Market Overview

The

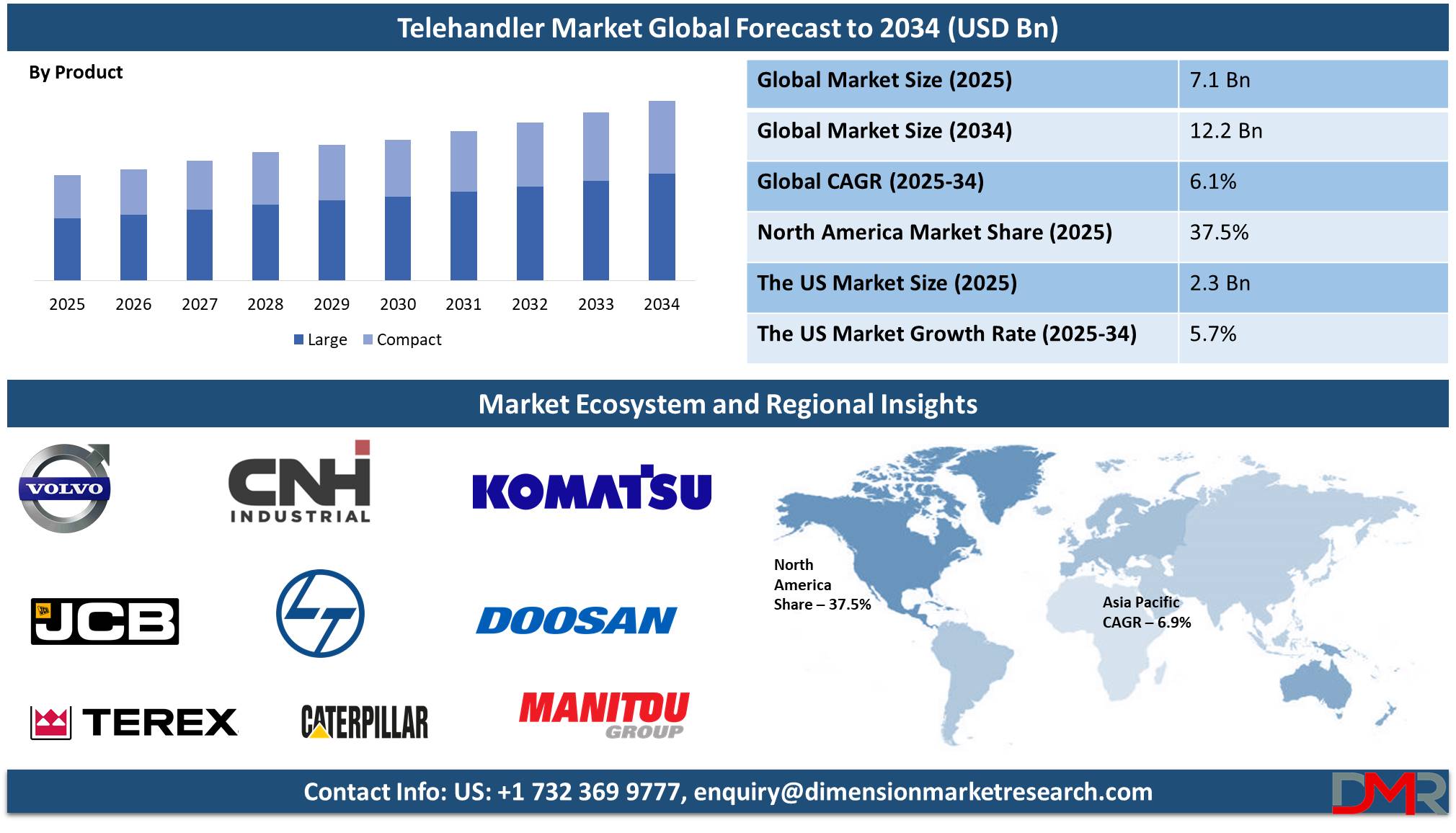

Global Telehandler Market is projected to reach

USD 7.1 billion in 2025 and grow at a compound annual growth rate of 6.1% from there until 2034 to reach a

value of USD 12.2 billion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Telehandlers are versatile lifting machines often employed in construction, agriculture, and industry settings. Their telescopic boom can extend forwards and upwards, similar to a forklift, but with greater reach and flexibility; their use enables users to lift heavy loads, transport materials over rough terrain efficiently, and work safely despite uneven ground. Telehandlers typically come equipped with buckets, pallet forks, and lifting jibs that enable efficient multitasking, thus becoming key equipment across numerous fields.

The demand for telehandlers has grown as cities grow rapidly, infrastructure projects become more costly, and more efficient material handling solutions become a necessity. Construction sites and large construction projects are driving sales of these machines; agricultural sites also depend heavily on them for handling hay bales, loading feed, and other farm operations. Warehouses, logistics companies, and manufacturing plants have increasingly adopted them to increase operational efficiency, as warehouse rental services for heavy machinery have contributed further to the market expansion of telehandlers.

Additionally, various trends are shaping the future of telehandlers. One such trend is their shift toward electric and hybrid models in response to rising environmental concerns and emission regulations; manufacturers now produce battery-powered telehandlers to reduce fuel costs and pollution levels. Another important trend involves the integration of advanced technologies like telematics, GPS tracking, and automation, which help operators monitor machine performance more closely as well as increase safety. Furthermore, compact telehandlers have gained immense popularity, especially among urban dwellers, due to their excellent maneuverability without compromising lifting capacity.

Recent years have witnessed several significant events affecting the telehandler industry, with notable examples being pandemic delays in construction projects and supply chain disruptions temporarily slowing it down, but subsequent recovery and government investments led to a strong rebound. Manufacturers investing in eco-friendly telehandler designs has prompted manufacturers like JCB, Manitou and Caterpillar introducing models with smart features designed to increase efficiency and safety reshaping the industry as whole.

As part of its rapid expansion, however, the telehandler market does face some obstacles and difficulties. High initial costs & maintenance expenses may act as barriers for small businesses; additionally, skilled operator shortages could limit usage as these machines require trained operators for safe operation. On the flipside, rental market opportunities exist as many companies prefer renting instead of purchasing outright; automation & AI driven telehandlers hold great promise in improving operational efficiencies while decreasing human intervention.

The telehandler industry is projected to experience sustained expansion due to construction projects, technological development and environmental regulations. Companies investing in electric and hybrid models could gain an edge as society shifts toward greener solutions; furthermore, automation and smart features will likely make telehandlers safer and more efficient, providing industries around the globe with increased safety and productivity benefits. Businesses seeking to invest in telehandlers should pay attention to these trends as part of an evolving market.

The US Telehandler Market

The US Telehandler Market is projected to reach USD 2.3 billion in 2025 at a compound annual growth rate of 5.7% over its forecast period.

The telehandler market in the US presents growth opportunities through expanding infrastructure projects, including roads, bridges, and airports. Increased automation and mechanization in the agriculture and logistics sectors also drive demand. Additionally, the shift towards electric and hybrid telehandlers for sustainability is fueling market growth, while advancements in safety features and fuel efficiency provide competitive advantages.

Further, there is a surge in infrastructure projects and a growing need for mechanized material handling in the construction, agriculture, and logistics sectors. Additionally, the transformation towards electric and hybrid models is expanding market potential. However, a restraint includes the high initial costs of advanced telehandlers, particularly electric versions, and the limited adoption of such machines in certain industries due to budget constraints and maintenance requirements.

Telehandler Market: Key Takeaways

- Market Growth: The Telehandler Market size is expected to grow by 4.7 billion, at a CAGR of 6.1% during the forecasted period of 2026 to 2034.

- By Product: The large segment is anticipated to get the majority share of the Telehandler Market in 2025.

- By End Use: The construction sector is expected to be leading the market in 2025

- By Propulsion: The ICE segment is expected to get the largest revenue share in 2025 in the Telehandler Market.

- Regional Insight: North America is expected to hold a 37.5% share of revenue in the Global Telehandler Market in 2025.

- Use Cases: Some of the use cases of Telehandler include the construction industry, agriculture & farming, and more.

Telehandler Market: Use Cases:

- Construction Industry: Telehandlers are broadly used for lifting & moving heavy materials like steel beams, bricks, and concrete blocks to high elevations on construction sites. Their ability to reach difficult areas makes them critical for high-rise projects.

- Agriculture and Farming: Farmers use telehandlers to handle hay bales, load animal feed, and transport heavy farm equipment. Their versatility with different attachments helps in various agricultural tasks efficiently.

- Warehousing and Logistics: Telehandlers help in loading and unloading goods in warehouses and shipping yards. Their extended reach allows them to stack materials at higher levels, optimizing storage space.

- Industrial and Maintenance Work: Factories, power plants, and maintenance crews use telehandlers for lifting heavy machinery, repairing infrastructure, and installing large components in hard-to-reach areas.

Stats & Facts

- According to the Health & Safety Executive, Government of UK, various serious telehandler accidents occur due to vehicle movement, mainly reversing into pedestrians or overturning while lifting, trapping the operator or bystanders. Proper risk assessments, traffic management plans, and site organization are important to separate pedestrians from vehicles and prevent these hazards.

- Telehandlers must be selected based on site conditions, ensuring optimal visibility, especially at the rear, where blind spots pose a major hazard. Visibility aids like cameras or signallers may be required. Forward visibility is also a concern when the boom is raised, creating blind spots that increase accident risks.

- Further, operating telehandlers on uneven, unstable, or sloping ground increases the risk of tipping, even for rough-terrain models, which have strict operational limits. Proper site preparation with flat, graded surfaces is necessary. Additionally, speeding, particularly around corners, significantly raises overturning risks, making site speed limits crucial.

- In addition, overloading telehandlers or moving with a raised load is extremely dangerous and must be avoided. Proper load management, selecting the correct vehicle, and enforcing site protocols reduce overturning incidents and improve operational safety.

- Only trained, competent, and authorized drivers should operate telehandlers. Valid training certificates from recognized schemes must be checked, and pedestrians should be educated on safe walking routes and alert procedures to minimize accidents.

- A structured, inspection and maintenance program is essential for telehandler safety. Daily visual checks, regular inspections, and servicing should follow manufacturer guidelines. Operators must report defects immediately, and safety-critical faults should be addressed before use.

- As per the International Powered Access Federation (IPAF) 2022, falls from platforms, electrocution, and overturning are the top causes of serious injuries and fatalities in the powered access industry. From 2012-2021, 4,374 accident reports were recorded globally, including 4,462 lost-time incidents and 585 fatalities across 41 countries.

- In 2021, there were 603 incident reports from 28 countries involving 628 individuals, resulting in 109 fatalities—a decrease from 126 in 2020. The UK accounted for 60.8% of these reports, followed by the US (18.7%) and South Korea (4.9%). The powered access rental sector reported the most incidents (43%), followed by construction (29%).

- Also, IPAF 2022 reported that electrocution remains a significant hazard, with the US and Canada accounting for nearly 90% of cases in the past decade. Most electrocutions involve overhead power lines, but incidents also occur in workshops and rental depots with live electrical components. From 2019-2021, there were 103 fatalities, two major injuries, and five minor injuries due to electrocution involving MEWPs. In 2021 alone, 27 people died from electrocution, up from 21 fatalities in 2020.

- Further, Public areas and roadsides are the most common sites for fatal powered access accidents. Almost 50% of electrocution fatalities involve static boom-type (1b) MEWPs, while 30% occur with mobile boom-type (3b) MEWPs. Since 2016, electrocution reports have increased due to improved reporting, but near-miss incidents remain heavily underreported.

- Moreover, the industry must improve incident reporting across more countries and sectors to enhance safety data. The “Don’t Fall for It!” global safety campaign aims to reduce platform falls, which remain the leading cause of fatalities. Additionally, stricter safety protocols in rental activities such as delivery, collection, loading, and machine maintenance can help prevent workplace injuries.

Market Dynamic

Driving Factors in the Telehandler Market

Infrastructure Development and UrbanizationWith the fast pace of global construction projects, like roads, bridges, commercial buildings, and residential complexes expanding globally, demand for telehandlers has skyrocketed. Both governments and private investors alike are making heavy investments in infrastructure around the world, mainly in developing nations, making telehandlers an invaluable part of modern construction projects by efficiently lifting and transporting heavy materials, an indispensable feature that modern building relies on heavily.

Technological Advancements and Sustainability Trends

Telehandler adoption has increased due to stricter emission regulations and increasing sustainability efforts, prompting manufacturers to integrate advanced technologies like telematics, automation, and GPS tracking into these machines to improve efficiency and safety, improve machine performance, and reduce operating costs while making them more affordable and eco-friendly solutions. These innovations make these telehandlers even more attractive as potential solutions in industries looking for eco-friendly yet cost-cutting options.

Restraints in the Telehandler Market

High Initial Investment and Maintenance Costs

Telehandlers are expensive machines, with high upfront costs that can be a barrier for small and medium-sized businesses. In addition to the cost price, regular maintenance, fuel, and spare parts add to operational expenses. Companies often hesitate to invest in telehandlers, especially when rental options are available, which slows down overall market growth.

Shortage of Skilled Operators and Safety Concerns

Operating a telehandler requires specialized training to ensure safety and efficiency, but there is a shortage of skilled operators in many regions. Without proper handling, telehandlers create risks like tipping over or accidents on job sites. Stricter safety regulations and compliance requirements can further limit adoption, as companies must invest in operator training and certification.

Opportunities in the Telehandler Market

Rental Market Development

Telehandler rentals have become an increasingly attractive alternative to outright purchases for many small and mid-sized enterprises (SME), creating significant opportunities for rental service providers. Letting advanced telehandlers access advanced features without incurring large upfront investments can open up greater demand for rental fleets as a whole, encouraging manufacturers to partner with these fleets and expand their reach.

Advances in Automation and Smart Features

Technological advancements such as automation, telematics, and AI-driven controls are dramatically improving telehandler efficiency and safety. Features such as remote operation, real-time performance monitoring, and predictive maintenance are attracting industries seeking increased productivity; as technology rapidly progresses, so too will smart telehandlers create opportunities in large scale construction, logistics, and industrial applications.

Trends in the Telehandler Market

Shift Toward Electric and Hybrid Models

As environmental concerns grow and emission standards become stricter, there is a major shift toward electric and hybrid telehandlers. These models provide lower carbon emissions and reduced operational costs due to energy efficiency. The demand for eco-friendly equipment is driving manufacturers to innovate in the production of electric-powered telehandlers, which are becoming more popular in urban and indoor settings where emissions are a concern.

Increased Demand for Compact Telehandlers

Compact telehandlers, which provide high maneuverability and smaller sizes, are gaining popularity, mainly in urban environments with limited space. These machines are designed to work efficiently in confined areas while still providing impressive lifting capacity. Their versatility makes them ideal for construction sites, warehouses, and agricultural operations, where space constraints require more agile machinery without compromising on performance.

Research Scope and Analysis

By Product

In 2025, it is anticipated that large telehandlers will take up a larger share of the market due to rapid expansion in the construction industry and an increase in infrastructure projects around the world. These large machines are important in lifting heavy loads to great heights, making them a critical asset on construction sites. Their ability to move massive materials precisely while operating efficiently in difficult conditions makes them especially useful. Large telehandlers are widely utilized for material transportation, heavy construction component placement, and smooth operations in tight or high-reach spaces. As construction projects increase in scope and complexity, demand for high-capacity lifting equipment such as large telehandlers will only increase further.

Further, compact telehandlers are anticipated to experience rapid growth over the coming years. Their popularity is on the rise as these models combine the power of traditional telehandlers with smaller designs that make them suitable for urban settings or spaces with limited clearance. Compact telehandlers are capable of maneuvering easily through narrow pathways and tight work sites while offering impressive lifting height and capacity.

Widely utilized across various sectors, including construction, agriculture, warehouse storage facilities and facility maintenance, compact telehandlers offer unrivaled versatility. As cities continue to expand and space becomes scarcer, businesses requiring efficient material handling solutions while staying within tighter confines are turning increasingly towards this compact yet powerful equipment. Their increasing adoption will further fuel this segment's expansion.

By Propulsion

Combustion-driven telehandlers will remain dominant in the telehandler market shares in 2025. Decade after decade, these machines remain the go-to choice in various industries due to their proven durability, high power output, and ability to work without needing charging infrastructure. Combustion engines contribute to air pollution and environmental degradation, prompting increased regulations and sustainability concerns that will ultimately limit their growth over time. As such, their expansion is anticipated to decrease. Occupational areas that demand high power or extended operating hours will continue to depend on combustion models; however, industries will gradually move toward cleaner alternatives—hybrid and electric telehandlers becoming a focal point for future innovation.

Electric telehandler sales are projected to experience rapid growth over the coming years as more customers opt for environmentally friendly machines and vehicles. Climate change impacts, as well as stricter emissions regulations, are prompting industries to adopt electric alternatives as they strive toward sustainability. Electric telehandlers provide numerous advantages, such as lower operating costs, reduced noise levels and zero emissions making them perfect for urban construction sites, indoor operations and environmentally sensitive areas. However, transitioning from traditional combustion engines to fully electric models is no simple feat, due to infrastructure restrictions, battery lifespan concerns and higher initial costs.

In addition, hybrid telehandlers should therefore experience strong demand up until 2025. These hybrid machines combine the reliability and efficiency of combustion engines with that of electric power to offer users lower emissions and fuel savings while still allowing them to benefit from traditional power and range capabilities. Businesses using hybrid solutions can gradually transition toward fully electric solutions without impacting performance or functionality.

By Lift Capacity

Based on lift capacity, 3-10-ton telehandlers are projected to become market leaders, holding the greatest market share in 2025 and growing at the fastest rate in the coming years. Telehandlers have become an indispensable asset to construction professionals, serving a critical purpose by lifting and moving heavy materials with precision while improving work efficiency and productivity. They're ideal for logistics and warehousing applications due to their compact size and maneuverability, providing easy load and unload services in tight spaces. Telehandlers have an essential place in mining and extraction industries, helping transport materials across rough or uneven terrain. As workplace safety concerns increase, so has demand for these machines; modern telehandlers now come equipped with ergonomic operator cabins for maximum comfort to reduce fatigue while decreasing accidents - making them an invaluable choice across various sectors.

Further, 10-ton and over telehandler segments are projected to experience strong growth during the forecast period. These heavy-duty machines boast superior lifting capacity that allows them to handle large loads in the construction, mining, and logistics industries, saving businesses both time and costs on job sites by moving heavy materials more efficiently than before. As global infrastructure projects, such as building new roads bridges airports increase globally so too will demand for high-capacity telehandlers to become an essential tool for industries handling significant loads.

By End Use

Construction industries are anticipated to become the primary users of telehandlers by 2025, accounting for most of their market and projecting significant growth at an accelerated rate. As infrastructure development becomes an ever-increasing priority in emerging economies, demand has skyrocketed for powerful and flexible machinery capable of lifting heavy loads in tight spaces. Construction sites demand equipment that increases efficiency, safety, and productivity, as telehandlers offer that solution with features like improved visibility, stability improvements, and higher lifting capacities. As technology has advanced, advances such as improved fuel efficiency, smart control systems, and integrated telematics have further made telehandlers more user-friendly and effective for construction companies to complete projects faster and with greater precision, leading to widespread adoption across various projects, including residential, commercial and infrastructure development globally.

Further, agriculture businesses can expect a surge in the adoption of telehandlers over the coming years due to mechanized farming's increasing trend of mechanization; more agricultural businesses are turning towards these machines to enhance efficiency and lower labor costs. These machines offer an efficient, cost-effective, and multitasking solution, capable of performing numerous tasks that would normally necessitate multiple machines or manual labor. Recent technological innovations, including precision farming, automation, and data-driven decision-making, are revolutionizing agriculture. These advances allow farmers to maximize crop yields while simultaneously cutting costs and increasing overall productivity. As agricultural practices become more modernized, demand for telehandlers in farming operations should increase dramatically, creating significant growth opportunities within this segment.

The Telehandler Market Report is segmented on the basis of the following

By Product

By Propulsion

By Lift Capacity

- Less than 3 Ton

- 3 to 10 Ton

- More than 10 Ton

By End Use

- Construction

- Agriculture

- Manufacturing

- Others

Regional Analysis

North America will be leading the global telehandler market in 2025

with over 37.5% market share in 2025, driven by growth in construction & infrastructure development projects that require versatile material-handling equipment with superior performance capabilities. Telehandlers have become an indispensable asset to industries like agriculture, manufacturing, and logistics that depend heavily on mechanization and automation, as their ability to multitask efficiently increases.

These machines improve productivity, reduce labor requirements, and boost operational efficiency across various sectors. Recent developments in telehandler technology, like improved fuel efficiency, advanced control systems, and telematics integration, have further made these machines attractive to businesses in North America looking for modernized yet cost-effective yet high-performing solutions for worksite efficiency and safety. Telehandler sales remain particularly strong among companies operating within this region.

Further, Asia Pacific is anticipated to experience the highest growth rate over the coming years, as China, India, and Southeast Asian nations are witnessing rapid urbanization and undertaking large infrastructure projects at an incredible rate, which has increased demand for telehandlers as an essential construction tool. Governments and private investors alike are investing significantly in residential and commercial structures, highways, bridges, and airports, growing demand for reliable material-handling equipment. In addition, Asia's agriculture sector is rapidly developing.

Farmers have adopted modern machinery to enhance efficiency and decrease manual labor. Telehandlers have become an indispensable asset to farmers due to their versatility when loading, unloading, and transporting crops or equipment an invaluable asset in farming operations. Manufacturing and logistics sectors, mainly manufacturing and logistics operations, are driving the adoption of telehandlers for efficient material handling and warehouse operations. With urbanization increasing rapidly across the Asia Pacific, demands for compact yet maneuverable telehandlers for city construction projects remain on the rise, creating a high potential market for the adoption of these systems.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The telehandler market consists of numerous players offering a wide range of products to cater to the needs of various industries like construction, agriculture, and logistics. Companies focus on technological innovation, enhanced safety features, and fuel efficiency to differentiate their products. Key factors like pricing, product performance, reliability, and customer service play a crucial role in gaining market share. Manufacturers are also expanding their portfolios to include electric and hybrid models in response to increasing environmental concerns and the growing demand for sustainable and energy-efficient equipment.

Some of the prominent players in the global Telehandler are

- AB Volvo

- CNH Industrial NV

- Komatsu Ltd

- Caterpillar

- L&T Technologies

- Doosan Corp

- JCB

- Manitou Group

- Terex Corp

- Oshkosh Corp

- Other Key Players

Recent Developments

- In January 2025, Caterpillar Inc. launched its next generation of Cat Telehandlers, the Cat TH0642, TH0842, TH1055, and TH1255 models, to replace the previous TL642, TL943, TL1055, and TL1255 machines. The new Cat Telehandlers are powered by the Cat C3.6TA (turbocharged and aftercooled) engine that meets U.S. EPA Tier 4 Final/EU Stage V emissions standards. The 74 hp (55 kW) engine contains a zero-service diesel particulate filter (DPF) and does not require diesel exhaust fluid (DEF). Further, a 115 hp (86 kW) option for the TH0842, TH1055, and TH1255 models also uses selective catalytic reduction (SCR) technology.

- In October 2024, JCB announced the expansion of its telehandler line with the launch of a pair of range-topping models. The JCB 558-210R Pro and the 558-260R Pro, featuring increased capacity, among other specifications and options, have been launched alongside other new equipment from the manufacturer, which incorporates the new AI-based Intellisence system for the company’s range of Loadall telescopic handlers, designed to reduce the risk to workers of being struck by moving material handling machines on construction sites.

- In October 2024, Bobcat Company introduced its all-new TL623 telehandler, a telescopic tool carrier loaded with premium performance and comfort features not found on other standard-equipped telehandlers. The TL623 provides the extended reach and superior lift capacity of a heavy-duty telescoping boom integrated with Bobcat’s leading multi-attachment versatility, allowing operators to tackle a wide range of jobs with one machine. Reach high and stack, then quickly change attachments to take the TL623 telehandler’s productivity beyond pick-and-place tasks.

- In March 2024, JCB India unveiled the production of its 500,000th machine. JCB, which has been in India since 1979, has six manufacturing facilities in India and exports ‘Made-in-India’ machines to over 130 countries. The milestone rollout took place in the presence of JCB’s Group chairman at the company’s India headquarters at Ballabgarh.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 7.1 Bn |

| Forecast Value (2033) |

USD 12.2 Bn |

| CAGR (2024-2033) |

6.1% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 2.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Large and Compact), By Propulsion (ICE, Hybrid, and Electric), By Lift Capacity (Less than 3 Ton, 3 to 10 Ton, and More than 10 Ton), By End Use (Construction, Agriculture, Manufacturing, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

AB Volvo, CNH Industrial NV, Komatsu Ltd, Caterpillar, L&T Technologies, Doosan Corp, JCB, Manitou Group, Terex Corp, Komatsu, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Telehandler Market?

▾ The Global Telehandler Market size is expected to reach a value of USD 7.1 billion in 2025 and is expected to reach USD 12.2 billion by the end of 2034.

Which region accounted for the largest Global Telehandler Market?

▾ North America is expected to have the largest market share in the Global Telehandler Market with a share of about 37.5% in 2025.

How big is the Telehandler Market in the US?

▾ The Telehandler Market in the US is expected to reach USD 2.3 billion in 2025.

Who are the key players in the Global Telehandler Market?

▾ Some of the major key players in the Global Telehandler Market are AB Volvo, CNH Industrial NV, Komatsu Ltd, and others

What is the growth rate in the Global Telehandler Market?

▾ The market is growing at a CAGR of 6.1 percent over the forecasted period.