Tire Material Market Overview

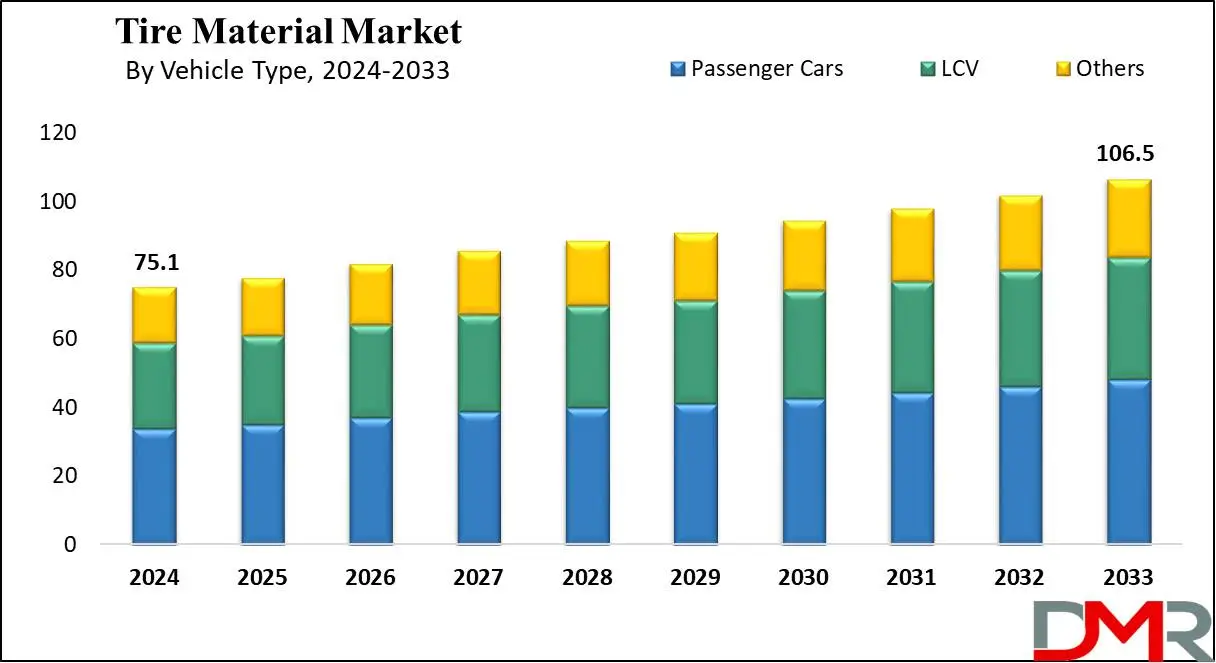

The Global Tire Material Market is expected to attain a valuation of USD 75.1 billion in 2024 & USD 106.5 billion by 2033, having expanded at a CAGR (Compound Annual Growth Rate) of 3.9% during the period from 2024 to 2033. The demand for high-performance tires has increased due to the inclusion of hydraulic power brakes & better movement-control technology in vehicles.

Tire materials, consisting of elastomers, chemicals, plasticizers, metals, reinforcing fillers, & more, play an important role in making tires tailored to several vehicles. These materials, along with rims, form tires, using distinct rubber compounds for various tire components. The growing demand arising from the manufacturing of electric & hybrid vehicles has acted as a significant growth driver.

However, the decline in global automotive manufacturing poses a challenge, and the recent pandemic has added further hindrances to the progression of the market. In this scenario, focusing on eco-friendly tire material R&D opens up promising prospects for the Tire Material Market for the forecast period (2023-2032). Notably, the Asia Pacific region, led by nations such as India & China, dominates the global scenario with an increasing consumption trend. Integration with the

sustainable marine fuel market and other green technologies emphasizes the broader shift toward eco-conscious automotive practices.

The Tire Material Market is evolving, driven by demand for performance, durability, and sustainability. Key segments include natural rubber, synthetic rubber, textiles, and fillers. Natural rubber, valued at $25 billion in 2023, is set to reach $32 billion by 2032 due to its superior elasticity and grip.

Synthetic rubber, dominating the market at $30 billion in 2023, is projected to hit $40 billion by 2032, favored for durability across weather conditions. Textiles and fillers, integral to tire strength and wear resistance, are also growing steadily. Environmental concerns and technological advancements are shaping the market, emphasizing sustainable material innovation.

Key Takeaways

- On the basis of type, elastomers dominate the global tire material market as they hold 28.1% of market share.

- After elastomers, reinforcing fillers are showing the highest growth potential in the type segment in 2024.

- In the context of vehicle type, passenger cars dominate this market as they hold the highest market share in 2024.

- The Asia Pacific is expected to dominate the global tire material market as it holds 38.3% of market share in 2024.

- Following Asia Pacific, North America shows the highest growth potential in the global tire material market.

Use Cases

- Gradeall one of a leading innovator of tire recycling machinery is now discussing to utilize 1.5 billion annual waste produced by tire production which will utilized as a rubber mulch, rubberized bricks, mats, fuels and art projects.

- Streamlining manufacturing processes is vital to minimize the rate of rubber waste production during manufacturing. Innovative technologies like computer-controlled cutting and laser-guided systems ensure precision, minimizing material loss.

- Murata Manufacturing offers an RFID solution to the tire industry, which aim to change business practices within this sector. Entrenched RFID tags allow processes from logistics to check tires, which increases efficiency and sustainability.

- The continental company wants to achieve sustainability in the manufacture of tires with materials such as dandelion rubber, recycled rubbers and silica from rice husks. This approach aligns with innovations in the Automotive Plastic Compounding.

Tire Material Market Dynamic

The rise in worldwide sales of mining & construction machinery, along with a rising requirement for tire replacements in emerging nations, constitutes the primary driving forces behind the market's expansion. The growth of the tire material market is also driven by factors such as escalating urbanization & growing population.

Manufacturing has shifted focus to materials such as wire, carbon black, & synthetic rubber to improve tire performance. Proper testing by the automotive sector has fostered material demand & propelled the tire material sector. Moreover, the increased acceptance of high-performance tires having exceptional properties including increased abrasion resistance & low energy loss will further accelerate the growth of the tire material market.

Furthermore, government spending & investments in automotive engineering technology play a key role. Investments by the government in the automotive sector have an impact on the Tire Material Market. However, challenges such as fluctuations in prices & issues regarding supply & demand. On the other side, opportunities arise from environmentally friendly materials & collaborative technological developments.

The rise of advanced tire technologies & materials with high performance has elevated the markets’ growth. The development of materials such as silica & carbon black leads to better tire quality & fuel efficiency, further driving the market’s growth.

Driving Factors

The tire material market is driven by the growing demand for automobiles, including passenger vehicles, commercial vehicles, and

electric vehicles (EVs). Expanding urbanization and rising disposable incomes, particularly in emerging economies, have boosted vehicle sales, increasing the need for high-quality tire materials.

Additionally, the focus on fuel efficiency and reduced rolling resistance has led to the adoption of advanced materials like silica and synthetic rubber. Stricter environmental regulations have also encouraged the use of sustainable and eco-friendly tire materials, further driving the market as manufacturers innovate to meet performance standards while minimizing environmental impact.

The integration of tire monitoring and connected vehicle systems demonstrates overlap with

Digital Health technologies for smart vehicle safety and monitoring solutions.

Trending Factors

A notable trend in the tire material market is the shift toward sustainable and eco-friendly solutions. Manufacturers are increasingly adopting recycled and bio-based materials to meet environmental standards and reduce carbon footprints. Innovations in material science, such as functionalized polymers and nano-materials, are enhancing tire performance in durability, grip, and fuel efficiency.

The growing demand for electric vehicles (EVs) has spurred the development of specialized tire materials optimized for EV-specific requirements like lower noise and higher load capacity. Furthermore, advancements in digital tire monitoring systems influence the design and composition of materials to ensure compatibility with smart technologies.

Restraining Factors

Fluctuating raw material prices, particularly for natural rubber and petroleum-based synthetic rubber, pose a significant restraint to the tire material market. Price volatility affects production costs and profit margins, challenging manufacturers' ability to maintain competitive pricing.

Additionally, the high cost of developing and transitioning to advanced, sustainable materials can limit adoption, especially for smaller players. Stringent environmental regulations in certain regions add compliance burdens, requiring substantial investment in R&D and production processes. Economic uncertainties, including trade disruptions and inflation, further hinder market growth by impacting demand and supply chain stability in key regions.

Opportunity

The tire material market offers significant opportunities through innovations in sustainable and high-performance materials. The growing focus on electric vehicles (EVs) has created demand for tire materials tailored to their specific needs, such as improved rolling resistance and durability.

Emerging markets in Asia-Pacific and Latin America present untapped potential, driven by increasing vehicle ownership and industrialization. Collaborations between tire manufacturers and material developers can drive innovation and market differentiation. Additionally, the rise of smart tires integrated with IoT and sensor technologies opens new avenues for advanced material development, enabling enhanced connectivity, safety, and performance in modern vehicles.

Tire Material Market Research Scope and Analysis

By Type

The leading force within the market landscape arises from the elastomer segment, mainly propelled by the increasing demand arising from the automotive sector. This segment consists of both natural & synthetic rubber, playing an important role in the intricate process of tire manufacturing.

Specifically notable is the usage of butadiene, a key constituent in rubber production, providing distinct benefits such as diminished rolling resistance & more wear resistance. These features culminate in an enhanced tire lifespan, alongside a reduction in fuel consumption, marking a notable leap forward within the tire sector.

Recent times have observed a dip in automotive production, remarkably in economies such as the US, Germany, & China. This has, in turn, resulted in a decline in the demand for tire materials. However, a positive change is on the rise, from 2021 onwards, a potential recovery in production levels across the automotive sector can be observed. This trajectory holds the potential to increase the demand for tire materials, aligning with the projected course of the market.

By Tire Type

On the basis of tire type, pneumatic tiers are expected to dominate the global tire material market in 2024. They are highly popular in as they are commonly used in vehicles like automobiles, bicycles, motorcycles and various heavy equipment. As it should be clear with its name pneumatic refers to the tires that are filled with air that provide extra cushioning and support to tires.

Another factor that play major role in their popularity is their better shock absorption, improved traction and a smoother ride to the consumer. The only back draw the pneumatic tires have is that they are susceptible to punchers and require regular maintenance to ensure proper inflation.

By Vehicle Type

Passenger cars take the lead in the Global Tire Material Market and are predicted to grow with a substantial CAGR for the period 2024-2033. Tires are made for tough terrains & heavy loads. Among vehicles on the road, passenger cars & light-duty trucks are the most common for carrying passengers. Passenger car tires are designed for stability, comfortable rides, appearance, longevity, handling, & affordability.

They're also known for their better mileage performance. All-season tires, which are apt for passenger cars, provide a smooth ride, & good traction even in dry or wet conditions.

Furthermore, tires not only provide grip & traction but also act as a cushion for a moving vehicle's wheels. This practical functionality has led to an enhanced utilization in passenger cars, propelling the growth in the tire material market over the forecasted period.

The Tire Material Market Report is segmented on the basis of the following

By Type

- Reinforcing Fillers

- Elastomers

- Chemicals

- Plasticizers

- Metal Reinforcements

- Textile Reinforcements

By Tire Type

- Pneumatic Tire

- Retreated Tire

- Solid Tire

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCV)

- Others

Tire Material Market Regional Analysis

The Asia-Pacific region dominates the market as it is expected to hold a

revenue share of 38.3% globally in 2023. Despite this, the market will continue to grow in near future concerning size and rate of growth during the forecast period majorly driven by strong demand from automotive sector specifically in emerging economies such as China & India.

China is the largest tire manufacturer in the world, accounting for approximately one-third of global output. India also contributes notably to the tire industry with several domestic and global competitors such as JK Tyres, CEAT, and MRF Michelin Pirell Apollo Tires.

While the demand challenges & rising labor costs are leading to reduced vehicle speeds, increased EV demands will increase tire product consumption in the future. Another factor that plays a major role in the growth of Asia Pacific in this market is its rapidly growing infrastructure driven by the burst in population and their purchasing power. These factors collectively pushing the growth of the global tire material market in this region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Tire Material Market Competitive Landscape

The growth of the tire material market is elevated by the increasing desire for materials that align with sustainability and ecological consciousness. A multitude of tire producers are presently integrating elements such as natural rubber and other eco-friendly resources into their offerings. This progressive shift is significantly propelling the expansion of the market.

A notable illustration is observed in the actions of The Goodyear Tire & Rubber Company, which, in January 2023, unveiled a prototype tire embodying a remarkable 90% of sustainable constituents. Notably, this tire has successfully navigated internal assessments conducted by Goodyear, alongside meeting all pertinent regulatory requisites.

Some of the prominent players in the Global Tire Material Market are

- Royal Dutch Shell

- Orion Engineered Carbons

- Chevron Corporation

- PetroChina Company Limited

- China Petroleum & Chemical Corporation

- SIBUR INTERNATIONA

- S. Zinc. Inc.

- Longxing Chemical

- PPG

- Phillips

- Umicore

- LANXESS

- Other Key Players

Recent Development

- In November 2023: Lilium and Michelin have entered an agreement for designing & serial production of tires for Lilium's electric vertical take-off and landing (eVTOL) jet.

- In July 2023: Michelin's car tire containing 45% sustainable materials won the Automotive INNOVATIONS Award in Frankfurt for its commitment to producing tires with 100% sustainable materials by 2050.

- In May 2023: Toyo Tire Corporation and the University of Toyama have developed catalysts that convert carbon dioxide into butadiene, a key raw material used in tire production, which showcase progress in sustainable tire manufacturing.

- In April 2023: Pirelli unveils its new tire range which is graphene-reinforced that enhance its durability and fuel efficiency.

- In January 2023: Goodyear has unveiled a new tire range has passed regulatory and internal tests which is made-up of 90% sustainable materials.

Tire Material Market Report Details

| Report Characteristics |

| Market Size (2023) |

USD 75.1 Bn |

| Forecast Value (2032) |

USD 106.5 Bn |

| CAGR (2023-2032) |

3.9% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Reinforcing Fillers, Elastomers, Chemicals, Plasticizers, Metal Reinforcement, and Textile Reinforcement), By Tire Type (Pneumatic Tire, Retreated Tire, and Solid Tire) and By Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Others). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Royal Dutch Shell, Orion Engineered Carbons, Chevron Corporation, Petro China Company Limited, China Petroleum & Chemical Corporation, SIBUR INTERNATIONA, S. Zinc. Inc., Longxing Chemical, PPG, Phillips, Umicore, LANXESS and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |