Market Overview

The Global Textile Chemicals Market is expected to be valued at

USD 32.9 billion in 2025 and is expected to grow to

USD 51.0 billion by 2034, registering a compound annual growth rate

(CAGR) of 5.0% from 2025 to 2034.

Textile chemicals are essential compounds used in fabric processing to improve performance, appearance, and durability. They include dyes, pigments, flame retardants, softeners, and water repellents that enhance color fastness, strength, and texture. These substances facilitate fiber treatment, printing, and finishing processes, ensuring consistent quality in production. While many textile chemicals are synthetic, eco-friendly alternatives are gaining traction to minimize environmental and health impacts. Innovations in green chemistry and strict regulations promote responsible use, waste management, and sustainable practices. The textile industry continues to balance performance with safety, driving progress toward environmentally conscious manufacturing. Innovative solutions consistently benefit consumers and the environment.

The push for eco-conscious practices in textile production has parallels in adjacent markets like the

Specialty Chemicals Market, where innovation and customization drive demand for performance-enhancing compounds across industries.

Global demand for textile chemicals accelerates because the apparel and clothing market expands at a tremendous rate. Global populations are increasing, urbanization is intensifying, and disposable income is escalating, driving consumer demand for good-quality textile products to meet different functional needs. The manufacturers, in return, are investing in the latest chemical solutions to enhance fabric longevity, resistance to stains, and overall comfort.

Technological innovations, such as nanotechnology and digital printing, are also creating new opportunities in the market. The advances require specialized chemicals to achieve precise color deposition and to increase the quality, and this offers new market segments to the chemical providers. The surge in textile production in developing nations with low-cost labor is also fueling demand for chemicals in compliance with global quality and environmental specifications. The growing influence of

Artificial Intelligence (AI) in Chemicals Market is expected to further streamline production processes and predictive quality control in textile manufacturing.

Sustainability has become a priority, and green dyes and green finishing agents are making inroads among green-oriented buyers. Not only does the green trend eliminate pollution, but it also aligns with the world's agenda to attain sustainability. Demand from the healthcare, automotive, and construction industries also drives additional demand because the applications require specialized chemicals to deliver the desired performance. This intersects with the

Construction Chemicals Market, which also prioritizes performance, safety, and environmental responsibility through chemical innovations.

The US Textile Chemicals Market

The US Textile Chemicals market is projected to be valued at

USD 7.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds

USD 11.8 billion in 2034 at a

CAGR of 5.0%.

The US textile chemicals market drivers are fueled by rapid industrialization, rising demand for advanced functional textiles, and increasing consumer awareness regarding performance and sustainability. Significant investments in research and development, stringent quality regulations, and technological breakthroughs propel growth. Expanding emerging economies and evolving fashion trends stimulate market demand. Moreover, the shift toward eco-friendly solutions and innovative applications in technical, apparel, and industrial textiles contributes to significantly robust global market expansion.

Emerging trends in the US textile chemicals market include the adoption of sustainable, biodegradable, and energy-efficient formulations. Innovations in nanotechnology, smart textiles, and digital printing are reshaping product development and customization. Increasing regulatory pressures and consumer demand for eco-friendly processes are driving research toward low-impact chemicals. Additionally, strategic partnerships, mergers, and technological collaborations enhance market competitiveness, enabling manufacturers to address evolving fashion and performance requirements with advanced, versatile chemical solutions. Similar trends can be observed in the Global

Textile Machinery Market, where automation, sustainability, and smart manufacturing are transforming textile production at scale.

Textile Chemicals Market: Key Takeaways

- Market Growth: The Global Textile Chemical Market is anticipated to expand by USD 279.0 million, achieving a CAGR of 5.0% from 2026 to 2034.

- Product Type Analysis: Coating and sizing agents are expected to dominate the textile chemicals market, with the highest revenue share of 53.2% by the end of 2025.

- Location Analysis: Synthetic fibers are predicted to dominate in the textile chemicals market, with the highest revenue share by the end of 2025.

- Process Analysis: Coating processes are expected to dominate the global textile chemicals market with the highest revenue share in 2025.

- Application Analysis: Apparel is likely to lead in the global textile chemicals market with the highest revenue share of 46.2% by the end of 2025

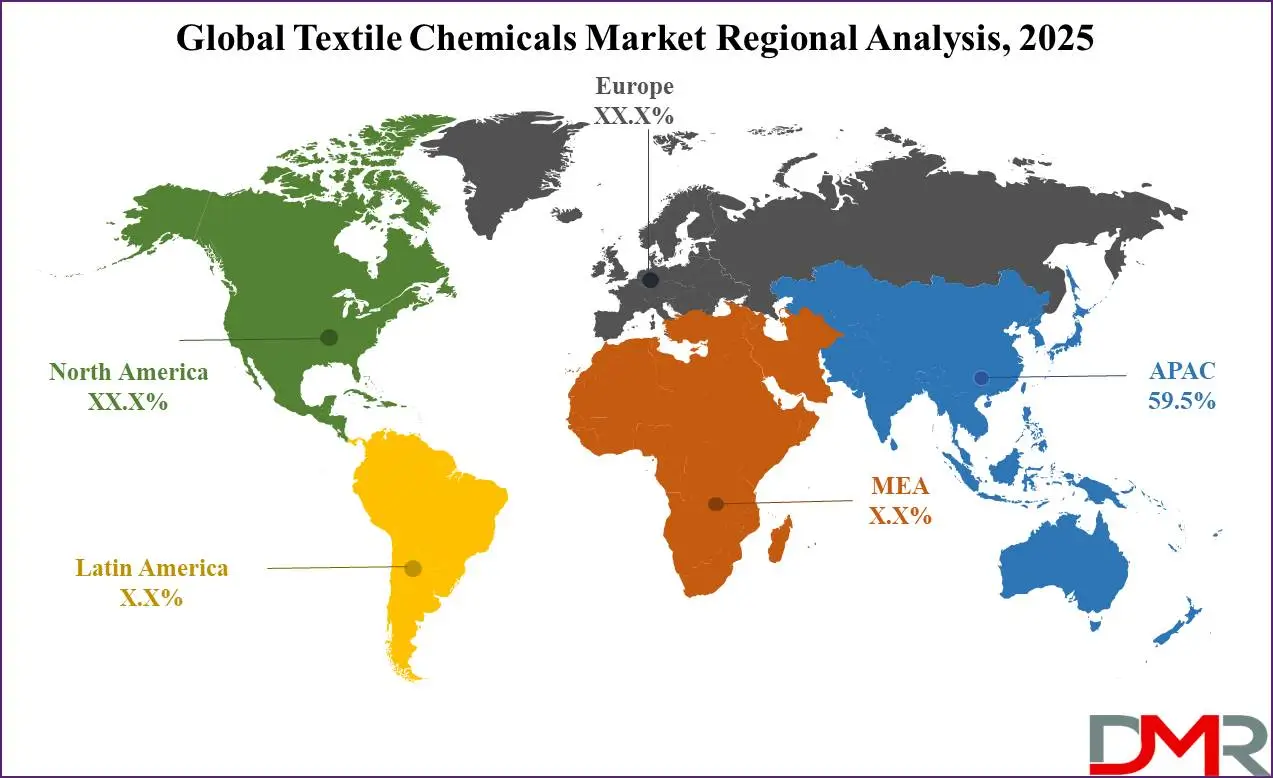

- Regional Analysis: Asia Pacific is predicted to lead the global textile chemical Market with a revenue share of 59.5% in 2025.

- Prominent Players: Some of the major key players in the Global Textile Chemicals Market are BASF SE, BioTex Malaysia, Dow, and many others.

Textile Chemicals Market: Use Cases

- Pre-treatment and Cleaning: Chemicals such as scouring agents and bleaches remove natural impurities, waxes, and oils from raw fibers. This essential pre-treatment improves the fabric's ability to absorb dyes evenly and ensures a higher-quality final product.

- Dyeing and Coloration: Specialized dyeing chemicals, including dyes, mordants, and auxiliaries, to help bond colors to fibers. They ensure vibrant, uniform, and long-lasting coloration across a range of textile materials.

- Printing: Printing chemicals are used to apply specific designs or patterns onto fabrics. They work in tandem with inks and pigments to enhance color fixation, providing precision and durability in textile prints.

- Finishing Treatments: Finishing agents are employed to impart desired properties such as softness, wrinkle resistance, water repellency, and flame retardancy. These treatments enhance both the performance and aesthetic appeal of textiles.

Textile Chemicals Market: Stats & Facts

- In February 2024, the Government of India (GoI) announced a total budget allocation of more than INR 1000 crore, an increase of nearly 27.6%, mainly due to the allocation of INR 600 crore for the Cotton Corporation of India. Such government initiatives and expansion drive the demand for the product to meet production needs.

- “According to IBEF, India emerged as the second largest exporter of textiles. The Indian textile market was valued at USD 197.2 billion in 2023, with exports worth USD 36.68 billion in 2023.”

Textile Chemicals Market: Market Dynamic

Driving Factors in the Textile Chemicals Market

Increased Consumer Spending in the Fashion IndustryThe fashion industry has seen remarkable expansion driven by increased consumer spending and shifting lifestyle preferences. Rising disposable incomes and new fashion trends have encouraged investments in premium clothing, accessories, and designs with cutting-edge aesthetics. As consumers increasingly prioritize quality, sustainability, and aesthetics over quantity, demand for specialty textile chemicals has skyrocketed. These chemicals improve fabric performance, such as color retention and durability, to meet stringent quality standards. Online retail and global brand expansion fuel this trend, providing chemical suppliers with new opportunities. Therefore, textile chemicals markets around the globe benefit from diverse product applications that build customer loyalty while supporting market expansion.

Increasing Demand for Furnishing and Modern Home Decor Items

Rising demand for furnishing and modern home decor items has dramatically transformed the textile chemicals market. Modern consumers seek products that combine functionality with sophisticated aesthetics, driving innovation in fabric treatments and finishing. Manufacturers rely heavily on advanced textile chemicals for creating desired textures, colors, and durability in upholstery fabrics for upholstery pieces, curtains, decorative fabric upholstery designs, curtains, and drapery products - this trend fueled by rapid urbanization, shifting interior design trends, and personalized living spaces. Chemical suppliers invest heavily in research and development efforts that produce eco-friendly yet high-performance solutions, meeting both aesthetic and technical home decor market requirements globally - thus meeting customer demand steadily as demand surges worldwide.

Restraints in the Textile Chemicals Market

Adverse Environmental and Human Health Implications

The synthetic dyes that fail to fix onto textiles often enter wastewater, creating a pollution problem. Approximately 10–15% of these dyes are lost, resulting in highly colored effluent that compromises water quality, disrupts photosynthesis, and threatens aquatic life. This polluted discharge is among the most challenging wastes across various industries. Additionally, toxic substances from synthetic dyes can contaminate soil, air, and water, posing hazards for ecosystems and human populations. Prolonged exposure or contact with these chemicals can lead to skin irritation, allergies, or even severe health disorders. Thus, environmental and health concerns remain major constraints in the textile chemicals market.

Impact of the Cyclic Nature of the Textile Industry

Fluctuating economic cycles create substantial volatility in textile-related markets. As textiles are heavily influenced by changing capital market conditions, their stock values often experience wider swings than larger benchmark indices. This cyclical behavior can significantly reduce stability for manufacturers and prospective investors alike. Moreover, the sector depends on raw materials linked to crude oil, making it vulnerable to shifts in petroleum prices. Similarly, variations in cotton costs add pressure to profit margins. As raw material expenses rise, textile production costs increase, ultimately impacting final product prices. Such financial fluctuations pose significant challenges for participants in the global textile chemicals market.

Opportunities in the Textile Chemicals Market

Rising Adoption of Bio-Based and Low-VOC Ingredients

Due to environmental pressure and regulation, textile production presently utilizes low volatile organic compound (VOC) and biodegradable components and, less in terms of emissions, and also fewer ecological prints. This trend suggests how textile manufacturers are determined to lessen the emissions and less ecological prints. The manufacturers are investing in eco-friendly components from nature to lessen the use of petrochemicals and increase air quality, employee protection, and sustainability, and also to please the demand from the consumer side to use greener products. Green innovations enhance quality and longevity and induce market growth and competitive advantage in the textile and chemical industries. Harmonizing the practices in the company to global environmental objectives and sustainable development, the trend encourages market growth.

Production of Non-Hazardous Textile Chemicals

Non-hazardous textile chemicals are the tools required to attain compliance with environmental regulations by the manufacturers and also to safeguard the workers. This demand in the market promotes the invention of less toxic, eco-friendly formulations by the use of less toxic chemicals in place of toxic chemicals, minimizing health risks and environmental pollution, and adhering to stringent regulations. The investments in such technologies by the industries ensure they attain the benefit of a good corporate image and market differentiation from the investments. Green chemistry developments and stern safety mechanisms are the cornerstones of product formulation, making efficient textile manufacture also eco-friendly. Transitions from toxic chemicals to less toxic chemicals ensured healthier practices in the industries and helped in the long-term environmental sustainability in the world.

Trends in the Textile Chemicals Market

Adopting Sustainable Products in Textile Manufacturing

Due to increasingly stringent environmental regulations and rising commitments towards sustainability practices, textile and chemical manufacturers are turning towards eco-friendly alternatives in response to environmental pressures and an ever-increasing emphasis on sustainability practices. Colorifix recently joined forces with major players like Switzerland's Forster Rohner and India's Arvind to test industrial-scale biological dye trials; Croda International introduced 100% bio-based surfactants as 100% renewable alternatives in 2018. As developed economies adopt stringent environmental standards while developing economies set ambitious sustainability goals, green textile chemicals appear primed for significant growth across mature economies as both developed nations implement rigorous standards while emerging economies set ambitious sustainability goals - setting off significant expansion across mature and developing economies alike.

Circular Economy and Textile Recycling

Another significant trend shaping the textile industry is a shift toward circular economy practices. Manufacturers are increasingly implementing recycling and upcycling practices into their operations to minimize waste while optimizing resource usage efficiency. By recycling post-consumer and pre-consumer textile waste into new raw materials, companies not only minimize their environmental footprint but also decrease dependence on virgin resources - leading to cost savings, innovative product designs, as well as global sustainability initiatives being met more easily - marking an amazing shift in how textiles are produced and consumed today.

Textile Chemicals Market: Research Scope and Analysis

By Product Type

Coating and sizing agents are expected to dominate the textile chemicals market with the highest revenue share of 53.2% by the end of 2025 because they play such an integral part in optimizing fabric performance and meeting consumer expectations. Due to an increasing consumer desire for textiles with stain-resistant fabric properties such as stain resistance, wrinkle-free properties, enhanced comfort features such as stain repellency and enhanced stain protection, manufacturers utilizing coating & sizing agents have led to their use, among others, for manufacturing processes ranging from fashion apparel production lines through industrial applications; these agents improve key physical properties including strength durability abrasion resistance water repellency making them suitable fabrics suitable for fashion applications as well as industrial uses alike - further underscoring their place among textile chemicals producers worldwide!

Finishing agents, widely recognized for improving fabric feel and performance, are expected to become one of the dominant segments within textile chemicals worldwide. Their use can improve softness, smoothness, drape quality, and elasticity, as well as provide functional finishes such as water repellency, stain resistance, and flame retardancy, all generating significant market demand across various applications.

By Fiber Type

Synthetic fibers are predicted to dominate the textile chemicals market with the highest revenue share by the end of 2025. Synthetic fibers, including polyester, nylon, and acrylic fibers, are expected to dominate the global textile chemicals market over the coming years. Their superior characteristics, such as durability, strength, and moisture resistance, make them suitable for various textile applications that demand durability, strength, and moisture resistance in fibers; furthermore, they require specialty chemicals like dyes, pigments lubricants, softeners to process and finish, fuelling demand for textile chemicals further still. Their versatility and performance characteristics make synthetics popular choices within textile manufacturing industries, helping lead them to their predicted dominance within textile chemicals markets worldwide.

Natural fibers such as cotton and wool, which are biodegradable and renewable resources, will likely emerge as one of the top two segments in the textile chemicals market over the coming decade. Unfortunately, however, intensive chemical treatments during processing are often necessary to attain desirable properties; this could subsequently impact overall market shares as opposed to synthetic alternatives.

By Process

Coating processes are expected to dominate the global textile chemicals market with the highest revenue share in 2025 due to their unique capability of adding functionalities beyond conventional treatments. By coating textiles with coatings, textiles gain enhanced properties such as anti-piling protection, waterproofing, and water repellency that make them suitable for high-performance textile applications and smart textile solutions. Coatings offer precise customization to meet diverse consumer demands while simultaneously encouraging innovation. Their flexibility in adding value and functionality creates greater efficiency, durability, and overall market competitiveness while increasing revenue benefits and technological advances continue to establish them as market leaders, guaranteeing long-term industry expansion.

Pretreatment - which includes processes like de-sizing, scouring, and bleaching - is expected to become the second dominant segment due to its vital function of prepping textiles for further processing. Proper pretreatment removes impurities while increasing dye affinity and adhesion for coating applications for improved overall production efficiency and cost efficiency.

By Application

Apparel is likely to lead in the global textile chemicals market with the highest revenue share of 46.2% by the end of 2025 due to a rapidly expanding global population, increased disposable incomes, and shifting consumer tastes towards fashionable yet high-performance garments. E-commerce has broadened apparel brands' reach, driving rapid expansion. Meanwhile, advances in materials and finishing processes are continuously improving fabric quality, durability, and comfort - driving demand for specialty chemicals. Fast fashion trends contribute to shorter product lifespans, leading to faster production rates and, thus, an increase in chemical use. Furthermore, as sustainability gains more ground among apparel segments worldwide, eco-friendly chemicals with reduced environmental impact further propel apparel segment growth.

Technical textile chemicals are experiencing increasing demand due to various factors. Technical textiles differ from apparel in that they're tailored for specific uses across sectors like automotive, construction, healthcare, and industry - like automotive seat covers or hospital blankets, for instance - needing chemical treatments such as strength enhancement for strength durability flame resistance water repellency antimicrobial performance as well as special treatments designed specifically to meet strict regulatory standards while offering exceptional functionality. With so much attention being focused on sustainable high-performance materials today, textile chemicals that fulfill those strict regulatory standards while offering exceptional functionality continue being innovated upon.

The Global Textile Chemicals Market Report is segmented based on the following

By Product Type

- Coating & Sizing Agents

- Colorants & Auxiliaries

- Finishing Agents

- Surfactants

- Desizing Agents

- Bleaching Agents

- Others

By Fiber Type

- Natural Fiber

- Synthetic Fiber

By Process

- Coating

- Anti-Piling

- Protection

- Water Proofing

- Water Repellant

- Others

- Pretreatment

- Bleaching Agents

- Desizing Agents

- Scouring Agents

- Others

- Treatment Of Finished Products

- Softening

- Stiffening

- Others

By Application

- Apparel

- Technical Textile

- Home Textile

- Others

Regional Analysis

Region with the largest Share

Asia Pacific is predicted to dominate the textile chemicals market with the highest revenue

share of 59.5% in 2025 due to its status as the epicenter of global textile manufacturing. Countries such as China, India, Bangladesh, and Vietnam offer robust infrastructure, lower production costs, and abundant raw materials. The region’s vast labor force drives high-volume production, increasing demand for chemicals used in dyeing, printing, finishing, and treating textiles. Supportive government policies and continuous technological advancements further enhance its competitive edge. With major exporters like China ensuring consistent output, the region benefits from economies of scale and diversified production, guaranteeing a clear dominant share in the textile chemicals market worldwide.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with Highest CAGR

Europe is experiencing the highest CAGR in the textile chemicals market due to its emphasis on technological innovation and sustainability. The region’s mature textile industry is increasingly investing in advanced chemical formulations to meet strict environmental regulations and consumer demands for eco-friendly products. High R&D investments and strategic collaborations between chemical manufacturers and textile producers foster innovation. Moreover, Europe’s focus on quality, efficiency, and sustainable practices drives demand for specialized chemicals in dyeing, printing, and finishing processes.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global textile chemicals market is highly competitive, featuring a mix of multinational corporations and regional players. Major companies, including BASF, Huntsman, DyStar, Clariant, and Archroma, drive innovation and expansion through R&D investments and strategic mergers and acquisitions. These industry leaders focus on sustainable and eco-friendly chemical solutions to address stringent environmental regulations. Price competitiveness, product differentiation, and technological advancements are critical factors. Companies are targeting emerging markets for growth and diversifying portfolios to cater to varying textile segments.

Some of the prominent players in the global Textile Chemicals are

- AB Enzymes

- Archroma

- BASF SE

- BioTex Malaysia

- Dow

- Ethox Chemicals, LLC

- Evonik Industries AG.

- Fibro Chem, LLC

- German Chemicals Ltd.

- Govi N.V.

- Huntsman International LLC

- Other Key Players

Recent Developments

- In January 2024, Devan Chemicals, a provider of sustainable textile finishes, is excited to announce its upcoming participation in Heimtextil 2024. Devan invites attendees to visit their booth in Hall 11.0, booth A21, to experience firsthand the latest sustainable textile finishes they have developed.

- In April 2024, BASF SE announced its portfolio of polyamides for the textile industry. The company’s sustainable polyamide PA6 and PA6.6 product range have been certified under the Recycled Claim Standard (RCS) for textile applications. This certification allows BASF SE to market textiles produced using recycled raw materials.

- In May 2023, Dystar announced its eco-advanced indigo dyeing, which aims to reduce energy consumption by up to 30% and water usage by up to 90% during the production process.

- In November 2023, Solvay introduced a textile fiber that decomposes rapidly in the oceans, minimizing the environmental impact of microplastics. The new textile polyamide, set to be manufactured at the company's industrial facility in Brazil, will decrease oceanic impact by roughly 40 times compared to traditional fibers.

- In August 2022, Archroma entered into a definitive agreement with Huntsman Corporation to purchase Textile Effect business from IIT. The transaction, subject to regulatory approvals, is expected to be concluded by H1-2023. This acquisition shall enable Archroma to create a range of chemical solutions required by the textile industry.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 32.9 Bn |

| Forecast Value (2034) |

USD 51.0 Bn |

| CAGR (2025-2034) |

5.0% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 7.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Coating & Sizing Agents, Colorants & Auxiliaries, Finishing Agents, Surfactants, Desizing Agents, Bleaching Agents, and Others), By Fiber Type (Natural Fiber, and Synthetic Fiber), By Process (Coating, Pretreatment, and Treatment Of Finished Products), By Application (Apparel, Technical Textile, Home Textile, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

AB Enzymes, Archroma, BASF SE, BioTex Malaysia, Dow, Ethox Chemicals, LLC., Evonik Industries AG., Fibro Chem, LLC, German Chemicals Ltd., Govi N.V., Huntsman International LLC. and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Textile Chemicals Market?

▾ The Global Textile Chemicals Market size is estimated to have a value of USD 32.9 billion in 2025 and is expected to reach USD 51.0 billion by the end of 2033.

Which region accounted for the largest Global Textile Chemicals Market?

▾ Asia Pacific is expected to be the largest market share for the Global Textile Chemicals Market, with a share of about 59.5% in 2025.

Who are the key players in the Global Textile Chemicals Market?

▾ Some of the major key players in the Global Textile Chemicals Market are BASF SE, BioTex Malaysia, Dow, and many others.

What is the growth rate in the Global Textile Chemicals Market?

▾ The market is growing at a CAGR of 5.0 percent over the forecasted period.

How big is the US Textile Chemicals Market?

▾ The US Textile Chemicals Market size is estimated to have a value of USD 7.8 billion in 2025 and is expected to reach USD 11.8 billion by the end of 2034.