Market Overview

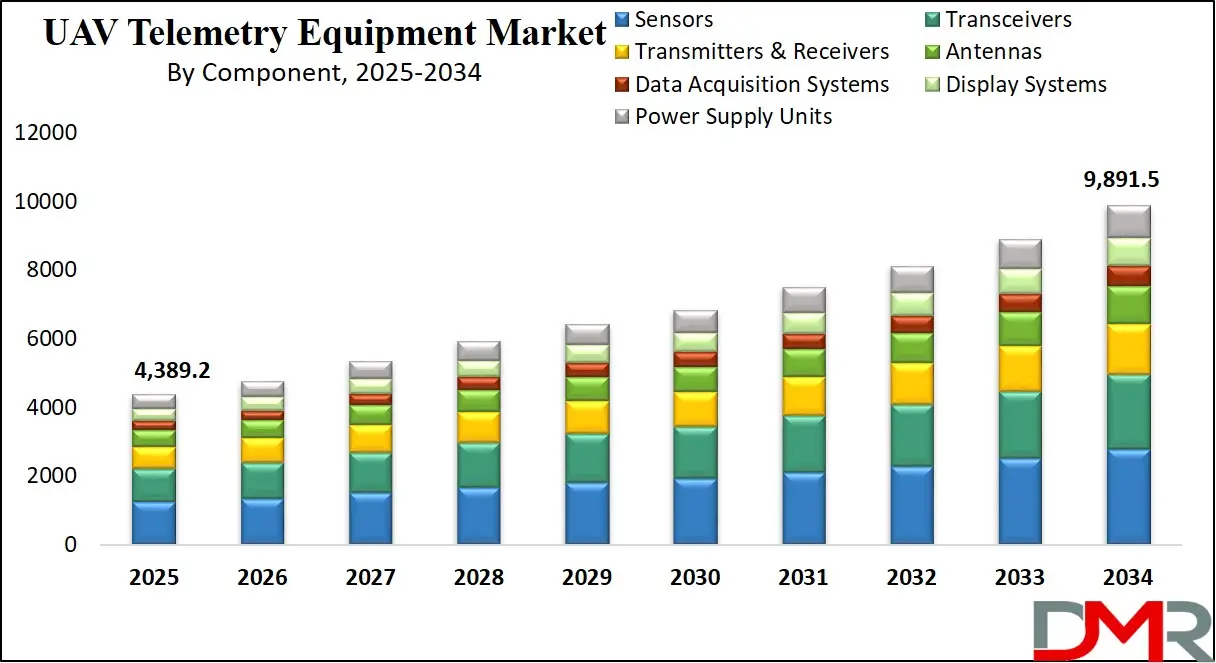

The Global UAV Telemetry Equipment Market is projected to reach

USD 4,389.2 million in 2025 and grow at a compound annual growth rate of

9.4% from there until 2034 to reach a value of

USD 9,891.5 million.

The global UAV telemetry equipment market is poised for rapid growth due to expanding UAV adoption in sectors such as defense, agriculture, environmental monitoring, and logistics. One of the prominent trends driving this growth is the rising demand for real-time data exchange between ground stations and UAVs, allowing for more precise mission control and automation.

Telemetry solutions are increasingly leveraging advancements in low-latency communication systems, miniaturized electronics, and high-speed data processing modules. Furthermore, integration with edge computing and AI-based data analytics allows telemetry systems to process and transmit critical mission data with minimal delay, enhancing UAV performance and decision-making.

Despite the rapid evolution, the market encounters certain limitations. High development and operational costs for advanced telemetry infrastructure, especially in long-range or high-altitude UAVs, can hinder adoption in price-sensitive regions. Additionally, there are growing concerns around data security, spectrum availability, and cross-border UAV regulation, which add complexity to deployment. Telemetry systems must often meet strict compliance requirements that vary significantly by jurisdiction, slowing down the time to market for global UAV projects.

Nevertheless, future growth prospects remain robust. The emergence of commercial drone corridors, urban air mobility programs, and smart farming initiatives is creating new avenues for telemetry system integration. Demand for high-bandwidth, encrypted, and adaptive telemetry solutions is expected to rise sharply with the increase in autonomous UAV operations. Moreover, investments in domestic UAV manufacturing and system interoperability across platforms will further accelerate global telemetry equipment deployment. This evolution underscores the market’s transition from tactical toolsets to strategic enablers of unmanned systems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

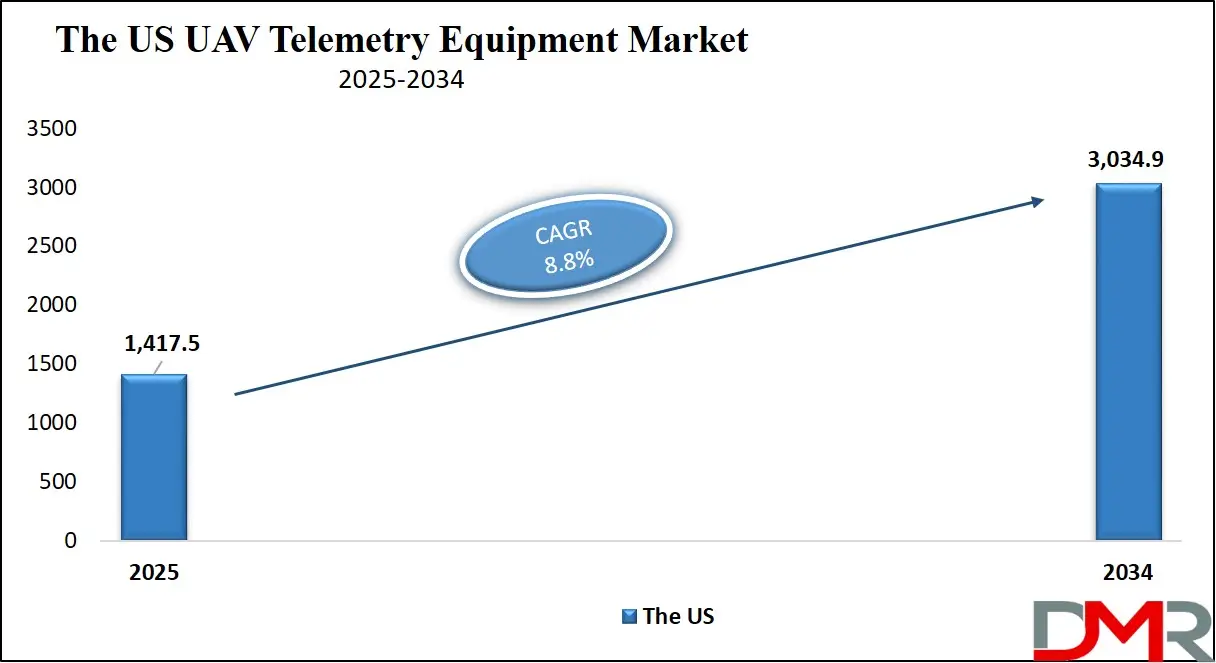

The US UAV Telemetry Equipment Market

The US UAV Telemetry Equipment Market is projected to reach

USD 1,417.5 million in 2025 at a compound annual growth rate of

8.8% over its forecast period.

The UAV telemetry equipment market in the United States is advancing rapidly, propelled by its mature UAV ecosystem and strong emphasis on technological innovation. The U.S. has a high concentration of drone operators and unmanned systems manufacturers, spanning both commercial and defense applications. With a favorable regulatory climate for beyond-visual-line-of-sight (BVLOS) UAV operations, telemetry equipment is becoming essential for safe and secure remote control, situational awareness, and data transmission. In commercial sectors, drones are increasingly used in logistics, agriculture, energy, and infrastructure monitoring, all of which depend on telemetry systems for accurate, continuous data flow.

One demographic advantage lies in the country’s expansive and diverse geography, which presents a wide variety of UAV use cases from urban package delivery and agricultural surveillance in rural states to wildfire mapping in mountainous regions. With a large number of drone-certified professionals and robust training infrastructure, there is an ample talent pool capable of operating and maintaining advanced telemetry systems. Furthermore, increased funding for domestic UAV production is encouraging localized telemetry system manufacturing, minimizing reliance on foreign supply chains.

The government continues to support innovation in unmanned systems through public-private partnerships, air traffic integration pilots, and designated drone testing corridors. These initiatives are fostering a regulatory environment conducive to scaling telemetry-based UAV operations. As the U.S. prepares for more autonomous airspace solutions and national drone delivery frameworks, the demand for real-time telemetry systems with enhanced encryption, redundancy, and signal stability is projected to grow significantly in both civilian and military domains.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European UAV Telemetry Equipment Market

The European UAV Telemetry Equipment Market is estimated to be valued at

USD 772.5 million in 2025 and is further anticipated to reach

USD 1,609.78 million by 2034 at a

CAGR of 8.5%.

The European UAV telemetry equipment market is thriving, supported by a harmonized regulatory framework, strong emphasis on sustainability, and an industrial ecosystem focused on precision applications. European nations are aggressively adopting UAV technologies for critical sectors such as renewable energy, agriculture, smart cities, and defense. This growth is increasing demand for telemetry solutions capable of delivering secure, high-throughput communication in real-time operational environments.

Lightweight, modular telemetry systems are especially popular, enabling integration into both fixed-wing and rotary UAVs used across varying terrains and mission requirements. Europe's demographic advantage stems from its dense network of urban and industrial centers, creating high demand for UAVs in logistics, infrastructure inspection, and public safety.

Advanced education systems and strong aerospace engineering talent have given rise to a robust innovation ecosystem. European industries are pioneering telemetry solutions with data redundancy, edge analytics, and long-range communication capabilities for intercontinental operations and cross-border air traffic management.

Additionally, coordinated research programs across the continent are investing in UAV and telemetry standardization for interoperability. Government-backed green energy projects are leveraging drones with telemetry systems for solar farm inspection, wind turbine monitoring, and emissions tracking. Rural regions benefit from UAV-enabled smart farming practices that require high-frequency telemetry feedback to optimize yield and resource usage.

As Europe continues to push toward its digital transformation goals, including air mobility and autonomous freight, telemetry systems will play a central role in enabling real-time data exchange. This market is expected to see sustained growth through expanded integration of artificial intelligence and IoT-linked telemetry platforms.

The Japan UAV Telemetry Equipment Market

The Japan UAV Telemetry Equipment Market is projected to be valued at USD 263.35 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 517.73 million in 2034 at a CAGR of 7.8%.

Japan's UAV telemetry equipment market is gaining momentum, driven by the country’s push for digital innovation and automation in both public and private sectors. With its aging population and labor shortages, especially in agriculture and infrastructure maintenance, UAVs are increasingly used to monitor fields, dams, roads, and disaster-prone regions. These applications demand sophisticated telemetry systems that can transmit real-time visuals, geospatial data, and sensor readings to control centers across varying terrains.

Japan’s geographic layout, characterized by mountainous regions, remote islands, and dense urban centers, creates a natural need for efficient UAV systems equipped with robust telemetry tools. These tools must function seamlessly in complex environments with minimal signal loss, latency, or interference. Domestic companies are engineering telemetry solutions that address these challenges through adaptive frequency modulation, multi-band switching, and compact hardware designs tailored to small UAVs.

Local governments and industrial bodies are actively funding UAV programs for infrastructure surveillance, maritime monitoring, and disaster preparedness. These projects rely on telemetry equipment for real-time response coordination and condition-based maintenance systems. Moreover, Japan’s commitment to building a smart mobility ecosystem that includes drone delivery, aerial taxis, and autonomous cargo aircraft necessitates the widespread use of telemetry systems that can operate within national air traffic control systems.

In tandem with its strong electronics and robotics industry, Japan is also investing in software-based telemetry enhancements, including edge computing and predictive analytics. These efforts are transforming telemetry systems from basic transmitters into intelligent, networked tools essential for the next generation of autonomous aerial operations.

Global UAV Telemetry Equipment Market: Key Takeaways

- The Global Market Size Insights: The Global UAV Telemetry Equipment Market size is estimated to have a value of USD 4,389.2 million in 2025 and is expected to reach USD 9,891.5 million by the end of 2034.

- The US Market Size Insights: The US UAV Telemetry Equipment Market is projected to be valued at USD 1,417.5 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3,034.9 million in 2034 at a CAGR of 8.8%.

- Regional Insights: North America is expected to have the largest market share in the Global UAV Telemetry Equipment Market with a share of about 38.4% in 2025.

- Regional Insights: Some of the major key players in the Global UAV Telemetry Equipment Market are L3Harris Technologies, Honeywell Aerospace, BAE Systems, Collins Aerospace (Raytheon Technologies), Lockheed Martin, Northrop Grumman, Thales Group, Leonardo S.p.A., Safran Electronics & Defense, General Atomics, Elbit Systems, and many others.

- The Global Market Growth Rate Insights: The market is growing at a CAGR of 9.4 percent over the forecasted period of 2025.

Global UAV Telemetry Equipment Market: Use Cases

- Precision Agriculture: UAV telemetry enhances crop health analysis and real-time field monitoring by transmitting multispectral imaging and sensor data directly to operators. This allows farmers to make rapid, data-driven decisions regarding irrigation, fertilization, and harvesting while reducing manual labor and boosting yield efficiency in both small-scale and industrial farms.

- Search and Rescue Operations: Telemetry-enabled UAVs help first responders map disaster zones, detect survivors, and assess structural damage remotely. They transmit continuous video and environmental sensor data in real time, aiding ground teams in coordinating rescue operations quickly and safely, especially in inaccessible or hazardous terrain following natural calamities.

- Oil & Gas Infrastructure Inspection: UAVs equipped with telemetry systems are widely used for inspecting oil rigs, pipelines, and refineries. Real-time transmission of infrared imaging, gas leak data, and structural analysis reduces the need for manual inspections, lowers operational downtime, and enhances worker safety in these often dangerous industrial settings.

- Border Surveillance and Reconnaissance: For border control and defense agencies, UAV telemetry enables constant aerial monitoring of sensitive zones. By transmitting positional, visual, and thermal data in real time, UAVs can identify unauthorized crossings or suspicious activity, enhancing national security and supporting rapid response units with situational intelligence.

- Meteorological Observation: Unmanned aerial vehicles equipped with telemetry hardware collect atmospheric pressure, humidity, and wind speed data at various altitudes. This real-time data transmission supports weather forecasting, storm tracking, and climate modeling efforts, especially in regions where traditional weather stations may be limited or inaccessible.

Global UAV Telemetry Equipment Market: Stats & Facts

United States Department of Defense (DoD)

- The U.S. military allocated approximately $820.3 billion in 2023, representing about 13.3% of the federal budget.

- For 2024, the Department of Defense requested $842.0 billion, marking a 2.6% increase from the previous year.

- The DoD emphasizes the integration of advanced telemetry systems to enhance the capabilities of unmanned aerial vehicles (UAVs) in defense operations.

European Union Aviation Safety Agency (EASA)

- EASA has established comprehensive regulations to ensure the safe integration of UAVs into European airspace, promoting the adoption of telemetry systems that enhance operational safety and compliance.

- The agency supports the development of standardized telemetry protocols to facilitate cross-border UAV operations within the EU.

Japan Ministry of Land, Infrastructure, Transport and Tourism (MLIT)

- MLIT has implemented policies to promote the use of UAVs in sectors such as agriculture, where drones help mitigate labor shortages by enabling precision farming practices.

- The ministry is investing in research and development to advance UAV telemetry technologies for infrastructure monitoring and disaster response.

Federal Aviation Administration (FAA)

- As of 2023, the FAA reported over 1.7 million registered commercial drones in the United States, reflecting the rapid adoption of UAV technology across various sectors.

- The FAA is actively developing regulations to support beyond-visual-line-of-sight (BVLOS) operations, which rely heavily on advanced telemetry systems.

International Civil Aviation Organization (ICAO)

- ICAO is working on global standards for UAV operations, including telemetry requirements, to ensure safe and efficient integration into international airspace.

- The organization emphasizes the importance of secure and reliable telemetry systems for the successful implementation of unmanned aircraft systems traffic management (UTM).

National Aeronautics and Space Administration (NASA)

- NASA's research into urban air mobility (UAM) includes the development of advanced telemetry systems to support autonomous flight operations in urban environments.

- The agency is collaborating with industry partners to test and validate telemetry technologies that enable real-time data exchange between UAVs and ground control stations.

United Nations Office for Outer Space Affairs (UNOOSA)

- UNOOSA highlights the role of telemetry in space operations, including the monitoring and control of satellites and other spacecraft.

- The office advocates for international cooperation in the development of telemetry standards to support the growing number of space missions.

Civil Aviation Administration of China (CAAC)

- The CAAC has implemented policies to accelerate the integration of UAVs into civil airspace, emphasizing the need for robust telemetry systems to ensure safety and efficiency.

- China is investing in the development of indigenous telemetry technologies to support its rapidly expanding UAV industry.

Transport Canada Civil Aviation (TCCA)

- TCCA has established regulations for UAV operations that include requirements for telemetry systems to maintain control and situational awareness.

- Canada is promoting the use of UAVs equipped with advanced telemetry for applications in environmental monitoring and resource management.

- Australian Civil Aviation Safety Authority (CASA)

- CASA mandates the use of telemetry systems in UAV operations to ensure compliance with safety standards and airspace regulations.

- Australia is exploring the use of UAV telemetry in sectors such as agriculture, mining, and emergency services.

Global UAV Telemetry Equipment Market: Market Dynamics

Driving Factors in the Global UAV Telemetry Equipment Market

Surge in UAV Deployments for Commercial and Civil Applications

The rapid adoption of UAVs in sectors such as agriculture, infrastructure, mining, energy, delivery services, and public safety is a primary growth driver for telemetry equipment. As UAVs take on diverse roles like crop monitoring, pipeline inspection, traffic surveillance, and emergency response, the need for accurate, real-time telemetry becomes indispensable. These applications demand telemetry systems that can track UAV location, monitor onboard health parameters, relay sensory data, and facilitate mission updates over long distances.

Governments in countries like the U.S., Japan, and India are increasingly supporting the civilian use of UAVs through regulatory reforms and subsidies, further expanding the market scope. In agriculture alone, the deployment of UAVs for precision farming has surged due to the need for efficient water use, pest control, and yield optimization. Similarly, smart cities are integrating drones into their traffic management and environmental monitoring systems. These emerging applications necessitate telemetry equipment that ensures robust communication, safety, and flight efficiency.

Expansion of Long-Range and BVLOS Drone Operations

Beyond Visual Line of Sight (BVLOS) operations are transforming the UAV landscape and driving demand for advanced telemetry systems. BVLOS missions—such as border surveillance, infrastructure mapping, cargo delivery, and forest monitoring—require reliable and uninterrupted telemetry over extended distances. Traditional line-of-sight telemetry systems are no longer sufficient for such complex missions. This shift has prompted developers to adopt high-bandwidth, multi-band telemetry equipment integrated with GPS, satellite, and cellular communication capabilities.

Regulatory bodies like the FAA, EASA, and CAAC are gradually enabling BVLOS operations through pilot programs and drone corridors, signaling institutional support for long-distance UAV missions. As BVLOS operations gain traction globally, telemetry systems must offer enhanced features like real-time signal strength adaptation, multi-channel failover, and remote health diagnostics. The ability to remotely command, control, and update UAVs in real-time across 50+ kilometers is now a basic requirement in many commercial and military contracts.

Restraints in the Global UAV Telemetry Equipment Market

Cybersecurity Threats and Vulnerability to Signal Interference

One of the most significant challenges facing the UAV telemetry equipment market is the growing threat of cybersecurity breaches and signal interference. Telemetry systems transmit sensitive real-time data such as location, flight status, payload parameters, and mission-critical commands, which makes them prime targets for cyberattacks. In military and government surveillance applications, a breach in telemetry communication could result in data theft, mission compromise, or even hijacking of the UAV.

Additionally, commercial UAVs used in sensitive sectors such as energy, infrastructure, and healthcare are also vulnerable. Adversaries can exploit weak encryption, unprotected signal bands, or legacy protocols to launch jamming, spoofing, or man-in-the-middle attacks. While modern telemetry systems now incorporate encrypted communication and anti-jamming technologies, the fast-evolving nature of cyber threats often outpaces regulatory and manufacturing safeguards.

High Cost and Technical Complexity of Advanced Telemetry Systems

The integration of high-performance telemetry systems—particularly those incorporating multi-band communication, encryption, AI, and satellite connectivity—comes at a steep financial and technical cost. For commercial drone operators, especially small and mid-sized businesses, the upfront investment in such telemetry systems can be prohibitive.

Additionally, ongoing costs related to licensing, data plans, hardware maintenance, and software upgrades further add to the total cost of ownership. The complexity of these systems often requires specialized personnel for setup, calibration, and troubleshooting, which introduces operational inefficiencies for non-expert users. In developing economies, the affordability barrier severely restricts UAV adoption in sectors like agriculture or public safety, limiting the potential customer base for telemetry vendors.

Opportunities in the Global UAV Telemetry Equipment Market

Demand for Telemetry Systems in Environmental Monitoring and Disaster Management

The increasing frequency of natural disasters, climate change effects, and environmental degradation has made UAVs a crucial tool for real-time monitoring and response operations. Telemetry equipment plays a central role in enabling these missions by transmitting real-time data on air quality, temperature, water levels, forest density, and hazardous material detection.

Governmental bodies and environmental organizations are increasingly funding UAV programs to conduct ecological surveys, wildlife tracking, flood prediction, and fire mapping. In countries like Australia, Canada, and Brazil, drones equipped with sophisticated telemetry tools are being used to monitor forest fires, oil spills, and coral bleaching events.

This creates an opportunity for telemetry manufacturers to customize their offerings for ecological conditions, such as telemetry units resistant to high heat, moisture, or terrain obstructions. Furthermore, with the rise of predictive disaster management strategies, telemetry systems are being integrated with GIS software, remote sensors, and AI-powered data platforms.

Integration with Satellite and 5G Networks for Global UAV Coverage

The deployment of telemetry systems integrated with satellite and 5G infrastructure represents a major opportunity in the global UAV telemetry equipment market. Traditional radio-based telemetry systems face limitations in remote and underdeveloped areas, especially in missions that involve transcontinental travel or operate in oceans, deserts, and polar regions. Satellite telemetry, using LEO and GEO constellations, offers a viable solution by enabling uninterrupted, real-time data communication across any geography.

Similarly, 5G networks—with their ultra-low latency, high-speed data transfer, and edge computing compatibility—are opening up new applications such as drone taxis, smart logistics, and telemedicine deliveries. Leading telecom operators and aerospace companies are partnering to develop hybrid telemetry solutions that switch seamlessly between terrestrial and satellite links.

Trends in the Global UAV Telemetry Equipment Market

Integration of AI-Enhanced Telemetry for Autonomous UAV Operations

The emergence of artificial intelligence (AI) in UAV telemetry systems is revolutionizing the global market. Traditionally, telemetry focused on data collection and transmission, but now, AI integration allows drones to self-diagnose, predict faults, optimize flight patterns, and adapt to dynamic environments in real time. These AI-enhanced telemetry systems are particularly beneficial in military and high-risk commercial applications, where autonomous decision-making is essential.

The fusion of AI and telemetry also enables adaptive communication protocols that optimize bandwidth and reduce latency during operations, ensuring continuous connectivity. With increasing global investments in autonomous aerial systems—especially for urban air mobility, border patrol, and smart agriculture—the demand for telemetry solutions that offer intelligence beyond simple tracking is surging. This trend is also pushing manufacturers to develop next-generation telemetry software that integrates with cloud-based analytics, edge computing, and AI training platforms.

Rise of Secure and Encrypted Telemetry Systems in Defense and Surveillance

With the intensification of geopolitical tensions and the rising use of UAVs in defense and surveillance, the demand for secure and encrypted telemetry equipment has sharply increased. Government and defense agencies are now prioritizing systems that offer end-to-end data protection against cyber threats, jamming, spoofing, and interception. Encrypted telemetry ensures the integrity and confidentiality of mission-critical data being transmitted between UAVs and ground control stations.

Recent defense modernization programs across the U.S., Europe, and Asia have mandated secure telemetry communication as a core capability. Additionally, with increased UAV operations in contested or sensitive environments, the risk of data exploitation by adversaries is significant. As a result, telemetry systems are now incorporating advanced encryption standards, dynamic frequency hopping, and quantum-resistant algorithms. Manufacturers are also integrating secure key management protocols that allow authentication of communication sessions in real time.

Global UAV Telemetry Equipment Market: Research Scope and Analysis

By Component Analysis

Sensors are projected to dominate the component segment of the global UAV telemetry equipment market due to their indispensable role in real-time data acquisition, navigation, and mission-critical functions. UAVs rely on a diverse array of onboard sensors such as inertial measurement units (IMUs), gyroscopes, accelerometers, GPS modules, barometric sensors, and magnetometers to monitor parameters like altitude, speed, orientation, air pressure, temperature, and position.

These sensor-derived data streams are the primary inputs transmitted through telemetry systems to ground control stations for flight stabilization, decision-making, and situational awareness. In both commercial and military UAV applications, the accuracy, frequency, and resolution of sensor data directly impact mission success, particularly during autonomous operations and in dynamic or high-risk environments.

Moreover, advancements in miniaturization and sensor fusion technology have enabled UAVs to carry multi-functional sensors without compromising payload capacity or battery efficiency. These integrated sensor suites are capable of delivering real-time diagnostics, obstacle detection, terrain mapping, and health monitoring, making them essential components of intelligent UAV ecosystems. In tactical military missions and long-endurance operations, sensors provide telemetry feedback that ensures stealth, precision, and survivability in complex scenarios.

Additionally, with the growing trend toward BVLOS operations, smart agriculture, and remote environmental monitoring, demand for robust sensor-enabled telemetry systems is surging. UAV manufacturers and operators prioritize sensor performance as a foundational requirement, leading to higher spending in this subsegment. As a result, sensors remain the cornerstone of UAV telemetry architecture, cementing their dominance in the component category of the market.

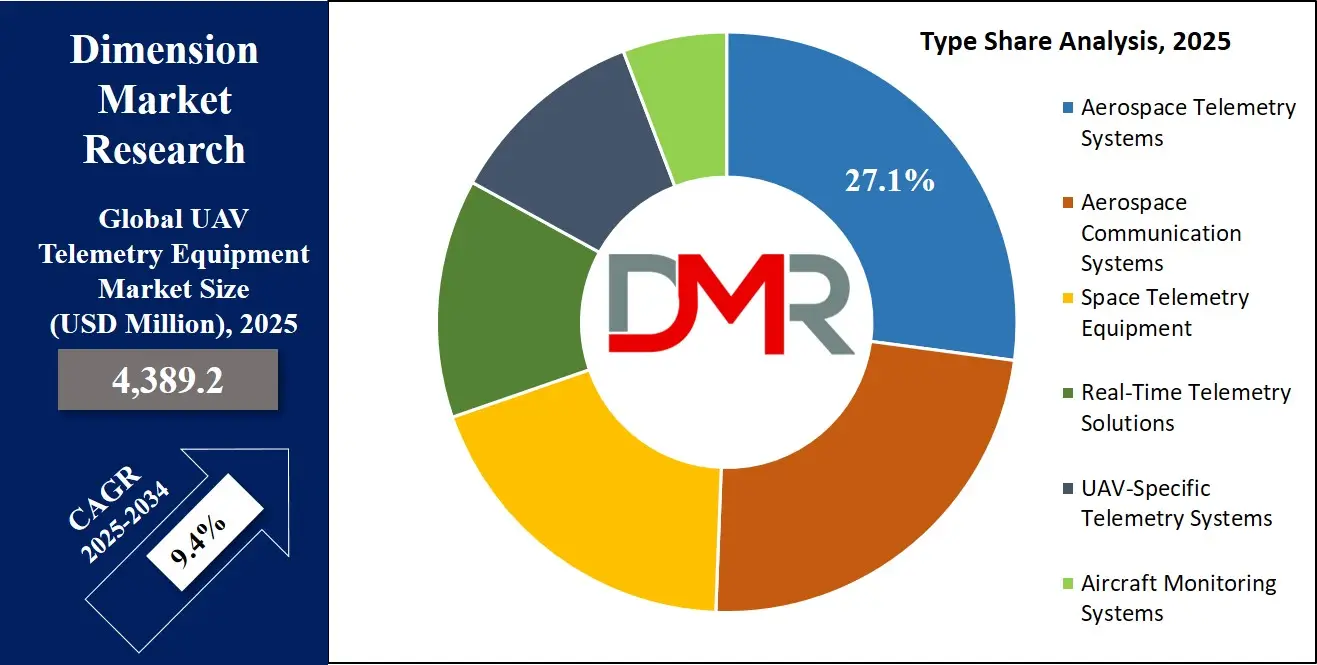

By Type Analysis

Aerospace telemetry systems are expected to dominate the type segment of the UAV telemetry equipment market because they are specifically designed for high-precision, long-range, and mission-critical applications typical of aerospace environments. These systems are engineered to withstand extreme conditions such as high altitudes, temperature variations, and electromagnetic interference, which are common during UAV flights in both defense and commercial aerospace sectors. They offer unmatched accuracy and reliability in data transmission, making them the preferred choice for UAVs used in flight testing, military reconnaissance, border patrol, and space-bound operations.

One of the key reasons for their dominance is their compliance with aerospace-grade standards like MIL-STD, DO-160, and AS9100, which ensures durability, interoperability, and safety. Aerospace telemetry systems often feature multi-frequency capability, real-time redundancy, and encrypted data links, all essential for secure UAV operations in contested airspace or sensitive missions. Furthermore, they offer advanced error correction, high bandwidth, and low-latency communication, enabling seamless transmission of complex data sets including video feeds, diagnostics, and flight parameters.

Aerospace-grade telemetry systems are also widely integrated into UAVs developed for national defense agencies, space research organizations, and aviation regulatory bodies. Their use in flight validation, performance benchmarking, and airworthiness certification further increases their market penetration. Additionally, rising investment in high-altitude long-endurance (HALE) UAVs and growing defense modernization initiatives globally have reinforced the demand for aerospace telemetry solutions. Because of their superior capabilities, stringent reliability, and alignment with global aerospace missions, these systems have emerged as the most dominant type within the UAV telemetry equipment market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Frequency Analysis

Very High Frequency (VHF) is poised to dominate the frequency segment in the UAV telemetry equipment market due to its optimal balance between range, signal integrity, and resistance to environmental interference. Operating between 30 MHz and 300 MHz, VHF bands are highly suitable for medium-to-long-range UAV operations, which makes them especially valuable in applications such as military reconnaissance, agricultural surveying, disaster response, and cross-border monitoring. VHF signals are less affected by obstacles such as buildings, trees, and hilly terrain compared to higher frequencies, allowing for more reliable telemetry in complex geographic environments.

A major reason for the dominance of VHF lies in its robust penetration capabilities, even in densely forested or remote areas where traditional telemetry using higher frequencies may falter. This capability makes VHF telemetry ideal for missions requiring persistent surveillance or uninterrupted communication. Additionally, VHF equipment typically consumes less power, which aligns well with the constraints of UAVs that have limited battery life and payload capacity.

Moreover, VHF frequency bands are internationally accepted and widely regulated, ensuring compatibility across different UAV platforms and geographic regions. Defense and public safety agencies, in particular, rely on VHF for secure and extended communication links during coordinated UAV deployments. The ongoing expansion of UAV usage in civil aviation, emergency services, and smart infrastructure also favors the VHF band due to its reliability and cost-efficiency.

As BVLOS operations become more common and UAVs are deployed in rural or infrastructure-poor regions, the demand for VHF telemetry will only grow. Its versatility, performance in varied terrains, and low susceptibility to interference affirm its dominance in the telemetry frequency spectrum.

By Application Analysis

Flight testing and monitoring are anticipated to hold the dominant share in the application segment of the UAV telemetry equipment market due to their foundational role in UAV development, certification, and operational validation. Before any UAV is deployed for military or commercial use, it undergoes rigorous testing to assess flight dynamics, performance, and control reliability. During these testing phases, telemetry systems play a critical role by providing real-time feedback on parameters such as engine performance, aerodynamic behavior, altitude, velocity, orientation, and system health.

This application is particularly crucial in aerospace and defense industries, where UAVs are developed for high-stakes missions and must comply with stringent safety and quality standards. Flight testing ensures compliance with aviation regulations and offers actionable insights for design refinements and software calibration. Telemetry equipment used during these operations must be precise, low-latency, and capable of handling multi-sensor data streams across varying environmental conditions.

Moreover, continuous flight monitoring is necessary even after the UAV is operational, especially in high-risk missions or BVLOS operations, where real-time diagnostics can prevent mission failure or system loss. The increasing integration of telemetry with simulation and AI-driven flight analytics tools also strengthens its role in predictive maintenance and fleet performance optimization.

As the UAV industry expands into cargo delivery, air taxis, and autonomous urban flights, regulatory bodies demand extensive testing and monitoring before approval. This regulatory pressure, combined with the rising complexity of UAVs, drives the demand for sophisticated telemetry systems in flight testing and operational oversight, making it the most dominant application segment.

By End User Analysis

The defense and military sector is projected to dominate the end-user segment of the global UAV telemetry equipment market owing to its extensive use of UAVs in intelligence, surveillance, reconnaissance (ISR), combat, and logistics operations. Military UAVs operate in hostile and complex environments where reliable, real-time telemetry is crucial for mission success and system survivability. Telemetry systems provide commanders with continuous situational awareness, UAV position tracking, payload status, environmental feedback, and fault detection, enabling agile decision-making during combat or surveillance.

Moreover, defense UAVs typically operate at high altitudes and over long distances, requiring telemetry systems with robust transmission capabilities, encryption, and anti-jamming technology. These requirements lead to heavy investment in advanced telemetry platforms that can support real-time, secure communications with ground control stations and other defense systems, including radar, satellite, and command-and-control networks.

Global defense modernization programs, especially in the U.S., China, India, Israel, and NATO countries, have prioritized UAV expansion for border security, maritime patrol, and urban warfare. As a result, funding for advanced telemetry R&D and procurement is consistently high in this segment. Additionally, military UAVs often carry sophisticated sensors, weapons, and surveillance payloads that generate high volumes of data, further amplifying the need for high-capacity telemetry systems.

Given the strategic importance of UAVs in national security and the defense sector's higher tolerance for premium technologies and compliance with stringent operational standards, the defense and military end-user segment continues to dominate the market, setting the pace for telemetry innovation and adoption.

The Global UAV Telemetry Equipment Market Report is segmented on the basis of the following:

By Component

- Sensors

- Transceivers

- Transmitters & Receivers

- Antennas

- Data Acquisition Systems (DAS)

- Display Systems

- Power Supply Units

By Type

- Aerospace Telemetry Systems

- Aerospace Communication Systems

- Space Telemetry Equipment

- Real-Time Telemetry Solutions

- UAV-Specific Telemetry Systems

- Aircraft Monitoring Systems

By Frequency

- Very High Frequency (VHF)

- Ultra High Frequency (UHF)

- L-Band

- S-Band

- C-Band

- X-Band

By Application

- Flight Testing and Monitoring

- Mission Control and Navigation

- Surveillance and Reconnaissance

- Disaster Management and Emergency Response

- Weather and Atmospheric Research

- Space Exploration and Monitoring

- Payload Monitoring in UAVs

By End User

- Defense & Military

- Aerospace Manufacturers

- Commercial Aviation

- Space Agencies

- Research Institutions

- Telecommunications

- Agriculture, Mining, and Infrastructure

Global UAV Telemetry Equipment Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the global UAV telemetry equipment market with 38.4% of the total revenue by the end of 2025, due to its robust defense infrastructure, early adoption of unmanned systems, and high R&D investment in aerospace technologies. The U.S. Department of Defense (DoD) and allied agencies lead the world in UAV procurement and deployment across diverse missions, including surveillance, border patrol, electronic warfare, and disaster response.

These operations rely heavily on secure, high-performance telemetry systems for real-time data exchange between UAVs and command centers. Furthermore, North America hosts major aerospace and defense contractors such as Lockheed Martin, Northrop Grumman, Raytheon Technologies, and General Atomics that actively integrate advanced telemetry solutions into their UAV platforms.

Additionally, the Federal Aviation Administration (FAA) has established clear regulatory pathways for UAV testing and commercial operation, spurring demand for telemetry-based flight monitoring and certification systems. The presence of advanced telecommunications infrastructure, satellite networks, and a thriving ecosystem of sensor and communication component suppliers further reinforces the region’s leadership. North America’s technological edge, regulatory clarity, and military budget allocation make it the epicenter of UAV telemetry innovation and deployment globally.

Region with the Highest CAGR

Asia-Pacific exhibits the highest CAGR in the UAV telemetry equipment market, driven by expanding military modernization programs, border surveillance initiatives, and the growing use of UAVs in agriculture, infrastructure, and disaster management. Countries such as China, India, South Korea, and Japan are significantly increasing investments in indigenous UAV development to reduce reliance on foreign defense imports and enhance strategic autonomy.

These UAV programs require sophisticated telemetry systems to ensure secure, real-time communication over long distances and complex terrains. The rapid digitalization of rural economies, growing demand for smart farming, and increased emphasis on aerial data collection in large-scale infrastructure projects have created fertile ground for UAV telemetry adoption.

Moreover, the presence of low-cost electronic manufacturing hubs in China and Southeast Asia facilitates the affordable production of telemetry modules and sensors, accelerating domestic UAV integration. With rising security threats, strong GDP growth, and favorable government policies, Asia-Pacific is positioned as the fastest-growing region in this market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global UAV Telemetry Equipment Market: Competitive Landscape

The global UAV telemetry equipment market is moderately consolidated, with a mix of established defense giants and emerging tech firms driving innovation. Key players include Lockheed Martin, Raytheon Technologies, Northrop Grumman, BAE Systems, and Thales Group, which dominate defense UAV telemetry through proprietary systems integrated into tactical, MALE, and HALE UAVs. These companies offer end-to-end solutions featuring secure data links, high-throughput bandwidth, and compliance with military communication protocols.

On the commercial and dual-use side, firms like Elbit Systems, L3Harris Technologies, General Atomics Aeronautical Systems, and Collins Aerospace lead the deployment of telemetry in UAVs for border security, firefighting, and infrastructure inspection. Startups and mid-tier firms are also making significant strides, particularly in software-defined radio telemetry, edge computing, and AI-assisted telemetry diagnostics.

Technological differentiation, cybersecurity features, and integration with advanced avionics and ground control systems are primary areas of competition. Companies increasingly focus on modular, scalable telemetry platforms that can be tailored to various UAV sizes and mission profiles. Strategic collaborations, government contracts, and export partnerships continue to shape market dynamics, especially in defense-centric economies. Continuous innovation and customization remain key to gaining a competitive advantage in this evolving market.

Some of the prominent players in the Global UAV Telemetry Equipment Market are:

- L3Harris Technologies

- Honeywell Aerospace

- BAE Systems

- Collins Aerospace (Raytheon Technologies)

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Thales Group

- Leonardo S.p.A.

- Safran Electronics & Defense

- General Atomics Aeronautical Systems

- Elbit Systems Ltd.

- Israel Aerospace Industries (IAI)

- Teledyne Technologies Incorporated

- Curtiss-Wright Corporation

- Cobham Limited (Now part of Advent International)

- Sierra Nevada Corporation

- Airbus Defence and Space

- Textron Systems

- Kratos Defense & Security Solutions

- HENSOLDT AG

- Other Key Players

Recent Developments in Global UAV Telemetry Equipment Market

January 2024

- Near Earth Autonomy was awarded a USD 1.25 million contract by AFWERX to develop a next-gen hybrid multirotor UAV with high-performance telemetry systems optimized for contested airspace navigation.

- Ideaforge Technology signed a USD 1.18 million contract with the Indian Army to train personnel in UAV navigation and telemetry operations for missions in Jammu and Kashmir.

- During UMEX 2024, ADASI (Abu Dhabi Autonomous Systems Investments) received an order from the UAE Ministry of Defence for 200 autonomous rotary UAVs equipped with encrypted telemetry systems to boost strategic surveillance operations.

August 2024

- Guardian Agriculture, a U.S.-based UAV company, launched two UAVs Airtruck and Sprayhawk featuring integrated telemetry modules and long-range data transmission systems for precision agriculture and logistics. Each model supports autonomous flight through VHF-based telemetry.

July 2023

- IoTechWorld Aviation, in partnership with IFFCO, secured a contract to deliver 500 agri-drones integrated with telemetry systems for efficient tracking and real-time route monitoring. These drones support India's push for digitized farming operations under national agriculture missions.

June 2023

- Asteria Aerospace entered into a strategic distribution agreement with a North American UAV distributor to market rotary-wing drones embedded with telemetry hardware across Canada and Latin America.

- Aerovironment Inc. received funding from the U.S. Department of Defense to develop a high-altitude solar-powered UAV capable of ISR missions with real-time telemetry systems transmitting data from altitudes exceeding 60,000 feet.

March 2023

- Sagar Defence Engineering began negotiations to export its ‘Varuna’ maritime UAVs featuring long-range VHF telemetry to Australian naval forces for surveillance and coastal monitoring.

May 2022

- Teledyne FLIR received a USD 14 million extension contract from the U.S. Army to deliver enhanced Black Hornet Nano drones equipped with personal telemetry systems to support infantry-level reconnaissance and battlefield intelligence.

Mergers, Acquisitions & Collaborations

- Airbus Helicopters acquired a European VTOL UAV manufacturer specializing in telemetry-enhanced flight control, expanding its defense UAV portfolio.

- Robinson Helicopter Company acquired a U.S.-based coaxial drone startup to integrate telemetry-driven guidance systems into its rotary UAV lineup.

- Shield AI acquired Sentient Vision Systems, an AI-enabled ISR software firm, to boost its telemetry capabilities in contested environments using real-time analytics.

- Thales Group acquired UAV Navigation, a Spanish-based telemetry system provider, to enhance its integration with UTM (Unmanned Traffic Management) infrastructure.

- Red Cat Holdings acquired Teal Drones, reinforcing its tactical drone offerings with encrypted telemetry systems compliant with U.S. defense cybersecurity standards.

- Patria Group acquired a domestic UAV developer, enhancing its surveillance drone fleet with secure telemetry hardware suitable for NATO-aligned defense clients.

- Delair acquired a French drone swarm coordination startup, allowing synchronized telemetry across multiple UAV units for complex inspection missions.

- Field Group acquired a U.S.-based UAV analytics firm and launched a drone-focused subsidiary specializing in infrastructure inspections using telemetry-rich drones.

- Spright, formerly part of Air Methods, restructured into Areion, with renewed focus on autonomous drone delivery solutions powered by advanced telemetry and AI-based navigation systems.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 4,389.2 Mn |

| Forecast Value (2034) |

USD 9,891.5 Mn |

| CAGR (2025–2034) |

9.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1,417.5 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Sensors, Transceivers, Transmitters & Receivers, Antennas, DAS, Display Systems, Power Supply Units), By Type (Aerospace Telemetry, Communication Systems, Space Telemetry, Real-Time Solutions, UAV-Specific, Aircraft Monitoring), By Frequency (VHF, UHF, L-Band, S-Band, C-Band, L-Band), By Application (Flight Testing, Mission Control, Surveillance, Disaster Management, Weather Research, Space Exploration, UAV Payloads), By End User (Defense, Aerospace Manufacturers, Commercial Aviation, Space Agencies, Research, Telecom, Agriculture, Mining and Infrastructure). |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

L3Harris Technologies, Honeywell Aerospace, BAE Systems, Collins Aerospace (Raytheon Technologies), Lockheed Martin, Northrop Grumman, Thales Group, Leonardo S.p.A., Safran Electronics & Defense, General Atomics, Elbit Systems, Israel Aerospace Industries (IAI), Teledyne Technologies, Curtiss-Wright, Cobham Limited (Advent International), Sierra Nevada Corporation, Airbus Defence and Space, Textron Systems, Kratos Defense, HENSOLDT AG, Boeing, Raytheon, SpaceX, and NASA., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|