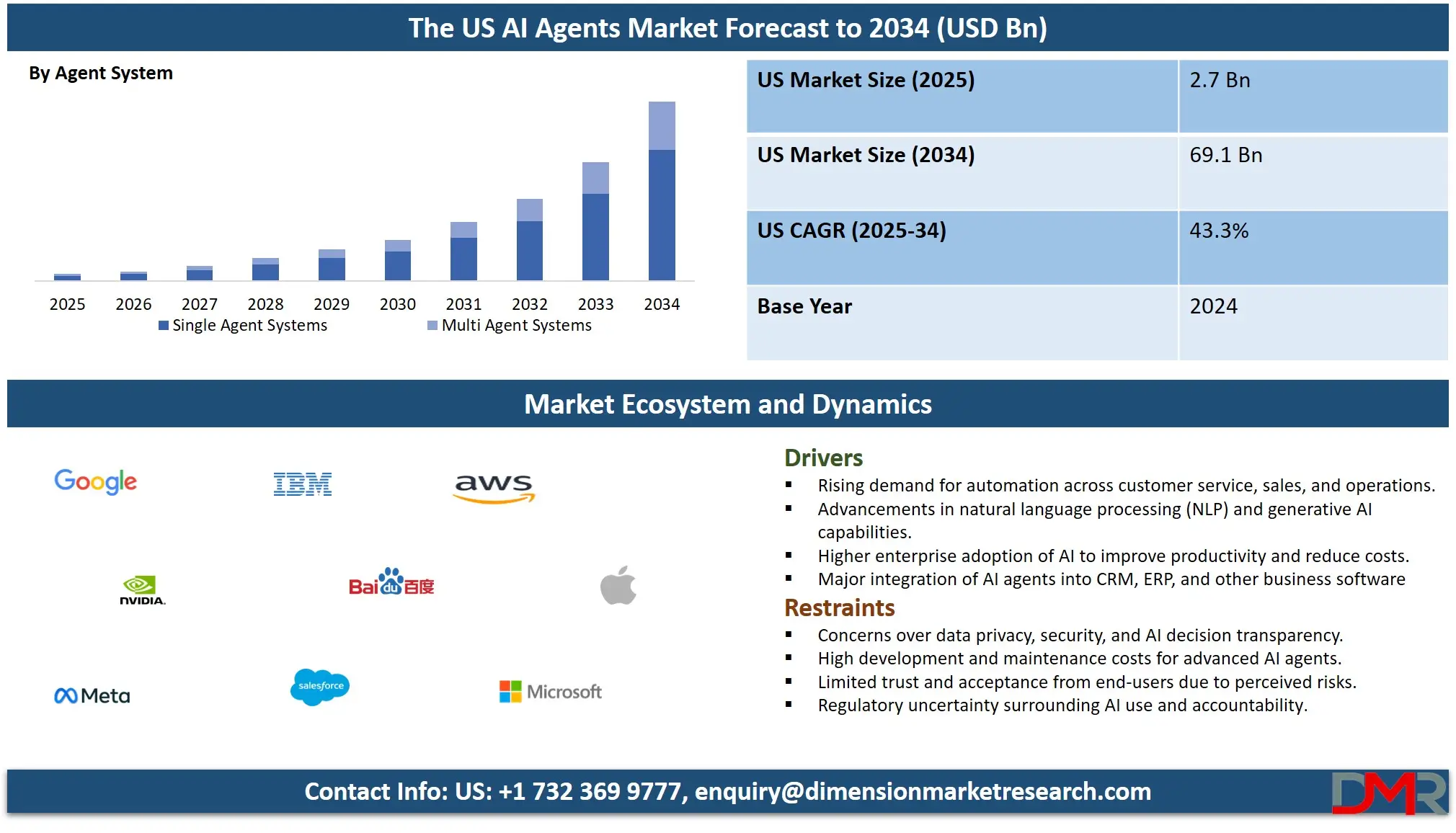

The U.S. AI Agents Market size is projected to reach USD 2.7 billion in 2025 and grow at a compound annual growth rate of 43.3% from there until 2034 to reach a value of USD 69.1 billion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

AI agent adoption has progressed rapidly as a trend throughout the US during recent years. The adoption of these agents by numerous organizations began in 2024 for multiple operational functions. McKinsey and Deloitte, apart from other consulting organizations, developed proprietary AI solutions that facilitate workers' research and analytics operations. These work tools provide enhanced effectiveness to job performers, yet nations remain uncertain about the resulting job loss patterns in future times.

The investments from large technology companies remain significant for developing AI agents. Microsoft devotes its resources to developing AI agents that will perform duties in sales and customer support alongside accounting functions. Meta dedicates resources to building AI infrastructure, which enables applications of business messaging and advertising. AI agents have gained a prominent role in organizational operations because companies make significant financial commitments to these technologies.

Different businesses now implement AI agents in their operations. Many healthcare facilities have embraced AI agents as part of their initiative to enhance medical services and anticipate patient illnesses. Retailers enhance their sales by using AI agents to deliver customized shopping experiences to customers. AI agents operate in finance for both fraud detection and risk management. The application of these agents assists manufacturers with predictive servicing operations, which minimizes operational delays while reducing operational expenses.

AI agent development receives substantial financial backing for its advancement. Generative AI technologies accounted for most of the substantial AI funding that the US hosted during 2024. The obtained financial resources have enabled the development of novel AI tools and platforms that simplify AI agent adoption for companies. Companies face difficulties when they try to implement these agents because they need modifications in their system infrastructure, combined with employee training requirements.

The U.S. AI Agents Market: Key Takeaways

- Market Growth: The AI Agents Market size is expected to grow by USD 65.3 billion, at a CAGR of 43.3%, during the forecasted period of 2026 to 2034.

- By Agent System: The single agent systems segment is anticipated to get the majority share of the AI Agents Market in 2025.

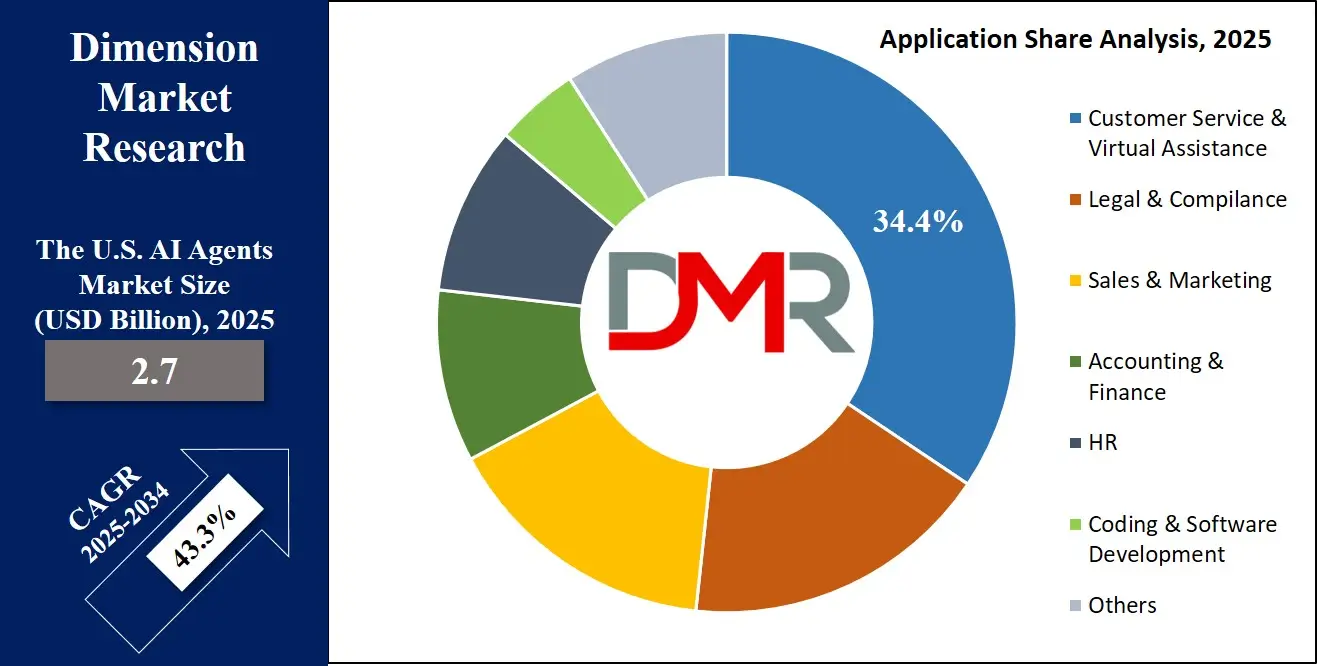

- By Application: The customer services & virtual assistance segment is expected to get the largest revenue share in 2025 in the AI Agents Market.

- Use Cases: Some of the use cases of AI Agents include sales assistance, healthcare support, and more.

The U.S. AI Agents Market: Use Cases:

- Customer Support Automation: AI agents operate by providing real-time support for customer inquiries that users access through different modes, including chat applications and email, and voice communications. These systems operate nonstop across all hours to support customers while reducing waiting periods, which results in better satisfaction outcomes. Through previous sessions, these agents acquire knowledge to produce higher-quality outputs in subsequent conversations.

- Sales Assistance: The sales team gets help from AI agents for the execution of regular duties, including meeting scheduling, email drafting, and contact management tasks. The system uses customer information to recommend potential clients along with suitable business approaches. Human representatives who staff the company can concentrate on sales activities and foster personal connections instead of manual administration.

- Healthcare Support: Hospital and clinic treatment facilities employ AI agents for managing appointments, together with patient admission procedures and medical information evaluation. By examining records and patterns, AI agents enable faster detection of health risks for physicians. The system enhances patient services and creates efficiency within administrative duties.

- Internal Workflow Automation: AI agents operate within many businesses to automate inside tasks, which include employee processing and data management along with report preparation. The automated system decreases human errors and works faster compared to manual operations. Such systems enable team collaboration through automatic information organization and performance alert creation.

Stats & Facts

- Bank of America estimated that AI agents will contribute a staggering USD 15.7 trillion to the global GDP, emphasizing their transformative impact on the global economy.

- As per HSO, AI-driven predictive maintenance has reduced downtime by 40% in manufacturing, leading to significant cost savings and improved operational efficiency.

- According to Forbes, financial institutions using AI agents for fraud detection and risk assessment have reported a 38% increase in profitability, demonstrating AI’s ability to enhance financial security and decision-making.

- As per Odin AI, AI agents are transforming HR processes by cutting resume screening time by 75%, allowing HR professionals to focus on strategic hiring, and boosting lead generation by up to 50% in businesses.

- According to AllaboutAI, the United States leads global AI discussions with over 150,000 mentions, followed by India (80,000), the United Kingdom (60,000), Canada and Japan (40,000 each), Germany (30,000), France (25,000), Spain (20,000), Australia (18,000), and Nigeria (10,000), indicating significant global interest in AI applications.

- In addition, X (formerly Twitter) dominates AI conversations with 96% of mentions (235,281), while Reddit (3%, 7,412 mentions) fosters deeper discussions, Instagram (1%, 1,668 mentions) focuses on visual engagement, and platforms like Tumblr (959 mentions) and Facebook Public (650 mentions) contribute to broader community engagement.

- As per Exploding Topics, by 2025, an estimated 97 million people will be working in the AI sector, reflecting its rapid expansion and influence on global employment.

- In addition, AI is a top business priority for 83% of companies, highlighting its increasing role in digital transformation and corporate innovation.

- Further, Netflix generates approximately USD 1 billion annually through AI-powered personalized recommendations, showcasing AI’s impact on content consumption and customer engagement.

Market Dynamic

Driving Factors in The U.S. AI Agents Market

Rising Demand for Workplace Automation

The US AI agent market constantly grows due to growing business requirements for the automation of repetitive workplace tasks. The adoption of basic workplace functions by AI agents happens as companies desire productivity increases and reduced operational expenses. These technology-based agents allow organizations of different scales to benefit from high-speed operations at reduced supervision requirements.

The finance as well as healthcare industries, and customer support services currently adopt AI agents to support their workforce. Organizations have raised their interest in these tools because they need to enhance operational efficiency and preserve quality standards. These tools provide businesses with a solution for operational demand, so they do not need to bring in additional personnel. The AI agent market grows continuously because of substantial automation push factors.

Improved AI Capabilities and Infrastructure

The US AI technology sector and infrastructure advancement rate stand as a major element driving market expansion. AI agents demonstrate advanced intelligence through better

natural language processing and

machine learning models, which allow them to understand both contextual meaning and sentiments and underlying objectives. These agents benefit from modern cloud computing and edge computing systems through fast operation abilities and large-scale operation potential.

Organizations can integrate their AI agents across their departments with minimal hardware needs and without requiring complicated IT infrastructure. The technological advancement has enabled AI agents to become available to organizations of different sizes, like both small startups and large establishments. The market has received a boost because developers can now access simpler platforms to develop and train AI agents for precise work assignments. The market advances because technological advancements remove obstacles while creating new business opportunities.

Restraints in The U.S. AI Agents Market

Data Privacy and Security Concerns

The US AI agent market experiences an important limitation as people mainly worry about protecting their data privacy, along with maintaining its security. AI agents need processing of sensitive information, which includes customer details and financial data, together with internal business documents. These systems develop security risks from poor management, due to which data breaches become possible, resulting in both legal difficulties and reputation damage.

Many organizations avoid critical system operations with AI agents since they want to secure unauthorized access and data leakage. AI solution deployment becomes more complex because organizations need to meet the requirements of regulations such as GDPR, along with HIPAA. Businesses need to establish robust security measures and constant monitoring systems that will boost costs and lower the pace of AI agent adoption. The doubt companies have about AI agents restricts their readiness for complete implementation.

Integration and Workforce Adaptation Challenges

The process of implementing AI agents proves challenging for multiple organizations because they struggle to merge AI elements with their current operational frameworks. AI agents need organizations to perform technical configuration work, while employees need training about the AI systems, along with modifications to operational procedures. The effective transition management that smaller organizations need usually requires specialized expertise beyond basic budgeting capabilities.

They are hesitant to adopt AI because they worry about job replacement, along with their inability to comprehend AI technology operations. AI implementation produces strain among personnel that interferes with the successful deployment of AI agents. New AI tools cannot operate with all existing legacy systems, so organizations must spend time and funding to upgrade their systems. Organizations encounter obstacles that slow down and dissuade their deployment of AI agents.

Opportunities in The U.S. AI Agents Market

Expansion into Industry-Specific Solutions

The United States AI agent market offers a major opportunity to build customized solutions for different industries. General-purpose AI agents serve many purposes, but modern businesses need tools with specific knowledge to handle their separate services, like healthcare and logistics. The implementation of industry-specific knowledge into AI agents leads to more precise analytical capabilities along with the performance of sector-approved tasks while following regulatory standards.

AI agents offer assistance for medical diagnostics and patient observations in healthcare, alongside providing legal support through case analysis and documentation preparation in law firms. The vertical development methodology enables developers, along with vendors, to establish innovative growth possibilities. The digital revolution within industries will trigger a major increase in the requirements for purpose-built AI agents during the upcoming period.

Rise of Low-Code and No-Code Platforms

The expanding market for low-code and no-code platforms emerges as a vital business opportunity because these platforms let users who are not programmers create and implement AI agents. Organizations that leverage these platforms eliminate technical programming requirements, which expands the AI agent development space to businesses of all scales and independent users. Organizations can develop AI agents that suit their specific requirements through basic drag-and-drop interfaces or step-by-step workflows without having to employ a complete technical staff.

Through the widespread availability of no-code and low-code platforms, many more users can develop artificial intelligence solutions, enabling accelerated innovation and broader market adoption. Companies can now let their departments, including HR and marketing, and operations, utilize independent AI tool-building capabilities. The growth of AI agent solutions in the US market will be driven by these user-friendly platforms that continue widening their capabilities.

Trends in The U.S. AI Agents Market

Proactive AI Agents

AI agents in the US market have developed into proactive assistants through a major industry trend, which has evolved their functionality from passive tools. These agents perform autonomous actions together with demand prediction through anticipating user needs. An AI assistant will use an understanding of user work habits alongside energy levels to generate optimal work schedules for breaks and tasks. These agents utilize data analysis and contextual understanding to identify solutions ahead of emerging issues, which improves both the user experience as well as efficiency.

The shift toward proactive action establishes better user interactions because it creates smoother communications between people and artificial intelligence systems. Business implementation of proactive AI agents will expand across organizations because the technology produces better productivity and satisfaction results which represents a fundamental shift in AI-operated everyday activities.

Adoption of Open-Weight and Specialized AI Models

Progressively more American companies are including open-weight and specialized AI models among their business strategies as a prominent new trend. The adoption of open-weight models by developers provides them with the capability to modify and adjust AI agents for individual industry needs. By offering flexibility, businesses extract benefits that include economical and specific AI solutions that meet their exclusive operational requirements.

Modernized healthcare diagnostics, together with enhanced supply chain management functionality, become achievable through specially designed AI agents that deliver better precision alongside increased efficiency. Open-weight models allow businesses to deeply embed AI into their operations because these models free companies from closed system limitations. Increased interest in flexible and accessible AI solutions makes it possible broader implement of AI agents into different sectors.

Research Scope and Analysis

By Type Analysis

Ready-to-deploy agents will dominate the US AI agent market in 2025 with a market share of 77.3% because of their influential role in sustaining rapid market expansion. These pre-fabricated solutions can be deployed without difficulty and require minimal technical expertise and enabling functions applicable to multiple sectors, including customer service as well as retail operations and financial and healthcare domains. Companies select ready-to-deploy agents due to their capability to save time while reducing cost and delivering reliable initial solutions.

Ready-to-deploy agents deliver continuous maintenance services to customers while providing them with updated capabilities, which make them an appealing option for organizations striving for swift outcomes. These tools enable teams to start automation while bypassing complicated programming codes alongside extended installation processes. Organizations choose robotic process automation tools because business competition intensifies in the digital world, and these tools help speed up operations while decreasing workloads and simplifying tasks.

During the forecast period, build-your-own agents show significant growth, which leads to increased business interest owing to their customizable capabilities. Through such tools, organizations gain the ability to develop AI agents that align mainly with their business requirements. These agents empower businesses to determine every functional aspect of their agents, starting from their language to their decision-making protocols.

These AI solutions prove beneficial for organizations with particular business needs and requirements. Teams employing build-your-own agents desire software systems integration and executable automation solutions that match their business-specific needs. The number of accessible low-code and no-code platforms increases, making it simpler for individuals without technical skills to develop these agents. This method of developing custom-made digital tools for specific business needs has emerged as a primary expansion sector within the AI agent market.

By Agent System Analysis

The US AI agent market will experience substantial growth, as single-agent systems reach a 73.1% share in 2025, since these systems offer straightforward solutions for particular business functions. Such systems operate as standalone entities yet remain simple to install because they serve businesses that need automation solutions apart from complicated frameworks. The AI agents that companies adopt help to manage their customers, along with data processing and task notification functions. The solutions prove popular because they provide first-rate cost-efficiency coupled with quick implementation times alongside straightforward management processes.

The implementation of single-agent systems results in simplified operations because they do not require technical expertise or demanding system requirements. These systems prove beneficial to businesses with operations of medium or small scale who want to boost their efficiency without constructing substantial digital platform networks. Organizations that require dependable automation solutions find single-agent systems to be an attractive option because they deliver functional business improvements to various industries.

Further, businesses highly depend on multi-agent systems due to their strong forecasting potential, as they allow AI devices to collaborate and execute intricate operations. The system integrates multiple agents who work together through communication while distributing work and team collaboration to reach complex business targets. Multiple agents are well-suited for complex systems involving supply chain activities, manufacturing automation, and immediate customer engagements because they excel at coordinated operations between many elements.

The split distribution of work and improved workload management, alongside environmental change reaction speed, are features enabled by a

multi-agent system. The system enhances problem-solving capabilities through agent-to-agent knowledge sharing, which results in effective team-based operation. Multi-agent systems experience growing popularity within organizations because they sustain adaptability and scalability in changing business environments.

By Application Analysis

Based on application, the customer service and virtual assistance in the US AI agent market will have a

35.3% market share dominance by 2025, as they serve as its primary growth drivers. User support applications managed by AI technology let organizations take care of service inquiries, together with support incident handling and continuous help service delivery, without needing big staff departments. The assistants address universal questions while they direct users through a series of processes and customize interactions for enhanced, rapid, and effortless customer interactions. Virtual assistant technology supports both internal staff teams with meeting arrangements and daily task management, and deadline-based reminder services.

The combined use of this system results in higher external service levels and increased organizational productivity. With these tools, multiple industries harm business operations to expedite tasks, along with minimizing mistakes, thus keeping their clients content. Companies need AI agents to meet expanding customer expectations while delivering affordable response services that ensure business leadership in competitive markets through continuous service support.

Further, the accounting and finance application where AI agents will show rise in importance in the coming years, as these agents perform routine operations that accelerate financial procedures and increase their precision levels for responsibilities like invoice review, expense tracking, and transaction documentation. The system supports teams to monitor budgets, along with preparing financial reports and conducting instant analysis of spending patterns.

Businesses accomplish better performance through automated key financial activities, which eliminate human mistakes and uphold financial standards. AI agents provide financial forecasting by conducting quick scans of large data volumes to detect fraud. AI-enhanced financial tools simplify complex financial operations, which provides them value to companies focused on better financial operation control, along with better transparency and improved decision-making capabilities. The modernization of business finance departments occurs because of this transformation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End User Analysis

The BFSI sector will hold the leading position of

21.9% in 2025, which drives US AI agent market expansion through its adoption of advanced smart tools for service quality enhancement alongside security and operational needs. Banks, along with insurance firms and financial institutions, implement AI agents to serve clients better and handle business operations for transaction processing and fraud detection while giving tailored product suggestions. Through their operations, these agents shorten response times and enhance service excellence while taking care of substantial interaction volumes without employing additional staff members.

The financial operations benefit from smart tools that create safer and more efficient solutions through compliance management capabilities, along with risk analysis benefits. BFSI organizations are using substantial funding to implement AI automation systems because they need to deliver smooth digital services. Financial organizations can remain competitive while building trust with customers by implementing AI agents to deliver fast, high-quality, secure banking services that meet growing customer demands.

Throughout the projected duration, the media & entertainment industry demonstrates notable expansion as AI agents drive transformations to content development and management, as well as distribution systems.

AI agents provide three primary functions to customers, including recommendation services and digital library order and subscription management, and they contribute to content creation. The customer experience is highly improved through their activities, which handle queries and provide personalized streaming platform experiences alongside gaming and social media services.

Media organizations depend on artificial intelligence agents to collect user preference data for providing quick, intelligent service solutions that align with customer needs. Media businesses adopt AI solutions because real-time and personalized content consumption has become a dominant industry practice. New advancements in digital entertainment require AI agents that help increase customer satisfaction and enhance media operation efficiency.

The U.S. AI Agents Market Report is segmented on the basis of the following:

By Type

- Ready to Deploy Agents

- Build Your Own Agents

By Agent System

- Single Agent System

- Multi-Agent System

By Application

- Legal & Compliance

- Sales & Marketing

- Customer Service & Virtual Assistance

- Accounting & Finance

- HR

- Coding & Software Development

- Others

By End Users

- BFSI

- Manufacturing

- Healthcare & Pharmaceuticals

- Media & Entertainment

- Litigation Firms

- Government & Defense

- Technology Providers

- Individual Users

- Others

Competitive Landscape

The US market for AI agent technology continues to grow more competitive because companies compete fast to create intelligent programs for business operations. New startups, along with experienced tech companies, now compete in the market by offering AI tools that control email management, respond to inquiries, arrange information, and execute operational decisions. Intense marketplace competition drives innovation through progressive development of agents that achieve higher speed along with better intelligence, alongside simplified usage interfaces.

These companies simultaneously develop their tools to complement various industrial sectors, like healthcare, finance, retail, and manufacturing. Market growth drives multiple organizations to link artificial intelligence solutions with their current software and services, which results in an increasingly competitive landscape featuring rapid technological enhancements.

Some of the prominent players in the U.S. AI Agents are:

- Google

- AWS

- IBM

- Salesforce

- Meta

- Microsoft

- NVIDIA

- Baidu

- Alibaba Group

- Apple

- OpenAI

- Adept AI

- Lamini

- Imbue

- Inflection AI

- Cresta AI

- LatticeFlow

- Other Key Players

Recent Developments

- In February 2025, OpenAI plans to launch a new artificial intelligence tool called Deep Research, which will be available to certain paying customers through OpenAI’s ChatGPT chatbot online. In response to a prompt, the tool will scour words, images, and PDFs online, along with files uploaded by the user, to develop an in-depth report.

- In January 2025, NTT DATA launched its next-generation Smart AI Agent, which is the latest of the company's strategy to accelerate the adoption of Generative AI, with an estimated USD 2 billion in revenue that it aims to achieve from Smart AI AgentTM-related business by 2027. The Smart AI AgentTM autonomously extracts, organizes, and executes tasks in response to user instructions, complementing existing workforces and simplifying time-consuming processes.

- In January 2025, ServiceNow introduced a series of new agentic AI innovations to autonomously solve the most complex enterprise challenges, which acts as the AI agent control tower one, central location to analyze, manage, and govern the rapidly transforming world of agentic AI across every corner of a business.

- In October 2024, Microsoft launched ten autonomous agents for its Copilot AI platform, customized to support sales, service, finance, and supply chain teams. These agents will be available for public preview starting in December, with a full rollout planned through 2025.