Market Overview

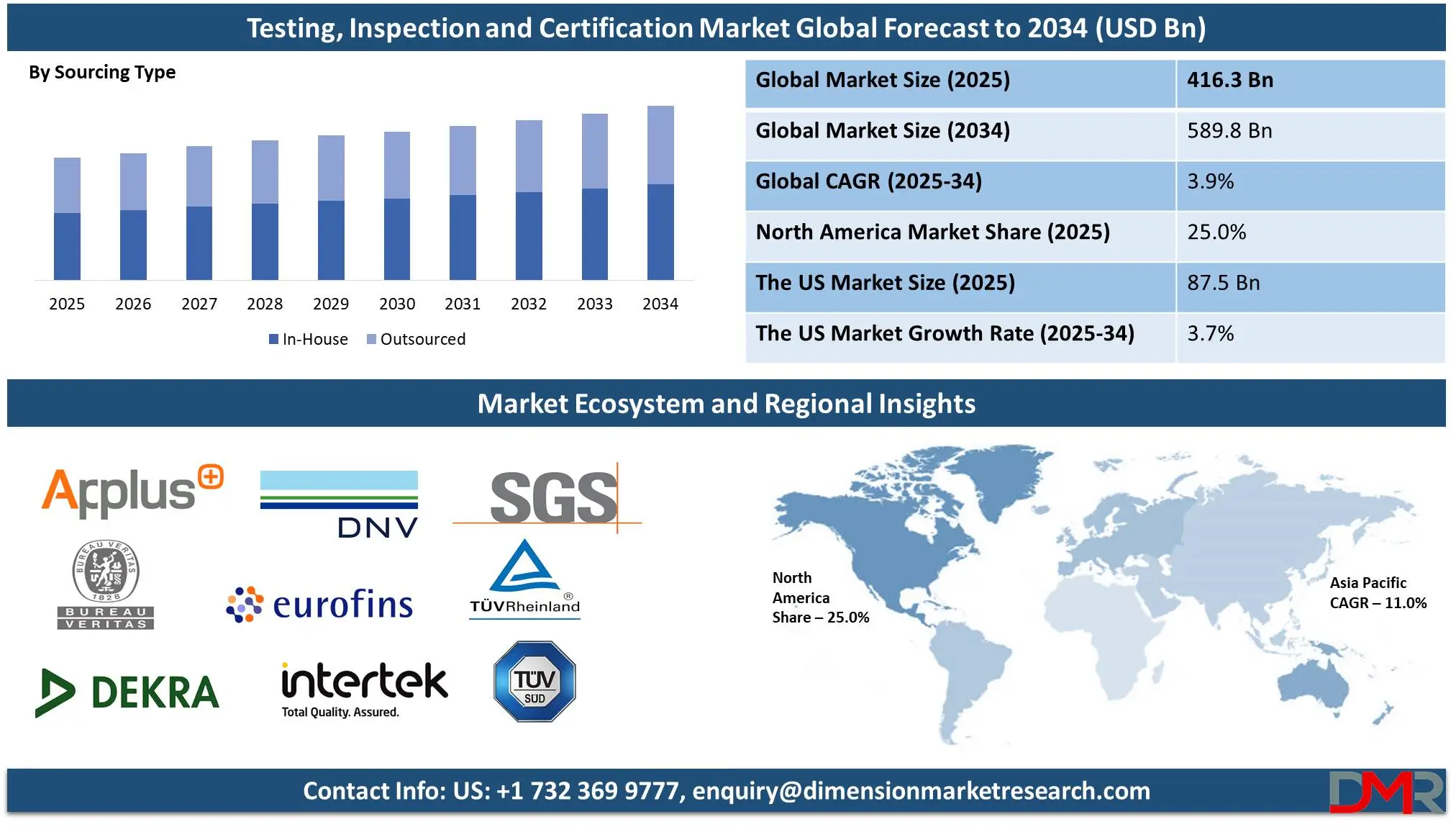

The Global Testing, Inspection and Certification Market is expected to be valued at

USD 416.3 billion in 2025, and is further anticipated to reach

USD 589.8 billion by 2034 at a

CAGR of 3.9%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Global Testing, Inspection, and Certification (TIC) market refers to the industry that provides services for testing, inspection, and certification (TIC), to ensure product and system compliance across various sectors and ensure they adhere to regulatory requirements, international standards, customer specifications or specific guidelines. Testing companies such as those offered by Testing Inspection & Certification Corporations act as third party entities providing independent assessment & validation in industries including healthcare, automotive, oil & Gas, consumer goods, and construction.

Global supply chains have increased the need for transportation information and management (TIC) services. As products and services come from different regions, ensuring consistent quality and regulatory compliance becomes important for companies seeking TIC services to mitigate risks, enhance operational efficiency, and meet evolving regulatory frameworks.

Technological advancements have also transformed the TIC market. The integration of artificial intelligence, blockchain, and the Internet of Things (IoT) in TIC processes has improved efficiency, accuracy, and transparency in inspections and certifications. Digital testing and remote inspection services are becoming more prevalent, enabling companies to conduct assessments without the need for physical presence. These technological innovations are expected to enhance the market's growth by offering cost-effective and time-efficient solutions.

The growing awareness about product safety, especially in sectors such as food, pharmaceuticals, and consumer electronics, has heightened the need for stringent testing and certification processes. Consumers are more conscious about product quality, safety, and sustainability, prompting manufacturers to adopt rigorous TIC protocols.

Additionally, environmental concerns and the implementation of sustainability standards have accelerated the demand for TIC services in renewable energy, water quality, and waste management sectors. The global TIC market is marked by multinational corporations and regional service providers operating both independently and collaboratively, offering services from product testing to calibration to certification and inspection.

Strategic partnerships, mergers, and acquisitions have become more frequent as companies seek to expand their service portfolios. Outsourcing TIC services by manufacturers and businesses further fuels market expansion as companies prioritize independent verification to boost credibility and ensure regulatory compliance.

The US Testing, Inspection and Certification Market

The US Testing, Inspection and Certification Market is projected to be valued at USD 87.5 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 121.0 billion in 2034 at a CAGR of 3.7%.

The US testing, inspection and certification (TIC) market is an integral component of the global testing, inspection and certification (TIC) industry due to stringent regulatory standards, technological advancements, and consumer safety demands. This market plays a critical role in assuring that products, systems, and services meet national and international quality, safety, environmental, and ethical standards while simultaneously fulfilling consumer requirements.

Independent verification and validation services offered help meet this demand across diverse industries such as healthcare, aerospace, automotive, and consumer goods, providing essential regulatory compliance. The US Government efforts toward regulatory compliance have significantly driven the growth of the TIC market.

Federal agencies such as Food and Drug Administration (FDA), Environmental Protection Agency (EPA), and Occupational Safety and Health Administration (OSHA) enforce stringent quality and safety regulations across multiple industries, mandating rigorous testing, inspection, and certification processes, particularly within pharmaceutical, food & beverage, and environmental sectors.

Technological advancements further bolster the demand for TIC services in the U.S. The country's leadership in innovation and research has led to the rapid development of high-tech industries such as aerospace, electronics, and renewable energy. As companies adopt new technologies like electric vehicles, smart devices, and renewable energy systems, the need for TIC services to ensure performance, safety, and regulatory compliance has intensified. The integration of digital tools such as artificial intelligence, blockchain, and IoT in TIC processes has also enhanced efficiency and transparency in the certification landscape.

Global Testing, Inspection and Certification Market: Key Takeaways

- Market Value: The global testing, inspection and certification market size is expected to reach a value of USD 589.8 billion by 2034 from a base value of USD 416.3 billion in 2025 at a CAGR of 3.9%.

- By Service Type Segment Analysis: Testing Services are anticipated to lead in the service type segment, capturing 73.0% of the market share in 2025.

- By Sourcing Type Segment Analysis: In-House sourcing type is poised to consolidate its market position in the sourcing type category segment capturing 55.0% of the total market share in 2025.

- By Application Type Segment Analysis: Consumer Goods & Retail are expected to maintain their dominance in the application type segment capturing 25.0% of the total market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global testing, inspection and certification market landscape with 34.0% of total global market revenue in 2025.

- Key Players: Some key players in the global testing, inspection and certification market are Applus+, Bureau Veritas, DEKRA SE, Det Norske Veritas group, Eurofins Scientific, Intertek Group Plc, SGS Societe Generale de Surveillance SA, TUV Rheinland, TUV SUD, UL LLC, and Other Key Players.

Global Testing, Inspection and Certification Market: Use Cases

- Consumer Electronics Certification: IC services ensure that smartphones, laptops, and smart home devices meet international safety and electromagnetic compatibility standards before reaching consumers, mitigating risks of malfunction and enhancing product reliability. These services involve comprehensive testing of device components, software, and wireless communication protocols to detect any potential safety hazards. Certification also includes electromagnetic compatibility (EMC) testing to verify that devices do not interfere with other electronic equipment. By adhering to these standards, manufacturers can gain market access in various regions and build consumer trust.

- Food Safety Testing: The agricultural and food industry utilizes TIC services to verify the quality, safety, and labeling of food products. This includes testing for contaminants, pesticides, and compliance with food safety regulations like HACCP and FDA guidelines. TIC companies conduct microbiological analysis, chemical testing, and nutritional labeling verification to ensure products meet health and safety standards. These services play a vital role in preventing foodborne illnesses and ensuring transparency in the supply chain. Additionally, traceability programs help manufacturers monitor the origin and distribution of products, reinforcing consumer confidence.

- Automotive Crash Testing: TIC companies conduct rigorous crash testing and safety inspections to certify that vehicles meet regulatory standards for occupant protection, emissions, and performance, ensuring compliance with national and international automotive safety regulations. Crash tests include frontal, side, and rollover impact simulations to evaluate structural integrity and passenger safety. Emissions testing ensures that vehicles adhere to environmental standards, such as EPA regulations for fuel efficiency and air quality. Furthermore, TIC providers perform component-level testing on braking systems, airbags, and electronic safety features to guarantee overall vehicle reliability.

- Renewable Energy Equipment Inspection: TIC providers assess wind turbines, solar panels, and other renewable energy equipment to ensure structural integrity, performance efficiency, and compliance with environmental and safety standards before installation and operation. These inspections include material quality verification, load testing, and environmental impact assessments to guarantee long-term operational safety. Performance testing helps manufacturers optimize energy output and improve system efficiency. Additionally, TIC companies offer ongoing maintenance inspections to identify wear and tear, reducing the risk of equipment failure and enhancing the lifespan of renewable energy systems.

Global Testing, Inspection and Certification Market: Stats & Facts

- The International Organization for Standardization (ISO) conducts an annual survey detailing the number of valid certificates for various ISO management system standards across countries. This data offers insights into global certification trends.

- The International Laboratory Accreditation Cooperation (ILAC) reports that, as of 2024, over 114,600 laboratories and more than 15,600 inspection bodies were accredited by ILAC MRA Signatories. This reflects the extensive global infrastructure supporting TIC activities.

- The Organization for Economic Co-operation and Development (OECD) provides guidelines and best practices for regulatory enforcement and inspections, offering insights into the effectiveness of inspection regimes globally.

- According to the World Bank Group, among 186 countries sampled by the Global Indicators of Regulatory Governance, 85 prepare forward regulatory plans in the form of a list of anticipated regulatory changes intended to be adopted in the near future.

- Additionally, 84.0% of OECD high-income and Europe and Central Asian economies adhere to this good practice, followed by only about a third of countries in East Asia and the Pacific as well as Sub-Saharan Africa. Providing advance notice on regulatory changes is still relatively rare in the Middle East and North Africa region.

- According to The International Laboratory Accreditation Cooperation (ILAC), as of 2024, 116 accreditation bodies from over 118 economies have signed the ILAC MRA, facilitating international acceptance of calibration, testing, medical testing, and inspection results.

- Additionally, ILAC MRA signatories have accredited approximately 40,000 laboratories and about 7,000 inspection bodies globally, ensuring consistent quality and reliability in conformity assessment services.

- ISO/IEC 17025 is an international standard specifying general requirements for the competence of testing and calibration laboratories, widely used in the TIC industry to ensure laboratory competence.

- The latest ISO Survey estimates the number of valid certificates as of December 31, 2023. Here are some of the key findings related to it:

- The ISO 9001:2015 (Quality Management Systems) standard recorded approximately 1.2 million certificates across 1.6 million sites globally, showcasing its continued prominence in quality management.

- The ISO 14001:2015 (Environmental Management Systems) certification was issued to 500,000 organizations, covering 700,000 sites, emphasizing the growing importance of environmental sustainability.

- Around 400,000 certificates were awarded under the ISO 45001:2018 (Occupational Health and Safety Management Systems), with 500,000 sites certified, reflecting heightened attention to workplace safety.

- The ISO/IEC 27001:2013 (Information Security Management Systems) saw 70,000 certificates granted across 120,000 sites, highlighting the increasing focus on data security and cyber risk management.

- The ISO 22000:2018 (Food Safety Management Systems) accounted for 45,000 certificates and 50,000 sites, indicating rising awareness of food safety standards globally.

- With 30,000 certificates covering 40,000 sites, the ISO 13485:2016 (Medical Devices Quality Management Systems) standard is playing a pivotal role in ensuring quality within the medical devices sector.

- The ISO 50001:2018 (Energy Management Systems) witnessed 28,000 certificates issued across 55,000 sites, reinforcing the commitment of organizations towards energy efficiency and sustainability.

- Approximately 27,000 certificates were awarded under the ISO/IEC 20000-1:2018 (IT Service Management Systems) standard, certifying 30,000 sites and promoting quality in IT service management.

Global Testing, Inspection and Certification Market: Market Dynamic

Global Testing, Inspection and Certification Market: Driving Factors

Rising demand for quality assurance in cross-border trade and global supply chainsInterconnected economy necessitates businesses across industries outsourcing manufacturing and raw material sourcing to multiple countries to reduce costs and improve operational efficiencies, but this fragmented production model creates significant challenges in maintaining product quality, safety, and regulatory compliance across various regions, necessitating independent TIC services as an indispensable solution.

For instance, a single product such as a smartphone might have components sourced from multiple countries like semiconductors from Taiwan, batteries from China, and assembly in Vietnam, each of which must meet specific regulatory guidelines before the final product reaches consumers. TIC providers help businesses conduct supplier audits, raw material inspections, and product testing at various stages of the supply chain to ensure that each component meets the desired quality standards.

Consumer awareness regarding product safety, quality, and sustainability

Consumers have become conscious of the health, environmental, and ethical impacts of products they purchase, particularly food & beverages, cosmetics, electronics, and automotive industries where product safety and quality play a crucial role in buying decisions. Manufacturers and service providers face growing pressure to adhere to high-quality standards while attaining third-party certifications that ensure product performance.

High-profile product recalls and incidents of counterfeit goods have raised consumer skepticism, prompting businesses to seek independent testing, inspection, and certification services to maintain brand credibility. They can play an essential role in verifying product claims such as organic ingredients, environmental sustainability or ethical sourcing that could give brands an edge in the market. Furthermore, the increased adoption of eco-friendly and energy efficient products has created a surge in demand for certifications like Energy Star, LEED and organic product labels.

Global Testing, Inspection and Certification Market: Restraints

High Cost of TIC Services

The comprehensive nature of TIC processes, which often involve advanced laboratory testing, field inspections, and detailed certification procedures, makes these services expensive, especially for small and medium-sized enterprises (SMEs). Many SMEs face financial constraints and may find it challenging to afford independent TIC services, particularly in price-sensitive markets. Pharmaceutical, aerospace, and automotive regulatory requirements demand stringent testing protocols and periodic inspections that further drive costs upward.

Not only do these costs contribute to operational expenses but they can also lengthen product development timelines. Companies operating in emerging markets often lack access to testing and certification (TIC) facilities and infrastructure, further compounding logistics and transportation expenses and increasing costs for third-party testing and certification (TPC).

Lack of Uniform Standards and Regulatory Variations

Different countries and regions often impose testing and certification standards that make compliance difficult when operating in global markets, leading to duplicate testing procedures, increased costs, and protracted certification timelines. Electronic products certified under European Union regulations might need additional testing to meet U.S. or Asian market standards, even though their specifications are identical.

This fragmented regulatory landscape creates barriers for manufacturers seeking seamless market entry across multiple regions. Additionally, frequent changes in regulatory policies and a lack of coordination among governing bodies further complicate certification processes, especially within emerging industries like electric vehicles, renewable energy, and biotechnology. This not only increases compliance costs but creates uncertainty for businesses that could delay product launches or global market expansion plans.

Global Testing, Inspection and Certification Market: Opportunities

Digital Transformation and Integration of Advanced Technologies

Artificial Intelligence (AI), Blockchain technology, and Internet of Things (IoT) connectivity and big data analytics have changed how TIC services are provided, making processes more efficient, accurate, and transparent. AI-enabled automated testing systems can quickly process large volumes of data, detect anomalies, and improve product quality assessments to save both time and cost compared to manual inspections.

IoT sensors enable real-time inspections in industries like energy, manufacturing, and infrastructure for real-time performance assessments without physical site visits. Blockchain technology is providing opportunities by increasing traceability and transparency within supply chains. Stakeholders can now access an untamperable record of product testing and certification processes to ensure product authenticity and regulatory compliance. Not only has this technological development enhanced service delivery but it has allowed TIC providers to expand their service offerings to meet the growing needs of industries adopting digital solutions.

Expansion of Renewable Energy and Sustainability Initiatives

As governments and organizations globally adhere to stringent environmental regulations and pledge to reduce carbon emissions, demand for testing, inspection, and certification services in renewable energy sectors such as solar, wind, hydro, and bioenergy grows steadily. With the rising adoption of solar panels, wind turbines, and energy storage systems, there is a surge in need for third-party inspection companies (TIC).

Their certification services help manufacturers gain credibility in competitive markets by verifying compliance with international environmental standards such as ISO 14001 and LEED. Additionally, companies across sectors are adopting sustainable practices to comply with CSR and ESG (Environmental, Social and Governance). This has increased demand for third-party certification services that validate products as eco-friendly and socially responsible.

Global Testing, Inspection and Certification Market: Trends

Rising Adoption of Remote and Virtual Inspection Services

Remote inspections utilize IoT sensors, drones, AR/VR headsets, and video conferencing technologies to perform visual assessments, performance monitoring, and safety checks without the need for physical presence. These solutions enable real-time collaboration between inspectors and clients and reduce operational costs by speeding up inspection timelines. Industries such as oil & gas, energy, infrastructure monitoring, and manufacturing have adopted such services for critical infrastructure maintenance and equipment monitoring purposes.

Additionally, AI-powered image recognition and data analytics tools increase accuracy during remote inspections by quickly detecting defects and anticipating maintenance requirements. With companies prioritizing digital transformation and operational efficiency strategies, demand for remote and virtual inspection services should grow substantially, shaping the global TIC market.

Growing Demand for Cybersecurity Testing and Certification

With the increasing reliance on digital technologies, connected devices, and cloud-based systems, the demand for cybersecurity testing and certification has emerged as a significant trend in the global TIC market. The rapid proliferation of smart devices, IoT networks, and digital payment systems has heightened concerns regarding data security, privacy breaches, and cyberattacks, prompting companies to seek independent verification of their cybersecurity measures. Cybersecurity testing services use software, hardware, and network vulnerability assessments to identify risks to data protection regulations like GDPR, ISO 27001, and SOC 2.

TIC providers offer penetration tests, vulnerability assessments, and encryption certification services that assess cybersecurity protocols across industries like banking, healthcare, automotive, and telecom. As businesses increasingly adopt digital transformation strategies and cloud-based infrastructure, cybersecurity certification has become a key requirement for market entry, particularly in sectors handling sensitive customer data.

Global Testing, Inspection and Certification Market: Research Scope and Analysis

By Service Type Analysis

Testing services are projected to dominate the global TIC market, contributing approximately 73.0% to the total market share in 2025. This dominance can be attributed to growing demand for product quality assurance, regulatory compliance, and performance validation across various industries. These testing services involve comprehensive procedures that subject products, systems, or materials to rigorous technical assessments to verify safety, functionality, durability, before market release. Testing services cover numerous forms, including performance, safety, and environmental and electromagnetic compatibility (EMC) tests to ensure products comply with international regulatory standards such as ISO, IEC, and FDA guidelines for market entry certification. Additionally, the rise in product recalls and growing consumer demand for certified products have further propelled the adoption of testing services across industries.

Inspection Services represent another integral element of the global TIC market, providing on-site assessments, quality checks, and operational monitoring to ensure products, equipment, and processes meet safety, quality, and environmental standards. In contrast to testing services which primarily utilize laboratory facilities to conduct product evaluations, inspection services conduct assessments at manufacturing sites, production facilities or operational environments. These services are widely utilized across industries such as construction, energy & power, oil & gas, and industrial manufacturing where continuous quality monitoring is critical to operational safety and regulatory compliance. Inspection services typically consist of pre-production inspections, in-process inspections, and final random inspections to help manufacturers detect defects at different stages in their production cycle and detect irregularities.

By Sourcing Type Analysis

In-House Sourcing Type is projected to lead the global testing, inspection and certification market in 2025 with 55.0% of the total market share. Companies conducting testing, inspection, and certification activities internally using their resources, facilities, and personnel is anticipated to account for most in-house TIC services adoption due to a need for greater control over quality assurance processes, quicker turnaround times, and protection of sensitive proprietary information. Industries such as automotive, electronics, aerospace, and pharmaceuticals are particularly inclined toward in-house sourcing due to the high level of technical complexity and confidentiality associated with their products. In-house testing services allow companies to design testing protocols according to their own specific needs and maintain consistent quality standards throughout the production lifecycle. Furthermore, dedicated facilities enable manufacturers to respond swiftly to regulatory changes, product modifications, or unexpected quality issues without relying on third-party service providers.

Outsourced Sourcing Type, where companies collaborate with third-party TIC service providers to conduct testing, inspection, and certification activities, is also contributing significantly to the growth of the global TIC market. This sourcing model has become particularly popular with industries seeking independent verification, regulatory compliance expertise, and cost-effective quality assurance solutions. Outsourcing has become more prevalent due to increasing regulatory complexity, global supply chains, and the need to access specialized testing facilities without incurring substantial capital investments. Outsourcing testing services has several advantages, including impartiality, global certification expertise, and access to cutting-edge testing technologies. Industries such as consumer goods, food & beverage, chemicals, and renewable energy often use third-party TIC providers as an assurance mechanism against local and international safety and quality standards compliance issues.

By Application

Consumer Goods & Retail are anticipated to maintain their dominant position in the global TIC market, capturing 25.0% of the total market share in 2025. The segment's dominance is primarily driven by the rising demand for product quality assurance, safety compliance, and performance validation across a wide range of consumer products such as electronics, personal care items, textiles, toys, and home appliances. Increasing consumer awareness about product safety, integrated with stringent regulatory mandates for product quality certification, has significantly amplified the need for third-party TIC services in this sector. Personal care and beauty product manufacturers rely on testing services to verify product safety, ingredient quality, and compliance with FDA, ISO, and European Union (EU) regulations.

In electronics goods production, electromagnetic compatibility (EMC), safety testing, and energy efficiency assessments are integral in certifying products before being launched on the market.

The Agriculture & Food segment is also emerging as a significant contributor to the global TIC market landscape, driven by rising concerns over food safety, quality assurance, and sustainability. With the increasing frequency of foodborne illnesses, product recalls, and counterfeit products, both regulatory bodies and consumers are demanding higher transparency and accountability across the food supply chain.

TIC services in this sector play an essential role in verifying product quality at various stages, from raw material sourcing and production, through packaging and distribution. With regulations such as Hazard Analysis and Critical Control Points (HACCP), FDA Food Safety Modernization Act (FSMA), and EU food safety standards mandating quality testing of food manufacturers and exporters, rising demand for organic, non-GMO, and ethically sourced foods are creating additional opportunities for certification services that help brands gain customer trust.

The Testing, Inspection and Certification Market Report is segmented on the basis of the following

By Service Type

- Testing

- Inspection

- Certification

By Sourcing Type

By Application

- Consumer Goods & Retail

- Personal Care & Beauty Products

- Hard Goods

- Softlines & Accessories

- Toys & Juvenile Products

- Electrical & Electronics

- Agriculture & Food

- Seeds & Crops

- Fertilizers

- Commodities

- Food

- Meat

- Forestry

- Others

- Chemical

- Asset Integrity Management Services

- Project Lifecycle Services

- Finished Product Services

- Chemical Feedstock Services

- Others

- Construction & Infrastructure

- Project Management Services

- Material Services

- Construction Machinery & Equipment Services

- Facilities Management & Inspection Services

- Others

- Energy & Power

- Energy Sources

- Nuclear

- Wind

- Solar

- Alternative Fuels

- Fuel oil & Gases

- Coal

- Power Generation

- Power Distribution

- Asset Integrity Management

- Project Lifecycle Management

- Others

- Industrial & Manufacturing

- Supplier Related Services

- Production and Product Related Services

- Project Related Services

- Others

- Medical & Life Sciences

- Medical Devices

- Health, Beauty, and Wellness

- Clinical Services

- Laboratory Services

- Biopharmaceutical & Pharmaceutical Services

- Others

- Mining

- Inspection & Sampling

- Analytical Services

- Exploration Services

- Metallurgy & Process Design Services

- Production & Plant Services

- Site Operation & Closure Services

- Project Risk Assessment & Mitigation Services

- Others

- Oil & Gas and Petroleum

- Upstream

- Downstream

- Biofuels and Feedstock

- Petrochemicals

- Asset Integrity Management

- Project Lifecycle

- Others

- Public Sector

- Product Conformity Assessment Services

- Monitoring Services

- Valuation Services

- Others

- Automotive

- Electrical Systems and Components

- Electric Vehicles, Hybrid Electric Vehicles, and Battery Systems

- Telematics

- Fuels, Fluids, and Lubricants

- Interior & Exterior Materials and Components

- Vehicle Inspection Services

- Homologation Testing

- Others

- Aerospace

- Services For Airports

- Services For Aviation

- Others

- Marine

- Marine Fuel System and Component Services

- Ship Classification Services

- Marine Material & Equipment Services

- Others

- Railway

- Rail Construction & Production Monitoring

- Infrastructure Management

- Others

- Supply Chain & logistics

- Packaging & Handling

- Risk Management

- Others

- IT & Telecommunication

- Telecommunication & IT Infrastructure Equipment

- Modules & Devices

- Sports & Entertainment

- Sports Venues & Facilities

- Sporting Goods & Protective Equipment

Global Testing, Inspection and Certification Market: Regional Analysis

The region with the largest Revenue Share

The region's dominance is primarily attributed to its rapid industrialization, expanding manufacturing base, and stringent regulatory frameworks across various industries. Countries such as China, Japan, India, South Korea, and Southeast Asian nations are major contributors to the TIC market's growth, driven by the rising demand for product quality assurance, safety compliance, and environmental sustainability. Asia Pacific economies that rely heavily on manufacturing and export have fuelled the demand for third-party testing and certification services (TIC).

China stands out as an expansive manufacturing hub that enforces stringent product quality and safety norms across industries including electronics, automobiles, textiles, and food & beverages. India is quickly emerging as a key regional player in the TIC market, due to initiatives from its government such as Make in India that aim to transform it into a global manufacturing hub. Increased demand for pharmaceutical testing services such as drug safety inspections and infrastructure quality assessments has driven wider use of TIC services across various industries.

The region with the highest CAGR

North America is projected to register the highest Compound Annual Growth Rate (CAGR) in the global testing, inspection, and certification (TIC) market in 2025, driven by rapid technological advancements, stringent regulatory frameworks, and growing consumer demands for product quality and safety. The region's robust industrial base across diverse sectors such as healthcare, automotive, aerospace, information technology, energy, and consumer goods is creating a high demand for TIC services to ensure compliance with national and international standards.

The US dominates the North American TIC market, due to regulatory agencies like Food and Drug Administration (FDA), Environmental Protection Agency (EPA), and Occupational Safety and Health Administration (OSHA), which enforce stringent safety, quality, and environmental standards across industries. These requirements necessitate extensive testing, inspection, and certification processes for products such as medical devices, pharmaceuticals, chemicals, and consumer electronics.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Testing, Inspection and Certification Market: Competitive Landscape

The global Testing, Inspection, and Certification (TIC) market is highly competitive with both established multinational corporations and regional players offering services across different industries. The competition is driven by the increasing demand for product safety, regulatory compliance, and quality assurance across sectors such as consumer goods, healthcare, automotive, energy, and infrastructure. Market players compete based on service quality, technological expertise, global reach, and customized service offerings. Companies such as SGS SA, Bureau Veritas, Intertek Group plc, TUV SUD, Rheinland, Applus+, DEKRA SE, UL LLC, and Eurofins Scientific lead the market with comprehensive testing services, including product testing, inspection, certification, and auditing services.

Leveraging their global networks, industry knowledge, technological capabilities, and advanced technical services, these leading TIC firms maintain an edge and grow customer bases.

One of the key competitive strategies adopted by major TIC players is the expansion of service portfolios through mergers, acquisitions, and strategic partnerships. For instance, leading companies often acquire smaller regional service providers to strengthen their market presence, penetrate new geographic markets, and gain access to specialized testing capabilities.

These acquisitions enable companies to enhance their service offerings across industries such as cybersecurity, renewable energy, and medical devices. Integration of digital technologies is also playing a significant role in shaping the competitive landscape, with companies increasingly adopting artificial intelligence (AI), blockchain technology, IoT devices, and cloud-based platforms to streamline inspection processes, improve data accuracy, and promote transparency. Automated testing solutions and remote inspection services have enabled TIC providers to offer faster and cost-effective services while meeting growing demands for real-time compliance monitoring.

Some of the prominent players in the global Testing, Inspection and Certification are

- Applus+

- Bureau Veritas

- DEKRA SE

- Det Norske Veritas group

- Eurofins Scientific

- Intertek Group plc

- SGS Societe Generale de Surveillance SA

- TUV Rheinland

- TUV SUD

- UL LLC

- Other Key Players

Recent Developments

February 2025: Bureau Veritas and Swiss company SGS entered advanced negotiations for a merger valued at approximately USD 33.17 billion. This strategic move aims to create a dominant entity in the TIC sector, combining their complementary portfolios across various industries.

September 2024: ALS Global acquired Europe-based Wessling Holding and US-based York Analytical Laboratories. These acquisitions aimed to expand ALS's geographical reach and service offerings, particularly in the environmental sector.

July 2024: Eurofins Scientific acquired Nanolab Technologies, a US-based provider of materials analysis and analytical services to the semiconductor industry. This acquisition aimed to strengthen Eurofins' position in the high-tech materials and engineering sector.

March 2023: Intertek Group plc acquired ABC Analytic, a Mexico-based laboratory specializing in environmental analysis. This acquisition aimed to enhance Intertek's environmental testing services in the Latin American region.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 9.5 Bn |

| Forecast Value (2033) |

USD 589.8 Bn |

| CAGR (2024-2033) |

3.9% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 87.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Service Type (Testing, Inspection, and Certification), By Sourcing Type (In-House, and Outsourced), By Application (Consumer Goods & Retail, Agriculture & Food, Chemical, Construction & Infrastructure, Energy & Power, Industrial & Manufacturing, Medical & Life Sciences, Mining, Oil & Gas and Petroleum, Public Sector, Automotive, Aerospace, Marine, Railway, Supply Chain & Logistics, IT & Telecommunication, and Sports & Entertainment) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Applus+, Bureau Veritas, DEKRA SE, Det Norske Veritas group, Eurofins Scientific, Intertek Group plc, SGS Societe Generale de Surveillance SA, TUV Rheinland, TUV SUD, UL LLC, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global testing, inspection and certification market?

▾ The global testing, inspection and certification market size is estimated to have a value of USD 416.3 billion in 2025 and is expected to reach USD 589.8 billion by the end of 2034.

What is the size of the US testing, inspection and certification market?

▾ The US testing, inspection and certification market is projected to be valued at USD 87.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 121.0 billion in 2034 at a CAGR of 3.7%.

Which region accounted for the largest global testing, inspection and certification market?

▾ Asia Pacific is expected to have the largest market share in the global testing, inspection and certification market with a share of about 34.0% in 2025.

Who are the key players in the global testing, inspection and certification market?

▾ Some of the major key players in the global testing, inspection and certification market are Applus+, Bureau Veritas, DEKRA SE, Det Norske Veritas group, Eurofins Scientific, Intertek Group plc, SGS Societe Generale de Surveillance SA, TUV Rheinland, TUV SUD, UL LLC, and many others.

What is the growth rate in the global testing, inspection and certification market?

▾ The market is growing at a CAGR of 3.9 percent over the forecasted period.