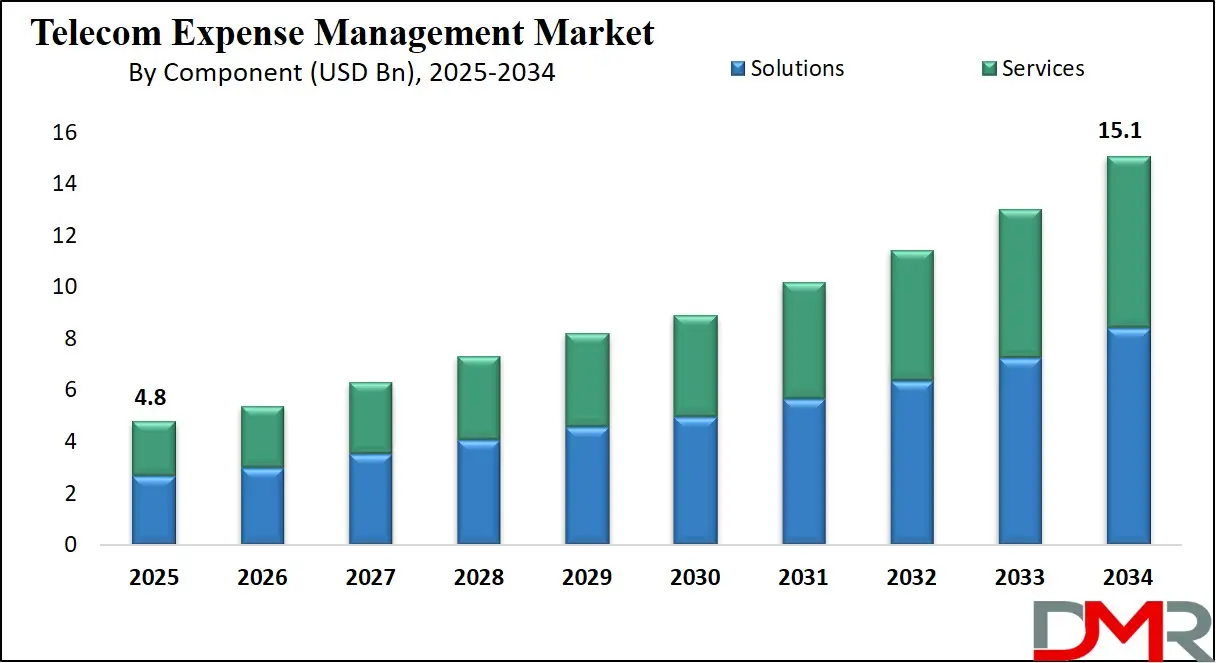

The Global Telecom Expense Management Market size is projected to reach USD 4.8 billion in 2025 and grow at compound annual growth rate of 13.6% from there until 2034 to reach a value of USD 15.1 billion.

Telecom Expense Management (TEM) refers to the systems, tools, and processes that help businesses manage and control costs associated with telecommunications services. These services include mobile and fixed-line voice, data usage, internet, cloud communication, and unified communication platforms. TEM allows companies to monitor, analyze, and optimize telecom spending, reduce billing errors, track usage, and manage inventory more efficiently. It is especially helpful for enterprises that use multiple service providers across different regions or have a large number of employees using telecom services.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

One of the major reasons for the growing interest in TEM is the rapid rise in communication costs due to increasing digital adoption. With more employees working remotely or in hybrid setups, the demand for mobile connectivity, collaboration tools, and cloud communication services has grown significantly. Companies are now looking for ways to keep these costs in check while ensuring uninterrupted communication. As a result, TEM has become a strategic function, helping businesses maintain control over their technology spending.

The growing use of cloud-based solutions is also contributing to TEM adoption. Cloud-based TEM platforms allow companies to access real-time data, automate invoice processing, and generate custom reports. These solutions are scalable and easy to integrate with other enterprise systems, making them suitable for organizations of all sizes. Automation in TEM also reduces manual errors, improves transparency, and helps with better decision-making.

Another trend is the integration of Artificial Intelligence and Machine Learning in TEM platforms. These technologies are used to predict usage patterns, identify unusual billing activities, and suggest cost-saving measures. AI-enabled systems can also automate dispute resolution and recommend vendor changes based on pricing and service quality. This enhances operational efficiency and improves the overall value delivered by TEM.

In recent years, several companies have shifted to unified communication systems and digital collaboration tools, which has made telecom spending more complex. As a result, managing expenses manually has become difficult. TEM solutions have evolved to support these complex environments by offering multi-vendor and multi-service support, helping organizations manage everything from voice services to internet, conferencing, and even IoT connections.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Important developments in the TEM market include strategic partnerships between TEM providers and telecom operators, the entry of IT service providers into the TEM space, and a focus on cybersecurity. With increasing data usage and privacy regulations, businesses are also choosing TEM solutions that offer compliance support and secure data handling. Overall, TEM is no longer just a cost-control tool—it is a key part of IT and financial strategy.

The US Telecom Expense Management Market

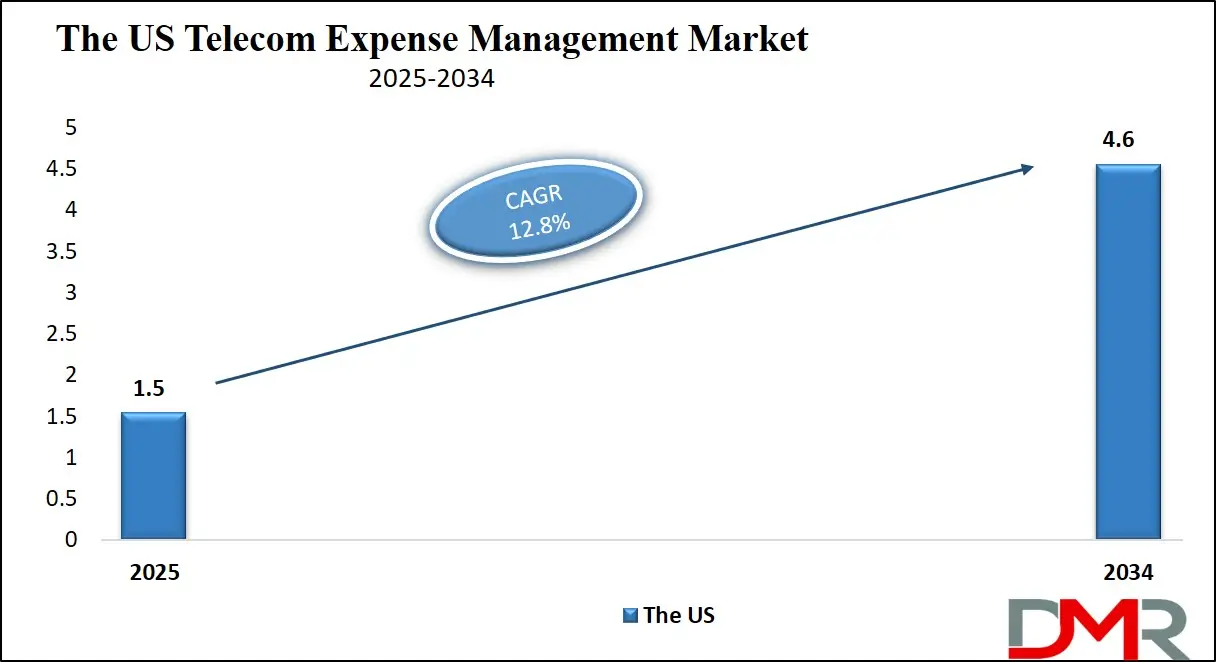

The US Telecom Expense Management Market size is projected to reach USD 1.5 billion in 2025 at a compound annual growth rate of 12.8% over its forecast period.

The US plays a leading role in the Telecom Expense Management (TEM) market due to its large base of enterprises with complex telecom infrastructures. Many US companies operate across multiple regions and rely heavily on mobile, cloud, and data communication services, creating a strong demand for advanced expense management tools. The US market is also quick to adopt innovations like AI, automation, and cloud-based TEM platforms, driving overall technological growth in the sector.

In addition, strict financial compliance and reporting standards push organizations in the US to seek accurate and transparent telecom cost controls. With a mature IT ecosystem and a strong focus on cost efficiency, the US continues to be a key driver of innovation, adoption, and investment in the TEM market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Telecom Expense Management Market

Europe Telecom Expense Management Market size is projected to reach USD 1.2 billion in 2025 at a compound annual growth rate of 13.2% over its forecast period.

Europe plays a significant role in the Telecom Expense Management (TEM) market, driven by its diverse regulatory landscape, growing emphasis on digital transformation, and increasing telecom usage across industries. European companies are focusing on optimizing telecom costs while ensuring compliance with data protection and privacy laws like GDPR. This creates strong demand for secure and transparent TEM solutions. The region’s push for green and efficient IT operations also encourages the adoption of cloud-based and automated TEM tools.

Additionally, the presence of multinational companies operating across several European countries increases the complexity of telecom management, further boosting the need for centralized and scalable TEM platforms. Europe’s mix of regulatory awareness and digital modernization makes it a key market for TEM growth and innovation.

Japan Telecom Expense Management Market

Japan Telecom Expense Management Market size is projected to reach USD 192.0 million in 2025 at a compound annual growth rate of 14.9% over its forecast period.

Japan holds a steadily rising, though still developing, position in the Telecom Expense Management (TEM) space. Japanese businessesespecially large enterprises and global corporations face complex telecom environments involving mobile devices, cloud platforms, and IoT deployments, all of which drive the need for strong cost control tools. Organizations in Japan are increasingly turning to TEM systems to automate billing processes, manage telecom assets, and monitor usage in real time, supporting better budgeting and cost optimization.

The adoption of advanced technologies like AI and machine learning enhances these platforms with smarter analytics and automated anomaly detection. Japan’s TEM market is projected to grow at a healthy pace, reflecting both rising telecom expenses and digital transformation across industries.

Telecom Expense Management Market: Key Takeaways

- Market Growth: The Telecom Expense Management Market size is expected to grow by USD 9.7 billion, at a CAGR of 13.6%, during the forecasted period of 2026 to 2034.

- By Component: The solutions is anticipated to get the majority share of the Telecom Expense Management Market in 2025.

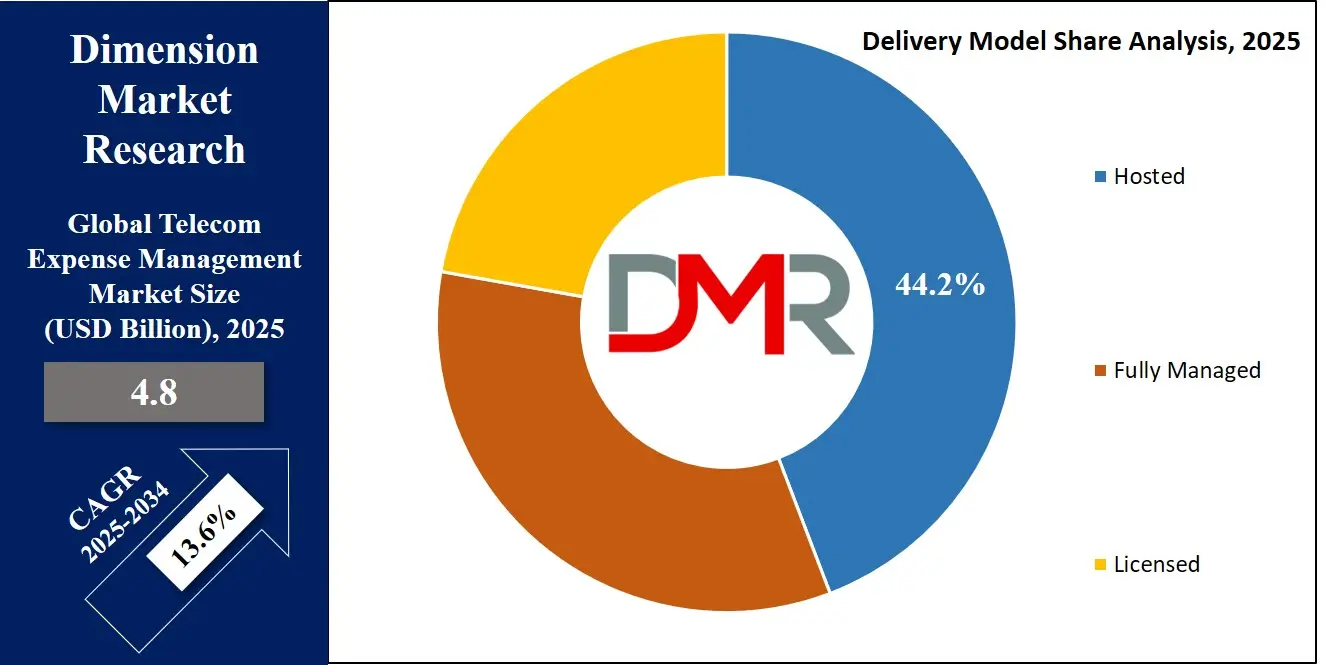

- By Delivery Model: The hosted segment is expected to get the largest revenue share in 2025 in the Telecom Expense Management Market.

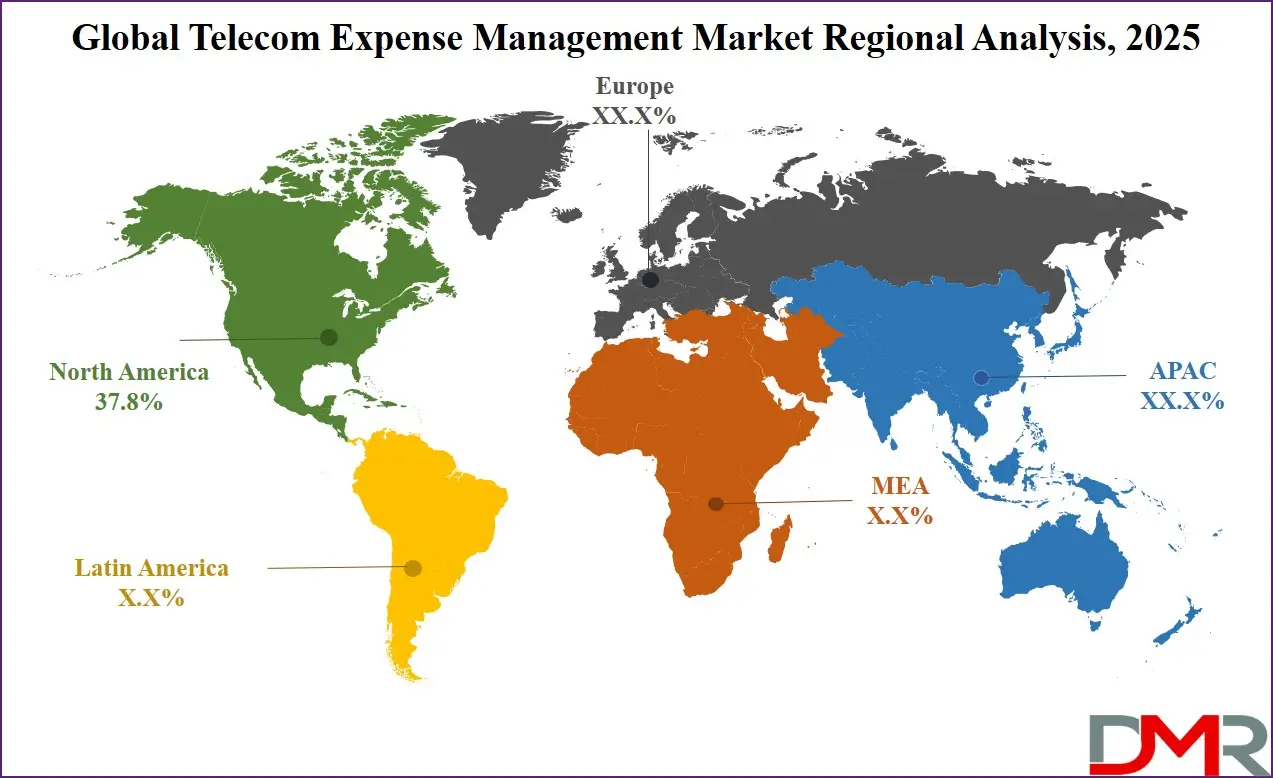

- Regional Insight: North America is expected to hold a 37.8% share of revenue in the Global Telecom Expense Management Market in 2025.

- Use Cases: Some of the use cases of Telecom Expense Management include cost optimization, inventory & asset tracking and more.

Telecom Expense Management Market: Use Cases

- Cost Optimization: Telecom Expense Management helps businesses identify unnecessary services, unused lines, and billing errors. By analyzing usage patterns, it provides actionable insights to cut down on extra telecom expenses. This leads to better budget control and improved financial efficiency.

- Invoice and Contract Management: TEM solutions automate the review and approval of telecom invoices, reducing manual effort and avoiding late fees. They also track contract terms and renewal dates, helping companies negotiate better deals. This ensures full compliance with vendor agreements.

- Inventory and Asset Tracking: TEM tools keep a detailed record of all telecom assets, such as mobile devices, SIM cards, and communication lines. This helps in managing resources efficiently and avoiding losses or misuse. It also simplifies lifecycle management of telecom assets.

- Usage Monitoring and Reporting: With real-time dashboards and customizable reports, businesses can monitor telecom usage across departments or locations. This helps spot unusual spikes or unauthorized use quickly. It also supports internal chargebacks and accurate budgeting.

Stats & Facts

- Coolest Gadget reports that as of June 2024, Oracle leads the global relational database management system (RDBMS) market with a score of 08. This score reflects its dominant position in a segment that comprised 72% of all database usage by December 2022. This underscores Oracle’s continued strength in enterprise data infrastructure.

- Vena Solutions highlights that 73% of companies still spend significant time on manual tasks that AI could automate, indicating a major opportunity for efficiency gains. This inefficiency persists even as staff using AI report an 80% boost in productivity, suggesting a gap between potential and actual implementation.

- According to Coolest Gadget, only 2% of the data generated in 2020 was retained in 2021, despite global data creation, copying, and consumption being expected to soar to 149 zettabytes in 2024 and surpass 394 zettabytes by 2028. This points to massive underutilization of data amid exponential digital growth.

- Based on data from Vena Solutions, corporate profits surged by 45% between January and April 2023, largely due to heightened interest in AI models. This profit spike suggests AI is not only transformative in operations but also directly impacts financial performance at a corporate level.

- Coolest Gadget reveals that 65% of CTOs and IT professionals view real-time data access as essential for AI success, aligning closely with the 90% who say their data management strategies are either somewhat or fully aligned with AI objectives, which illustrates a strong interdependence between effective data management and successful AI deployment.

- As per Enterprise Data Management Statistics via Coolest Gadget, 90% of IT professionals believe that improving data literacy will positively influence AI initiatives, with 40% asserting that it will have a significant impact. This finding underlines the growing emphasis on workforce readiness in supporting AI maturity.

- According to Coolest Gadget, 87% of IT professionals are enthusiastic about implementing AI, with 47% expressing strong enthusiasm, while 86% claim to have made solid progress in their AI efforts, which shows a widespread commitment to advancing AI capabilities within the enterprise IT landscape.

- Vena Solutions reports that 60% of businesses using AI do not have ethical AI policies, and 74% fail to address bias risks, suggesting a serious gap in governance and oversight even as adoption increases. Ethical concerns remain a weak point in current AI strategies.

- South Korea’s enterprise data management market is expected to grow at an annual rate of 20% from 2024 to 2032, according to Coolest Gadget, as it also highlights the country’s focus on strengthening digital infrastructure and supporting AI-driven transformation at a national level.

- Vena Solutions notes that 73% of employers place high importance on acquiring AI talent, yet the existing talent pool remains insufficient to meet demand. This talent shortfall could hinder innovation and implementation efforts despite organizational eagerness to scale AI use.

Market Dynamic

Driving Factors in the Telecom Expense Management Market

Rising Enterprise Mobility and Remote Work Expansion

One of the biggest growth drivers for the Telecom Expense Management market is the rising use of mobile devices and remote work arrangements across enterprises. With employees increasingly relying on smartphones, laptops, mobile data, and cloud-based communication platforms, telecom costs have become more complex and harder to manage.

Organizations need better visibility and control over their telecom usage and expenses, especially when dealing with multiple service providers across regions. TEM solutions provide centralized tools to monitor, track, and optimize these costs. As more companies adopt hybrid work models, the demand for effective management of mobile and data expenses is only increasing. This trend is pushing businesses to invest in advanced TEM solutions that ensure cost efficiency while maintaining seamless communication.

Growing Adoption of Cloud and SaaS-based Communication Tools

The widespread shift to cloud-based communication systems such as VoIP, unified communication platforms, and SaaS tools is driving the need for better expense tracking. These platforms often operate on usage-based or subscription pricing models, which can lead to unpredictable billing if not properly managed. TEM solutions help organizations monitor usage, avoid overcharges, and ensure that they are only paying for the services they use.

Cloud-based TEM tools also offer the advantage of scalability and easy integration with other enterprise systems. As digital transformation accelerates across industries, companies are looking for solutions that can keep up with the speed and complexity of modern telecom environments. This rising digital reliance is significantly boosting the growth of the TEM market.

Restraints in the Telecom Expense Management Market

High Implementation Costs and Integration Challenges

One of the major restraints in the Telecom Expense Management market is the high cost of implementation and integration, especially for small and medium-sized businesses. Setting up a full-scale TEM solution often requires upfront investment in software, customization, and staff training. Additionally, integrating TEM tools with existing enterprise systems like ERP or accounting platforms can be technically complex and time-consuming.

This becomes even more difficult for organizations with outdated IT infrastructure. The return on investment may not be immediate, which makes some companies hesitant to adopt such solutions. As a result, the adoption rate among smaller firms remains relatively low, limiting the market's overall growth potential despite rising demand.

Data Privacy Concerns and Vendor Dependence

Another key restraint is the growing concern around data privacy and security when using third-party TEM solutions. These platforms often handle sensitive information such as call records, user locations, and financial data. Any breach or misuse of this data can lead to serious legal and reputational issues for businesses.

Additionally, heavy dependence on a single TEM vendor can create challenges in terms of flexibility and long-term control. If the vendor fails to meet expectations or exits the market, it can disrupt operations. Such concerns make some organizations cautious about fully relying on external TEM providers, especially in regulated industries like finance or healthcare.

Opportunities in the Telecom Expense Management Market

Expansion into Emerging Markets and SMEs

A major opportunity for the Telecom Expense Management market lies in expanding services to small and medium-sized enterprises (SMEs) and emerging markets. As digital connectivity and mobile adoption grow rapidly in developing regions, businesses in these areas face rising telecom expenses and complex billing issues.

However, most SMEs lack dedicated tools or expertise to manage these costs efficiently. By offering scalable, affordable, and cloud-based TEM solutions tailored to smaller organizations, vendors can tap into a large, under-served market. Moreover, increasing awareness of cost optimization and automation benefits is creating strong interest among these businesses. Expansion in these markets not only increases revenue potential but also diversifies the customer base for TEM providers.

Integration with AI, IoT, and 5G Technologies

The rapid evolution of technologies like Artificial Intelligence (AI), Internet of Things (IoT), and 5G presents new opportunities for Telecom Expense Management solutions. As companies adopt IoT devices and 5G connectivity, the volume and complexity of telecom data will grow significantly. TEM platforms integrated with AI can automatically detect usage trends, flag unusual charges, and provide predictive analytics for better budgeting. These technologies enable smarter, more proactive expense management and improve the value of TEM tools.

Additionally, with IoT-enabled assets and 5G-based services becoming mainstream, organizations will need advanced tracking and cost control. This tech-driven transformation opens up fresh areas for innovation and service expansion in the TEM space.

Trends in the Telecom Expense Management Market

Shift Toward Cloud-Based TEM Platforms

A growing trend in the Telecom Expense Management market is the move from traditional, on-premise systems to cloud-based platforms. These solutions offer businesses greater flexibility, faster updates, and easier access to data from multiple locations. Cloud TEM tools allow companies to manage telecom usage, billing, and inventory in real time without the need for heavy IT support. This shift also helps reduce operational costs and speeds up decision-making. As remote and hybrid work environments become more common, companies are looking for systems that can adapt quickly and work across devices. Cloud-based platforms meet these needs efficiently and are quickly becoming the standard for modern telecom management.

AI and Automation for Smarter Expense Control

Artificial Intelligence and automation are being widely adopted in Telecom Expense Management systems to make processes faster and smarter. These technologies can automatically detect unusual usage, analyze complex billing data, and suggest areas where companies can save money.

They also reduce the time and effort needed to check invoices, resolve errors, or manage multiple service providers. AI helps predict telecom needs and highlights patterns that might not be obvious to humans. As telecom networks become more complex with new technologies and services, automation ensures better accuracy and faster handling of growing data volumes. This trend is reshaping how businesses manage and control telecom costs.

Impact of Artificial Intelligence in Telecom Expense Management Market

- Smarter Cost Analysis: AI helps analyze large volumes of telecom billing and usage data quickly. It identifies patterns, detects overcharges, and suggests cost-saving opportunities that would be hard to spot manually.

- Automated Invoice Audits: AI automates the checking of telecom invoices against contracts and usage logs. This reduces errors, speeds up the review process, and ensures that companies only pay for what they use.

- Predictive Insights: AI can forecast future telecom usage based on historical data. This helps businesses plan budgets better, avoid over-usage fees, and select the most cost-effective service plans.

- Real-Time Alerts: AI-powered TEM tools send alerts when unusual activity or unexpected spikes in usage occur. This allows businesses to react quickly and prevent wasteful spending.

- Improved Decision Making: By delivering clear insights through dashboards and reports, AI helps managers make better decisions about vendor selection, plan adjustments, and telecom policy enforcement.

Research Scope and Analysis

By Component Analysis

Solutions are expected to lead the Telecom Expense Management market in 2025 with a share of 55.7%, driven by the growing need for automation, cost optimization, and real-time tracking of telecom resources. Businesses are increasingly adopting TEM software to gain better control over mobile usage, voice and data spending, and inventory management. These solutions help reduce billing errors, simplify contract handling, and improve overall telecom lifecycle management. The shift toward cloud-based platforms has made these tools more scalable and accessible, especially for large enterprises managing telecom services across multiple regions.

As telecom networks grow more complex, the demand for centralized and customizable solutions continues to rise. This trend supports the strong position of solutions as a core component in the market’s expansion, enabling companies to manage their telecom infrastructure more efficiently and cut down unnecessary costs while staying compliant with internal and external policies.

On the other hand, services are having significant growth over the forecast period in the Telecom Expense Management market, mainly due to rising demand for specialized support, consulting, and managed services. Organizations are relying on service providers to handle complex telecom audits, vendor negotiations, and billing dispute resolutions. Many companies, especially those without in-house telecom teams, prefer outsourcing to experts who can help them uncover savings and improve contract terms.

Managed services also assist in real-time monitoring, reporting, and compliance management. As the telecom environment continues to evolve with new technologies and pricing models, businesses are looking for flexible service offerings that adapt to their changing needs. The ability of TEM services to provide end-to-end visibility and actionable insights plays a key role in boosting their importance across industries.

By Expense Type Analysis

Mobile is anticipated to dominate the Telecom Expense Management market in 2025 with a share of 28.8%, largely due to the rapid rise in mobile device usage across organizations. As more employees use smartphones, tablets, and mobile broadband for work, managing mobile-related costs has become a top priority. Businesses need better tools to monitor mobile data consumption, voice usage, roaming charges, and device inventories.

Mobile expense tracking also supports bring-your-own-device (BYOD) policies, helping companies manage reimbursements and maintain security. With remote and hybrid work models becoming more common, the demand for accurate and automated mobile expense control continues to grow. This has pushed organizations to adopt dedicated solutions that can optimize mobile plans, prevent overages, and provide detailed usage reports. Mobile expenses now play a critical role in overall telecom strategy, making this segment a major driver of TEM market growth in the coming years.

Cloud services are gaining strong momentum as an expense type and are expected to see significant growth over the forecast period in the Telecom Expense Management market. With more companies shifting their communication and operations to cloud-based platforms, managing the cost of these services has become more challenging. Cloud-related telecom costs often vary depending on usage, making it harder for businesses to predict and control spending.

TEM tools help track and manage cloud service expenses like VoIP, collaboration tools, storage, and virtual networks in real time. Companies are also seeking visibility into multi-cloud environments to avoid redundant services and ensure cost-efficiency. As digital transformation accelerates, cloud service management is becoming a central focus in telecom budgeting. This growing complexity of cloud usage is driving the need for specialized TEM capabilities, positioning cloud services as an essential category for future telecom expense planning and optimization.

By Delivery Model Analysis

Hosted delivery model is projected to lead the Telecom Expense Management market in 2025 with a share of 44.2%, as more businesses move away from complex in-house systems toward simplified, cloud-based solutions. Hosted platforms offer flexibility, faster setup, and lower maintenance, making them ideal for companies of all sizes. These solutions allow real-time access to telecom data, automated reporting, and centralized expense tracking without requiring heavy IT support.

As telecom networks become more dynamic, hosted models help businesses adapt quickly to changes in usage and cost structures. They also support integrations with other enterprise systems, providing seamless management of telecom assets, billing, and vendor contracts. The increasing demand for remote access, scalability, and cost control is driving the preference for hosted solutions, making this delivery model a key growth contributor in the TEM landscape, especially for enterprises managing multi-country operations or shifting to hybrid work environments.

Fully managed delivery model is seeing significant growth over the forecast period in the Telecom Expense Management market, fueled by organizations seeking end-to-end telecom cost control without internal workload. This model offers complete handling of telecom expense tasks from invoice audits and dispute resolution to inventory tracking and usage analysis—by an external team of experts. Many businesses prefer this approach to avoid the complexities of managing telecom operations internally, especially when dealing with multiple vendors and service plans.

Fully managed TEM allows companies to focus on their core operations while still benefiting from optimized telecom spending and strong compliance. The growing interest in outsourcing non-core functions and gaining predictable cost outcomes is pushing this model forward. As companies aim for efficiency, transparency, and reliable support, fully managed services are becoming a trusted choice in the broader delivery ecosystem of the TEM market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Industry Vertical Analysis

IT & Telecom is set to lead the Telecom Expense Management market in 2025 with a share of 27.1%, driven by its high dependence on complex communication networks and technologies. Companies in this sector manage a wide range of telecom services including mobile, data, cloud infrastructure, and international connectivity, all of which need constant monitoring and cost control. With the fast-paced nature of IT and telecom operations, expense tracking becomes even more important to ensure efficiency and avoid overuse or billing errors.

Telecom Expense Management solutions help these companies gain visibility into usage, streamline vendor management, and optimize telecom spending. The continuous push for digital upgrades and global expansion adds more complexity to telecom environments, increasing the need for automated tools. As service providers themselves, IT and telecom companies also use TEM to strengthen their internal systems and showcase best practices to clients, making this vertical a strong driver of market growth.

Healthcare is showing steady and significant growth over the forecast period in the Telecom Expense Management market, mainly due to rising reliance on digital health technologies, remote consultations, and data-intensive communication tools. Hospitals, clinics, and healthcare organizations are managing a growing number of devices, mobile users, and telehealth platforms that generate substantial telecom expenses. Managing these costs while maintaining data security and regulatory compliance is a critical need in this sector.

TEM solutions help healthcare providers track telecom usage, reduce unnecessary charges, and stay compliant with strict industry standards. The increasing need for streamlined communication between facilities, care teams, and patients further supports the adoption of advanced expense management tools. As the healthcare sector continues to embrace digital transformation, the demand for cost-effective and reliable telecom expense solutions will remain strong.

The Telecom Expense Management Market Report is segmented on the basis of the following:

By Component

- Solutions

- Services

- Managed Services

- Professional Services

- Consulting

- Auditing and Benchmarking

- Implementation and Integration

- Support and Maintenance

By Expense Type

- Voice

- Data

- Mobile

- Cloud Services

- Fixed Line

- Unified Communications

By Delivery Model

- Hosted

- Licensed

- Fully Managed

By Industrial Vertical

- BFSI

- IT and Telecom

- Retail and E-Commerce

- Healthcare

- Manufacturing

- Transportation and Logistics

- Government and Public Sector

- Energy and Utilities

- Others

Regional Analysis

Leading Region in the Telecom Expense Management Market

North America, leading the Telecom Expense Management (TEM) market with a share of 37.8% in 2025, plays a major role in the industry’s overall growth. This dominance comes from the region’s strong digital infrastructure, early adoption of cloud-based services, and widespread use of mobile and remote communication tools. Businesses across the US and Canada are increasingly using advanced TEM solutions to manage complex telecom environments, reduce unnecessary costs, and improve visibility into telecom usage. With more companies adopting hybrid work models, the demand for efficient cost management tools has grown rapidly.

The region also benefits from a high concentration of TEM providers, technology innovators, and large enterprises with global operations. As 2025 continues, the market is estimated to grow further, supported by rising investments in automation, artificial intelligence, and integrated platforms. North America’s focus on financial transparency, regulatory compliance, and digital transformation keeps it at the forefront of the global Telecom Expense Management landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Telecom Expense Management Market

Asia Pacific is showing significant growth in the Telecom Expense Management market due to increasing digital adoption, rising mobile workforce, and expanding telecom infrastructure across the region. Countries like China, India, Japan, and South Korea are witnessing higher use of cloud communication, data services, and mobile device management, which is driving demand for effective cost control solutions.

The growing number of small and medium-sized enterprises in the region is also contributing to market expansion as these businesses look for scalable and affordable telecom management tools. Over the forecast period, the market is estimated to grow steadily as organizations invest more in automation, telecom lifecycle management, and expense tracking technologies.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Telecom Expense Management market is highly competitive, with many companies offering a range of services and software solutions to help businesses manage their telecom costs. The competition is driven by increasing demand for automation, cloud-based platforms, and advanced analytics. Some providers focus on large enterprises with global operations, while others target small and mid-sized businesses.

Many offer extra features like real-time monitoring, contract management, and inventory tracking to stand out in the market. The entry of IT service companies and consulting firms has added more competition, pushing existing players to innovate and improve customer support. Overall, the market is dynamic, with companies competing on technology, service quality, pricing models, and the ability to adapt to changing telecom needs.

Some of the prominent players in the global Telecom Expense Management are:

- Tangoe

- Calero-MDSL

- Cass Information Systems

- Sakon

- Brightfin (formerly Mobile Solutions)

- Tellennium

- Accenture

- IBM Corporation

- Cisco Systems, Inc.

- Ericsson

- Infosys

- DXC Technology

- Atos

- Vodafone Global Enterprise

- Tata Communications

- Mindglobal

- vCom Solutions

- Asignet

- RadiusPoint

- ControlPoint

- Other Key Players

Recent Developments

- In March 2025, Service Now announced new AI agents for the telecom sector, built using NVIDIA AI Enterprise software and NVIDIA DGX Cloud. These agents aim to boost productivity across the service lifecycle by automating routine, labor-intensive workflows in customer service and network operations. Combining ServiceNow’s AI platform with NVIDIA NIM microservices and NeMo, the solution delivers ready-to-deploy, telecom-specific AI agents. This full-stack AI approach helps CSPs resolve issues faster, enhance customer experiences, and allow human agents to focus on more complex service needs.

- In March 2025, TEOCO launched its SmartSuite™ telecom cost optimization portfolio. Designed to enhance CSP revenues, margins, and profitability, SmartSuite offers an integrated suite of microservices-based solutions. CEO Atul Jain highlighted the company’s 30-year legacy in managing operational costs, stating that SmartSuite brings multiple tools together to help clients reduce expenses, boost margins, and streamline operations. The new portfolio reflects TEOCO’s ongoing commitment to driving efficiency and value for its clients.

- In December 2024, SK Telecom (SKT) announced its 2025 organizational restructuring and executive appointments to advance its dual priorities of telecommunications and artificial intelligence (AI). CEO Yoo Young-sang stated that 2025 will be a year focused on action, with the company reshaping its structure to improve execution and strengthen its core areas. The reorganization includes the formation of seven dedicated business divisions centered on telecom and AI, supported by a shared infrastructure group and essential staff functions, aiming to drive efficiency and innovation across the company’s operations.

- In November 2024, AppDirect announced the expansion of its services for MSPs and customers by acquiring vCom Solutions, an IT lifecycle management and managed services company. This move brings vCom’s AI-powered vManager suite and QuantumShift Buyers’ Club into AppDirect’s ecosystem. Post-acquisition, the vCom platform will be integrated with AppDirect’s procurement platform, offering a unified hub to manage cloud, telecom, and mobility services. Features like single sign-on, consolidated spend, and unified data management will enhance AppDirect’s value as a daily business operations tool.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 4.8 Bn |

| Forecast Value (2034) |

USD 15.1 Bn |

| CAGR (2025–2034) |

13.6%

|

| The US Market Size (2025) |

USD 1.5 Bn |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions and Services) By Expense Type (Voice, Data, Mobile, Cloud Services, Fixed Line, and Unified Communications), By Delivery Model (Hosted, Licensed, and Fully Managed), By Industrial Vertical (BFSI, IT and Telecom, Retail and E-Commerce, Healthcare, Manufacturing, Transportation and Logistics, Government and Public Sector, Energy and Utilities, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Tangoe, Calero-MDSL, Cass Information Systems, Sakon, Brightfin (formerly Mobile Solutions), Tellennium, Accenture, IBM Corporation, Cisco Systems, Inc., Ericsson, Infosys, DXC Technology, Atos, Vodafone Global Enterprise, Tata Communications, Mindglobal, vCom Solutions, Asignet, RadiusPoint, ControlPoint, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |