Market Overview

The

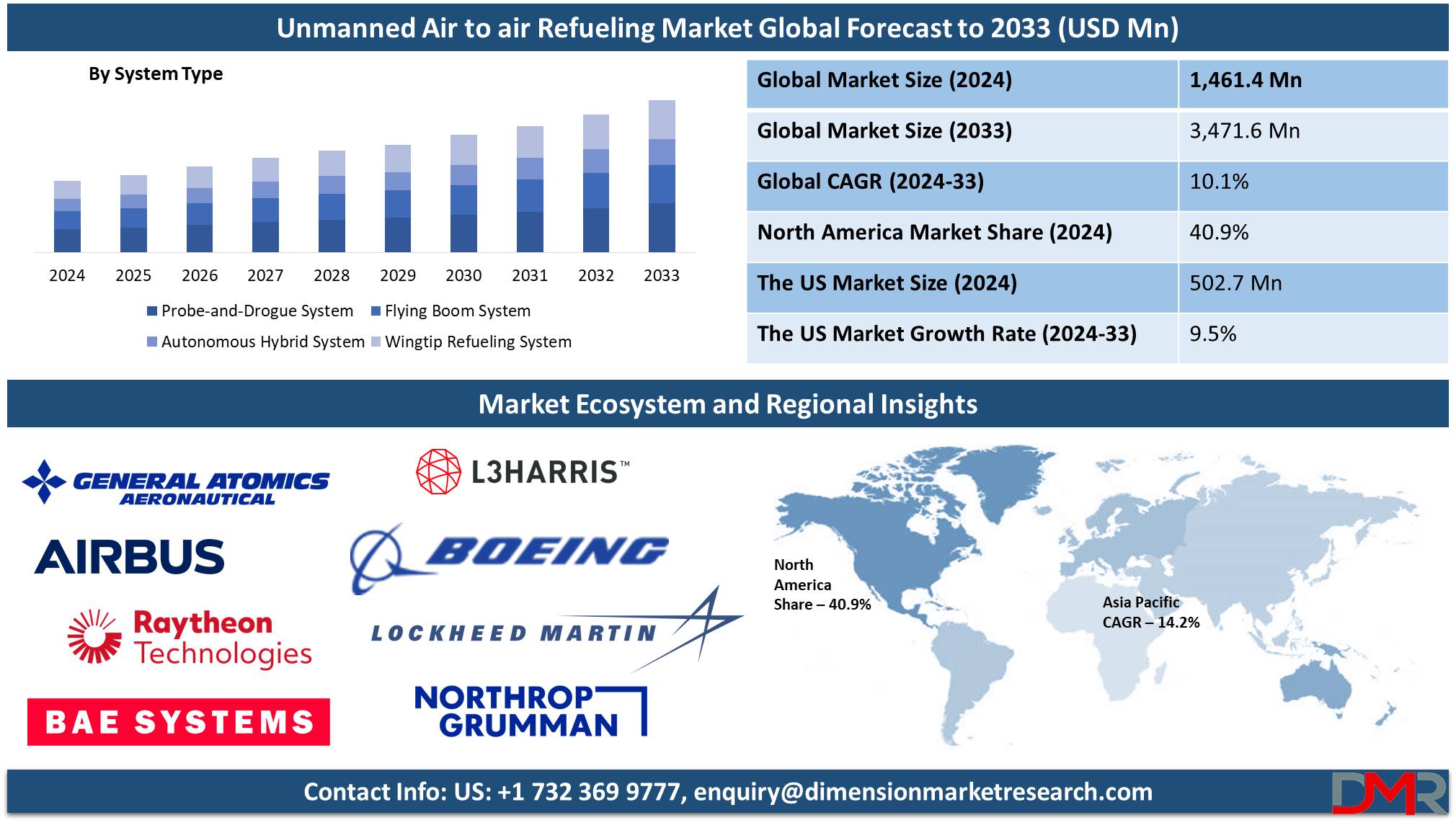

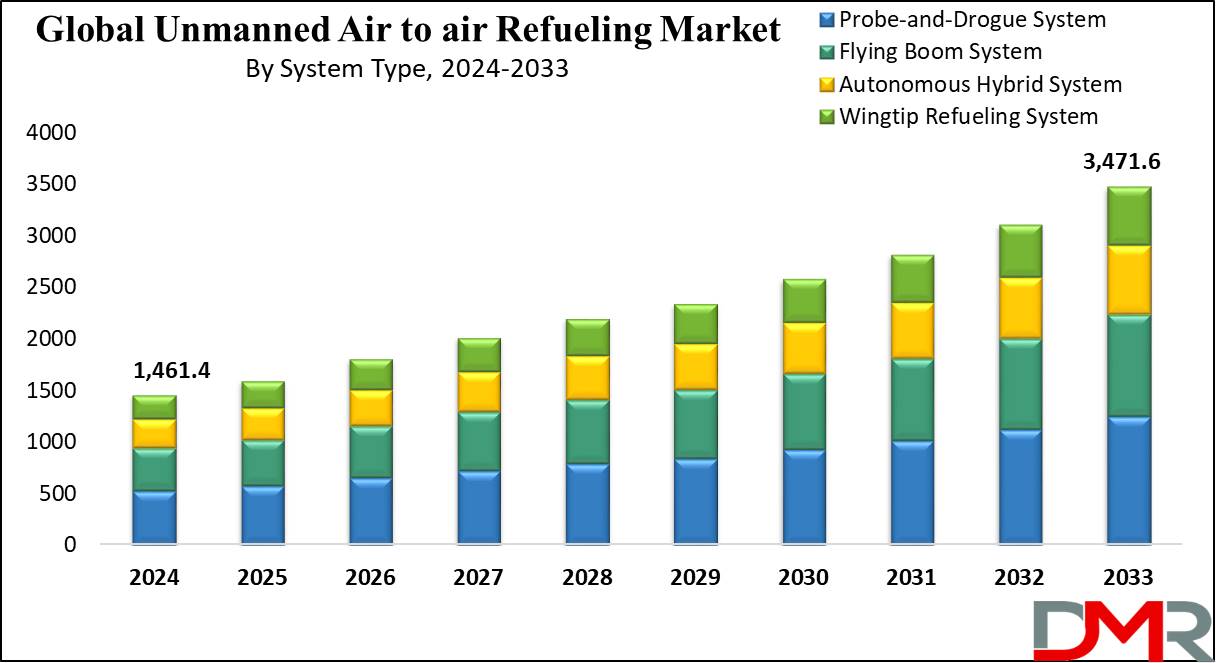

Global Unmanned Air to Air Refueling Market size is expected to reach a

value of USD 1,461.4 million in 2024, and it is further anticipated to reach a market

value of USD 3,471.6 million by 2033 at a

CAGR of 10.1%.

The unmanned air-to-air refueling market is gaining considerable momentum worldwide, amid increasing innovation in military aviation and unmanned systems that continue to change the face of aerial operations. Air-to-air refueling is expected to show strong growth during the forecast period, supported by the rapidly accelerating pace at which autonomous technologies for air-to-air refueling are being adopted.

These systems are fundamentally necessary for expanding the operational range of unmanned aerial vehicles and boosting mission endurance, especially in military applications. Key technologies, such as probe-and-drogue systems and boom refueling systems, are being innovated to cater to assorted operational needs. The growth of the market is lifted by increasing investments in defense modernization programs, coupled with advancements in aviation technology.

The unmanned air-to-air refueling market offers major growing opportunities, especially from the Asia Pacific region. Increasing defense budgets for countries like China, India, and Japan have driven investments toward modernization in their respective air forces and UAV capability expansion. With the demand for more sophisticated UAVs and modern defense strategies, the in-service range extension of unmanned platforms with autonomous refueling systems is gaining vital importance.

Besides, the growing aerospace and defense sector in the region, supported by technological developments, presents the ability for unmanned air-to-air refueling systems to be adopted and thus creates new growth opportunities in the rapidly developing market. AI and the integration of independent systems have transformed the view on air-to-air refueling technologies.

Autonomous refueling operations exclude the need for pilot control. This makes the concept of refueling not only effective but also minimizes human error, something very critical in high-operation missions. For instance, technologies like autonomous boom refueling systems leverage AI algorithms to make changes in real time and avoid obstacles, making refueling processes more precise. As most defense forces worldwide emphasize the incorporation of smart technologies, the future of unmanned aerial refuelings will include highly influential developing technologies upfront, which make the refueling operations much more autonomous, reliable, and efficient.

The first major milestone in the unmanned air-to-air refueling market was reportedly marked by Boeing's MQ-25 Stingray in operational missions for the U.S. Navy. The MQ-25 will be the first system designed to provide mid-air refueling to fighter aircraft, thus extending air missions. The event itself represents a milestone not only in military aviation but also in the unmanned air-to-air refueling sector, a surely welcome omen that in strategic refuelings, the military will be using more and more UAVs in the future. Successful trials and operational deployment have led to similar systems being inducted worldwide into service, thereby driving the growth of the market.

The autonomous refueling capabilities of the MQ-25 Stingray will drive a trend that might influence military aviation strategies across the globe for the next ten years. The air-to-air refueling market benefits from the reliability and efficiency related to long-standing probe-and-drogue systems, which keep the system type segment predominantly in their favor.

It was designed to allow aircraft to connect via a probe to a drogue on the refueling tanker. These refueling systems are highly interoperable across a wide range of military aircraft; hence, they represent a proven solution for global military aviation. Market stability is driven by the widespread adoption of these systems by NATO forces and air forces in the Middle East, Asia, and Europe. Besides, their simplicity, versatility, and low cost of implementation make these systems alluring to global air forces.

Integration into military aircraft with aerial refueling systems makes the probe-and-drogue systems assure high operational efficiency with minimal downtime and increased aircraft range, hence becoming an essential strength for the unmanned air-to-air refueling market. Their continued dominance underlines a resilient market segment supported by ongoing technological enhancements. Poor growth despite promising trajectory is due to several restraints to the adoption of unmanned air-to-air refueling systems.

Some of the major restraints include high R&D costs. Indeed, huge investments in this direction will be needed to develop reliable, safe, efficient autonomous refueling technologies. The development of UAV refueling systems requires bespoke components, advanced software integration, and extensive testing factors driving up the costs. Besides, very strict aviation safety regulations put in place by authoritative agencies such as the FAA and EASA ensure that every UAV refueling system maintains operational safety at the highest level.

These regulations, while essential for the safety of people's lives, also add to the time needed for product certification and in turn to market readiness. Overcoming such additional challenges will require ongoing technological advances coupled with cooperation between the private sector and governments.

In 2023, U.S. jet fuel consumption increased for the third consecutive year, averaging 1.65 million b/d but was still 5% below the pre-pandemic peak in 2019. The volume of airline passengers exceeded that in 2019, but U.S. aviation operations had not yet fully recovered due to lower activity by foreign carriers, reduced air freight, and gains in fuel efficiency within the commercial fleet.

Recoveries in consumption of jet fuel have been more sluggish than for other liquid fuels since 2020 compared to the low-consumption year of 1985. The pandemic caused a dramatic decline in air travel, and recoveries were further constrained by labor shortages in the aviation sector and high prices for fuel. By 2023, these constraints had mostly been resolved, but jet fuel consumption growth continued at a more sluggish rate.

Jet fuel consumption in the United States is dominated by three main industries: commercial aviation at 85%, general aviation at 8%, and military/government aviation at 7%. Commercial aviation includes passenger airlines and freight carriers, clearly the largest consumers. Lighter flying comprises general aviation from recreational and business flying. Military and government use are representative of aviation activities conducted by the public sector. As such, recovery in jet fuel consumption could be seen to mimic changes to dynamic markets and efficiency improvements across these various classes.

The US Unmanned Air-to-Air Refueling Market

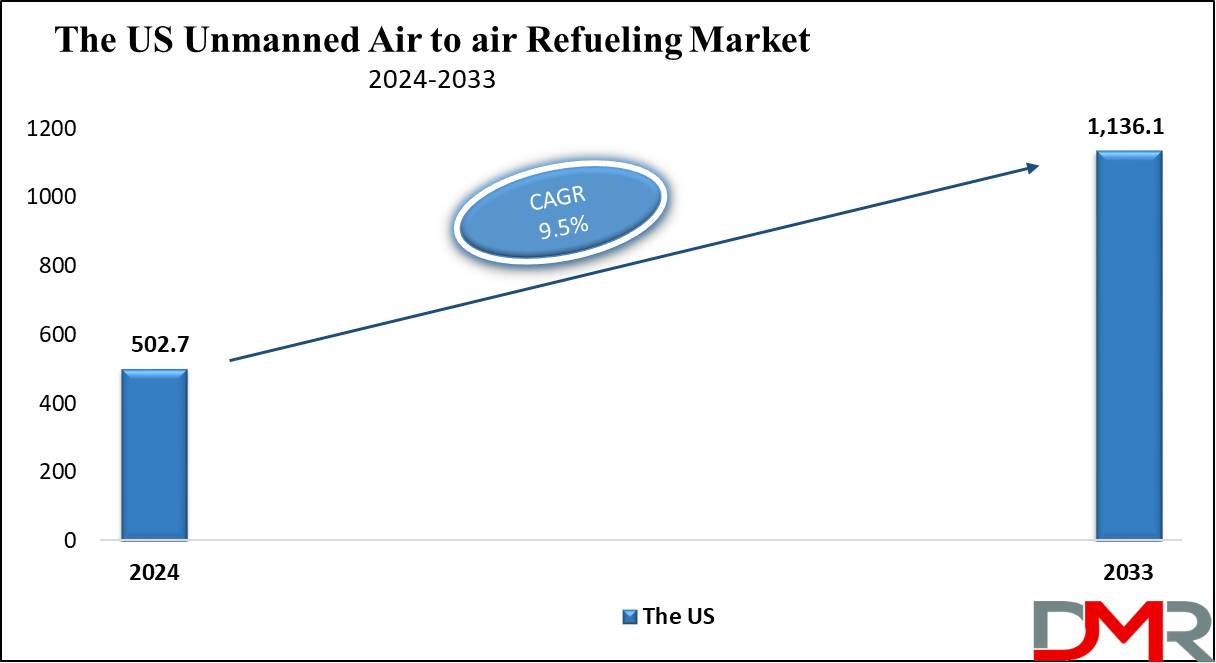

The US Unmanned Air to Air Refueling Market is projected to be valued at USD 502.7 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,136.1 million in 2033 at a CAGR of 9.5%.

It is because of the significant advancements of progressive, autonomous refueling technologies and massive investment in military aviation modernization that the US leads the unmanned air-to-air refueling market globally. The U.S. Department of Defense places regular emphasis on advanced aerial refueling system development, ensuring unmanned aircraft and combat aircraft maintain long-term operational superiority.

Key emerging trends are applications involving the use of AI to improve accuracy during fuel transfer operations. This development enhances mission success rates while reducing operational risks. Other key trends involve probe-and-drogue systems and boost refueling technologies deployed for various mission requirements.

Innovation by leading industry players like Boeing, Northrop Grumman Corporation, and Lockheed Martin Corporation in autonomous refueling systems thus gives an edge to the U.S. market. For instance, the successful autonomous refueling of fighter jets by Boeing's MQ-25 Stingray has marked a few important milestones, thus ensuring the leadership of the country in the sector. Growing defense budgets and government initiatives are another support for the growth of the air refueling market.

Diligent testing and adoption by the U.S. Air Force have also developed the capability of integration seamlessly with existing fleets by adding refueling pods along with advanced components. There is greater engagement of UAVs by different armed forces for combat, surveillance, and reconnaissance missions, which places additional demand on UAVs to be equipped with reliable and efficient refuel systems. This demand underlines the critical role of the U.S. in shaping the future of the air-to-air refueling market and therefore positions the country as a key driver of growth in the global market.

Unmanned Air to air Refueling Market: Key Takeaways

- Global Growth Rate: The Global Unmanned Air to Air Refueling Market size is estimated to have a value of USD 1,461.4 million in 2024 and is expected to reach USD 3,471.6 million by the end of 2033.

- The US Market Size: The US Unmanned Air to Air Refueling Market is projected to be valued at USD 502.7 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,136.1 million in 2033 at a CAGR of 9.5%.

- Regional Analysis: Global Unmanned Air to Air Refueling Market with a share of about 40.9% in 2024.

- Key Players: Some of the major key players in the Global Unmanned Air to air Refueling Market are Boeing, Lockheed Martin Corporation, Airbus SE, Northrop Grumman Corporation, General Atomics Aeronautical Systems Inc., Raytheon Technologies Corporation, and many others.

- Global Growth Rate: The market is growing at a CAGR of 10.1 percent over the forecasted period.

Unmanned Air to air Refueling Market: Use Cases

- Extended Range for UAV Missions: Enables UAVs to operate in remote and hostile regions by refueling mid-air, increasing mission range, and reducing the need for ground-based support.

- Enhanced Military Combat Capabilities: Provides fuel to fighter jets and combat UAVs during missions, ensuring uninterrupted operations and sustained aerial superiority.

- Disaster Relief Operations: It fuels fighter jets and combat UAVs on missions, maintaining operations without interruptions and ensuring continuous aerial superiority.

- Maritime Surveillance: Prolongs the endurance of UAVs in monitoring coastlines and maritime borders, something very important for national security and anti-piracy efforts.

Unmanned Air to air Refueling Market Dynamic

Trends in Unmanned Air to air Refueling Market

Rise of Autonomous Refueling SystemsThe integration of AI and autonomous systems in Unmanned Air-to-Air Refueling presents a market where significant technological changes are happening. Such innovations allow for precision and efficiency in refueling to be delivered even without human interference, which could mitigate risks of human error and operational delays far better.

Advanced sensors and algorithms are used by AI-driven systems to optimize fuel transfers under all conditions as far as safety is concerned, even during adverse weather conditions or high-speed maneuvers. Notable programs include DARPA's AAR project and the MQ-25 Stingray setting benchmarks in operational efficiency. It is expected that developments of this nature will emerge as a key factor in meeting the surging demand for high-precision, reliable refueling systems during the forecast period.

Increased Adoption of UAVs for Military Refueling

Military operations using UAVs have significantly enhanced the need for mid-air refueling to extend their working area. For example, reconnaissance drones and combat drones rely on aerial refueling to maintain flights over very long missions. Programs such as the X-47B UCAS-D by Northrop Grumman and the MQ-25 Stingray are evidence of the growing focus on equipping UAVs with aerial refueling capabilities. While the deployment of UAVs in conflict areas is on the rise, their coupling with continuous improvement of technologies for autonomous refueling is sure to add to market growth significantly shortly.

Growth Drivers in Unmanned Air to air Refueling Market

Rising Defense Budgets and Modernization Programs

Global defense expenditure was showing growth, increasingly in the US, China, and India, due to geopolitical conflict and security threats. This increasing trend in defense budgets is encouraging investments in air fleet modernization, along with unmanned air-to-air refueling systems. Several defense modernization programs are looking to foster innovations such as autonomous refueling pods and boom refueling systems to extend missions and become responsive in combat operations more quickly. Strategic investments across these lines will enforce strong demand for refueling technologies and further support the air-to-air refueling market size throughout the forecast period.

Need for Extended Range in Combat Operations

Equally, the need to project airpower over awfully long distances in modern warfare makes certain aspects of aerial refueling very critical. The unmanned refueling system is so designed to extend the radius of operational combat aircraft, transport planes, and UAVs with continued mission capability without the need to make landings often for refueling purposes. With several armed forces around the world relying on long-range strike capabilities and surveillance missions, aerial refueling acts as a strategic asset. Driven by this factor, the trend is likely to continue having a pivotal effect on shaping the dynamics of the global market over several years.

Growth Opportunities in Unmanned Air to air Refueling Market

Emerging Markets in Asia-Pacific and Middle East

Growing defense expenditure coupled with rising geopolitical tensions has facilitated rapid growth in military aviation in the APAC and Middle East regions. Increased investments are being witnessed in acquiring and developing advanced aerial refuelings for improving strategic air capabilities by countries such as India and China, among others, in APAC and Saudi Arabia from the Middle East region.

Besides, the increasing proliferation of UAVs, coupled with the adoption of autonomous refueling technologies in these regions, is a very good opportunity for the global market players; this is how revenue streams can be generated. Moreover, the moves by various governments to export more to boost indigenous defense production also increase the prospects for higher growth in such markets.

Advancements in Sustainable Fuels and Refueling Technology

Facing growing environmental concerns, the spotlight has shifted toward sustainable aviation fuel, better known as SAF, biofuels, and synthetic fuels. Developments in this field fall in line with international ambitions to diminish carbon emissions while increasing the efficiency of aerial refueling systems. Coupled with energy-efficient designs, advancements in lightweight refueling pods and materials are likely to offer sustainable and cost-effective refueling solutions. These factors are expected to open new avenues shortly for market expansion.

Restraints in Unmanned Air to air Refueling Market

High Initial Costs and Technological Complexities

It requires huge investments in money and advanced technical expertise for development and deployment. Autonomous Refueling Pods, AI controls, and Lightweight Boom will require heavy investment to undertake research and production. The high-cost aspect is a barrier to the less endowed countries' weaker defense budgets. Besides, their integration into currently existing planes in the military needs serious reworking, further inflating costs and discouraging the widespread adoption of such technologies in some regions.

Regulatory and Safety Concerns

In particular, air refueling activities combined with unmanned systems remain one of the highly regulated areas concerning regulatory frameworks and safety. Most of the time, the need to make sure that the design and manufactured products meet these regulations contributes to delaying the process of development and deployment related to refueling systems, especially in civil aviation. Safety issues involve mid-air collision, fuel spillage, and possible cybersecurity vulnerabilities within the autonomous system. All these issues require solid testing and certification that will minimize or eliminate risks, thus slowing down a possible rapid adoption rate for this market.

Research Scope and Analysis

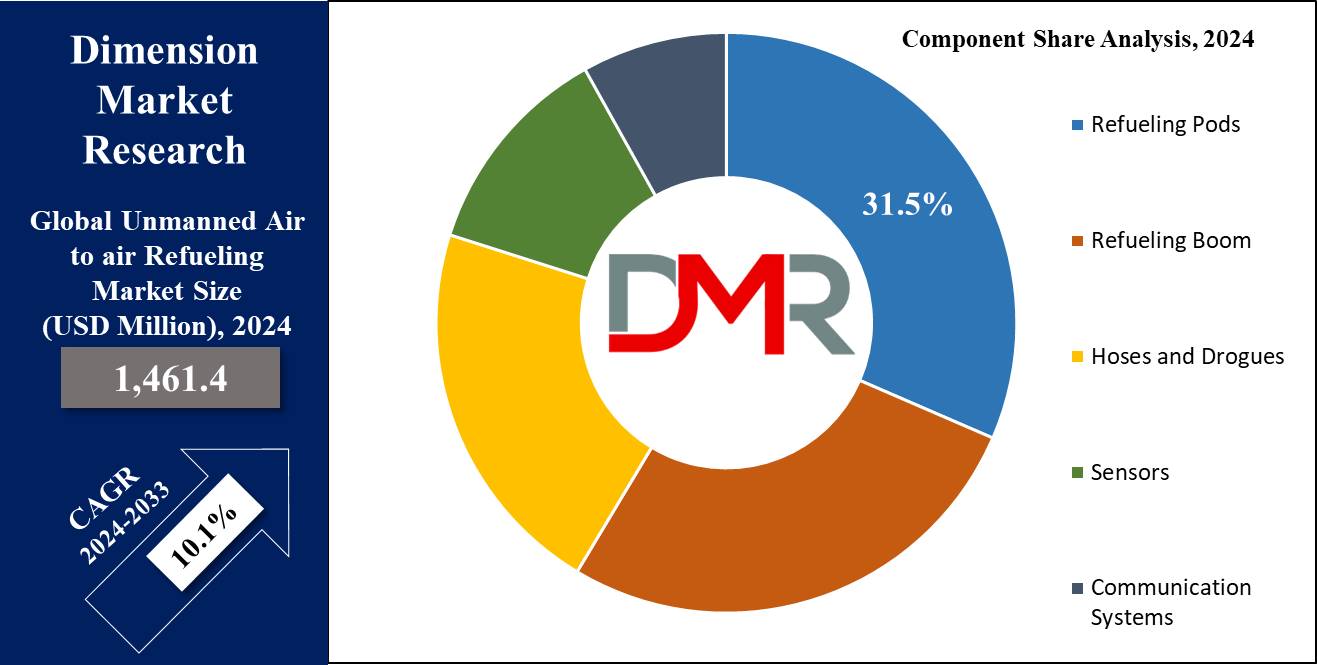

By Component Analysis

The refueling pods segment is projected to lead the component segment in the unmanned air-to-air refueling market as it holds 32.5% of the market share in 2024 due to aspects like versatility, efficiency, and a lot of significance in refueling. The pod gives room for storing fuel and transferring it from the tanker to the receiving aircraft to make operations continuous in different aerial missions. Their modularly designed architecture greatly allows integration with a wide range of platforms, including unmanned aerial vehicles (UAVs), fixed-wing aircraft, and rotary-wing aircraft.

Advanced sensors and communication systems installed in the refueling pods make the fuel delivery very accurate under bad weather conditions. One of the main reasons it is dominating the market is that it can be adapted to work with both probe-and-drogue and boom refueling systems, thus making them irreplaceable in many types of refueling missions. This, in turn, reduces the logistical headache of keeping components specific to different systems.

This refinement in refueling pods kept on improving with technological advances in lightweight materials and aerodynamically actionable designs for better efficiency, reducing drag to ultimately achieve better fuel economies during missions. Major players in the market, such as Cobham Limited and Boeing, have developed state-of-the-art refueling pods to increase fuel capacity and integrate safety features into them. Autonomous aerial refueling systems presently form an increasing trend in military aviation, which marks the importance of refueling pods.

With continued drive by defense agencies for operational readiness and cost efficiency, refueling pods indeed remain a preferred choice for their reliability and proven performances. Their widespread use in ongoing programs, such as the MQ-25 Stingray, underlines their key role in shaping the future of unmanned air-to-air refuelings worldwide.

By System Type Analysis

In the unmanned air-to-air refueling market, the probe-and-drogue system is anticipated to dominate this segment type with 36.0% of the market share in 2024 driven by its ease, economics, and versatility. It finds wide application in many nations because this is one of the common systems that are being widely used for unmanned refueling operations owing to multiple aircraft-type compatibilities and operational ease. Dynamic aerial refueling environments find this highly maneuverable system consisting of a flexible hose with a drogue at its end.

Having a lightweight, compact design further reduces the overall payload burden on a tanker aircraft; hence, this becomes an ideal choice for the refueling of UAVs. The probe-and-drogue system supports multirole operations whereby several aircraft can refuel simultaneously, which is a critical requirement within big missions including military applications. Its ability to integrate with fixed-wing aircraft and rotary-wing platforms widens the system's applicability even further.

Another advantage is its relatively low cost of upkeep compared to boom refueling systems; hence, the reason budget-conscious defense agencies find it highly attractive. Technological improvements in the system's reliability and precision have improved its ability to perform refueling activities in adverse weather or during high-speed flights.

For instance, major players like Cobham Limited and Airbus have developed the probe-and-drogue system to be integrated with high-end communication and sensor technologies, hence enabling safe and efficient fuel transfer. Also, its operational effectiveness in both combat and non-combat use segments has established its supremacy in the air-to-air refueling market, with wide acceptance in important markets like North America, Europe, and the Asia-Pacific region.

By Fuel Type Analysis

Jet A fuel dominates the fuel type segment in the unmanned air-to-air refueling market due to its widespread availability, compatibility, and superior performance characteristics. Used extensively in military and commercial aviation, Jet A is a kerosene-based fuel known for its high energy density and efficient combustion, making it an ideal choice for refueling operations. Jet A's compatibility with both unmanned aerial vehicles (UAVs) and conventional aircraft contributes significantly to its dominance. Its stable properties ensure reliable performance under diverse operational conditions, including extreme altitudes and temperatures.

Additionally, Jet A's widespread use in NATO countries and its compliance with international aviation standards simplify logistics and reduce operational complexities for defense forces. Leading manufacturers have also optimized refueling systems to handle Jet A fuel efficiently, further supporting its adoption.

The growing demand for long-range UAVs and combat aircraft capable of extended missions has boosted the use of jet A fuel in aerial refueling operations. Its ability to deliver consistent performance and maximize flight endurance aligns perfectly with the evolving needs of modern military aviation. Moreover, the cost-effectiveness of Jet A compared to alternative fuels makes it a preferred choice for defense agencies focusing on operational efficiency without compromising mission capabilities. As the global aviation industry prioritizes sustainability, advancements in synthetic and bio-jet fuels are being integrated into Jet A formulations, ensuring its relevance during the forecast period. This adaptability and widespread usage make Jet A the dominant fuel type in the air refueling market size.

By Aircraft Type Analysis

Fixed-wing aircraft are anticipated to dominate the segment type in the unmanned air-to-air refueling market due to their operational versatility, superior range, and wide military and defense usage. The aircraft plays a crucial role in both the tanker and receiver roles toward providing the required capability of extended missions and thereby supporting a wide range of military aviation needs. Fixed-wing platforms are better suited for mid-air refueling when considering issues of speed and endurance at high altitudes, such as tanker aircraft-e.g., KC-135 Stratotanker and KC-46 Pegasus-and fighter jets-e.g., F-35 and F-22. These designs are capable of carrying large fuel loads and advanced refueling systems, including probe-and-drogue and boom refueling, pivotal in unmanned aerial refueling missions.

Compatibility with mission types that range from reconnaissance and combat to transport further cements the dominance of a fixed-wing aircraft. For instance, military transport planes, the likes of which are the C-130 Hercules, would usually draw on mid-air refueling to reach distances farther than would normally be possible, especially in zones that are uncrossable or hostile. Innovations in autonomous refueling capabilities and aerial refueling systems also further solidify the placement of fixed-wing platforms.

They are primarily preferred in joint operations where interoperability among various aircraft types is of paramount importance. Fixed-wing UAVs, such as the MQ-25 Stingray, are increasingly part of unmanned refueling operations due to the growing importance this segment assumes. Considering the fact that global military budgets focus on enhancing their aerial capabilities, fixed-wing aircraft remain at the corner of air-to-air refueling operations. It continues to drive the air refueling market during the forecast period.

The Unmanned Air to air Refueling Market Report is segmented on the basis of the following

By Component

- Refueling Pods

- Refueling Boom

- Hoses and Drogues

- Sensors

- Communication Systems

By System Type

- Probe-and-Drogue System

- Flying Boom System

- Autonomous Hybrid System

- Wingtip Refueling System

By Fuel Type

By Aircraft Type

- Fixed Wing

- Fighter Aircraft

- Tanker Aircraft

- Military Transport Aircraft

- Reconnaissance Aircraft

- Unmanned Aerial Vehicles (UAVs)

- Rotary Wing

- Attack Helicopters

- Transport Helicopters

Regional Analysis

North America is projected to dominate the unmanned air-to-air refueling market, driven by advanced technological capabilities, high defense budgets, and a robust military aviation sector. The region's dominance is further bolstered by the presence of major players like Boeing, Lockheed Martin, and Cobham Limited, which spearhead innovation and supply chains for aerial refueling systems.

The United States, in particular, leads global defense expenditure, allocating significant resources to air-to-air refueling capabilities. Programs such as the MQ-25 Stingray for autonomous refueling underscore the region's commitment to maintaining aerial superiority. The integration of unmanned aerial refueling into military operations reflects the U.S. Department of Defense’s focus on enhancing mission flexibility and combat readiness.

North America's dominance is also attributed to a strong demand for fixed-wing aircraft, including tanker platforms like the KC-46 Pegasus, widely used in both manned and unmanned refueling operations. The region’s emphasis on adopting cutting-edge technologies, such as AI-powered autonomous refueling systems, further cements its leadership in the air refueling market size.

Geopolitical factors, including NATO alliances, amplify North America's role in providing refueling capabilities for allied nations, ensuring interoperability and joint mission success. Additionally, the growing use of UAVs in surveillance and combat applications has accelerated the adoption of unmanned refueling technologies in the region. As the market continues to expand, North America remains the epicenter of innovation and growth, driven by a focus on advancing military aviation capabilities during the forecast period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The unmanned air-to-air refueling market features a competitive landscape driven by technological advancements and strategic partnerships among key players. Major companies, such as Boeing, Lockheed Martin, Cobham Limited, and Airbus S.A.S., play a pivotal role in shaping the air-to-air refueling market size through continuous innovation in refueling systems and autonomous technologies.

Boeing leads with its cutting-edge MQ-25 Stingray program, designed to provide autonomous refueling capabilities for the U.S. Navy. Similarly, Lockheed Martin integrates its expertise in military aviation with advanced unmanned systems, ensuring interoperability across various platforms. Cobham Limited remains a significant player with its innovative probe-and-drogue systems, widely adopted by air forces worldwide.

Smaller companies, such as Draken International and Parker Hannifin Corp, contribute to the ecosystem by specializing in auxiliary components, such as fuel tanks, nozzles, and pumps. Their focus on lightweight materials and efficiency ensures competitive differentiation.

Strategic collaborations and government contracts dominate the market's growth strategy. For instance, partnerships between defense forces and aerospace companies drive innovation and ensure steady demand during the forecast period.

Some of the prominent players in the Global Unmanned Air to air Refueling Market are

- Boeing

- Lockheed Martin Corporation

- Airbus SE

- Northrop Grumman Corporation

- General Atomics Aeronautical Systems, Inc.

- Raytheon Technologies Corporation

- BAE Systems plc

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Cobham Limited

- Draken International, LLC

- Israel Aerospace Industries (IAI)

- Other Key Players

Recent Developments

- November 2024: Boeing announced the successful trial of the MQ-25 Stingray with a full refueling load for extended UAV missions.

- October 2024: Airbus revealed advancements in autonomous boom refueling systems, enhancing efficiency for multi-mission platforms.

- August 2024: Cobham Limited secured a contract to supply advanced probe-and-drogue systems for the European military aviation fleet.

- June 2024: Lockheed Martin introduced an AI-driven refueling software, improving accuracy in UAV-to-UAV refueling.

- May 2024: Draken International expanded its services to include UAV refueling trials for NATO allies.

- February 2024: Safran partnered with the U.S. Air Force for next-generation lightweight refueling pods.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 1,46.4 Mn |

| Forecast Value (2033) |

USD 3,471.6 Mn |

| CAGR (2024-2033) |

10.1% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 226.7 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Refueling Pods, Refueling Boom, Hoses and Drogues, Sensors, and Communication Systems), By System Type (Probe-and-Drogue System, Flying Boom System, Autonomous Hybrid System, and Wingtip Refueling System), By Fuel Type (Jet A, Jet A-1, and Jet B), By Aircraft Type (Fixed Wing, and Rotary Wing) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Boeing, Lockheed Martin Corporation, Airbus SE, Northrop Grumman Corporation, General Atomics Aeronautical Systems Inc., Raytheon Technologies Corporation, BAE Systems plc, L3Harris Technologies, Inc., Leonardo S.p.A., Cobham Limited, Draken International LLC, Israel Aerospace Industries (IAI), and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Unmanned Air to Air Refueling Market size is estimated to have a value of USD 1,461.4 million in 2024 and is expected to reach USD 3,471.6 million by the end of 2033.

The US Unmanned Air to Air Refueling Market is projected to be valued at USD 502.7 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,136.1 million in 2033 at a CAGR of 9.5%.

North America is expected to have the largest market share in the Global Unmanned Air to Air Refueling Market with a share of about 40.9% in 2024.

Some of the major key players in the Global Unmanned Air to air Refueling Market are Boeing, Lockheed Martin Corporation, Airbus SE, Northrop Grumman Corporation, General Atomics Aeronautical Systems Inc., Raytheon Technologies Corporation, and many others.

The market is growing at a CAGR of 10.1 percent over the forecasted period.