Market Overview

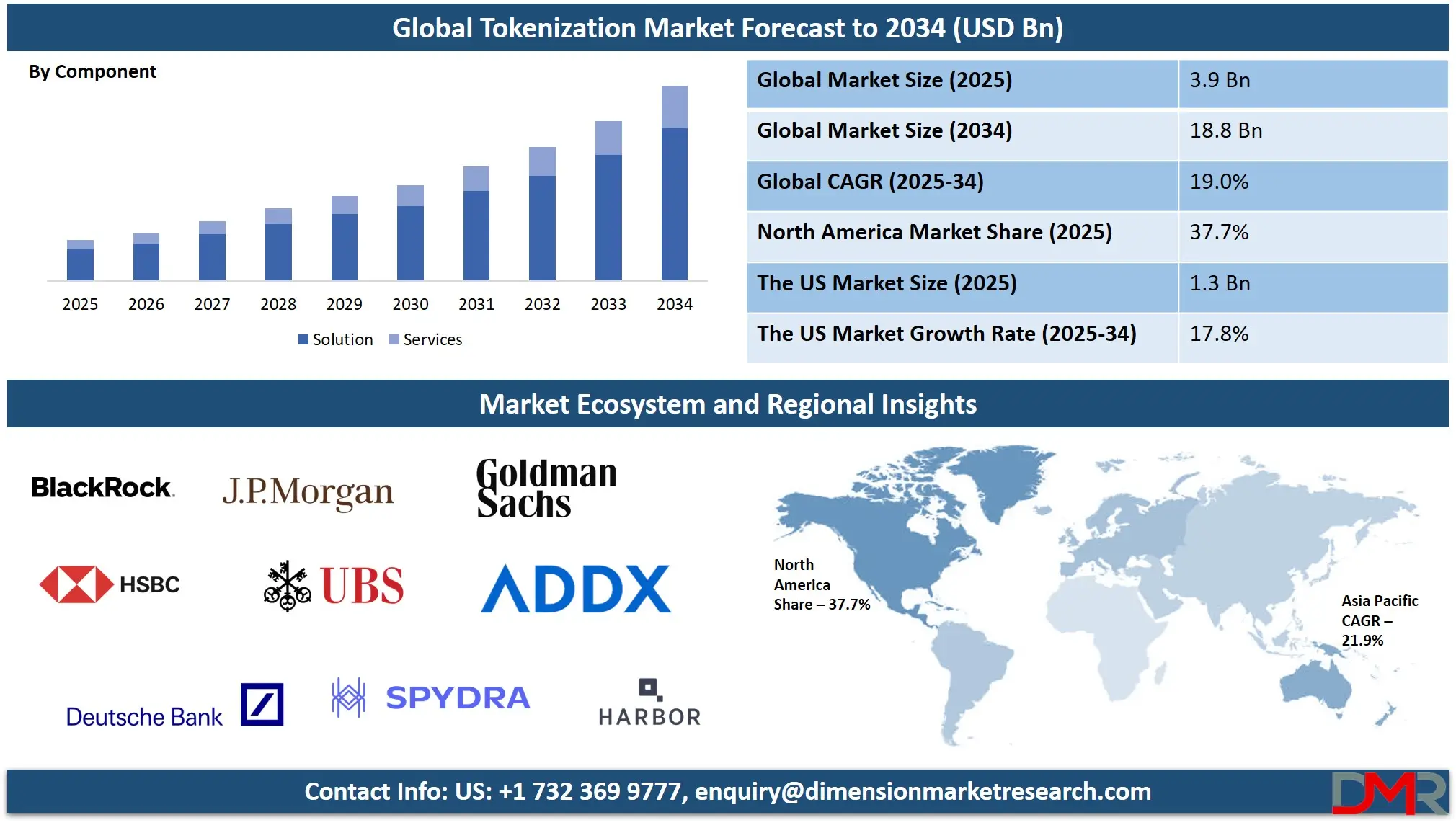

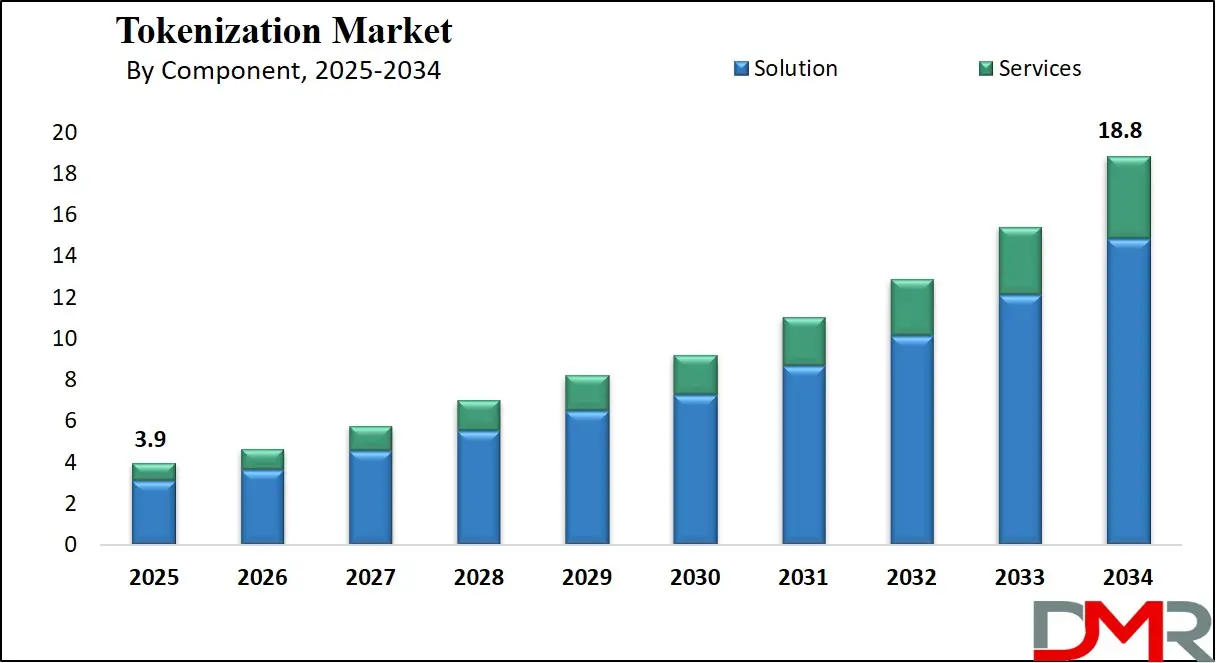

The Global Tokenization Market size is projected to reach USD 3.9 billion in 2025 and grow at a compound annual growth rate of 19.0% from there until 2034 to reach a value of USD 18.8 billion.

Tokenization is the process of turning real-world assets, like real estate, stocks, or gold, into digital tokens that live on a blockchain. These tokens represent ownership in the actual asset, just like a share in a company. By doing this, tokenization allows people to buy and trade small parts of assets that were once hard to divide or sell quickly.

Instead of needing a lot of money to buy a whole property or investment, people can now buy a fraction of it using tokens, which opens up more access for investors and brings more flexibility into how assets are managed and transferred.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Also, interest in tokenization has grown rapidly. Financial institutions, tech companies, and governments are exploring how to use blockchain to modernize traditional finance. Asset managers are looking at tokenization to improve liquidity, lower transaction costs, and offer more transparency.

Even companies like BlackRock and JPMorgan have entered the space. Tokenized assets can be traded 24/7, and transactions settle faster than in traditional markets. These benefits are attracting both retail and institutional investors looking for simpler and faster ways to invest.

One major reason for this growth is the demand for more flexible investment options. Tokenization allows assets to be broken into smaller parts, which lowers the entry barrier for many people.

It also makes it easier to diversify, meaning investors can spread their money across different kinds of assets, which is useful in both developed and emerging markets. Institutions are also interested because it reduces back-end costs like paperwork and third-party verification.

Several key trends are shaping the tokenization space. Tokenized U.S. Treasuries and government debt are gaining popularity, offering a safe and steady return in digital form. Stablecoins are being used more frequently for settlements.

Tokenized commodities like gold and diamonds are also being offered through trusted platforms. In private credit and real estate, tokenization is helping investors access high-yield opportunities that were traditionally limited to large institutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Recent years have seen big developments. Major asset managers have launched tokenized funds. Platforms like Matrixdock, Paxos, and InvestaX are offering tokenized versions of gold, government bonds, and short-term debt. Regulatory clarity is also slowly improving, with authorities in places like Singapore, the U.S., and Switzerland beginning to provide guidelines for tokenized assets. These changes are helping build trust and drive adoption.

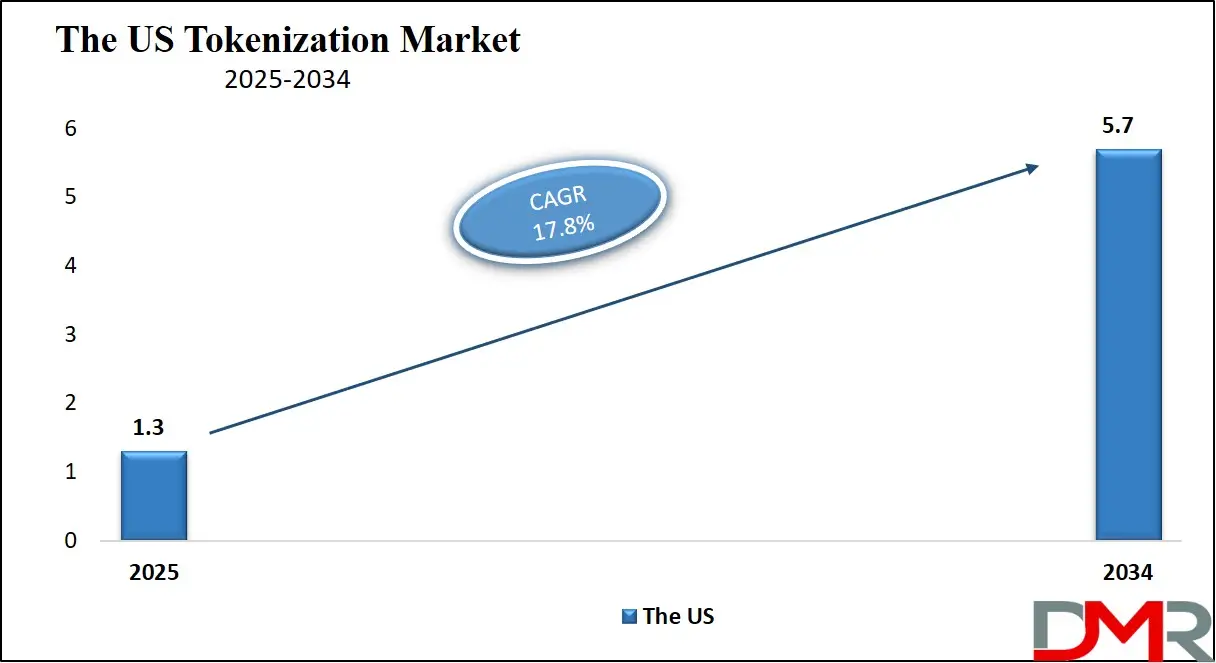

The US Tokenization Market

The US Tokenization Market size is projected to reach USD 1.3 billion in 2025 at a compound annual growth rate of 17.8% over its forecast period.

The US plays an important role in the tokenization market by driving innovation and adoption of digital assets. Many US-based financial institutions, fintech companies, and regulators are actively exploring tokenization to improve market efficiency and access. The US has one of the largest investor bases interested in tokenized assets like real estate, commodities, and government bonds.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Regulatory bodies in the US are working to establish clearer guidelines to balance innovation with investor protection, which helps build trust in tokenized products. Additionally, many tokenization platforms choose to launch or expand in the US due to its mature financial infrastructure and large capital markets. Overall, the US continues to be a key hub shaping the growth and regulatory landscape of tokenized assets globally.

Europe Tokenization Market

Europe Tokenization Market size is projected to reach USD 1.0 billion in 2025 at a compound annual growth rate of 18.7% over its forecast period.

Europe, being a vital region in the tokenization market by assists the growth by promoting innovation while focusing on clear regulatory frameworks. European countries are actively encouraging blockchain and digital asset development through supportive policies and initiatives. The region benefits from a diverse financial ecosystem, including strong banking sectors and growing fintech hubs, which foster the adoption of tokenized assets like real estate, commodities, and bonds.

European regulators are working to create harmonized rules across the EU to provide legal certainty and protect investors, making the market more attractive for both issuers and buyers. This balanced approach helps Europe remain competitive in the global tokenization space, encouraging collaboration between traditional finance and new digital platforms to expand access and liquidity for various asset classes.

Japan Tokenization Market

Japan Tokenization Market size is projected to reach USD 0.2 billion in 2025 at a compound annual growth rate of 21.2% over its forecast period.

Japan being one of the global leader in the tokenization market, particularly in real estate and securities. The country has established a robust regulatory framework that treats tokenized assets as securities under the Financial Instruments and Exchange Act (FIEA), providing legal clarity and fostering investor confidence.

Platforms like Osaka Digital Exchange (ODX), backed by major financial institutions such as SBI Holdings and Nomura, have been instrumental in supporting the trading and management of security tokens. Additionally, Japan's tax reform proposals aim to reduce crypto-related taxes from up to 55% to 20%, further incentivizing investment in tokenized assets.

Tokenization Market: Key Takeaways

- Market Growth: The Tokenization Market size is expected to grow by USD 14.2 billion, at a CAGR of 19.0%, during the forecasted period of 2026 to 2034.

- By Component: The solution segment is anticipated to get the majority share of the Tokenization Market in 2025.

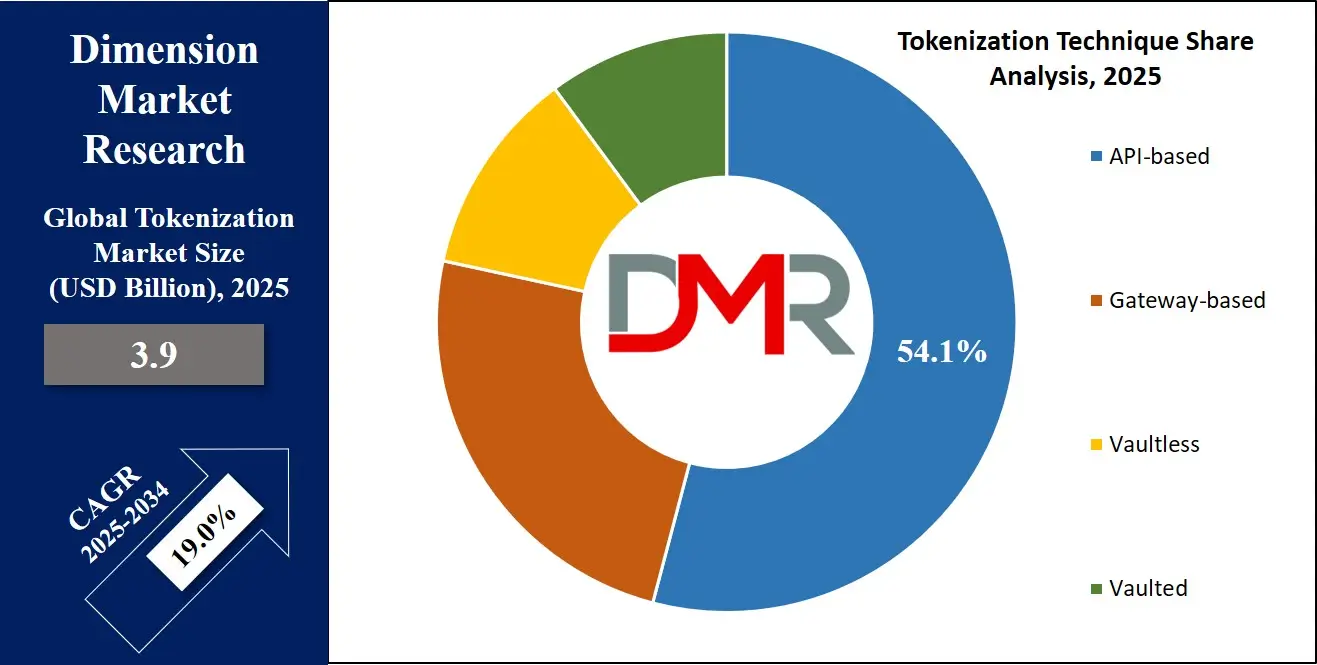

- By Tokenization Technique: The API-based segment is expected to get the largest revenue share in 2025 in the Tokenization Market.

- Regional Insight: North America is expected to hold a 37.7% share of revenue in the Global Tokenization Market in 2025.

- Use Cases: Some of the use cases of Tokenization include real estate investment, commodities ownership, and more.

Tokenization Market: Use Cases

- Real Estate Investment: Tokenization allows real estate properties to be split into digital shares, making it easier for multiple investors to own a portion of a building, which reduces entry costs and increases access to high-value properties. It also improves liquidity, as tokens can be traded more easily than physical real estate.

- Private Credit and Lending: Through tokenization, private credit deals can be opened to a major investor base by issuing tokens backed by loan agreements, as it provides more transparency, reduces settlement times, and gives investors a way to earn returns from assets that were once hard to access.

- Commodities Ownership: Gold, diamonds, and other commodities can be tokenized so people can invest without holding the physical item. Each token represents real ownership, stored in secure vaults, as it makes investing in commodities more convenient and tradable.

- Government Bonds and Treasuries: Tokenized treasury bills and bonds let investors buy digital versions of government debt. These offer steady returns, faster settlement, and easier portfolio management. It’s especially useful for global investors seeking exposure to low-risk assets in digital form.

Stats & Facts

- According to InvestX, over 119 issuers are actively engaged in asset tokenization, spanning private credit, real estate funds, corporate bonds, institutional alternatives, US and non-US treasury debt, and commodities, reflecting a broad and maturing tokenized asset landscape.

- Blackrock’s BUIDL fund, launched in March 2024, became the world’s largest tokenized fund within six weeks. It captured nearly 30% of the tokenized Treasury market, with AUM reaching USD 657.41 million by January 10, 2025.

- As per InvestX, Private credit led the tokenized real-world asset (RWA) sector’s growth in 2024, accounting for around 65% of the market, supported by over USD 1 billion in cumulative loans and offering an average yield of 9.42%.

- According to InvestX, the tokenized asset investor base has grown to 81,304 holders, while global stablecoin adoption has surpassed 140 million accounts, underscoring the expanding reach and acceptance of digital financial instruments.

- Pax Gold (PAXG), according to InvestX, holds a market cap of USD 529.54 million and is backed by one fine troy ounce of gold per token, stored in LBMA vaults and issued by Paxos Trust Company, providing direct ownership of physical gold.

- Matrixdock’s XAUm token, introduced in 2024, is backed by 99.99% pure gold held in high-security vaults in Singapore and Hong Kong, and is issued across BNB Chain and Ethereum, giving digital asset investors exposure to LBMA-certified gold (InvestX).

- According to InvestX, Hashnote’s USYC product—representing the Hashnote International Short Duration Yield Fund Ltd.—reached a market cap of USD 1.78 billion by January 2025, investing primarily in reverse repos on U.S. government-backed securities.

- The Diamond Standard Fund tokenizes investment in physical diamonds through a regulator-licensed commodity structure, aiming to establish diamonds as a new investable asset class for sophisticated investors.

- USTY tokens, issued on the XDC Network and accessible through Tradeteq, represent fractionalized shares in a U.S. Treasury bond ETF, demonstrating growing institutional use cases for blockchain-based fixed-income products.

- Matrixdock’s STBT product, launched on InvestaX, offers accredited investors access to short-term U.S. Treasury yields via tokenization, with daily yield distributions and seamless USDC redemptions, as outlined by InvestaX.

- InvestaX Earn, powered by OpenTrade’s USDC yield products, provides qualified investors with steady income opportunities via USDC-backed by liquid, high-quality assets like U.S. Treasury Bills, according to InvestaX.

Market Dynamic

Driving Factors in the Tokenization Market

Increased Demand for Liquidity and Accessibility

One of the main drivers of the tokenization market growth is the growing demand for liquidity and easier access to traditionally illiquid assets. Many investments, like real estate, private credit, and commodities, have high entry barriers due to their size and complexity. Tokenization breaks these assets into smaller, tradable digital units, allowing a broader range of investors to participate with lower capital.

This democratization of investment opportunities appeals to both retail and institutional investors who want flexible, round-the-clock trading options. As more people seek diversified portfolios and faster transactions, tokenization offers a practical solution that aligns with modern digital finance trends.

Technological Advancements and Regulatory Support

Another key growth driver is the rapid advancement of blockchain technology combined with increasing regulatory clarity. Blockchain enables secure, transparent, and efficient token transactions, which reduce costs and speed up settlement times compared to traditional methods. Meanwhile, regulators in various countries are gradually creating frameworks to govern tokenized assets, improving investor confidence and market legitimacy.

These technological and legal developments are encouraging more financial institutions and asset managers to explore tokenization, fueling innovation and market expansion. The evolving ecosystem supports seamless integration of tokenized assets into mainstream finance, helping the market grow steadily.

Restraints in the Tokenization Market

Regulatory Uncertainty and Compliance Challenges

A significant restraint in the tokenization market is the ongoing uncertainty around regulations. Since tokenized assets sit at the intersection of finance and technology, many countries are still developing clear rules on how to treat them legally. This lack of consistent regulation creates risks for issuers and investors, making some hesitant to fully participate.

Compliance can be complicated and costly, especially for cross-border transactions, as different jurisdictions may have conflicting requirements. Until regulatory frameworks become more uniform and predictable, the growth of tokenization may be slowed by concerns about legality, investor protection, and market stability.

Technology and Security Risks

Despite blockchain’s promise of security, the tokenization market faces challenges related to technology risks. Vulnerabilities such as hacking, smart contract bugs, or platform failures can threaten investor assets and shake confidence. Many tokenization projects rely on complex technical systems that require constant updates and audits to prevent fraud or errors.

Additionally, integrating traditional assets with digital tokens involves bridging old and new systems, which can create operational difficulties. These technical hurdles and the potential for cyberattacks act as barriers to wider adoption, as investors demand secure, reliable platforms before committing significant capital.

Opportunities in the Tokenization Market

Expansion into Emerging Markets

Tokenization presents a huge opportunity to unlock investment potential in emerging markets where access to traditional financial products is limited. Many people in these regions face barriers such as a lack of banking infrastructure or high minimum investment requirements.

By using digital tokens, assets like real estate, commodities, or government bonds can become accessible to a broader audience, including smaller investors. This can help drive financial inclusion and bring more capital into these economies. As internet access and smartphone usage grow globally, tokenization could become a key tool for connecting underserved populations to global investment opportunities.

Integration with Decentralized Finance (DeFi)

The growing DeFi ecosystem offers significant opportunities for tokenized assets to be used in new and innovative ways. Tokenization allows real-world assets to be brought into DeFi platforms where they can be used as collateral for loans, yield farming, or liquidity provision.

This integration can create more efficient and transparent financial services by combining the benefits of blockchain with traditional asset backing. As DeFi continues to mature, tokenized assets could become essential components in building decentralized, borderless financial products, attracting more investors and expanding the overall tokenization market.

Trends in the Tokenization Market

Integration with Decentralized Finance (DeFi)

A significant trend in the tokenization market is the increasing integration with Decentralized Finance (DeFi) platforms. This integration allows tokenized assets to be used as collateral for loans, enabling investors to access liquidity without selling their holdings.

For instance, platforms like Aave and Compound have incorporated tokenized real estate and luxury goods into their ecosystems, facilitating borrowing and lending activities. This trend enhances the liquidity of tokenized assets and provides more flexible financial solutions for investors.

Regulatory Advancements and Compliance

There have been significant strides in establishing clear regulatory guidelines for asset tokenization. The introduction of the Financial Innovation and Technology for the 21st Century Act (FIT21) in the United States clarifies the regulatory responsibilities of the SEC and CFTC over digital asset products and transactions, aiming to foster innovation while ensuring consumer protection.

Additionally, the Tokenization Report Act of 2024 mandates key financial regulatory bodies to submit a comprehensive report focusing on asset tokenization. These developments indicate a move towards a more structured and compliant tokenization market.

Research Scope and Analysis

By Component Analysis

In 2025, the solution segment is set to dominate the tokenization market with a share of 78.6%. This growth is driven by the increasing need for technology platforms and software that enable the creation, management, and trading of tokenized assets.

Solutions provide the essential infrastructure that ensures security, transparency, and efficiency in token transactions. As more industries explore asset digitization, demand rises for user-friendly and scalable platforms that can support various asset classes like real estate, commodities, and bonds.

The continuous improvement in blockchain technology and smart contract development also boosts the adoption of these solutions. Overall, these platforms act as the backbone of the tokenization ecosystem, making it easier for issuers and investors to participate and helping the market expand rapidly.

Moreover, services as a component of the tokenization market are expected to see significant growth over the forecast period. These include advisory, legal, and compliance services that help companies navigate the complex regulations surrounding tokenized assets. Professional services also support the integration of tokenization platforms with existing financial systems, ensuring smooth operations.

As tokenization is still an emerging field, expert guidance is crucial for trust-building and risk management. The rising awareness about tokenization’s benefits is increasing demand for consulting, auditing, and security services, which assist in maintaining transparency and protecting investor interests.

Consequently, the services segment plays a vital role in supporting the market’s steady expansion by addressing operational and regulatory challenges.

By Tokenization Technique Analysis

The API-based tokenization technique is expected to hold a significant market share of 54.1% in 2025, driving the growth of the tokenization market. This method allows seamless integration between traditional financial systems and blockchain platforms through easy-to-use interfaces.

API-based tokenization simplifies the process of creating, managing, and transferring digital tokens, making it more accessible for businesses and investors. It supports faster transactions, better scalability, and enhanced security by enabling real-time data exchange.

As companies look to digitize assets efficiently, API solutions reduce complexity and lower implementation costs. This technique also allows customization to fit various asset types, encouraging widespread adoption. Overall, API-based tokenization acts as a flexible and powerful tool that supports the market’s rapid expansion by bridging existing infrastructure with new digital asset technologies.

Gateway-based tokenization is set to experience significant growth over the forecast period due to its role in securely processing and managing tokenized transactions. This technique acts as a bridge between users and blockchain networks, ensuring smooth and safe token exchanges. Gateway-based solutions provide reliable transaction authorization, fraud detection, and compliance monitoring, which build trust among investors and regulators.

They also simplify user access to tokenized assets by handling complex backend processes behind the scenes. With increasing demand for secure and efficient digital asset trading, gateway-based tokenization is becoming essential for many platforms. This technique supports the market’s growth by improving transaction speed, security, and ease of use, attracting more participants to the tokenization ecosystem.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Deployment Mode Analysis

In terms of deployment, the cloud deployment mode will lead the tokenization market with a share of 61.5% in 2025, due to its flexibility, scalability, and cost-effectiveness. Cloud-based platforms allow companies to launch and manage tokenized assets without the need for heavy hardware investments. This makes it easier for small and large businesses alike to enter the market and scale their operations quickly.

Cloud services also support regular updates, strong data encryption, and real-time access, which are vital for secure and efficient token management. With the rise in remote working and digital operations, cloud deployment provides the agility needed to adapt to changing demands. It also enables integration with other digital financial tools, boosting adoption. Overall, cloud deployment supports faster innovation and reduces operational barriers, making it a strong driver of tokenization market growth.

Moreover, on-premises deployment is showing significant growth over the forecast period, especially among organizations needing high levels of data control and compliance. This method allows businesses to host tokenization platforms within their own IT infrastructure, ensuring sensitive information stays protected under internal security policies.

On-premises systems are often preferred by institutions dealing with regulated or confidential data, such as banks or government entities. While setup and maintenance costs may be higher than cloud solutions, the added control over infrastructure and operations makes it suitable for firms with strict data governance requirements.

It also reduces dependency on third-party providers, which appeals to businesses that prioritize in-house management. As security and data privacy concerns rise, on-premises deployment remains a key option for secure, customized tokenization solutions.

By Organization Size Analysis

In 2025, large enterprises are set to dominate the tokenization market with a share of 65.1%, driven by their strong financial resources and focus on digital transformation. These organizations are adopting tokenization to improve data security, streamline asset management, and increase transaction transparency across global operations. Large enterprises often deal with high volumes of sensitive data and complex transactions, making tokenization a valuable tool to reduce fraud and enhance trust.

Their ability to invest in advanced blockchain platforms and compliance solutions gives them a clear edge in adopting and scaling tokenized systems. These companies are also using tokenization to innovate in areas like supply chain, real estate, and cross-border payments. With dedicated IT teams and a strategic focus on security, large enterprises play a central role in expanding the use and awareness of tokenization across different industries.

Also, SMEs are showing significant growth over the forecast period in the tokenization market due to their rising interest in affordable, secure, and scalable digital solutions. These smaller businesses are turning to tokenization to protect customer data, enable efficient transactions, and gain access to new investment opportunities. With increasing digitalization, SMEs are more willing to adopt flexible platforms that reduce costs and help them stay competitive.

Cloud-based and API-driven tokenization options have made it easier for SMEs to implement these technologies without needing major infrastructure changes. Tokenization also allows them to enter global markets by supporting faster and more secure cross-border transactions. As awareness grows, more SMEs are exploring tokenization to improve operations, reduce risk, and build trust with customers and partners in a digital-first world.

By Application Analysis

Based on the application, payment security is leading the tokenization market with a share of 31.7% in 2025, fueled by the growing need to protect financial transactions from cyber threats and data breaches. Tokenization helps replace sensitive payment information like card numbers with unique tokens that cannot be reused or traced if intercepted. This reduces fraud risk and enhances trust between merchants and customers during digital transactions.

As online payments continue to grow across e-commerce, mobile apps, and digital wallets, businesses are adopting tokenization to comply with security standards like PCI-DSS and to ensure a safe payment environment.

Payment processors, banks, and fintech companies are integrating tokenization into their systems to offer secure and seamless experiences. This increased focus on transaction safety is a major factor driving the widespread adoption of tokenization in the financial and retail sectors.

User authentication is also showing significant growth over the forecast period in the tokenization market due to rising concerns over identity theft and account breaches. Businesses are using tokenization to protect personal information during login and verification processes by converting sensitive details into secure tokens. This adds an extra layer of security without storing actual user data, reducing the impact of data leaks or hacks.

As more services shift online, strong and seamless identity protection is becoming essential, especially in banking, healthcare, and government platforms. Tokenization supports multi-factor authentication and helps streamline access control while maintaining high privacy standards. The need to improve digital trust and prevent unauthorized access is encouraging organizations to adopt tokenization for secure and efficient user authentication systems.

By Industry Vertical Analysis

In 2025, the BFSI sector is set to have a prominent position in the tokenization market with a share of 29.6%, driven by its need to secure high volumes of financial and customer data. Banks, financial institutions, and insurance companies are turning to tokenization to protect sensitive information like credit card numbers, account details, and transaction histories.

This approach helps them reduce the risk of fraud, meet compliance standards, and boost customer confidence in digital services. With the growing use of mobile banking, online payments, and digital wallets, tokenization ensures that personal data remains safe during every transaction.

BFSI firms are also leveraging tokenization to simplify cross-border transfers, enable digital identity verification, and enhance operational efficiency. As cyber threats grow, the sector’s strong focus on data security and digital innovation continues to make it a key driver of the tokenization market growth.

Healthcare is seeing significant growth over the forecast period in the tokenization market due to the rising demand for data privacy and security. With the increasing use of electronic health records, telemedicine platforms, and patient management systems, healthcare providers need to safeguard sensitive medical and personal data.

Tokenization helps protect this information by replacing identifiable details with secure tokens, reducing the risk of data breaches and unauthorized access. Hospitals, clinics, and insurance firms are adopting tokenization to meet strict regulatory standards like HIPAA, while ensuring smooth access to patient data for authorized users. T

his technology also supports secure billing and payment processes, enhancing trust and transparency in healthcare services. As digital healthcare grows, the sector is embracing tokenization to improve security, compliance, and patient confidence.

The Tokenization Market Report is segmented based on the following:

By Component

- Solutions

- Services

- Professional Services

- Managed Services

By Tokenization Technique

- API-based

- Gateway-based

- Vaultless

- Vaulted

By Deployment Mode

By Organization Size

By Application

- Payment Security

- User Authentication

- Compliance Management

- Data Protection

By Industry Vertical

- BFSI

- Healthcare

- Retail & e-Commerce

- IT & Telecom

- Government

- Education

- Media & Entertainment

- Energy & Utilities

- Others

Regional Analysis

Leading Region in the Tokenization Market

North America will be leading the tokenization market with a share of 37.7% in 2025, supported by strong technological infrastructure and a growing push toward data security across industries. The region is home to many early adopters of blockchain technology, digital payments, and advanced cybersecurity solutions, all of which contribute to the rising demand for tokenization.

Financial institutions, healthcare providers, and e-commerce platforms across the US and Canada are increasingly turning to tokenization to protect sensitive data, improve transaction security, and meet regulatory requirements.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Cloud adoption and API-based integration are also gaining momentum, making deployment faster and more scalable. With the continuous rise in cyberattacks and online transactions, businesses are focused on enhancing digital trust and compliance, driving further growth.

Supportive regulations and high awareness of data protection standards are fueling the adoption of tokenization across both large enterprises and SMEs. North America continues to set the pace for global innovation in the tokenization space.

Fastest Growing Region in the Tokenization Market

Asia Pacific is showing significant growth over the forecast period in the tokenization market, driven by rising digital transformation, expanding fintech ecosystems, and increasing awareness around data security. Countries like China, Japan, India, and South Korea are rapidly adopting tokenization to secure digital payments, protect sensitive customer data, and comply with evolving data protection laws.

The growing use of smartphones, e-commerce, and online banking is pushing organizations to invest in secure transaction methods such as tokenization. Local governments are also encouraging innovation in blockchain and data privacy, helping boost market momentum. As 2025 progresses, the region is expected to emerge as a key hub for scalable and secure tokenization solutions across various sectors..

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The tokenization market is becoming more competitive as both traditional financial players and new tech startups rush to offer digital versions of real-world assets. Everyone wants a piece of this growing space, from banks and asset managers to blockchain platforms and fintech companies. They are working on making it easier, faster, and safer to turn assets like real estate, credit, and gold into tokens.

Each group brings different strengths, some have deep financial knowledge, while others bring strong tech skills. As demand increases, more platforms are launching new products, and partnerships between finance and tech are becoming common. The competition is pushing innovation and better services, making tokenized assets more accessible to investors around the world.

Some of the prominent players in the global Tokenization are:

- BlackRock

- JPMorgan

- Goldman Sachs

- BNY Mellon

- HSBC

- UBS

- Deutsche Bank

- Fireblocks

- ADDX

- Harbor

- ReaIT

- SolidBlock

- Franklin Templeton

- Zoniqx

- Spydra

- TOKO

- Soluab

- Certik

- Elliptic

- Other Key Players

Recent Developments

- In May 2025, VanEck launched its first tokenized fund, the VanEck® Treasury Fund, Ltd. ("VBILL"), in partnership with Securitize, which manages over USD 3.9 billion in tokenized securities. VBILL offers real-time access to U.S. Treasury-backed assets and is available on Avalanche, BNB Chain, Ethereum, and Solana, with cross-chain functionality via Wormhole. It supports 24/7 USDC-based issuance and integrates atomic liquidity through Agora’s AUSD, aiming to enhance access, efficiency, and liquidity for on-chain financial market participants.

- In April 2025, Bluefin introduced network tokenization to its ShieldConex® Tokenization as a Service and Orchestration platforms. This enhancement allows merchants to provision secure, network-issued payment tokens from major card brands like Visa, Mastercard, American Express, and Discover. ShieldConex now offers a robust data protection solution, combining vaultless tokenization, network tokenization, and PCI P2PE. Network tokenization replaces sensitive data like PANs with secure tokens, ensuring safer, more flexible transactions across processors, gateways, and acquirers.

- In March 2025, CME Group and Google Cloud introduced their strategic partnership by piloting secure, seamless wholesale payments and asset tokenization solutions. CME Group has completed the initial phase of integrating and testing the Google Cloud Universal Ledger (GCUL), a new distributed ledger technology. Further, the company highlighted the collaboration’s potential to enhance efficiency in collateral, margin, settlement, and fee payments, aligning with global momentum toward 24/7 trading and supporting the push for practical financial market reforms in the U.S.

- In February 2025, PhonePe launched a card tokenization feature, allowing users to securely tokenise credit and debit cards within its app for seamless use across services like bill payments, recharges, and travel bookings, which follows PhonePe’s recent initiative to integrate its payment solutions directly for merchants, becoming the first to bypass third-party orchestration platforms. Tokenization replaces actual card details with unique tokens, making transactions safer by ensuring that sensitive card data isn't shared with merchants, as per the Reserve Bank of India.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3.9 Bn |

| Forecast Value (2034) |

USD 18.8 Bn |

| CAGR (2025–2034) |

19.0% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.3 Bn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions and Services), By Tokenization Technique (API-based, Gateway-based, Vaultless, and Vaulted), By Deployment Mode (On-premises and Cloud), By Organization Size (SMEs, and Large Enterprises), By Application (Payment Security, User Authentication, Compliance Management, and Data Protection), By Industry Vertical (BFSI, Healthcare, Retail & e-Commerce, IT & Telecom, Government, Education, Media & Entertainment, Energy & Utilities, and Others |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

BlackRock, JPMorgan, Goldman Sachs, BNY Mellon, HSBC, UBS, Deutsche Bank, Fireblocks, ADDX, Harbor, ReaIT, SolidBlock, Franklin Templeton, Zoniqx, Spydra, TOKO, Soluab, Certik, Elliptic, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Tokenization Market?

▾ The Global Tokenization Market size is expected to reach a value of USD 3.9 billion in 2025 and is

expected to reach USD 18.8 billion by the end of 2034.

Which region accounted for the largest Global Tokenization Market?

▾ North America is expected to have the largest market share in the Global Tokenization Market, with a

share of about 37.7 % in 2025.

How big is the Tokenization Market in the US?

▾ The Tokenization Market in the US is expected to reach USD 1.3 billion in 2025.

Who are the key players in the Global Tokenization Market?

▾ Some of the major key players in the Global Tokenization Market are BlackRock, JPMorgan Chase, UBS,

and others

What is the growth rate in the Global Tokenization Market?

▾ The market is growing at a CAGR of 19.0 percent over the forecasted period.