Market Overview

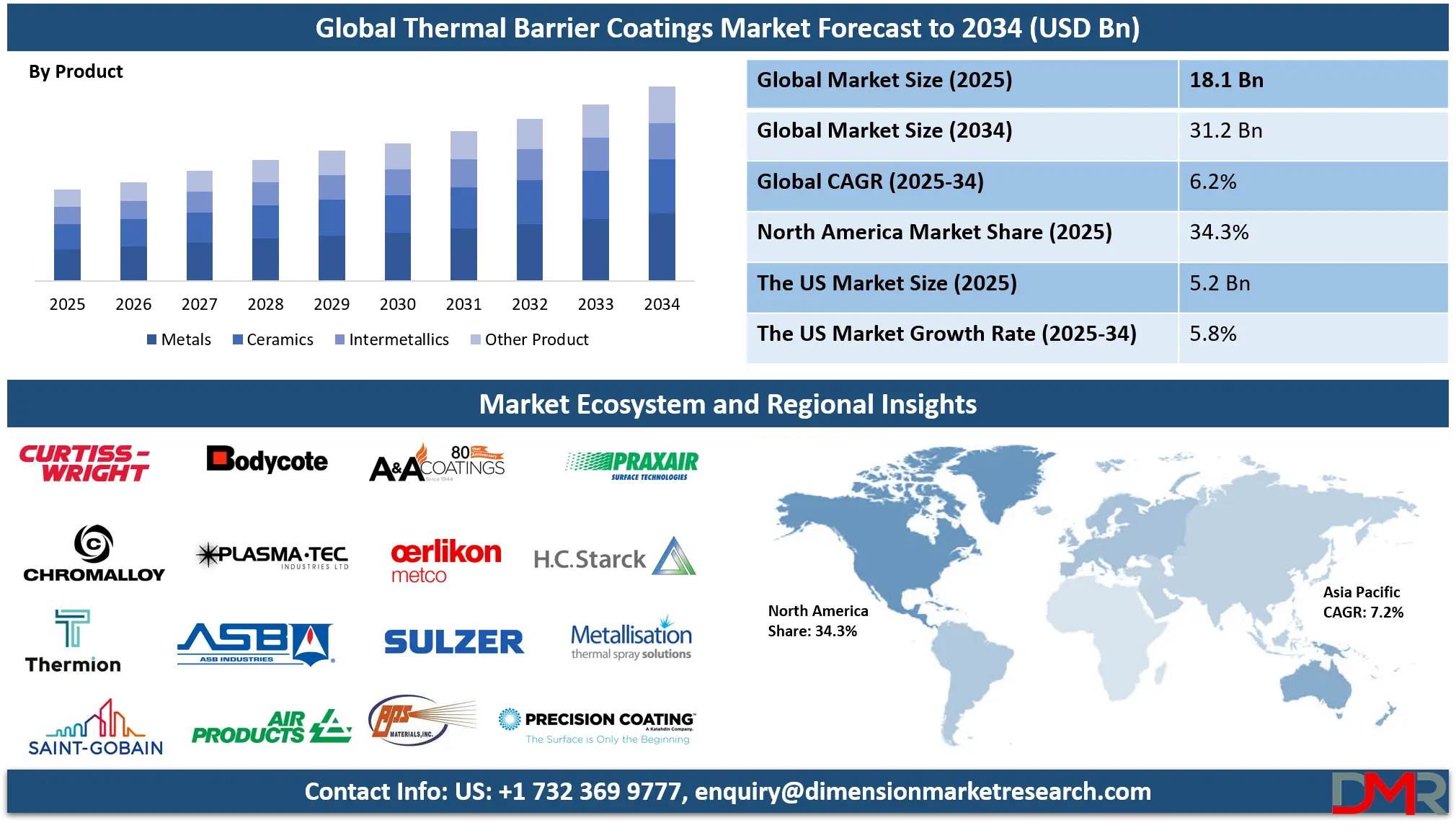

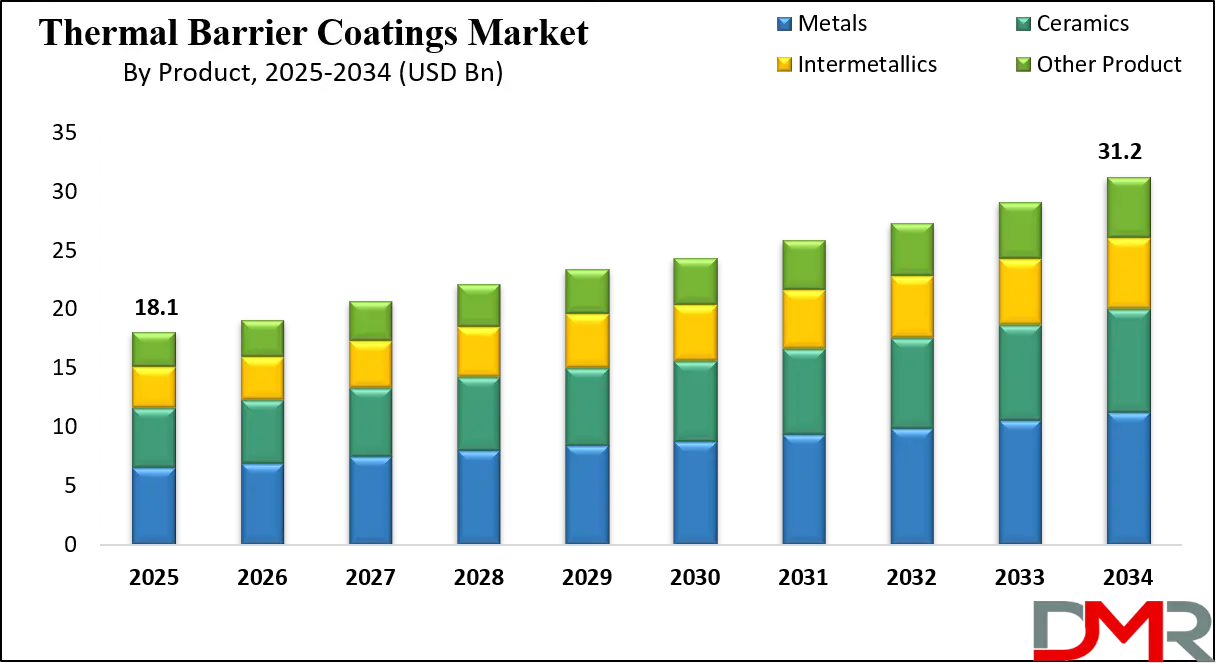

The Global Thermal Barrier Coatings (TBC) Market is projected to reach USD 18.1 billion by 2025, driven by rising demand across aerospace, automotive, power generation, and industrial gas turbines. The market is further expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2025 to 2034, ultimately achieving a value of USD 31.2 billion by 2034.

Growth is fueled by increasing adoption of advanced ceramic coatings, improvements in plasma spray and electron-beam physical vapor deposition technologies, and the push for enhanced engine efficiency, reduced carbon emissions, and durability of high-performance components. Additionally, rising investments in renewable energy systems, aerospace modernization, and automotive lightweighting are creating substantial opportunities for thermal barrier coating manufacturers worldwide.

Thermal-barrier coatings (TBCs) are increasingly engineered as multilayer systems bond coat, thermally grown oxide control, and ceramic topcoat applied by air plasma spray (APS) and electron-beam physical vapor deposition (EB-PVD) to protect hot-section metallic components. Research is focused on low-conductivity rare-earth-stabilized zirconias, novel bondcoat chemistries, and columnar microstructures to improve durability, enabling higher turbine inlet temperatures and extended component lifetimes.

Demand trends are driven by growth in gas-turbine power generation, expanding aerospace engine cycles, and wider adoption in heavy-duty diesel and industrial turbines. Aftermarket refurbishment and repair services for blades, combustors, and vanes are becoming major revenue streams, as fleets seek cost-effective life extension. Serviceable assets, retrofit programs, and OEM refurbishment contracts support recurring demand across the aviation and energy industries.

Opportunities lie in low-emission power generation, advanced combined-cycle turbines, and hydrogen-capable combustors. Integration with additive manufacturing is expanding the scope for coatings tailored to novel geometries. Functionally graded coatings, higher thermal-gradient tolerance, and cross-licensing between ceramic specialists and OEMs are accelerating the commercialization of next-generation solutions.

Restraints include the high technical bar for cyclic durability, ceramic sensitivity to calcium-magnesium-alumino-silicate (CMAS) infiltration, and lengthy aerospace qualification cycles. High costs for specialty powders and oxygen-sensitive processes, combined with the capital-intensive nature of OEM procurement, continue to present adoption barriers.

Growth prospects are supported by global fleet modernization, efficiency-driven investments, and emissions regulations. TBCs are vital to enabling higher operating temperatures, improved fuel flexibility, and reduced carbon intensity. With governments emphasizing advanced turbine development and sustainable aviation goals, the market is positioned for sustained expansion in both OEM production and aftermarket refurbishment.

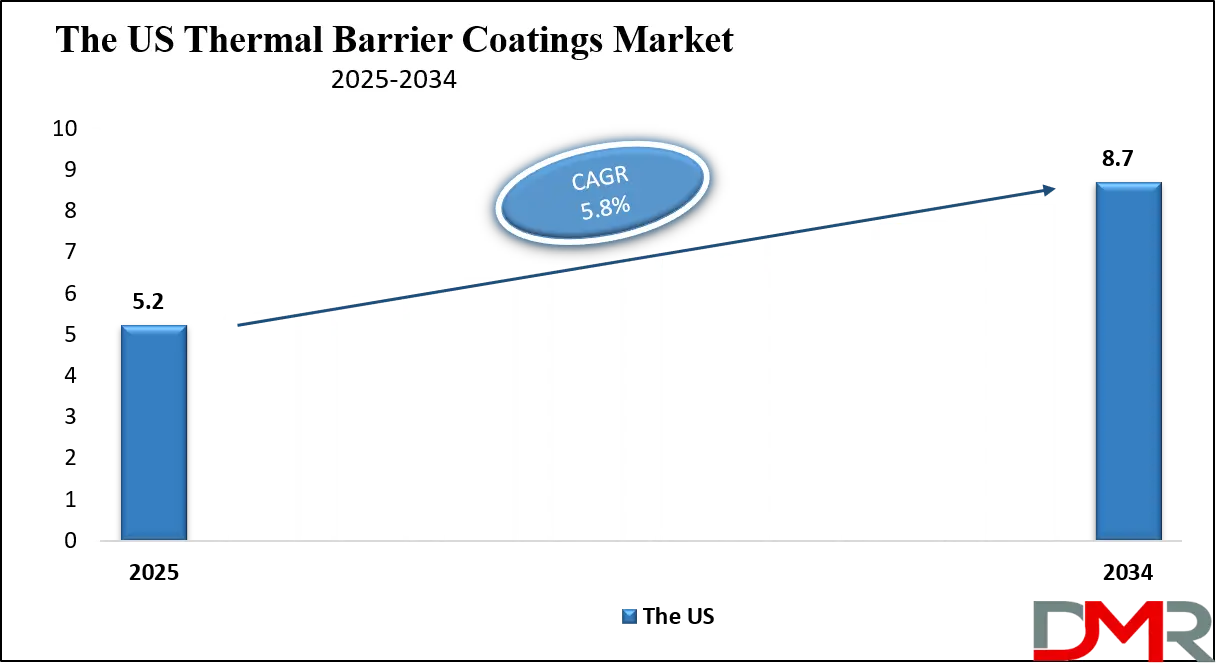

The US Thermal Barrier Coatings Market

The US Thermal Barrier Coatings Market is projected to reach USD 5.2 billion in 2025 at a compound annual growth rate of 5.8% over its forecast period.

The U.S. thermal-barrier coatings market benefits from a strong aerospace supply chain, concentrated turbine manufacturing, and federal support for advanced materials research. National laboratories and the Department of Energy (DOE) programs have prioritized turbine innovation, enabling TBC adoption in power generation and military and civil aviation. Government-funded initiatives support durability testing, hydrogen compatibility, and next-generation coating qualification, ensuring alignment with decarbonization and efficiency goals.

Demographically, the United States maintains specialized manufacturing clusters in states such as Ohio, Texas, and South Carolina, where aerospace and energy sectors converge. Bureau of Labor Statistics (BLS) data confirms robust employment in advanced manufacturing and metallurgy, sustaining a pipeline of skilled engineers, surface-coating technicians, and materials scientists. This workforce advantage underpins the country’s competitiveness in TBC innovation and application.

The U.S. turbine fleet provides another advantage. Energy Information Administration (EIA) data highlights the extensive use of natural gas combined-cycle plants, where TBCs support efficiency improvements and emissions reduction. This creates recurring aftermarket opportunities for coating refurbishment, stripping, and reapplication across the nation’s installed base of turbines.

The U.S. is also home to leading OEMs, MRO hubs, and coating houses, creating an ecosystem where new materials can be validated rapidly. With government policy backing advanced turbine development and sustainable aviation, the U.S. market holds significant potential for growth in OEM supply and aftermarket services, while strengthening its position as a global hub for innovation in high-performance protective coatings.

The Europe Thermal Barrier Coatings Market

The Europe Thermal Barrier Coatings Market is estimated to be valued at USD 2.7 billion in 2025 and is further anticipated to reach USD 4.5 billion by 2034 at a CAGR of 6.0%.

Europe’s thermal-barrier coatings market is supported by a diverse industrial base of aerospace manufacturers, power-generation companies, and metallurgical specialists. Eurostat data confirms manufacturing’s strong contribution to GDP, underlining the structural demand for coatings in high-temperature applications. Gas turbines, steam turbines, and aerospace propulsion systems are key drivers of adoption, with coatings enabling extended service life and performance improvements.

Public policy in the European Union promotes decarbonization and efficiency, pushing investments into high-efficiency gas plants and flexible low-carbon generation. Advanced turbine programs funded by cross-border initiatives support coating adoption to meet emissions targets. Collaborative projects involving OEMs, research institutes, and coating suppliers reduce qualification risks, accelerating the commercialization of next-generation ceramic systems.

Europe’s demographic advantage lies in the concentration of skilled engineering talent and industrial clusters. Countries like Germany and France maintain strong aerospace and energy sectors, while Italy and the UK contribute expertise in advanced ceramics and turbine repair. High-density maintenance, repair, and overhaul (MRO) facilities across Europe support quick refurbishment, providing aftermarket resilience and service continuity.

The regional market is further enhanced by close partnerships between universities and industry, with coating technologies regularly tested and validated in European research laboratories. By combining innovation with policy-driven demand, Europe is expected to sustain growth in both OEM and aftermarket segments, positioning itself as a key global center for thermal-barrier coating development.

The Japan Thermal Barrier Coatings Market

The Japan Thermal Barrier Coatings Market is projected to be valued at USD 1.0 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1.7 billion in 2034 at a CAGR of 5.6%.

Japan’s market for thermal-barrier coatings is deeply rooted in its advanced manufacturing ecosystem. According to the Ministry of Economy, Trade and Industry (METI), manufacturing remains a cornerstone of Japan’s economy, contributing significantly to GDP. This industrial strength sustains demand for TBCs in aerospace, automotive turbochargers, and industrial gas turbines, where coatings ensure durability and efficiency.

Government initiatives emphasize high-efficiency energy and propulsion technologies. National policies targeting emissions reduction and energy efficiency have spurred investment into turbines capable of operating at higher firing temperatures. TBCs are central to these advancements, protecting against thermal stresses and oxidation in extreme environments.

Japan benefits from its dense industrial clusters in regions such as Aichi and Shizuoka, which host leading aerospace, metallurgy, and automotive companies. These clusters promote efficient supply chains and foster close collaboration between OEMs, research institutions, and coating providers. The Japan External Trade Organization (JETRO) highlights the country’s export-oriented manufacturing as a demographic advantage, ensuring strong global market integration.

A skilled workforce specializing in materials science, ceramics, and thermal engineering strengthens Japan’s competitiveness. Local MRO and turbine service providers deliver high-quality refurbishment capabilities, ensuring coatings can be tested, validated, and reapplied in domestic facilities. This ecosystem fosters rapid feedback and product improvement.

With strong policy backing, advanced industrial infrastructure, and workforce expertise, Japan’s TBC market is positioned to expand steadily. Its leadership in precision engineering and high-performance materials will continue to make it a hub for innovation in protective coatings.

Global Thermal Barrier Coatings Market: Key Takeaways

- Global Market Size Insights: The Global Thermal Barrier Coatings Market size is estimated to have a value of USD 18.1 billion in 2025 and is expected to reach USD 31.2 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 6.2 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Thermal Barrier Coatings Market is projected to be valued at USD 5.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 8.7 billion in 2034 at a CAGR of 5.8%.

- Regional Insights: North America is expected to have the largest market share in the Global Thermal Barrier Coatings Market with a share of about 34.3% in 2025.

- Key Players: Some of the major key players in the Global Thermal Barrier Coatings Market are Praxair Surface Technologies, Sulzer Ltd., Oerlikon Metco, A&A Thermal Spray Coatings, APS Materials Inc., H.C. Starck GmbH, Metallisation Ltd., and many others.

Global Thermal Barrier Coatings Market: Use Cases

- Aero-engine hot-section protection: Ceramic TBCs protect turbine blades, vanes, and combustor liners in military and civil aircraft engines. They enable higher turbine inlet temperatures, improving fuel efficiency, lowering emissions, and extending service intervals. EB-PVD and APS processes produce the strain-tolerant microstructures essential for cyclic aerospace environments.

- Power-generation gas turbines: TBCs on stationary gas-turbine components raise firing temperatures, enhancing combined-cycle efficiency and lowering carbon intensity per megawatt-hour. Coatings support both new-build advanced turbines and retrofits, enabling operators to meet efficiency targets while adapting to natural gas and hydrogen fuel blends.

- Industrial and marine engines: Thick-film ceramic coatings applied to pistons and liners in diesel and marine engines reduce thermal losses, protect against corrosion, and improve overall fuel economy. These applications are vital for heavy-duty transport, locomotives, and maritime propulsion, where durability is critical.

- Aftermarket retrofits and MRO services: Blade refurbishment through stripping, recoating, and repair is a recurring revenue source. Advanced low-conductivity ceramics are reapplied to extend component life in existing turbines, reducing replacement costs. Regional MRO hubs and OEM networks enhance the global aftermarket ecosystem.

- Additive manufacturing integration: Functionally graded coatings tailored for 3D-printed components allow novel cooling geometries and improved performance. Combining additive manufacturing substrates with optimized TBCs creates opportunities for lightweight, high-efficiency aero and energy components, shortening qualification cycles and enabling faster innovation.

Global Thermal Barrier Coatings Market: Stats & Facts

U.S. Energy Information Administration (EIA)

- U.S. utility-scale electricity generation in 2023: ≈4,178 billion kWh.

- About 60% of U.S. electricity generation in 2023 came from fossil fuels (coal, natural gas, petroleum, and other gases).

- 9,274 MW of new natural-gas turbine generating capacity was added to the U.S. grid in 2023 (7,376 MW combined-cycle, 1,756 MW simple-cycle gas turbines, 142 MW internal combustion).

- The U.S. combined-cycle gas turbine (CCGT) fleet capacity factor rose from ~40% in 2008 to ~57% in 2022.

- Between 2022–2023, 13 new CCGT plants entered service with a combined capacity of ~12.4 GW.

U.S. Department of Energy (DOE) / National Energy Technology Laboratory (NETL)

- DOE announced USD 8.8 million in funding for 11 university-based turbine research projects in 2024.

- DOE awarded ~USD 34 million in 2023 for clean hydrogen and turbine-related R&D.

- DOE FY2023 budget request included USD 27 million for gas-turbine combustion systems capable of hydrogen blending.

- Since 2021, DOE has invested more than USD 122 million across 72 projects targeting hydrogen and turbine performance.

- The Bipartisan Infrastructure Law earmarked USD 7 billion to accelerate clean-hydrogen hubs, creating downstream demand for hydrogen-capable turbines.

U.S. Bureau of Labor Statistics (BLS)

- Median annual wage for materials engineers in 2024: USD 108,310.

- Employment for painting and coating workers is projected to grow 1% from 2023 to 2033.

- About 16,900 openings per year are expected for coating workers during 2023–2033, mainly replacement needs.

NASA (Aeronautics Research)

- NASA research has documented advanced TBC and TEBC systems since the 1970s.

- Experimental results show that advanced ceramic coatings can increase turbine gas-path temperatures significantly, reducing cooling requirements.

U.S. Federal Aviation Administration (FAA) / Bureau of Transportation Statistics (BTS)

- FAA and BTS datasets record over 210,000 active general aviation aircraft in the U.S., driving sustained turbine-engine coating demand.

- FAA certification and airworthiness guidance enforce long qualification cycles for aerospace coatings, extending development timelines.

U.S. Environmental Protection Agency (EPA)

- U.S. coal generation in 2023 was about one-third of its 2007 peak level.

- Natural-gas generation in the U.S. has more than doubled since 2007, supporting gas-turbine expansion.

Eurostat / European Commission

- In 2022, Germany’s manufacturing sector contributed ~32% of EU value added, the largest among member states.

- EU aerospace industries show productivity per worker ~1.5× higher than the general manufacturing average.

Ministry of Economy, Trade & Industry (METI, Japan) / JETRO

- Manufacturing accounted for ~15% of total employment in Japan as of 2023.

- METI productivity index (1991=100): United States 162; Japan 148, highlighting long-term industrial competitiveness trends.

International Energy Agency (IEA)

- Natural gas provides about 25% of global electricity generation, maintaining strong demand for advanced turbines and coatings.

EIA Generator Cost & Equipment Data

- Capacity-weighted average cost for a combustion turbine (in combined cycle): ~USD 782 per kW.

- Average new-plant combustion turbine capacity: ~431 MW.

- EIA listed 861 new combustion-turbine units at combined-cycle plants in recent reports.

OECD / IEA Efficiency Analysis

- Average efficiency of natural-gas plants in OECD countries has risen by ~8 percentage points since 1990, due to the adoption of advanced CCGTs.

Additional DOE / NETL Grant Records

- DOE funding notices show USD 6.4 million awarded for turbine materials and coating projects in recent years.

- Multiple university–industry award packages total in the multi-million-dollar range, supporting coating durability studies.

EIA Fleet Utilization Data

- New CCGT units (since 2014) operate at an average capacity factor of ~66%, higher than the overall fleet average, ensuring strong aftermarket coating demand.

Global Thermal Barrier Coatings Market: Market Dynamics

Driving Factors in the Global Thermal Barrier Coatings Market

Increasing Demand for Fuel Efficiency and Reduced Carbon Emissions

A key growth driver for the global thermal barrier coatings market is the escalating demand for improved fuel efficiency and reduced greenhouse gas emissions across industries. In aerospace, stricter environmental mandates from organizations such as the International Civil Aviation Organization (ICAO) are pushing engine manufacturers to adopt TBCs that enable higher operating temperatures while consuming less fuel.

Similarly, in stationary power generation, the shift toward combined cycle plants and high-efficiency gas turbines relies heavily on TBCs to protect critical components from extreme heat. By allowing engines and turbines to run at higher temperatures, TBCs reduce energy losses and enhance combustion efficiency, translating into lower fuel consumption and carbon emissions. With the global emphasis on climate change mitigation and sustainable energy, thermal barrier coatings are increasingly recognized as indispensable for meeting decarbonization targets. This driver ensures long-term demand, particularly in high-growth regions such as Asia-Pacific and the Middle East, where power generation and aviation sectors are expanding rapidly.

Expansion of Aerospace and Defense Expenditures Worldwide

The growing investments in the aerospace and defense industries globally are a major driver for thermal barrier coatings. Military aircraft, helicopters, drones, and naval vessels require high-performance engines that can withstand harsh operational environments. TBCs play a crucial role in extending the life of turbine blades, exhaust systems, and afterburner liners, directly impacting mission readiness and operational safety.

Civil aviation is also expanding, with demand for next-generation aircraft rising in emerging markets such as India and China, fueling the need for advanced TBCs. Defense budgets in the U.S., Europe, and Asia-Pacific are increasingly directed toward upgrading propulsion systems and ensuring engines operate efficiently at extreme conditions.

Furthermore, space exploration initiatives by NASA, ESA, and private players like SpaceX are accelerating TBC adoption in rocket engines and spacecraft thermal protection systems. The intersection of commercial aviation growth, defense modernization, and space missions solidifies aerospace as a powerhouse driver for the TBC market.

Restraints in the Global Thermal Barrier Coatings Market

High Cost of Advanced Coating Processes and Materials

One of the major restraints in the thermal barrier coatings market is the high cost associated with advanced coating materials and deposition techniques. Technologies such as Electron-Beam Physical Vapor Deposition (EB-PVD) and advanced ceramics like gadolinium zirconate are significantly more expensive compared to conventional options. The capital-intensive nature of coating facilities, coupled with stringent quality control requirements, limits adoption among smaller manufacturers and in cost-sensitive industries.

In addition, maintenance and re-coating cycles add to the lifecycle cost, making adoption challenging outside of aerospace and power generation. For many industrial applications, alternative solutions such as cheaper metallic coatings or material substitutions are often preferred, slowing down TBC penetration. The high investment burden for R&D and equipment procurement acts as a barrier to entry for new players, consolidating the market among established leaders but restraining overall market growth potential.

Durability Challenges and Performance Limitations

Another key restraint is the durability and reliability issues associated with TBCs under extreme operating conditions. Coating spallation, cracking, and delamination due to thermal cycling and mechanical stresses remain persistent challenges. While ceramic coatings like YSZ perform well at high temperatures, they are prone to phase transformation at prolonged exposure above 1,200°C, limiting long-term performance.

Moreover, oxidation of bond coats and mismatch in thermal expansion between substrates and coatings often lead to premature failures, necessitating frequent maintenance and replacements. In automotive and marine environments, exposure to corrosive conditions further accelerates degradation. These durability issues raise concerns about long-term cost-effectiveness and operational safety, particularly in mission-critical aerospace and defense applications. Despite continuous advancements in materials science, the inability to eliminate failure risks constrains the broader adoption of TBCs across industries, acting as a critical restraint for market expansion.

Opportunities in the Global Thermal Barrier Coatings Market

Rising Penetration of TBCs in Automotive Applications

An emerging growth opportunity lies in the increasing application of thermal barrier coatings within the automotive industry, particularly in high-performance vehicles, electric vehicles (EVs), and heavy-duty engines. Automakers are exploring TBCs for turbochargers, exhaust manifolds, pistons, and cylinder heads to manage high thermal loads and enhance engine durability. In EVs, TBCs are being investigated for thermal management of battery systems and advanced power electronics. As emission regulations tighten globally, automotive OEMs are compelled to adopt coatings that enhance fuel efficiency, reduce exhaust heat loss, and improve performance.

Additionally, the growing motorsport and performance car segment further accelerates demand for lightweight, high-efficiency coating systems. With EV adoption rising rapidly, coatings that improve thermal management, extend component life, and optimize energy efficiency present lucrative opportunities. This diversification beyond aerospace and power generation highlights automotive as a significant growth frontier for the global TBC market.

Adoption of Nanostructured and Multilayered Coatings

A key opportunity for growth in the TBC market lies in the commercialization of nanostructured and multilayered coatings that provide superior thermal shock resistance, durability, and insulation properties. Nanostructured coatings reduce thermal conductivity while enhancing strain tolerance, making them highly desirable for next-generation engines and turbines.

Similarly, multilayered systems combining ceramics, metals, and intermetallics offer unique benefits by distributing thermal stresses and preventing premature coating failures. With research advancing in functionally graded materials (FGMs), the opportunity to design customized coatings for specific applications is expanding.

Universities, R&D institutions, and leading companies are actively collaborating to bring such innovations to market. The successful deployment of nanostructured and multilayered coatings promises to unlock high-value opportunities in aerospace propulsion, industrial gas turbines, and automotive thermal systems. This technological advancement creates strong incentives for manufacturers to differentiate offerings and capture premium market share through innovation-driven growth.

Trends in the Global Thermal Barrier Coatings Market

Rising Adoption of Advanced Ceramic-Based Coatings in Aerospace and Power Generation

A major trend shaping the thermal barrier coatings market is the increasing reliance on advanced ceramic-based coatings, particularly yttria-stabilized zirconia (YSZ), gadolinium zirconate (GZ), and nanostructured ceramics. These coatings provide superior resistance to high operating temperatures, oxidation, and thermal shock, which are critical for extending the lifespan of turbine blades, combustion chambers, and engine nozzles in aerospace and power generation. With next-generation jet engines expected to operate above 1,500°C, demand for robust TBCs is accelerating.

Moreover, advanced ceramic materials are enabling the use of higher efficiency gas turbines in stationary power plants, supporting the global transition toward cleaner energy by improving combustion efficiency and reducing emissions. This trend is reinforced by the aerospace industry’s push for lightweight, high-performance engines and stringent environmental regulations driving efficiency improvements. The focus on sustainable and fuel-efficient propulsion systems ensures long-term adoption of advanced ceramics, cementing their role in the TBC market.

Integration of Novel Deposition Techniques such as SPS and SPPS

The thermal barrier coatings market is witnessing a strong trend toward the adoption of advanced deposition technologies such as Suspension Plasma Spray (SPS) and Solution Precursor Plasma Spray (SPPS). These innovative coating methods enable finer microstructures, superior adhesion, and improved strain tolerance compared to conventional Air Plasma Spray (APS).

SPS and SPPS allow for the creation of columnar and porous microstructures, mimicking EB-PVD coatings but at lower costs, thereby expanding applications across aerospace, automotive, and industrial machinery sectors. This trend is particularly significant as manufacturers seek coatings with higher durability and cost-effectiveness.

Additionally, advancements in cold spray and hybrid coating methods are further driving innovation, offering potential for lower thermal conductivity and enhanced thermal cycling life. The shift toward advanced deposition techniques reflects an industry-wide move to optimize performance, lower maintenance costs, and achieve compliance with stricter efficiency and environmental standards, thereby transforming the competitive landscape of the TBC market.

Global Thermal Barrier Coatings Market: Research Scope and Analysis

By Product Analysis

Bond coats made of MCrAlY (M = nickel, cobalt, or iron) are projected to dominate the metallic product category in the global thermal barrier coatings market because they form the foundation of a durable coating system. Their main role is to act as an intermediate layer between the metallic substrate and the ceramic topcoat, preventing failure from oxidation, hot corrosion, and spallation. Without this critical layer, ceramic coatings would quickly delaminate under high thermal stress, leading to catastrophic component damage.

MCrAlY coatings excel due to their ability to develop a dense, slow-growing alumina (Al₂O₃) scale during high-temperature exposure. This protective oxide acts as a barrier against oxygen diffusion, reducing material degradation while ensuring coating adherence. Their metallurgical stability, toughness, and resistance to thermal fatigue make them indispensable in environments characterized by cyclic heating and cooling.

In aerospace, MCrAlY bond coats are widely used on turbine blades, combustors, and vanes, extending engine life and enabling higher operating temperatures that improve fuel efficiency. For stationary power plants, they ensure prolonged operational reliability in gas turbines, where uninterrupted performance is critical to power supply. Their consistent ability to enhance efficiency while minimizing maintenance costs ensures continued demand.

Furthermore, advances in MCrAlY formulations such as optimized nickel-cobalt blends and advanced deposition methods are pushing performance boundaries further. With industries like aerospace and energy demanding more efficiency and resilience, MCrAlY bond coats remain irreplaceable. Their unique balance of adhesion, oxidation resistance, and thermal fatigue durability explains why they dominate the metals segment, serving as the backbone of modern thermal barrier coating systems.

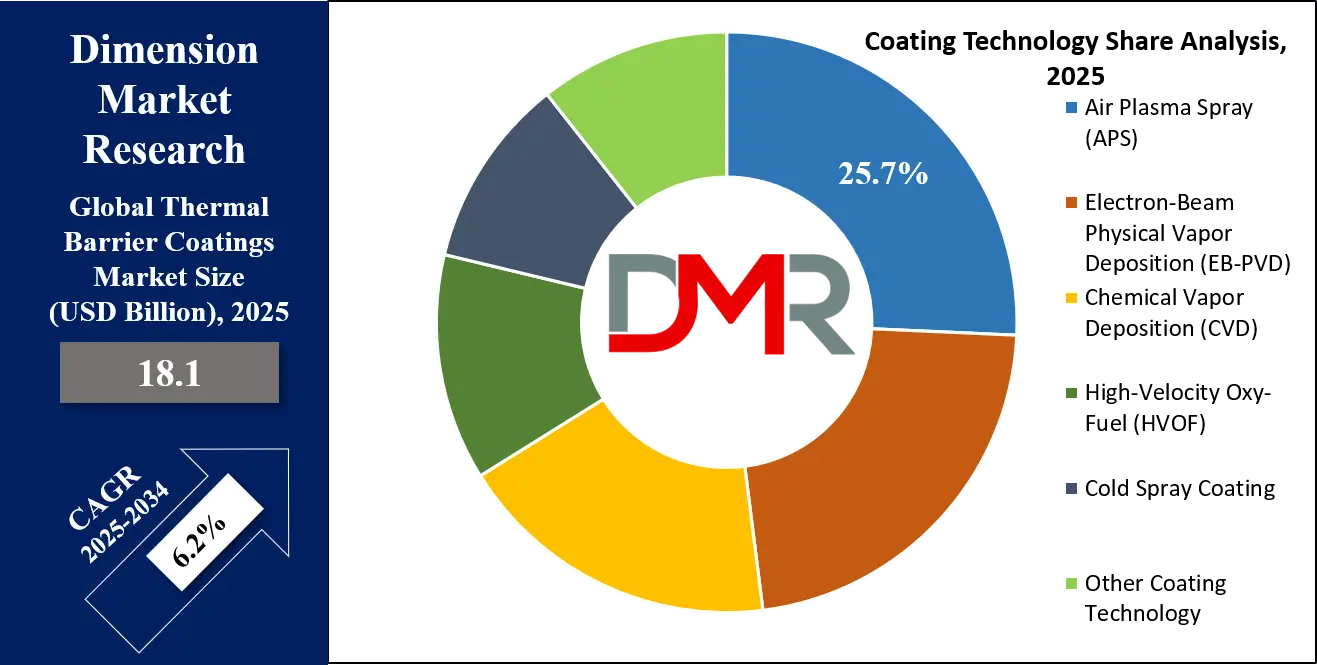

By Coating Technology Analysis

Air Plasma Spray (APS) is poised to hold dominance in the thermal barrier coatings market’s coating technology segment due to its versatility, scalability, and cost-effectiveness. APS allows for the deposition of high-performance ceramics, particularly yttria-stabilized zirconia (YSZ), with strong adhesion and reliable thermal insulation across a wide variety of substrates. The method uses a high-temperature plasma jet to melt and project powdered material onto a surface, producing dense coatings capable of withstanding extreme thermal and mechanical stress.

One of APS’s greatest strengths lies in its adaptability. Unlike Electron-Beam Physical Vapor Deposition (EB-PVD), which requires high-vacuum chambers and offers limited scalability, APS is more economical and suitable for large-scale industrial deployment. It is widely applied in aerospace for turbine blades and combustion chambers, in power generation for turbines and heat exchangers, and in automotive engines for exhaust systems and turbochargers.

Moreover, APS technology continues to evolve. Advances such as Suspension Plasma Spray (SPS) and Solution Precursor Plasma Spray (SPPS) allow the production of thinner, denser coatings with reduced porosity and enhanced durability. These innovations lower thermal conductivity and extend component lifetimes, further solidifying APS’s dominance.

In addition, APS accommodates complex geometries and large component sizes, a significant advantage over other methods. Its balance between cost, efficiency, and reliability makes it the go-to solution for industries demanding high-performance coatings under strict economic constraints.

As global industries strive for higher energy efficiency and emission reductions, APS remains at the forefront, offering an effective compromise between advanced performance and production practicality. This makes it the undisputed leader in coating technology.

By Application Analysis

Within stationary power plant applications, gas turbines are expected to dominate the thermal barrier coatings market due to their critical role in high-efficiency electricity generation. Gas turbines operate under extremely high combustion chamber and turbine inlet temperatures that far exceed the endurance limits of uncoated base materials. Thermal barrier coatings (TBCs) allow turbine components to withstand these extreme conditions, enabling higher operating temperatures that directly improve power output and fuel efficiency.

TBCs are applied to turbine blades, vanes, and combustors, where durability and resistance to oxidation and thermal fatigue are essential. In stationary power plants, where turbines run continuously for extended periods, the reliability provided by TBCs reduces maintenance frequency and operational downtime, translating into major economic advantages. By improving heat resistance, TBCs also help lower emissions and enhance overall plant efficiency, which aligns with global energy transition goals.

The demand for gas turbines is further fueled by the expansion of combined cycle gas turbine (CCGT) power plants, which offer higher efficiency and lower carbon emissions compared to coal-fired systems. Regions like Asia-Pacific and the Middle East, experiencing rapid industrialization and rising energy demand, are increasingly investing in gas-fired plants, thereby driving TBC adoption.

Additionally, the integration of renewables into power grids necessitates flexible gas turbines capable of frequent cycling and load adjustments. TBCs ensure turbine components can withstand these stressors without rapid degradation.

Given their indispensable role in extending turbine life, improving performance, and ensuring economic efficiency, gas turbines represent the largest and most critical application area for thermal barrier coatings in stationary power plants, cementing their dominance globally.

The Global Thermal Barrier Coatings Market Report is segmented on the basis of the following:

By Product

- Metals

- Bond Coats (Mcraly: Ni, Co, Fe-Based)

- Diffusion Alloys

- Superalloys

- Ceramics

- Yttria-Stabilized Zirconia (YSZ)

- Alumina

- Mullite

- Others

- Intermetallics

- Nial-Based Coatings

- Feal-Based Coatings

- Other Advanced Alloys

- Other Product

By Coating Technology

- Air Plasma Spray (APS)

- Electron-Beam Physical Vapor Deposition (EB-PVD)

- Chemical Vapor Deposition (CVD)

- High-Velocity Oxy-Fuel (HVOF)

- Cold Spray Coating

- Other Coating Technology

By Application

- Stationary Power Plants

- Gas Turbines

- Industrial Boilers

- Combined Cycle Plants

- Aerospace

- Aircraft Engines

- Spacecraft Components

- Automotive

- Engine Parts

- Turbochargers

- Exhaust Systems

- Pistons & Cylinder Heads

- Valves & Manifolds

- Marine

- Gas Turbines In Naval Vessels

- Marine Diesel Engines

- Other Application

Impact of Artificial Intelligence in the Global Thermal Barrier Coatings Market

- AI-Driven Coating Design Optimization: Artificial Intelligence accelerates the development of advanced thermal barrier coatings by simulating microstructural properties, predicting performance, and reducing trial-and-error in material formulation, resulting in improved durability, thermal resistance, and cost-efficient solutions for aerospace and power applications.

- Predictive Maintenance for TBC Systems: Machine learning algorithms analyze real-time operational data from turbines and engines to predict coating degradation, enabling proactive maintenance scheduling that prevents unexpected failures, reduces downtime, and extends equipment lifespan in power generation and aviation industries.

- Smart Quality Control in Manufacturing: AI-powered inspection systems ensure consistency in TBC thickness, porosity, and adhesion by detecting micro-defects during production. This enhances coating reliability, minimizes waste, and enables manufacturers to meet stringent aerospace and automotive performance standards.

- Process Automation and Efficiency: AI optimizes thermal spray and vapor deposition processes by regulating temperature, particle velocity, and spray patterns. This automation ensures precision, reduces energy consumption, and lowers operational costs while improving coating reproducibility across large-scale industrial applications.

- Digital Twins for Performance Simulation: AI-enabled digital twins replicate real-world behavior of coated components under extreme conditions, allowing manufacturers to forecast performance, simulate wear, and test coating modifications virtually, accelerating innovation cycles and reducing R&D expenses in the TBC market.

Global Thermal Barrier Coatings Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the global thermal barrier coatings (TBC) market with 34.3% of the market share by the end of 2025, primarily due to its advanced aerospace and defense ecosystem, strong automotive industry, and significant investment in energy infrastructure. The U.S. aerospace sector, led by Boeing, Lockheed Martin, and General Electric, heavily relies on TBCs for turbine blades, combustion chambers, and aerospace engines to enhance durability and efficiency.

According to the Federal Aviation Administration (FAA), the U.S. commercial aviation industry is expected to see passenger traffic double by 2040, driving demand for high-performance coatings that reduce heat and improve fuel efficiency. Additionally, the U.S. Department of Energy highlights the critical role of thermal coatings in gas turbines and power generation, which contribute significantly to the energy mix. The automotive industry in North America, particularly with General Motors and Ford, uses TBCs to improve engine performance and meet stricter emission norms set by the Environmental Protection Agency (EPA).

Canada also contributes with a strong aerospace cluster, particularly in Quebec, where Rolls-Royce and Pratt & Whitney operate. Strong government funding for defense aircraft and energy R&D further boosts adoption. High R&D spending, robust intellectual property generation, and the presence of global coating manufacturers like Praxair Surface Technologies and Curtiss-Wright solidify North America’s leadership in this market.

Region with the Highest CAGR

Asia Pacific is projected to experience the highest CAGR in the thermal barrier coatings market due to rapid industrialization, a booming automotive sector, and significant investments in aerospace manufacturing and energy generation. China, for instance, is expanding its aviation sector with the COMAC C919 aircraft program, directly increasing demand for advanced coatings in jet engines and turbines.

The International Air Transport Association (IATA) projects that by 2035, China will become the world’s largest aviation market, creating a sustained need for TBCs in commercial and defense aircraft. India’s strong emphasis on energy diversification and power generation, highlighted by the Ministry of Power’s initiatives to expand thermal and gas turbine plants, fuels coatings adoption for higher operational efficiency. Japan and South Korea, with advanced automotive industries led by Toyota, Honda, Hyundai, and Kia, integrate TBCs in engines and exhaust systems to meet stringent emission standards and enhance fuel economy.

Government-backed innovation programs, such as Japan’s New Energy and Industrial Technology Development Organization (NEDO) initiatives, accelerate TBC research and applications in next-gen gas turbines. Moreover, the Asia Pacific benefits from low manufacturing costs, rising domestic demand, and rapid localization of aerospace supply chains, particularly in China and India. This combination of industrial expansion, regulatory pressure for clean energy and emissions control, and growing passenger travel demand ensures the region’s accelerated growth in the thermal barrier coatings market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Thermal Barrier Coatings Market: Competitive Landscape

The thermal barrier coatings (TBC) market is characterized by the presence of established global players, specialized surface technology providers, and emerging regional manufacturers. Companies such as Praxair Surface Technologies, A&A Thermal Spray Coatings, H.C. Starck, and Metallisation Ltd. are at the forefront, offering advanced plasma-sprayed and electron-beam physical vapor deposition (EB-PVD) solutions tailored for aerospace and industrial gas turbines.

Major aerospace engine OEMs, including Rolls-Royce, GE Aviation, and Pratt & Whitney, partner with coating specialists to extend turbine blade life and improve fuel efficiency. North American and European companies dominate high-end applications, while Asian firms are increasingly investing in localized coating facilities to serve rapidly growing domestic industries. The market also sees strong involvement from chemical giants like Saint-Gobain and 3M, which provide ceramic materials such as yttria-stabilized zirconia, widely used in top coats.

Competitive differentiation is driven by innovation in nanostructured coatings, multilayer systems, and environmentally compliant processes. Strategic collaborations, defense contracts, and R&D partnerships with government labs remain central to staying ahead in this technology-intensive space.

Furthermore, companies are focusing on sustainability by reducing coating defects, improving recyclability, and developing eco-friendly thermal spray methods. With increasing demand from both aerospace and energy sectors, competition is intensifying globally, prompting mergers, technological integration, and expansion into the Asia Pacific to tap into the fastest-growing market.

Some of the prominent players in the Global Thermal Barrier Coatings Market are:

- Praxair Surface Technologies

- Sulzer Ltd.

- Oerlikon Metco

- A&A Thermal Spray Coatings

- APS Materials, Inc.

- H.C. Starck GmbH

- Metallisation Ltd.

- Precision Coatings, Inc.

- Air Products and Chemicals, Inc.

- ASB Industries, Inc.

- Saint-Gobain Coatings Solutions

- Thermion, Inc.

- Plasma-Tec, Inc.

- Chromalloy Gas Turbine LLC

- Bodycote plc

- Curtiss-Wright Surface Technologies

- Progressive Surface, Inc.

- Flame Spray Coating Company

- Thermal Spray Technologies, Inc.

- Zircotec Ltd.

- Other Key Players

Recent Developments in the Global Thermal Barrier Coatings Market

2024

- Oerlikon Metco: Continued significant investment and focus on developing TBC solutions for additive manufacturing (AM) components, particularly for aerospace programs like the GE Aerospace LEAP engine.

- ASM International & DVS: Successfully organized the ITSC 2024 expo in Milan, a key industry event where major TBC manufacturers showcased their latest R&D.

2023

Investments & Expansions:

- Praxair Surface Technologies (Linde): Announced a multi-million dollar expansion of its advanced coatings facility in Carmel, Indiana, USA, to increase TBC capacity for aerospace and industrial turbines.

- Bodycote plc: Opened a new state-of-the-art thermal spray coating facility in Monterrey, Mexico, to serve the North American industrial and automotive markets.

Collaborations:

- NASA & GE Aerospace: Continued collaboration on the HyTEC project, focusing on developing new, more durable TBCs and EBCs for next-generation fuel-efficient jet engines.

- Siemens Energy & Rolls-Royce: Engaged in numerous research partnerships with universities to develop laser-based TBC processing, new feedstock materials, and AI-driven lifetime prediction models.

Conferences:

- ASME: Hosted the Turbo Expo 2023 in Boston, the leading event for turbine technology, featuring dozens of technical papers on advanced TBCs.

- AeroEngines Americas 2023: Featured key discussions on MRO practices, a critical sector for TBC players like Praxair and Oerlikon.

2022

Mergers and Acquisitions (M&A):

- Ceres: Acquired L&L Special Furnace Co., highlighting the cross-industry strategic importance of high-temperature thermal processing and coatings.

Developments:

- Treibacher Industrie AG & H.C. Starck: Accelerated R&D and initial commercial deployment of next-generation TBC materials like Gadolinium Zirconate (GZO).

- Oerlikon, Praxair: Invested heavily in automating coating processes with robotic spray systems and automated powder handling to improve quality and reduce costs.

Conferences:

- ASM International & DVS: Hosted the ITSC 2022 conference in Vienna, which highlighted advancements in processes like Cold Spray (for bond coats) and the use of Machine Learning for optimization.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 18.1 Bn |

| Forecast Value (2034) |

USD 31.2 Bn |

| CAGR (2025–2034) |

6.2% |

| The US Market Size (2025) |

USD 5.2 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product (Metals, Ceramics, Intermetallics, and Other Product), By Coating Technology (Air Plasma Spray (APS), Electron-Beam Physical Vapor Deposition (EB-PVD), Chemical Vapor Deposition (CVD), High-Velocity Oxy-Fuel (HVOF), Cold Spray Coating, and Other Coating Technology), By Application (Stationary Power Plants, Aerospace, Automotive, Marine, and Other Application)

|

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Praxair Surface Technologies, Sulzer Ltd., Oerlikon Metco, A&A Thermal Spray Coatings, APS Materials Inc., H.C. Starck GmbH, Metallisation Ltd., Precision Coatings Inc., Air Products and Chemicals Inc., ASB Industries Inc., Saint-Gobain Coatings Solutions, Thermion Inc., Plasma-Tec Inc., Chromalloy Gas Turbine LLC, Bodycote plc, Curtiss-Wright Surface Technologies, Progressive Surface Inc., Flame Spray Coating Company, Thermal Spray Technologies Inc., Zircotec Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Thermal Barrier Coatings Market size is estimated to have a value of USD 18.1 billion in 2025 and is expected to reach USD 31.2 billion by the end of 2034.

The market is growing at a CAGR of 6.2 percent over the forecasted period of 2025.

The US Thermal Barrier Coatings Market is projected to be valued at USD 5.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 8.7 billion in 2034 at a CAGR of 5.8%.

North America is expected to have the largest market share in the Global Thermal Barrier Coatings Market with a share of about 34.3% in 2025.

Some of the major key players in the Global Thermal Barrier Coatings Market are Praxair Surface Technologies, Sulzer Ltd., Oerlikon Metco, A&A Thermal Spray Coatings, APS Materials Inc., H.C. Starck GmbH, Metallisation Ltd., and many others.