Market Overview

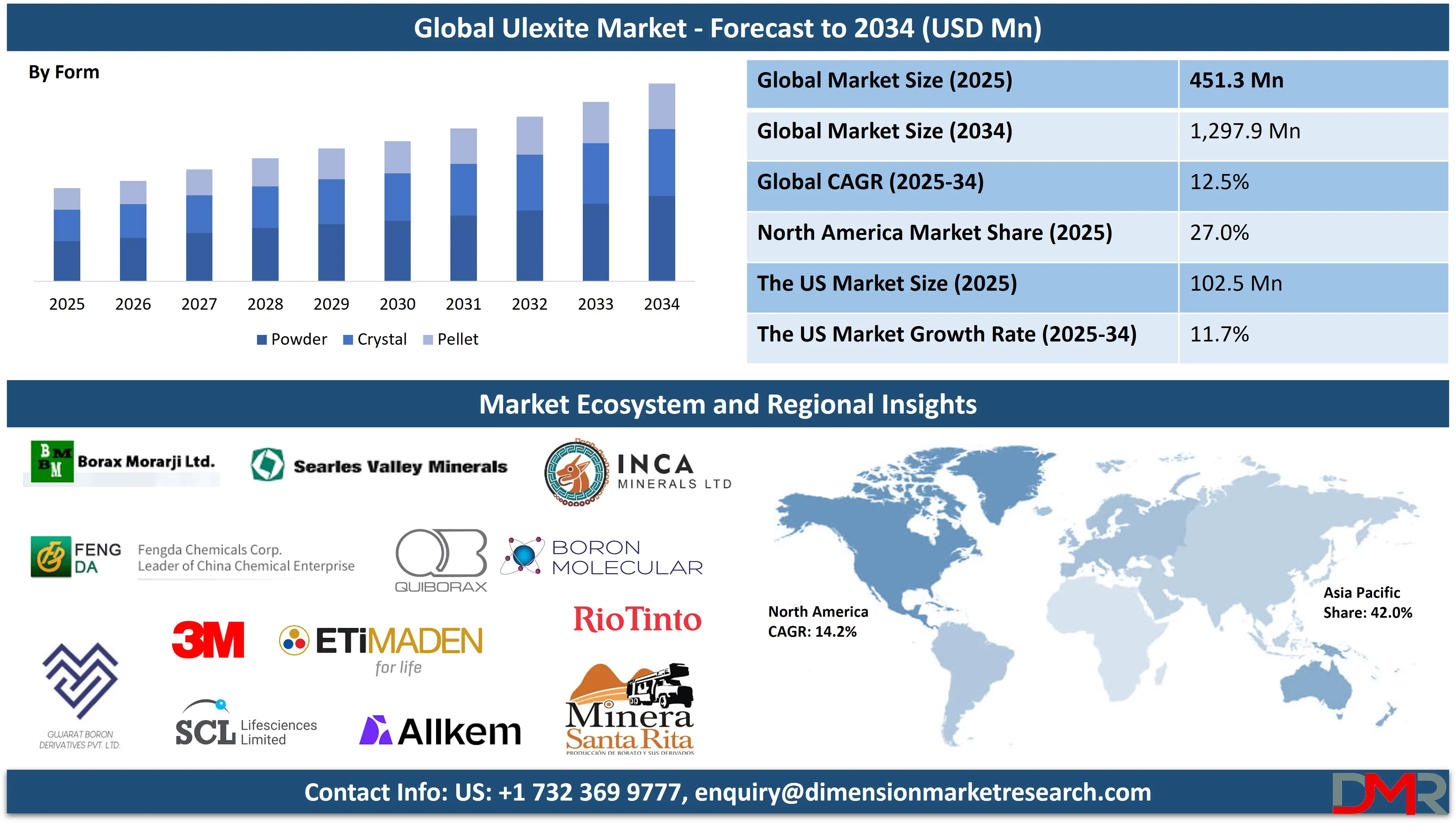

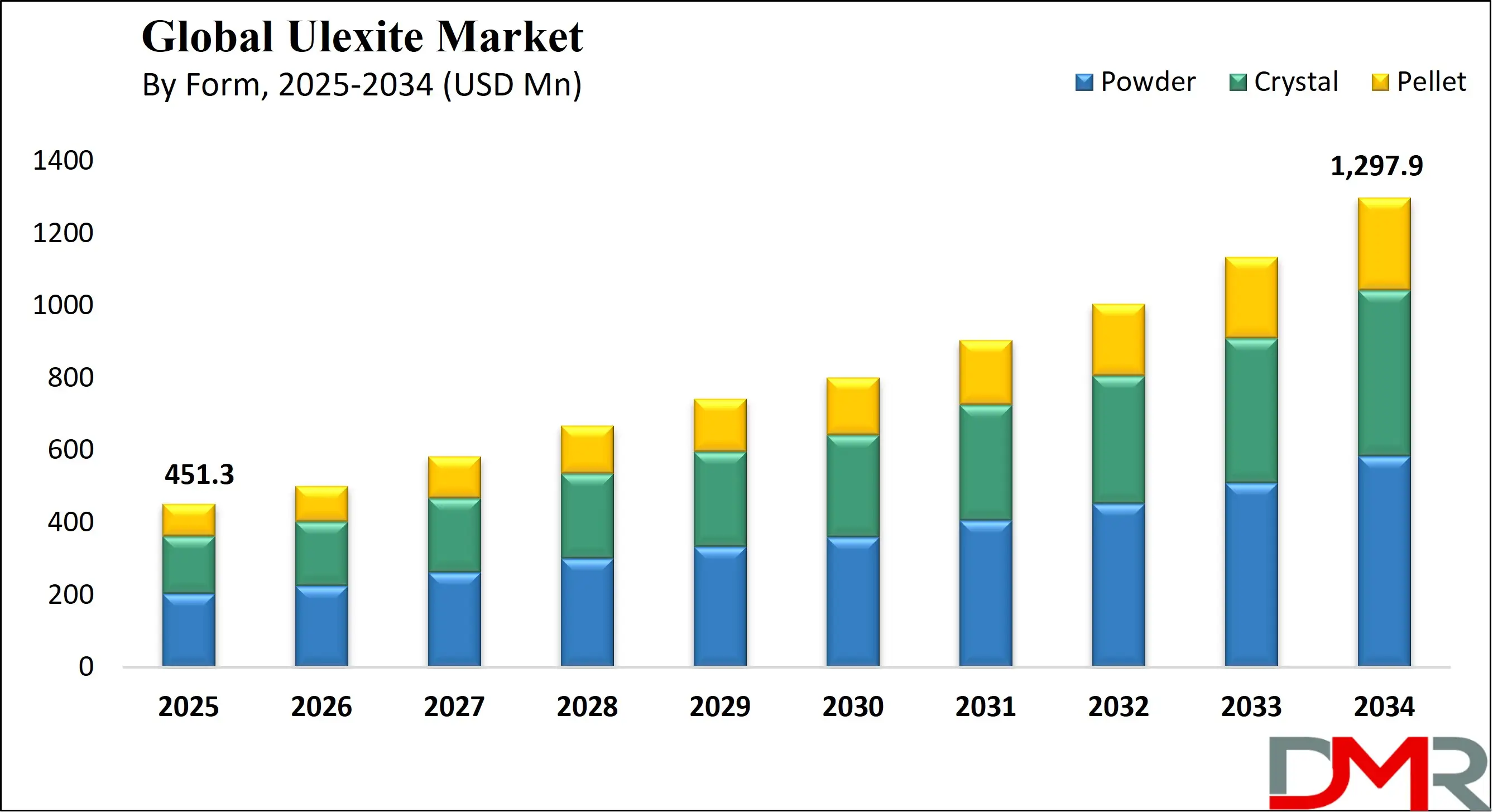

The Global Ulexite Market is anticipated to reach USD 451.3 million in 2025, driven by its critical role as a primary boron source across multiple industrial sectors. The market is expected to expand at a steady compound annual growth rate (CAGR) of 12.5% from 2025 to 2034, reaching a projected value of USD 1,297.9 million by 2034.

Growth is propelled by increasing demand from the fiberglass insulation market, rising adoption in advanced ceramic applications, and expanding use of boron-based micronutrients in precision agriculture. Additionally, emerging applications in flame retardant formulations and specialty detergents, coupled with technological advancements in mineral processing and purification, are expected to further accelerate market expansion globally. The unique fibrous structure and high boron content of ulexite make it particularly valuable for specialized industrial processes where consistent chemical composition and physical properties are paramount.

The global ulexite market is undergoing a significant transformation, evolving from a basic industrial mineral to a strategically important raw material for high-value applications. A prominent trend is the shift towards value-added ulexite products with enhanced purity and specific particle size distributions, catering to the stringent requirements of technical glass and advanced ceramic manufacturers.

This quality-focused approach is driving investments in advanced processing technologies and quality control systems across the supply chain. Concurrently, the agricultural sector is witnessing a paradigm shift towards soil-specific micronutrient management, where ulexite-derived boron fertilizers play a crucial role in addressing widespread boron deficiencies across diverse cropping systems. The integration of ulexite in intumescent flame retardant systems for plastics and textiles represents another emerging application frontier, though commercialization varies significantly by regional regulatory frameworks and industry adoption rates.

The US Ulexite Market

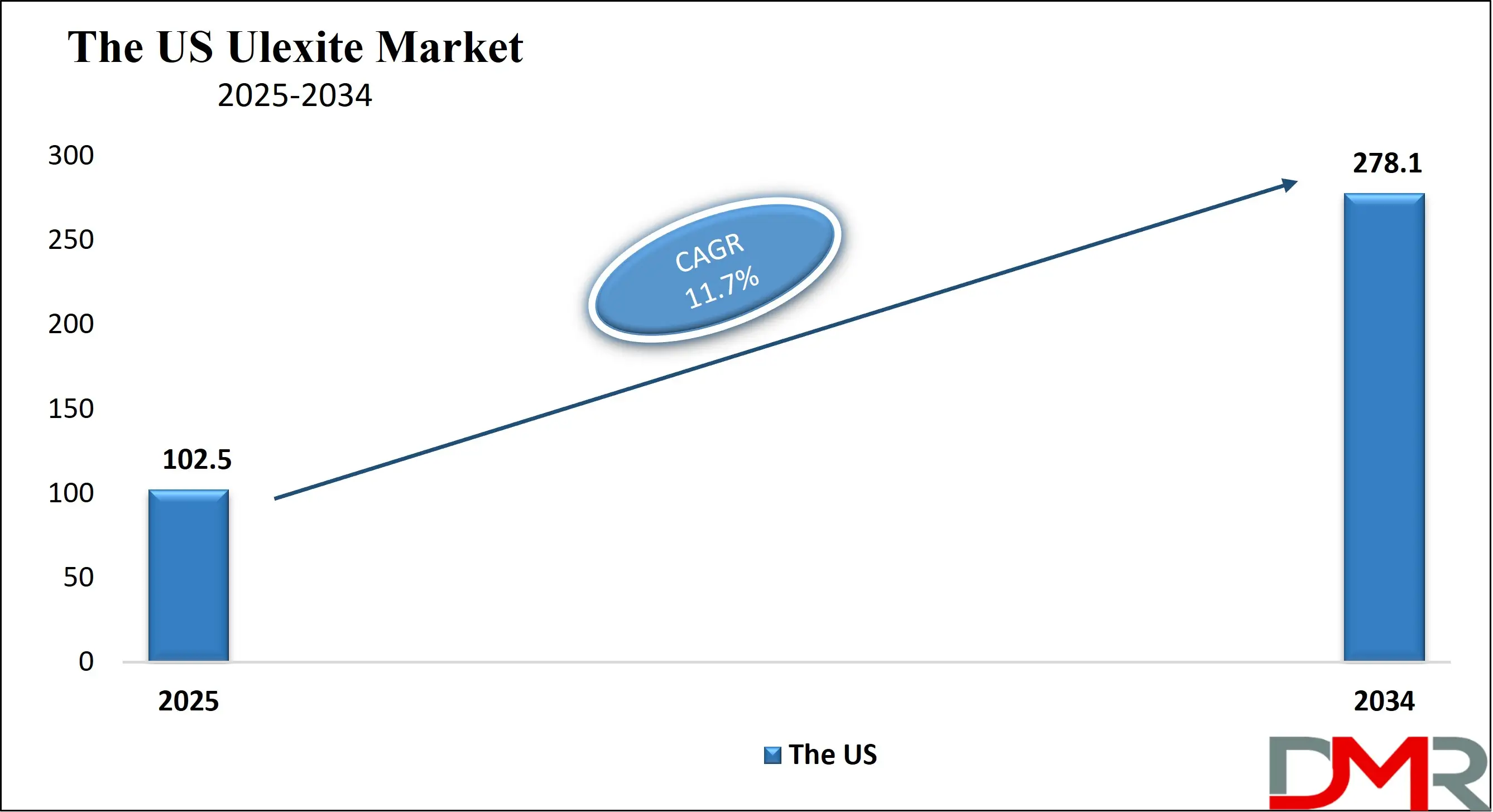

The US Ulexite Market is projected to reach USD 102.5 million in 2025 at a compound annual growth rate of 11.7% over its forecast period. The United States maintains a strategically important position in the global ulexite market, supported by substantial domestic production capabilities and diverse industrial consumption patterns. Federal agencies including the U.S. Geological Survey (USGS) systematically monitor boron mineral production, trade flows, and reserve base statistics, providing critical market intelligence that supports investment decisions and supply chain planning.

Regulatory bodies including the Environmental Protection Agency (EPA) and Occupational Safety and Health Administration (OSHA) have established comprehensive frameworks governing boron compound handling, workplace exposure limits, and environmental management, providing operational clarity for domestic producers and industrial consumers.

This regulatory predictability, combined with well-developed transportation infrastructure, creates a stable environment for ulexite distribution across multiple industrial sectors. The presence of world-leading fiberglass manufacturers and advanced ceramic producers further drives consistent demand through their integrated supply chains and quality assurance requirements.

A significant structural advantage for the U.S. market is its diversified industrial base with strong inter-sectoral linkages between ulexite supply and consuming industries. The robust construction sector, documented by consistent growth in non-residential building starts, sustains demand for fiberglass insulation and composite materials that incorporate ulexite as a boron source. Simultaneously, the sophisticated agricultural sector, as tracked by the U.S. Department of Agriculture (USDA), demonstrates increasing adoption of precision nutrient management practices that utilize boron fertilizers to optimize crop quality and yield parameters.

The Europe Ulexite Market

The Europe Ulexite Market is projected to reach a value of USD 38.6 million in 2025, with expectations to climb to USD 111.1 million by 2034, registering a robust CAGR of 12.5%. The European ulexite industry functions within a highly regulated framework, driven by strict chemical management standards and a growing commitment to sustainable industrial practices. Additionally, chemical logistics plays a crucial role in ensuring efficient transportation, safe storage, and compliant handling of ulexite across various end-use sectors, supporting the market’s continuous expansion across Europe.

The EU's Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) framework establishes comprehensive requirements for boron substance registration, risk assessment, and supply chain communication, ensuring consistent safety standards across member states.

This regulatory landscape is complemented by regional research initiatives funded through Horizon Europe programs, focusing on sustainable material processing and circular economy applications for industrial minerals including ulexite. Major manufacturing economies including Germany, Italy, and France are advancing technical specifications for ulexite in high-performance applications, particularly in engineered ceramics and specialty glass sectors, establishing quality benchmarks that influence global market standards.

Europe's industrial composition, as analyzed by Eurostat and industry associations, presents distinct drivers for ulexite consumption patterns. The region maintains globally competitive manufacturing sectors for technical ceramics, energy-efficient glass, and automotive composites, all requiring consistent supplies of high-purity boron compounds with verified quality parameters.

This creates sustained demand for premium ulexite products that meet exacting technical specifications for advanced material applications. Concurrently, the implementation of the European Green Deal is accelerating the adoption of sustainable agricultural practices across the continent, driving utilization of boron micronutrients to enhance nutrient use efficiency and crop resilience.

The Japan Ulexite Market

The Japan Ulexite Market is projected to be valued at USD 112.8 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 323.4 million in 2034 at a CAGR of 12.5%. Japan's engagement with the ulexite market reflects its advanced manufacturing ethos and strategic approach to critical raw material security.

The country's industrial policy, as articulated by the Ministry of Economy, Trade and Industry (METI), identifies boron compounds as important materials for high-technology sectors including electronics, advanced ceramics, and specialty glass. This strategic recognition has fostered long-term supply agreements and quality assurance partnerships between Japanese industrial consumers and global ulexite producers.

The Japanese industrial standards (JIS) framework establishes rigorous specifications for boron-containing raw materials, creating a quality-focused market environment where consistency, purity, and technical performance parameters determine material selection and supplier qualification.

The technological advantage for Japan lies in its manufacturing excellence and continuous innovation in high-value industrial segments. This drives demand for precisely characterized ulexite products that meet the exacting requirements of electronic substrate manufacturing, technical ceramic production, and specialty glass formulation.

National research institutions including the National Institute of Advanced Industrial Science and Technology (AIST) are actively investigating novel applications for boron minerals in advanced material systems, including thermally stable composites and functional glass formulations.

Global Ulexite Market: Key Takeaways

- Global Market Size Insights: The Global Ulexite Market size is estimated to have a value of USD 451.3 million in 2025 and is expected to reach USD 1,297.9 million by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 12.5 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Ulexite Market is projected to be valued at USD 102.5 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 278.1 million in 2034 at a CAGR of 11.7%.

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Ulexite Market with a share of about 42.0% in 2025.

- Key Players: Some of the major key players in the Global Ulexite Market are Rio Tinto Group, Eti Maden, Searles Valley Minerals, Quiborax SA, Minera Santa Rita SRL, Inca Mining Pty Ltd, American Borate Company, Sociedad Industrial Tierra S.A., Dalian Jinma Boron Technology Group Co., Ltd., and many others.

Global Ulexite Market: Use Cases

- Fiberglass Manufacturing: Ulexite serves as the primary boron source in fiberglass production, where boron oxide content directly influences the thermal stability, mechanical strength, and chemical resistance of glass fibers used in insulation, reinforcement composites, and specialty textiles.

- Ceramic Glaze Formulation: In sanitaryware, tile, and technical ceramic production, ulexite functions as an efficient fluxing agent that reduces vitrification temperatures, enhances glaze durability, and improves color development while minimizing surface defects in fired ceramic products.

- Agricultural Micronutrient Delivery: Processed ulexite products provide plant-available boron in granular fertilizers, liquid formulations, and soil amendments, addressing deficiency symptoms in crops like fruits, vegetables, nuts, and oilseeds to improve yield quality and quantity.

- Industrial Detergent Systems: Boron compounds derived from ulexite contribute bleaching efficacy, buffer capacity, and stain removal properties in laundry detergents, industrial cleaners, and sanitizing formulations where controlled peroxide activation is required.

- Flame Retardant Synergism: Ulexite-based additives function as synergistic components in halogen-free flame retardant systems for plastics, textiles, and wood products, promoting char formation and reducing smoke generation during combustion scenarios.

Global Ulexite Market: Stats & Facts

U.S. Geological Survey (USGS)

- USGS Mineral Commodity Summaries report Turkey dominates global boron reserves with approximately 72% of the world total, with significant ulexite deposits in the Bigadiç and Kestelek mines.

- Global boron mineral production (B₂O₃ content) reached 4.35 million metric tons in 2023, with ulexite representing approximately 25% of total boron mineral production by volume.

European Chemicals Agency (ECHA)

- ECHA's REACH registration list includes 17 boron substances with full registration dossiers, establishing authorized uses and exposure scenarios for ulexite-derived compounds in European markets.

- The EU Classification, Labelling and Packaging (CLP) regulation mandates specific hazard statements for certain boron compounds, including H360FD reproductive toxicity warnings that impact handling protocols.

International Maritime Organization (IMO)

- IMO's International Maritime Solid Bulk Cargoes (IMSBC) code classifies ulexite concentrates as Group C cargoes (non-hazardous), with specific moisture content and transport condition requirements for international shipping.

Food and Agriculture Organization (FAO)

- FAO soil bulletins identify boron deficiency as the second most widespread micronutrient constraint globally, affecting crops across approximately 30% of the world's agricultural soils and driving ulexite demand in agronomic applications.

International Organization for Standardization (ISO)

- ISO standard ISO 21078-1:2008 establishes methods for determining boron oxide in refractory products, providing standardized testing protocols relevant to ulexite quality verification in ceramic applications.

- The ISO technical committee TC 33 (Refractories) maintains multiple standards addressing boron-containing raw materials used in refractory manufacturing processes.

American Society for Testing and Materials (ASTM)

- ASTM standard C146-94(2019) covers chemical analysis of glass sand, including boron trioxide determination methods applicable to ulexite quality assessment for glass manufacturing.

- ASTM E11-20 specification for woven wire test sieves is critical for particle size distribution analysis of powdered ulexite products across industrial applications.

Global Ulexite Market: Market Dynamic

Driving Factors in the Global Ulexite Market

Expansion of Fiberglass and Insulation Industries

The global push for energy efficiency in construction and the growing automotive lightweighting trend are primary drivers for ulexite demand. Fiberglass insulation, a major consumer of boron from ulexite, is experiencing sustained growth due to building energy codes and green construction standards.

Similarly, fiberglass composites in automotive and wind energy applications require consistent boron content to achieve desired mechanical properties, creating stable demand growth across multiple industrial sectors.

Precision Agriculture and Micronutrient Management

The increasing scientific understanding of boron's critical role in plant physiology and the expansion of precision farming techniques are driving ulexite consumption in agriculture. Soil testing programs consistently identify boron deficiencies in agricultural regions worldwide, creating structured demand for ulexite-based soil amendments. The trend toward high-value crop production, particularly fruits, nuts, and vegetables with high boron requirements, further accelerates adoption of boron nutrition programs.

Restraints in the Global Ulexite Market

Geographic Supply Concentration and Logistics Challenges

The global ulexite supply is heavily concentrated in specific regions, with Turkey, South America, and the United States accounting for the majority of production. This geographic concentration creates supply chain vulnerabilities, including transportation bottlenecks, trade policy uncertainties, and potential disruption risks from localized environmental or political factors. The logistical challenges of transporting bulk mineral products from remote mining locations to global markets add cost and complexity to the supply chain.

Environmental Compliance and Sustainable Mining Pressures

Ulexite mining and processing operations face increasing regulatory scrutiny and environmental compliance requirements, particularly concerning water management, energy consumption, and site rehabilitation. Environmental regulations governing boron levels in discharged water and air emissions continue to tighten globally, increasing operational costs for producers. Community expectations regarding sustainable mining practices and transparent environmental management are also rising, requiring significant investment in environmental controls and monitoring systems.

Opportunities in the Global Ulexite Market

Value-Added Product Development and Specialty Applications

Significant opportunity exists in developing processed ulexite products with enhanced properties for specific applications. This includes surface-modified ulexite powders for improved polymer compatibility, engineered particle size distributions for controlled-release fertilizers, and high-purity grades for technical ceramics and specialty glass. Investing in beneficiation technologies and application-specific formulations can create premium product segments with higher margins and reduced commodity price sensitivity.

Emerging Market Expansion and Industrial Growth

Rapid industrialization and infrastructure development in Asia, Latin America, and Africa present substantial growth opportunities for ulexite consumption. The establishment of new fiberglass production facilities in emerging economies, expansion of ceramic manufacturing capacity, and modernization of agricultural practices all drive increased boron demand. Developing distribution partnerships and technical support services in these growth regions can capture expanding market opportunities.

Trends in the Global Ulexite Market

Quality Specification and Product Consistency Focus

A dominant trend is the shift toward specification-grade ulexite products with guaranteed chemical and physical properties. Industrial consumers increasingly demand consistent boron content, controlled particle size distribution, and minimal impurity levels to ensure manufacturing process stability and end-product quality. This quality focus is driving investments in advanced processing technologies, quality control systems, and product certification protocols throughout the industry.

Integrated Supply Chain and Strategic Partnerships

The ulexite market is witnessing increased vertical integration and long-term strategic partnerships between producers and major consumers. Fiberglass manufacturers are establishing secured supply arrangements with ulexite producers to ensure material consistency and supply stability. Similarly, agricultural input companies are developing co-branded boron nutrient products with integrated supply chains from mine to field. These partnerships create market stability and facilitate technical collaboration on product development.

Global Ulexite Market: Research Scope and Analysis

By Form Analysis

The Powder segment is projected to represents the cornerstone of the global ulexite market, accounting for the largest share of volume consumption due to its unparalleled versatility across industrial applications. This fine, free-flowing form integrates seamlessly into manufacturing processes where rapid dissolution and homogeneous mixing are critical. In the fiberglass industry, powdered ulexite's high surface area ensures quick melting and uniform boron distribution within the glass matrix, directly enhancing the thermal stability and mechanical strength of the final product.

Ceramics manufacturers value powdered ulexite for its consistent fluxing action, which lowers vitrification temperatures and improves glaze quality while reducing energy consumption during firing cycles. The agricultural sector utilizes finely ground ulexite powder for soil amendment applications, where its physical properties facilitate even distribution through conventional spreading equipment and prompt availability to plant root systems.

The dominance of this form is further reinforced by established handling infrastructure, cost-effective processing methods, and compatibility with existing industrial equipment across multiple sectors.

The Pellet segment represents the fastest-growing form category, particularly in agricultural applications. Pelletized ulexite offers significant handling and application advantages, including reduced dust generation, improved flow characteristics, and controlled nutrient release properties.

The agriculture industry's shift toward precision application equipment and blended fertilizer formulations favors pelletized forms that provide uniform particle size and compatibility with bulk blending operations. The development of specialized pellet coatings for enhanced soil mobility and nutrient availability further drives adoption in premium agricultural markets.

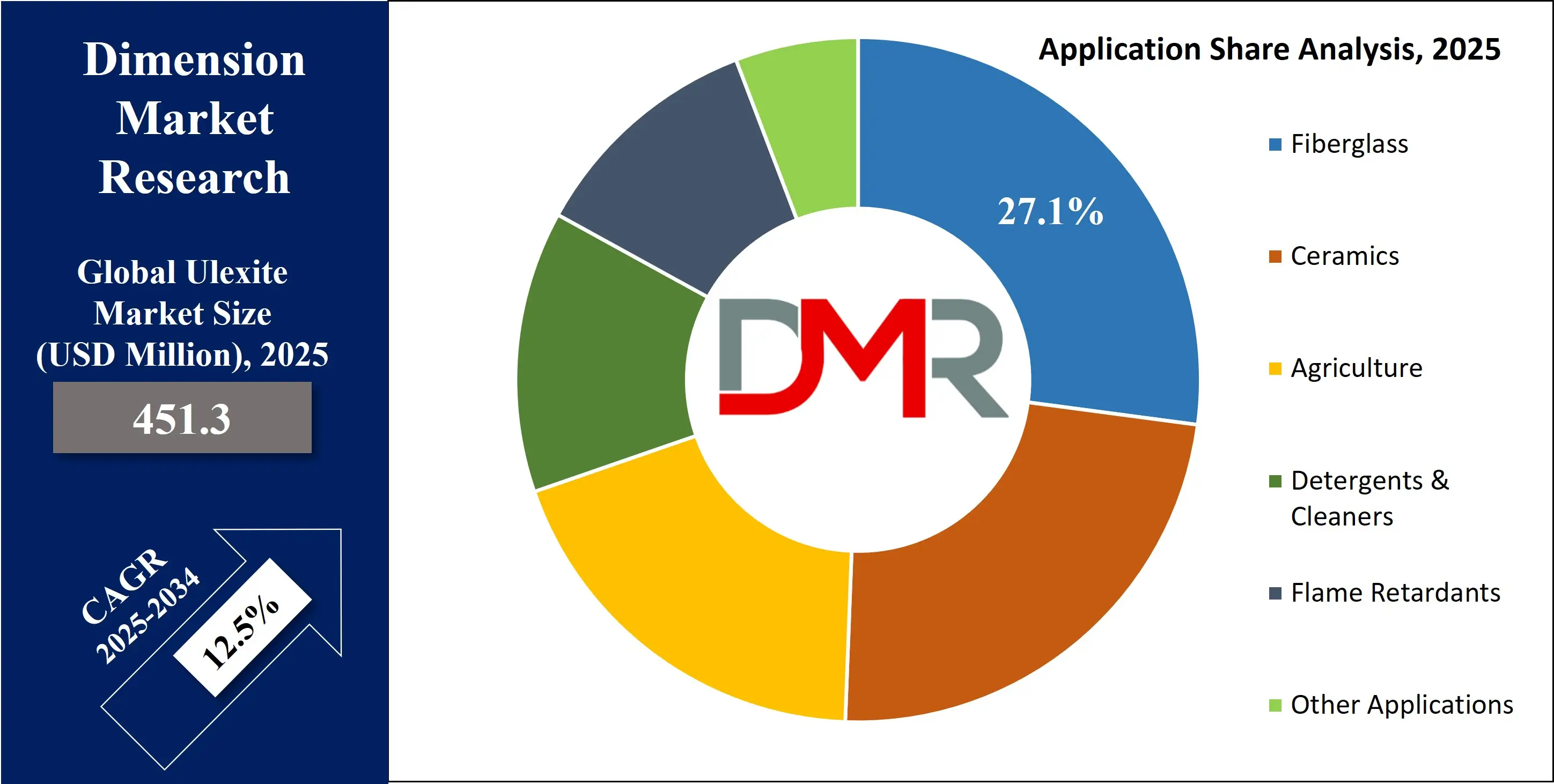

By Application Analysis

The Fiberglass application constitutes the primary demand driver for ulexite globally, expected to be consuming the largest volume share due to boron's irreplaceable role in glass chemistry and composite material performance. Ulexite serves as the preferred boron source in continuous filament and insulation fiberglass production, where it fundamentally modifies the glass network structure to achieve specific performance characteristics.

In insulation-grade fiberglass, boron content significantly reduces thermal expansion coefficients and enhances resistance to moisture degradation, directly contributing to long-term building energy efficiency. For reinforcement fiberglass used in automotive and wind energy composites, boron imparts superior mechanical strength, chemical durability, and interfacial bonding properties with polymer matrices.

The sustained growth of this application segment is underpinned by global megatrends including urbanization, energy conservation mandates, and lightweight vehicle design requirements. Major fiberglass producers maintain stringent specifications for ulexite quality, particularly regarding boron oxide consistency and impurity levels, driving continuous quality improvements throughout the supply chain.

The Agriculture segment represents a major and strategically important application area, driven by the fundamental role of boron in plant nutrition and crop productivity. Ulexite-based boron fertilizers are essential for addressing widespread soil deficiencies that limit yields in numerous cropping systems. The segment's growth is fueled by increasing scientific understanding of boron's physiological functions in plants, expansion of high-value boron-responsive crops, and adoption of soil testing and precision nutrient management practices. The critical nature of boron for reproductive development in many crops ensures sustained demand from the agricultural sector.

By End-User Analysis

Glass & Ceramics Industry end-users is poised to constitute the foundational consumer base for ulexite, characterized by high-volume consumption, stringent quality requirements, and established supply chain relationships. This diverse sector encompasses multiple segments including container glass, fiberglass, technical ceramics, and traditional ceramic products, each with specific material specifications and performance expectations.

Fiberglass manufacturers represent the most significant volume consumers within this category, operating continuous production processes that demand consistent ulexite quality and reliable supply security.

The capital-intensive nature of glass manufacturing facilities creates strong incentives for long-term contractual arrangements with qualified ulexite suppliers, often involving detailed quality assurance protocols and technical collaboration. Ceramics producers utilize ulexite across various product categories including sanitaryware, tiles, and tableware, where it functions as a flux to reduce firing temperatures and enhance product durability.

The continuous innovation in glass and ceramic products, particularly in technical and specialty segments, drives ongoing demand for high-purity ulexite with precisely controlled chemical and physical properties.

Meanwhile, Agriculture end-users are the most diverse consumer segment, ranging from large-scale commercial farming operations to specialty crop producers and agricultural input distributors. This segment demonstrates growing sophistication in boron management practices and increasing demand for formulated products with enhanced agronomic efficiency.

The Global Ulexite Market Report is segmented on the basis of the following:

By Form

By Application

- Fiberglass

- Ceramics

- Agriculture

- Detergents & Cleaners

- Flame Retardants

- Other Applications

By End-User Industry

- Glass & Ceramics Industry

- Agriculture

- Chemical Industry

- Construction

- Automotive

- Other End-User Industries

Impact of Artificial Intelligence in the Global Ulexite Market

- AI in Ulexite Exploration: Artificial intelligence enhances ulexite exploration by analyzing geological datasets, predicting mineral-rich zones, reducing manual surveying efforts, improving accuracy, and significantly lowering operational costs for mining companies across diverse global environments.

- AI-Driven Extraction Optimization: AI-driven automation optimizes ulexite extraction through smart equipment, real-time performance monitoring, predictive alerts, and reduced downtime, enabling improved productivity, safer mining operations, and better resource utilization throughout the mining lifecycle.

- AI for Quality Assessment: Machine learning models refine ulexite quality assessment by identifying impurities, classifying mineral grades, automating laboratory analytics, and enabling faster decision-making for processing strategies, ensuring higher product consistency and improved commercial value.

- AI in Supply Chain Efficiency: AI-enabled supply chain platforms support the ulexite market by forecasting demand, optimizing logistics, preventing bottlenecks, and strengthening procurement efficiency, resulting in reduced waste, improved delivery reliability, and enhanced market competitiveness.

- AI for Environmental Sustainability: Artificial intelligence improves environmental sustainability in ulexite mining by monitoring ecological indicators, minimizing extraction impacts, optimizing energy consumption, and helping companies achieve greener operations aligned with global environmental compliance standards.

Global Ulexite Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is projected to command the largest share of the global ulexite market with 42.0% of market share by the end of 2025, driven by massive manufacturing capacity and rapid industrial development. China's position as the world's primary manufacturing hub for fiberglass, ceramics, and agricultural inputs creates enormous demand for industrial minerals including ulexite. The region's continuous infrastructure development, urbanization trends, and expanding middle class sustain strong growth in construction materials and agricultural productivity requirements.

Additionally, government initiatives supporting domestic manufacturing and agricultural modernization, particularly in China and India, create favorable policy environments for industrial mineral consumption. The concentration of fiberglass production capacity in China, which accounts for over 60% of global output, establishes a foundational demand base that solidifies Asia Pacific's dominant market position.

Region with the Highest CAGR

The North America ulexite market is projected to achieve the highest Compound Annual Growth Rate (CAGR) globally, driven by a confluence of strategic industrial and economic factors. The region is experiencing a significant resurgence in domestic manufacturing, particularly in fiberglass and composite materials, fueled by supportive policies like the U.S. Inflation Reduction Act and initiatives to strengthen supply chains. This has led to substantial investments in new production facilities for wind energy components, automotive composites, and building insulation, directly increasing demand for ulexite as a critical boron source.

Furthermore, North America's technological leadership in high-value sectors such as advanced ceramics, precision agriculture, and flame-retardant formulations accelerates the adoption of specification-grade ulexite. The region's access to affordable energy provides a competitive edge for energy-intensive industries like fiberglass manufacturing.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Ulexite Market: Competitive Landscape

The competitive landscape of the global ulexite market is moderately consolidated, characterized by the dominance of a limited number of major producers who control significant reserves and production capacity.

The market is led by Eti Maden of Turkey, which operates the world's largest boron mineral reserves and maintains predominant influence over global supply and pricing. Rio Tinto Group through its Boron operations in California represents the other major integrated producer with substantial market presence. These industry leaders compete on the basis of production scale, product quality consistency, and geographic supply chain reach.

The competitive framework also includes established South American producers such as Quiborax SA and Minera Santa Rita SRL who leverage local resource advantages and regional market positions.

High barriers to entry resulting from capital-intensive mining operations, processing technology requirements, and the geological scarcity of economic ulexite deposits limit new market entrants. Competition increasingly focuses on value-added product development, technical customer support services, and sustainable production practices alongside traditional factors of price and quality.

Some of the prominent players in the Global Ulexite Market are

- Rio Tinto Group

- Eti Maden

- Searles Valley Minerals

- Minera Santa Rita SRL

- Quiborax SA

- Inca Mining Pty Ltd

- American Borate Company

- Sociedad Industrial Tierra S.A.

- Boron Molecular Pty Ltd

- Dalian Jinma Boron Technology Group Co., Ltd.

- 3M Company

- Orocobre Limited (Allkem)

- SCL Borax

- Gujarat Boron Derivatives Private Limited

- Russian Bor

- Mudanjiang Fengda Boron Chemical Co., Ltd.

- Borax Morarji Limited

- Trona Mineral

- Boron Specialties LLC

- Other Key Players

Recent Developments in the Global Ulexite Market

- May 2024: Eti Maden announces a USD 150 million investment in a new ulexite processing facility featuring advanced purification technology to produce high-purity boron compounds for specialty applications.

- April 2024: Rio Tinto Borates implements a comprehensive water recycling system at its California operations, reducing freshwater consumption by 25% in ulexite processing.

- March 2024: Quiborax SA signs a long-term supply agreement with a major Asian fiberglass manufacturer, ensuring stable ulexite supply through 2030.

- January 2024: The International Boron Symposium convenes in Istanbul, featuring technical sessions on ulexite applications in flame retardants and advanced ceramics.

- November 2023: Eti Maden launches a traceability program for its ulexite products, providing customers with detailed origin and quality documentation.

- September 2023: The Chinese Ceramics Association releases updated technical guidelines recommending ulexite quality specifications for high-performance glaze formulations.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 451.3 Mn |

| Forecast Value (2034) |

USD 1,297.9 Mn |

| CAGR (2025–2034) |

12.5% |

| The US Market Size (2025) |

USD 102.5 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Form (Powder, Crystal, Pellet), By Application (Fiberglass, Ceramics, Agriculture, Detergents & Cleaners, Flame Retardants, Other Applications), and By End-User (Glass & Ceramics Industry, Agriculture, Chemical Industry, Construction, Automotive, Other End-User Industries). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Rio Tinto Group, Eti Maden, Searles Valley Minerals, Minera Santa Rita SRL, Quiborax SA, Inca Mining Pty Ltd, American Borate Company, Sociedad Industrial Tierra S.A., Boron Molecular Pty Ltd, Dalian Jinma Boron Technology Group Co., Ltd., 3M Company, Orocobre Limited (Allkem), SCL Borax, Gujarat Boron Derivatives Private Limited, Russian Bor, Mudanjiang Fengda Boron Chemical Co., Ltd., Borax Morarji Limited, Trona Mineral, Boron Specialties LLC., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Ulexite Market size is estimated to have a value of USD 451.3 million in 2025 and is expected to reach USD 1,297.9 million by the end of 2034.

The market is growing at a CAGR of 12.5 percent over the forecasted period of 2025.

The US Ulexite Market is projected to be valued at USD 102.5 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 278.1 million in 2034 at a CAGR of 11.7%.

Asia Pacific is expected to have the largest market share in the Global Ulexite Market with a share of about 42.0% in 2025.

Some of the major key players in the Global Ulexite Market are Rio Tinto Group, Eti Maden, Searles Valley Minerals, Minera Santa Rita SRL, Quiborax SA, and many others.