Market Overview

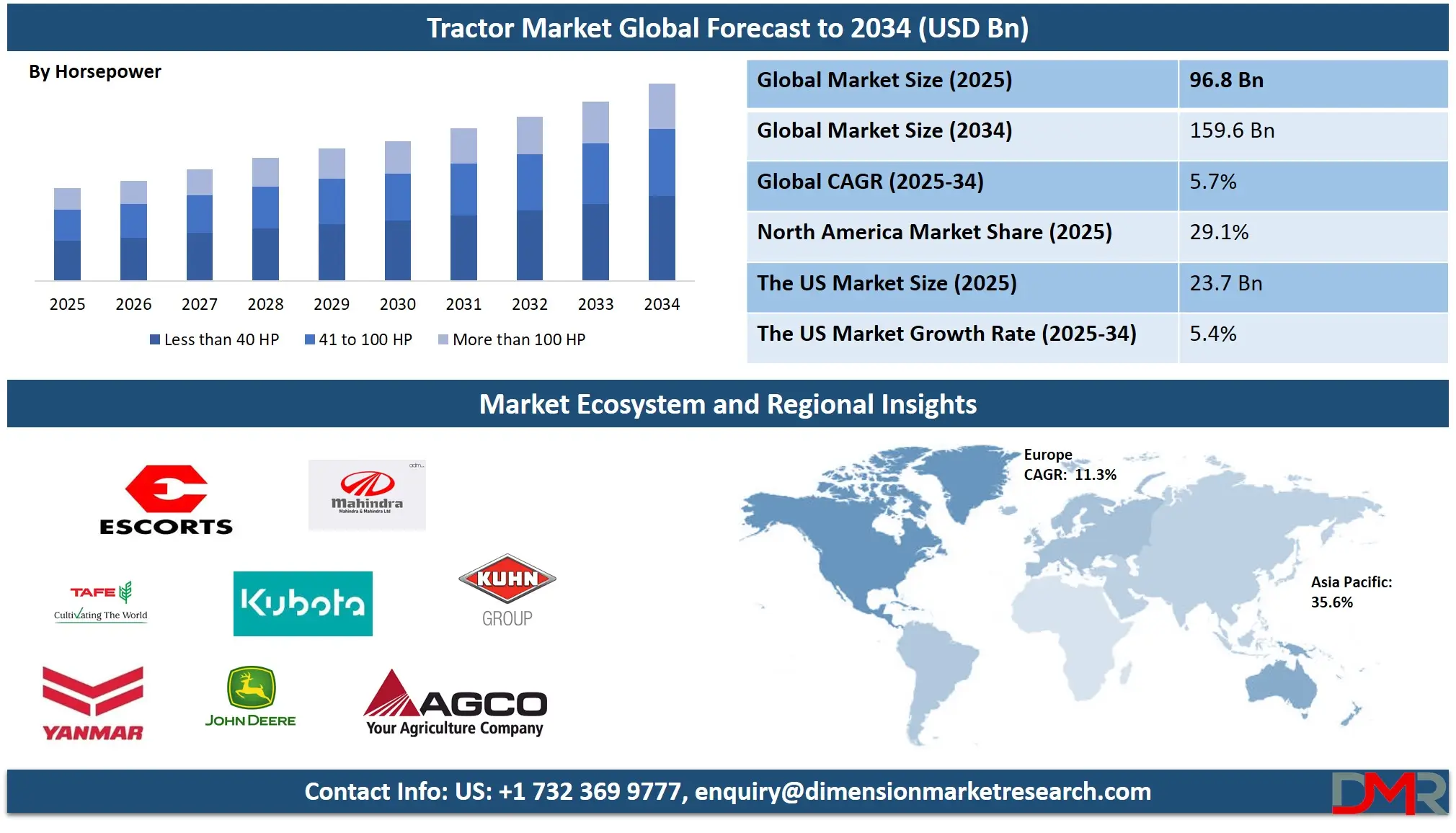

The Global Tractors Market size is estimated at USD 96.8 billion in 2025 and is expected to reach USD 159.6 billion by 2034, at a CAGR of 5.7% during the forecast period of 2025 to 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

A tractor is a powerful vehicle primarily used in agriculture, construction, and transportation. Designed for rugged terrains, it features large rear wheels for stability and high torque for heavy-duty tasks. In farming, tractors are indispensable for plowing, tilling, planting, and harvesting, streamlining labor-intensive activities. Attachments such as plows, harrows, and seed drills expand their versatility, enhancing productivity.

Tractors are also essential in construction, towing heavy equipment, or transporting materials across sites. Their hydraulic systems enable operations like lifting and digging with implements like loaders and backhoes. Compact and utility tractors cater to smaller tasks, ensuring efficiency across diverse industries.

The global tractor market is driven by growing demand across agriculture, construction, and allied industries. Rising global food demands drive this demand tractor technology makes life simpler by automating labor-intensive agricultural tasks such as plowing and tilling for increased productivity additionally advances such as GPS integration, autonomous systems, and fuel-efficient designs are driving their adoption as more modern farming and construction operations utilize seed drills, harrows, and loaders as essential farm tools or construction machinery.

The US Tractor Market

The US Tractor market is projected to be valued at USD 23.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 37.9 billion in 2034 at a CAGR of 5.4%.

The US tractor market is primarily driven by the increasing demand for advanced farming equipment, which enhances agricultural productivity and efficiency. The growing adoption of precision farming techniques, including GPS technology and automation, has accelerated tractor sales. Additionally, the rising global population and the need for more food production have led to an increased focus on mechanized farming to meet growing demands.

One significant trend is the rising popularity of compact and sub-compact tractors, which offer versatility for small farms and urban agriculture. Additionally, the demand for electric and hybrid tractors is growing as farmers seek more environmentally friendly options. Automation and autonomous tractors are becoming more prevalent, reducing labor costs and increasing efficiency.

Key Takeaways

- Market Growth: The global tractor market is anticipated to expand by USD 57.9 billion, achieving a CAGR of 5.7% from 2026 to 2034.

- Horse Power Analysis: Less than 40 HP is predicted to dominate the global market based on type by the end of 2025.

- Driveline Analysis: Two-wheel drive (DWD) tractors are projected to dominate the global tractor market with the highest revenue share by 2025.

- Application Analysis: Agriculture is likely dominate the tractor market with the largest revenue share by 2025.

- Regional Analysis: Asia Pacific is projected to dominate the global tractor market, holding a market share of 35.6% by 2025.

Use Cases

- Plowing and Tilling Fields: Tractors are widely used in agriculture for plowing and tilling the soil. They help break up compacted earth, creating a fine seedbed for planting crops and improving soil aeration.

- Hauling and Transporting Materials: Tractors are equipped with trailers or other attachments to transport heavy loads, such as harvested crops, feed, fertilizers, or building materials across farmland or construction sites.

- Mowing and Grass Cutting: Tractors fitted with mowers are used to maintain large grassy areas, such as pastures, parks, or sports fields. They help manage vegetation and keep fields neat and safe for livestock or recreational activities.

- Farming Operations with Attachments: Tractors are versatile machines used with various attachments, such as seeders, cultivators, and sprayers. These attachments enable efficient planting, crop maintenance, and pesticide application in farming operations.

Stats & Facts

- In 2023, approximately 2.05 million tractors were shipped globally, driven by demand in Asia-Pacific, which accounted for 60% of total sales. India leads with over 900,000 annual units, followed by China with 600,000 units, reflecting robust agricultural mechanization efforts in these countries.

- Europe and North America also contribute significantly, with tractor registrations in Europe reaching 250,000 units annually, particularly in Germany, France, and the UK. The U.S. market witnessed sales of around 310,000 units in 2023. Small and compact tractors under 40 horsepower represent 40% of global demand, while high-horsepower models above 100 horsepower dominate large-scale farming applications.

- In 2022, Germany emerged as the top exporter of tractors, with export values reaching $11.1 billion, followed by the Netherlands at $6.32 billion. The United States exported $5.65 billion, while France and China recorded tractor exports worth $4.71 billion and $3.74 billion, respectively, showcasing their strong presence in the global tractor market.

- The United States led global tractor imports in 2022 with a value of $8.01 billion, reflecting its high domestic demand. Canada followed with imports worth $4.59 billion, and France imported $4.06 billion. Germany and Poland also featured prominently, importing tractors valued at $3.37 billion and $3.3 billion, respectively, emphasizing their reliance on external supplies for agricultural machinery.

Market Dynamic

Driving Factors

Rising Demand for Agricultural Production

As global population growth contributes directly to an increasing agricultural production need, so does the demand for tractors. Farmers utilizing them for essential tasks such as planting, harvesting and plowing in response to rising food demands are adopting them more and more as labor costs decrease and productivity rises - helping meet an urgent global food security requirement while simultaneously maintaining sustainable practices and creating increased output with their mechanized farming techniques - leading to worldwide tractor sales increases and making mechanized farming an invaluable investment option. This has resulted in record global tractor sales globally.

Technological Innovations in Tractor Machinery

Tractor technology plays an essential role in driving market expansion. Features like automated systems, GPS positioning systems, and precision farming equipment have drastically enhanced modern tractors' efficiency allowing farmers to maximize resource use more effectively while improving yields and making data-driven decisions, ultimately increasing productivity overall. As technology continues its rapid advancement the demand for upgraded machinery continues to expand as both new customers as well as established farmers upgrade their machinery thus further expanding the market for advanced models that promise greater performance efficiencies and greater efficiencies.

Restraints

High Initial Investment Costs

One of the main impediments to global tractor market development is the high purchase costs of tractors. Initial investments that require substantial upfront capital often deter small farmers and agricultural enterprises, particularly in developing regions where financial liquidity may be scarce. Even with available financing solutions available to them, fear of accruing significant debt often dissuades potential buyers.

Due to budgetary restraints, many farmers opt for traditional farming techniques or older tractor models over modern agricultural technology - further diminishing productivity while inhibiting advancements in farming practices and stunting expansion and growth in the global tractor market. This tendency towards conservatism limits productivity while hampering advancement and stagnating global tractor markets.

Environmental Regulations

Strict environmental regulations pose another significant barrier to the global tractor market. Conformance to emission and fuel efficiency standards necessitates costly upgrades or modifications of existing tractor models, impacting production timelines and profit margins manufacturers must invest heavily in research and development of sustainable technologies aimed at meeting long-term sustainability goals despite short-term costs being higher or manufacturing processes becoming more complicated; whilst such efforts do serve a purpose long term they often backfire by raising prices or complicating production processes significantly.

Opportunities

Rising Demand for Compact Tractors

Compact tractors have quickly gained popularity among small farmers, landscapers, and horticulturists due to their affordability, ease of use, and remarkable versatility. These compact machines can handle multiple tasks--from plowing fields and planting crops, mowing lawns or managing gardens--while their compact size makes them suitable for use on smaller farms, tight spaces or urban settings where larger machines would otherwise prove impractical - while urban farming initiatives and sustainable landscaping practices have significantly fueled this rise in their use.

Government Initiatives and Subsidies

Governments are taking active steps to promote agricultural mechanization to increase productivity and meet growing food demands, offering subsidies and financial assistance programs for farmers to purchase tractors and other machinery. These initiatives seek to modernize agriculture, reduce labor dependency, and enhance yields in regions experiencing resource constraints.

By making tractors more readily accessible for smallholder farmers and improving rural livelihoods, governments aim to empower smallholder farmers while simultaneously strengthening food security. Furthermore, such programs support the adoption of environmentally friendly machinery which meets sustainable development goals as part of an agenda of economic growth and self-sufficiency for agriculture.

Trends

Shift toward Electric-Powered Tractors

The agricultural industry is witnessing a significant shift toward electric-powered tractors, driven by increasing awareness of environmental sustainability and the need to reduce operating costs. These tractors operate on clean energy, producing zero emissions, which helps mitigate greenhouse gas emissions and minimize air pollution. In addition to their environmental benefits,

electric tractors require less maintenance and have lower fuel costs, making them an economical choice in the long run. Governments and organizations promoting green energy solutions are also supporting this transition through incentives and funding. As technology advances, electric-powered tractors are expected to play a pivotal role in modern, eco-friendly agriculture.

Adoption of Intelligent and Smart Tractors

The adoption of intelligent and smart tractors is transforming farming by integrating advanced technologies like

artificial intelligence (AI) and

machine learning (ML). These tractors can perform various tasks autonomously, such as plowing, planting, and harvesting, significantly reducing labor requirements and enhancing operational efficiency.

Equipped with GPS, sensors, and data analytics capabilities, smart tractors can optimize field management, monitor soil conditions, and even predict crop health. This level of automation and precision enables farmers to increase productivity while conserving resources. As technology continues to evolve, intelligent tractors are set to revolutionize agriculture, paving the way for a smarter and more sustainable future.

Research Scope and Analysis

By Horsepower

By 2025, less than 40 HP is expected to dominate the global tractor market with the highest revenue share and capture most tractor sales, particularly those occurring in developing nations and rural environments. Tractors with horsepower levels under 40 are great choices for small farmers as they tend to be more cost-effective, efficient, and versatile than their larger counterparts. Such tractors can help facilitate basic agricultural tasks like plowing, tilling, sowing, and transportation on small to medium-sized farms.

Small tractor designs are easier to operate and maintain, which makes them popular choices among smallholder farmers in emerging markets with tight budgets. The 41 to 100 HP category dominates global tractor markets. Tractors in this range provide more power and capability compared to those under 40 HP, making them suitable for medium-sized farms as well as an array of agricultural activities including larger-scale cultivation, planting, and harvesting operations. Their higher productivity and efficiency are especially valued in developed markets or more mechanized settings where more productivity may be necessary.

By Driveline

Two-wheel drive (DWD) tractors are projected to dominate the global tractor market with the highest revenue share by 2025 due to their convenience, affordability, and user-friendliness. Two WDD models are particularly favored when handling tasks that involve maneuverability on uneven terrain as well as lighter workloads. Agriculture sector farmers looking for reliable equipment without complex technology often prefer these machines due to their user-friendly designs, making them simple for both emerging and established agricultural sectors alike.

Massey Ferguson, John Deere, New Holland and Mahindra & Mahindra have made significant strides toward the expansion of 2WD segment and maintaining its dominance within market. Farmers appreciate the cost-efficiency and dependability of 2WD tractors, making them the go-to option for daily farming operations at smaller scale. Meanwhile, four-wheel drive (FWD) technology looks set for tremendous expansion over the coming years.

4WD tractors provide several advantages over two-wheel drives for farmers operating on uneven terrain or handling heavier loads. Four wheel drive (FWD) tractors offer superior traction and stability, making them the ideal solution for challenging agricultural tasks such as plowing, hauling and working sloped fields or muddy soils. Rising demand for high performance equipment coupled with new farming practices have contributed to 4WD tractor's rapidly rising popularity.

By Application

Agriculture is likely dominate the tractor market with the largest revenue share by 2025, accounting for most global demand for these machines. Tractors play an increasingly prominent role in modern farming operations, where they're relied upon for various tasks including plowing, planting, tilling, irrigation, and harvesting. Population expansion, rising food demand, and shifting towards mechanized farming methods all play a part in driving agricultural tractor sales to increase. Tractors in this segment play an essential role in improving productivity, decreasing labor costs, and supporting large-scale farming operations.

Industrial applications make up another large segment within the global tractor market. Industrial tractors are an essential piece of heavy-duty equipment in construction, mining, and material handling applications where large loads need to be moved around quickly or dug out in large trenches for excavation purposes. Transporting materials across job sites also relies heavily on these machines' capabilities for efficiently moving massive materials across sites. Durability and strength are hallmarks of industrial tractor design; designed for harsh terrains and demanding tasks alike. As construction industries grow alongside increasing infrastructure development needs, so too has industrial tractor use increased.

The Global Tractor Market Report is segmented based on the following

By Horsepower

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

By Driveline

By Application

- Agriculture

- Industrial

- Utility

- Others

Regional Analysis

The Asia Pacific region is predicted to dominate the global tractor market with a revenue

share of 35.6% in 2025 due to its large agricultural base, rapid economic growth, and increasing mechanization of farming practices. With countries like India and China heavily reliant on agriculture, the demand for tractors is driven by efforts to boost productivity and efficiency in farming operations. These nations have substantial rural populations and smaller landholdings, necessitating affordable and versatile tractors suited for diverse agricultural needs.

Governments in the region actively promote farm mechanization through subsidies, loans, and initiatives to modernize agriculture, further fueling tractor sales. Additionally, the region's expanding middle class and rising disposable incomes have enabled farmers to invest in advanced machinery. Asia Pacific also benefits from being home to several leading tractor manufacturers, which cater to both domestic and international markets with competitively priced and technologically advanced products.

Local production of Indian Tractors reduces costs, ensures accessibility, and supports innovation tailored to regional farming conditions. The region’s diverse agricultural landscape, ranging from rice paddies to dry fields, creates a consistent demand for specialized and efficient Indian Tractors. Furthermore, the push towards sustainable farming and precision agriculture technologies has encouraged the adoption of modern

Indian Tractors equipped with smart features.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global tractor market is highly competitive, driven by the rising demand for efficient agricultural machinery and rapid technological advancements. Dominated by a few key players, the market also features strong regional manufacturers catering to specific geographical needs. The integration of precision farming technologies, telematics, and autonomous tractor systems has intensified competition.

Companies like John Deere and Kubota are investing heavily in R&D to introduce AI-driven electric tractors, enhancing operational efficiency and sustainability. Intense price competition, fluctuating raw material costs, and strict environmental regulations pose challenges. However, increasing demand for sustainable farming practices and government subsidies for farm mechanization provide growth opportunities.

Some of the prominent players in the global tractor market are

- Deere and Company

- CNH Global NV

- AGCO Corporation

- CLAAS KGaA mbH

- Mahindra and Mahindra Corporation

- Kubota Corporation

- Escorts Limited

- Tractors and Farm Equipment Limited

- Kuhn Group

- Yanmar Company Limited

- Deutz-Fahr

- Other Key Players

Recent Developments

- In August 2024, New Holland, a CNH brand, launched the 100+ HP (Horsepower) tractor made in India. The WORKMASTER 105 has a modern FPT engine that produces 106 horsepower and some notable features like a lift capability of 3,500 kg, electro-hydraulic 4WD engagement, and an air-suspended seat with an adjustable backrest.

- In August 2024, AutoNxt launched an electric tractor at Talao Pali Lake Side in Thane. The launch of this truck offers various benefits to farmers and contributes to environmental conservation.

- In October 2023, Ag-Pro proudly announced the acquisition of a John Deere dealership in South Daytona, Florida. Formerly known as "South Daytona Tractor & Mower," this dealership has been serving Volusia County and surrounding areas since 1990.

- In February 2023, Mahindra Electric Mobility Limited (MEML) officially merged with its parent company, Mahindra & Mahindra Limited (M&M). The M&M Board had previously decided on this integration, effective from April 1, 2021, to streamline the development, manufacturing, and sales of electric vehicles (EVs).

- In April 2023, Mahindra & Mahindra will launch 40 tractor models based on the newly introduced OJA platform. The company aims to strengthen its presence in markets across Africa, Asia, India, and Thailand.

- In March 2023, John Deere unveiled MY24 updates for its 7, 8, and 9 Series Tractors, enhancing their readiness for the future of precision agriculture.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 96.8 Bn |

| Forecast Value (2033) |

USD 159.6 Bn |

| CAGR (2024-2033) |

5.7% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 23.7 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Horsepower (Less than 40 HP, 41 to 100 HP, and More than 100 HP), By Driveline (2WD, and 4WD), By Application (Agriculture, Industrial, Utility, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Deere and Company, CNH Global NV, AGCO Corporation, CLAAS KGaA mbH, Mahindra and Mahindra Corporation, Kubota Corporation, Escorts Limited, Tractors and Farm Equipment Limited, Kuhn Group, Yanmar Company Limited, Deutz-Fahr and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Tractor Market?

▾ The Global Tractor Market size is estimated to have a value of USD 96.8 billion in 2024 and is expected to reach USD 159.6 billion by the end of 2033.

Which region accounted for the largest Global Tractor Market?

▾ Asia Pacific is expected to be the largest market share for the Global Tractor Market with a share of about 35.6% in 2024.

Who are the key players in the Global Tractor Market?

▾ Some of the major key players in the Global Tractor Market are Deere & Company, CNH Global NV, Mahindra & Mahindra Corporation, and many others.

What is the growth rate in the Global Tractor Market?

▾ The market is growing at a CAGR of 5.7 percent over the forecasted period.

How big is the US Tractor Market?

▾ The US Tractor Market size is estimated to have a value of USD 23.7 billion in 2024 and is expected to reach USD 37.9 billion by the end of 2033.