Market Overview

The Global Translation Management Software Market is expected to reach a value of USD 5.2 billion in 2024, and it is further anticipated to reach a market value of USD 10.7 billion by 2033 at a CAGR of 8.3%.

Translation management software is a kind of software that is designed to help the user in localizing their entire content like glossaries, and translation. This market offers solutions that facilitate and automate the translating process of content from one language to another. This software consists variety of functions like memory management, terminology management, workflow automation, project management, and quality assurance.

In the memory management function, this software allows the user to store translated segments and phrases for reuse in future translations which will help in minimizing redundancy and improving the consistency of the content. These markets provide their services to a wide range of industries like publishing, E-commerce, manufacturing, Healthcare, Legal, and Finance sectors.

As per the LLCbuddy, the Translation Management Software (TMS) market is witnessing robust growth driven by the increasing demand for localized content and digital transformation efforts. Europe dominates nearly half of the global language services market, with a 49% share, followed by North America at 39.41%. Notably, the top 100 language companies account for only 15% of the market, leaving 85% to small and mid-sized players.

Consumer preferences further underline the need for localized content, with 76% of online users favoring native-language content and 87% of B2C consumers avoiding English-only websites. Despite this, only 16% of organizations report successful digital transformation, hindered by low adoption rates. Translation memory tools are pivotal, enhancing productivity by 10–60%, saving up to 50% in costs, and improving quality (70%) and consistency (83%). Income for 52% of language professionals has risen in recent years, with U.S. translators earning an average of $52,000 annually.

Translation Management Software (TMS) continues to be a dynamic sector, with notable events, conferences, and deals shaping the market. Leading events like the Globalization and Localization Association (GALA) conference and LocWorld bring together industry leaders to discuss innovations in TMS and AI-powered localization.

Recently, mergers and acquisitions have surged, with major players acquiring smaller firms to expand capabilities, such as

Artificial Intelligence integration and multilingual content automation. Strategic deals, like partnerships between TMS providers and e-commerce giants, reflect the growing demand for efficient global communication. These developments underscore TMS’s critical role in enabling seamless cross-border collaboration and enhancing digital globalization.

Key Takeaways

- The Global Translation Management Software Market size is estimated to have a value of USD 5.2 billion in 2024 and is expected to reach USD 10.7 billion by the end of 2033.

- North America has the largest market share for the Global Translation Management Software Market with a share of about 40.3% in 2024.

- The market is growing at a CAGR of 8.3% over the forecasted period

- Translation software is projected to hold 64.1% of the product segment in 2024

- Based on content type, audio based content are projected to hold a significant portion of the translation management software in 2024.

Use Cases

- This software offers a database option where the user can store the translated segments or phrases are stored for future reference.

- The glossaries and terminology a database offers the user to manage their content to ensure consistency across translations.

- By streamlining the translation process the user can manage automating tasks like tracking progress, and managing revisions of assignments on the user.

- TMS provides tools for organizing and managing translation projects, including scheduling, resource allocation, and budgeting.

- TMS typically includes features for quality control, such as spell-checking, grammar-checking, and validation against style guides..

Market Dynamic

The rapid growth in the field of translation services and software companies that provide translation management software has been filling the gaps left by the various languages. This market utilizes this gap left and now it has been transformed into a well-grown market with various growth prospects. The development of TMS programs, which have improved speed and precision, has been fueled by technologies, particularly those about Artificial Intelligence and Machine Learning.

Process flow automation is made easier by the coupling of the other systems, and Cloud Computing solutions offer accessibility and scalability. Respecting data privacy regulations is still a challenge, even with TMS systems facilitating data management by contemporary data handling specifications. Additionally, the custom permits that cater to the unique requirements of the respective businesses cause the technology to proliferate across sectors like Legal, Healthcare, and Finance.

Research Scope and Analysis

By Offering

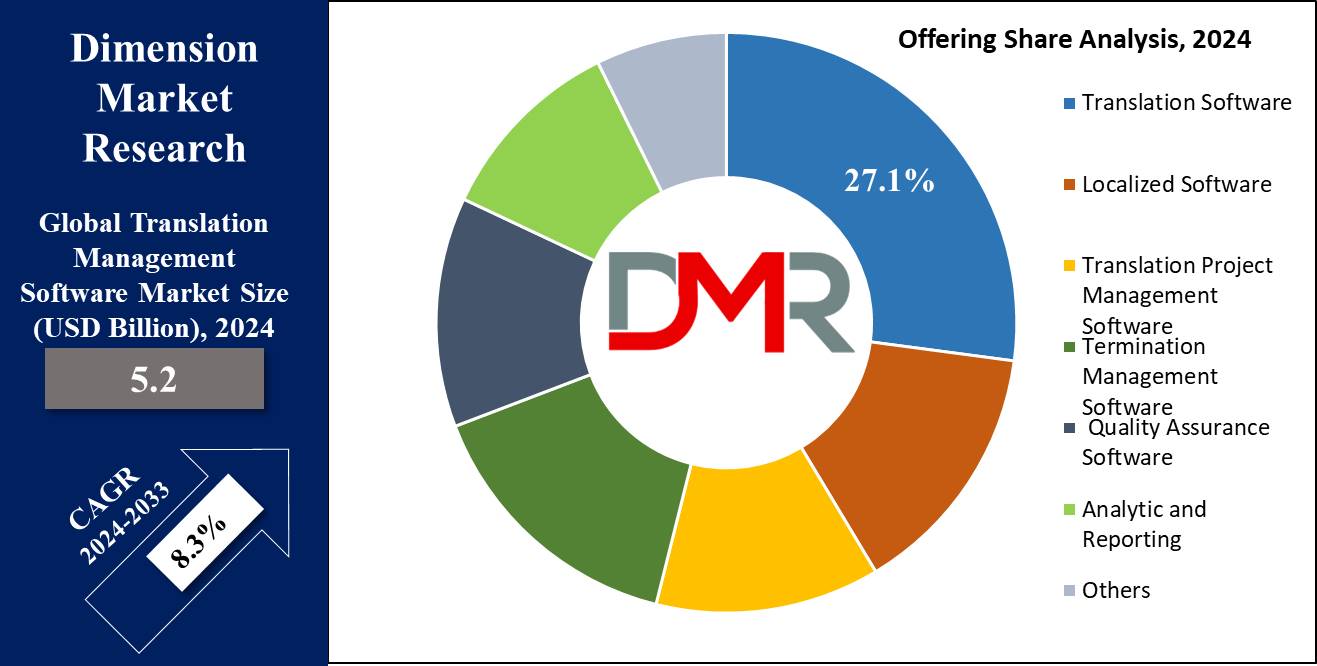

Translation software is projected to

hold 64.1% of the product segment in 2024 and is further anticipated to show subsequent growth in the forthcoming period of 2023 to 2033. Translation software program dominates the offering section of the translation management software market due to its comprehensive suite of gear catering to diverse translation needs. With laptop-assisted translation skills, inclusive of translation memory control and alignment gear, alongside advanced system translation technology consisting of rule-based totally, statistical, and neural device translation, it offers efficiency and accuracy.

Moreover, the inclusion of localized software program like content material control systems and globalization management systems complements adaptability to numerous linguistic and cultural contexts. Additionally, translation task control and high-quality guarantee gear make certain streamlined workflows and excellent outputs. This breadth of functionality makes translation software program imperative for businesses in search of effective multilingual communication solutions, driving its dominance in the market.

By Content Type

Based on content type, audio based content are projected to hold a significant portion of the translation management software in 2024. Audio-based content dominates this section because of its accessibility and comfort. With the proliferation of smartphones and audio streaming structures, customers can without difficulty devour content material while at the move or acting other responsibilities. Unlike textual content-primarily based content, audio requires minimal visible attention, making it best for multitasking.

Additionally, properly-produced audio content engages listeners through storytelling, track, and sound consequences, growing immersive stories. This layout also caters to people with visible impairments and people who decide upon auditory getting to know patterns, growing inclusivity. Overall, the convenience, accessibility, engagement, and inclusivity of audio content make a contribution to its dominance in this section.

By Application

Terminology management dominates this phase due to its pivotal position in making sure consistency and accuracy across translations. Dynamic terminology control allows the creation, organization, and preservation of terminology databases, vital for keeping consistency in language use. Industry-particular terminology lets in for specialized language model, enhancing translation precision in technical fields. Automated terminology extraction streamlines the identity and integration of applicable terms, optimizing translation efficiency.

Cross-language terminology integration ensures coherence in multilingual contexts. Ultimately, powerful terminology control not best improves translation satisfactory however additionally enhances verbal exchange within and throughout industries, making it a cornerstone of translation techniques and therefore dominating this segment.

By Business Function

Finance and accounting dominate this segment due to the crucial need for correct and specific translation in monetary documentation. Multilingual financial reviews, go-border invoicing, tax record translation, and audit record translation are essential for international companies running in various markets. Financial compliance documentation calls for meticulous translation to make sure adherence to regulations across jurisdictions.

The complexity and sensitivity of monetary facts demand specialized linguistic information and interest to element, making finance and accounting translation a priority. Moreover, the implications of mistranslation in economic documents can have intense legal and economic effects, underscoring the importance of this phase in making sure integrity and transparency in international monetary transactions.

By End User

BFSI (Banking, Financial Services, and Insurance) dominates this segment due to its unique translation needs driven with the aid of regulatory necessities, global operations, and risk control concerns. As a heavily regulated industry, BFSI is based on accurate translation of economic files, compliance substances, and felony contracts to fulfill regulatory requirements throughout various jurisdictions.

With global operations spanning more than one international locations, BFSI institutions require translation services to speak efficiently with clients, partners, and stakeholders global.

Additionally, particular translation is vital for handling risks associated with financial transactions and ensuring client information of complicated financial merchandise. The touchy nature of financial information additionally necessitates stable and exclusive translation offerings. These elements together position BFSI as the dominant give up person in the translation industry, emphasizing the crucial position of translation within the area's operations and compliance efforts.

The Translation Management Software Market Report is segmented on the basis of the following:

By Offering

- Translation Software

- Computer-Assisted Translation

- Translation Memory Management

- Translation Alignment Tools

- Machine Translation

- Rule-Based Machine Translation

- Statistical Machine Translation

- Neural Machine Translation

- Localized Software

-

- Content Management System (CMS)

- Globalization Management Systems (GMS)

- Cultural Adoption Tools

- Locale-Specific Content Management

- Translation Project Management Software

- Project Planning Tools

- Resource Allocation Software

- Task Scheduling Tools

- Team Communication Tools

- Workflow Automation Tools

- Task Automation

- Notification Systems

- Termination Management Software

- Terminology Database

- Multilingual Database

- Domain-Specific Database

- Terminology Extraction Tools

- Statistical Extraction

- Machine Learning-Based Extraction

- Quality Assurance Software

- Linguistic Quality Assurance Tools

- Spellcheckers

- Grammar Checkers

- Automation Tools for Quality Assurance

- Test Scripting Tools

- Regression Testing Tools

- Analytic and Reporting

- Professional Services

- Training & Consulting Services

- System Integration & Deployment Services

- Support & Maintenance services

- Others

By Content Type

- Audio-based Content

- Video-based Content

- Text-based Content

By Application

- Terminology Management

- Dynamic Terminology Management

- Industry-Specific Terminology

- Automated Terminology Extraction

- Cross-Language Terminology Integration

- Translation

-

- Machine Translation

- Neural Machine Translation

- Quality Assurance

-

- Linguistic Quality Assurance

- Automated Quality Assurance Tools

- Real-Time Consistency Checks

- Multilingual Completeness Verification

- Project Management

-

- Agile Project Management

- Real-Time Collaboration Tools

- Resource Allocation and Tracking

- Automated Project Scheduling

- Resource Management

-

- Translation Memory Management

- Linguistic Resource Sharing

- Integration With External Translation Resources

- Intelligence Resources Recommendation

- Billing & Invoicing Analysis

-

- Cost Estimation and Forecasting

- Budget Tracking and Analysis

- Automated Invoicing Systems

- Revenue Optimization Analytics

- Others

By Business Function

- Finance & Accounting

- Multilingual Financial Reports

- Cross-Border Invoicing

- Tax Document Translation

- Audit Report Translation

- Financial Compliance Documentation

- Others

- Legal

-

- Legal Document Translation

- Compliance and Regulatory Translation

- Court Filing Translation

- Intellectual Property Documentation

- Litigation Support Translation

- Others

- Sales and Marketing

-

- Multilingual Marketing Campaigns

- Market Entry Strategy

- Product Packaging Translation

- Advertising Content Localization

- Social Media Campaign Translation

- Others

- Human Resources

-

- Multilingual Employee Communications

- Global Workforce Development

- Training Program localization

- HR Policy Translation

- Employee Benefits Documentation

- Others

- Others

By End User

- BFSI

- Healthcare & Life Science

- Manufacturing

- Retail & E-commerce

- Education

- Others

Regional Analysis

North America is projected to dominate the global translation management software (TMS) market as it is projected to have 40.3% of market share by the end of 2024 and further expected to show subsequent growth chart in the forthcoming period of 2024 to 2033.

This dominance can be attributed to the increasing demand for multilingual content in this region where this market offers the perfect solution to this problem. Notably, companies from this region have been consistently seeking wider coverage as their aspiration for international expansion grows, and implementing TMS is one of the foundations of their translation operations.

On the other hand, localization is also more of a trend nowadays in the North American market so the firms cater more to the local audiences in terms of the content they provide. It leads to the need for investment in this market. The enterprise wanting to be in alignment with this is going for TMS solutions, which aid them with their localization.

In addition, the demand for cloud-based transportation management system solutions is increasing fueling the North American market. These businesses aim to slash their IT expenses this is the reason why they are this moment conveniently trying to use cloud-based solutions that will help the management of the translation projects they have for now.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the global translation management software market is highly competitive with the presence of various established and emerging startups. As this is a growing market major players within this landscape as primarily focus on their research and development, so they can introduce new products according to the consumer's demand.

The major players in this market include Translation Exchange, Paraphrase, Text United Software, BaccS, SDL International, and many others. These companies are also following various organic and inorganic growth strategies to solidify their market position in the case of organic strategies these companies mainly focus on research and development to improve their product portfolio so that they can get a competitive edge over others. These companies compete not only in terms of product features and capabilities but also in terms of pricing models, customer support, language coverage, security, and compliance certifications.

Some of the prominent players in the Global Translation Management Software Market are

- Translation Exchange

- Pairaphrase

- Text United Software

- BaccS

- SDL International

- Ginger Software

- Kilgray Translation Technologies

- Plunet Business Manager

- Rus Incoud

- Wordbee

- Across Systems

- Bablic

- Other Key Players

Recent Development

- In October 2023, Trados introduces Linguistic AI in its cloud platform, enhancing translation quality, productivity. Features include Copilot assistance, Generative Translation, AI-driven quality assurance, project creation.

- In September 2023, Transifex ranks first in G2's Translation Management Software, praised by customers. Offers simple integration, localization for web-based apps, websites. Trusted globally.

- In Septmeber 2023, Phrase introduces advanced AI features, including Language AI for scalable, high-quality machine translation, and Custom AI for tailored models, enhancing localization efficiency.

- In April 2023, Smartling introduces patent-pending AI technology, enhancing machine translation quality by incorporating style guidelines, brand voice, and gender preferences for accurate and fluent translations.

- In April 2023, Lionbridge partners with Phrase, integrating Phrase's CAT tool into its workflow. Phrase's advanced features impressed Lionbridge, marking a strategic move for both companies.

- In March 2022, Weglot secures USD 49 million investment, offers website translation tools to companies like Microsoft, Spotify. Translation software sector garners over USD 490 million.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 5.2 Bn |

| Forecast Value (2033) |

USD 10.7 Bn |

| CAGR (2023-2032) |

8.3% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offering (Translation Software, Localized Software, Translation Project Management Software, Termination Management Software, Quality Assurance Software, Analytic and Reporting, and Others), By Content Type (Audio-based Content, Video-based Content, and Text-based Content), By Application (Terminology Management, Translation, Quality Assurance, Project Management, Resource Management, Billing & Invoicing Analysis , and Others), By Business Function (Finance & Accounting, Legal, Sales and Marketing, Human Resources, and Others), By End User (BFSI, Healthcare & Life Science, Manufacturing, Retail & E-commerce, Education, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Translation Exchange, Pairaphrase, Text United Software, BaccS, SDL International, Ginger Software, Kilgray Translation Technologies, Plunet Business Manager, Rus Incoud, Wordbee, Across Systems, Bablic, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Translation Management Software Market size is estimated to have a value of USD 5.2 billion in 2024 and is expected to reach USD 10.7 billion by the end of 2033.

North America has the largest market share for the Global Translation Management Software Market with a share of about 40.3% in 2024.

Some of the major key players in the Global Translation Management Software Market are Translation Exchange, Pairaphrase, Text United Software, BaccS, SDL International and many others.

The market is growing at a CAGR of 8.3 percent over the forecasted period.