Market Overview

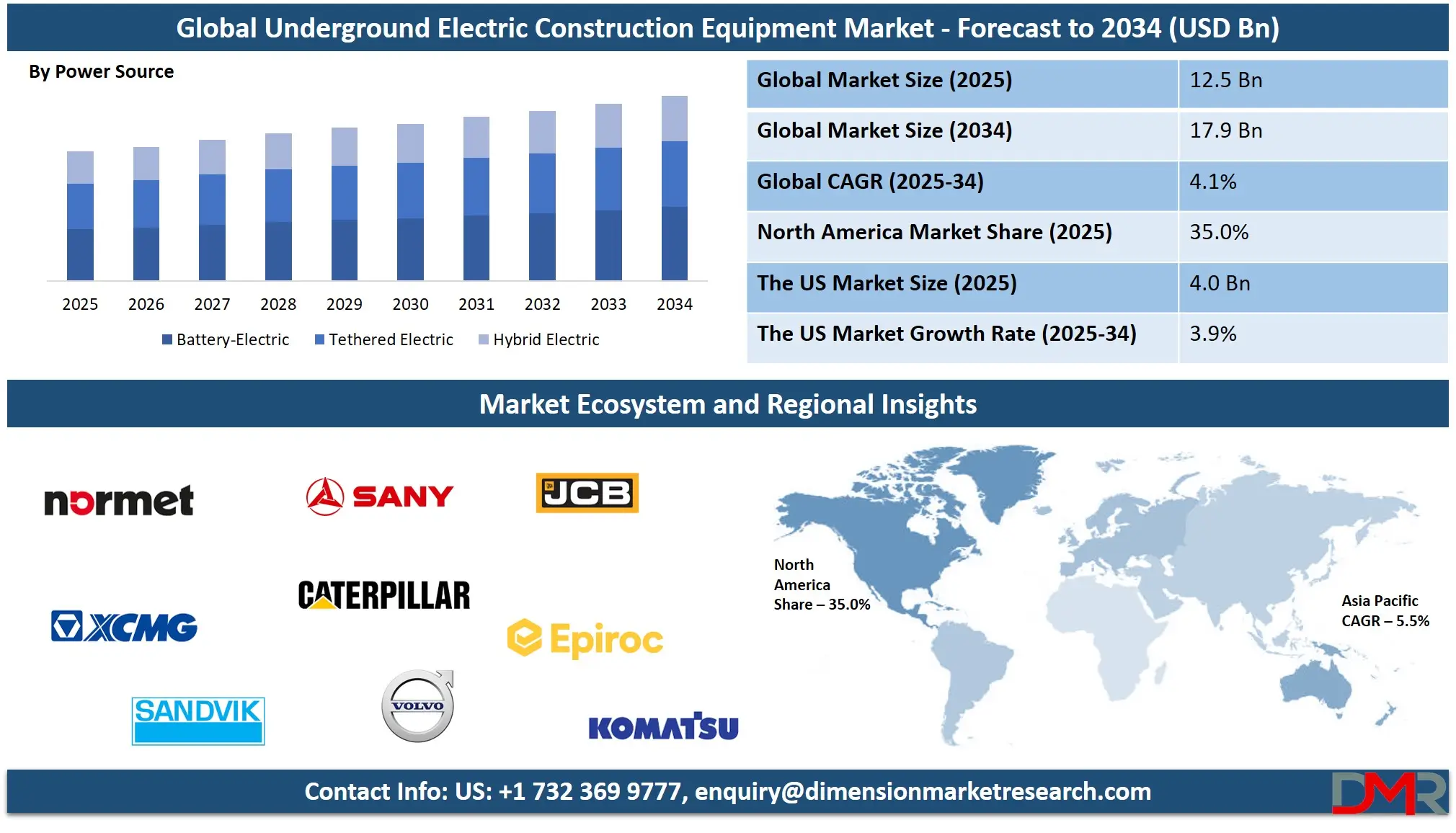

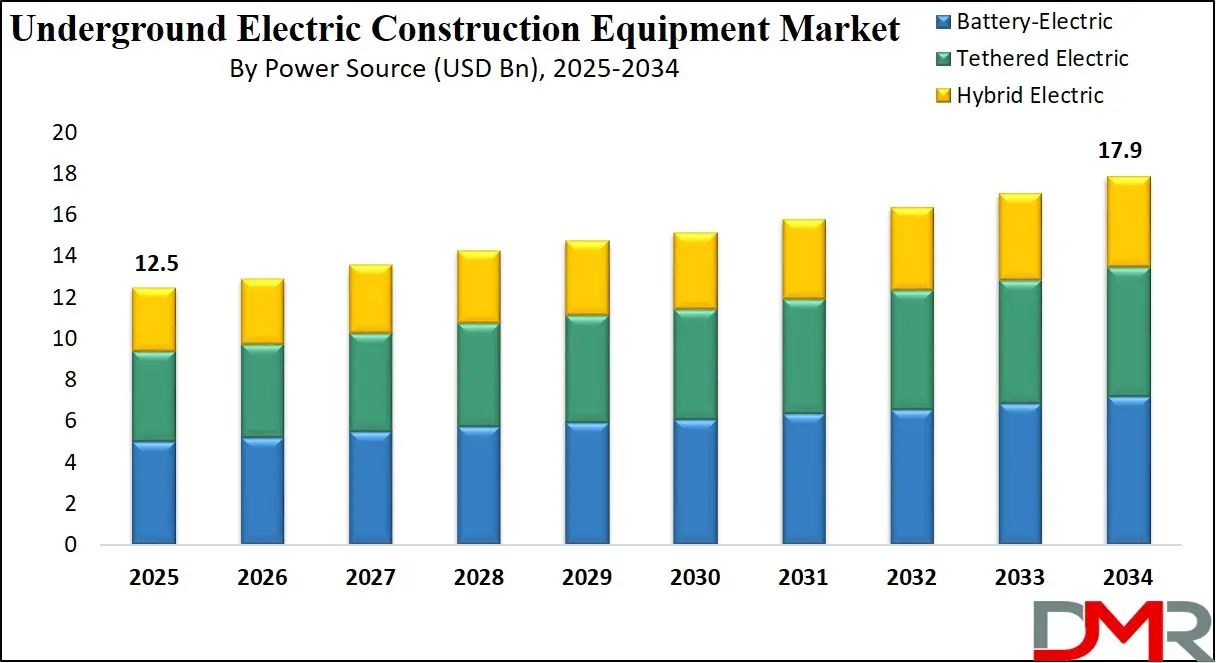

The Global Underground Electric Construction Equipment Market size is projected to reach USD 12.5 billion in 2025 and grow at a compound annual growth rate of 4.1% to reach a value of USD 17.9 billion in 2034.

The underground electric construction equipment refers to the use of electrically-powered machinery and vehicles in underground construction applications, such as mining, tunneling, and utility infrastructure projects. This category includes a range of equipment like electric excavators, loaders, drilling machines, haulage vehicles, and ventilation systems.

These machines are specifically designed for use in confined, high-pressure environments, where reducing emissions and energy consumption is crucial. By replacing diesel-powered equipment with electric alternatives, these technologies offer significant environmental benefits, such as lower carbon emissions and reduced noise pollution, making them ideal for environmentally conscious industries.

The adoption of electric underground construction equipment is gaining momentum due to several driving factors, including advances in battery technology and electric drivetrains. These innovations enable better performance, increased operational time, and more efficient energy use, which are essential for the demanding conditions found in underground construction and mining operations.

Additionally, the rising global focus on sustainability and stricter environmental regulations have prompted companies to explore greener alternatives to traditional diesel-powered machinery. Governments around the world are increasingly offering incentives and subsidies to encourage the use of low-emission equipment, further accelerating the shift toward electric-powered solutions.

In the coming years, the market is expected to experience significant growth as industries such as construction and mining continue their efforts to decarbonize. Manufacturers are collaborating with mining operators and other industry players to optimize the design and functionality of electric underground construction equipment. These partnerships aim to develop more powerful, durable, and energy-efficient machinery, capable of withstanding the harsh conditions of underground environments. As the focus on operational efficiency, cost reduction, and regulatory compliance intensifies, the demand for electric underground construction equipment is anticipated to rise, shaping the future of the industry.

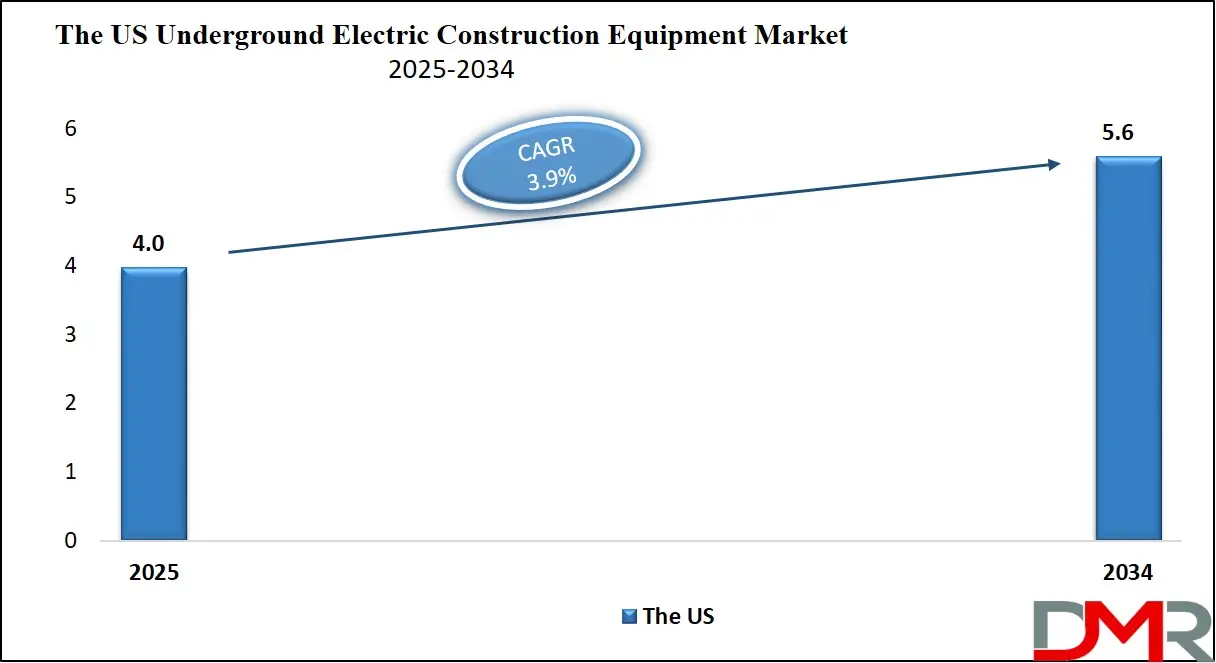

The US Underground Electric Construction Equipment Market

The US Underground Electric Construction Equipment Market size is projected to reach USD 4.0 billion in 2025 at a compound annual growth rate of 3.9% over its forecast period.

The U.S. underground electric construction equipment market is poised for significant growth driven by stringent environmental regulations and advancements in battery technology. The construction and mining sectors are increasingly adopting electric machinery to meet sustainability goals and reduce carbon footprints. The U.S. government has set ambitious targets for reducing greenhouse gas emissions, pushing industries to invest in cleaner technologies. Moreover, the growing demand for efficient and low-maintenance equipment is expected to support the expansion of electric construction equipment in underground applications.

Europe Underground Electric Construction Equipment Market

Europe Underground Electric Construction Equipment Market size is projected to reach USD 3.8 billion in 2025 at a compound annual growth rate of 3.7% over its forecast period.

In Europe, the underground electric construction equipment market is experiencing robust growth due to aggressive de-carbonization policies and green energy initiatives. The European Union has introduced policies that promote sustainable construction practices, encouraging the adoption of electric equipment. Furthermore, European manufacturers are at the forefront of developing innovative electric solutions tailored for underground construction. The demand for electric underground construction equipment is expected to grow as countries like Germany, France, and the UK aim for net-zero emissions in the coming decades. This is further supported by the increasing awareness of environmental impacts within the region.

Japan Underground Electric Construction Equipment Market

Japan Underground Electric Construction Equipment Market size is projected to reach USD 625 million in 2025 at a compound annual growth rate of 3.8% over its forecast period.

Japan’s underground electric construction equipment market is witnessing steady growth, driven by technological innovation and the country’s focus on creating sustainable infrastructure. The Japanese government has rolled out initiatives encouraging the use of low-emission technologies in construction, and electric underground machinery is increasingly being adopted for tunneling and mining projects. Japanese companies are investing heavily in research and development to improve battery efficiency, equipment reliability, and overall performance. With Japan’s expertise in robotics and electric mobility, the country is expected to lead the market in terms of technological advancements.

Underground Electric Construction Equipment Market: Key Takeaways

- Market Growth: The Underground Electric Construction Equipment Market size is expected to grow by USD 4.9 billion, at a CAGR of 4.1%, during the forecasted period of 2026 to 2034.

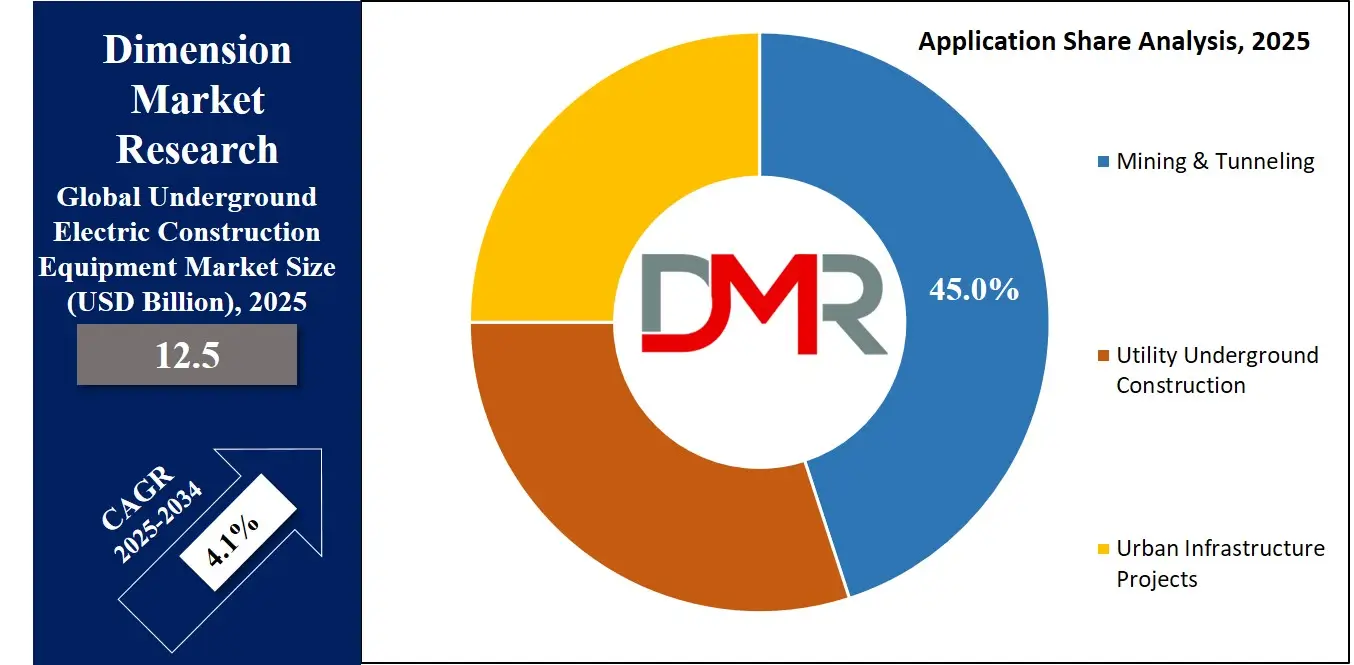

- By Application: The mining & tunneling segment is anticipated to get the majority share of the Underground Electric Construction Equipment Market in 2025.

- By Power Source: The battery-electric segment is expected to get the largest revenue share in 2025 in the Underground Electric Construction Equipment Market.

- Regional Insight: North America is expected to hold a 35.0% share of revenue in the Global Underground Electric Construction Equipment Market in 2025.

- Use Cases: Some of the use cases of Underground Electric Construction Equipment include mining & tunneling, urban infrastructure projects, and more.

Underground Electric Construction Equipment Market: Use Cases

- Utility Underground Construction: Electric construction equipment is ideal for power cable installations and water-sewer developments, particularly in urban environments where reducing emissions is critical.

- Mining & Tunneling: Electric-powered machines provide a viable alternative for hard-rock mining and tunnel construction, offering lower operational costs and enhanced environmental compliance.

- Urban Infrastructure Projects: Electric construction machinery can be used in city-based infrastructure projects, where reduced noise and pollution are essential for minimal disruption to surrounding areas.

- Energy & Telecom Service Providers: The adoption of electric underground equipment supports energy and telecom service providers in implementing underground installations while aligning with sustainability targets.

Stats & Facts

- According to the U.S. Department of Energy, electric vehicles in construction applications are expected to reduce CO2 emissions by 25% by 2025.

- The European Commission reports that the adoption of electric equipment in the construction sector could reduce energy consumption by up to 15% by 2025.

- Japan’s Ministry of the Environment estimates that 30% of all construction equipment will be electric-powered by 2030, with underground equipment representing a significant portion.

- The U.S. Environmental Protection Agency (EPA) has set a target for reducing diesel-powered machinery emissions by 50% by 2025.

Market Dynamic

Driving Factors in the Underground Electric Construction Equipment Market

Environmental Regulations and Sustainability Goals

Governments across the globe are intensifying environmental regulations to combat climate change and reduce air pollution. These regulations are prompting industries such as mining, tunneling, and construction to shift towards sustainable practices, with electric construction equipment emerging as a key solution. Businesses in these sectors are increasingly required to meet stringent emissions targets and adopt technologies that contribute to cleaner, greener operations.

Electric underground construction equipment plays a crucial role in this transition by offering zero-emission solutions that help organizations comply with regulatory frameworks while minimizing their carbon footprints. Furthermore, companies that integrate electric equipment into their operations can benefit from enhanced sustainability credentials, potentially opening up new market opportunities and strengthening their competitive advantage in an environmentally conscious market.

Technological Advancements in Battery and Electric Drive Systems

Recent breakthroughs in battery technology and electric drive systems have significantly improved the efficiency, reliability, and performance of electric underground construction equipment. Innovations such as increased energy density, faster charging times, and longer-lasting battery life are making electric-powered machinery a viable alternative to traditional diesel-powered systems. Additionally, advancements in electric drivetrains are helping to enhance the durability and performance of these machines in demanding underground environments, where high power and reliability are critical. As electric drive systems continue to improve, the total cost of ownership for electric machinery will decrease, making it an even more attractive option for businesses looking to reduce operational costs and minimize downtime. This growing technological capability is one of the key factors driving the increased adoption of electric equipment in the underground construction industry.

Restraints in the Underground Electric Construction Equipment Market

High Initial Costs

One of the most significant barriers to the widespread adoption of electric underground construction equipment is the high initial purchase cost. While the operational costs of electric machinery, such as fuel and maintenance, as they are lower compared to diesel-powered machines, the upfront capital investment required for electric equipment is considerably higher. This can be a substantial hurdle, especially for smaller contractors or operators with limited access to financing.

Despite the long-term savings associated with reduced fuel consumption, lower maintenance costs, and tax incentives, the initial cost is a major consideration for businesses looking to transition to electric-powered equipment. In addition, the integration of advanced technologies, such as high-capacity batteries and electric drivetrains, further drives up the price of these machines. However, as production volumes increase and economies of scale kick in, the cost of electric equipment is expected to decrease over time.

Limited Charging Infrastructure

A significant challenge for the adoption of electric underground construction equipment is the lack of charging infrastructure, particularly in remote underground mining and tunneling sites. Unlike traditional diesel-powered machinery, which can refuel quickly at a variety of locations, electric vehicles rely on a reliable and accessible charging infrastructure to operate effectively. In underground environments, setting up and maintaining charging stations can be complicated due to space constraints, ventilation issues, and the need for constant power supply.

This lack of infrastructure limits the operational flexibility of electric-powered equipment, especially in areas where electric grids are not easily accessible or in regions with less developed power networks. Without widespread and reliable charging facilities, the adoption of electric underground construction equipment will face a significant bottleneck. Addressing these infrastructure challenges is key to accelerating the uptake of electric machinery in these industries.

Opportunities in the Underground Electric Construction Equipment Market

Growth in Green Building Projects

The global trend towards sustainable development, particularly in the construction industry, is creating significant opportunities for electric underground construction equipment. As the demand for green building certifications, such as LEED (Leadership in Energy and Environmental Design)—continues to rise, construction firms are increasingly adopting eco-friendly solutions. Electric equipment offers a key advantage in these projects due to its zero-emission operation, making it easier to meet the environmental criteria required for certifications. In addition to reducing the carbon footprint, electric-powered machinery also helps address issues such as noise pollution, which is becoming an increasingly important consideration in urban development projects. The growing focus on eco-conscious infrastructure projects, including renewable energy installations, sustainable transportation systems, and smart cities, is driving the adoption of electric equipment across various sectors.

Government Incentives and Subsidies

Governments worldwide are recognizing the environmental benefits of electric construction equipment and are offering various incentives to encourage its adoption. These financial incentives, including tax credits, grants, subsidies, and rebates, can significantly reduce the overall cost of purchasing electric-powered underground machinery. In addition, many countries have implemented "green procurement" policies, which require government agencies and municipalities to purchase environmentally friendly equipment, further boosting the demand for electric vehicles in public infrastructure projects. These incentives, combined with the potential for long-term operational cost savings, make electric equipment more accessible to businesses of all sizes, enabling them to transition to sustainable practices more affordably. As governments continue to prioritize sustainability and clean energy, these incentives are expected to play a critical role in the market's growth.

Trends in the Underground Electric Construction Equipment Market

Integration of Autonomous Features

Automation is rapidly transforming the construction and mining industries, and the underground electric construction equipment sector is no exception. Manufacturers are increasingly integrating autonomous capabilities into their electric machinery, which offers a variety of benefits, including enhanced safety, improved productivity, and reduced labor costs. Autonomous electric equipment can operate continuously in hazardous underground environments, reducing the need for human intervention and minimizing safety risks for operators.

These machines are capable of performing tasks such as excavation, drilling, and material handling without human supervision, which not only improves efficiency but also allows for better utilization of resources and time. The integration of autonomous features into electric equipment is expected to become a standard trend, particularly in industries like mining, where the working environment can be extremely dangerous.

Hybrid Power Systems

Hybrid power systems are becoming a significant trend in the underground electric construction equipment market, especially in regions with limited charging infrastructure or in projects requiring higher power outputs. Hybrid electric vehicles combine the benefits of electric propulsion with the reliability and power of traditional diesel engines or tethered electric systems. These systems provide greater operational flexibility, allowing machines to run on electric power when possible, and switch to diesel or tethered power when needed to meet higher energy demands.

Hybrid systems are particularly useful in situations where frequent recharging is not feasible, such as in remote mining sites or long-duration tunneling projects. This trend is helping to bridge the gap between fully electric and traditional diesel-powered equipment, offering an environmentally friendly solution that can operate in a wider range of conditions.

Impact of Artificial Intelligence in Underground Electric Construction Equipment Market

- Automation and Safety: AI is enhancing the safety features of electric underground construction equipment, providing real-time monitoring of hazardous environments and enabling autonomous operation.

- Predictive Maintenance: AI-driven predictive maintenance tools help identify potential equipment failures before they occur, reducing downtime and repair costs for electric machinery.

- Optimized Energy Use: AI algorithms optimize energy consumption by monitoring operational patterns and adjusting power usage for maximum efficiency in electric underground equipment.

- Design Innovation: AI is driving the development of new, more efficient electric vehicles tailored for underground construction, using data-driven design to improve battery life and performance.

- Operational Efficiency: AI applications in route planning, task automation, and fleet management are enhancing the overall operational efficiency of electric underground equipment.

Research Scope and Analysis

By Equipment Type Analysis

Electric excavators are expected to be the leading segment in the underground electric construction equipment industry by 2025, holding around 30% of the market share. These machines provide a sustainable solution for underground excavation, offering powerful performance while significantly reducing emissions when compared to traditional diesel-powered excavators. The transition to electric excavators is driven by the increasing demand for eco-friendly construction practices and strict regulations on carbon emissions. These machines are ideal for demanding tasks such as digging, trenching, and material handling in underground construction and mining, making them a preferred choice for contractors aiming to meet environmental standards.

Electric loaders are a rapidly growing segment, particularly in urban infrastructure projects where noise reduction and environmental concerns are a priority. These machines are gaining popularity in confined spaces and smaller-scale operations, where maneuverability and energy efficiency are crucial. As construction projects increasingly prioritize sustainability, electric loaders are expected to see a surge in adoption. They offer advantages such as reduced emissions, quieter operations, and lower maintenance costs, making them ideal for urban environments with stricter environmental standards.

By Power Source Analysis

Battery-electric systems are the dominant power source in the underground electric construction equipment market, expected to hold over 40% of the market share by 2025. The demand for battery-electric systems is growing due to advancements in battery technology, which allow for longer operational hours and increased energy density. These systems are favored for their zero-emissions and energy efficiency, making them ideal for underground construction and mining environments. Battery-electric equipment offers a reliable, environmentally friendly alternative to diesel-powered machines, and their continued adoption is being driven by both sustainability goals and operational cost reduction.

The tethered electric power source segment is growing rapidly, driven by the need for continuous power in underground mining and tunneling operations. Unlike battery-electric systems, tethered machines are connected to an external power source, enabling them to operate for extended periods without worrying about battery life. These systems are particularly suited for high-demand applications in mining and tunneling where large amounts of power are needed continuously. Tethered electric equipment provides uninterrupted performance, making it a key solution for large-scale underground projects.

By Power Rating Analysis

Medium-power electric underground equipment is expected to dominate the market by 2025, with a 35% market share. These machines offer an optimal balance of performance and energy efficiency, making them suitable for a wide range of underground construction tasks. Medium-powered equipment is commonly used for tasks such as excavation, tunneling, and material handling, where both power and efficiency are needed. This power range is ideal for many underground applications, offering the necessary power output while ensuring the equipment remains energy-efficient and cost-effective.

Low-power electric equipment is the fastest-growing segment in underground electric construction. These machines, often smaller and more compact, are increasingly being adopted for smaller-scale projects such as utility installations and minor tunneling. The rising demand for lightweight, efficient machines in urban areas where space is limited and environmental concerns are high is driving this growth. Improved battery technology is making low-power machines more practical, extending operational times and reducing the need for frequent charging.

By Application Analysis

Mining and tunneling applications are expected to continue dominating the underground electric construction equipment sector. The segment is driven by the growing push towards sustainable mining practices and the increasing need for low-emission equipment in underground environments. As mining companies face mounting pressure to comply with environmental regulations and reduce their carbon footprints, electric-powered equipment for tasks like tunneling, drilling, and material hauling has become essential.

The transition to electric machinery is being further encouraged by the potential for significant cost reductions, particularly through savings on fuel, maintenance, and overall operational efficiency. Mining and tunneling are projected to account for the largest market share in the underground electric construction equipment market, with a share of around 45% by 2025. With the mining and tunneling sectors increasingly prioritizing sustainability and eco-friendly solutions, electric equipment has become a key component in modernizing underground operations.

Urban infrastructure projects represent one of the fastest-growing application areas for underground electric construction equipment. The demand for low-emission machinery in urban construction, including underground utilities and transportation tunnels, is accelerating. Municipalities and construction firms are increasingly prioritizing eco-friendly solutions in order to meet local and national sustainability goals. As cities grow and the demand for more sustainable infrastructure increases, the adoption of electric equipment in urban projects is expected to continue expanding rapidly.

By End User Analysis

Construction contractors are expected to hold the largest share of the underground electric construction equipment market, driven by the increasing demand for sustainable and green building practices. As urban development accelerates, particularly in infrastructure projects such as tunnels, utility systems, and transportation networks, contractors are investing more in electric-powered machinery to meet stringent emissions standards and reduce operational costs. With government incentives, regulations promoting cleaner technologies, and a growing focus on environmental responsibility, construction contractors are turning to electric equipment to meet both their operational goals and sustainability objectives. This segment is anticipated to represent 40% of the underground electric construction equipment market by 2025. As urban areas grow and the demand for green infrastructure rises, electric construction equipment is becoming a critical tool for contractors seeking to comply with modern environmental standards.

Mining operators are rapidly adopting electric underground construction equipment, driven by both regulatory pressures and the desire to cut operational costs. The mining industry, traditionally a heavy user of diesel-powered equipment, is now transitioning towards electric alternatives due to their lower fuel costs, reduced maintenance needs, and improved safety. Electric mining machinery, such as haul trucks and drilling rigs, are becoming more popular in underground operations, where emissions and ventilation issues are significant concerns. As the industry shifts towards more sustainable mining practices, the demand for electric equipment in the sector is expected to continue growing.

The Underground Electric Construction Equipment Market Report is segmented on the basis of the following:

By Equipment Type

- Electric Excavators

- Electric Loaders

- Electric Drilling & Boring Equipment

- Horizontal directional drilling rigs

- Tunnel boring machines

- Electric Haulage & Transport Vehicles

- Underground trucks

- Shuttle vehicles

- Electric Support & Ancillary Equipment

- Ventilation systems

- Pumps

By Power Source

- Battery-Electric

- Tethered Electric

- Hybrid Electric

By Power Rating

- Low Power (Up to 50 kW)

- Medium Power (50–200 kW)

- High Power (Above 200 kW)

By Application

- Utility Underground Construction

- Power cable installation

- Water and sewer development

- Mining & Tunneling

- Hard-rock mining

- Tunnel development

- Urban Infrastructure Projects

By End User

- Construction Contractors

- Mining Operators

- Government & Municipal Utilities

- Energy & Telecom Service Providers

Regional Analysis

Leading Region in the Underground Electric Construction Equipment Market

North America is expected to hold the largest market share in the underground electric construction equipment sector by 2025, driven by strong regulatory frameworks and a robust push towards sustainability in both the mining and construction industries. The United States and Canada are leading the charge, with stringent environmental regulations that encourage the adoption of low-emission machinery. North America is projected to account for around 35% of the total market share in 2025.

The region is also home to major mining and construction companies, which are adopting electric equipment to meet government-mandated environmental standards, reduce operational costs, and improve long-term sustainability. Government incentives, combined with the growing demand for cleaner technologies in construction and mining operations, are expected to ensure North America's continued dominance in the electric underground construction equipment market.

Fastest Growing Region in the Underground Electric Construction Equipment Market

The Asia-Pacific region is projected to be the fastest-growing region for underground electric construction equipment, with a high annual growth rate expected through 2025. The rapid urbanization and industrialization in countries like China, India, and Japan are driving this growth, as demand for underground construction equipment increases for infrastructure projects and urban development. Governments in this region are pushing for more sustainable construction practices, offering incentives for the adoption of electric equipment. Additionally, the mining sector in countries such as China and Australia is undergoing significant transformation, with mining operators increasingly moving towards electric alternatives to meet both environmental standards and operational efficiency targets. The continued investments in infrastructure, coupled with the increasing awareness of environmental impacts, make the Asia-Pacific region a key area for expansion in the underground electric construction equipment market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The underground electric construction equipment market is shaped by a mix of established industry giants and innovative startups. These companies are heavily investing in research and development to create next-generation electric machinery that offers enhanced efficiency, longer operational hours, and lower environmental impact. They are also leveraging digital technologies, such as IoT and AI, to integrate smart features that optimize equipment performance and maintenance. Partnerships with mining operators, construction firms, and government agencies play a crucial role in driving market adoption, as they enable the development of tailored solutions that meet the specific needs of underground construction projects.

Some of the prominent players in the global Underground Electric Construction Equipment are:

- Caterpillar

- Komatsu

- Volvo Construction Equipment

- Sandvik

- Epiroc

- Hitachi Construction Machinery

- Liebherr

- Bobcat

- Wacker Neuson

- JCB

- Takeuchi

- Doosan

- Hyundai Construction Equipment

- XCMG

- Sany Heavy Industry

- Zoomlion

- Normet

- MacLean Engineering

- GHH Fahrzeuge

- Herrenknecht

- Other Key Players

Recent Developments

- In June 2025, Caterpillar Inc. unveiled its latest innovation, the Cat® 374XE Electric Underground Excavator, an all-electric model designed specifically for underground mining and construction applications. This new electric-powered excavator is built to meet the growing demand for low-emission, energy-efficient machinery in industries that are becoming increasingly focused on sustainability.

- In May 2025, Komatsu Ltd. made a strategic investment to accelerate the development of hybrid electric haulage vehicles designed for underground mining operations. These new machines, which combine the efficiency of electric power with the reliability of traditional internal combustion engines, aim to reduce fuel consumption and lower the overall operational costs of underground mining.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 12.5 Bn |

| Forecast Value (2034) |

USD 17.9 Bn |

| CAGR (2025–2034) |

4.1% |

| The US Market Size (2025) |

USD 4.0 Bn |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Equipment Type (Electric Excavators, Electric Loaders, Electric Drilling & Boring Equipment, Electric Haulage & Transport Vehicles, and Electric Support & Ancillary Equipment), By Power Source (Battery-Electric, Tethered Electric, and Hybrid Electric), By Power Rating (Low Power (Up to 50 kW), Medium Power (50–200 kW), and High Power (Above 200 kW)), By Application (Utility Underground Construction, Mining & Tunneling, and Urban Infrastructure Projects), By End User (Construction Contractors, Mining Operators, Government & Municipal Utilities, and Energy & Telecom Service Providers) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Caterpillar, Komatsu, Volvo Construction Equipment, Sandvik, Epiroc, Hitachi Construction Machinery, Liebherr, Bobcat, Wacker Neuson, JCB, Takeuchi, Doosan, Hyundai Construction Equipment, XCMG, Sany Heavy Industry, Zoomlion, Normet, MacLean Engineering, GHH Fahrzeuge, Herrenknecht, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Underground Electric Construction Equipment Market size is expected to reach a value of USD 12.5 billion in 2025 and is expected to reach USD 17.9 billion by the end of 2034.

North America is expected to have the largest market share in the Global Underground Electric Construction Equipment Market, with a share of about 35.0% in 2025.

The Underground Electric Construction Equipment Market in the US is expected to reach USD 4.0 billion in 2025.

Some of the major key players in the Global Underground Electric Construction Equipment Market include JCB, Caterpillar, Komatsu and others.

The market is growing at a CAGR of 4.1 percent over the forecasted period.