The global thermoform packaging market is witnessing significant growth, driven by the need for convenient and efficient packaging in various industries. Thermoform packaging is shaping plastic sheets through heat application. Such packaging solutions have broad usage in the food and beverage, healthcare, and consumer goods industries. Thermoforming packaging in food and beverage helps with product freshness, prolongs the shelf life, and addresses the demanding need for packaged and ready-to-eat foods.

Two of the most adopted forms of packaging are blister and clamshell packaging, which have proven to offer better durability and tamper resistance, besides providing clear visibility of the products; hence, they are preferred for items in consumer goods and pharmaceuticals. In healthcare, one of the prominent segments of thermoformed blister packaging finds its best application in unit-dose medication due to its hygienic and protective nature in packaging.

Other market participants, such as Sonoco Products Company, Anchor Packaging, and Display Pack Inc., are distinguishing their market presence through innovations in design and sustainable materials. Sustainability in packaging solution development along with the usage of recycled plastic material is the most valued factor for the growing thermoform packaging market size, wherein companies have to abide by environmental practices over global ecological concerns.

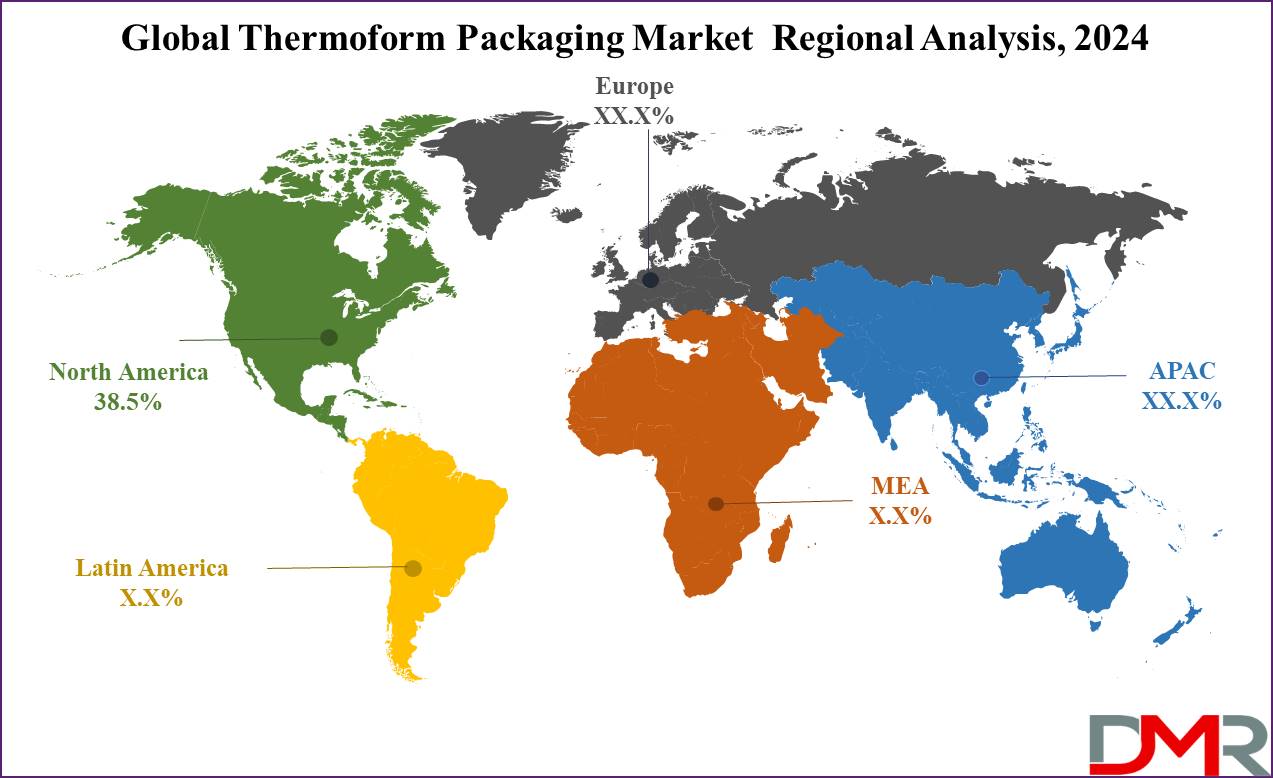

The dominant share in the regional segment comes from North America, due to its better packaging industry, strong healthcare sector, and growing demand for packaged food. With the consumer trend shifting toward sustainable options, this is expected to fuel growth in the global thermoform packaging market, moving forward based on technological advancements and diversified applications in end-use industries.

The US Thermoform Packaging Market

The US Thermoform Packaging Market is projected to be valued at USD 17.0 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 33.2 billion in 2033 at a CAGR of 7.7%.

Following are a couple of the trending factors and developments that are capable of shaping the U.S. One of them involves the leading trend for consuming thermoformed plastic packaging from the food and beverages industry, owing to the growing demand for convenient and single-serve packaging solutions, which, in turn, propels the blister packaging and clamshell packaging market. Key developments include a move towards sustainable packaging solutions due to increasing consumer and regulatory emphasis on the environment.

This shift has encouraged thermoform packaging manufacturers to consider recyclable materials and alternative resources through the development of bio-based plastics, thereby driving the growth rate of sustainable packaging across the region. Similarly, Modified Atmosphere Packaging and development related to vacuum-forming processes are other innovative ideas that have been seen within the U.S. market, improving the shelf life of perishable foods. Key players, such as D&W Fine Pack and Dart Container, invest in state-of-the-art thermoforming techniques to keep up with the changing standards of the industry.

The region also consists of strategic partnerships between key participants to develop better products, which in turn is likely to further strengthen the position of thermoform packaging solutions in the U.S. market. Increasing consumer expectations for food safety and convenience further underpin the potential of market expansion in the North American thermoform packaging industry.

Key Takeaways

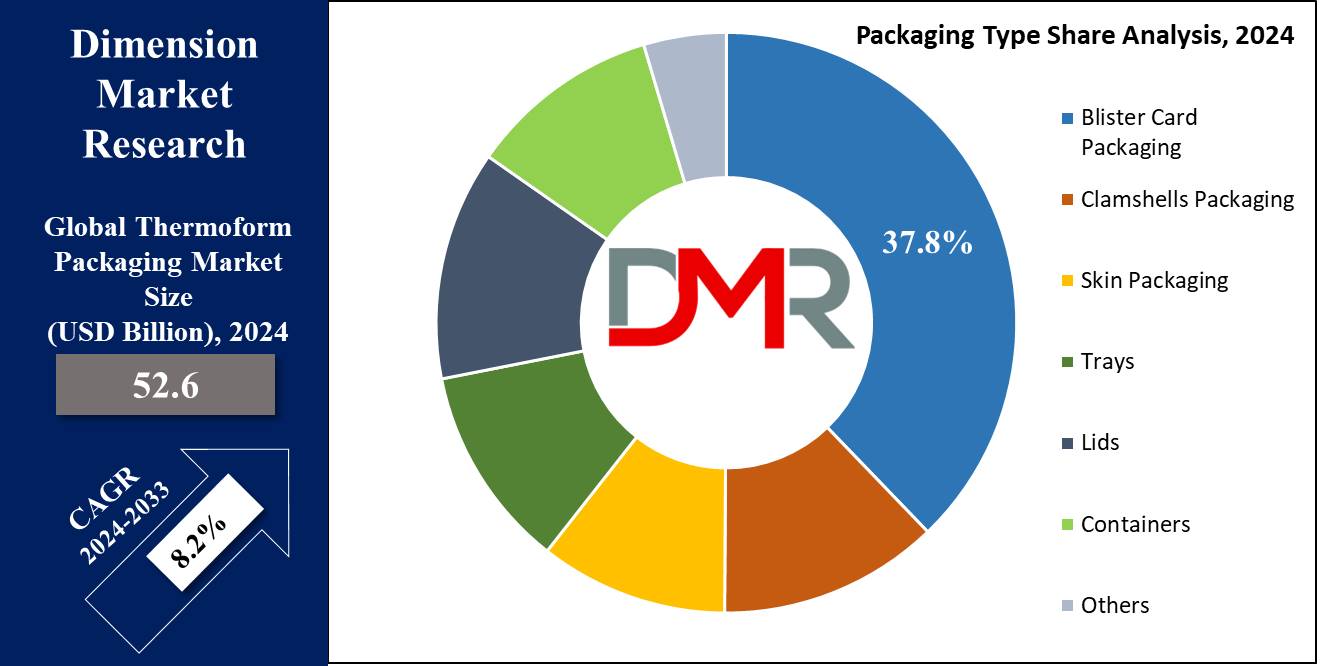

- Global Market Share: The Global Thermoform Packaging Market size is estimated to have a value of USD 52.6 billion in 2024 and is expected to reach USD 107.0 billion by the end of 2033.

- The US Market Share: The US Thermoform Packaging Market is projected to be valued at USD 17.0 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 33.2 billion in 2033 at a CAGR of 7.7%.

- Regional Analysis: North America is expected to have the largest market share in the Global Thermoform Packaging Market with a share of about 38.5% in 2024.

- By Packaging Type Segment Analysis: Blister card packaging is expected to dominate this segment with 37.8% of the market share in 2024.

- By Material Segment Analysis: Plastic is anticipated to dominate the material segment in this market with 33.2% of the total market share in 2024.

- Key Players: Some of the major key players in the Global Thermoform Packaging Market are Amcor, Sonoco Products Company, Placon Corp., Display Pack Inc., Pactiv LLC, Dart Container Corp., Constantia, Tray-Pak Corp., and many others.

- Global Growth Rate: The market is growing at a CAGR of 8.2 percent over the forecasted period.

Use Cases

- Food and Beverage Packaging: Thermoforming allows for safe packaging of fresh produce, meats, and ready-to-eat meals, giving them a longer shelving life and keeping them much fresher.

- Pharmaceuticals: Blister packaging provides safety in tamper evidence packing of medications for exact dosage intake and protection from contamination.

- Electronics: Both clamshell and skin packaging offer secure transit without damage to electronics, while allowing good visibility for added product security.

- Consumer Goods: Thermoformed trays find extensive application in the display and retail handling of commodities like personal care products and toys in an effective yet decent manner.

Market Dynamic

Trends

Shift Toward Sustainable Packaging Solutions

As awareness of environmental issues increases, more and more consumers and companies demand Products whose packaging is biodegradable and recyclable. No doubt, this trend will continue to encourage thermoform packaging manufacturers to conduct further studies and invest in greener alternatives to conventional plastics, such as bioplastics and compostable materials.

PLA or cellulose-based materials are increasingly finding applications across industries since these are strong yet do less harm to the environment. This also corresponds to strict regulatory requirements from regions like Europe and North America that insist on the reduction of plastic waste. More companies are using post-consumer recycled content for packaging to reduce virgin plastics dependence and please environmentally sensitive customers.

Rising Demand for Customization

Increasingly, brands are seeking differentiated packaging designs to enhance brand visibility, ensuring the involvement of customers in purchase decisions. Specifically, food and beverage packaging greatly relies on customized packaging, which allows companies to create unique shapes, colors, and logos, thus giving them an individualistic identity in the competitive space of cluttered retail store shelves.

Some other evolved thermoforming techniques include pressure forming and plug-assist forming, allowing manufacturers to make sophisticated designs targeted for the particular product requirement. Bespoke thermoform packaging not only adds to the aesthetics but also brings functionality and shelf appeal to the products themselves, while consumers increasingly ask for accordant packaging-very personalized, very appealing.

Growth Drivers in Thermoform Packaging Market

Expansion in the Packaged Food and Beverage Sector

The growth of the packaged food and beverage market is driven by rapid urbanization and increasingly busy lifestyles, there is a sharp rise in packaged food consumption globally. Therefore, it has substantially raised the demand for thermoformed packaging. Prepackaged single-serve food products need resilient packaging to avoid food degradation and prolong its freshness, a vital concern of the quality of the product during transportation and storage.

For this reason, thermoformed packaging in such contexts offers all these advantages and thus sees a wide application in the packaging of ready-to-eat meals and frozen food. On top of that, the versatility of thermoformed packaging supports other broad categories of food, including snacks, dairy products, and fresh produce, among others, promoting more ways in which this category can be grown.

Healthcare and Pharmaceutical Industry Needs

The healthcare and pharmaceutical industries are growing at alarming rates and there is increasing demand for unit-dose blister packs to ensure appropriate dosages and protection of products from contamination. Given the critical nature of medications, this form of packaging not only ensures patient safety but also meets various regulatory requirements governed by health authorities.

Thermoformed packaging is widely adopted for blister packaging in the pharmaceutical industry due to its tamper-evident property, which protects the integrity of the product and ensures patient safety. High growth in pharmaceuticals and health services is witnessed across different geographies worldwide, thereby translating into increased production and demand for thermoformed packaging solutions.

Growth Opportunities in Thermoform Packaging Market

Development of Biodegradable Thermoform Packaging

Research into biodegradable materials provides a huge growth opportunity for the thermoform packaging market. Most consumers show interest in sustainability. Furthermore, with the development of greener materials like PLA and PHA, a group of polyhydroxyalkanoates, it would therefore become easy for manufacturers to meet consumer expectations.

In addition, major retailers and brands have begun to put in place sustainability targets at the heart of which are reductions in plastic waste. Companies will, therefore, be positioned as leaders in sustainable packaging solutions by expanding biodegradable and compostable options within thermoform packaging.

Technological Advancements in Thermoforming

Advancement in thermoforming machinery and automation continues to improve efficiency, bringing down production costs. Automated systems decrease time and labor for production while guaranteeing precision and quality consistency.

Moreover, multi-layer thermoforming innovations develop the barrier properties of packaging, and it becomes more qualified to take a position for a wide range of applications. These technological improvements give thermoform packaging makers the efficiency to scale operations and expand their market reach across sectors.

Restraints in Thermoform Packaging Market

Environmental Concerns Over Plastic Waste

While the plastics used in thermoform packaging are strong and flexible, satisfying demands for their use, one of the major challenges arises out of growing environmental concern about plastic waste. Plastics used in thermoforming as PET and PVC contribute to landfill waste and continue to face environmental and regulatory pressure for sustained alternatives.

On the other hand, it puts an increasing demand on the industry to use biodegradable materials, which, though environmentally friendly, generally require higher costs in production and infrastructure changes.

Volatility in Raw Material Prices

Thermoform packaging is highly dependent on petroleum-based plastics. Fluctuations in the prices of raw materials, such as PP and PS, make it difficult to achieve steady growth. These commodity materials are susceptible to price volatility influenced by the prices of global oil and geopolitical events.

Their sudden change may raise the operational cost and lower the profit margin of thermoform packaging manufacturing, thus reducing the overall stability of the market.

Research Scope and Analysis

By Packaging Type Analysis

Blister card packaging is projected to lead this segment within the thermoform packaging market as it will hold 37.8% of the market share in 2024. Blister card packaging is the leading segment in thermoform packaging due to its versatility, protective attributes, and visual appeal. This makes blister card packaging the favorable pack solution within varied industries, especially the pharmaceutical and FMCG sectors.

Such a packaging type provides crystal-clear visibility of the product and is an effective tamper-evident solution, assuring consumers about the integrity of the product in real time. The packaging saves money in production and is light in weight; therefore, lowering material consumption and transportation costs. These facts reflect the trend for greener packaging.

Blister card packaging in pharmaceuticals protects the dose per unit, hence reducing contaminations and increasing patient compliance due to longer shelf life. Moreover, through blister card packaging, effective branding is provided because the design allows for customizable graphics and product information on the packaging of the product, thus making it marketing-friendly too.

This inexorable march towards recyclable materials in blister card packaging further fortifies the market's growth in more environmentally sensitive markets, such as North America and Europe. Innovations within thermoforming processes, allowing for more complex shapes and sizes catering to various consumer and regulatory demands, continue to drive growth within the segment.

By Material Analysis

Plastic is projected to dominate the material segment in this market as it is attributed to holding 33.2% of the total market share in 2024. Plastics keep the dominant position in the global thermoform packaging market due to the lightness, cheapness, and versatility of this packaged format. For example, PE, PP, and PET are some of the commonly used packaging materials for thermoforming since they provide excellent durability, and flexibility, and can be molded into any shape according to the requirements, of industries such as food and beverage, pharmaceuticals, and consumer electronics.

Barrier qualities of specific plastics in particular help protect products from contaminants, moisture, and oxygen, which is highly critical in food packaging, especially when it comes to maintaining product freshness for an extended period. In addition, the easy recyclability of certain plastics meets the growing demand taken up worldwide for sustainable packaging solutions.

Another reason for the high demand is that thermoformed plastic packaging can work together with a wide range of thermoforming processes, such as vacuum forming and pressure forming, each of which permits the production of complex shapes with high quality in a very consistent manner. Again, this constitutes one of the reasons for the predominance of plastics in the thermoform packaging industry.

Further helping the segment is the development in the field of bio-based plastics that meet the required environmental standards without compromising performance issues, thus finding plastics indispensable in thermoforming packaging solutions during the forecast period.

By Forming Process Analysis

Vacuum vacuum-forming process is projected to dominate this segment with the highest market share in 2024. The reason vacuum forming is among the popular processes in the thermoform packaging market deals with its highly sufficient simplicity for diverse applications. A vacuum-forming process involves heating a plastic sheet and forcing it against a mold through a vacuum.

In such a way, it is possible to come to the output productively and qualitatively while spending relatively low financial means. Such unique features also mean that vacuum forming is particularly effective in producing single-use and customized packaging solutions and containers-which present an improvement in presentation and convenience for the consumer.

Vacuum forming also is an energy-efficient process in that it requires much lower heat and pressure compared to other processes, which will make it cost-effective for the manufacturers of thermoform packaging. Its wide applicability also stems from its ability to work with a wide range of material inputs, including PET, HDPE, and polypropylene, because it can reach a wide array of end-use industries.

The recent developments in automated vacuum forming further enhance its productivity, thereby enabling manufacturers to supply large volumes of high-speed thermoformed plastic packaging and support market growth across sectors. Because of process efficiency, material flexibility, and low production costs, therefore, vacuum forming continues to dominate.

By Heat Seal Coating Analysis

Water-based coatings have emerged as the largest segment in the heat seal coating category in the global thermoform packaging market owing to their environmental acceptance along with the fact that these coatings can operate well with most the thermoformed plastic materials. These coatings develop a very strong permanent seal meeting the requirements of the food and beverage and pharmaceutical industry due to the high standards of safety.

Unlike solvent-based coatings, water-based coatings emit very low VOCs, hence responding to global sustainability concerns and meeting even the strictest environmental regulations. Other properties include very good adhesion to PET, PP, and HDPE plastics, hence versatile for a range of packaging solutions such as blister packaging and clamshell packaging.

Water-based coatings boast fast-drying properties along with clarity and gloss retention, hence assuring better product presentation. Besides these, compatibility with recyclable materials seals the bargain for their favor amongst thermoform packaging manufacturers. Furthermore, consolidating their position in the market, continuous development related to eco-friendly coating technologies places water-based coatings in just the right position to become the solution sought by various industries in meeting the demands for sustainable packaging during the forecast period.

By End-Use Industry Analysis

The pharmaceutical industry is projected to dominate the global market with the highest market share in 2024. One of the biggest drivers of demand within the thermoform packaging market is the stringent pharmaceutical industry, which requires very secure and tamper-evident packaging to ensure the integrity of the product and dose accuracy. Protection from contaminants, moisture, and UV light maintains the usability of sensitive drugs by extending their shelf life; thus, both blister and clamshell packaging have pointed uses for pharmaceuticals.

Thermoformed plastic packaging enables convenient unit-dose packaging of oral drugs, ensuring patient compliance and minimizing waste. Besides, stringent regulatory demands on strong and tamper-evident packaging make thermoformed packaging particularly suitable for protection in pharmaceuticals. Further demand in this sector is also being stirred by increased growth in healthcare sectors around the globe, which, in turn, has put an increased topical emphasis on medical supplies.

Another driving force in the use of recyclable and eco-friendly plastics in packaging by the pharmaceutical industry is the industry's focus on sustainability, considering the commitment of the industry to environmental standards. The strong usage of thermoform packaging by the pharmaceutical sector has placed the sector amongst the leading end-use industries within the thermoform packaging market.

The Thermoform Packaging Market Report is segmented on the basis of the following

By Packaging Type

- Blister Card Packaging

- Face Seal

- Trapped Blister

- Full Card Blister

- Clamshells Packaging

- Skin Packaging

- Trays

- Lids

- Containers

- Others

By Material

- Plastics

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Polystyrene (PS)

- Polylactic Acid (PLA)

- Others (PE, HDPE, LDPE)

- Paper & Paperboard

- Aluminum

- Wood

- Others

By Forming Process

- Vacuum Forming

- Pressure Forming

- Plug Assist Forming

- Drape Forming

- Cavity Forming

- Two Sheet Forming

By Heat Seal Coating

- Water-Based Coatings

- Solvent-Based Coatings

- Hot Melt Coatings

By End-Use Industry

- Food & Beverage

- Pharmaceuticals

- Healthcare & Medical Devices

- Electronics

- Homecare & Personal Care

- Automotive

- Others

Regional Analysis

North America is projected to dominate the largest share in the global thermoform packaging market as it

hold 38.5% of the market share in 2024. With a proper infrastructure of the food and beverage industry, which is one of the main end-users for thermoform packaging solutions, North America has the largest share in the global thermoform packaging market.

This, in turn, has triggered demand mainly for convenient, ready-to-eat foods and single-serve packaging, which is the reason for the adoption of clamshell and blister packaging in the region. Besides that, strong growth in the pharmaceutical industry contributes highly, as the region focuses on safe and tamper-evident packaging for medical and personal care products.

Due to increased sensitivity regarding environmental awareness, huge investments have characterized North America in terms of sustainable packaging solutions, as many companies have shifted to recyclable and biodegradable plastic options. Leading players like Anchor Packaging and D&W Fine Pack are headquartered in the region and invest actively in research and development, which continuously improves the quality and functionality of thermoformed plastic packaging.

Government regulations for sustainability and recyclable materials further support the market growth in North America. Technological advances in thermoforming processes reinforce the lead taken by North America due to the ability to enable cost-efficient, high-volume, quality production, thereby reinforcing the region's standing in the thermoform packaging market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competition in the market for thermoform packaging is huge, with immense innovation by reputed players and emergent companies to cater to the rising demands of the market. Some key players include Anchor Packaging, Sonoco Products Company, Dart Container, and D&W Fine Pack, among others. These players dominate the market by providing a range of thermoformed packaging solutions to diverse industries such as food and beverages, pharmaceuticals, and electronics.

These companies, through R&D investments and partnerships, are improving sustainable packaging solutions and thermoforming processes that include vacuum forming and pressure forming to ensure strength and eco-friendliness in their products. The competitive landscape involves strategic mergers and acquisitions to widen market share and strengthen product portfolios. Emerging companies are focusing on recyclable materials and biodegradable plastics, catering to the demand for sustainable packaging.

More so, regional players are also entering the market, and this increased competition faces its basis on product innovation, custom solutions, and advanced methods of production as a means of differentiating firms. Competition is also important between North America and Europe because it still has a strong clientele base due to its consumers and environmental regulations.

Some of the prominent players in the Global Thermoform Packaging Market are

- Amcor

- Sonoco Products Company

- Placon Corp.

- Display Pack, Inc.

- Pactiv LLC

- Dart Container Corp.

- Constantia

- Tray-Pak Corp.

- D&W Fine Pack

- Lacerta Group, Inc.

- RPC Group Plc

- Silgan Holdings, Inc.

- Sinclair & Rush, Inc.

- Other Key Players

Recent Developments

- October 2024, Sonoco Products Company unveiled a new line of thermoformed packaging solutions using post-consumer recycled materials, addressing growing sustainability demands in the food and beverage industry.

- August 2024, Anchor Packaging introduced recyclable thermoform containers for the food industry, aligning with eco-friendly practices and regulatory standards.

- July 2024, Sonoco Products Company completed the acquisition of Thermoformed Solutions, strengthening its North American presence and expanding its product offerings.

- June 2024, D&W Fine Pack launched an automated thermoforming system, enhancing productivity and efficiency for high-demand applications, especially in food packaging.

- May 2024, Dart Container Corporation increased investment in R&D for developing biodegradable thermoform packaging, addressing the growing need for sustainable solutions.

- April 2024, Display Pack Inc. announced an expansion of its sustainable packaging line with new thermoformed trays made from 100% recyclable materials, catering to both food and pharmaceutical applications.

- March 2024, Placon Corporation launched its EcoStar line featuring thermoformed packaging made from recycled PET, focusing on sustainable solutions for the consumer goods market.

- December 2023, D&W Fine Pack expanded its manufacturing capabilities by installing energy-efficient thermoforming equipment to reduce carbon emissions, aligning with its environmental sustainability goals.

- September 2023, Anchor Packaging introduced compostable thermoform packaging options targeting eco-conscious food service providers.

- July 2023, Sonoco Products Company collaborated with a leading bioplastics company to develop bio-based thermoform packaging, reducing reliance on petroleum-based plastics.

- May 2023, Amcor Ltd. introduced lightweight thermoform packaging aimed at reducing material usage without compromising product protection, catering to cost-effective and sustainable packaging needs.