Market Overview

The

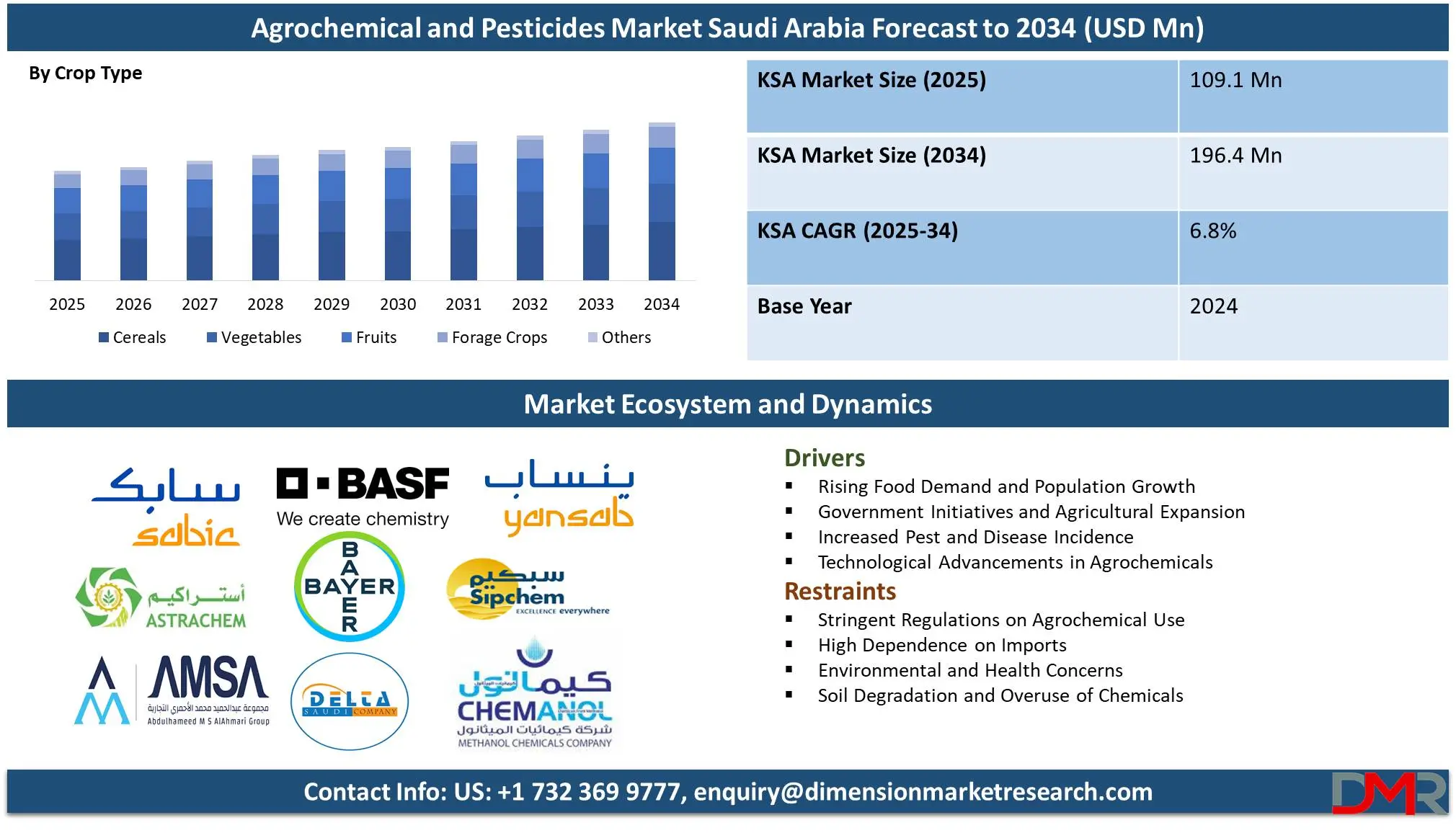

Kingdom of Saudi Arabia's Agrochemical and Pesticides Market is expected to be valued at

USD 109.1 million in 2025, and it is further anticipated to reach a market value of

USD 196.4 million by 2034 at a

CAGR of 6.8%.

The Kingdom of Saudi Arabian market for agrochemicals and pesticides includes various chemical products designed to increase agricultural productivity by improving soil fertility and protecting against pests, diseases, or weeds. This market comprises fertilizers that supply essential nutrients to crops and pesticides that act as crop protectors, such as herbicides, insecticides, and fungicides.

As Egypt is known for its arid climate and limited arable land, agrochemicals play a critical role in maintaining sustainable agricultural output, and food security, and meeting the demands of a growing population. Market shares for local production and imports vary, as advanced agriculture technology helps maximize yields even under challenging environmental conditions. This aligns with broader developments in the

Agrochemical Market regionally, including integration with The Kingdom of Saudi Arabia (KSA) Artificial Intelligence (AI) Market for smarter applications.

Saudi Arabia has actively encouraged agricultural development with policies and investments designed to bolster local production while decreasing dependence on imported foods. Their Vision 2030 initiative includes strategies designed to modernize agriculture, encourage sustainable farming practices, and enhance water management techniques. Biofertilizers, organic pesticides, and precision farming techniques are now widely adopted solutions among companies operating within this sector as demand continues, they focus on research and development efforts for eco-friendly solutions that comply with global sustainability standards while improving agricultural efficiency simultaneously.

Climate change, soil degradation, and water scarcity all play a significant role in driving Saudi agrochemical and pesticide market growth. Irrigation and greenhouse farming require specialist agrochemicals to maximize yields in controlled environments while the introduction of precision agriculture techniques (drones with AI-powered monitoring systems) ensures efficient application while simultaneously minimizing their environmental impact. Although Saudi Arabian agriculture continues to experience rapid expansion, its market still faces hurdles such as stringent regulations on chemical usage, environmental concerns, and rising consumer preference for organic produce.

Strict government policies seek to regulate the sale and application of agrochemicals to avoid overuse or contamination of soil and water resources. Rising awareness about health risks related to synthetic pesticides has sparked a gradual move away from synthetic options towards organic or biological alternatives.

Companies will need to find sustainable and innovative ways of meeting these demands while simultaneously remaining productively profitable within Saudi Arabia's dynamic agricultural landscape. As these shifts occur, synergies with

The Kingdom of Saudi Arabia (KSA) Cloud Computing Market become increasingly important, with data-driven farming tools enhancing decision-making.

The Kingdom of Saudi Arabia Agrochemical and Pesticides Market: Key Takeaways

- Market Value: The global crop protection chemicals market size is expected to reach a value of USD 196.4 million by 2034 from a base value of USD 109.1 million in 2025 at a CAGR of 6.8%.

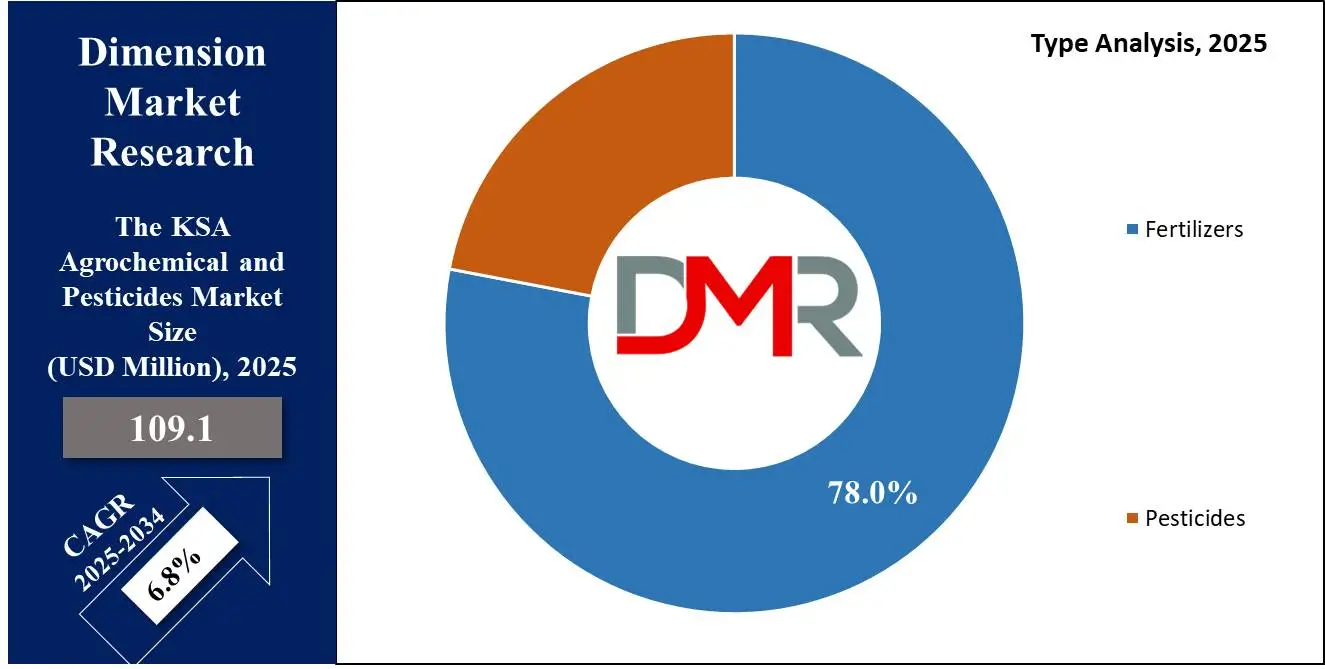

- By Type Segment Analysis: Fertilizers are anticipated to lead in the type segment, capturing 78.0% of the market share in 2025.

- By Crop Type Segment Analysis: Cereals are poised to consolidate their market position in the crop type segment capturing 43.0% of the total market share in 2025.

- Key Players: Some key players in the Saudi Arabia agrochemical and pesticides market are Saudi Basic Industries Corporation (SABIC), Astra Industrial Group (AstraChem), Alahmari Group, BASF SE, BAYER AG, Saudi Delta Company for Chemical Industries, Yanbu National Petrochemical Company (YANSAB), Sahara International Petrochemical Company (Sipchem), Methanol Chemicals Company, and Other Key Players.

The Kingdom of Saudi Arabia Agrochemical and Pesticides Market: Use Cases

- Enhancing Crop Yield and Quality: Agrochemicals such as fertilizers and pesticides are extensively used in Saudi Arabia to boost crop yield and improve quality, particularly for staple crops like wheat, barley, and dates. Given the country’s arid climate and nutrient-deficient soil, fertilizers help replenish essential nutrients, while pesticides protect crops from insects, weeds, and fungal infections. This ensures higher productivity and better-quality produce, supporting the country’s food security goals.

- Greenhouse and Controlled Environment Agriculture: With limited arable land and extreme weather conditions, greenhouse farming is a popular method in Saudi Arabia. Agrochemicals play a crucial role in this system by maintaining optimal soil conditions and protecting crops from pests in enclosed spaces. The use of specialized fertilizers and bio-pesticides in greenhouses ensures that vegetables, fruits, and herbs grow efficiently with minimal water usage, making agriculture more sustainable and productive.

- Pest and Disease Management in Date Palm Cultivation: Date palms are one of Saudi Arabia’s most important agricultural products, and they are highly susceptible to pests like red palm weevils and fungal diseases. The use of targeted insecticides and fungicides is essential to protect these trees from infestations that can cause significant yield losses. Integrated pest management (IPM) programs, which combine chemical and biological solutions, are widely used to ensure sustainable date production while minimizing environmental impact.

- Precision Agriculture and Smart Farming Applications: Modern agrochemical applications in Saudi Arabia are increasingly integrated with precision farming techniques, including drone-based pesticide spraying and AI-driven soil analysis. These technologies enable farmers to apply fertilizers and pesticides more efficiently, reducing waste and environmental damage. By using data-driven insights, farmers can optimize agrochemical usage, lower costs, and maximize output, making agriculture more efficient and sustainable. These technological synergies mirror innovations seen in The Kingdom of Saudi Arabia (KSA) Artificial Intelligence (AI) Market.

The Kingdom of Saudi Arabia Agrochemical and Pesticides Market: Stats & Facts

- The Ministry of Environment, Water, and Agriculture (MEWA) has updated the regulations governing the licensing of activities related to the extraction and distribution of non-potable water. These updated guidelines aim to conserve water resources and ensure their sustainable management, which is crucial for agricultural practices that rely on such water sources.

- The Ministry of Environment, Water, and Agriculture (MEWA) offers the Naama portal, a unified electronic services platform providing access to various services and data across sectors such as environment, water, agriculture, livestock, land, and fisheries.

- The General Authority for Statistics (GASTAT) publishes comprehensive agricultural statistics, including data on crop production, livestock, and fisheries. The 2023 Agricultural Statistics Bulletin reported that local vegetable production accounted for 80.6% of the total vegetable supply in the Saudi Arabian Kingdom, while local fruit production constituted 63.7% of the total fruit supply.

- In October 2021, MEWA reported the first detection of the fall armyworm (Spodoptera frugiperda) in maize crops within the country, highlighting the ongoing challenges posed by agricultural pests.

The Kingdom of Saudi Arabia Agrochemical and Pesticides: Market Dynamic

The Kingdom of Saudi Arabia Agrochemical and Pesticides: Driving Factors

Government Initiatives and Agricultural Development ProgramsOne key driver behind the increase in agrochemicals and pesticide market growth is governmental programs designed to ensure food security in an arid region with limited arable land. For example, subsidizing fertilizers, pesticides, and other essential agrochemicals makes them more accessible for local farmers while encouraging the use of advanced inputs which helps increase crop productivity and self-sufficiency.

As well as financial assistance, the government is also introducing stringent regulations to improve the quality and safety of agrochemicals on the market. Both the Saudi Food and Drug Authority (SFDA) and MEWA have implemented policies regulating pesticide imports to ensure only environmentally safe products reach store shelves. This shift has seen an increased demand for bio-based and low-toxicity pesticides that align with global sustainability trends, and these regulations also encourage multinational agrochemical companies to invest in research and development for innovative solutions designed specifically for Saudi Arabia's climate conditions.

Technological Advancements in Agrochemicals

Nanotechnology-based fertilizers, slow-release pesticides, and bio-pesticides are transforming how farmers manage crop protection and soil nutrition. Advanced formulations help improve nutrient absorption while decreasing chemical runoff. They extend pesticide effectiveness further making large-scale agricultural operations more sustainable and cost-effective. Precision agriculture represents another significant technological shift, employing satellite imaging, drones, and AI-powered analytics to optimize pesticide and fertilizer applications.

By enabling farmers to apply chemicals only where needed, these technologies reduce waste while simultaneously lowering costs and environmental damage. Companies are also offering specific agrochemical blends for Saudi soil types and climatic conditions to guarantee maximum output with minimum input use. Government and private sectors are turning to biotechnology-based pest control solutions such as genetically modified (GM) crops resistant to pests and diseases as a means of mitigating synthetic pesticide use while still maintaining crop productivity.

The Kingdom of Saudi Arabia Agrochemical and Pesticides: Restraints

Water Scarcity and Dependence on Desalination

One of the key impediments to Saudi Arabia's agrochemicals and pesticides market is extreme water scarcity, which negatively impacts agricultural activities. With less than one percent of land being arable and an annual rainfall average of only 59.3 mm, farmers struggle to produce large-scale crops without significant water management solutions. Irrigation-dependent farming limits effectiveness as inadequate supply can reduce absorption rates for fertilizers and pesticides.

Saudi Arabia relies on desalination and groundwater extraction as means to address water shortages, both of which carry high operational costs. Excessive desalinated water use in agriculture increases soil salinity over time, which compromises soil health and lowers crop yields. Further, decreased efficiency of agrochemicals such as fertilizers may not function optimally due to altered microbiology in soil, while pesticides may no longer function effectively due to altered microbiology in the groundwater table. Government policies encouraging water conservation limit excessive water usage in farming, which in turn can curb pesticide and fertilizer applications.

Stringent Regulations and Import Dependence

Saudi Arabia's agrochemicals and pesticides market faces numerous hurdles due to strict government regulations and an overreliance on imported agrochemicals. The Saudi Food and Drug Authority (SFDA) and the Ministry of Environment, Water, and Agriculture (MEWA) have implemented stringent policies regarding the sale, distribution, and application of pesticides that can become an impediment to market players. Due to concerns over toxicity, environmental impact, and human health risks, many commonly used pesticides have now been banned or restricted.

The Saudi government has aligned its policies with global standards such as FAO (Food and Agriculture Organization) and WHO (World Health Organization), which limit certain chemical pesticide usage forcing farmers and suppliers to opt for more expensive, eco-friendly solutions and ultimately driving up production costs. Saudi Arabia relies on imports for most of its agrochemicals, leaving its market vulnerable to global supply chain disruptions, currency fluctuations, and trade restrictions.

The Kingdom of Saudi Arabia Agrochemical and Pesticides: Opportunities

Rising Demand for Bio-Based Agrochemicals

With increasing pressure from government regulatory bodies for more environmentally sustainable agriculture practices, farmers and agribusinesses are switching toward eco-friendly fertilizers, biopesticides, and organic crop protection solutions, creating an immense market for biological alternatives to conventional ones. Vision 2030 initiatives designed to advance organic farming and sustainable agriculture provide strong policy support for bio-based agrochemicals' expansion in Saudi Arabia. Programs like the Saudi Organic Farming Initiative provide financial incentives and subsidies to farmers adopting organic practices, directly increasing demand for natural pesticides and biofertilizers.

Furthermore, growing consumer preferences toward chemical-free food products have encouraged large farms to transition towards more sustainable methods, fuelling demand for bio-based inputs. Biotechnology and microbial formulation innovations are driving growth in this sector, with companies developing plant-based pesticides, inoculants, and enzyme-based fertilizers to enhance soil health while managing pests and diseases effectively.

Expansion of Precision Agriculture and Smart Farming Technologies

Drones and sensor-based spraying systems are revolutionizing how pesticides and fertilizers are applied in Saudi farms, using precise GPS-guided pesticide spraying drones that ensure precise application while simultaneously reducing chemical wastage and improving crop protection. Furthermore, this innovation opens up opportunities for agrochemical companies to create customized high-efficiency formulations designed specifically for automated and targeted use, leading to a higher demand for premium solutions.

Data-driven soil and crop health monitoring systems are helping farmers optimize their agrochemical usage by offering real-time insights on nutrient deficiencies, pest infestations, and soil conditions. Companies investing in smart agrochemical products such as controlled-release fertilizers and sensor-responsive pesticides stand to gain an advantage in the market. Saudi Arabia's investments in AgriTech startups and partnerships with global agribusiness firms are creating innovative precision agriculture solutions. AI-powered decision support systems for pesticide and fertilizer application will not only increase efficiency but also drive the adoption of specialty agrochemicals for high-tech farming environments.

The Kingdom of Saudi Arabia Agrochemical and Pesticides: Trends

Adoption of Integrated Pest Management (IPM) and Sustainable Pest Control Solutions

Due to concerns over excessive pesticide use, soil degradation, and chemical residues in food, both governments and agricultural sectors are adopting sustainable pest control solutions such as biological control agents, crop rotation techniques, pest-resistant crop varieties, and precision application techniques that reduce synthetic pesticide reliance while effectively controlling pests sustainably.

IPM relies on biological controls such as crop rotations or biological control agents while precision application techniques help manage pests more effectively and sustainably. MEWA and SFDA in Saudi Arabia have taken proactive steps to promote IPM practices through awareness programs, farmer training sessions, and policy incentives. Their efforts encourage responsible pesticide use as well as eco-friendly alternatives like biopesticides and microbial solutions. Consequently, agrochemical companies have increasingly invested in hybrid pest management products that combine chemicals with biological agents for low-residue solutions with minimal environmental impacts.

Localization of Agrochemical Production and Supply Chain Optimization

Saudi Arabian agrochemical and pesticide markets have witnessed a notable shift towards local manufacturing and supply chain optimization. In the past, imports of fertilizers, pesticides, and crop protection chemicals had become heavily reliant on foreign suppliers, leaving their markets susceptible to global supply chain disruptions, currency fluctuations, or trade restrictions. Saudi Arabia is now seeing an upsurge in agrochemical companies setting up manufacturing facilities within its borders to meet local demand while simultaneously cutting transportation costs and improving supply reliability.

Furthermore, investment incentives, tax breaks, and subsidies are being offered by both international and domestic firms to establish regional production hubs. Additionally, companies are placing increasing emphasis on logistics and distribution networks to ensure the timely availability of agrochemicals across the country.

The Kingdom of Saudi Arabia Agrochemical and Pesticides Market: Research Scope and Analysis

By Type

Fertilizers are expected to dominate the Saudi Arabian agrochemical market, accounting for 78.0% of the total share in 2025. This high demand is driven primarily by the need to increase agricultural productivity in areas where natural soil fertility does not support large-scale crop production. Saudi Arabia relies heavily on irrigation-based farming, integrated with limited arable land, making fertilizer application essential to improving soil quality and increasing yields.

Additionally, controlled-environment agriculture (CEA), including hydroponic and greenhouse farming, has become more prevalent and requires specific nutrient formulations to maximize plant growth. Slow-release, water-soluble, micronutrient-enriched fertilizers are helping Saudi Arabia expand their market, as these advanced formulations provide enhanced nutrient absorption, reduce wastefulness, and foster long-term soil health benefits.

Pesticide demand has steadily been on the rise due to the need for effective crop protection against pests, diseases, and environmental stressors. Commercial and greenhouse farming has increased the susceptibility of high-value crops to infestation, necessitating the use of synthetic and bio-based pesticides as preventives against infestation. Climate variability, rising temperatures, and irregular rainfall patterns have all combined to fuel an explosion of pest populations and crop damage.

Saudi Arabia's efforts to expand fruit and vegetable exports have also spurred pesticide usage, as producers must adhere to stringent food safety and quality standards that mandate advanced crop protection measures. As consumers demand more organic produce without chemical residues, the market is witnessing a shift towards biological pesticides and Integrated Pest Management (IPM) techniques which combine multiple approaches for insect control.

By Crop Type

Cereals are projected to dominate the Saudi Arabian agrochemical and pesticides market, accounting for 43.0% of the total market share in 2025. This domination can be directly attributed to Saudi Arabia's strategic focus on staple crop production for increased food security and reduced import dependency. Cereals like wheat, barley, and sorghum form the cornerstone of Saudi Arabian diets, therefore the government continues to promote their cultivation through incentive programs, financial subsidies, and technological advancements in farming practices.

Mechanized and precision farming techniques have increased productivity in Saudi Arabia, with agrochemicals playing a critical role in maintaining soil fertility, warding off disease outbreaks, and optimizing crop growth. Furthermore, limited water resources and climate conditions limit cultivation options for cereal varieties that resist drought conditions being developed.

The demand for vegetables is experiencing significant growth due to evolving consumer dietary preferences, increasing urbanization, and rising investments in greenhouse and hydroponic farming. Consumer health awareness has led to increased consumption of fresh, organic, and locally sourced vegetables like tomatoes, cucumbers, bell peppers, and leafy greens.

Vegetable farming differs significantly from cereal farming, as it requires intensive pest and disease management, necessitating bio-pesticides, organic fertilizers, and nutrient-rich soil amendments for success. Another factor is the growing focus on vertical farming and greenhouse agriculture which use minimal water resources and resources. Modern farming systems utilize sophisticated agrochemical products, including soluble fertilizers, micronutrient formulations, and controlled-release pesticides, to achieve consistent quality and high yields.

The Kingdom of Saudi Arabia Agrochemical and Pesticides Market Report is segmented on the basis of the following

By Type

- Fertilizers

- Pesticides

- Fungicides

- Herbicides

- Insecticides

- Others

By Crop Type

- Cereals

- Vegetables

- Fruits

- Forage Crops

- Others

The Kingdom of Saudi Arabia Agrochemical and Pesticides Market: Competitive Landscape

Saudi Arabia's agrochemicals and pesticides market is highly competitive, featuring both global agrochemical companies as well as regional manufacturers vying for market share. An increased focus on agricultural productivity, food security, and sustainable farming has created high competition between manufacturers. Companies have responded with product innovations, strategic collaborations, and local production capabilities plans to stay competitive in this market. Market players differentiate their product portfolios through advanced formulations, biological alternatives, or precision agriculture technologies within their product segments. International corporations like BASF SE, Bayer AG, Syngenta AG, Corteva Agriscience, and FMC Corporation exert their dominance in the Saudi Arabian agrochemical and pesticides market.

These global leaders leverage their superior research and development (R&D) capabilities, diverse product offerings, and well-established distribution networks. Their fertilizers, pesticides, and crop protection solutions meet the evolving needs of commercial farmers, greenhouse cultivators, and hydroponic growers. Furthermore, these firms often partner with local distributors for regulatory compliance and optimized supply chain operations within Saudi Arabia.

Regional and local manufacturers have also gained ground as the Saudi government endeavors to reduce import dependency and improve market resilience through domestic production of agrochemicals. Companies such as Saudi Basic Industries Corporation (SABIC) and Gulf Advanced Chemicals have expanded their product lines with customized fertilizers, region-specific pesticides, and eco-friendly crop protection solutions.

Some of the prominent players in the Kingdom of Saudi Arabia agrochemical and pesticides are

- Saudi Basic Industries Corporation (SABIC)

- Astra Industrial Group (AstraChem)

- Alahmari Group

- BASF SE

- BAYER AG

- Syngenta AG

- Saudi Delta Company for Chemical Industries

- Corteva Agriscience

- Yanbu National Petrochemical Company (YANSAB)

- Sahara International Petrochemical Company (Sipchem)

- Methanol Chemicals Company

- FMC Corporation

- Other Key Players

The Kingdom of Saudi Arabia Agrochemical and Pesticides Market: Recent Developments

- February 2025: SALIC agreed to purchase an additional 44.58% stake in Olam Agri for USD 1.78 billion, increasing its total ownership to 80.01% and valuing the company at USD 4.0 billion. This acquisition provides Saudi Arabia with direct access to Olam Agri's extensive sourcing and logistics networks across Asia, Africa, and the Middle East, aligning with the Kingdom's economic diversification and food security objectives.

- December 2022: The Saudi Agricultural and Livestock Investment Company (SALIC), a subsidiary of Saudi Arabia's sovereign wealth fund, acquired a 35.43% stake in Singapore-based Olam Agri for USD 1.24 billion, valuing the company at USD 3.5 billion. This investment aimed to secure critical agricultural supply chains and reduce the nation's reliance on imports, as Saudi Arabia imports over 80.0% of its food.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 109.1 Mn |

| Forecast Value (2033) |

USD 196.4 Mn |

| CAGR (2024-2033) |

6.8% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Fertilizers, and Pesticides), and By Crop Type (Cereals, Vegetables, Fruits, Forage Crops, and Others) |

| Regional Coverage |

The Kingdom of Saudi Arabia |

| Prominent Players |

Saudi Basic Industries Corporation (SABIC), Astra Industrial Group (AstraChem), Alahmari Group, BASF SE, BAYER AG, Saudi Delta Company for Chemical Industries, Yanbu National Petrochemical Company (YANSAB), Sahara International Petrochemical Company (Sipchem), Methanol Chemicals Company, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Saudi Arabia Agrochemical and Pesticides market is projected to be valued at USD 109.1 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 196.4 million in 2034.

Some of the major key players in the Saudi Arabia Agrochemical and Pesticides market are Saudi Basic Industries Corporation (SABIC), Astra Industrial Group (AstraChem), Alahmari Group, BASF SE, BAYER AG, Saudi Delta Company for Chemical Industries, Yanbu National Petrochemical Company (YANSAB), Sahara International Petrochemical Company (Sipchem), Methanol Chemicals Company, and many others.

The market is growing at a CAGR of 6.8 percent over the forecasted period.