Market Overview

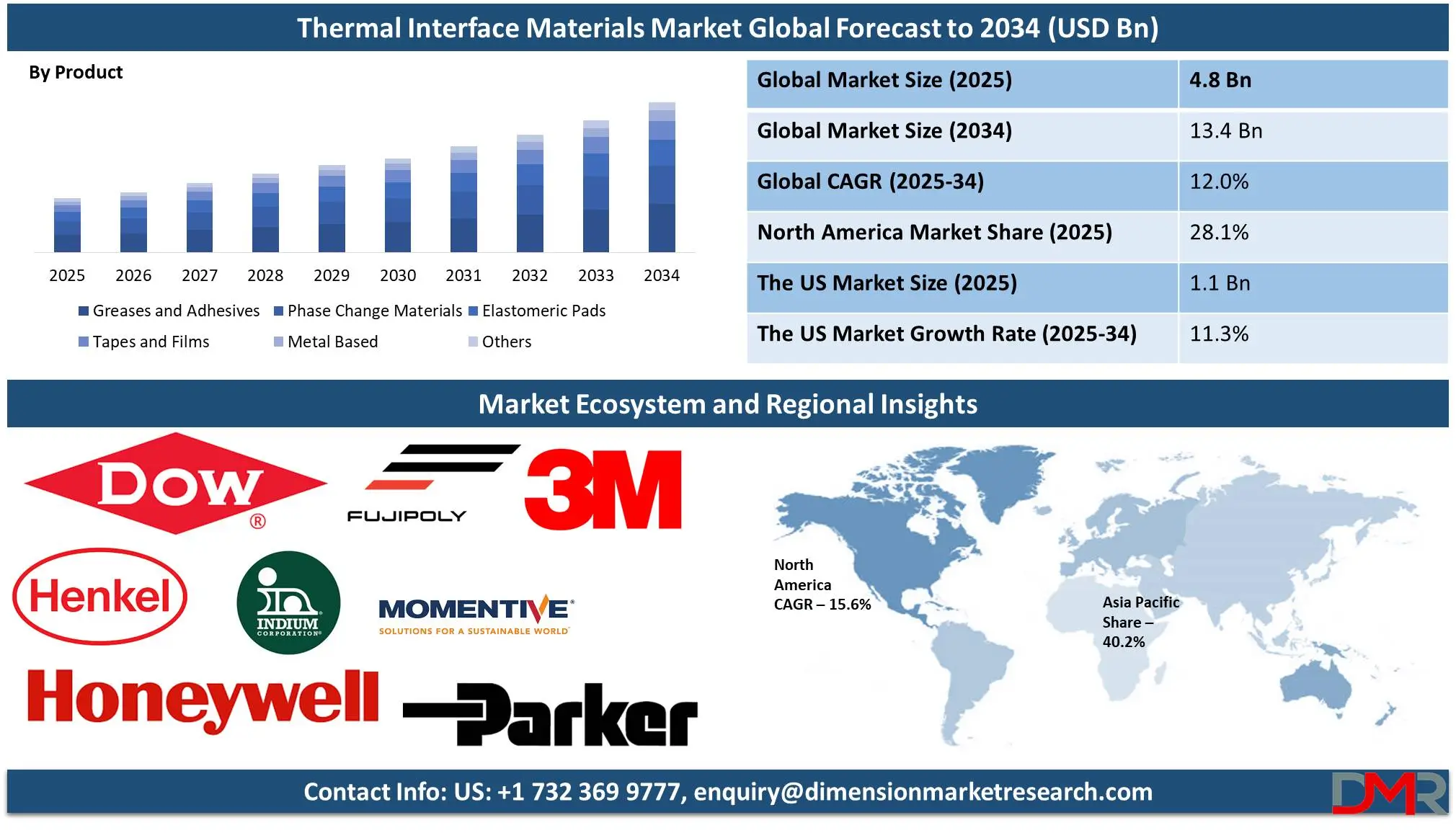

The global

Thermal Interface Materials market is anticipated to

value USD 4.8 billion in 2025 and is expected to

grow to USD 13.4 billion by 2034, registering a

CAGR of 12.0% from 2025 to 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Thermal Interface Materials (TIMs) are substances used to enhance heat transfer between two surfaces, typically in electronic devices. They fill microscopic gaps between components, such as processors and heat sinks, improving thermal conductivity and preventing overheating. TIMs can be in the form of pastes, pads, or films and are essential for efficient thermal management in electronics.

Common materials include thermal pastes (based on metal oxides or graphite), phase change materials, and silicone-based compounds. Effective TIMs reduce thermal resistance, ensuring devices maintain optimal performance and longevity by efficiently dissipating heat generated during operation.

The growing demand for thermal interface materials (TIMs) is driven by the increasing use of electronic consumer products, such as smartphones and laptops, as well as automation in industries, particularly in developing countries.

As modern electronics demand higher performance, TIMs play a crucial role in conducting heat between components. The rising disposable income of the middle-class further fuels demand, increasing the need for advanced electronic devices. Additionally, the commercial availability of various types of TIMs in multiple forms, combined with their expanding applications across the electronics industry, is expected to significantly boost market growth in the coming years.

The US Thermal Interface Materials Market

The US Recombinant Proteins market is projected to be valued at USD 1.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3.0 billion in 2034 at a CAGR of 11.3%.

Thermal interface materials (TIMs) in the United States have seen tremendous expansion due to a surge in government emphasis on renewable energy and sustainability initiatives. Energy-efficient technologies and green building practices are driving increased demand for reliable thermal management solutions; industries including renewable energy storage systems, LED lighting, and industrial automation increasingly depend upon them, contributing significantly to market expansion.

An emerging trend in the United States is adopting eco-friendly thermal interface materials to support sustainability goals, with innovative TIM formulations shaping the market. Smart energy-saving devices and automation systems like LED lighting and renewable energy drive the development of next-gen solutions for thermal management.

Key Takeaways

- Market Growth: The global thermal interface materials market is anticipated to expand by USD 8.0 billion, achieving a CAGR of 12.0% from 2026 to 2034.

- Product Analysis: Greases and adhesives are predicted to dominate the global market with a revenue share of 37.5% based on product by the end of 2025.

- Chemistry Analysis: Silicone is predicted to dominate the global market based on chemistry by the end of 2025.

- Application Analysis: Computers are projected to dominate the global market with the highest revenue share by 2025 in terms of application.

- Regional Analysis: Asia Pacific is projected to dominate the global thermal interface materials market, holding a market share of 40.2% by 2025.

Use Cases

- Electronics Cooling: Thermal interface materials (TIMs) are extensively used in electronics to improve heat dissipation between heat-generating components, such as CPUs, GPUs, and power transistors, and their associated heat sinks. This ensures efficient thermal management and prevents overheating, thereby improving the performance and longevity of the devices.

- LED Lighting Systems: High-power LED systems generate significant heat during operation. TIMs are applied between the LED chips and heat sinks or substrates to facilitate efficient heat transfer. This enhances the brightness, efficiency, and lifespan of the LEDs by maintaining optimal operating temperatures.

- Automotive Electronics: In modern vehicles, electronic control units (ECUs), battery packs, and power modules generate substantial heat. TIMs are used in these systems to ensure effective heat dissipation, especially in electric and hybrid vehicles, where thermal management is critical for safety and performance. The Automotive Battery Thermal Management System Market plays a vital role in maintaining optimal temperatures for battery efficiency and longevity.

- Telecommunications Equipment: Thermal interface materials are crucial in telecommunications infrastructure, such as base stations and network servers. These systems rely on TIMs to manage heat between processors, power amplifiers, and cooling systems, ensuring reliable operation and minimizing downtime.

Stats & Facts

- Thermal interface materials (TIMs) play a crucial role in heat management, with their efficiency primarily determined by thermal conductivity and contact resistance. Standard polymers without fillers have a thermal conductivity of approximately 0.1 W/m·K, while TIMs enhanced with fillers can reach thermal conductivity values of up to 7 W/m·K. Diamond-based TIMs are exceptional in this regard, offering thermal conductivity as high as 2000 W/m·K.

- TIMs typically have a thickness ranging from 0.1 to 0.5 mm. When poorly applied, the contact resistance of TIMs can exceed 1.0°C·cm²/W, but with proper application and sufficient pressure, this resistance can be reduced to below 0.1°C·cm²/W. TIMs are also enhanced with fillers such as aluminum nitride (100–180 W/m·K), boron nitride (~600 W/m·K), and graphite (200–2000 W/m·K), which significantly improve their thermal conductivity.

- In modern electronic devices, such as CPUs and GPUs, heat flux densities range from approximately 100–200 W/cm², which necessitates the use of effective TIMs. Silicone-based TIMs typically compress by 10–50% under load to ensure better contact, while phase-change TIMs melt at temperatures between 45°C and 60°C, thereby reducing thermal impedance.

Market Dynamic

Driving Factors

Rising Global Demand for Energy-Efficient LED LightingThe increasing global demand for energy-efficient lighting solutions is driving expansion in the Thermal Interface Materials Market (TIMs). As LEDs gradually replace less efficient fluorescent lamps, their use requires materials that effectively manage heat generation while producing desired lumen output at minimal energy loss and heat output. LEDs require high power while using minimal current consumption to maximize lumen output while simultaneously minimizing loss and heat generation.

TIMs become key elements in such an environment to ensure effective heat dissipation, prevent overheating, extend performance lifespan, and improve performance over the lifespan. Its adoption continues across residential, commercial, and industrial sectors which increases the demand for these essential materials and drives the market expansion further.

Thermal Management for Electronics

With electronics becoming compact and more powerful, managing heat has become an increasing difficulty. Other than LED lighting applications, numerous consumer electronics, automotive systems, and industrial applications rely heavily on effective thermal management strategies to increase performance and reliability.

Thermal Interface Materials (TIMs) have become indispensable tools in dissipating heat efficiently from electronic components, maintaining optimal operating temperatures, and avoiding overheating. As demand for smaller, energy-efficient electronic devices increases, so does the demand for high-performance thermal management solutions and therefore market demand for Thermal Interface Materials (TIMs).

Restraints

Limited Thermal Conductivity in Certain TIMs

While various types of TIMs are available, not all provide the high thermal conductivity needed for optimal heat dissipation in demanding applications. This limitation can restrict their effectiveness in high-performance systems such as advanced computing devices, automotive electronics, and power management systems. Research and development efforts aim to overcome these challenges, but current constraints in material capabilities can impact market growth.

High Cost of Advanced TIMs

The production of advanced thermal interface materials with superior thermal conductivity and durability often involves high manufacturing costs and the use of specialized materials. These costs can translate to higher prices for end consumers, limiting adoption, particularly in price-sensitive markets or applications where cost-effectiveness is a key consideration.

Opportunities

Enhanced Thermal Management for High-Performance Electronics

The use of Nanodiamond thermal interface materials offers significant opportunities to advance high-performance electronics thermal management. Materials with excellent heat dissipation capabilities and low dielectric constant can assist devices operating at higher clock speeds by efficiently dissipating heat transfer, thus providing efficient heat transfer.

This breakthrough addresses the shortcomings of traditional thermal interface materials (TIMs), opening new possibilities for faster, more reliable semiconductors used in consumer electronics, data centers and AI systems. By improving heat dissipation while still retaining insulation properties, nanodiamonds offer unprecedented possibilities for compact energy efficient designs in next-generation electronic devices.

Electric Vehicles and Renewable Energy

Nanodiamond-based thermo-management interface modules (TIMs) offer unique benefits in the expanding markets for electric vehicles (EV) and renewable energy sources, where effective thermal management plays a critical role in performance and safety. These materials can significantly improve heat dissipation in power electronics, batteries, and energy storage systems to guarantee reliability and efficiency under high thermal loads.

Nanodiamond thermal management components fulfill an increasing demand for sustainable technologies by helping overcome heat-dissipating challenges faced by electric vehicles (EV) and solar inverters, as nanodiamond TIMs do. Their integration also promotes innovation in energy-saving solutions while contributing towards green technology advancement - cementing nanodiamond's place as the cornerstone of future thermal management applications.

Trends

Thermal Interface Materials Market Experiences Explosive Growth

The thermal interface materials market is experiencing substantial expansion as high-speed computing and miniaturized electronic devices continue their trend of increasing adoption. As industries embrace advanced technologies, heat dissipation solutions in compact devices have seen increased demand from industries. Telecommunications advances, smartphone use and expanding IT operations all compound this need for heat mitigation devices in smaller devices. Thermal interface materials play an essential part in maintaining system efficiency, particularly as high-performance computing and compact designs continue to dominate the market. Such trends highlight how important thermal management will be in meeting the demands of next-generation electronic systems.

Expansion of Electric Vehicles and Eco-Friendly Regulations

The rapid adoption of electric vehicles (EVs) combined with stringent carbon emission regulations has had a substantial effect on thermal interface materials markets worldwide. As more cars transition toward electric vehicle (EV) technologies, thermal management systems for batteries and power electronics have become an increasing necessity. Thermal interface materials ensure optimal performance of crucial components to address thermal challenges specific to EV systems. Regulation-induced eco-friendlier materials have also become more readily available and this trend underscores thermal solutions' pivotal role in shaping sustainable transportation while aligning with global initiatives to fight climate change.

Research Scope and Analysis

By Product

Greases and adhesives are expected to capture 37.3% of the Thermal Interface Materials (TIMs) market revenue share by 2025 due to their excellent thermal conductivity and ease of application. Greases provide superior thermal performance by efficiently filling any small gaps between surfaces to facilitate efficient heat transfer. Adhesives provide thermal conductivity as well as mechanical bonding properties making them suitable for many industries and applications. Together, these products accounted for an extensive market share due to their widespread consumer usage and ability to handle high thermal resistance requirements.

With industries constantly demanding higher-performing devices, greases and adhesives continue to drive revenue growth within TIMs market. Other segments also hold significant market relevance; phase change materials in particular should experience growth due to their use in building construction for thermal management purposes. Elastomeric pads, beloved for their ease of handling and installation, have found widespread application across a range of electrical and electronics applications; their growth, however, remains restricted due to higher costs and narrower applicability scope.

Tapes and films made of metals provide tailored solutions for toughness, environmental resistance, and compatibility with electronic devices. Each segment can be selected based on factors like its tensile strength, hardness, and thermal performance to meet diverse industry-wide applications.

By Chemistry

Silicone is predicted to lead the thermal interface materials (TIMs) market with the largest revenue share in 2025 due to its superior properties and versatile applications, including excellent adhesion properties across numerous substrates that enable strong bonding within complex assemblies. They offer excellent thermal conductivity, making it an excellent material choice for effective heat dissipation in electronic devices. Silicone's inherent flexibility & durability allow it to withstand thermal cycling as well as mechanical stresses over time, maintaining performance over time.

This material finds widespread application as greases, adhesives, thermal pads, and gap fillers for use across industries including electronics, automotive, and telecommunications. Due to its wide applicability and outstanding performance characteristics, its market dominance and rapid expansion continue unabated.

Epoxy resins are projected to account for second place in the thermoset ink market due to their exceptional thermal and mechanical properties, making it suitable for use as protective coverings on electronic components such as in encapsulates or potting compounds. Epoxy's superior adhesion and heat resistance make it the material of choice when reliability and cost efficiency are required in industrial applications, thus further strengthening its presence within the market.

By Application

Computers as applications are predicted to dominate the Thermal Interface Materials market with revenue share in 2025 due to the rising popularity of high-performance computing devices like desktops, laptops, and servers. As computing devices become more powerful, they produce more heat. To prevent overheating and ensure proper performance, proper thermal management must be employed to keep performance intact and avoid overheating issues. Heat dissipation from critical components such as processors, GPUs, and memory modules requires thermal management interface modules (TIMs).

They play an essential role in keeping these essential systems functioning at maximum capacity while prolonging their lifespans. Rapid advances in computer technologies such as faster processors and high-resolution displays as well as AI and gaming have necessitated increased cooling solutions; Thermal Interface Modules provide reliable yet cost-effective ways of mitigating these temperature challenges.

The telecom sector ranks second-highest for thermal management solutions worldwide. Demand for faster networks, greater bandwidth capacity, and enhanced system performance has resulted in the widespread deployment of advanced telecom equipment, making thermal management integral in maintaining reliability and avoiding overheating - hence driving its adoption within this sector.

The Thermal Interface Materials Market Report is segmented based on the following

By Product

- Greases and Adhesives

- Phase Change Materials

- Elastomeric Pads

- Tapes and Films

- Metal Based

- Others

By Chemistry

- Silicone

- Epoxy

- Polyamide

- Others

By Application

- Computer

- Telecom

- Medical Devices

- Industrial Machinery

- Consumer Durables

- Automotive Electronics

- Others

Regional Analysis

Asia Pacific is likely to lead the Thermal Interface Material (TIM) market with a revenue

share of 40.2% in 2025, due to its rapidly expanding electronics and electrical industries, particularly in countries like China, Japan, and South Korea. These nations are home to some of the world’s largest electronics manufacturers, contributing significantly to the demand for TIMs. China, as the largest electronics producer globally, has strong manufacturing capabilities that drive the need for effective heat dissipation solutions in various devices.

The country's booming electronics sector, including smartphones, computers, and consumer electronics, directly fuels the market for thermal interface materials. Additionally, Japan's leadership in the automotive and semiconductor industries further strengthens the region's dominance, as these sectors require advanced TIMs to manage heat in high-performance systems. North America, on the other hand, is the second-largest market for TIMs, and it is expected to see substantial growth in the forecast period. The demand for TIMs in North America is primarily driven by the increasing need for advanced electronic devices, such as high-performance computing systems, consumer electronics, and electric vehicles (EVs).

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Thermal Interface Materials market is highly competitive, with major players working to strengthen their presence. Many companies prioritize product innovation, research and development, and strategic partnerships to maintain a competitive advantage. They invest in cutting-edge technologies and materials to improve the performance of thermal interface materials, ensuring effective heat dissipation in electronic devices and systems. Additionally, market participants focus on expanding their global reach by pursuing geographical expansions, mergers and acquisitions, and forming collaborations with regional distributors.

Some of the prominent players in the global Thermal Interface Materials are

- Henkel AG & Co. KGaA

- Dow Inc.

- 3M Company

- Parker-Hannifin Corporation

- Honeywell International Inc.

- Momentive Performance Materials Inc.

- Fujipoly

- Shin-Etsu Chemical Co., Ltd.

- Indium Corporation

- Zalman Tech Co., Ltd.

- SEMIKRON International GmbH

- Avery Dennison Corporation

- Other Key Players

Recent Developments

- In March 2024, Advanced Thermal Solutions, Inc. (ATS) introduced pcbCLIP, a frame-and-clip system designed to securely attach larger, high-performance heat sinks to smaller, high-power PCB components.

- In February 2024, Indium Corporation was honored with the prestigious Supplier Award in China from Jabil Wuxi, a trusted partner offering comprehensive engineering, manufacturing, and supply chain services to leading global brands. The award was presented at Jabil Wuxi's 20th anniversary celebration on January 26.

- In January 2024, RAK Ceramics played a key role in the architectural success of Ayodhya's Ram Mandir. Known for its contributions to significant projects across India, RAK Ceramics has made a lasting impact on iconic structures such as the Kashi Vishwanath temple complex, the UP PWD project, and major airports in Lucknow, Chennai, Bangalore, and Delhi.

- In March 2024, Resonac Corporation announced plans to significantly boost its capacity to develop materials for high-performance semiconductor chips used in AI CPUs, with an increase of 3.5 to 5 times its current capabilities. The company plans to ramp up production of non-conductive film (NCF) and thermal interface materials (TIM), with an investment of 15 billion yen to expand its facilities, starting in 2024.

- In February 2023, Indium Corporation revealed that it would showcase its high-performance metal thermal interface materials (TIMs) for burn-in and testing at TestConX, taking place from March 5th to 8th in Mesa, Arizona, U.S. These indium-based TIMs offer superior thermal conductivity, with pure indium delivering 86W/mK. The TIMs are available in forms such as pure indium, indium-silver alloys, and indium-tin.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 4.8 Bn |

| Forecast Value (2033) |

USD 13.4 Bn |

| CAGR (2024-2033) |

12.0% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 1.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Greases and Adhesives, Phase Change Materials, Elastomeric Pads, Tapes and Films, Metal Based, and Others), By Chemistry (Silicone, Epoxy, Polyamide, and Others), By Application (Computer, Telecom, Medical Devices, Industrial Machinery, Consumer Durables, Automotive Electronics, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Henkel AG & Co. KGaA, Dow Inc., 3M Company, Parker-Hannifin Corporation, Honeywell International Inc., Momentive Performance Materials Inc., Fujipoly, Shin-Etsu Chemical Co., Ltd., Indium Corporation, Zalman Tech Co., Ltd., SEMIKRON International GmbH, Avery Dennison Corporation, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |