Market Overview

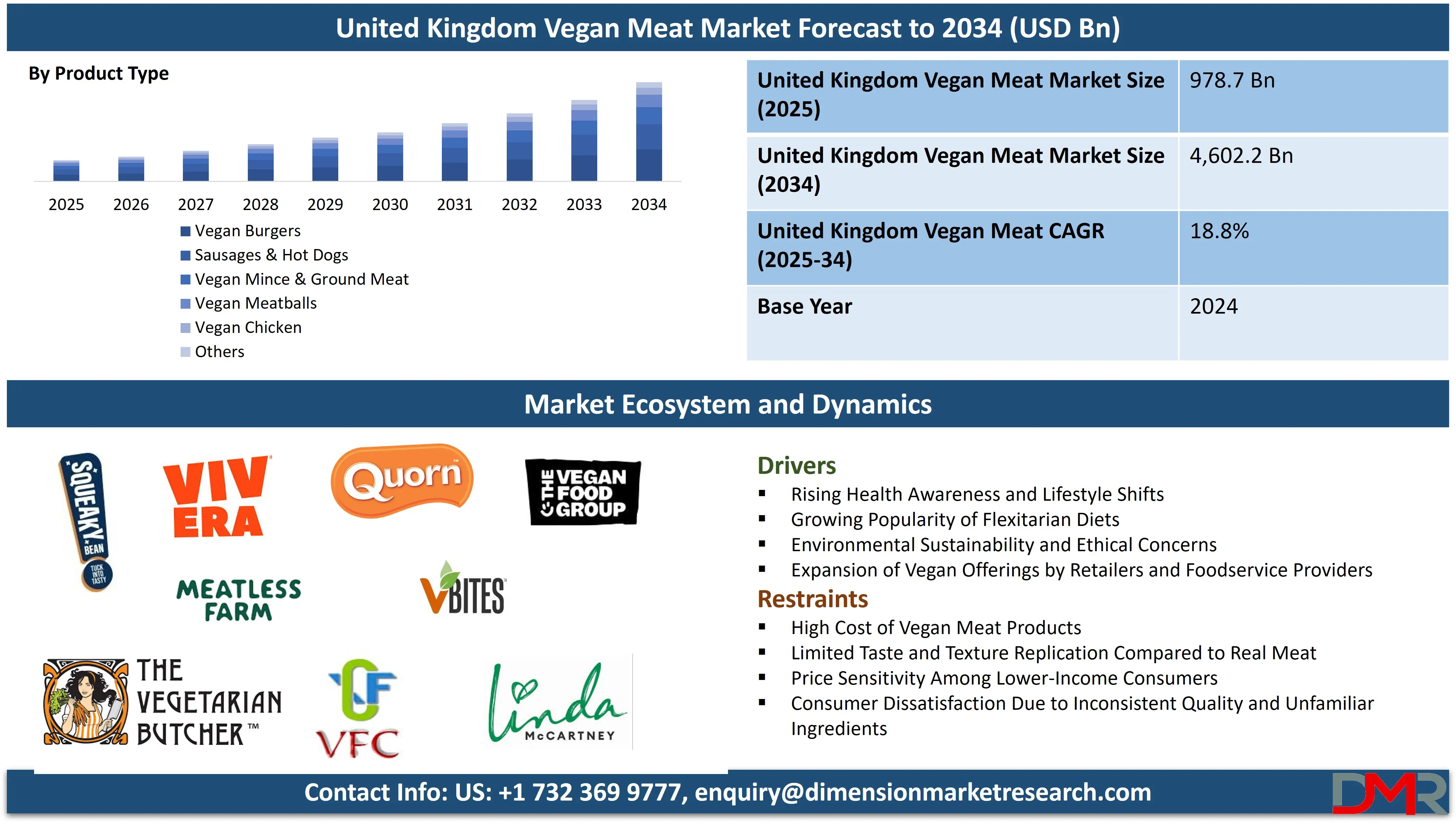

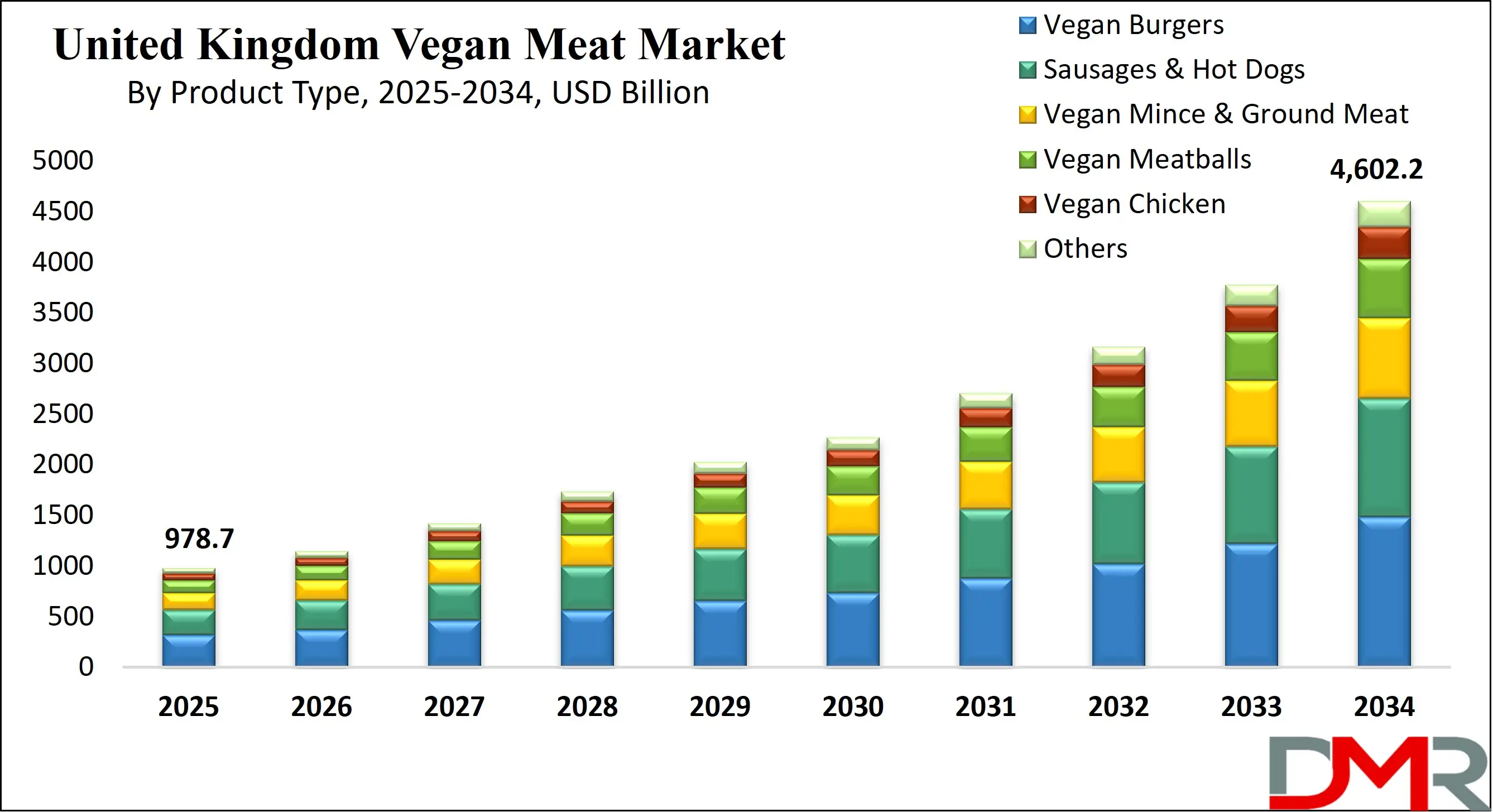

The United Kingdom Vegan Meat Market is predicted to be valued at

USD 978.7 billion in 2025 and is expected to grow to

USD 4,602.2 billion by 2034, registering a compound annual growth rate

(CAGR) of

18.8% from 2025 to 2034.

The United Kingdom Vegan Meat market encompasses plant-based alternatives designed to replicate the taste, texture, and nutritional profile of traditional animal-derived meat products. This market includes a wide range of offerings such as burgers, sausages, nuggets, and mince made primarily from ingredients like soy, pea protein, wheat gluten, and mushrooms. Driven by increasing consumer awareness around animal welfare, environmental sustainability, and health consciousness, the demand for vegan meat products has seen significant momentum.

Consumers are increasingly shifting toward plant-based diets due to concerns over climate change, ethical considerations, and rising incidences of lifestyle-related diseases. This shift is further supported by advancements in food technology, such as precision fermentation and cellular agriculture, which enhance product taste and nutritional quality. Despite these positive trends, the market faces challenges including higher production costs compared to conventional meat, limited consumer familiarity in some demographics, and occasional skepticism about the nutritional adequacy of vegan alternatives.

Innovations such as improved meat analogues with better texture and flavor profiles, as well as fortified products enriched with vitamins and minerals, are opening new avenues for growth. Retailers and foodservice providers are increasingly incorporating vegan meat options, responding to evolving consumer preferences for plant-based and flexitarian diets. The regulatory framework in the UK emphasizes food safety standards, labeling transparency, and recently, discussions around the definition of “meat” and related terms, which could impact marketing strategies.

Major players like Beyond Meat, Quorn, and Moving Mountains are actively expanding their portfolios and distribution networks, investing in R&D to differentiate their offerings. The rising popularity of online grocery platforms and the influence of social media are also shaping buying behaviors, with younger consumers driving demand for innovative and ethically produced vegan meat alternatives.

United Kingdom Vegan Meat Market: Key Takeaways

- Market Overview: The United Kingdom Vegan Meat Market is forecasted to reach a value of USD 978.7 billion in 2025 and is anticipated to expand to USD 4,602.2 billion by 2034, growing at a compound annual growth rate (CAGR) of 18.8% between 2025 and 2034.

- By Product Type Analysis: Vegan Burgers are expected to lead the UK vegan meat market, making up around 32.4% of the total market share in 2025.

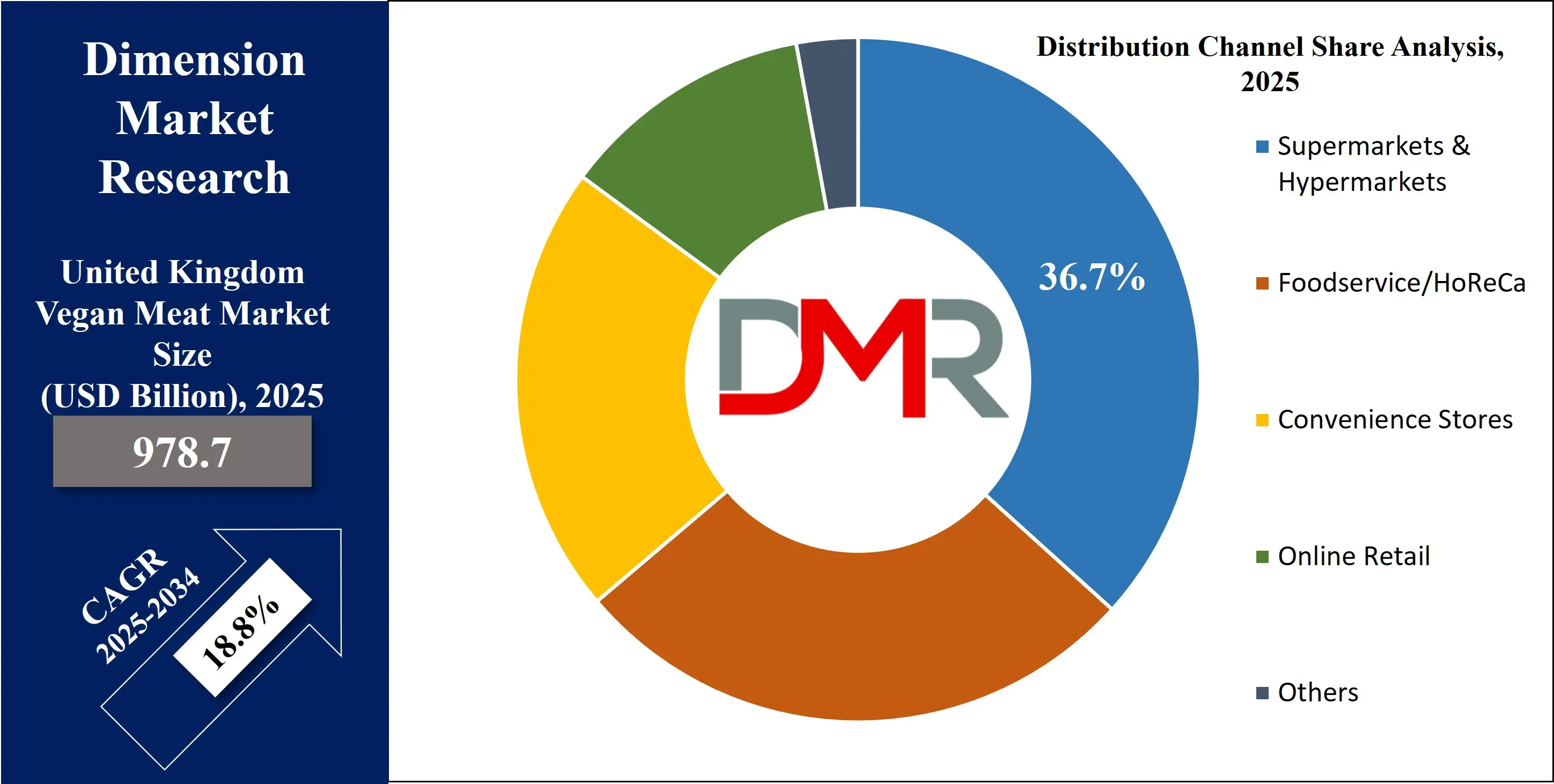

- By Source Analysis: Soy-Based vegan meat products are predicted to hold the largest share in the UK market, accounting for roughly 36.7% of the total market in 2025.

- By Distribution Channel Analysis: Supermarkets and Hypermarkets are projected to be the dominant distribution channels in the UK vegan meat market, representing about 41.2% of the overall distribution in 2025.

- Key Players: Key players in the UK Vegan Meat Market include VBites, Quorn, Meatless Farm, among others.

United Kingdom Vegan Meat Market: Use Cases

- Retail Consumption: Vegan meat products are widely available in supermarkets and specialty stores across the UK, providing consumers with convenient, plant-based protein options for everyday cooking and meal preparation at home.

- Foodservice Industry: Restaurants, cafes, and fast-food chains incorporate vegan meat alternatives into their menus to cater to the growing demand for plant-based meals and appeal to vegan, vegetarian, and flexitarian customers.

- Ready-to-Eat Meals: Packaged vegan meat-based ready meals offer quick, nutritious, and sustainable food choices for busy consumers seeking convenient, meat-free options without compromising on taste or variety.

- Catering and Events: Corporate and private catering services increasingly include vegan meat options in their offerings to accommodate diverse dietary preferences and promote sustainability at conferences, weddings, and social gatherings.

United Kingdom Vegan Meat Market: Stats & Facts

- The Guardian: In 2023, one in three Britons reported reducing their meat consumption, with vegan meat being a common alternative cited.

- BBC News: Sales of plant-based meat products in UK supermarkets grew by 30% between 2019 and 2022.

- The Vegan Society: As of 2022, over 600,000 people in the UK identified as vegan, many of whom regularly purchase vegan meat alternatives.

- Statista: In 2023, the value of the UK meat substitute market was estimated at around £600 million.

- The Independent: Greggs’ vegan sausage roll became one of its best-selling items following its 2019 launch, highlighting strong consumer demand.

- The Times: Tesco committed to increasing its sales of plant-based products by 300% by 2025, citing strong growth in vegan meat.

- Waitrose & Partners Food Report: In 2022, 70% of UK shoppers said they were buying vegan food products, with many listing health and environmental concerns as reasons.

- NHS (via Change4Life campaign): Government-backed health initiatives have encouraged plant-based eating to help reduce heart disease and obesity risks.

- Food Standards Agency (FSA): A 2023 survey showed 16% of UK consumers frequently purchase plant-based meat, with younger demographics leading adoption.

- British Retail Consortium: Major UK retailers have added over 1,000 new plant-based meat products to shelves since 2020 to meet rising demand.

United Kingdom Vegan Meat Market: Market Dynamics

Driving Factors in the United Kingdom Vegan Meat Market

Rising Health Awareness and Lifestyle Shifts

Increasing awareness of the health implications of red meat consumption is significantly influencing consumer preferences in the UK vegan meat market. As people seek healthier lifestyles, there's a growing demand for plant-based protein alternatives rich in fiber and low in saturated fats. Vegan meat products appeal to individuals looking to reduce cholesterol levels and manage weight. The shift towards flexitarian diets, which favor occasional meat consumption, is also contributing to the popularity of meat substitutes. Consumers are increasingly exploring vegan-friendly food options that support cardiovascular health and align with wellness trends. As a result, both retailers and foodservice providers are expanding their offerings of vegan meat alternatives to meet this evolving demand.

Environmental Sustainability and Ethical Concerns

Concerns over environmental impact and animal welfare are strong driving forces in the UK vegan meat market. Consumers are more conscious of sustainable food choices, opting for meat alternatives that contribute to reduced carbon emissions and lower water usage compared to traditional livestock farming. Ethical eating, driven by campaigns and documentaries highlighting factory farming's consequences, encourages the adoption of plant-based diets. Younger generations, particularly Millennials and Gen Z, are leading the shift towards eco-friendly meat substitutes that reflect their values. The rise of climate-conscious consumers and the demand for cruelty-free food products are compelling manufacturers to innovate and invest in environmentally responsible production methods, further propelling the vegan meat industry forward.

Restraints in the United Kingdom Vegan Meat Market

High Cost of Vegan Meat Products

One of the key barriers to wider adoption in the UK vegan meat market is the relatively high price point of vegan meat compared to traditional meat products. Many plant-based meat options involve sophisticated processing and premium ingredients, making them less affordable for average consumers. While interest is growing, price sensitivity still plays a critical role, particularly in lower-income households. The cost of production for meat substitutes, including the use of novel proteins and R&D expenses, is passed on to consumers. This limits market penetration, especially among those not fully committed to a vegan or flexitarian lifestyle. Until economies of scale reduce prices, the affordability challenge will continue to restrain market growth.

Taste and Texture Limitations

Despite technological advancements, many vegan meat alternatives still fall short in replicating the taste and texture of real meat, which deters mainstream adoption. Meat eaters and flexitarians often find that plant-based protein lacks the juiciness or umami flavor of traditional meat, making the transition less appealing. While brands are investing heavily in product innovation, consumer dissatisfaction remains a challenge, especially in products like vegan burgers, sausages, and chicken substitutes. Inconsistent quality and unfamiliar ingredients can reduce the perceived value and culinary satisfaction. This sensory gap continues to hinder the acceptance of vegan meat products among those seeking a seamless substitute for animal-based meat.

Opportunities in the United Kingdom Vegan Meat Market

Technological Innovation in Plant-Based Proteins

Advancements in food technology present significant opportunities for the UK vegan meat market. Companies are investing in alternative protein sources such as pea protein, soy, jackfruit, and even fermented fungi to replicate meat’s texture and flavor more convincingly. Innovation in cellular agriculture and 3D food printing could further enhance the sensory appeal and nutritional value of vegan meat products. As meat analogue technology evolves, manufacturers can create more realistic and diverse offerings, expanding market reach. These developments also align with consumer interest in clean-label, minimally processed plant-based protein products. By leveraging cutting-edge research and production methods, brands can capture growing demand and set themselves apart in an increasingly competitive market.

Expansion across Foodservice and Quick-Service Restaurants

The growing presence of vegan meat on menus at restaurants, cafés, and fast-food chains is creating new growth avenues. Major quick-service brands in the UK are launching plant-based meat options, catering to the surging number of flexitarians and vegan consumers. This accessibility outside retail stores enhances consumer exposure and familiarity with meat substitutes, boosting demand. Partnerships between vegan brands and popular chains also generate consumer trust and trial.

Additionally, as the UK foodservice industry embraces sustainable dining trends, incorporating vegan-friendly food becomes a strategic move. This offers significant potential for expansion in ready-to-eat vegan meals, particularly among urban consumers looking for convenience without compromising ethical or health values.

Trends in the United Kingdom Vegan Meat Market

Clean Label and Minimal Processing Preference

UK consumers are increasingly seeking clean-label vegan meat products with simple, recognizable ingredients. This trend reflects a growing skepticism towards overly processed foods and artificial additives. Shoppers are now looking for plant-based meat alternatives made from whole foods like legumes, grains, and vegetables without excessive flavorings or preservatives.

Transparency in ingredient sourcing, allergen information, and nutritional labeling is becoming a strong purchase driver. This trend also ties into the broader natural and organic food movement. As a result, brands focusing on minimal processing, ethical sourcing, and healthy vegan meat options are gaining traction, especially among health-conscious and environmentally aware consumers in the UK.

Rise of Local and Artisanal Vegan Meat Brands

A growing trend in the UK vegan meat market is the emergence of local and artisanal producers offering innovative and regionally inspired meat substitutes. These small-batch brands focus on authenticity, high-quality plant-based ingredients, and ethical sourcing, appealing to consumers seeking unique and traceable food experiences. With an emphasis on British-made vegan products, these companies are capitalizing on demand for sustainability and local food security.

This aligns with consumer interest in supporting independent, eco-conscious businesses that prioritize flavor, community values, and craftsmanship. As this movement gains traction, it presents competition to mass-market players and expands the diversity of offerings in the UK vegan food sector.

United Kingdom Vegan Meat Market: Research Scope and Analysis

By Product Type Analysis

Vegan Burgers are expected to dominate the United Kingdom vegan meat market, accounting for approximately 32.4% of total market share in 2025. This dominance stems from their wide availability in retail outlets and quick-service restaurants, coupled with their appeal to flexitarians seeking meat substitutes with a familiar taste and texture. Innovations in plant-based protein formulations, particularly those using pea protein and soy protein isolates, have significantly improved the mouthfeel and flavor of vegan burgers.

Additionally, the rise in demand for sustainable food products and ethical consumption habits has propelled this segment forward. Key players in the plant-based protein industry are also focusing their R&D on improving the nutritional profile of these offerings, supporting the segment’s leadership in the broader plant-based meat alternative space.

The Vegan Chicken segment, including nuggets, tenders, and fillets, is projected to grow at the highest CAGR in the United Kingdom’s vegan meat market in 2025. This growth is driven by increasing consumer interest in meat-free, high-protein foods that replicate the texture of poultry. Startups and established food tech companies are investing in extrusion technologies and fermentation processes to closely mimic the fibrous structure of chicken.

Moreover, the rising adoption of clean-label products and allergen-friendly options in alternative meat formats is fueling demand. With growing availability in mainstream foodservice chains and health-conscious parents seeking better lunchbox options, the demand for chicken-style plant-based food continues to climb within the broader cruelty-free food category.

By Source Analysis

Soy-Based vegan meat is projected to dominate the United Kingdom market, capturing approximately 36.7% of the total share in 2025. Its popularity stems from a long-standing presence in plant-forward diets and its versatility across various product forms, including burgers, sausages, and deli slices. Soy protein delivers a high biological value and functional properties such as emulsion stability and chewiness, making it a preferred base in meat analog production.

As consumers increasingly pursue protein-rich vegetarian meals, soy remains a cost-effective and nutritionally dense option. The segment continues to benefit from innovations in meat texture simulation, supported by developments in food processing technologies within the meat substitutes industry focused on sustainable nutrition and environmental responsibility.

The Pea Protein-Based segment is anticipated to grow at the highest CAGR in the UK vegan meat market in 2025. This surge is driven by rising consumer demand for allergen-free and non-GMO plant proteins, particularly among those avoiding soy and gluten. Pea protein isolates provide high digestibility and a neutral flavor profile, allowing for seamless integration into clean-label plant meat products.

With increased interest in functional foods and wellness-centric eating, pea-based formulations are being used in everything from vegan chicken tenders to blended meat replacement products. Moreover, advancements in texturization processes are enhancing sensory characteristics, making pea protein a key driver in the evolution of sustainable protein innovation.

By Distribution Channel Analysis

Supermarkets and Hypermarkets are expected to dominate the United Kingdom vegan meat market, accounting for approximately 41.2 percent of total distribution in 2025. These large-format retailers offer extensive shelf space, competitive pricing, and convenient access to a wide variety of plant-based food products. Strategic placement of vegan meat in both chilled and frozen aisles has helped drive consumer impulse purchases and trial.

The increased visibility of private label plant protein ranges alongside established meat alternative brands supports this dominance. In addition, major grocery chains are expanding their free-from and flexitarian product portfolios, responding to growing interest in climate-conscious and animal-free eating habits. Promotional discounts and in-store tastings have further enhanced shopper engagement with vegan protein choices.

Online Retail is projected to experience the highest CAGR in the United Kingdom vegan meat market by the end of 2025. This growth is fueled by shifting consumer preferences toward digital grocery shopping and the rise of direct-to-consumer models offering plant-based food delivery. E-commerce platforms provide broader access to niche vegan offerings, including gluten-free meat substitutes and high-protein meat analogs.

Subscription-based services and ethical food box schemes are also making it easier for health-focused consumers to explore new cruelty-free innovations. The increasing popularity of functional vegan nutrition and convenience-driven food habits is accelerating the adoption of alternative protein through online retail, supported by targeted marketing and product personalization through data-driven platforms.

The United Kingdom Vegan Meat Market Report is segmented on the basis of the following:

By Product Type

- Vegan Burgers

- Sausages & Hot Dogs

- Vegan Mince & Ground Meat

- Vegan Meatballs

- Vegan Chicken

- Others

By Source

- Soy-Based

- Wheat-Based

- Pea Protein-Based

- Mushroom-Based

- Legume-Based (Lentils, Chickpeas, Beans)

- Jackfruit-Based

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Foodservice/HoReCa

- Convenience Stores

- Online Retail

- Others

Competitive Landscape

The competitive landscape of the United Kingdom vegan meat market is characterized by intense rivalry among established food manufacturers, innovative startups, and global plant-based protein brands. Leading companies such as Beyond Meat, Quorn, and The Vegetarian Butcher are investing heavily in research and development to improve product taste, texture, and nutritional profiles, addressing evolving consumer demands for healthier and more sustainable protein alternatives.

Strategic partnerships and collaborations with retailers and foodservice providers are expanding distribution networks and increasing market penetration. Additionally, emerging players focusing on clean-label ingredients and allergen-friendly formulations are gaining traction, leveraging advances in plant protein extraction and meat analog technology.

Brand differentiation through sustainable sourcing, organic certification, and transparent labeling is becoming critical for consumer loyalty in this rapidly growing segment. Marketing strategies increasingly emphasize ethical consumption, environmental impact reduction, and animal welfare, aligning with shifting dietary preferences toward flexitarian and plant-based lifestyles.

The market is also witnessing increased investment in automated manufacturing processes and product innovation, including hybrid meat blends and novel protein sources like fungi and legumes. Overall, competitive dynamics drive continuous product development, price optimization, and diversified distribution channels, fostering a robust ecosystem that supports premium and mass-market vegan meat offerings in the UK.

Some of the prominent players in the United Kingdom Vegan Meat Market are:

- VBites

- Quorn

- Meatless Farm

- Vivera

- The Vegetarian Butcher

- Squeaky Bean

- VFC (Vegan Fried Chicken)

- Linda McCartney Foods

- Vegan Food Group (VFG)

- Richmond (Kerry Group)

- Plamil Foods

- Ivy Farm Technologies

- Beyond Meat

- Impossible Foods

- Gardein

- The Vegetarian Butcher

- Tofurky

- OZO (Planterra Foods)

- Lightlife (Maple Leaf Foods)

- Alpro

- Oumph

- Beyond Meat

- Other Key Players

Recent Developments

- In April 2025, the Food Foundation hosted its second UK Investor Summit, focusing on reshaping the food system to support health and environmental goals. The event emphasized the role of investors in driving sustainable food strategies.

- In May 2025, Beyond Meat launched its Beyond Steak in the UK for the first time. The product is now available exclusively in 650 Tesco stores across the country. It is made to look, cook, and taste like real beef, but it's 100% plant-based. It also offers 24g of protein per 100g and has low saturated fat, making it a healthier and more sustainable choice for consumers.

- In May 2025, Heura, a plant-based food company based in Barcelona, received USD 22.2 million from the European Investment Bank to expand its technology platform for vegan meat and dairy alternatives. The company, which started in 2017, is developing new methods to improve plant-based foods like cold cuts, cheese, and pasta by increasing protein content, reducing saturated fat, and cutting down on additives. Heura expects to become profitable by the end of 2025.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 978.7 Bn |

| Forecast Value (2034) |

USD 4,602.2 Bn |

| CAGR (2025–2034) |

18.8% |

| Historical Data |

2019 – 2024 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Vegan Burgers, Sausages & Hot Dogs, Vegan Mince & Ground Meat, Vegan Meatballs, Vegan Chicken, Others), By Source (Soy-Based, Wheat-Based, Pea Protein-Based, Mushroom-Based, Legume-Based, Jackfruit-Based, Others), By Distribution Channel (Supermarkets & Hypermarkets, Foodservice/HoReCa, Convenience Stores, Online Retail, Others) |

| Regional Coverage |

The UK |

| Prominent Players |

VBites, Quorn, Meatless Farm, Vivera, The Vegetarian Butcher, Squeaky Bean, VFC (Vegan Fried Chicken), Linda McCartney Foods, Vegan Food Group (VFG), Richmond (Kerry Group), Plamil Foods, Ivy Farm Technologies, Beyond Meat, Impossible Foods, Gardein, The Vegetarian Butcher, Tofurky, OZO (Planterra Foods), Lightlife (Maple Leaf Foods), Alpro, Oumph, Beyond Meat, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The United Kingdom Vegan Meat Market size is estimated to have a value of USD 978.7 billion in 2025 and is expected to reach USD 4,602.2 billion by the end of 2034.

Some of the major key players in the United Kingdom Vegan Meat Market are VBites, Quorn, Meatless Farm, and many others.

The market is growing at a CAGR of 18.8 % over the forecasted period.