Market Overview

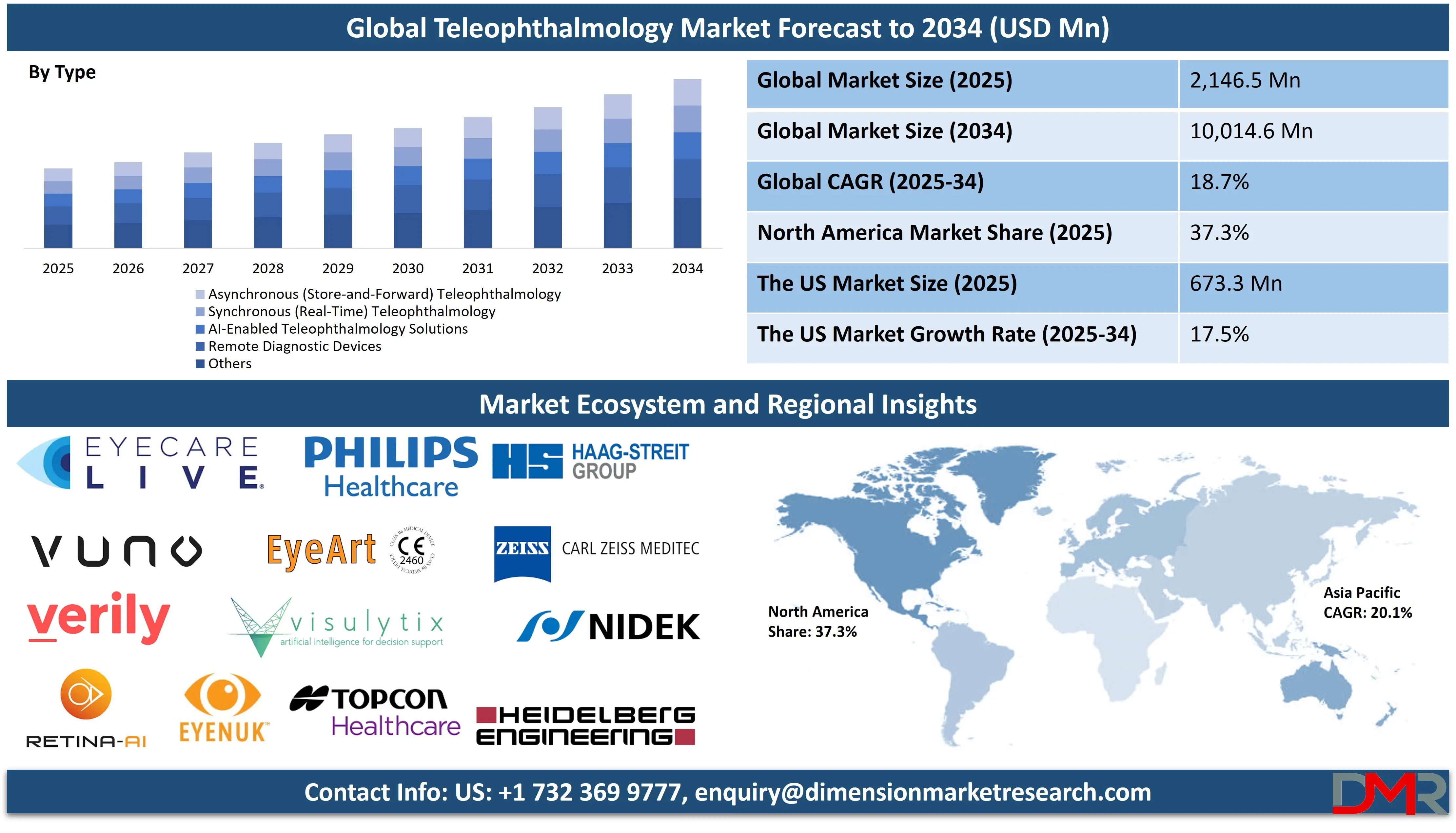

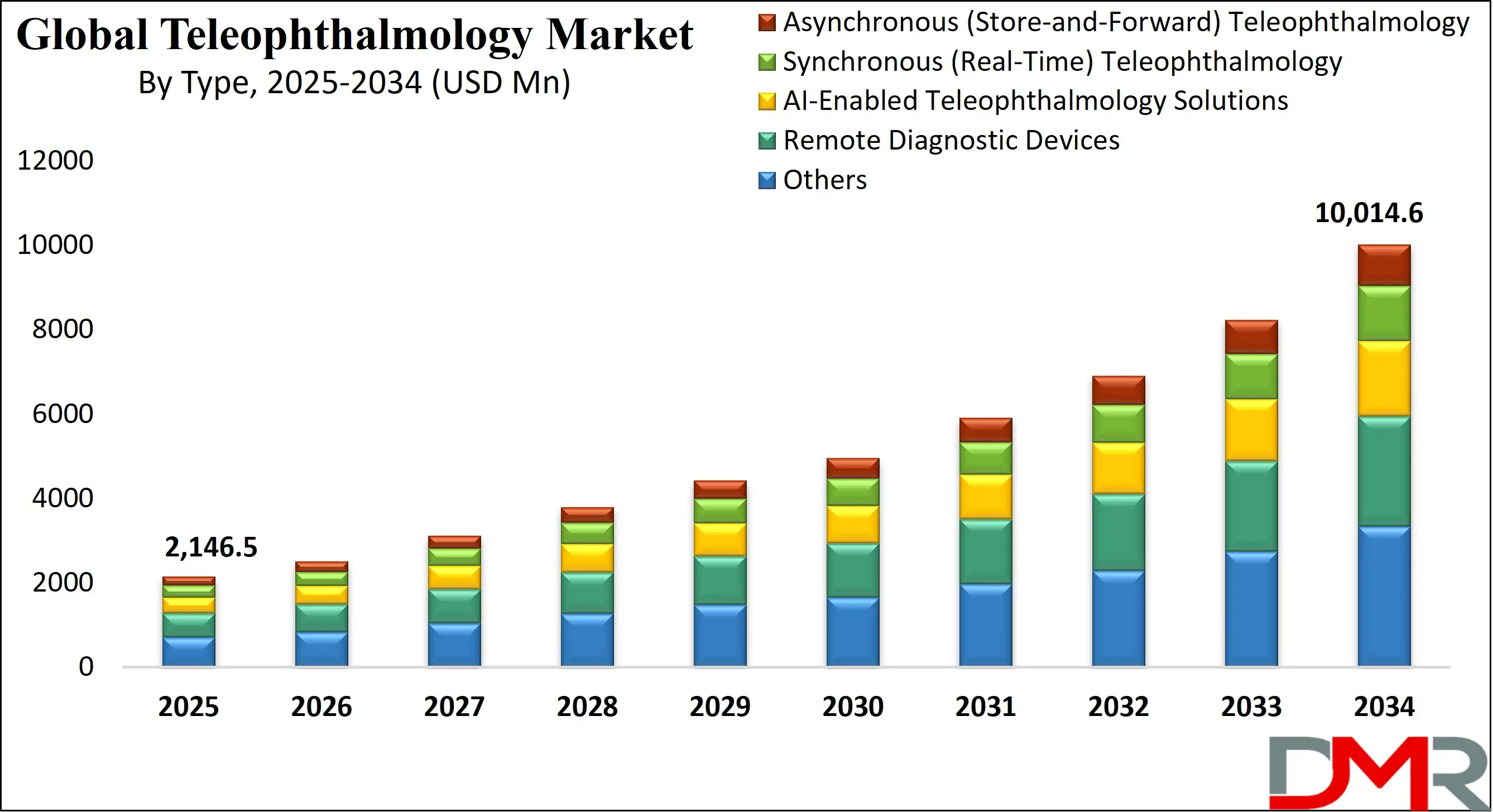

The Global Teleophthalmology Market is projected to reach USD 2,146.5 million in 2025 and is expected to grow at a CAGR of 18.7% from 2025 to 2034, attaining a value of USD 10,014.6 million by 2034. The market's rapid growth is driven by the increasing burden of diabetic retinopathy, glaucoma, macular degeneration, and refractive disorders, combined with the global shift toward digital healthcare delivery and early disease detection.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Teleophthalmology enables remote eye examinations through AI-enabled retinal imaging, connected diagnostic devices, and real-time teleconsultations, supporting patients in rural and remote regions where ophthalmologists are scarce. The model addresses global challenges related to vision impairment, affecting over 2.2 million people worldwide, and helps reduce preventable blindness through timely screening.

Technological advancements, including smartphone-based fundus cameras, cloud-based PACS, AI-driven disease classification, EHR-integrated ophthalmic workflows, 5G-enabled live video consultations, and remote slit-lamp imaging, are transforming the market into a scalable and highly accessible ecosystem. Integration of machine learning algorithms for diabetic retinopathy grading, OCT analysis, and glaucoma risk assessment is reshaping diagnostic accuracy.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Growing government initiatives promoting remote eye screening, national diabetic retinopathy programs, and telemedicine reimbursement reforms further accelerate global adoption. However, barriers such as limited digital infrastructure, cost of imaging devices, inconsistent regulations, and data privacy concerns remain. Despite these limitations, the convergence of digital health, AI innovation, and ophthalmic device modernization positions teleophthalmology as a central driver of global eye care transformation through 2034.

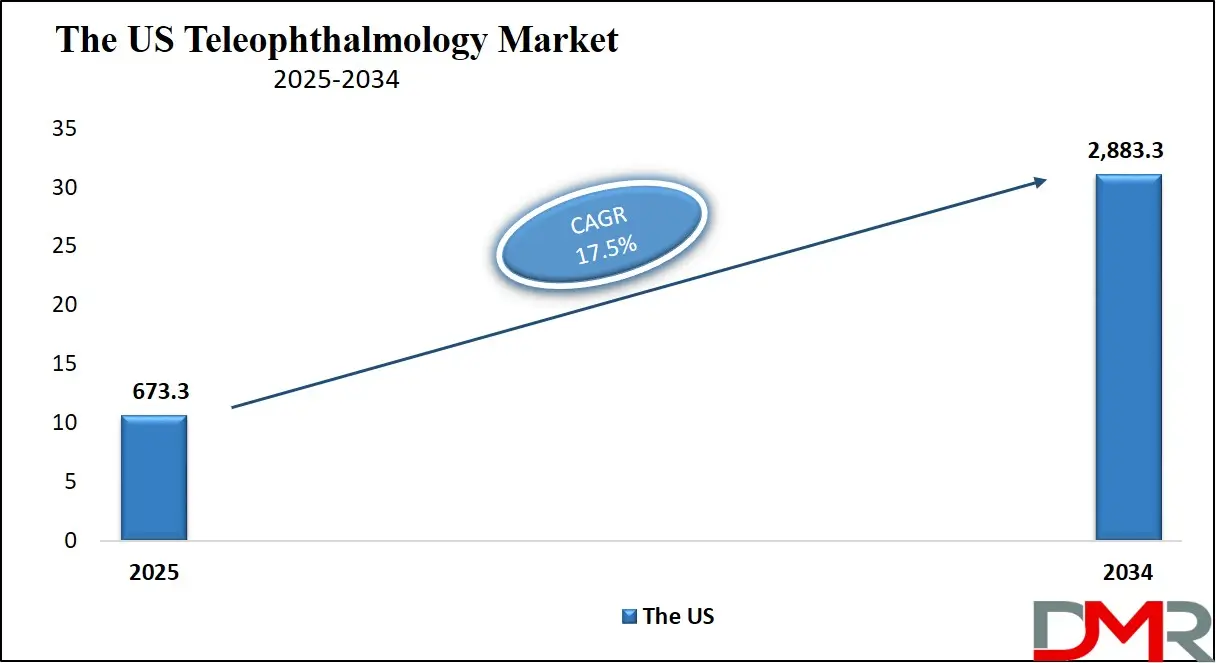

The US Teleophthalmology Market

The U.S. Teleophthalmology Market is projected to reach USD 673.3 million in 2025 and grow at a CAGR of 17.5%, reaching USD 2,883.3 million by 2034. The U.S. leads global adoption due to its advanced digital health ecosystem, rising prevalence of diabetes, and broad implementation of remote eye screening programs by healthcare systems and payers.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

More than 37 million Americans live with diabetes, fueling demand for tele-screening for diabetic retinopathy (DR) one of the leading causes of blindness. The CDC, HRSA, and Veterans Health Administration (VHA) are scaling teleophthalmology solutions across primary care and community health centers. Major health systems such as Kaiser Permanente, Mayo Clinic, and Cleveland Clinic have integrated AI-enabled DR screening, remote OCT interpretation, and video-based ophthalmology triage.

U.S. reimbursement is expanding, with Medicare covering tele-ophthalmology under various telehealth codes and asynchronous imaging workflows. Meanwhile, national initiatives such as the Indian Health Service–Joslin Vision Network (IHS-JVN) have demonstrated dramatic reductions in diabetes-related blindness through remote retinal screening programs.

The rapid rise of smartphone ophthalmoscopy, portable fundus cameras, AI-based image triage (FDA-cleared algorithms), and interoperable cloud-based eye care platforms continues to redefine the U.S. ophthalmology landscape, positioning the country as a global leader in digital eye care innovation.

The Europe Teleophthalmology Market

The Europe Teleophthalmology Market is projected to valued at approximately USD 620 million in 2025 and is projected to reach around USD 2,720 million by 2034, growing at a CAGR of about 17.5% from 2025 to 2034. Europe’s leadership is anchored by strong regulatory frameworks, public health programs, and government-supported screening for diabetic retinopathy and glaucoma.

Countries such as the U.K., Germany, France, Italy, the Netherlands, and the Scandinavian region have widely adopted tele-screening programs, driven by national health services and insurance payers. The NHS Diabetic Eye Screening Programme (DESP) in the U.K. represents one of the world’s largest teleophthalmology systems, screening millions annually through remote imaging and centralized grading.

Europe's Aging population, increasing prevalence of chronic eye diseases, and shortage of ophthalmologists in rural regions further drive teleophthalmology uptake. Funding through the EU4Health Program, Horizon Europe, and country-level digital health strategies supports adoption of AI in retinal imaging, teleconsultation infrastructure, and mobile eye clinics.

Urban and rural hospitals increasingly deploy cloud-based ophthalmic PACS, 5G-enabled remote slit-lamp microscopes, and automated disease detection systems. With strong clinical governance, digital maturity, and investment in population-wide screening, Europe remains one of the most advanced regions in teleophthalmology penetration.

The Japan Teleophthalmology Market

The Japan Teleophthalmology Market is anticipated to be valued at approximately USD 56 million in 2025 and is expected to attain nearly USD 291 million by 2034, expanding at a CAGR of about 20% during the forecast period. Japan's rapid population aginganearly 30% of citizens above 65, drives high demand for chronic eye disease monitoring, including screening for glaucoma, AMD, and diabetic retinopathy.

The Ministry of Health, Labour and Welfare (MHLW) actively supports telemedicine adoption through national digital health strategies, enabling remote ophthalmic consultations, AI-based retinal imaging, and mobile screening units. Japan’s leadership in imaging technologies, robotics, and precision optics accelerates innovation in portable fundus cameras, AI disease detection, and retinal image enhancement.

Japan’s concept of “Connected Healthcare Ecosystems”, driven by companies like Panasonic, Topcon, and NIDEK, integrates IoT-enabled ophthalmic devices with cloud telemedicine platforms. Urban regions such as Tokyo and Osaka are deploying AI-driven screening kiosks in pharmacies and clinics, while rural prefectures use remote imaging systems to connect patients with specialists. Japan’s cultural emphasis on preventive medicine, combined with cutting-edge imaging technologies, positions the country as a high-growth innovator in teleophthalmology.

Global Teleophthalmology Market: Key Takeaways

- Strong Global Market Growth Outlook: The Global Teleophthalmology Market is expected to be valued at USD 2,146.5 million in 2025 and is projected to reach USD 10,014.6 million by 2034, showcasing rapid expansion supported by rising demand for remote ophthalmic screening and digital diagnostic solutions.

- High CAGR Driven by Digital Eye-Care Adoption: The market is expected to grow at an impressive CAGR of 18.7% from 2025 to 2034, fueled by accelerated telehealth adoption, AI-integrated image analysis, cloud-based workflows, and increasing chronic eye disease prevalence worldwide.

- Strong Growth Trajectory in the United States: The U.S. Teleophthalmology Market stands at USD 673.3 million in 2025 and is projected to reach USD 2,883.3 million by 2034, expanding at a CAGR of 17.5% due to robust reimbursement structures and deep integration of virtual eye care into clinical pathways.

- North America Maintains Regional Dominance: North America is expected to capture approximately 37.3% of the global market share in 2025, supported by advanced healthcare infrastructure, high digital literacy, early AI adoption, and strong ophthalmology–primary care integration.

- Rapid Advancement in Teleophthalmology Technologies: Innovations including AI-based retinal grading, smartphone-enabled imaging, cloud-integrated fundus cameras, and portable diagnostic devices are significantly accelerating scalability, accuracy, and accessibility of remote eye-care services.

- Growing Burden of Vision Disorders Boosts Adoption: Rising global prevalence of diabetic retinopathy, glaucoma, hypertensive retinopathy, and age-related macular degeneration is driving sustained demand for early detection, remote disease monitoring, and tele-enabled population screening programs.

Global Teleophthalmology Market: Use Cases

- Diabetic Retinopathy Screening: Primary care centers capture fundus images using portable retinal cameras, transmit them to ophthalmologists or AI systems for grading, enabling early detection and reducing blindness.

- Remote Glaucoma Monitoring: Patients use home-based tonometry devices and AI-analyzed optic nerve imaging to track glaucoma progression, reducing clinic visits.

- Pediatric Eye Care: Teleophthalmology supports early screening for amblyopia, retinopathy of prematurity (ROP), and refractive errors in underserved pediatric populations.

- Emergency Ophthalmic Triage: Remote video consultations help emergency providers differentiate true emergencies, such as retinal detachment or acute glaucoma, from non-emergent cases.

- Rural Tele-Eye Clinics: Mobile eye vans equipped with digital slit lamps, fundus cameras, and telemedicine platforms connect remote communities with specialists.

Global Teleophthalmology Market: Stats & Facts

- The World Health Organization (WHO) states that 2.2 million+ people have vision impairment, nearly 1 million preventable, reinforcing how teleophthalmology through AI triage, remote imaging, and virtual reviews can reduce blindness rates, especially in LMICs where over 70% lack specialist access.

- The International Diabetes Federation (IDF) projects global diabetes cases reaching 643 million by 2030, with one-third developing diabetic retinopathy, driving teleophthalmology adoption as remote retinal screening boosts coverage in regions where over 60% of patients miss annual eye exams.

- The U.S. FDA reports AI-based systems like IDx-DR and EyeArt achieve 90–96% sensitivity detecting referable DR, enabling primary-care-level diagnosis and reducing specialist workload by up to 50%, validating AI as essential infrastructure for scalable teleophthalmology programs.

- The American Academy of Ophthalmology (AAO) notes home IOP monitoring improves disease control in up to 70% of glaucoma patients, with smart tonometry detecting pressure spikes missed in clinics; glaucoma already affects over 80 million people globally, intensifying telemanagement needs.

- According to Global Eye Health Technology Surveys, smartphone-based retinal imaging is growing over 30% annually across emerging markets, as devices like Remidio and D-Eye expand screenings where 40–50% of communities lack equipment, integrating seamlessly with cloud-AI platforms for instant grading.

- The International Agency for the Prevention of Blindness (IAPB) reports over 50% of rural hospitals lack an ophthalmologist, causing delayed treatment; teleophthalmology mitigates this by enabling remote review of retinal images and OCT scans, improving early detection for hundreds of millions underserved.

Global Teleophthalmology Market: Market Dynamic

Driving Factors in the Global Teleophthalmology Market

Rising Prevalence of Eye Diseases

The growing burden of chronic eye diseases including diabetic retinopathy, glaucoma, cataracts, refractive disorders, and age-related macular degeneration, is a major driver for teleophthalmology adoption. Aging populations across Europe, Japan, and North America significantly increase demand for continuous eye monitoring. Meanwhile, diabetes and hypertension in Asia and Africa contribute to a surge in diabetic eye complications.

Teleophthalmology expands screening capacity, enabling early disease detection via remote imaging and AI-assisted analysis. This reduces the need for in-person visits and minimizes specialist shortages, especially in rural regions. Early detection through teleophthalmology can prevent vision loss, reduce treatment costs, and improve long-term patient outcomes across global healthcare systems.

Technology Innovation

Teleophthalmology benefits heavily from rapid progress in AI algorithms, connected diagnostic devices, 5G-enabled real-time consultations, edge computing, and cloud interoperability. Modern handheld fundus cameras, smartphone-based retinal imaging, portable OCT devices, and remote slit-lamps allow eye examinations to occur outside traditional clinical settings. AI-powered retinal grading automates the diagnosis of diabetic retinopathy, AMD features, and glaucoma risk factors, dramatically improving efficiency.

5G connectivity enables high-resolution video transmission and remote specialist collaboration. Cloud-based ophthalmic PACS systems centralize imaging, ensuring easy access across networks. These innovations greatly enhance scalability, accuracy, and accessibility, making teleophthalmology an essential element of modern eye care delivery.

Restraints in the Global Teleophthalmology Market

Limited Digital Infrastructure

Many low- and middle-income regions lack high-speed internet, reliable electricity, or digital equipment limitations that directly impact teleophthalmology adoption. High-quality retinal imaging requires stable bandwidth for uploading large files such as OCT scans or high-resolution fundus images. Unreliable connectivity disrupts asynchronous workflows and undermines real-time teleconsultations.

In regions where basic internet penetration is low, teleophthalmology programs often struggle to achieve scale. Additionally, health facilities in rural areas may lack trained personnel to operate imaging devices, further restricting implementation. Without structural improvements in digital infrastructure and targeted investments in rural digitization, remote eye screening cannot be deployed at the levels required for population-wide coverage.

Regulatory and Reimbursement Barriers

Telemedicine regulations vary significantly across countries, creating ambiguity in teleophthalmology adoption. Issues include cross-border teleconsultation restrictions, outdated licensure requirements, and unclear classifications of AI-assisted diagnostics. Reimbursement remains inconsistent, with many regions lacking coverage for store-and-forward imaging or home-based monitoring. This discourages providers from investing in teleophthalmology infrastructure.

Moreover, data privacy laws such as GDPR require strict compliance frameworks, which smaller providers may struggle to implement. In developing regions, limited insurance penetration means patients often pay out of pocket, slowing uptake. For teleophthalmology to scale globally, regulatory harmonization and structured reimbursement reforms are essential to support long-term sustainability.

Opportunities in the Global Teleophthalmology Market

AI-Integrated National Screening Programs

Governments worldwide are increasingly adopting national-level tele-screening initiatives for diabetic retinopathy, glaucoma, refractive errors, and AMD. These programs integrate AI-based retinal grading to process high screening volumes rapidly, significantly reducing specialist workload. Countries such as the U.K., India, Singapore, and Japan are already deploying automated screening models in primary care centers.

National programs ensure early diagnosis, reduce blindness rates, and promote uniform access to care. AI also enables standardized grading criteria, supporting consistent clinical quality. As cloud teleophthalmology platforms expand, national-scale disease registries, epidemiology dashboards, and real-time population analytics will create new opportunities for innovation and public health integration.

Expansion in Emerging Economies

Emerging markets represent major growth opportunities due to high diabetes prevalence, limited access to specialists, and increasing smartphone penetration. Countries in Asia-Pacific, Latin America, and Sub-Saharan Africa are adopting tele-eye clinics, portable retinal imaging devices, and low-cost telemedicine hubs. The affordability of smartphone-based retinal cameras allows community workers and nurses to conduct screenings at scale.

Government-led programs in India, Indonesia, and Brazil are incorporating teleophthalmology into national health missions. NGOs and global health organizations also support remote screening projects, creating sustainable demand. As AI-assisted diagnostics become more affordable, emerging economies will drive the next phase of teleophthalmology expansion.

Trends in the Global Teleophthalmology Market

Smartphone-Based Ophthalmic Imaging

Smartphones are becoming transformative diagnostic tools due to innovations in add-on lenses, AI-enabled imaging apps, and portable adapters. These low-cost systems convert a standard smartphone into a retinal camera capable of capturing fundus images comparable to conventional non-mydriatic cameras. They are ideal for rural, remote, and resource-constrained settings. Smartphone imaging supports mass screening initiatives by enabling nurses, health workers, and technicians to capture retinal images without needing expensive equipment.

Advances in AI further enhance image quality, enabling real-time disease detection. The model also allows instant cloud upload, enabling ophthalmologists to review cases asynchronously. This democratizes eye care and accelerates teleophthalmology adoption worldwide.

Cloud-Integrated Ophthalmic Workflows

Cloud-based ophthalmic platforms are modernizing teleophthalmology by centralizing imaging, AI analysis, reporting, and teleconsultation workflows. Cloud PACS enables instant data sharing between primary care centers, hospitals, and specialists. Diagnostic AI engines integrated into cloud workflows provide automated grading for DR, AMD, glaucoma, and pediatric eye conditions.

Integration with EHR systems ensures seamless patient record updates and longitudinal tracking. Cloud platforms reduce hardware costs, enabling scalability across large health networks. They also support remote OCT interpretation, store-and-forward image workflows, teletriage, and real-time specialist collaboration. By streamlining processes, cloud solutions enhance care efficiency and enable global teleophthalmology networks.

Global Teleophthalmology Market: Research Scope and Analysis

By Type Analysis

Asynchronous teleophthalmology is projected to dominates the global market due to its scalability, low cost, and ease of integration into primary care workflows. It enables retinal images, OCT scans, and slit-lamp photos to be captured by technicians or nurses and securely transmitted to ophthalmologists or AI engines for evaluation. This workflow does not require simultaneous presence of doctor and patient, making it ideal for high-volume screening in rural areas, community health centers, and diabetes clinics. Store-and-forward models support population-level diabetic retinopathy screening programs, which are rapidly expanding across Asia, Europe, and North America.

Because it eliminates the need for live consultations, asynchronous teleophthalmology addresses workforce shortages and reduces clinical bottlenecks. AI-enabled platforms further enhance this segment by automatically detecting pathologies and prioritizing urgent cases. Its widespread compatibility with portable fundus cameras, smartphone-based imaging tools, and automated diagnostic software strengthens its dominance.

Additionally, public health agencies prefer asynchronous workflows for national-scale programs due to their affordability and ability to generate structured clinical data for disease registries. As teleophthalmology shifts toward automation and remote diagnostics, the asynchronous model will continue to hold the largest market share through 2034.

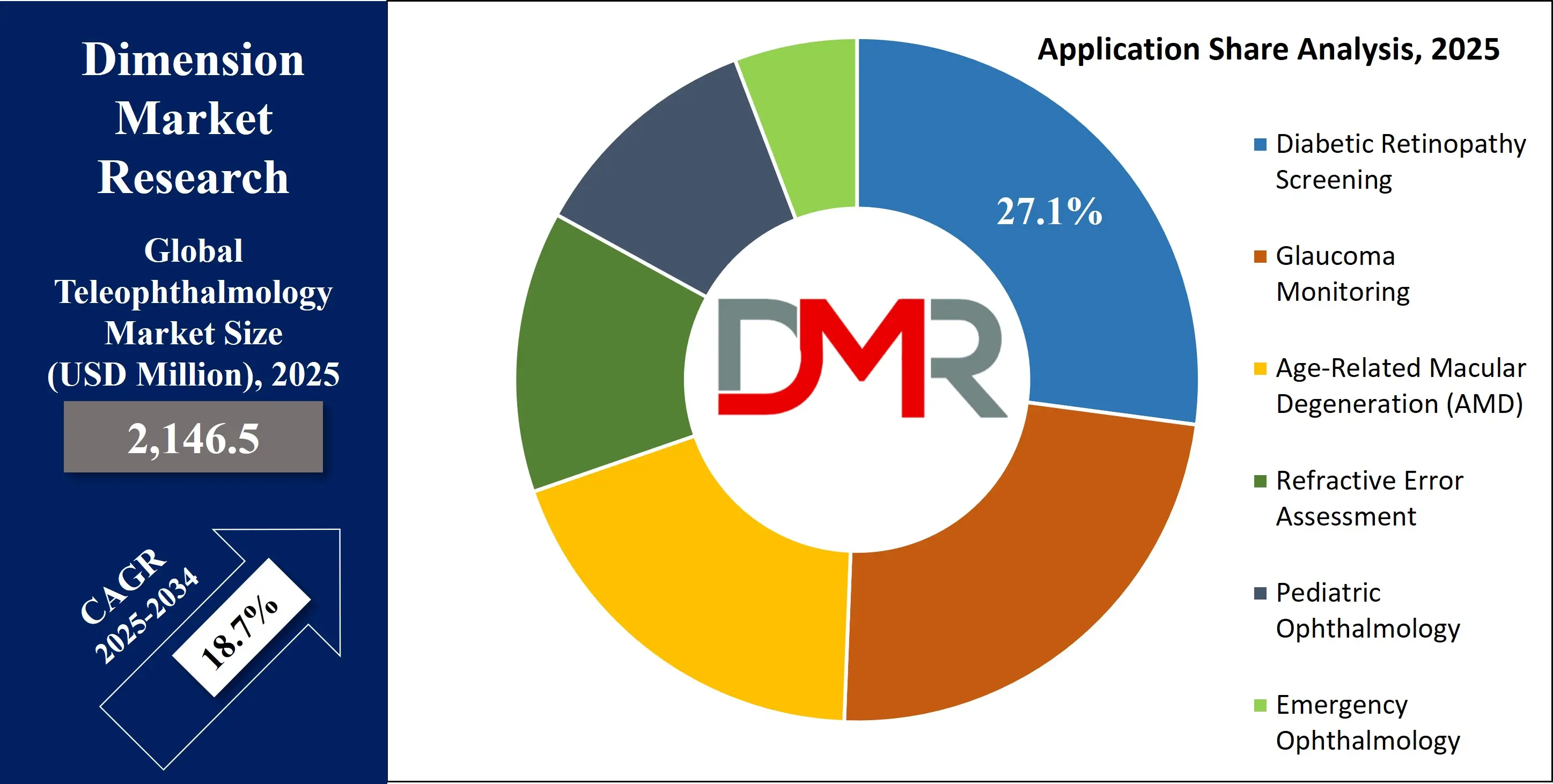

By Application Analysis

Diabetic retinopathy (DR) screening is the poised to be the largest and most dominant application segment in the teleophthalmology market, accounting for the highest share globally. With diabetes cases rising sharply worldwide, millions are at risk of vision-threatening retinopathy. DR screening requires routine retinal imaging, and teleophthalmology enables this at scale by integrating portable cameras and cloud-based AI analysis directly into primary care. DR screening’s dominance is reinforced by government-led national programs such as the NHS Diabetic Eye Screening Programme in the U.K., IHS-JVN in the U.S., and large-scale screening initiatives in India and Singapore.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

AI solutions capable of automated DR grading dramatically increase efficiency, allowing same-day results and reducing specialist workload. Because untreated DR can lead to irreversible blindness, governments prioritize its screening, making it a major focus within teleophthalmology investment. The synergy between portable imaging devices, AI-driven diagnostics, and primary-care-level deployment ensures that DR screening retains the largest market share through the forecast period.

Glaucoma monitoring ranks as the second-largest application segment within teleophthalmology due to the chronic nature of the disease and the necessity of regular intraocular pressure (IOP) monitoring. Glaucoma is often asymptomatic in early stages, making routine screenings and follow-ups essential to prevent optic nerve damage. Teleophthalmology facilitates continuous monitoring through home-based tonometry devices, remote optic nerve imaging, and AI-assisted visual field interpretation.

By End User Analysis

Hospitals and eye clinics are anticipated to dominate the teleophthalmology market because they are the primary centers for retinal imaging, OCT interpretation, treatment planning, and specialist consultation. They house the necessary diagnostic equipment, trained technicians, and ophthalmologists required for comprehensive eye care. Teleophthalmology integrates seamlessly with hospital workflows through cloud-based PACS, AI grading systems, and remote triage tools.

Hospitals frequently serve as the central hub for interpreting images captured at primary care centers, pharmacies, and community clinics. In countries with national screening programs, hospitals function as the core diagnostic backbone, handling confirmed and complex cases. The need for advanced clinical validation, specialist review, and treatment interventions such as laser therapy or intravitreal injections further strengthens hospital dominance. With increasing digital transformation, hospital networks are expanding tele-screening programs to widen their reach, making them the largest and most essential end users in the market.

Primary care centers are the second-largest end-user segment due to their strategic position in conducting mass screenings, particularly for diabetic retinopathy. Teleophthalmology integrates seamlessly into primary care workflows, enabling non-specialist staff to capture retinal images with portable cameras. This decentralizes eye screening and eliminates the need for patients to visit ophthalmologists for initial evaluations. Countries such as India, the U.S., the U.K., and Australia heavily rely on primary care-based DR screening programs. AI-enabled image grading further empowers primary care providers by offering immediate diagnostic insights.

The Global Teleophthalmology Market Report is segmented on the basis of the following

By Type

- Asynchronous (Store-and-Forward) Teleophthalmology

- Synchronous (Real-Time) Teleophthalmology

- AI-Enabled Teleophthalmology Solutions

- Remote Diagnostic Devices

- Others

By Application

- Diabetic Retinopathy Screening

- Glaucoma Monitoring

- Age-Related Macular Degeneration (AMD)

- Refractive Error Assessment

- Pediatric Ophthalmology

- Emergency Ophthalmology

By End User

- Hospitals & Eye Clinics

- Primary Care Centers

- Telemedicine Platforms

- Diagnostic Imaging Centers

- NGOs & Public Health Programs

- Homecare Patients

Impact of Artificial Intelligence in the Global Teleophthalmology Market

-

- AI for Automated DR Grading: AI automates diabetic retinopathy detection by analyzing retinal images for microaneurysms, hemorrhages, and exudates within seconds. It reduces specialist workload, supports primary care screening, improves early diagnosis, and enables large-scale population screening with consistent accuracy.

- AI-Assisted OCT Analysis: AI algorithms analyze OCT scans to detect macular edema, structural changes, and early AMD markers. This accelerates diagnostic workflows, assists ophthalmologists in complex cases, and enables remote interpretation hubs to manage high volumes efficiently.

- AI-Based Glaucoma Risk Scores: AI evaluates optic nerve structure, retinal nerve fiber layer thickness, and visual field patterns to generate glaucoma risk scores. This supports early detection, continuous monitoring, and proactive management, especially in patients unable to attend regular in-person visits.

- Advanced Image Enhancement for Low-Quality Retinal Images: AI enhances poor-quality retinal images by reducing blur, improving contrast, and reconstructing missing details. This is especially valuable in rural screenings where imaging conditions are suboptimal, enabling accurate diagnosis from previously unusable images.

- AI-Based Triage and Routing Systems: AI triage systems automatically classify cases as normal, urgent, or complex, routing them to appropriate specialists. This streamlines care pathways, reduces delays, and optimizes ophthalmologist time in high-volume screening environments.

Global Teleophthalmology Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominates the Global Teleophthalmology Market with 37.3% of market share by the end of 2025, owing to a powerful combination of advanced healthcare infrastructure, strong reimbursement frameworks, rapid digital health adoption, and a high prevalence of chronic eye diseases requiring continuous monitoring.

The United States and Canada have deeply integrated telemedicine into routine clinical practice, supported by national-level telehealth policies, HIPAA-compliant cloud ecosystems, and widespread use of electronic health records (EHRs) that seamlessly integrate teleophthalmology workflows. Large healthcare networks such as Kaiser Permanente, Mayo Clinic, Cleveland Clinic, and the Veterans Health Administration have successfully institutionalized teleophthalmology for diabetic retinopathy, glaucoma monitoring, and post-operative evaluations, setting global benchmarks.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The region has one of the highest diabetes burdens, with over 37 million diabetics in the U.S. alone, driving demand for diabetic retinopathy screening. Teleophthalmology allows primary care physicians and endocrinologists to incorporate retinal imaging into routine diabetes care, supported by FDA-cleared AI systems such as IDx-DR and EyeArt. These systems enable immediate DR grading, reducing specialist workload and ensuring timely referrals.

North America’s strong reimbursement support is one of the most significant reasons for dominance. Medicare, Medicaid, private insurers, and value-based care programs reimburse teleophthalmology services, making adoption financially viable for hospitals and clinics.

Region with the Highest CAGR

Asia-Pacific holds the highest CAGR and is poised to achieve the largest market share in teleophthalmology due to its massive population base, rapidly increasing diabetes prevalence, widening rural healthcare gaps, and strong government-driven digital health initiatives. The region accounts for more than 60% of the world’s diabetic population, with India and China leading global diabetes statistics. This creates enormous demand for large-scale diabetic retinopathy screening programs that teleophthalmology can deliver more efficiently and affordably than traditional hospital-based models.

Asia-Pacific faces critical shortages of ophthalmologists, especially in rural areas. Many countries India, Indonesia, Vietnam, the Philippines, and Bangladesh, have fewer than 3 ophthalmologists per million people in rural districts. Teleophthalmology bridges this gap by enabling technicians, nurses, and community health workers to capture retinal images with portable fundus cameras, smartphone-based devices, and low-cost adapters, which are then evaluated by urban specialists or AI systems.

Government programs and public–private partnerships significantly accelerate adoption. India’s National Digital Health Mission (NDHM), Ayushman Bharat, and state-level DR screening programs integrate teleophthalmology at the primary health center level. China’s “Internet+Healthcare” strategy and Japan’s Smart Healthcare Vision promote remote diagnostics, AI-assisted imaging, and cloud-based eye health platforms. APAC governments increasingly endorse AI-led screening as a cost-effective solution for mass populations.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Teleophthalmology Market: Competitive Landscape

The Global Teleophthalmology Market is moderately fragmented, driven by a diverse ecosystem of ophthalmic device manufacturers, AI-driven diagnostic companies, telemedicine platforms, and cloud imaging solution providers. Leading ophthalmology technology firms Topcon Healthcare, Carl Zeiss Meditec, NIDEK, Heidelberg Engineering, and Haag-Streit dominate the hardware landscape with advanced fundus cameras, OCT systems, digital slit-lamps, and remote-enabled imaging devices. These companies increasingly integrate teleophthalmology readiness through cloud connectivity, DICOM interoperability, and remote access capabilities.

AI-focused innovators such as Eyenuk, EyeArt, Visulytix, VUNO, RetinaAI, and Google’s Verily significantly influence market dynamics by offering automated diabetic retinopathy grading, OCT analytics, glaucoma risk scoring, and image enhancement models. Their solutions reduce ophthalmologist workload and enable large-scale screening, making them essential partners in government and enterprise tele-screening programs.

Telemedicine leaders like Teladoc, Amwell, EyeCareLive, and MDLive expand their portfolios by integrating remote ophthalmic consultations, asynchronous retinal image uploads, and EHR-linked virtual care pathways. Meanwhile, emerging teleophthalmology specialists Remidio, D-Eye, Forus Health, and ODocs Eye Care strengthen market penetration with affordable smartphone-based retinal imaging systems ideal for rural and low-resource settings.

Some of the prominent players in the Global Teleophthalmology Market are

- Topcon Healthcare

- Carl Zeiss Meditec

- NIDEK Co., Ltd.

- Heidelberg Engineering

- Haag-Streit Group

- Eyenuk, Inc.

- Visulytix

- VUNO Inc.

- EyeArt (Digital Diagnostics Inc.)

- RetinaAI Health, Inc.

- Remidio Innovative Solutions

- Forus Health

- D-Eye Srl

- ODocs Eye Care

- Eyenovia Inc.

- Teladoc Health

- Amwell (American Well Corp.)

- EyeCareLive

- Verily Life Sciences

- Philips Healthcare

- Other Key Players

Recent Developments in the Global Teleophthalmology Market

November 2025: Remidio launches Neubo-130

Remidio introduced the Neubo-130 neonatal retinal imaging system, enhancing early detection of pediatric eye diseases. The AI-enabled platform supports teleophthalmology workflows by enabling remote evaluation, improving screening capacity in neonatal units, and strengthening hospital-to-specialist connectivity for underserved infant populations worldwide.

October 2025: Topcon showcases AI and cloud platforms at AAO

Topcon Healthcare presented advanced AI, cloud-based diagnostics, and connected eye-care technologies at AAO 2025. Demonstrations emphasized remote OCT interpretation, automated retinal analysis, and teleophthalmology-integrated workflows aimed at transforming early detection across primary care and population-scale diabetic eye programs.

October 2025: Teleophthalmology highlighted in AAO scientific sessions

AAO 2025 featured major teleophthalmology discussions covering remote triage, AI-based disease detection, asynchronous screening, and primary-care integration. Global experts emphasized the transformative roles of cloud imaging, decentralized diagnostics, and emerging portable retinal cameras in expanding equitable access to eye care services.

September 2025: Eyenuk secures national deployment in Norway

Eyenuk’s EyeArt received national rollout approval with Norway’s regional health authority, becoming the world’s first autonomous AI eye-screening adoption by a national health system. The deployment strengthens population-wide diabetic retinopathy screening by enabling scalable, real-time evaluations across distributed clinical environments.

August 2025: Topcon acquires Intelligent Retinal Imaging Systems (IRIS)

Topcon completed the acquisition of IRIS to expand its teleophthalmology ecosystem. The merger integrates advanced cloud imaging, automated screening solutions, and primary-care-centered retinal workflows, reinforcing Topcon’s leadership in AI-enhanced remote diagnostics and improving accessibility across large health networks.

July 2025: Topcon announces collaboration with OKKO Health

Topcon partnered with OKKO Health to integrate digital home-based vision monitoring with teleophthalmology workflows. The collaboration enables remote symptom tracking, early disease detection signals, and improved patient engagement, supporting continuous monitoring models for chronic retinal and glaucoma-related conditions.

June 2025: APAO 2025 showcases teleophthalmology innovation

APAO 2025 highlighted emerging trends in AI-driven retinal analysis, portable imaging devices, mobile eye units, and cloud-connected screening programs. Regional ministries, ophthalmologists, and technology providers discussed large-scale diabetic retinopathy screening and next-generation tele-eye models tailored for diverse Asia-Pacific populations.

April 2025: Telemedicine platforms integrate retinal imaging workflows

Telemedicine companies globally expanded support for asynchronous retinal imaging uploads, EHR integration, and AI-enhanced diagnosis. New partnerships with hospitals and diagnostic networks enable cohesive teleophthalmology pathways, strengthening early disease detection and reducing specialist bottlenecks in high-volume diabetic populations.

March 2025: Cloud-enabled OCT reading hubs deployed in Europe

Hospitals and diagnostic centers across Europe implemented cloud-integrated OCT reading hubs, enabling remote specialist interpretation and faster glaucoma and macular disease assessments. These hubs support regional shortage mitigation, improving access for rural populations through centralized teleophthalmology workflows.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2,146.5 Mn |

| Forecast Value (2034) |

USD 10,014.6 Mn |

| CAGR (2025–2034) |

18.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 673.3 Mn |

| Forecast Data |

2025 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Asynchronous (Store-and-Forward) Teleophthalmology, Synchronous (Real-Time) Teleophthalmology, AI-Enabled Teleophthalmology Solutions, Remote Diagnostic Devices, and Others) By Application (Diabetic Retinopathy Screening, Glaucoma Monitoring, Age-Related Macular Degeneration (AMD), Refractive Error Assessment, Pediatric Ophthalmology, and Emergency Ophthalmology), q (Hospitals & Eye Clinics, Primary Care Centers, Telemedicine Platforms, Diagnostic Imaging Centers, NGOs & Public Health Programs, and Homecare Patients) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Topcon Healthcare, Carl Zeiss Meditec, NIDEK Co., Ltd., Heidelberg Engineering, Haag-Streit Group, Eyenuk, Inc., Visulytix, VUNO Inc., EyeArt (Digital Diagnostics Inc.), RetinaAI Health, Inc., Remidio Innovative Solutions, Forus Health, D-Eye Srl, ODocs Eye Care, Eyenovia Inc., Teladoc Health, Amwell (American Well Corp.), EyeCareLive, Verily Life Sciences, Philips Healthcare., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Teleophthalmology Market?

▾ The Global Teleophthalmology Market size is estimated to have a value of USD 2,146.5 million in 2025 and is expected to reach USD 10,014.6 million by the end of 2034.

What is the growth rate in the Global Teleophthalmology Market in 2025?

▾ The market is growing at a CAGR of 18.7 percent over the forecasted period of 2025.

What is the size of the US Teleophthalmology Market?

▾ The US Teleophthalmology Market is projected to be valued at USD 673.3 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2,883.3 million in 2034 at a CAGR of 17.5%.

Which region accounted for the largest Global Teleophthalmology Market?

▾ North America is expected to have the largest market share in the Global Teleophthalmology Market with a share of about 37.3% in 2025.

Who are the key players in the Global Teleophthalmology Market?

▾ Some of the major key players in the Global Teleophthalmology Market are Topcon Healthcare, Carl Zeiss Meditec, NIDEK Co., Ltd., Heidelberg Engineering, Haag-Streit Group, Eyenuk, Inc., Visulytix, VUNO Inc., and many others.