COVID-19 brought major disruptions in supply chains and labor shortages that caused manufacturing activities and construction projects to cease, along with delays to cosmetic production lines and cosmetic manufacturers.

This forced an overall decrease in titanium dioxide demand across various application sectors such as paints & coatings, plastic market applications, and cosmetics industries such as L'Oreal's loss in sales by EUR 1,735 Millions USD from their first half 2020 loss versus 2019, though market recovery began by 2022 when L'Oreal began seeing positive signs that growth trajectory rebounding again.

Future growth of the titanium dioxide market should be fueled by expansions within the paints and coatings industry. PPG Industries Inc. invested USD 13 million to expand their coating facility in China with eight new powder coating production lines and an upgraded technology center, increasing capacity by over 8,000 tons annually.

Titanium Dioxide Market Key Takeaways

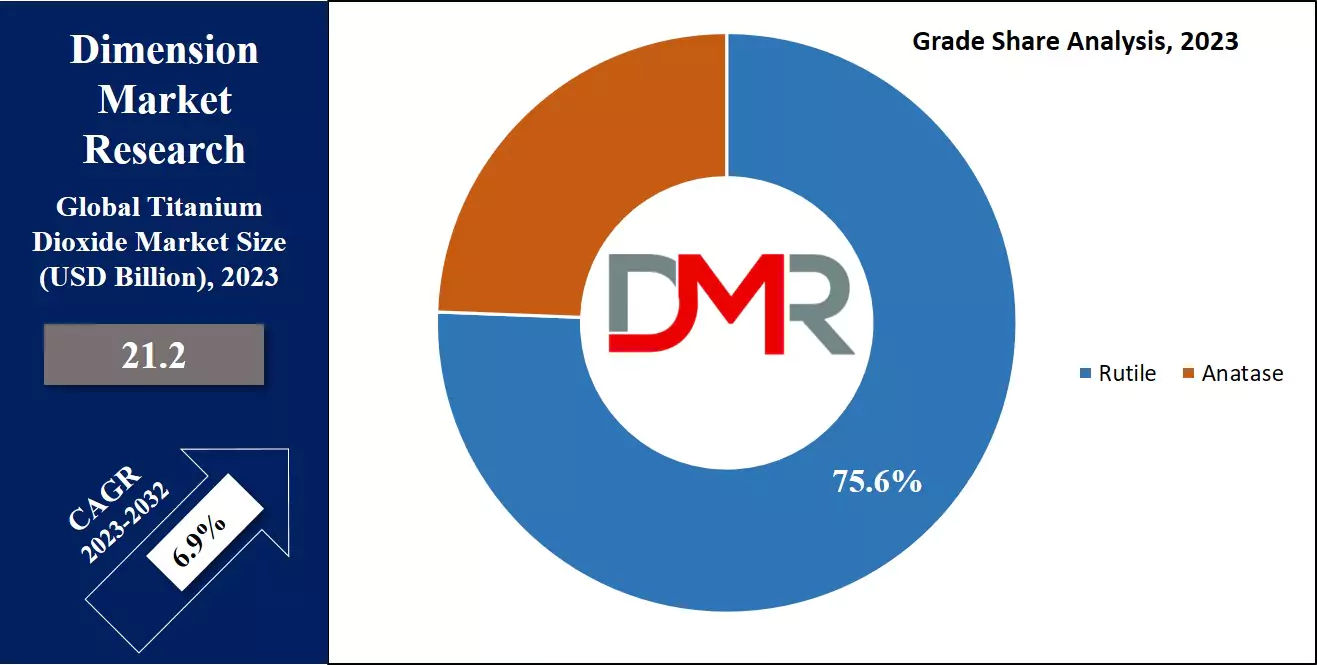

- Market Size & Share: Global Titanium Dioxide Market is expected to hold a market value of USD 21.2 billion in 2023 and is projected to show subsequent growth with a market value of USD 38.5 billion in 2032 at a CAGR of 6.9%.

- Grade Analysis: Rutile dominates this market as it holds 75.6% of the total market share in 2023.

- Production Process Analysis: The sulfate system dominates this marketplace as it's miles utilized in 53.5%.

- Application Analysis: The Painting and coating industry dominates this market in terms of application as it holds 53.8% of the market share in 2023.

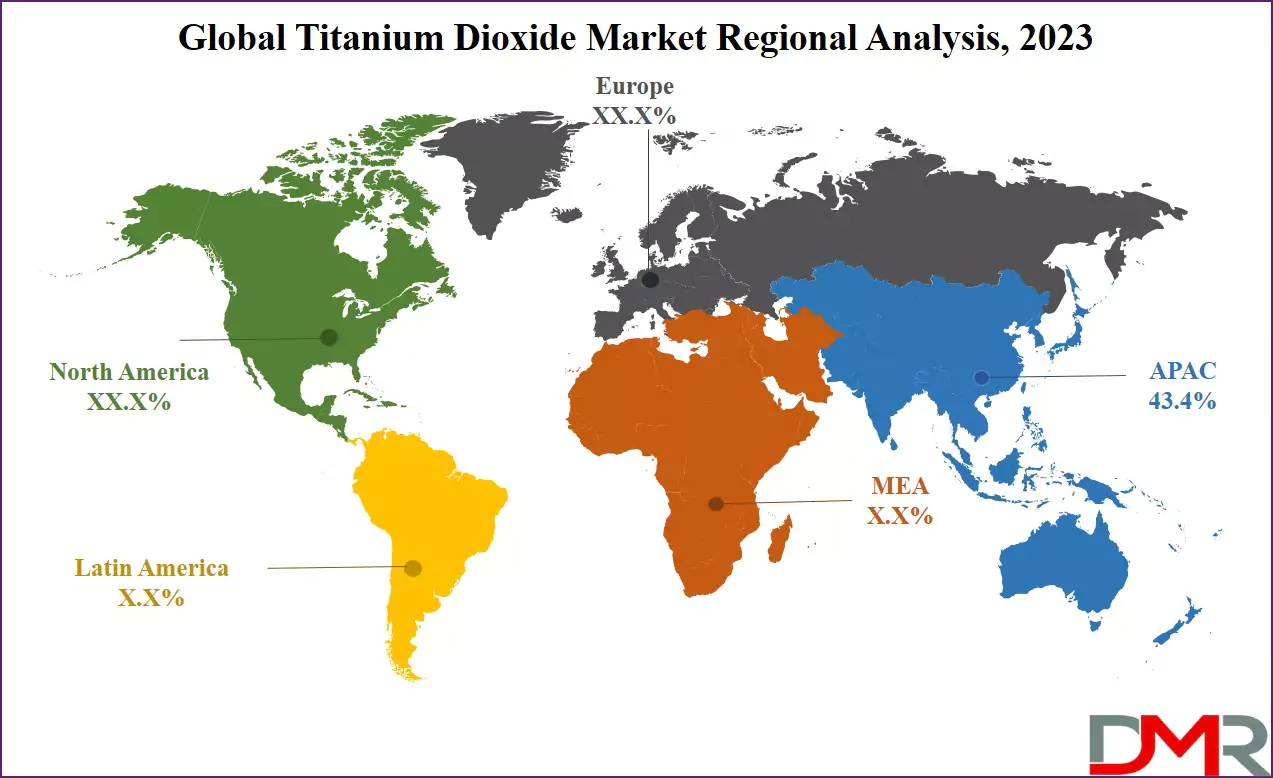

- Regional Analysis: Asia-Pacific dominates the global titanium dioxide marketplace as it holds 43.3% of the market proportion in 2023.

- Capacity Expansions: Major players are increasing production capacity to meet global demand.

- Regulatory Pressure: Environmental regulations are pushing the industry towards safer, sustainable practices, especially in line with chemical logistics trends.

Titanium Dioxide Market Use Cases

- Paints & Coatings: Used as a whitening and opacifying agent in paints, coatings, and varnishes to enhance durability and UV resistance.

- Plastics & Polymers: Enhances color brightness, opacity, and UV protection in plastic products like packaging materials, automotive parts, and consumer goods.

- Cosmetics & Personal Care: Found in sunscreens, makeup, and skincare products due to its excellent UV-blocking and skin-safe properties, making it essential in the cosmetic ingredients.

- Paper & Printing Inks: Improves brightness, opacity, and print quality in high-grade paper, magazines, and packaging materials.

- Pharmaceuticals & Food Industry: Used as a whitening agent in pills, tablets, and food products like confectionery coatings and dairy items.

Titanium Dioxide Market Dynamic

The construction and automobile are the primary industries that drive the growth of the titanium dioxide market. The factors that have an impact on the growth of this marketplace are the rise in purchasing strength, a shift in client preference, and infrastructure development impacting the demand for titanium dioxide. The rate of titanium dioxide keeps fluctuating because of the mining of titanium ore and minerals that are critical for its production.

Titanium Dioxide is appreciably used as an essential factor in shade pigments which can be utilized in automobile coating, aircraft

coating, marine coating as well as in architecture

and ornamental coating. Titanium Dioxide is extraordinarily sought-after inside the cosmetic enterprise, thanks to its superior color properties, oil-soaking up capabilities, and UV protection, which make it a perfect desire for the production of sun creme.

Despite its many advantages, regulations posed by means of the extraordinary governments on its production pose many challenges to the Global Titanium Dioxide marketplace. During the manufacturing of titanium dioxide, dust debris is produced which is carcinogenic in nature it truly is why the government has set many parameters for producers to observe in the course of the manufacturing and handling of titanium. These restrictions impact the utility and consumption of titanium dioxide in diverse products.

Driving Factors

Titanium dioxide pigment is widely utilized by the paints and coatings industry due to its excellent whiteness, opacity and UV resistance properties. Rising construction activity across both developing economies as well as developed ones has contributed significantly to market demand for this pigment.

Titanium dioxide's use in automotive coatings has seen rapid expansion since the pandemic hit, as the automotive sector recovers. Titanium dioxide's enhanced durability and weather resistance makes it an excellent protective coating choice; government investments in smart cities and sustainable housing projects further boost demand ensuring titanium dioxide remains essential to advancements in architectural and industrial coatings worldwide.

Trending Factors

Nanotechnology

has seen nano titanium dioxide gain prominence, offering enhanced performance over traditional forms. Nano titanium dioxide finds applications in sunscreens, cosmetics and self cleaning coatings due to its superior UV blocking properties and transparency. Nano titanium dioxide has also become widely utilized for environmental applications such as water purification and air filtration as industries adopt more eco friendly technologies.

Lightweight materials have made use of nano titanium dioxide's potential in automotive and aerospace sectors and increased research and development efforts are underway to leverage it further as advanced composites. Research efforts also seek to harness its antibacterial and photocatalytic properties further, making nano titanium dioxide an innovative component of sustainable materials with superior performance properties.

Restraining Factors

The titanium dioxide industry has come under intense scrutiny regarding its environmental and health impacts. Extraction and production processes require substantial energy inputs that generate carbon emissions as well as waste byproducts. Concerns surrounding inhalation of titanium dioxide particles, specifically nanoparticle form, raises concerns over their safety for workers and consumers.

As a result, regulatory agencies in Europe and North America have tightened restrictions on its use specifically cosmetics and food products leading to higher production costs as market players must invest in sustainable practices to comply with stringent regulations without jeopardizing competitive pricing or profitability.

Opportunities

Titanium dioxide offers considerable potential in renewable energy technology, especially solar technology. It has found use in dye sensitized solar cells (DSSCs) and photocatalytic hydrogen production systems due to its affordability, chemical stability, and light absorption efficiency attributes which also enhance durability and performance of panels.

Furthermore, titanium dioxide coatings enhance durability and performance enhancing durability and performance of solar panels. With growing global efforts at decarbonization offering lucrative market opportunities particularly through investments in R&D to optimize titanium dioxide applications which could unlock growth this emerging sector may offer tremendous growth prospects!

Titanium Dioxide Market Research Scope and Analysis

By Grade

In terms of grade, the Global Titanium Dioxide Market is segmented into rutile and anatase. Rutile dominates this market as it

holds 75.6% of the total market share in 2023 and is projected to show subsequent growth in the upcoming years as well. Rutile is a high-quality form of titanium oxide which is popular for its superior optical properties. It is characterized by its excellent brightness, whiteness, and color consistency, making it popular in major industries.

It is also preferred in industries where color purity and opacity are critical elements. As titanium dioxide offers tremendous color consistency, making sure that the end products keep their favored shades over the years. Rutile titanium dioxide is often used in top-rate paints, plastics, and cosmetic merchandise due to its ability to grow depth and stable color, making it suitable for high-end, excessive-performance programs.

In other words, rutile titanium dioxide's fantastic optical characteristics, shade consistency, versatility and efficiency to fulfill high-performance demand have solidified its role in the global titanium dioxide marketplace.

By Production Process

Based on the production procedure that is used in the production of titanium dioxide, this market is segmented into the sulfate technique and chloride method. The sulfate system dominates this marketplace as it's miles utilized in

53.5% of producing industries to produce titanium oxide in 2023 and is also anticipated to be appreciably utilized in the approaching years as nicely.

The sulfate system, additionally called the sulfuric acid procedure, has a long history as one of the conventional strategies used within the manufacturing of titanium dioxide. This technique includes the reaction of titanium ore with sulfuric acid that produces the answer of titanium sulfate. Subsequently, this solution undergoes hydrolysis wherein it yields hydrated titanium dioxide.

Even if the sulfate method is vintage but is famous now as it produces top-notch titanium dioxide with correct opacity and brightness, making it appropriate for a huge range of programs which includes painting, coating, paper, and plastic.

By Application

The Painting and coating industry dominates this market in terms of application as it holds 53.8% of the market share in 2023 and is projected to subsequent growth in the forthcoming years as well. Titanium dioxide is used in the paint and coating enterprise as it complements the visible attraction and protects the homes from external threats like moisture or ceiling.

Titanium dioxide acts as a barrier because of the white pigment that provides paints with brighter shades, opacity, and shade balance, making it an quintessential factor in the painting and coating industry. In the case of outside paint, the use of titanium dioxide complements their shade pallet as they emerge as extra vibrant and durable. In the car enterprise titanium dioxide is utilized in coating wherein it adds a glossy and durable finish to the cars, defending them from corrosion.

The Global Titanium Dioxide Market Report is segmented on the basis of the following:

By Grade

By Production Process

By Application

- Paints & Coatings

- Plastics

- Pulp & Paper

- Cosmetics

- Others

How Does Artificial Intelligence Contribute To Improve Titanium Dioxide Market ?

- Material Optimization: AI-driven simulations help develop high-purity and efficient TiO formulations, improving performance in paints, plastics, and coatings.

- Smart Manufacturing: AI-powered process automation enhances efficiency, reduces waste, and ensures consistent product quality in TiO production.

- Supply Chain & Demand Forecasting: AI analyzes market trends, raw material availability, and demand patterns, optimizing inventory management and logistics.

- Sustainability & Waste Reduction: AI assists in recycling TiO from industrial waste, promoting eco-friendly practices and reducing environmental impact.

- Product Customization: AI-driven insights help manufacturers develop tailored TiO solutions for industries like cosmetics, pharmaceuticals, and automotive coatings.

Titanium Dioxide Market Regional Analysis

Asia-Pacific dominates the global titanium dioxide marketplace as it

holds 43.3% of the market proportion in 2023 and is expected to show next growth in the upcoming period of 2023 to 2032 as well. Asia's dominance in this market may be attributed to its expanding creation and automotive sector that is pushed through the short-growing populace, fast urbanization, & infrastructure development.

This surge in production activities considerably boosts the demand for paints, coatings, and other products wherein titanium dioxide acts as an important thing. Additionally, the presence of the most important titanium dioxide producers in this area additionally provides up to enhance Asia's main position. These producers cater to the needs of both the nearby and international markets, reinforcing the continent's pivotal position within the worldwide supply chain.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Driver

Soaring Demand in Paints and Coatings

Titanium dioxide market growth can largely be attributed to its widespread application within the paints and coatings sector. Titanium dioxide's exceptional whiteness, brightness, and opacity make it an excellent pigment choice for improving the look and durability of paints used in construction, automotive, consumer goods sectors. As urbanization and infrastructure projects increase globally, demand for paints and coatings also increases rapidly, particularly among emerging economies.

Automotive manufacturers seek high-quality finishes for their vehicles which further drive this demand for coatings. Titanium dioxide's UV resistance and non-toxicity make it suitable for eco-friendly paints and coatings, catering to consumer preferences for sustainable solutions. The demand in end use industries drives up its market growth significantly worldwide.

Trend

Rising Use in Personal Care and Cosmetics

Increased Usage in Personal Care and Cosmetic Products One key trend influencing the titanium dioxide market is its increasing application in personal care and cosmetic products. Titanium dioxide is widely utilized in sunscreens, foundations, and other cosmetics due to its UV-blocking capabilities; helping protect skin from potentially damaging radiation exposure. With increased awareness about skin health and increasing demand for high SPF mineral-based sunscreens, titanium dioxide's popularity in cosmetics is rising steadily.

Furthermore, due to its non-reactive and safe profile it has found use across various formulations. Consumer preference for natural and mineral-based beauty products reinforces this trend, as titanium dioxide aligns with modern standards of clean beauty. We anticipate this trend will only become stronger as awareness and demand for high-quality skin protection products continues to increase globally.

Restraint

Environmental and Health Concerns

Environmental and Health Concerns Although titanium dioxide applications are widespread, its market has limitations due to environmental and health considerations. Titanium dioxide particles, particularly nanoparticle forms, have raised alarm about potential respiratory and environmental risks during production and disposal. Studies suggest that prolonged exposure may have detrimental health impacts on employees, necessitating strict handling and safety measures to be implemented by employers.

Furthermore, regulatory bodies in both Europe and North America are implementing stringent environmental guidelines on titanium dioxide production and usage that may increase operational costs for manufacturers. Complying with such regulations as well as their potential classification as possible carcinogens pose difficulties to market growth.

Opportunity

Renewable Energy and Nanotechnology

Titanium dioxide offers great potential as applications increase across renewable energy and nanotechnology fields. Titanium dioxide has long been utilized as an integral component of photovoltaic cells to increase efficiency and prolong their durability, contributing to cleaner energy production. With increasing investments into global solar infrastructure projects, its demand is expected to increase further.

Titanium dioxide's photocatalytic properties also make it an indispensable element of environmental remediation technologies such as air and water purification systems. Nanotechnology uses titanium dioxide's unique properties to develop innovative materials for self-cleaning surfaces and antimicrobial coatings that adhere to market demands for sustainable materials, providing significant growth prospects for the titanium dioxide industry in coming years.

Titanium Dioxide Market Competitive Landscape

The competitive landscape of the global titanium dioxide market is marked by intense competition among the major players vying for market share and seeking to get a competitive edge over others. Major key players in this market like Chemoursn Tronox, Venator Material Plc, and Kronos Worldwise Inc. are at the forefront of this highly dynamic market.

This market is experiencing consolidation, with a few key players shaping the industry landscape. These companies utilize inorganic & organic strategies for their market expansion. The inorganic strategies include the development of new product catalogs and innovation while the organic strategies deal with partnerships, mergers & acquisitions.

Furthermore, these mergers & partnerships further boost their market position and pave the way for the expansion of the market conditions. This market has many key players who hold a significant portion of the market are The Chemours Company, The Tronox Holdings Plc, LB Group, Venator Materials Plc, KRONOS Worldwide Inc., The Kerala Minerals & Metals Limited, CATHAY Industries, TOR Minerals International Inc. and other key players.

Some of the prominent players in the Global Titanium Dioxide Market are

- Chemours Company

- The Tronox Holdings Plc

- LB Group

- Venator Materials Plc

- KRONOS Worldwide Inc.

- Evonik Industries AG

- ISHIHARA SANGYO KAISHA LTD.

- CNNC HUAN YUAN Titanium Dioxide Co. Ltd.

- The Kerala Minerals & Metals Limited

- CATHAY Industries

- TOR Minerals International Inc.

- Other Key Players