The global tourism guidance service market is evolving rapidly, driven by increasing international travel, rising demand for personalized travel experiences, and the adoption of digital technologies. Tourists now seek interactive, culturally immersive journeys where professional guides enhance storytelling and local insights. Mobile applications, AI-enabled virtual tours, augmented reality overlays, and GPS-based audio guides are reshaping how tourists consume destination information. These tools not only improve accessibility and convenience but also allow tourists to enjoy hybrid formats, combining self-guided freedom with expert insights.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Opportunities are especially notable in eco-tourism, heritage tourism, and offbeat destination exploration. Travelers are placing a premium on sustainability, cultural preservation, and authentic local engagement. Countries rich in biodiversity and heritage such as India, Brazil, Morocco, and Indonesia stand to benefit significantly by promoting community-driven tourism and trained local guides. There is also a rising demand for guided medical tourism, educational tours, and wellness retreats.

The market faces certain restraints. A shortage of certified, multilingual guides limits scalability in several regions. Moreover, infrastructural gaps in remote areas, political instability in certain destinations, and the lingering economic effects of global pandemics can hamper growth. Additionally, overtourism in iconic destinations raises concerns over cultural erosion, environmental degradation, and inadequate capacity management.

In recent years, the market has shown robust growth in both mature and emerging economies. Tourism now accounts for more than 10% of GDP in many countries. With increasing disposable income and improved air connectivity, guided travel is no longer a luxury but a standard expectation for safety and enriched experiences.

Looking forward, the tourism guidance service market is set to flourish, propelled by integrated digital platforms, multilingual content delivery, and sustainable tourism policy support from governments. Businesses that invest in innovation, guide training, and destination marketing will capitalize on expanding global travel demographics and rising experience-centric travel trends.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

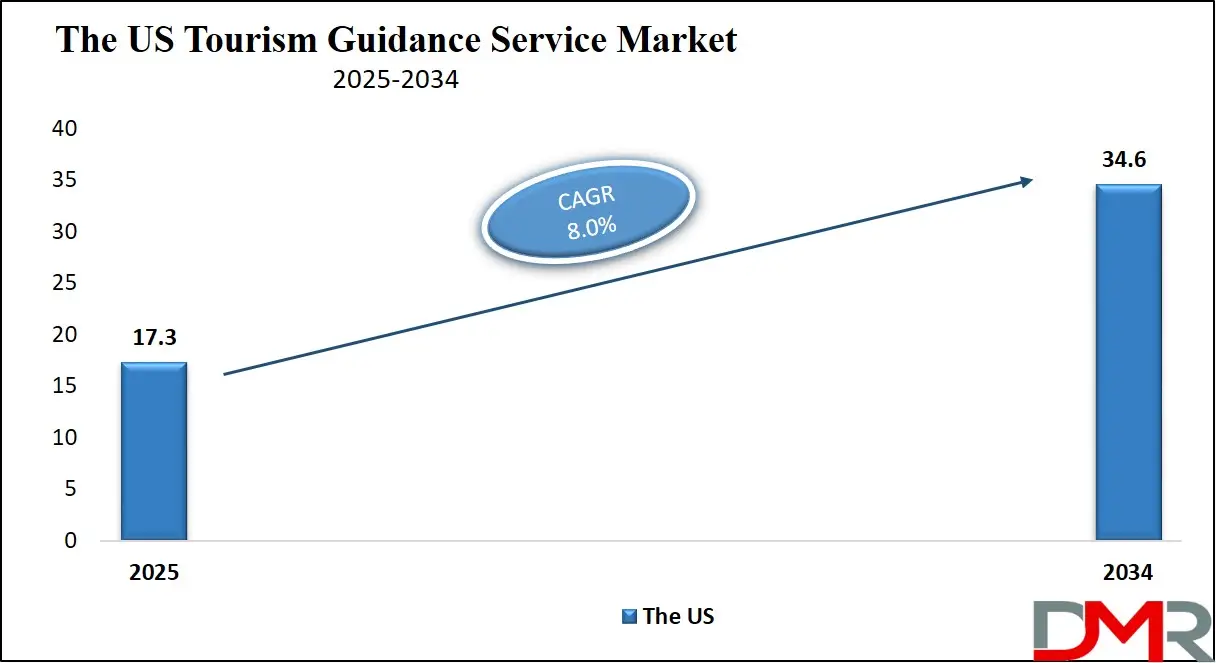

The US Tourism Guidance Service Market

The US Tourism Guidance Service Market is projected to reach

USD 17.3 billion in 2025 at a compound annual growth rate of

8.0% over its forecast period.

The U.S. tourism guidance service market is a dynamic sector enriched by the country's geographic diversity and multicultural appeal. From the natural landscapes of national parks like Yellowstone and Yosemite to metropolitan centers such as New York City, Chicago, and San Francisco, the range of guided experiences is vast. According to the U.S. Department of Commerce and the National Travel and Tourism Office, tourism contributed to over 9.5 million jobs and generated significant federal, state, and local tax revenues in recent years.

The U.S. demographic advantage lies in its large, diverse population and high inbound tourist volumes. Its appeal to global visitors includes historical landmarks, cultural hubs, and entertainment attractions like theme parks, Broadway shows, and heritage trails. Tour guides often specialize in localized content, providing services in multiple languages to meet the needs of international travelers.

Government initiatives, including the National Travel and Tourism Strategy, prioritize increasing international visitation and expanding rural and tribal tourism. Programs from the U.S. National Park Service and cultural institutions such as the Smithsonian enhance the value of guided experiences through education and interpretation. Additionally, visa waivers, promotional campaigns, and infrastructure investment have made the U.S. more accessible and visitor-friendly.

The increasing use of digital platforms, such as app-based audio tours and virtual bookings, is streamlining tourism guidance. With a strong emphasis on safety, inclusivity, and quality interpretation, the U.S. remains a leading player in the global tourism guidance landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European, Tourism Guidance Service Market

The Europe Tourism Guidance Service Market is estimated to be valued at

USD 9.38 billion in 2025 and is further anticipated to reach

USD 17.99 billion by 2034 at a

CAGR of 7.5%.

Europe is the epicenter of global heritage tourism, offering centuries-old history, diverse languages, and cultural richness across its countries. Tourists are drawn to iconic landmarks such as the Eiffel Tower in France, the Colosseum in Italy, and the Acropolis in Greece. These sites are complemented by a dense network of professional tourism guidance services that elevate the visitor experience through storytelling, historical interpretation, and multilingual delivery.

According to data published by the European Commission, the tourism sector employs over 20 million people across member states and contributes significantly to GDP. Europe’s compact geography enables multi-country tours, enhancing demand for professional guides with cross-cultural expertise. Urban destinations like Paris, Berlin, and Barcelona see high guide deployment, while rural locations in the Balkans, Scandinavia, and Eastern Europe are emerging as alternative destinations due to overcrowding in traditional hotspots.

Europe’s demographic strength lies in its appeal to both intra-European travelers and long-haul visitors from Asia and the Americas. The Schengen Area eases border movement, facilitating multi-country travel packages supported by standardized tourism services. Moreover, the EU’s support for digital transformation in tourism and sustainable destination development is reinforcing the demand for certified local guides.

Cultural preservation remains central to guidance services. Many regions are integrating sustainability training for guides and encouraging the use of local languages. The rise in cycling tours, walking routes, and wine and culinary trails reflects a broader shift toward slow tourism, where personalized guidance enhances the value of the experience.

The Japan Tourism Guidance Service Market

The Japan Tourism Guidance Service Market is projected to be valued at USD 3.20 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 6.39 billion in 2034 at a CAGR of 8.0%.

Japan’s tourism guidance service market is experiencing a renaissance, driven by a surge in international arrivals and strong government support. According to Japan National Tourism Organization (JNTO), the country welcomed over 36 million tourists recently, with a government target of reaching 60 million by 2030. This growth aligns with Japan’s broader strategy to revitalize regional economies and increase tourism’s contribution to GDP.

Japan’s unique cultural dichotomy where centuries-old traditions coexist with high-tech innovation makes it an ideal destination for guided tourism. Visitors seek expert-led experiences ranging from historical temple tours in Kyoto and Hiroshima to pop-culture trails in Tokyo’s Akihabara and Shibuya districts. Professional guides enrich these experiences by bridging linguistic and cultural gaps, particularly for non-Japanese-speaking visitors.

A strong demographic advantage includes a rising number of travelers from Southeast Asia, China, and Western countries. To accommodate this, Japan has been investing in multilingual services, developing AI-powered translation tools, and expanding certification programs for interpreters and guides. Regional revitalization initiatives encourage tourism to lesser-known prefectures, supported by local guidance services that promote unique customs, festivals, and crafts.

Challenges include workforce shortages in tourism services and overcrowding in urban hotspots. However, the government’s Smart Tourism strategy featuring digital bookings, cashless travel, and real-time navigation apps is mitigating these issues and improving tourist flows. Additionally, Japan's dedication to cleanliness, safety, and efficiency enhances its global appeal.

The integration of traditional hospitality, or "omotenashi," into guided services ensures a culturally rich, respectful, and deeply immersive travel experience. Japan remains a model for balanced, technology-enhanced tourism growth.

Global Tourism Guidance Service Market: Key Takeaways

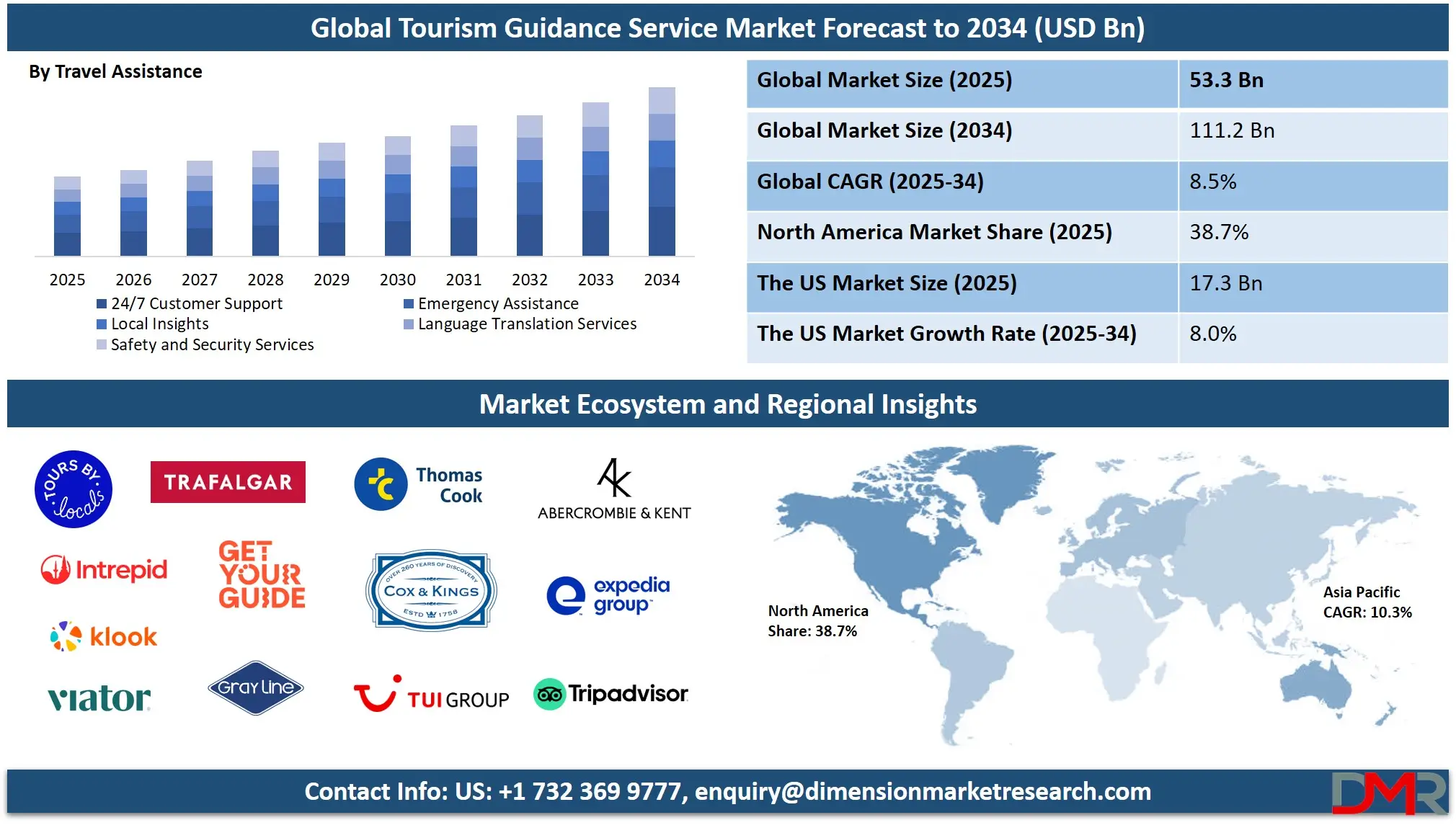

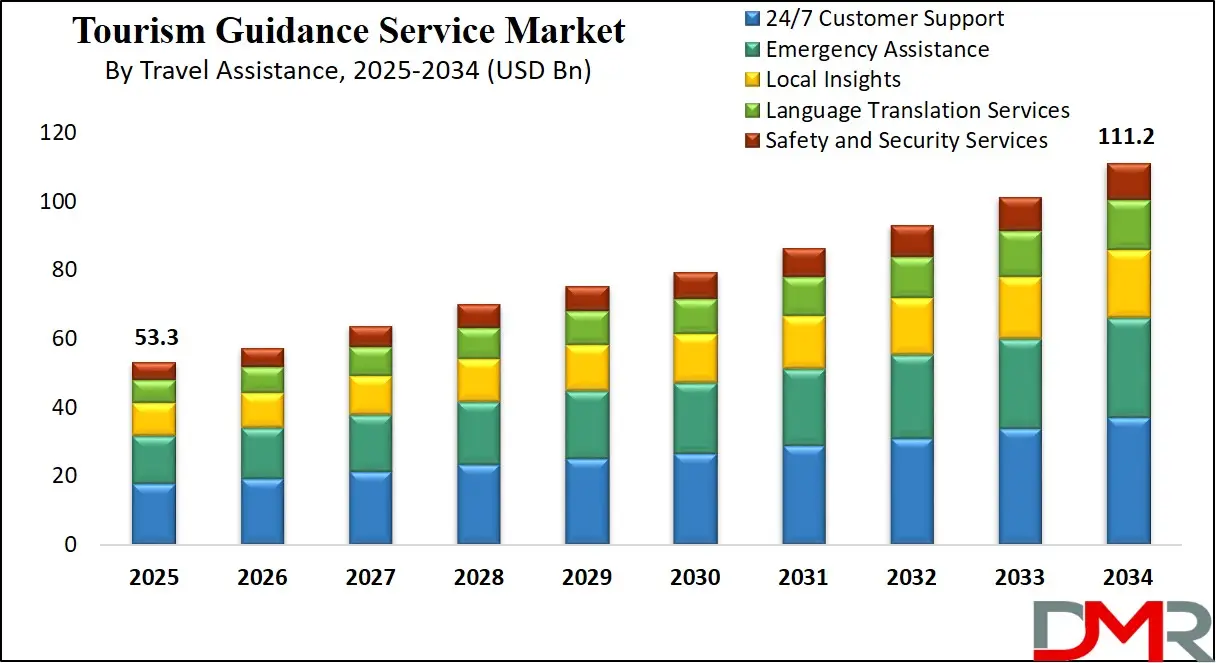

- Global Market Size Insights: The Global Tourism Guidance Service Market size is estimated to have a value of USD 53.3 billion in 2025 and is expected to reach USD 111.2 billion by the end of 2034.

- The US Market Size Insights: The US Tourism Guidance Service Market is projected to be valued at USD 17.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 34.6 billion in 2034 at a CAGR of 8.0%.

- Regional Insights: North America is expected to have the largest market share in the Global Tourism Guidance Service Market with a share of about 38.7% in 2025.

- Key Players: Some of the major key players in the Global Tourism Guidance Service Market are TUI Group, Expedia Group, TripAdvisor Inc., Cox & Kings Ltd., Thomas Cook India Ltd., Gray Line Worldwide, GetYourGuide, Viator (a TripAdvisor company), Klook, Trafalgar Tours, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 8.5 percent over the forecasted period of 2025.

Global Tourism Guidance Service Market: Use Cases

- Cultural Heritage Tours: Trained local guides offer historical context and cultural storytelling at ancient sites, monuments, and museums, enhancing tourists' understanding of local civilizations and traditions.

- Adventure Travel Guidance: Certified guides ensure safety and interpretation during outdoor activities such as rock climbing, diving, hiking, or jungle safaris, making challenging terrains accessible to tourists.

- Food and Culinary Exploration: Gastronomic tours led by local experts introduce tourists to traditional cuisine, hidden eateries, and food preparation techniques unique to regional culinary cultures.

- Spiritual and Religious Tourism: Guides facilitate pilgrimages to sacred places, providing detailed background on rituals, local beliefs, and religious significance in temples, churches, mosques, or monasteries.

- Academic and Educational Tours: Guidance services for students and researchers focus on historical, scientific, or ecological learning, often with structured itineraries and scholarly interpretations.

Global Tourism Guidance Service Market: Stats & Facts

United Nations World Tourism Organization (UNWTO)

- International tourist arrivals worldwide reached 1.4 billion in 2024, marking a 99% recovery to pre-pandemic levels and reflecting an 11% increase over 2023, demonstrating a rapid industry rebound.

By region:

- The Middle East showed exceptional performance by surpassing 2019 levels by 32%, driven by aggressive tourism investments and events.

- Europe achieved a 1% increase over 2019 arrivals, benefiting from stable intra-regional travel.

- Africa experienced a 7% increase compared to pre-COVID figures, with North and Sub-Saharan Africa recovering strongly.

- The Americas recovered 97% of pre-pandemic arrivals, boosted by strong U.S. outbound and regional tourism.

- Asia and the Pacific reached 87% of their 2019 levels, reflecting a steady recovery after prolonged travel restrictions.

- The Tourism Confidence Index for 2025 was recorded at 130, where 100 signifies a stable performance. This indicates a highly optimistic outlook across tourism professionals and organizations.

World Travel and Tourism Council (WTTC)

- Tourism-related industries are expected to support 348 million jobs globally in 2024, surpassing the 2019 pre-pandemic high by 13.6 million, emphasizing their labor-intensive nature.

- The U.S., China, and Germany are expected to be the top contributors to this surge, backed by strong domestic travel, infrastructure, and outbound tourism capacity.

World Bank Tourism Watch

- In the third quarter of 2024, global tourism grew by 7% year-on-year, outperforming other services sectors, as easing inflation and improved consumer confidence boosted travel.

- All regions recorded positive growth in air passenger arrivals from July to September 2024, with East Asia and the Pacific leading the increase, driven by the reopening of Chinese outbound travel.

Organisation for Economic Co-operation and Development (OECD)

- Before the COVID-19 pandemic, tourism in OECD countries directly contributed an average of 4.4% to GDP and 6.9% to employment, reflecting its structural importance to developed economies.

- In 2020, tourism’s contribution to GDP in OECD countries fell to 2.8%, averaging a 1.9% point decline versus pre-pandemic performance, illustrating the magnitude of disruption.

UNWTO Tourism Data Dashboard

- Export revenues from international tourism hit USD 1.8 trillion in 2023, almost matching pre-pandemic highs and reflecting renewed global demand for international travel.

- The tourism direct GDP reached USD 3.4 trillion in 2023, equal to 3% of the global GDP, showing that the sector has rebounded to pre-pandemic levels in monetary contribution.

ITOMA.IO Global Tourism Statistics

- In 2024, global tourist arrivals were 1.445 billion, up 10.71% from the previous year, suggesting strong annual growth and widespread travel recovery.

- The average number of daily global visitors in 2024 was approximately 3.96 million, marking a 10.41% increase from 2023, showing consistent upward momentum.

RoadGenius Global Tourism Forecast

- Spending on international tourism is expected to reach USD 1.89 trillion in 2024, nearly matching the 2019 peak, as travelers return to long-haul and luxury trips.

- Domestic tourism spending is anticipated to hit a record USD 5.4 trillion in 2024, driven by increased intra-country travel and the rise of “staycations” in major markets.

Global Tourism Guidance Service Market: Market Dynamic

Driving Factors in the Global Tourism Guidance Service Market

Surge in International and Domestic Tourist Volumes Post-COVID

The rapid resurgence of international and domestic tourism in the post-pandemic era is a critical growth driver for the tourism guidance service market. According to the UNWTO, international tourist arrivals recovered to over

1.4 billion in 2024, nearing or exceeding pre-pandemic benchmarks in most regions. This rebound is driven by lifted travel restrictions, increasing consumer confidence, vaccine coverage, and pent-up demand for travel after prolonged lockdowns.

Additionally, domestic tourism has surged even more robustly, with many countries launching campaigns to promote internal travel, thereby creating more job opportunities for local guides. Destinations are also experiencing a shift in visitor patterns, with emerging and secondary cities gaining traction due to travelers seeking less-crowded, authentic experiences.

Guided services, particularly those offered by locals, are instrumental in navigating these unfamiliar regions and enriching the tourist experience. The rise in multi-generational and elderly travelers who often prefer the safety and structure of guided tours adds another layer of demand. As tourism resumes, governments and private stakeholders are expanding tourism infrastructure, promoting heritage trails, eco-tours, and cultural festivals, which often require professional guiding services. Thus, the consistent increase in both domestic and international tourist footfall across continents directly supports the steady, long-term expansion of the global tourism guidance service sector.

Government-Led Tourism Promotion and Digitalization Programs

Numerous governments across the globe are implementing strategic policies to boost tourism’s economic contribution, and these efforts directly enhance the demand for tourism guidance services. Initiatives such as “Incredible India,” “Visit Japan,” “Experience Africa,” and the EU’s “Smart Tourism Destinations” focus on improving tourist inflow through infrastructure upgrades, destination branding, and heritage preservation all of which increase demand for organized guiding services. Governments are also investing heavily in training and certification programs for guides to improve service quality, safety, and multilingual capabilities, fostering professionalization of the guidance sector.

Moreover, several public-sector initiatives now incorporate digital transformation by launching mobile apps, virtual tour platforms, and smart tourism maps that integrate guide recommendations or booking features.

For instance, the Japanese government supports virtual and hybrid tour platforms for inbound tourists, combining remote guidance with physical exploration. This approach expands the market beyond in-person services and offers new revenue models. National tourism boards are also collaborating with global OTAs (Online Travel Agencies) and experience platforms to ensure visibility for certified guides. Financial incentives, tax relief for tour operators, and public-private partnerships further stimulate tourism-related service development. The coordinated push from public authorities to position tourism as a pillar of post-COVID recovery is thus a structural growth enabler for the guidance service market.

Restraints in the Global Tourism Guidance Service Market

Regulatory Barriers and Informal Service Providers

The tourism guidance service market is often challenged by fragmented regulations and a proliferation of unlicensed or informal service providers. Many countries have inconsistent or outdated regulatory frameworks governing tour guides, including varying standards for licensing, certification, and training. This lack of uniformity creates confusion for tourists and difficulty for professional guides attempting to operate cross-border or even inter-regionally within a country.

In regions with lax enforcement, unlicensed guides who may lack historical accuracy, safety training, or customer service skills undercut prices, degrade service quality, and jeopardize the reputation of legitimate operators. Furthermore, such informal actors often evade taxation, reducing government revenues and undermining structured tourism growth. Tourists relying on these informal guides may also face misinformation or exploitation, eroding trust.

For professional guide associations and legitimate companies, navigating licensing costs, complex visa procedures for international operations, and inconsistent labor laws presents further obstacles. Regulatory ambiguity can hinder investment and deter smaller players from scaling operations. Governments may also impose restrictions on foreign language-speaking guides or independent operators, creating entry barriers. These systemic issues limit market formalization and reduce the scalability of guidance businesses. Without harmonized policies, professional recognition, and effective enforcement, the tourism guidance industry will struggle to fully realize its potential in a competitive, globalized travel ecosystem.

Vulnerability to Geopolitical and Health Crises

The tourism guidance service market remains highly vulnerable to geopolitical tensions, natural disasters, and public health emergencies, which can instantly disrupt travel flows and service demand. Events such as international conflicts, terrorism, or diplomatic strains like visa bans or border closures can significantly reduce inbound tourism. For instance, civil unrest in parts of the Middle East, visa restrictions between major economies, or regional wars often lead to last-minute tour cancellations and months-long operational shutdowns for guides. Furthermore, tourism is sensitive to public health conditions. The COVID-19 pandemic exemplified how global health crises can devastate the sector. Despite technological resilience, guidance services, especially in-person ones, rely heavily on stable travel environments.

Health concerns like outbreaks of Zika, Ebola, or Monkeypox in specific regions have historically deterred travelers, reducing income for local guides and tour operators. Natural disasters hurricanes, earthquakes, or wildfires, also lead to loss of business continuity, damaged infrastructure, and reputational harm for affected destinations. These uncertainties make long-term planning difficult for guidance service providers, especially small enterprises or freelancers with limited financial buffers. Insurance premiums rise, bookings slow, and consumer confidence diminishes. Consequently, without contingency strategies or government support mechanisms, the sector remains susceptible to external shocks that restrict scalability and operational stability.

Opportunities in the Global Tourism Guidance Service Market

Expansion of Virtual and Hybrid Tour Guidance Models

The global shift toward digitization presents vast opportunities for virtual and hybrid tourism guidance services. The COVID-19 pandemic accelerated the acceptance of virtual travel experiences, which continue to thrive as a complementary or alternative mode of exploration. Tour guides now offer real-time, interactive digital tours via Zoom, YouTube Live, and proprietary platforms, allowing global audiences to explore destinations from their homes. These services benefit students, seniors, physically limited individuals, and even casual learners seeking cultural exposure without travel. Hybrid models, where a physical guide offers real-time streaming to remote clients, are also emerging in attractions with limited physical accessibility.

This format allows a single guide to cater to both on-site and remote audiences simultaneously, expanding reach and monetization. Virtual tourism guidance also presents monetization via monthly subscriptions, sponsored streams, or paid archives, unlocking long-term revenue beyond seasonal tourism. Language translation tools and real-time captions further broaden access to global users.

Virtual experiences are now bundled with AR/VR elements or digital souvenirs to enhance immersion. Moreover, tourism boards and cultural institutions are supporting digital tours as part of inclusive tourism initiatives. As consumer openness to hybrid and virtual tourism grows, tour operators embracing these models will capture new audiences, differentiate offerings, and ensure operational continuity during seasonal or geopolitical travel disruptions.

Growing Demand for Multilingual and Inclusive Guidance Services

As global tourism diversifies, the demand for multilingual and inclusive tour guidance is rapidly increasing. Tourists from emerging outbound markets such as China, India, Brazil, and Southeast Asia are expanding the linguistic landscape of global travel. In response, guidance service providers are hiring multilingual guides or using translation technologies to cater to these segments.

Offering tours in native languages significantly enhances comfort and engagement, especially for older or less-traveled tourists. Language-specific guides are also preferred for educational, historical, and religious tours where nuance matters. Moreover, inclusivity extends beyond language. There is a growing demand for specially trained guides who can lead tours for travelers with disabilities, neurodivergent visitors, and those with sensory sensitivities.

Accessible tours with sign language interpreters, wheelchair-friendly routes, and audio descriptions for the visually impaired are becoming integral to responsible tourism. Additionally, gender-sensitive guiding, LGBTQ+ inclusive routes, and age-friendly pacing are helping expand service appeal. UNESCO sites and cultural attractions increasingly require tour operators to meet inclusivity benchmarks for licensing and funding. By offering language and accessibility inclusivity, guidance services can tap into underserved demographics, meet legal and ethical mandates, and improve tourist satisfaction. This inclusive positioning strengthens destination branding and opens up new market segments globally.

Trends in the Global Tourism Guidance Service Market

Integration of AI and Smart Tech in Tourism Guidance

The global tourism guidance service market is witnessing an increasing adoption of artificial intelligence (AI), natural language processing (NLP), and machine learning (ML) to revolutionize tourist experiences. AI-driven tools, such as intelligent chatbots, virtual assistants, real-time language translation apps, and facial recognition for seamless entry at tourist attractions, are transforming how guides interact with tourists.

These technologies enhance personalization by analyzing traveler preferences, behavior, and location to offer tailored itineraries. Augmented reality (AR) and virtual reality (VR) are also being leveraged by tour operators to offer immersive pre-trip previews and interactive tours, reducing information overload and enhancing decision-making. For instance, interactive AR-powered mobile maps are replacing paper brochures, allowing travelers to navigate cities more confidently.

This convergence of tech and tourism services boosts traveler satisfaction, especially among millennials and Gen Z tourists, who demand tech-integrated experiences. The market is trending toward "smart tourism" ecosystems, cities, or attractions designed with digital layers that facilitate independent exploration while still requiring professional guidance for deeper cultural understanding.

The convergence of traditional guiding with AI-powered enhancements not only modernizes the profession but creates a dual-service model where human and digital experiences coexist. As destinations globally invest in digital tourism infrastructure, the integration of AI and smart technologies in guidance services becomes a key competitive differentiator for tour operators.

Rise of Niche and Experience-Based Guidance Services

There is a global shift in tourism preferences toward more authentic, personalized, and immersive travel experiences. Modern travelers increasingly value unique journeys rooted in local culture, history, gastronomy, wellness, or ecology. This trend has accelerated the rise of niche tourism guidance services that specialize in highly curated themes such as food trails, art walks, ancestral heritage journeys, LGBTQ+ tours, dark tourism (exploring historic tragic sites), and slow travel itineraries. Tourists are no longer satisfied with conventional sightseeing; they seek meaningful connections, insider narratives, and local engagement.

In response, tourism guidance providers are hiring or training local experts, historians, and even artists as guides, who bring specialized insights that generalist guides may lack. Platforms like Airbnb Experiences and GetYourGuide have further fueled this trend by enabling individual guides or small businesses to offer tailored activities based on hyper-local expertise. This transformation reshapes the traditional guide’s role from basic information provider to cultural interpreter, storyteller, and lifestyle ambassador.

Furthermore, as solo and female travel rises, niche services emphasizing safety, personal comfort, and community engagement are increasingly in demand. Sustainability and ethical tourism have also pushed travelers toward eco-conscious guided trips. As niche tourism continues to grow across all age segments, guidance service providers are restructuring offerings to capture micro-markets and establish premium value in a highly competitive tourism landscape.

Global Tourism Guidance Service Market: Research Scope and Analysis

By Type Analysis

Cultural tourism guidance services are projected to dominate the tourism guidance service market due to the increasing global interest in immersive and authentic travel experiences. Unlike conventional sightseeing,

cultural tourism allows travelers to engage directly with the heritage, traditions, festivals, cuisine, and local lifestyles of their destination. This growing demand has led to a significant surge in services that specialize in cultural interpretation, storytelling, guided heritage site tours, and interactions with local artisans and communities.

Tourists from developed regions such as North America and Europe are particularly drawn to Asian, African, and Latin American destinations for their cultural depth, historical richness, and diverse practices. The rise of experiential tourism and government initiatives to preserve and promote cultural assets has further elevated the need for cultural tourism guides.

Moreover, UNESCO World Heritage Sites, cultural festivals, culinary tourism, and indigenous community experiences are increasingly promoted as central offerings of many countries’ tourism strategies. Tourists actively seek knowledgeable guides who can provide historical context and cultural relevance, enhancing their travel experience. These guides offer educational insights and customized itineraries based on historical relevance, local traditions, and customs, thereby creating memorable travel moments.

Digital platforms and tourism apps have also enabled cultural tourism service providers to reach global audiences with ease, offering virtual previews, ratings, and real-time bookings. Cultural tourism’s contribution to sustainable tourism by supporting local economies and preserving heritage has gained favor with eco-conscious travelers. All these factors collectively make cultural tourism guidance services the most dominant and resilient segment in the global tourism guidance market.

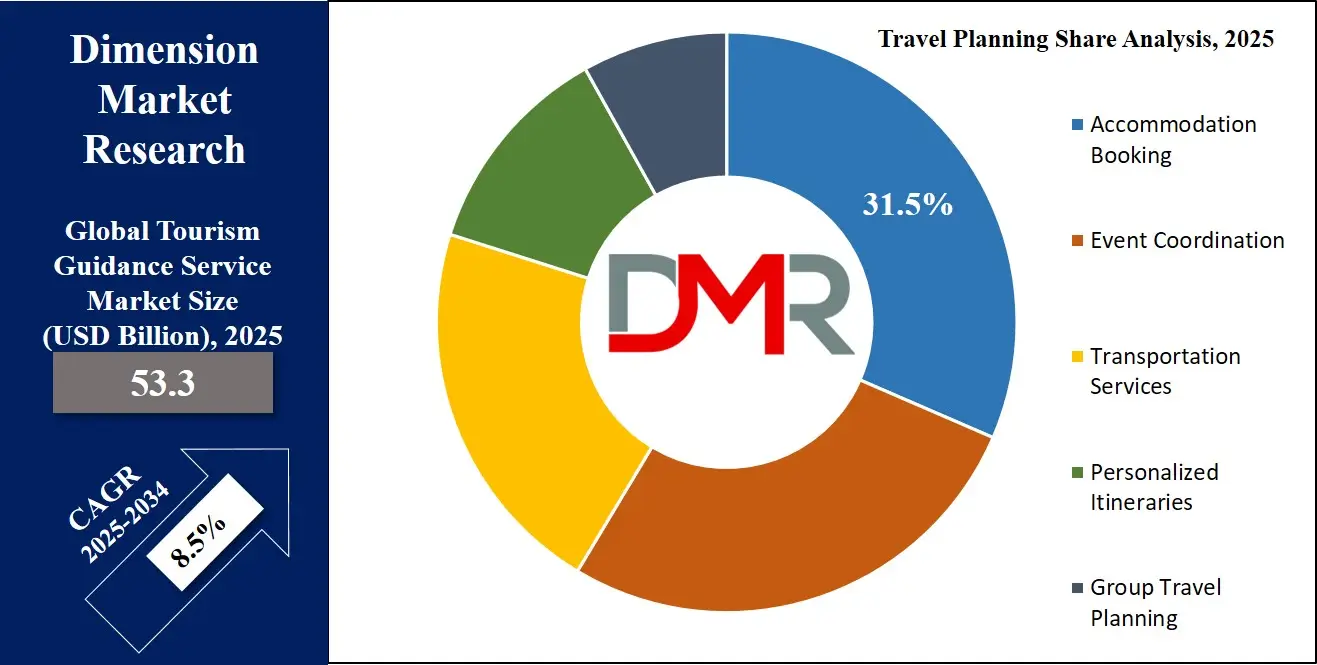

By Travel Planning Analysis

Accommodation booking is anticipated to hold a dominant position in the travel planning segment of the global tourism guidance service market because lodging is a foundational component of any travel itinerary. The demand for reliable, cost-effective, and experience-enhancing accommodation options drives travelers to seek expert guidance to avoid common pitfalls such as overpricing, subpar amenities, or inconvenient locations. Professional guidance services provide tailored recommendations based on traveler preferences, budgets, and proximity to tourist attractions, thereby enhancing convenience and trip satisfaction.

Additionally, the diversity of accommodation choices, ranging from luxury resorts and boutique hotels to eco-lodges and homestays, has created a complex decision-making landscape for travelers. Tourism guidance platforms simplify this process by offering curated lists, verified user reviews, and bundled deals, which appeal to individual tourists and group travelers alike. These services often include local insights, cancellation policies, and real-time availability updates, which build consumer trust and loyalty.

Another major driver of dominance is the integration of accommodation booking with broader travel services. Tour packages, which often include lodging as a bundled offering, make accommodation a strategic touchpoint in the overall travel experience. The rise of mobile apps and AI-based recommendation systems further enhances real-time customization and upselling opportunities, cementing accommodation booking as a critical part of travel planning services.

The post-pandemic rebound in travel has reinforced the importance of health and safety-certified accommodations. Travelers now prioritize verified cleanliness standards and refund flexibility, increasing reliance on guidance services that specialize in risk-averse planning. Consequently, the accommodation booking subsegment remains a key revenue-generating pillar in the global tourism guidance service industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Travel Assistance Analysis

24/7 customer support is projected to dominate the travel assistance segment of the global tourism guidance service market due to the inherent unpredictability of travel. Travelers often encounter issues such as flight delays, misplaced bookings, medical emergencies, or changes in itinerary, necessitating immediate and reliable assistance regardless of time zones. The availability of round-the-clock customer service significantly enhances customer confidence and satisfaction, leading to repeat business and positive brand perception.

In an era of real-time expectations, modern travelers demand instant resolution to problems. Tourism guidance services that provide 24/7 multilingual support via phone, chat, or mobile apps have a distinct competitive advantage. They offer assistance with rebooking flights, arranging emergency transportation, navigating language barriers, or sourcing local emergency contacts. This high-touch support is especially critical for solo travelers, elderly tourists, and high-end clientele who expect premium service.

Furthermore, 24/7 customer support aligns with the digital transformation of the tourism industry. AI chatbots, CRM platforms, and omnichannel contact centers enable guidance providers to deliver seamless assistance with greater speed and personalization. This service also strengthens business continuity for travel agencies and online booking platforms by reducing cancellations and managing reputational risks.

Tourists today value flexibility, security, and peace of mind, particularly when traveling in unfamiliar destinations. The global increase in long-haul and multi-country travel makes real-time support even more essential. Whether addressing minor inconveniences or major disruptions, 24/7 assistance is now a non-negotiable standard in high-quality tourism guidance services, driving its dominance in the travel assistance segment.

By Target Audience Analysis

Individual travelers are anticipated to represent the dominant target audience in the global tourism guidance service market due to the rising trend of personalized and self-directed travel experiences. Unlike group tours, individual travel allows tourists to explore destinations at their own pace, with flexibility in itinerary planning, activity selection, and budgeting. The demand for tailored travel guidance, such as personalized recommendations, location-based insights, and real-time assistance, has surged with the rise of solo travelers, digital nomads, and remote workers seeking unique cultural and recreational experiences.

Modern tourism guidance services cater effectively to this segment by offering mobile apps, online booking platforms, AI-powered chatbots, and interactive itinerary planning tools. These technologies empower individual travelers to make informed decisions while still benefiting from expert advice. Safety, convenience, and customized support are especially valued by solo travelers, who often rely on professional guidance to navigate unfamiliar environments.

Additionally, millennial and Gen Z consumers, major contributors to tourism growth, prefer DIY travel experiences supported by digital tools and on-demand assistance rather than fixed group itineraries. They are more likely to use tourism guidance services to discover off-the-beaten-path attractions, authentic local cuisines, or sustainable travel options. This growing preference for autonomy, combined with the ease of accessing expert support digitally, makes individual travelers the most lucrative and influential target segment.

As travel becomes more democratized and inclusive, tourism guidance providers increasingly prioritize individual traveler needs, offering multilingual support, budget flexibility, and customized experiences, further reinforcing this segment's market dominance.

The Global Tourism Guidance Service Market Report is segmented on the basis of the following:

By Type

- Cultural Tourism Guidance Services

- Adventure Tourism Guidance Services

- Eco-Tourism Guidance Services

- Religious Tourism Guidance Services

- Wellness & Medical Tourism Guidance Services

- Business/Corporate Tourism Guidance Services

By Travel Planning

- Accommodation Booking

- Event Coordination

- Transportation Services

- Personalized Itineraries

- Group Travel Planning

By Travel Assistance

- 24/7 Customer Support

- Emergency Assistance

- Local Insights

- Language Translation Services

- Safety and Security Services

By Target Audience

- Individual Travelers

- Group Tours

- Family Tours

- Business Travelers

Global Tourism Guidance Service Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the global tourism guidance service market with 38.7% of total revenue share in 2025, due to its mature travel infrastructure, high international tourist arrivals, and strong domestic tourism activity. The United States and Canada are home to diverse attractions ranging from natural parks and cultural heritage sites to urban entertainment hubs like New York, Los Angeles, and Toronto.

These destinations attract millions of tourists annually who often rely on professional guidance services to navigate complex itineraries and maximize their experiences. Additionally, North America boasts one of the highest per capita travel expenditures globally, further supporting demand for premium and customized guidance offerings.

The region is also a leader in adopting digital technologies in tourism, including mobile travel apps, AI-powered chatbots, and virtual tour platforms. The presence of large online travel agencies (OTAs), integrated booking systems, and multilingual support services enhances market maturity. Furthermore, government support for tourism through branding campaigns like "Brand USA" and funding for national parks and cultural institutions sustains continuous tourist inflow. High safety standards, service professionalism, and easy accessibility reinforce North America’s dominant position in the global tourism guidance service market.

Region with the Highest CAGR

Asia Pacific is projected to record the highest CAGR in the tourism guidance service market due to its rapidly expanding middle class, increased regional connectivity, and booming outbound and domestic tourism. Countries like China, India, Thailand, Indonesia, and Vietnam are witnessing rising disposable incomes and growing travel aspirations among younger demographics. This economic uplift, combined with affordable flight options and improved infrastructure, is enabling more frequent and longer travel, boosting demand for guided experiences.

Cultural richness and biodiversity also make Asia Pacific a magnet for global travelers seeking authentic and spiritual experiences. Governments across the region are actively promoting tourism through campaigns such as “Incredible India,” “Visit Japan,” and “Amazing Thailand,” which emphasize cultural tours, eco-tourism, and community-based travel. Additionally, tourism start-ups and local operators are leveraging mobile apps and multilingual platforms to cater to diverse traveler needs. With increased investments in digital tourism, guide training, and sustainable travel initiatives, Asia Pacific continues to emerge as the fastest-growing region in the global tourism guidance services market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Tourism Guidance Service Market: Competitive Landscape

The global tourism guidance service market is highly fragmented and competitive, featuring a mix of global OTAs, regional operators, and specialized niche service providers. Key players include TUI Group, TripAdvisor (Viator), GetYourGuide, Klook, Gray Line Worldwide, and ToursByLocals. These companies dominate through extensive networks, strong branding, and user-friendly digital platforms that enable real-time booking, multilingual support, and secure payment integration.

Start-ups and mid-sized operators are leveraging technological innovation to challenge incumbents by offering highly customized, experience-driven tours focused on culinary, eco-tourism, wellness, and local immersion. Platforms like Airbnb Experiences and TourRadar empower independent guides and micro-enterprises to directly access international markets, democratizing tourism guidance services.

Strategic partnerships, mergers, and acquisitions are shaping market consolidation, with companies expanding their global footprints and service portfolios. AI integration, 24/7 customer support, and seamless app-based itineraries are becoming essential differentiators. Furthermore, destination management organizations and national tourism boards increasingly collaborate with private operators to standardize service quality and promote certified local guides.

Sustainability, personalization, and accessibility remain key trends influencing competition. Companies investing in multilingual, inclusive, and tech-enabled guiding solutions are well-positioned to lead in an increasingly experience-oriented and digitally driven market environment.

Some of the prominent players in the Global Tourism Guidance Service Market are:

- TUI Group

- Expedia Group

- TripAdvisor, Inc.

- Cox & Kings Ltd.

- Thomas Cook India Ltd.

- Gray Line Worldwide

- GetYourGuide

- Viator (a TripAdvisor company)

- Klook

- Trafalgar Tours

- Intrepid Travel

- Abercrombie & Kent

- G Adventures

- TourRadar

- Insight Vacations

- Context Travel

- ToursByLocals

- LocalGuiding

- Travel Leaders Group

- World Expeditions

- Other Key Players

Recent Developments in the Global Tourism Guidance Service Market

- June 2024: International Tourism Investment Forum (ITIF) 2024 will be conducted in Jakarta, Indonesia. This event focuses on promoting international collaboration and sustainable investment in tourism. It featured interactive sessions, project showcases, and discussions on investment opportunities in the tourism and creative economy sectors.

- January 2024: The International Tourism Trade Fair in Madrid highlighted sustainable development, climate action, and enhanced collaboration within the global tourism sector. UNWTO hosted key investment forums and launched "Investment Guidelines for Ecuador" to promote tourism investment prospects.

- January 2024: EasyJet expanded its partnership with TUI Musement Tours and Activities, allowing customers to add experiences to their flight or holiday packages, enhancing the overall travel offering.

- January 2024: TUI Group extended its decade-long partnership with IBS Software to optimize its airline IT operations platform, aiming to improve scalability and enhance customer experience.

- April 2023: India's Ministry of Tourism organized industry outreach roadshows in Delhi and Mumbai to encourage private sector investment in the tourism sector. Over 24 states prepared action plans for investment opportunities, aiming to position India's travel and tourism sector as an ideal investment destination.