Market Overview

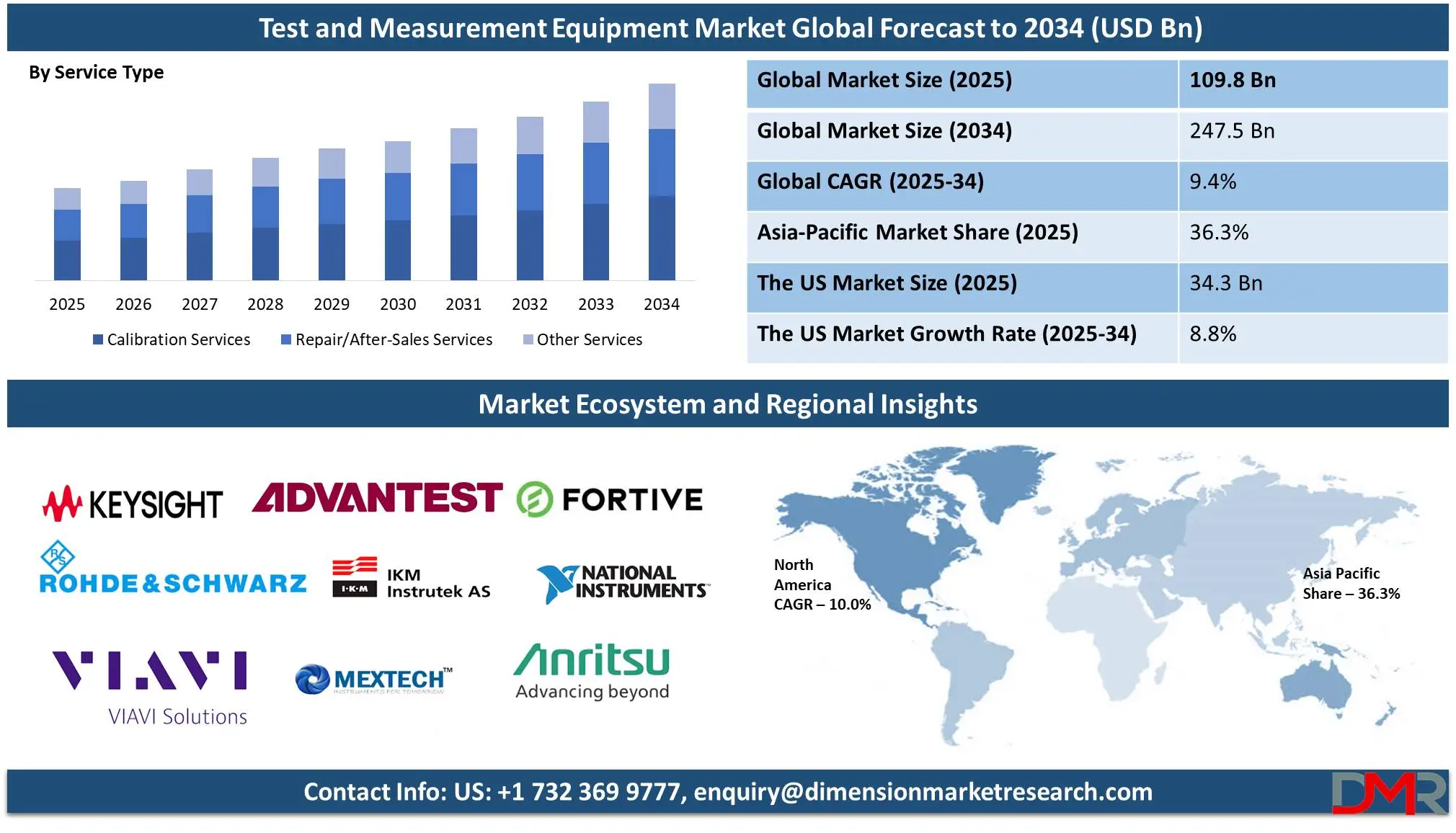

The Global

Test and Measurement Equipment Market size is expected to reach a value of

USD 109.8 billion in 2025, and it is further anticipated to reach a market value of

USD 247.5 billion by 2035 at a

CAGR of 9.4%.

The global test and measurement equipment market is an indispensable element of industries such as telecommunications, automotive, aerospace, electronics healthcare, and manufacturing. Test and measurement tools are essential in assuring accuracy, reliability, and performance across devices systems products across various applications. Market growth is being propelled by rapid advancements in technology integrated with increasing electronic device complexity and demand for accurate testing solutions that deliver efficient testing solutions.

The global test and measurement equipment market is currently experiencing sustained growth, due to rapid technological advancements and growing adoption across various industries. Emerging technologies, including 5G, IoT, autonomous vehicles, and renewable energy systems have created an unprecedented surge in the need for sophisticated testing equipment. Strict regulatory standards and quality requirements in healthcare and aerospace fuel this trend.

Key product categories for testing tools include oscilloscopes, spectrum analyzers, signal generators, and automated testing systems among many others. Automation systems play an essential role, in reducing time and costs while increasing accuracy and efficiency. Furthermore, wireless testing tools are seeing increasing use across sectors such as telecommunications and consumer electronics.

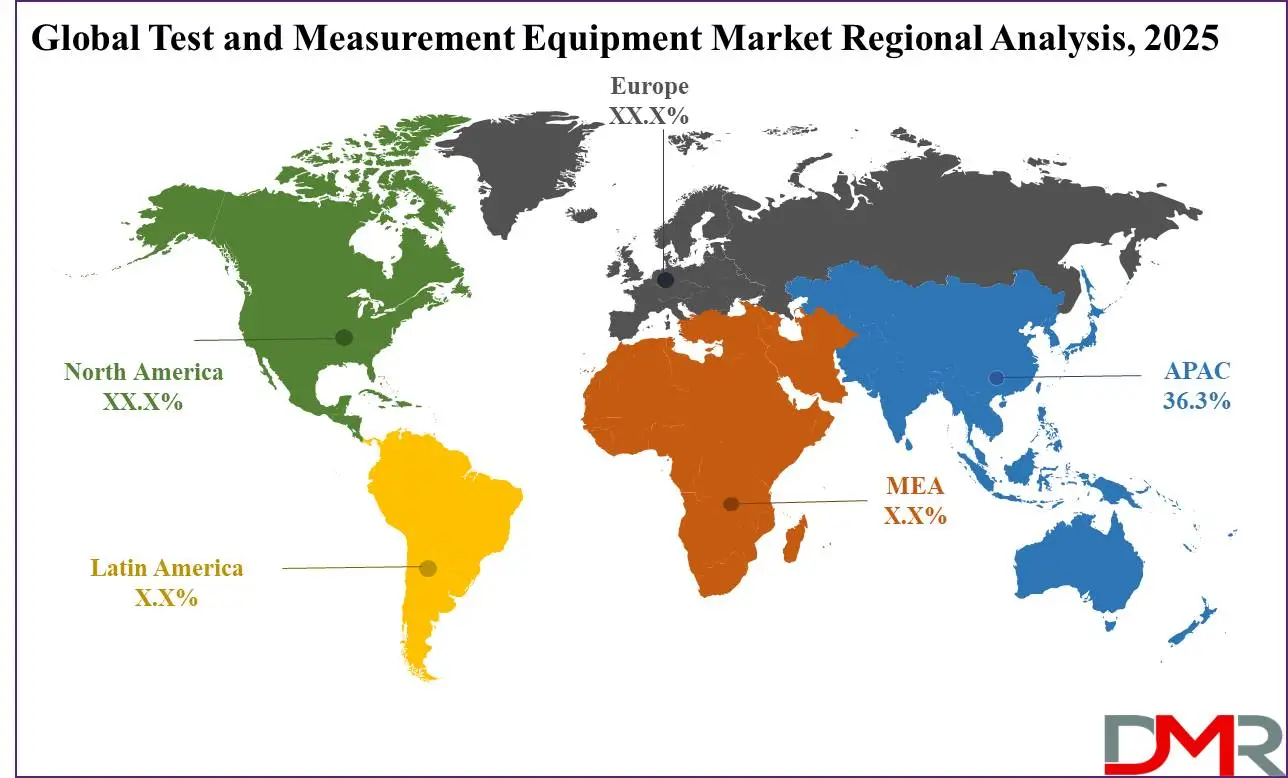

Asia-Pacific leads the test and measurement equipment market due to its strong electronics manufacturing base, while North America and Europe provide significant contributions with their emphasis on research & development (R&D) and technological innovation.

Industry players invest heavily in R&D efforts aimed at creating wireless and modular testing equipment solutions to address customer demands as they change. Overall, global demand for test & measurement equipment looks set for continued innovation as more advanced technologies come online.

Challenges such as high initial costs and the need for skilled operators persist. However, these issues should be overcome through advances in cloud-based testing, artificial intelligence, and data analytics. These developments should help address initial costs as well as skill requirements for operators, while further expanding market potential.

The US Global Test and Measurement Equipment Market

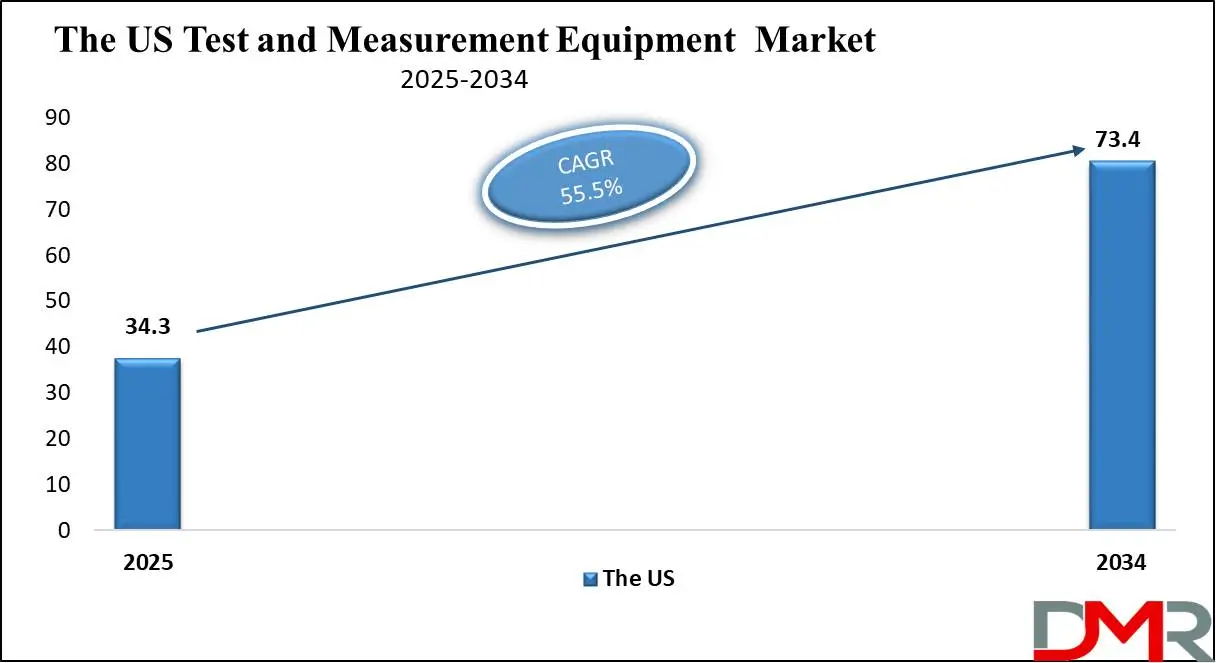

The US Test and Measurement Equipment Market is projected to be valued at USD 34.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 73.4 billion in 2035 at a CAGR of 8.8%.

The test and measurement equipment market holds a significant proportion in the field of technological innovations and industrialization in the US. Sectoral leadership that the country has globally in terms of telecommunications, aerospace, defense, and healthcare raises huge demand in the country for advanced testing solutions. The onset of 5G networks along with the increasing adoption rate of IoT, autonomous vehicles, and renewable energy systems have driven the need to have precise, reliable, and accurate testing equipment.

US market characteristics include significant investments in research and development (R&D), particularly within aerospace and defense. Furthermore, healthcare's focus on developing cutting-edge medical devices has resulted in more sophisticated measurement tools being adopted for testing purposes.

Key players in the US such as Keysight Technologies and National Instruments are leading the charge when it comes to creating innovative test systems, including wireless, modular, and automated test systems. Both companies also enjoy significant support from government authorities as well as collaborations with technology firms and research institutions.

Key Takeaways

- Market Value: The global test and measurement equipment market size is expected to reach a value of USD 247.5 billion by 2035 from a base value of USD 109.8 billion in 2025 at a CAGR of 9.4%.

- By Product Type: General-purpose test equipment is projected to maintain its dominance in the product type segment, capturing 60.0% of the market share in 2025.

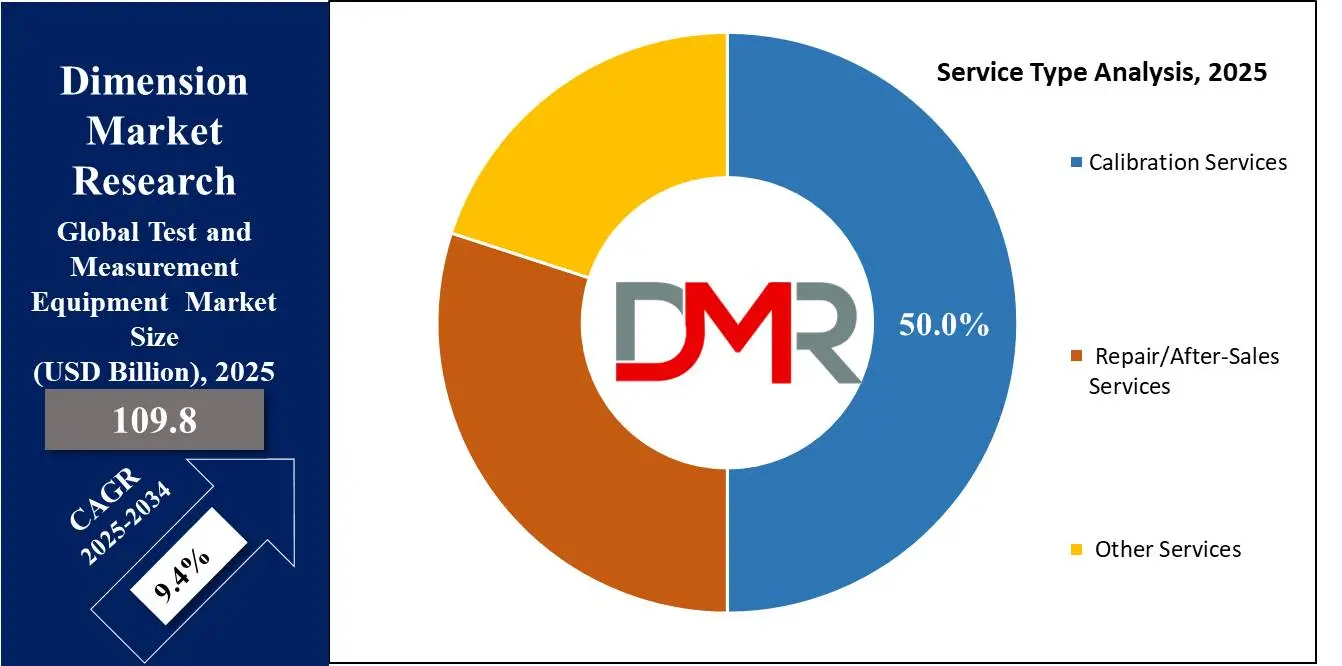

- By Service Type: Calibration Services is anticipated to capture the highest market share of 50.0% in the service type segment by 2025.

- By Application: Healthcare is projected to lead the global test and measurement equipment landscape with 25.0% of total global market revenue and it is further anticipated to maintain its dominance by 2025.

- By Region: Asia Pacific is expected to lead the global test and measurement equipment market with 36.3% of the market share in 2025.

- Key Players: Some major key players in the global test and measurement equipment market are, Atos SE, Cray, Dell Technologies, Fujitsu, and Other Key Players.

Use Cases

- Telecommunications and 5G Deployment: Test and measurement equipment plays a crucial role in the implementation of 5G technology, assuring seamless connectivity and performance. Signal analyzers, spectrum analyzers, network testers, and radio frequency (RF) testers play an essential part in measuring signal quality, spectrum efficiency, and latency, respectively.

- Automotive and Autonomous Vehicles: Automotive industries rely heavily on test and measurement tools for validating autonomous vehicle systems like LiDAR, radar, and camera-based sensors, while testing equipment helps validate advanced driver assistance systems (ADAS) while verifying compliance with safety standards. Battery performance analyzers and powertrain testers for electric vehicles (EVs) provide essential testing functions necessary for assessing battery efficiency, charging systems, and electric motor performance tools which ensure the reliability, safety, and longevity of cutting-edge automotive technologies.

- Semiconductor Testing: Semiconductors are the backbone of modern electronics and their increasing complexity requires rigorous testing with equipment such as oscilloscopes, logic analyzers, and automated test systems used to ensure the functionality and performance of integrated circuits (ICs) and microprocessors. With increasing demands for smaller, faster, and more energy-efficient chips from sectors like consumer electronics, computing, telecommunications, etc.

- Healthcare and Medical Device Testing: In healthcare, test and measurement equipment plays an essential role in validating the performance of medical devices like imaging systems, patient monitors, and diagnostic tools. Calibration equipment ensures accurate readings while specialty testing tools help assess compliance with regulatory standards such as FDA or ISO certifications. In wearable medical devices, for instance, testing connectivity, battery life, and sensor accuracy is also a necessity to ensure patient safety as well as the efficacy of critical healthcare technologies.

Stats & Facts

- Automotive Sector: According to Tektronix, the test and measurement equipment market in the automotive sector is expected to grow at a CAGR of 5.8%. This growth is fueled by the increasing complexity of testing requirements for autonomous and electric vehicles, such as radar, LiDAR, and battery systems.

- Test Equipment for Aerospace and Defense: According to Rohde-Schwarz, the aerospace and defense sector's adoption of test equipment is expected to grow at a 4.5% CAGR, driven by advances in avionics, radar systems, and communications. In aerospace and defense, the test and measurement equipment are crucial for validating the performance of highly complex systems.

Market Dynamic

Driving Factors

Advancements in 5G and IoT TechnologiesFast growth in the 5G networks and the constantly expanding Internet of Things (IoT) infrastructures are significantly changing global communication infrastructures. As industries adopt them across telecommunications, automotive, healthcare, and manufacturing sectors, as well as other sectors, the need for reliable testing solutions is greater than ever.

5G technology promises ultrafast data transfer speeds, low latency times, and the capacity to connect billions of devices simultaneously. To meet its promise, advanced testing tools must be deployed in order to verify its efficiency and quality. Spectrum analyzers, signal generators, and network testers are essential pieces of test equipment for evaluating the performance of 5G base stations, devices, and antennas. These tools are essential in testing signal strength, network interference, bandwidth usage, and latency issues which have an effect on 5G performance.

Internet of Things (IoT) technology is rapidly expanding across industries, connecting smart home appliances, industrial sensors, and healthcare monitoring devices. IoT applications are creating vast networks of interconnected devices that must communicate seamlessly and reliably, this poses unique challenges related to device interoperability, network congestion, and security. As the number of IoT devices increases, reliable testing tools are necessary to assess signal quality, network reliability, and device communication in real-time conditions. Signal analyzers, network testers, and protocol analyzers help ensure IoT devices can handle complex communications while remaining functional across networks.

Growing Complexity of Electronics and Semiconductor Devices

As electronic devices, semiconductors, and automotive systems become more sophisticated, demand for precise test and measurement solutions has seen exponential growth. Miniaturizing components, increasing processing speed requirements, and the integration of advanced technologies such as autonomous systems and sophisticated sensors are pushing design and performance boundaries across industries.

Miniaturization of electronic components has emerged as one of the defining trends of modern technology. As devices shrink in size, the components within them, such as microchips, transistors, and sensors, also decrease in size, allowing for more powerful devices in a compact form. However, miniaturization introduces unique challenges in terms of testing. Testing requires equipment capable of handling higher frequencies, more intricate circuitry, and smaller physical sizes without compromising accuracy.

Optoscopes, signal analyzers, and automated test systems can be deployed to assess the performance of miniaturized components to ensure they function as intended. These tools can handle the high speeds and small features of modern electronics to provide accurate insights into their performance and quickly identify any potential faults early in their design and manufacturing process.

Restraints

High Initial Costs of Test Equipment

Initial costs associated with advanced test and measurement equipment can be an obstacle for many companies, particularly smaller enterprises, startups, and those operating in regions with limited technological infrastructure. Industries reliant on highly specialized test instruments, like semiconductor manufacturing, aerospace engineering, and telecom, often need sophisticated tools like oscilloscopes, spectrum analyzers, signal generators, and automated test systems. All of these instruments help to guarantee the performance, reliability, and safety of complex systems and devices. At the same time, prices for the equipment may sometimes amount to the high amount of capital in top models with the latest capabilities.

Test equipment maintenance costs can further strain financial resources, with its regular calibration, repairs, and upgrades consuming valuable funds. As technology evolves, test equipment should also adapt to new standards or protocols such as 5G or IoT support.

Regions with limited technological infrastructure often face additional difficulty in overcoming financial barriers to innovation and technological development. Emerging markets or regions without access to advanced manufacturing or testing facilities often struggle to afford advanced test systems. The lack of funding hinders local innovation and technological development as companies in these regions have limited access to high-precision equipment necessary for quality and safety testing.

Complexity in Operation and Skill Shortages

As test and measurement equipment becomes more advanced, so need for personnel with advanced operating skills capable of operating these complex systems increases exponentially. Modern test solutions, specifically automated and modular systems, have made significant advances in both efficiency and capability. However, they require both equipment expertise as well as knowledge of complex technologies, such as 5G networks, autonomous vehicles, semiconductors, and IoT devices. Furthermore, such testing systems often include cutting-edge features like AI-driven testing algorithms, real-time data analysis tools, and high-frequency measurements, which require in-depth knowledge of both the hardware and software components involved.

Companies often struggle to recruit enough highly specialized labor to run and maintain advanced test systems, creating a significant shortage of skilled personnel needed for the operations and maintenance of these complex systems. The skills gap is particularly prominent in industries like semiconductors, automotive, and telecom where technology evolves quickly. Although many employees may possess the foundational knowledge necessary for basic testing procedures, to operate new equipment effectively or keep up with technological advances they will require advanced training. Training and upskilling the workforce can be both time-consuming and costly for companies. This can lead to inefficiencies, suboptimal use of expensive tools, and missed opportunities to leverage new technologies that could provide competitive advantages.

Opportunities

Integration of Artificial Intelligence (AI) and Machine Learning (ML) in Test Solutions

Artificial Intelligence (AI) and Machine Learning (ML) give a transformative opportunity for test and measurement equipment manufacturers, providing significant advances in efficiency, precision, and adaptability. As testing processes become more complex, AI and ML solutions not only automate repetitive tasks but also enable predictive analysis and dynamic optimization, significantly expanding their value proposition for modern testing systems.

AI can analyze signals and performance data across millions of transistors on a chip to detect inconsistencies with unparalleled speed and accuracy. It shortens testing times while eliminating human errors, assuring only high-quality products are released onto the market. In automotive testing, artificial intelligence algorithms simulate real driving conditions to test autonomous systems' safety while validating performance against performance indicators ensuring safe and reliable operation of autonomous systems ensuring safe operation without human oversight.

Machine Learning (ML) enhances the adaptability of test systems, enabling them to keep pace with shifting technologies. ML algorithms can learn from each test cycle, refining methodologies and increasing accuracy over time. Adaptability is especially vital in rapidly evolving fields like 5G and IoT where new standards, protocols, and technologies are constantly emerging. For instance, ML can optimize test configurations for 5G networks to ensure efficient yet accurate testing processes even as network architectures become increasingly complex.

Growing Demand for IoT and 5G Testing Solutions

Demand for IoT and 5G testing solutions represents an enormous opportunity in the test and measurement equipment market. IoT (Internet of Things) is rapidly spreading throughout various sectors such as smart homes, industrial automation, healthcare, and smart cities connecting millions of devices that must work seamlessly together for optimal functioning. Testing IoT devices presents unique challenges due to the vast number of communication protocols as they utilize Wi-Fi, Bluetooth, Zigbee, LoRaWAN, and cell networks among them. Rigorous testing is necessary to ensure connectivity, interoperability, and low power consumption.

As 5G networks spread globally, advanced testing solutions are required to evaluate performance, reliability, and compliance with emerging standards. High millimeter-wave frequency tools like spectrum analyzers and signal generators for signal integrity present additional testing challenges. Its applications range from telecom to autonomous vehicles to smart factories to telemedicine all necessitating unique testing equipment to validate network capabilities and device compatibility. The convergence of IoT and 5G amplifies these demands, as many IoT devices rely on 5G networks for enhanced connectivity, necessitating integrated testing solutions that can meet complex requirements simultaneously, such as validating 5G connectivity while also testing device interoperability and security.

Trends

Adoption of Automated and Modular Test Systems

Automation and modular test systems are revolutionizing the test and measurement equipment market, meeting the industry's rising need for speed, precision, and adaptability. Automated test systems, which leverage advanced software and hardware integration, are designed to minimize manual intervention, reduce errors, and significantly enhance testing efficiency.

Automation streamlines repetitive and time-intensive tasks like signal analysis, data processing, and defect detection allowing companies to achieve faster testing cycles and quicker time-to-market for their products. Automated test systems in semiconductor manufacturing enable rapid validation of complex integrated circuits across thousands of test parameters quickly. Automation also facilitates comprehensive testing of advanced driver assistance systems (ADAS) and autonomous driving technologies that require extensive validation under real-world scenarios.

As industries adopt increasingly advanced technologies, automated and modular test systems will become an integral component of modern testing solutions. Businesses that invest in such technologies may reap increased efficiency, reduced costs, and the ability to adapt quickly in an ever-evolving technological landscape.

Emphasis on Sustainability in Testing

Sustainability in testing has emerged as a central trend within the test and measurement equipment market, driven by global efforts to reduce environmental impact and meet sustainability goals. This shift represents a broader industry shift toward eco-friendly practices that influence the design, operation, and application of test and measurement systems across various sectors. It is also playing a role in the use of test and measurement systems in industries dedicated to green technologies.

Test solutions are increasingly tailored to support the development and validation of sustainable innovations, including renewable energy systems, electric vehicles (EVs), and energy-saving appliances. Specialized equipment is deployed to test the performance and reliability of solar panels, wind turbines, energy storage systems, and energy conservation technology to ensure they meet efficiency and durability standards.

Regulated frameworks and corporate social responsibility initiatives (CSR) initiatives are also driving companies toward sustainable testing practices. Governments and industry bodies globally are enacting stricter environmental regulations, prompting businesses to invest in greener technologies and processes. Test and measurement equipment suppliers that prioritize sustainability not only meet regulatory requirements but also enhance their reputation with eco-conscious customers and stakeholders.

Research Scope and Analysis

By Product Type

General-purpose test equipment (GPTE) is expected to maintain its dominance in the product type segment, capturing 60.0% of the market share in 2025. Its dominance can be attributed to its versatility, cost-efficiency, and widespread applicability across a variety of industries such as electronics, telecoms, automotive, and aerospace including oscilloscopes, multimeters, spectrum analyzers, signal generators, and power meters which all play essential roles for testing measurement diagnostic tasks.

GPTE stands out as an economical solution because of its flexibility to meet various testing scenarios, making it the optimal cost-cutting choice for organizations. As technologies like 5G, IoT, and autonomous vehicles continue to advance, the need for high-performing testing solutions like general-purpose test equipment continues to increase. Spectrum analyzers play an integral part in measuring signal quality and interference within 5G networks while multimeters provide tools to measure basic electrical parameters in IoT devices.

Integration of cutting-edge features such as automation, AI, and machine learning into GPTE has further expanded its utility and efficiency. Automated solutions reduce testing times and eliminate human error for seamless data analysis, while AI-powered systems offer predictive insights and adaptive testing capabilities.

By Service Type

Calibration Services is anticipated to capture the highest market share of 50.0% in the service type segment by 2025, due to increasing reliance on precise and accurate measurements across many industries, including electronics, telecom, aerospace, automotive, manufacturing, and others. Calibration ensures test equipment delivers consistent, reliable, and accurate results that protect product quality as well as compliance with regulatory standards while mitigating operational risks.

Calibration services play a pivotal role in maintaining the performance of test equipment over time, especially as their use becomes more widespread in demanding environments.

Regular calibration helps avoid measurement errors that could lead to defective products, compromised safety, or violations that put product quality or regulatory compliance at risk. It plays an essential role in industries such as aerospace where safety and reliability are of utmost importance, and where accurate measurements are essential to the operation of complex systems. These services help ensure instruments used for these applications operate at peak accuracy for flight safety, and compliance with international standards, reducing failure risk, as well as minimizing costly failures.

By Application

Healthcare is likely to lead the global test and measurement equipment market with 25.0% of market revenue and it is further anticipated to maintain its dominance by 2025. This trend can be explained by their increasing need for accurate, reliable, and precise diagnostic and monitoring tools that help provide high-quality healthcare services and improve patient outcomes. Aging populations, greater healthcare awareness among doctors, and the increased prevalence of chronic diseases have created significant investments in medical technology and associated test and measurement equipment.

As healthcare systems globally prioritize patient safety and quality of care, maintaining and calibrating test and measurement equipment becomes ever more essential. Regular calibration and maintenance of healthcare-related test instruments is necessary to ensure accurate readings, compliance with regulatory standards, and meeting both provider expectations as well as patient needs. Thus, fueling significant growth of calibration and maintenance services for medical equipment in recent years and contributing significantly to healthcare's dominance in the market.

The Global Test and Measurement Equipment Market Report is segmented on the basis of the following

By Product Type

- General-Purpose Test Equipment

- Oscilloscopes

- Signal Generators

- Multimeters

- Logic Analyzers

- Spectrum Analyzers

- Bert Solutions

- Network Analyzers

- Power Meters

- Electronic Counters

- Modular Instruments

- Automated Test Equipment

- Power Supplies

- Mechanical Test Equipment

- Non-Destructive Test Equipment

- Machine Vision Inspection Systems

- Machine Condition Monitoring Systems

By Service Type

- Calibration Services

- Repair/After-Sales Services

- Other Services

By Application

- Healthcare

- Automotive & Transportation

- Aerospace & Defense

- IT & Telecommunications

- Education & Government

- Electronics & Semiconductors

- Industrial

Regional Analysis

Asia Pacific is expected to lead the global test and measurement equipment market

with 36.3% of the market share in 2025. This dominance can be attributed to rapid industrialization, technological innovations, and an increase in high-performance test solutions across industries including electronics, automotive, telecommunications, and healthcare. One key contributor to Asia Pacific is the region's robust manufacturing base, particularly in countries like China, Japan, South Korea, and India. These countries are home to major electronics manufacturers and semiconductor fabrication plants that rely heavily on test and measurement equipment to ensure product quality, functionality, and reliability.

As consumer electronics, smartphones, 5G devices, and automotive electronics become more in demand, the demand for advanced testing solutions has become ever more pressing. APAC plays an integral part in the global semiconductor supply chain, as their production requires precise testing and measurement of complex device parameters such as signal integrity, power consumption, and temperature stability.

Healthcare sectors in APAC are contributing significantly to its dominance of the test and measurement market, with advances in medical technologies, expansion of healthcare infrastructure, and increasing diagnostic needs leading to an increasing need for precise and reliable test instruments. Furthermore, as demographic shifts occur such as an aging population with greater health awareness demand is anticipated to surge for healthcare-related equipment in this region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

In the global test and measurement equipment market, competition comes from both multinational corporations as well as smaller specialized firms. Keysight Technologies, Tektronix, National Instruments (NI), Fluke Corporation, Rohde & Schwarz, and Anritsu hold notable shares due to their vast product offerings, strong R&D capabilities, and solid brand recognition. These companies compete across sectors including telecom, electronics, automotive, aerospace, and healthcare where demand for precise high-performance testing equipment continues to expand rapidly.

Product innovation and technological advances such as AI, machine learning, and IoT integration into test equipment are critical competitive elements. Businesses have increasingly focused on creating automated test systems to streamline testing efficiency and shorten test times to maintain an edge over their rivals in industries like automotive, telecommunications, and healthcare. With new-generation devices such as smartphones and autonomous vehicles becoming ever more prevalent on the market, demand for test equipment capable of supporting these new-gen devices should continue growing significantly.

Some of the prominent players in the global test and measurement equipment market are

- Keysight Technologies

- Fortive

- AMETEK Inc.

- Rohde & Schwarz

- National Instruments Corp.

- Teledyne Technologies

- VIAVI Solutions Inc.

- Anritsu

- Yokogawa Electric Corporation

- Advantest Corporation

- EXFO Inc

- Other Key Players

Recent Developments

- March 2024: Keysight Technologies launched an advanced 5G network emulator aimed at accelerating the development and testing of 5G devices and network infrastructures. The emulator allows engineers to simulate real-world 5G network conditions, including mobility, interference, and handover scenarios. This solution is tailored for 5G device manufacturers, telecom operators, and R&D centers looking to ensure the performance and reliability of their 5G technologies.

- February 2024: Anritsu Corporation launched a 5G mmWave test solution designed to meet the increasing demand for high-frequency testing in the 5G and next-generation wireless communication sectors. This solution offers precise measurement capabilities for mmWave frequencies, which are essential for 5G deployments, especially in urban areas where high bandwidth and low latency are required.

- September 2023: National Instruments (NI) launched a new 5G/LTE RF test platform specifically designed for automotive applications. The platform addresses the growing demand for advanced driver assistance systems (ADAS) and connected vehicle technologies that rely on reliable wireless communication. NI’s test platform offers customizable testing solutions for automotive manufacturers and suppliers involved in the development of connected vehicles.

- June 2023: Rohde & Schwarz launched a new Over-the-Air (OTA) testing solution for 5G mobile devices. This solution is designed to test the performance of 5G handsets in real-world conditions, evaluating parameters such as signal strength, bandwidth, and connection reliability. The 5G OTA test solution provides high accuracy and supports testing for sub-6 GHz and millimeter-wave frequencies, which are essential for the upcoming phase of 5G network deployment.

- January 2023: Tektronix introduced the MDO4000B Mixed Domain Oscilloscope, designed to meet the increasing demands of IoT, 5G, and automotive electronics testing. The MDO4000B offers high bandwidth, deep memory, and advanced triggering capabilities, enabling precise analysis of both analog and digital signals. This oscilloscope is optimized for engineers working with next-generation devices and systems, providing the flexibility needed to test complex, multi-domain systems.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 109.8 Bn |

| Forecast Value (2034) |

USD 247.5 Bn |

| CAGR (2025-2034) |

9.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 34.3% |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (General-Purpose Test Equipment and Mechanical Test Equipment), By Service Type (Calibration Services, Repair/After- Sales Services, and Other Services), By Application (Healthcare, Automotive & Transportation, Aerospace & Defense, IT & Telecommunications, Education & Government, Electronics & Semiconductors, and Industrial) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Keysight Technologies, Fortive, AMETEK Inc., Rohde & Schwarz, National Instruments Corp., Teledyne Technologies, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The global test and measurement equipment market size is estimated to have a value of USD 109.8 billion in 2025 and is expected to reach USD 247.5 billion by the end of 2035.

The US test and measurement equipment market is projected to be valued at USD 34.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 73.4 billion in 2033 at a CAGR of 8.8%.

Asia Pacific is expected to have the largest market share in the global test and measurement equipment market with a share of about 36.3% in 2024.

Technologies, Fortive, AMETEK Inc., Rohde & Schwarz, National Instruments Corp., Teledyne Technologies, and many others.

The market is growing at a CAGR of 9.4 percent over the forecasted period.